Key Insights

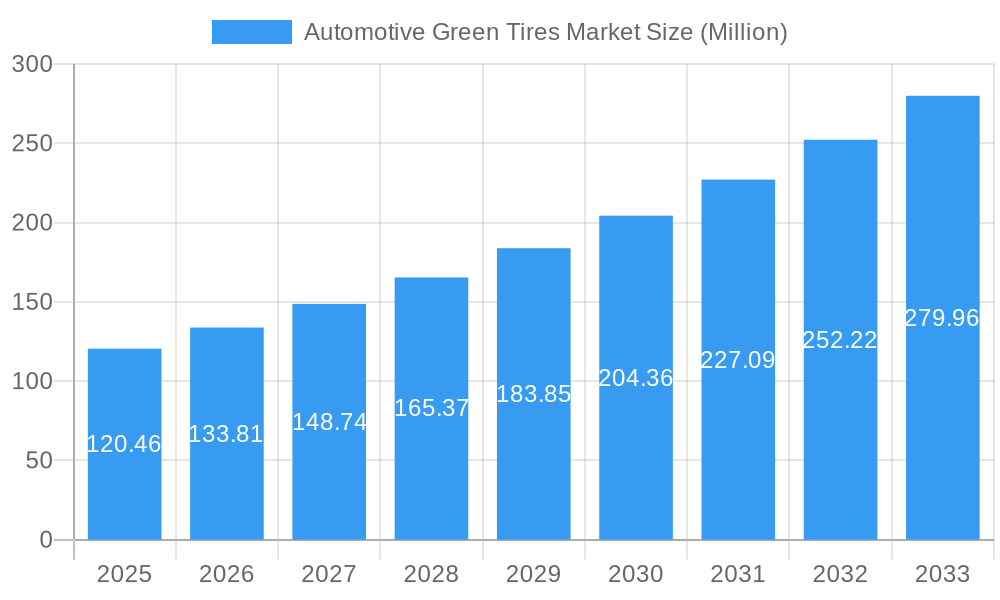

The global Automotive Green Tires Market is experiencing robust growth, projected to reach a substantial USD 120.46 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 11.02% throughout the forecast period of 2025-2033. This significant expansion is fueled by a confluence of critical drivers, including increasingly stringent environmental regulations worldwide, a heightened consumer demand for sustainable products, and advancements in tire technology that enable reduced rolling resistance and improved fuel efficiency. The shift towards eco-friendly mobility solutions is a primary catalyst, pushing both Original Equipment Manufacturers (OEMs) and the aftermarket to prioritize the adoption of green tire technologies. Key trends like the development of bio-based and recycled materials in tire production, alongside innovative tread designs for enhanced performance and reduced environmental impact, are shaping the market landscape.

Automotive Green Tires Market Market Size (In Million)

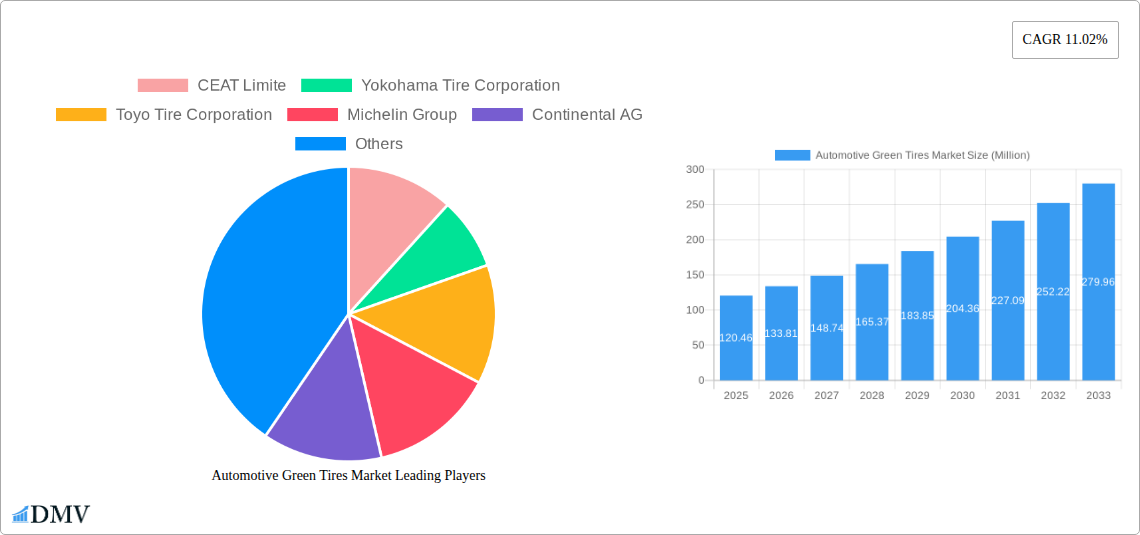

The market's trajectory is further supported by the growing emphasis on corporate social responsibility among automotive manufacturers and tire companies. While the market demonstrates a strong upward trend, certain restraints such as the higher initial cost of some green tire variants compared to conventional options, and the need for greater consumer awareness and education regarding their long-term benefits, present challenges. However, these are being steadily overcome through technological innovation and economies of scale. Leading companies such as Bridgestone Corporation, Michelin Group, and Continental AG are at the forefront of this evolution, investing heavily in research and development to offer a wider range of high-performance, sustainable tire solutions. The market segmentation by vehicle type, encompassing Passenger Vehicles and Commercial Vehicles, and by end-user type, covering OEM and Aftermarket, indicates a broad adoption across the automotive ecosystem. Regions like Asia Pacific, driven by China and India, are expected to be significant growth contributors due to rapid industrialization and increasing vehicle ownership.

Automotive Green Tires Market Company Market Share

Automotive Green Tires Market Analysis: Sustainable Solutions for a Greener Future (2019–2033)

This comprehensive report provides an in-depth analysis of the Automotive Green Tires Market, a rapidly expanding sector driven by increasing environmental consciousness, stringent regulations, and the burgeoning electric vehicle (EV) revolution. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025 and a forecast period extending to 2033, this report delves into market composition, industry evolution, product innovations, growth drivers, obstacles, and future opportunities.

Key findings include:

This report is an indispensable resource for stakeholders including tire manufacturers, automotive OEMs, suppliers, investors, and policymakers seeking to understand and capitalize on the significant growth potential of the sustainable tire market.

- Market Dynamics: Analysis of market concentration, innovation catalysts, regulatory landscapes, substitute products, end-user profiles, and M&A activities.

- Industry Evolution: Detailed examination of market growth trajectories, technological advancements, and shifting consumer demands.

- Regional Dominance: Identification of leading regions, countries, and segments within the Automotive Green Tires Market.

- Product Innovations: Spotlight on cutting-edge green tire technology, applications, and performance metrics.

- Growth Catalysts & Obstacles: Comprehensive overview of factors propelling market growth and the challenges hindering expansion.

- Future Outlook: Insights into emerging opportunities and a strategic market forecast.

Automotive Green Tires Market Market Composition & Trends

The Automotive Green Tires Market is characterized by a dynamic interplay of established tire giants and emerging innovators, all vying for market share in a sector increasingly defined by sustainability. Market concentration is moderately high, with dominant players investing heavily in R&D to develop tires that not only meet environmental standards but also enhance vehicle performance, particularly for electric vehicles. Innovation catalysts include advancements in eco-friendly rubber compounds, low rolling resistance technologies, and the use of recycled and bio-based materials. Regulatory landscapes globally are becoming more stringent regarding tire efficiency and environmental impact, further accelerating the adoption of green tires. Substitute products, while traditional, are increasingly challenged by the superior fuel efficiency and reduced emissions offered by green alternatives. End-user profiles span both the OEM (Original Equipment Manufacturer) and aftermarket segments, with OEMs prioritizing integrated sustainability solutions and the aftermarket focusing on replacement tires that offer long-term cost savings through improved fuel economy. M&A activities are anticipated to rise as companies seek to acquire innovative technologies and expand their portfolios in the sustainable automotive components sector.

- Market Share Distribution: Dominated by key players such as Michelin Group, Bridgestone Corporation, and Continental AG, with significant contributions from Yokohama Tire Corporation, Toyo Tire Corporation, and CEAT Limited.

- M&A Deal Values: Expected to increase as companies consolidate expertise in EV tire technology and circular economy initiatives within the automotive supply chain.

- Innovation Focus: Emphasis on low rolling resistance tires, lightweight tire construction, and the incorporation of materials like natural rubber, silica, and recycled PET bottles.

Automotive Green Tires Market Industry Evolution

The Automotive Green Tires Market has undergone a significant transformation, evolving from niche offerings to mainstream demand, particularly driven by the global push towards decarbonization and the exponential growth of the electric vehicle sector. Over the historical period (2019-2024), the industry witnessed a steady increase in research and development focused on improving the environmental footprint of tires. Early adopters and forward-thinking manufacturers recognized the potential of eco-friendly tire technologies to reduce vehicle emissions and enhance fuel efficiency, thereby appealing to a growing segment of environmentally conscious consumers. Technological advancements have been pivotal in this evolution. The development of advanced rubber compounds, incorporating high-performance silica and bio-based materials, has been crucial in achieving lower rolling resistance without compromising grip and durability. This led to the introduction of tires that significantly reduce energy loss during rotation, translating directly into improved fuel economy for internal combustion engine vehicles and extended driving range for electric vehicles.

The base year of 2025 marks a critical juncture where green tires are transitioning from a competitive advantage to a market necessity. This shift is fueled by evolving consumer demands, which are increasingly prioritizing sustainability and ethical sourcing in their purchasing decisions, extending to their vehicle components. Consumers are actively seeking environmentally friendly car tires that align with their personal values and contribute to a greener planet. The increasing prevalence of mandates and regulations worldwide aimed at improving vehicle energy efficiency and reducing tire-related pollution has further accelerated this evolutionary process. Governments and international bodies are setting stricter standards for tire performance metrics related to rolling resistance, noise pollution, and the use of sustainable materials. This regulatory push has incentivized manufacturers to invest more aggressively in sustainable tire innovation, leading to a continuous stream of new products designed to meet these evolving requirements. The market trajectory clearly indicates a move towards tires that offer a holistic approach to sustainability, encompassing reduced environmental impact throughout their lifecycle, from raw material sourcing to end-of-life management. The adoption of these advanced eco-conscious tire solutions is projected to accelerate exponentially throughout the forecast period (2025-2033), solidifying their position as the standard for the future of automotive mobility.

Leading Regions, Countries, or Segments in Automotive Green Tires Market

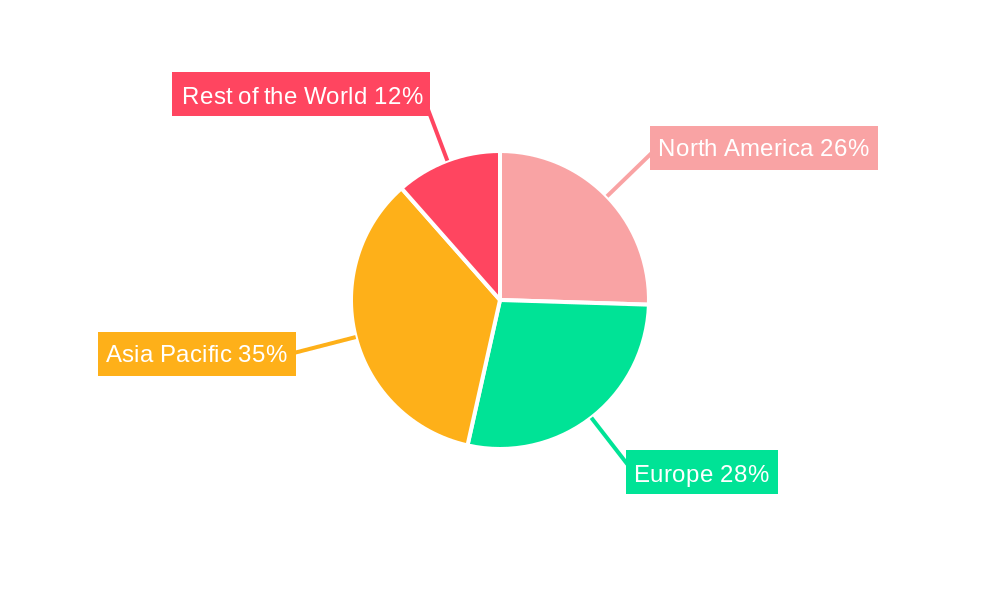

The Automotive Green Tires Market is experiencing robust growth across various segments and geographies, with certain regions and vehicle types emerging as dominant forces. Europe, North America, and Asia-Pacific are at the forefront of this revolution, driven by a combination of stringent environmental regulations, substantial investments in electric vehicle infrastructure, and a heightened consumer awareness regarding sustainability. Within these regions, passenger vehicles represent the largest segment by volume, owing to the sheer number of cars on the road and the growing demand for fuel-efficient and eco-friendly alternatives for daily commuting. The increasing adoption of electric passenger vehicles further amplifies the need for specialized green tires designed to handle the unique characteristics of EVs, such as instant torque and higher weight.

The OEM segment plays a crucial role in driving the adoption of automotive green tires. As automotive manufacturers increasingly integrate sustainability into their vehicle designs, there is a growing demand for factory-fitted green tires that contribute to overall vehicle efficiency and environmental compliance. This creates a significant push for tire manufacturers to innovate and supply tires that meet the specific performance and sustainability requirements of new vehicle models. Consequently, collaborations between tire makers and OEMs are becoming more prevalent, fostering the development of advanced green tire technologies. The aftermarket segment, while also growing, is influenced by consumer awareness and the availability of cost-effective green tire solutions. As consumers become more informed about the long-term benefits of low rolling resistance tires, such as fuel savings and reduced wear, the demand for green tires in the aftermarket is expected to surge.

Dominant Region: Europe

- Key Drivers: Strict EU emissions standards (e.g., CO2 regulations for vehicles), significant EV adoption rates, strong government incentives for sustainable mobility, and a highly environmentally conscious consumer base.

- Segment Dominance: Passenger Vehicles, with a strong emphasis on OEM supply for new EV models.

- Investment Trends: High investment in R&D for advanced rubber compounds and sustainable materials.

- Regulatory Support: Comprehensive regulatory framework promoting energy-efficient tires.

Significant Region: North America

- Key Drivers: Rapid EV market expansion, increasing consumer demand for fuel-efficient vehicles, and growing awareness of the environmental impact of tire wear and emissions.

- Segment Dominance: Passenger Vehicles and the growing Commercial Vehicles sector focusing on fleet efficiency.

- Industry Developments: Focus on lightweight tire construction and the use of recycled materials in tire manufacturing.

Emerging Region: Asia-Pacific

- Key Drivers: Growing automotive production, increasing disposable incomes, and a rising awareness of environmental issues, particularly in countries like China and India.

- Segment Dominance: Passenger Vehicles, with potential for significant growth in commercial vehicle applications.

- Market Potential: Large untapped market for affordable and performance-oriented green tires.

Segment Dominance: Passenger Vehicles

- Rationale: Highest production volumes, direct impact on fuel efficiency for daily commuters, and strong consumer preference for sustainable choices.

- Key Features: Focus on low rolling resistance, noise reduction, and enhanced wet grip for passenger safety.

Segment Dominance: OEM

- Rationale: Essential for meeting vehicle homologation standards and brand sustainability commitments. Drives innovation and large-scale production of green tires.

- Impact: Shapes the future of tire technology by integrating advanced green solutions into new vehicle platforms.

Automotive Green Tires Market Product Innovations

The Automotive Green Tires Market is witnessing a surge in innovative product development, focusing on enhancing sustainability without compromising performance. Key advancements include the integration of advanced eco-friendly rubber compounds that significantly reduce rolling resistance, leading to improved fuel efficiency and extended EV range. For instance, the use of high-dispersion silica and bio-based polymers derived from renewable resources like soybean oil and plant-based materials is becoming more prevalent. Manufacturers are also prioritizing the use of recycled materials, such as polyester from recycled plastic bottles and reclaimed rubber, contributing to a circular economy. Product innovations are specifically tailored for the demands of electric vehicles, featuring reinforced sidewalls to support increased weight and instant torque, alongside advanced tread patterns for optimal grip and wear resistance. The goal is to achieve a harmonious balance between reduced environmental impact, superior driving experience, and enhanced safety.

Propelling Factors for Automotive Green Tires Market Growth

The Automotive Green Tires Market is experiencing robust growth propelled by several key factors that underscore the shift towards sustainable mobility. Foremost among these is the global acceleration in the adoption of electric vehicles (EVs). EVs inherently require tires that can handle their increased weight and torque while maximizing range, making green tires with low rolling resistance and durable construction a necessity. Concurrently, increasingly stringent government regulations worldwide, mandating lower CO2 emissions and improved fuel efficiency for all vehicles, directly incentivize tire manufacturers to develop and promote their green tire offerings. Consumers are also becoming more environmentally conscious, actively seeking out products that align with their values. This rising consumer awareness, coupled with the long-term cost savings realized through improved fuel economy and reduced tire wear, acts as a significant market pull. Furthermore, technological advancements in material science, particularly in the development of sustainable rubber compounds and lightweight construction techniques, are enabling manufacturers to produce green tires that offer superior performance alongside their environmental benefits.

Obstacles in the Automotive Green Tires Market Market

Despite the significant growth prospects, the Automotive Green Tires Market faces several obstacles that could temper its expansion. One primary challenge is the higher initial cost associated with producing green tires, which often utilize advanced materials and manufacturing processes. This cost premium can deter price-sensitive consumers in the aftermarket segment, even with the promise of long-term fuel savings. Supply chain complexities for sustainable and recycled materials can also present issues, leading to potential price volatility and availability challenges. Furthermore, consumer perception and awareness remain a hurdle; while growing, many consumers may still be unaware of the benefits of green tires or skeptical about their performance compared to traditional alternatives, particularly concerning durability and grip in adverse conditions. Regulatory fragmentation across different regions can also create complexity for global manufacturers aiming to meet diverse compliance standards. Finally, intense competition from established players and the continuous need for substantial R&D investment to stay ahead of technological advancements can strain the resources of smaller manufacturers.

Future Opportunities in Automotive Green Tires Market

The future of the Automotive Green Tires Market is replete with opportunities driven by ongoing technological advancements and evolving market trends. The continued exponential growth of the electric vehicle (EV) market presents a colossal opportunity for specialized green tires designed to meet the unique demands of EVs, such as enhanced load capacity, reduced rolling resistance for extended range, and improved noise reduction. The increasing global emphasis on the circular economy opens doors for innovations in tire recycling and the development of fully recyclable or biodegradable tire components, creating new revenue streams and enhancing brand reputation. Furthermore, the expansion into emerging markets, particularly in Asia and developing economies, where vehicle ownership is rising, offers significant potential for market penetration with affordable and sustainable tire solutions. The development of smart tire technologies integrated with green materials could also unlock new opportunities for enhanced vehicle performance monitoring and predictive maintenance, further adding value for consumers and fleet operators.

Major Players in the Automotive Green Tires Market Ecosystem

- CEAT Limited

- Yokohama Tire Corporation

- Toyo Tire Corporation

- Michelin Group

- Continental AG

- Apollo Tyres Limited

- Pirelli & C Spa

- MRF Limited

- Goodyear Tire & Rubber Company

- Bridgestone Corporation

Key Developments in Automotive Green Tires Market Industry

- March 2023: Sumitomo Rubber Industries announced the launch of Falken e.ZIEX's new line of replacement tires for the electric vehicles fleet across Europe.

- January 2023: Goodyear announced the launch of its automotive green tire, which is made up of 90% sustainable material which would be used for electric vehicles. The tire material comprises soybean oil and polyester from recycled plastic bottles.

- September 2022: TOYO Tire Corporation delivered its Nano energy tire model J67 to Toyota Motor Corporation as OE for its new model Toyota Sienta. Due to their low rolling resistance, the company delivered 185/65 R15 88S dimension J67 green tires with exceptional fuel-saving capabilities.

- May 2022: Bridgestone Corporation introduced the R192E all-position radial tire specially designed for electric urban transit. The R192E tire offers ultra-low rolling resistance and high load capacity, increasing daily ranges.

- May 2022: ZC Rubber recently launched its new Westlake and Goodride flagship range of ultra-high-performance passenger car tires for the European market at Tire Cologne 2022. The tire range also offers a 5% reduction in overall rolling resistance owing to its redesigned tire profile based on ZC rubber's updated design configuration. The tires also add improved handling and grip performance in wet conditions as well.

- March 2022: Pirelli unveiled its new range of aftermarket tires for electric vehicles in North America. The tires offer a reduction in rolling resistance by 15%, specifically made for Lucid Air Dream Edition or Tesla Model S All-Wheel Drive.

- February 2022: Yokohama Tire Corporation announced the launch of tires with sustainable materials for Supercars. The company would produce synthetic rubber from biomass and recyclable thermo-reversible rubber.

Strategic Automotive Green Tires Market Market Forecast

The Automotive Green Tires Market is poised for substantial growth, driven by the accelerating global transition to sustainable mobility solutions. The forecast period (2025–2033) will witness a significant surge in demand for green tires, primarily fueled by the burgeoning electric vehicle (EV) market and the continuous tightening of environmental regulations across major automotive economies. Innovations in eco-friendly materials, such as advanced bio-based compounds and increased use of recycled components, will become industry standards, enhancing both performance and sustainability. The market will also benefit from growing consumer awareness regarding the long-term cost advantages of low rolling resistance tires, including improved fuel efficiency and extended tire lifespan. Strategic partnerships between tire manufacturers and automotive OEMs will be crucial in integrating these advanced green tire technologies into new vehicle platforms, further solidifying their market presence and driving adoption. The increasing focus on a circular economy will also present opportunities for companies investing in tire recycling and sustainable end-of-life management solutions.

Automotive Green Tires Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. End-User Type

- 2.1. OEM

- 2.2. Aftermarket

Automotive Green Tires Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Automotive Green Tires Market Regional Market Share

Geographic Coverage of Automotive Green Tires Market

Automotive Green Tires Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electric Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. High Cost May Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Electric Vehicle Sales is Likely to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Green Tires Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Green Tires Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by End-User Type

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Green Tires Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by End-User Type

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Green Tires Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by End-User Type

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Green Tires Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by End-User Type

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 CEAT Limite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Yokohama Tire Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toyo Tire Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Michelin Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Apollo Tyres Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pirelli & C Spa

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 MRF Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Goodyear Tire & Rubber Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bridgestone Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 CEAT Limite

List of Figures

- Figure 1: Global Automotive Green Tires Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Green Tires Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Green Tires Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Green Tires Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 5: North America Automotive Green Tires Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 6: North America Automotive Green Tires Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Green Tires Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Green Tires Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Automotive Green Tires Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Automotive Green Tires Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 11: Europe Automotive Green Tires Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 12: Europe Automotive Green Tires Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Green Tires Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Green Tires Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Green Tires Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Green Tires Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Green Tires Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Green Tires Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Green Tires Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Green Tires Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Automotive Green Tires Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Automotive Green Tires Market Revenue (Million), by End-User Type 2025 & 2033

- Figure 23: Rest of the World Automotive Green Tires Market Revenue Share (%), by End-User Type 2025 & 2033

- Figure 24: Rest of the World Automotive Green Tires Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Green Tires Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Green Tires Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Green Tires Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 3: Global Automotive Green Tires Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Green Tires Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Green Tires Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 6: Global Automotive Green Tires Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Green Tires Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Green Tires Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 12: Global Automotive Green Tires Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Green Tires Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Green Tires Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 19: Global Automotive Green Tires Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Green Tires Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Green Tires Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 27: Global Automotive Green Tires Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: United Arab Emirates Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Other Countries Automotive Green Tires Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Green Tires Market?

The projected CAGR is approximately 11.02%.

2. Which companies are prominent players in the Automotive Green Tires Market?

Key companies in the market include CEAT Limite, Yokohama Tire Corporation, Toyo Tire Corporation, Michelin Group, Continental AG, Apollo Tyres Limited, Pirelli & C Spa, MRF Limited, Goodyear Tire & Rubber Company, Bridgestone Corporation.

3. What are the main segments of the Automotive Green Tires Market?

The market segments include Vehicle Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 120.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electric Vehicle Sales.

6. What are the notable trends driving market growth?

Electric Vehicle Sales is Likely to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost May Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Sumitomo Rubber Industries announced the launch of Falken e.ZIEX's new line of replacement tires for the electric vehicles fleet across Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Green Tires Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Green Tires Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Green Tires Market?

To stay informed about further developments, trends, and reports in the Automotive Green Tires Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence