Key Insights

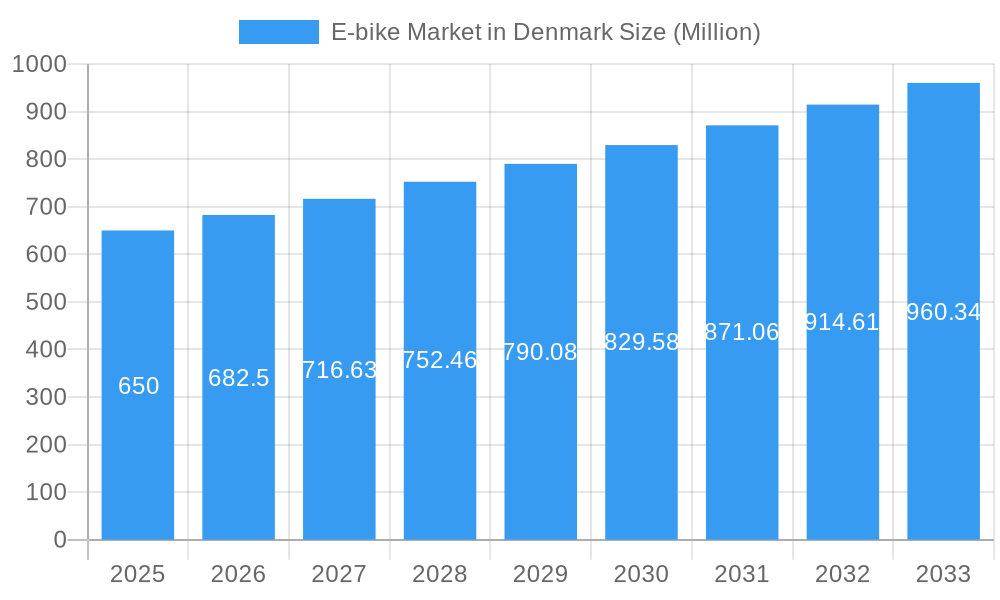

The Danish e-bike market is set for substantial growth, propelled by a strong national focus on sustainable transportation and increasing consumer acceptance of electric mobility. With an estimated market size of 412.6 million by 2025, and a projected Compound Annual Growth Rate (CAGR) of 8.23%, this sector presents a significant opportunity. Key drivers include the rising demand for eco-friendly commuting, supportive government incentives, and advancements in battery technology. Denmark's established cycling culture, combined with the need for convenient urban mobility solutions, positions e-bikes as an ideal choice for daily commutes and leisure.

E-bike Market in Denmark Market Size (In Million)

The market is segmented by propulsion type, with Pedal Assist e-bikes expected to lead due to their intuitive cycling experience. Speed Pedelecs and Throttle Assist variants will cater to specific user requirements for speed and ease of use. Cargo/Utility and City/Urban applications are anticipated to be the dominant segments, highlighting the practical integration of e-bikes into daily routines for errands, commuting, and family transportation. Lithium-ion batteries are projected to be the preferred technology, offering superior energy density, lighter weight, and extended lifespan. Key players such as Royal Dutch Gazelle, Giant Manufacturing Co. Ltd., and Van Moof are actively innovating and expanding their reach in this competitive landscape. Denmark's strategic position in the Nordic region underscores its importance for continued investment and product development focused on enhancing user experience and sustainability.

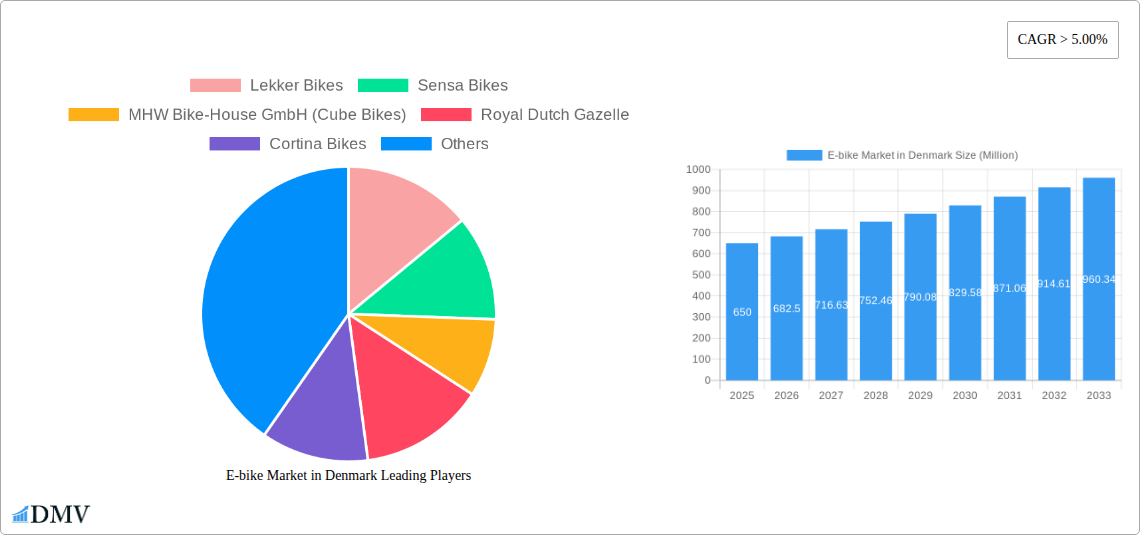

E-bike Market in Denmark Company Market Share

E-bike Market in Denmark: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report delivers a detailed exploration of the burgeoning e-bike market in Denmark, offering critical insights for stakeholders, investors, and industry participants. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis covers market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, key players, and strategic forecasts. Leveraging a robust research methodology, this report provides actionable intelligence on the Danish e-bike landscape, including market share distribution, M&A deal values, growth rates, and adoption metrics.

E-bike Market in Denmark Market Composition & Trends

The Danish e-bike market exhibits a dynamic composition characterized by increasing market concentration among a few dominant players, driven by ongoing innovation in battery technology and motor efficiency. Catalysts for innovation include significant R&D investments by major manufacturers and a growing demand for sustainable urban mobility solutions. The regulatory landscape in Denmark is generally supportive, with government incentives and infrastructure development favoring electric bicycle adoption. Substitute products, such as traditional bicycles and public transportation, face stiff competition from the convenience and extended range offered by e-bikes. End-user profiles are diverse, encompassing commuters seeking efficient travel, recreational riders looking for enhanced cycling experiences, and logistics companies adopting e-cargo bikes for last-mile delivery. Mergers and acquisitions (M&A) activities, while currently moderate, are expected to increase as companies seek to consolidate market share and expand their product portfolios. For instance, M&A deal values are anticipated to reach several hundred million Euros in the coming years as strategic alliances and acquisitions shape the market's future.

E-bike Market in Denmark Industry Evolution

The Danish e-bike industry has witnessed a remarkable evolution, transforming from a niche product to a mainstream transportation solution. Market growth trajectories have been consistently upward, fueled by a growing awareness of environmental sustainability and the health benefits of cycling. Adoption metrics indicate a significant increase in e-bike ownership, with penetration rates now exceeding 15% of the total bicycle market. Technological advancements have been pivotal, with the introduction of lighter, more powerful lithium-ion batteries and sophisticated electric motor systems enhancing performance and rider experience. Shifting consumer demands are increasingly prioritizing longer battery life, integrated smart features, and stylish designs that blend functionality with aesthetics. The average annual growth rate for the e-bike market in Denmark has been approximately 18% over the historical period, a testament to its burgeoning popularity. The widespread adoption of pedal-assisted bicycles, offering a natural cycling feel with an added boost, has been a key driver. Furthermore, the emergence of speed pedelecs, capable of reaching higher speeds and providing a viable alternative to cars for commuting, is reshaping urban mobility patterns. The market is responding with a continuous stream of product upgrades and new model releases, ensuring sustained interest and market expansion.

Leading Regions, Countries, or Segments in E-bike Market in Denmark

The City/Urban application segment stands out as the dominant force within the Danish e-bike market. This dominance is underpinned by several interconnected factors:

- Pedal Assisted Propulsion Type: This is the most prevalent propulsion type, catering to a broad user base seeking assistance without compromising the cycling experience. Its popularity is driven by its versatility for commuting and recreational riding.

- Lithium-ion Battery Type: This battery type is the clear leader due to its superior energy density, lighter weight, and longer lifespan compared to older technologies. The continuous improvements in lithium-ion technology directly contribute to enhanced e-bike performance and range, aligning with consumer expectations for city commuting.

- City/Urban Application Type: Denmark's well-developed urban infrastructure, including extensive cycling paths and a strong pro-cycling culture, makes e-bikes an ideal mode of transportation for daily commutes, errands, and leisure within cities. The practical benefits of e-bikes, such as reducing travel time and effort, are particularly appealing to urban dwellers.

Key drivers supporting the dominance of these segments include:

- Investment Trends: Significant investment in urban cycling infrastructure, including dedicated bike lanes and charging stations, by Danish municipalities creates a conducive environment for e-bike adoption.

- Regulatory Support: Favorable government policies, such as subsidies for e-bike purchases and tax incentives for businesses using e-cargo bikes, further stimulate demand.

- Environmental Consciousness: A strong societal emphasis on sustainability and reducing carbon footprints makes e-bikes an attractive and eco-friendly transportation choice for Danish consumers.

- Technological Advancements: Continuous innovation in battery technology and motor efficiency by leading manufacturers has made e-bikes more accessible, reliable, and appealing for urban use.

While Speed Pedelecs are gaining traction for longer commutes, and Cargo/Utility e-bikes are carving out a significant niche in last-mile logistics, the sheer volume of daily urban commutes and recreational cycling ensures the City/Urban segment's continued leadership. The prevalence of Pedal Assisted and Lithium-ion Battery configurations within this segment further solidifies its position. The total addressable market for the City/Urban segment is estimated to be in the range of 1.5 to 2 million units annually.

E-bike Market in Denmark Product Innovations

Product innovations in the Danish e-bike market are consistently pushing the boundaries of performance, comfort, and user experience. Giant's unveiling of the Stormguard E+, a full-suspension e-bike, exemplifies a move towards more robust and versatile designs, catering to both adventurous terrain and urban commuting. The integration of advanced Bosch electric motors, as seen in Cube's Hybrid One E-Bike, offers powerful yet efficient performance for budget-conscious cyclists, highlighting a trend towards accessible high-quality components. Companies are also focusing on lighter frame materials, improved battery integration for sleeker aesthetics, and smart connectivity features that enhance security and navigation. The average price range for innovative models like the Stormguard E+ varies, with models like the E+1 priced around 7,999 Euros and the E+2 at 6,499 Euros, indicating a premium segment for cutting-edge technology.

Propelling Factors for E-bike Market in Denmark Growth

Several key factors are propelling the Danish e-bike market forward. Technological advancements in battery density, motor efficiency, and lightweight materials are making e-bikes more accessible and practical. Economic incentives, including government subsidies and tax benefits, coupled with a growing awareness of the environmental benefits of electric mobility, are significantly boosting consumer adoption. Furthermore, the increasing investment in urban cycling infrastructure by Danish municipalities makes cycling a more convenient and safer mode of transportation, directly benefiting the e-bike market. The rising popularity of e-bikes as a sustainable and healthy alternative to traditional transportation methods is a powerful ongoing trend.

Obstacles in the E-bike Market in Denmark Market

Despite its robust growth, the e-bike market in Denmark faces certain obstacles. Regulatory challenges related to speed limits for certain e-bike categories and varying insurance requirements can create confusion for consumers and manufacturers. Supply chain disruptions, as experienced during the pandemic which temporarily paused commercial relationships between manufacturers and retailers, can lead to product availability issues and increased costs. High initial purchase costs for premium e-bike models can be a barrier for some consumers, although this is being addressed by more affordable options. Furthermore, competition from established public transportation networks remains a factor, although the unique benefits of e-bikes often outweigh these for specific use cases. The total market impact of these obstacles is estimated to be a slight dampening of the growth rate by 1-2% annually.

Future Opportunities in E-bike Market in Denmark

Emerging opportunities in the Danish e-bike market are abundant. The growing demand for e-cargo bikes presents a significant opportunity for logistics and delivery companies, as well as for individuals needing to transport larger items. Technological innovation in areas like swappable batteries, regenerative braking, and advanced GPS integration will further enhance user convenience and attract new demographics. The expansion of shared e-bike services in more urban and suburban areas can tap into a wider customer base. Furthermore, the increasing focus on connected e-bikes with app integration for route planning, diagnostics, and security offers a platform for recurring revenue streams and enhanced customer engagement. The potential for the e-bike market to reach an estimated 30% of the total bicycle market within the next decade is substantial.

Major Players in the E-bike Market in Denmark Ecosystem

- Lekker Bikes

- Sensa Bikes

- MHW Bike-House GmbH (Cube Bikes)

- Royal Dutch Gazelle

- Cortina Bikes

- Giant Manufacturing Co Ltd

- Batavus Intercycle Corporation

- Qwic

- Van Moof B

- Koga

Key Developments in E-bike Market in Denmark Industry

- November 2022: Giant unveils the Stormguard E+, a full-suspension e-bike, set for European release in 2023, with models priced at 7,999 Euros (E+1) and 6,499 Euros (E+2). This development signals a push into premium, versatile e-bike segments.

- August 2022: Evans Cycles reintroduces Cube bikes across all 71 locations. This marks a significant step in restoring the commercial relationship, which was paused due to pandemic-related supply chain issues, ensuring greater availability of Cube's popular e-bike models.

- August 2022: Cube's Hybrid One E-Bike is highlighted for offering significant mileage for budget-minded cyclists, featuring a Bosch electric motor and urban-centric amenities. This underscores a strategy to broaden market appeal by offering robust performance at competitive price points.

Strategic E-bike Market in Denmark Market Forecast

The strategic outlook for the Danish e-bike market remains exceptionally positive, with sustained growth anticipated throughout the forecast period. Key growth catalysts include the continued expansion of urban cycling infrastructure, supportive government policies, and ongoing technological advancements that enhance e-bike performance and affordability. The increasing environmental consciousness of consumers, coupled with a desire for efficient and healthy transportation alternatives, will continue to drive demand. Emerging opportunities in e-cargo bikes and shared mobility services are poised to further diversify and expand the market. The market is projected to reach a valuation of over 2.5 Billion Euros by 2033, with an average annual growth rate of approximately 12-15%.

E-bike Market in Denmark Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

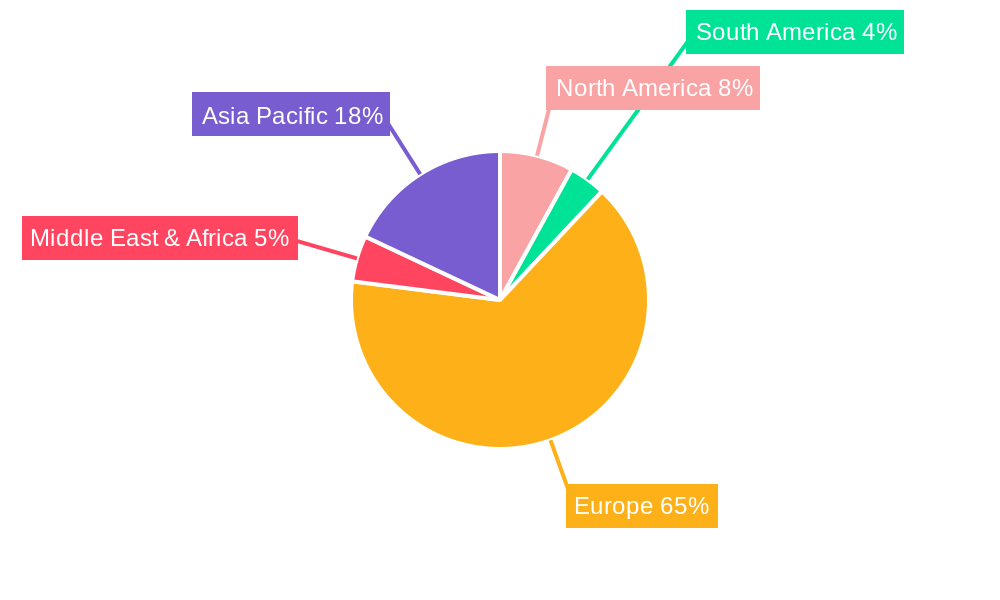

E-bike Market in Denmark Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-bike Market in Denmark Regional Market Share

Geographic Coverage of E-bike Market in Denmark

E-bike Market in Denmark REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Commercial Vehicle Sales to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Interest Rates to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Cargo/Utility

- 6.2.2. City/Urban

- 6.2.3. Trekking

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lead Acid Battery

- 6.3.2. Lithium-ion Battery

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Cargo/Utility

- 7.2.2. City/Urban

- 7.2.3. Trekking

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lead Acid Battery

- 7.3.2. Lithium-ion Battery

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Cargo/Utility

- 8.2.2. City/Urban

- 8.2.3. Trekking

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lead Acid Battery

- 8.3.2. Lithium-ion Battery

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Cargo/Utility

- 9.2.2. City/Urban

- 9.2.3. Trekking

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lead Acid Battery

- 9.3.2. Lithium-ion Battery

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Cargo/Utility

- 10.2.2. City/Urban

- 10.2.3. Trekking

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lead Acid Battery

- 10.3.2. Lithium-ion Battery

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lekker Bikes

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sensa Bikes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MHW Bike-House GmbH (Cube Bikes)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Dutch Gazelle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cortina Bikes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Giant Manufacturing Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Batavus Intercycle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qwic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Van Moof B

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Koga

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lekker Bikes

List of Figures

- Figure 1: Global E-bike Market in Denmark Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 3: North America E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 4: North America E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 5: North America E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 7: North America E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 8: North America E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 9: North America E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 11: South America E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: South America E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 13: South America E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: South America E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 15: South America E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 16: South America E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 17: South America E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 19: Europe E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 20: Europe E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 21: Europe E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Europe E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 23: Europe E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 24: Europe E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 25: Europe E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 27: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 28: Middle East & Africa E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 29: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East & Africa E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 31: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 32: Middle East & Africa E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 35: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 36: Asia Pacific E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 37: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 38: Asia Pacific E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 39: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 40: Asia Pacific E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 4: Global E-bike Market in Denmark Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 13: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 15: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 21: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 22: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 34: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 35: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 43: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 44: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 45: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 46: China E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-bike Market in Denmark?

The projected CAGR is approximately 8.23%.

2. Which companies are prominent players in the E-bike Market in Denmark?

Key companies in the market include Lekker Bikes, Sensa Bikes, MHW Bike-House GmbH (Cube Bikes), Royal Dutch Gazelle, Cortina Bikes, Giant Manufacturing Co Ltd, Batavus Intercycle Corporation, Qwic, Van Moof B, Koga.

3. What are the main segments of the E-bike Market in Denmark?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 412.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Commercial Vehicle Sales to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Fluctuations in Interest Rates to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.August 2022: Evans Cycles reintroduces Cube bikes to all 71 locations, During the height of the pandemic, Cube and Evans Cycles put their commercial relationship on pause due to supply chain issues.August 2022: Cube's Hybrid One E-Bike Offers Big Miles For Budget-Minded Cyclists, the Hybrid One packs a Bosch electric motor and urban-focused amenities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-bike Market in Denmark," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-bike Market in Denmark report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-bike Market in Denmark?

To stay informed about further developments, trends, and reports in the E-bike Market in Denmark, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence