Key Insights

The Indian CNG Vehicles Market is poised for robust expansion, projected to surpass a significant valuation, driven by a compelling CAGR exceeding 4.00%. This growth trajectory is underpinned by a confluence of factors, including the government's strong push towards a gas-based economy and ambitious targets for increasing the share of natural gas in the energy mix. The inherent cost-effectiveness of CNG as a fuel, especially in the wake of fluctuating petrol and diesel prices, makes it an attractive proposition for both commercial and personal vehicle owners. This economic advantage is a primary catalyst, encouraging fleet operators to transition towards CNG-powered vehicles for enhanced operational efficiency and reduced running costs. Furthermore, a growing environmental consciousness among consumers and stricter emission norms are compelling manufacturers and buyers to opt for cleaner fuel alternatives like CNG. The increasing availability of CNG refueling infrastructure across Tier 1, Tier 2, and emerging urban centers is also playing a pivotal role in alleviating range anxiety and facilitating wider adoption.

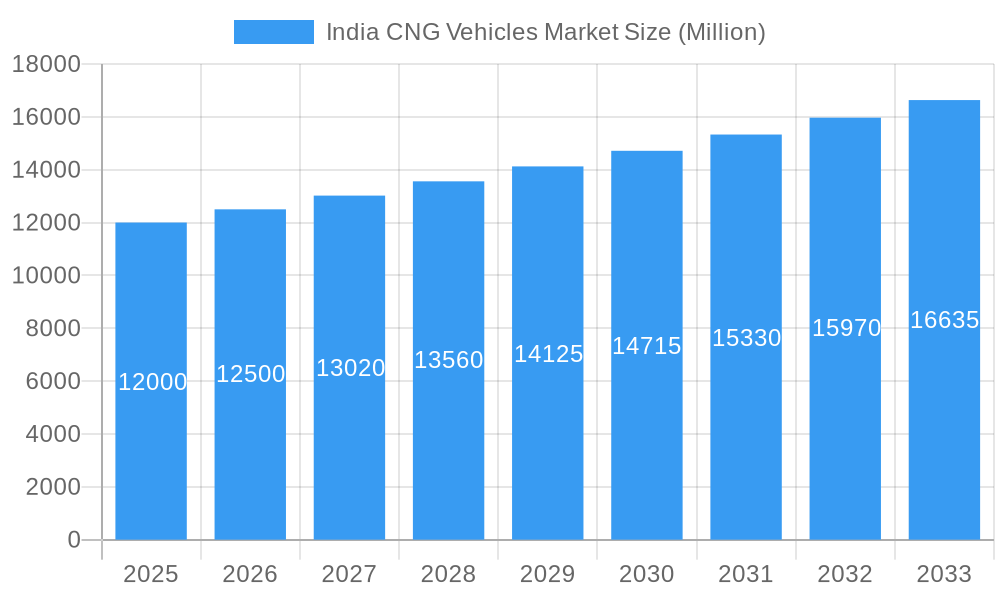

India CNG Vehicles Market Market Size (In Billion)

The market segmentation reveals a strong presence of Commercial Vehicles, with Light Commercial Pick-up Trucks and Light Commercial Vans leading the charge due to their extensive application in last-mile delivery and logistics. Heavy-duty and Medium-duty Commercial Trucks are also witnessing a gradual shift towards CNG, driven by large fleet operators aiming to optimize their operational expenses on long-haul routes. Key players like Tata Motors, Ashok Leyland, and VE Commercial Vehicles are actively investing in developing and expanding their CNG vehicle portfolios, introducing innovative models and enhancing their production capacities to meet the escalating demand. Mahindra & Mahindra and SML Isuzu are also significant contributors, offering a range of commercial vehicles that cater to diverse business needs. The study period from 2019 to 2033, with a base year of 2025, indicates a well-established market foundation and a clear vision for future development. The forecast period highlights sustained positive momentum, suggesting that the Indian CNG Vehicles Market is on a path to significant and consistent growth.

India CNG Vehicles Market Company Market Share

This in-depth report provides a detailed analysis of the India CNG Vehicles Market, exploring its current composition, historical evolution, and future trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025, the report offers actionable insights for stakeholders including manufacturers, suppliers, investors, and policymakers. Leveraging high-ranking keywords like "India CNG market," "CNG vehicle sales India," "alternative fuel vehicles India," and "commercial CNG vehicles," this report aims to be the definitive resource for understanding the dynamic Indian compressed natural gas vehicle landscape.

India CNG Vehicles Market Market Composition & Trends

The India CNG Vehicles Market is characterized by a growing concentration of key players, driven by increasing demand for cost-effective and environmentally friendly transportation solutions. Innovation catalysts are primarily focused on enhancing fuel efficiency, extending range, and improving the performance of CNG powertrains across various vehicle segments. The regulatory landscape, particularly government initiatives promoting natural gas adoption and stricter emission norms, plays a pivotal role in shaping market dynamics. Substitute products, such as electric vehicles (EVs) and diesel-powered vehicles, present ongoing competition, yet the affordability and widespread availability of CNG continue to favor its growth. End-user profiles range from large fleet operators seeking operational cost savings in the commercial vehicle sector to individual car owners prioritizing lower running expenses. Mergers and acquisitions (M&A) activities are expected to intensify as companies seek to expand their market share and product portfolios. The market share distribution is currently dominated by a few major automotive manufacturers, with a notable trend towards consolidation and strategic alliances. M&A deal values are anticipated to rise as companies invest in expanding their CNG offerings and manufacturing capabilities. XXX

India CNG Vehicles Market Industry Evolution

The India CNG Vehicles Market has witnessed a remarkable evolution driven by a confluence of economic, environmental, and technological factors. Over the historical period (2019-2024), the market has experienced robust growth, fueled by rising fuel prices of petrol and diesel, coupled with increasing government support for natural gas as a cleaner alternative. This sustained growth trajectory is projected to continue through the forecast period (2025-2033). Technological advancements have been central to this evolution, with manufacturers consistently introducing more efficient and powerful CNG engines. Early CNG vehicles often faced concerns regarding performance and range, but recent innovations have addressed these limitations, making CNG a viable option for a wider spectrum of applications. Shifting consumer demands have also played a crucial role. As environmental awareness grows and the cost of traditional fuels escalates, consumers, both individual and commercial, are actively seeking more economical and sustainable mobility solutions. The adoption metrics for CNG vehicles, particularly in the commercial segment, demonstrate a clear preference for lower operating costs, which translates to significant savings for fleet operators. The penetration of CNG technology into passenger cars has also accelerated, supported by a wider availability of factory-fitted CNG options. This shift signifies a maturing market where CNG is no longer perceived as a niche alternative but as a mainstream fuel choice. The growth rate of the India CNG market has consistently outperformed traditional fuel vehicle segments, indicating a strong and enduring demand.

Leading Regions, Countries, or Segments in India CNG Vehicles Market

Within the India CNG Vehicles Market, Commercial Vehicles stand out as the dominant segment, showcasing significant growth and widespread adoption. This dominance is particularly evident in the sub-segments of Light Commercial Pick-up Trucks and Light Commercial Vans, which are the workhorses of India's logistics and last-mile delivery networks. Heavy-duty Commercial Trucks and Medium-duty Commercial Trucks are also experiencing increasing CNG penetration as operators seek to reduce operating expenses and comply with evolving emission standards.

Key Drivers of Dominance in Commercial Vehicles:

- Cost-Effectiveness: CNG offers substantially lower fuel costs compared to petrol and diesel, directly impacting the bottom line for commercial operators. This economic advantage is the primary driver for the segment's leadership.

- Regulatory Support: Government policies promoting the use of natural gas as a cleaner fuel, coupled with incentives for fleet owners to transition to CNG, have been instrumental. Stricter emission norms for diesel vehicles further push operators towards CNG.

- Expanding CNG Infrastructure: The continuous expansion of CNG refueling stations across major urban centers and key transportation corridors makes CNG vehicles a practical choice for commercial fleets.

- Growing E-commerce and Logistics Sector: The burgeoning e-commerce industry and the overall growth in the logistics sector necessitate efficient and cost-effective transportation solutions, making CNG commercial vehicles highly sought after.

- Availability of Dedicated CNG Models: Manufacturers have responded to the demand by introducing a wide array of commercial vehicles specifically designed or adapted for CNG, offering robust performance and payload capacities.

The dominance of commercial vehicles, especially light-duty variants, in the India CNG market is a direct consequence of their extensive usage in daily transportation and delivery operations where fuel efficiency and lower running costs are paramount. This segment's robust performance is projected to continue driving the overall growth of the India CNG vehicles market.

India CNG Vehicles Market Product Innovations

Product innovations in the India CNG Vehicles Market are primarily focused on enhancing the performance and convenience of CNG powertrains. Manufacturers are introducing advanced CNG injection systems for improved fuel efficiency and reduced emissions. Innovations include dual-fuel capabilities, offering seamless switching between CNG and petrol, and extended range options to address range anxiety. Performance metrics are seeing improvements with more powerful CNG engines that can rival their petrol counterparts. Unique selling propositions often revolve around the significant cost savings per kilometer, reduced carbon footprint, and the increasing availability of factory-fitted CNG kits for a hassle-free ownership experience. Technological advancements are also incorporating better safety features and integrated infotainment systems for a more modern user experience.

Propelling Factors for India CNG Vehicles Market Growth

The India CNG Vehicles Market growth is propelled by several key factors. Technological advancements in engine efficiency and emission control are making CNG vehicles more attractive. Economic influences, particularly the volatile prices of petrol and diesel, significantly boost the appeal of CNG's lower running costs. Government policies and initiatives that promote natural gas as a cleaner fuel and encourage CNG adoption through infrastructure development and subsidies are crucial drivers. The expanding CNG refueling infrastructure across India directly supports increased vehicle adoption. Furthermore, the growing environmental consciousness among consumers and businesses demanding sustainable transportation solutions is a significant factor.

Obstacles in the India CNG Vehicles Market Market

Despite its growth, the India CNG Vehicles Market faces certain obstacles. Regulatory challenges can arise from varying state-level policies regarding CNG pricing and infrastructure development. Supply chain disruptions for CNG components or refueling station equipment can impact production and availability. Limited model availability in certain vehicle segments, though improving, can still be a restraint for some consumer needs. Price sensitivity remains a factor, with the initial cost of CNG vehicles sometimes being higher than their petrol counterparts. Perceived safety concerns, though largely addressed by modern technology, can still influence some buyers. The pace of CNG infrastructure expansion in remote areas also presents a challenge for widespread adoption.

Future Opportunities in India CNG Vehicles Market

Future opportunities in the India CNG Vehicles Market are abundant. The expansion of CNG infrastructure into Tier-2 and Tier-3 cities presents a significant untapped market. The development of advanced CNG engine technologies offering even greater efficiency and performance will further broaden adoption. The growing trend of fleet electrification could see CNG playing a transitional role or complementing EVs for specific use cases. New vehicle segments, such as buses and specialized commercial vehicles, are emerging markets for CNG adoption. The increasing focus on green logistics and sustainable supply chains will continue to drive demand for CNG commercial vehicles.

Major Players in the India CNG Vehicles Market Ecosystem

- Ashok Leyland Limited

- SML Isuzu Limited

- Tata Motors Limited

- VE Commercial Vehicles Limited

- Mahindra & Mahindra Limited

- JBM Auto Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

Key Developments in India CNG Vehicles Market Industry

- August 2023: Tata Motors introduced upgraded CNG variants for its Tiago and Tigor models, along with the launch of the new Punch iCNG. The Tiago iCNG is priced between INR 654.9 thousand to INR 809.9 thousand, while the Tigor iCNG is priced between INR 779.9 thousand to INR 894.9 thousand. The Punch iCNG is priced from INR 709.9 thousand to INR 967.9 thousand.

- July 2023: Maruti Suzuki India Limited introduced FRONX S-CNG in their premium retail channel NEXA for a starting price of INR 841.5 thousand and going to INR 927.5 thousand.

- July 2023: Hyundai Motor India Limited (HMIL), launched the compact SUV Exter for a price of INR 599.9 thousand and going to INR 932 thousand. It comes equipped with a 1.2 l Kappa gasoline, a 4-cylinder engine (E20 fuel ready) with an option to choose from 3 powertrains that are manual transmission (MT), automated manual transmission (AMT) and gasoline with CNG engine with manual transmission MT.

Strategic India CNG Vehicles Market Market Forecast

The strategic India CNG Vehicles Market forecast indicates sustained and robust growth, driven by a powerful synergy of economic prudence and environmental consciousness. The escalating costs of traditional fuels, coupled with proactive government policies promoting natural gas, are set to accelerate the adoption of CNG vehicles across passenger and commercial segments. Expansion of the CNG refueling network will be a critical catalyst, diminishing range anxiety and enhancing convenience. Innovations in engine technology, focusing on improved performance and longer range, will further solidify CNG's position as a practical and cost-effective alternative. The burgeoning e-commerce sector and the increasing demand for sustainable logistics solutions will continue to fuel the demand for CNG-powered commercial vehicles. The market is poised for significant expansion, offering substantial opportunities for manufacturers and stakeholders aligned with the clean energy transition in the Indian automotive landscape.

India CNG Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

-

1.1.1. Light Commercial Vehicles

- 1.1.1.1. Light Commercial Pick-up Trucks

- 1.1.1.2. Light Commercial Vans

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Medium-duty Commercial Trucks

-

1.1.1. Light Commercial Vehicles

-

1.1. Commercial Vehicles

India CNG Vehicles Market Segmentation By Geography

- 1. India

India CNG Vehicles Market Regional Market Share

Geographic Coverage of India CNG Vehicles Market

India CNG Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India CNG Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Light Commercial Vehicles

- 5.1.1.1.1. Light Commercial Pick-up Trucks

- 5.1.1.1.2. Light Commercial Vans

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Medium-duty Commercial Trucks

- 5.1.1.1. Light Commercial Vehicles

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ashok Leyland Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SML Isuzu Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tata Motors Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VE Commercial Vehicles Limite

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mahindra & Mahindra Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBM Auto Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maruti Suzuki India Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hyundai Motor India Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Ashok Leyland Limited

List of Figures

- Figure 1: India CNG Vehicles Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India CNG Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: India CNG Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: India CNG Vehicles Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: India CNG Vehicles Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 4: India CNG Vehicles Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India CNG Vehicles Market?

The projected CAGR is approximately 6.88%.

2. Which companies are prominent players in the India CNG Vehicles Market?

Key companies in the market include Ashok Leyland Limited, SML Isuzu Limited, Tata Motors Limited, VE Commercial Vehicles Limite, Mahindra & Mahindra Limited, JBM Auto Limited, Maruti Suzuki India Limited, Hyundai Motor India Limited.

3. What are the main segments of the India CNG Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Tata Motors introduced upgraded CNG variants for its Tiago and Tigor models, along with the launch of the new Punch iCNG. The Tiago iCNG is priced between INR 654.9 thousand to INR 809.9 thousand, while the Tigor iCNG is priced between INR 779.9 thousand to INR 894.9 thousand. The Punch iCNG is priced from INR 709.9 thousand to INR 967.9 thousand.July 2023: Maruti Suzuki India Limited introduced FRONX S-CNG in their premium retail channel NEXA for a starting price of INR 841.5 thousand and going to INR 927.5 thousand.July 2023: Hyundai Motor India Limited (HMIL), launched the compact SUV Exter for a price of INR 599.9 thousand and going to INR 932 thousand. It comes equipped with a 1.2 l Kappa gasoline, a 4-cylinder engine (E20 fuel ready) with an option to choose from 3 powertrains that are manual transmission (MT), automated manual transmission (AMT) and gasoline with CNG engine with manual transmission MT.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India CNG Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India CNG Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India CNG Vehicles Market?

To stay informed about further developments, trends, and reports in the India CNG Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence