Key Insights

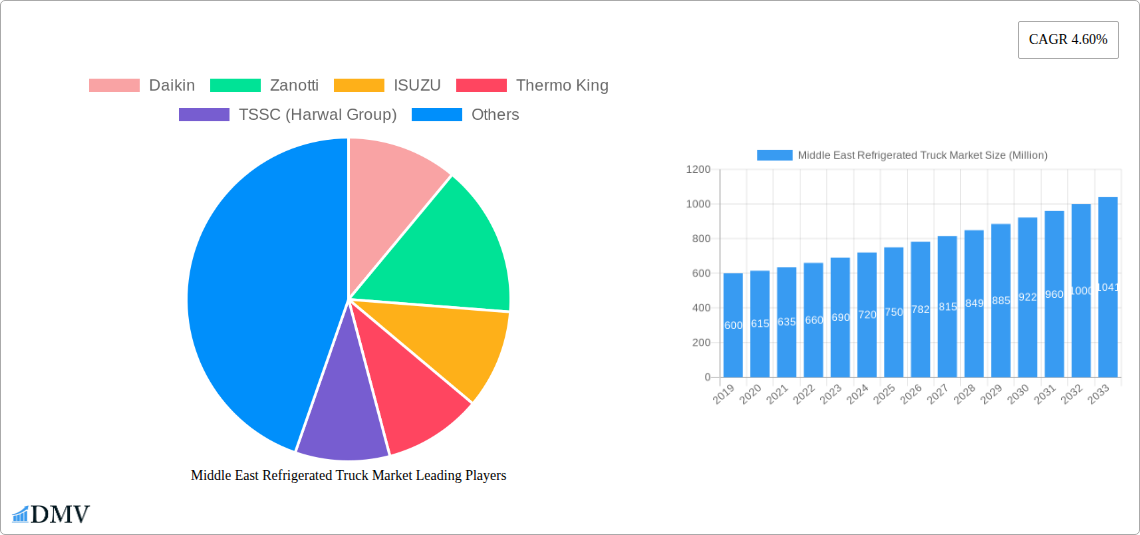

The Middle East Refrigerated Truck Market is poised for robust growth, projected to reach USD 0.84 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This expansion is primarily fueled by the increasing demand for temperature-sensitive goods, particularly in the food and beverage and healthcare and pharmaceutical sectors across the region. The burgeoning populations in countries like Saudi Arabia and the UAE, coupled with significant investments in logistics and supply chain infrastructure, are creating a fertile ground for refrigerated transportation solutions. Furthermore, the ongoing development of cold chain logistics, driven by government initiatives and private sector investments aimed at improving food security and access to medicines, acts as a significant catalyst for market growth.

Middle East Refrigerated Truck Market Market Size (In Million)

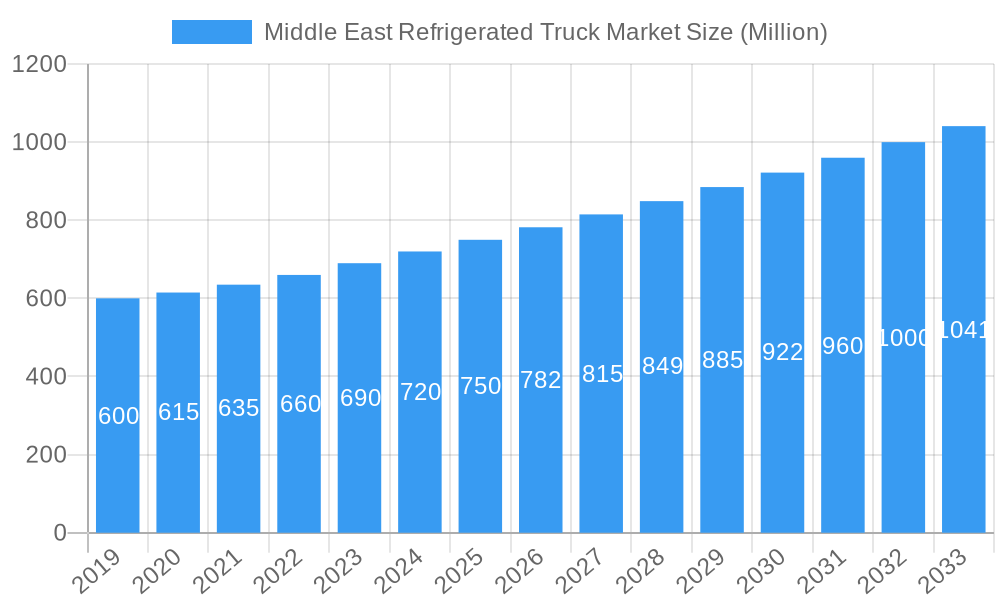

The market segmentation reflects the diverse needs within the Middle East. Light Commercial Vehicles (LCVs) are expected to witness substantial adoption due to their flexibility and suitability for last-mile delivery of perishable goods. In terms of tonnage capacity, trucks with less than 10 tons are likely to dominate, catering to the increasing e-commerce and fresh produce delivery services. Key end-users such as Food and Beverages and Healthcare and Pharmaceuticals are the primary demand drivers, necessitating reliable and efficient refrigerated transport. Leading companies like Thermo King, Carrier Transicold, and Daikin are actively innovating and expanding their presence in the region, offering advanced cooling technologies and integrated fleet management solutions to meet the evolving market demands. The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, all striving to capture market share by offering cost-effective and technologically advanced refrigerated trucking solutions.

Middle East Refrigerated Truck Market Company Market Share

Middle East Refrigerated Truck Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth market research report provides a meticulously analyzed overview of the Middle East Refrigerated Truck Market. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report offers invaluable insights for stakeholders seeking to understand market dynamics, growth drivers, and emerging opportunities. Dive deep into market segmentation by vehicle type (LCV, MCV, HCV), tonnage capacity (<10 tons, 10-20 tons, >20 tons), and end-user industries (Food & Beverages, Agriculture, Healthcare & Pharmaceuticals, Others). Gain a strategic advantage with our expert analysis of market composition, industry evolution, leading regions, product innovations, growth catalysts, obstacles, and future prospects.

Middle East Refrigerated Truck Market Market Composition & Trends

The Middle East refrigerated truck market is characterized by a dynamic interplay of established players and emerging innovators, with market concentration shifting due to strategic M&A activities and a growing demand for specialized cold chain solutions. Innovation catalysts are primarily driven by the need for enhanced fuel efficiency, stricter temperature control, and compliance with evolving food safety and pharmaceutical regulations across the GCC and MENA regions. Substitutes, while present in the form of traditional refrigerated containers for stationary storage, are less effective for the critical last-mile delivery segment. End-user profiles reveal a strong reliance on the Food and Beverages sector, closely followed by Agriculture and the rapidly expanding Healthcare and Pharmaceuticals industry, necessitating advanced refrigerated transport solutions. Market share distribution is influenced by the capacity of manufacturers to deliver reliable and cost-effective refrigerated trucks capable of withstanding the region's challenging climatic conditions. Merger and acquisition deals, valued in the tens of millions, are strategically reshaping the competitive landscape as key companies aim to broaden their product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with key global players holding significant shares.

- Innovation Catalysts: Growing demand for cold chain logistics, stringent temperature control requirements, advancements in cooling technologies, and regional infrastructure development.

- Regulatory Landscapes: Increasing focus on food safety standards, pharmaceutical cold chain integrity, and emissions regulations impacting truck design and operations.

- Substitute Products: Traditional refrigerated containers (limited for transport), insulated trucks without active cooling (unsuitable for prolonged transport).

- End-User Profiles:

- Food and Beverages: Dominant user, requiring transport for fresh produce, dairy, frozen goods, and processed foods.

- Agriculture: Growing demand for transporting perishable agricultural products from farms to markets.

- Healthcare and Pharmaceuticals: Critical need for temperature-controlled transport of vaccines, medicines, and biological samples.

- Other End Users: Including floriculture, laboratory samples, and specialized industrial goods requiring temperature maintenance.

- M&A Activities: Strategic acquisitions aimed at expanding market presence and product offerings, with deal values estimated in the range of $10 million to $50 million.

Middle East Refrigerated Truck Market Industry Evolution

The Middle East refrigerated truck market has undergone a significant transformation over the historical period (2019-2024) and is poised for substantial growth in the coming years. Market growth trajectories are being propelled by a confluence of factors including increasing disposable incomes, a burgeoning tourism sector driving demand for diverse food products, and a proactive government push towards diversifying economies away from oil dependency, which includes investments in robust logistics and cold chain infrastructure. Technological advancements have been a cornerstone of this evolution, with manufacturers continuously innovating to introduce more energy-efficient and environmentally friendly cooling systems. The adoption of electric and hybrid refrigerated trucks is gaining traction, albeit at an early stage, driven by sustainability goals and increasing operational cost considerations. Shifting consumer demands play a crucial role, with a growing preference for fresh, organic, and ready-to-eat food products that necessitate sophisticated cold chain management from farm to fork. The expansion of e-commerce and online grocery delivery services has further amplified the need for reliable and temperature-controlled last-mile delivery solutions. Specific data points indicate a compound annual growth rate (CAGR) in the range of 6-8% during the forecast period, driven by increased fleet modernization and the introduction of advanced telematics for real-time temperature monitoring and route optimization. Adoption metrics for advanced cooling technologies, such as variable speed compressors and advanced insulation materials, have seen a significant uptick, contributing to reduced operational costs and enhanced product integrity. The market's evolution is a testament to its increasing maturity and its critical role in supporting the region's economic development and improving the quality of life for its residents. The robust investments in cold storage facilities and the development of intermodal transportation networks further solidify the indispensable nature of refrigerated trucks in the regional supply chain.

Leading Regions, Countries, or Segments in Middle East Refrigerated Truck Market

The United Arab Emirates (UAE) consistently emerges as a leading region in the Middle East refrigerated truck market, driven by its advanced infrastructure, strategic geographical location as a global trade hub, and a strong focus on economic diversification through sectors like food processing, healthcare, and logistics. Within the UAE, Dubai and Abu Dhabi are particularly significant markets, attracting substantial investment in cold chain logistics and advanced transportation solutions. The Food and Beverages segment represents the dominant end-user sector, accounting for an estimated 40-45% of the total market demand. This is due to the region's large expatriate population, a thriving hospitality industry, and a growing demand for imported and locally sourced perishable goods.

Dominant Region/Country: United Arab Emirates (UAE)

- Key Drivers:

- Investment Trends: Significant government and private sector investment in logistics and cold chain infrastructure, aiming to position the UAE as a regional hub for food and pharmaceutical distribution.

- Regulatory Support: Favorable trade policies, simplified customs procedures, and initiatives promoting food security and healthcare standards.

- Economic Diversification: Strong emphasis on non-oil sectors, leading to increased demand for efficient supply chain solutions.

- Infrastructure Development: World-class ports, airports, and road networks facilitating seamless transportation.

- Key Drivers:

Dominant Segment: Food and Beverages End User

- Analysis of Dominance: The UAE's status as a major consumer market, coupled with its role as a re-export hub, creates a perpetual demand for refrigerated trucks to transport a vast array of perishable goods. This includes fresh produce, dairy products, frozen foods, seafood, and processed meats. The growth of modern retail formats, hypermarkets, and the burgeoning e-commerce grocery sector further amplifies this demand. The increasing consumer preference for a wider variety of food products, including imported exotic fruits and vegetables, necessitates a sophisticated and reliable cold chain network. Furthermore, the country's large tourism sector sustains a high demand from hotels, restaurants, and catering services that rely heavily on uninterrupted cold chain logistics. The presence of major food and beverage manufacturers and distributors also contributes significantly to the market size within this segment. The continuous expansion of the food processing industry in the UAE, with a focus on value-added products, further bolsters the need for specialized refrigerated transport.

Vehicle Type Dominance: Heavy Commercial Vehicles (HCV) often lead in terms of volume and value due to the long-haul transportation of large quantities of goods across the country and for re-export. However, Light Commercial Vehicles (LCV) are experiencing rapid growth due to the increasing demand for last-mile delivery in urban centers.

Tonnage Capacity Dominance: The 10-20 tons capacity segment is highly prevalent, offering a balance between payload and maneuverability for urban and inter-city logistics. However, larger capacities (>20 tons) are crucial for bulk transport, particularly for major distribution centers and export operations.

End User Dominance Analysis (Food and Beverages): The UAE's consumer base, coupled with its role as a vital trading hub, fuels an insatiable demand for a wide range of perishable food products. This includes everything from fresh produce and dairy to frozen goods and prepared meals. The sophisticated retail landscape, encompassing hypermarkets, supermarkets, and the rapidly expanding online grocery delivery services, further underscores the critical need for efficient and reliable refrigerated transport solutions. The hospitality sector, with its numerous hotels, restaurants, and catering services, also represents a significant and consistent consumer of refrigerated logistics. The growth of the food processing industry within the UAE, with an increasing focus on value-added products, further solidifies the dominance of this end-user segment.

Middle East Refrigerated Truck Market Product Innovations

Product innovations in the Middle East refrigerated truck market are centered on enhancing thermal efficiency, reducing operational costs, and improving cargo integrity. Manufacturers are actively developing advanced insulation technologies using composite materials that offer superior R-values, minimizing heat ingress and reducing reliance on cooling units. The integration of smart telematics systems is a significant advancement, enabling real-time monitoring of temperature, humidity, and cargo location, with alerts for any deviations. Furthermore, there's a growing emphasis on eco-friendly refrigeration units powered by electric auxiliary power units (APUs) or hybrid systems, catering to stricter environmental regulations and corporate sustainability goals. Performance metrics are improving with the introduction of variable speed compressors and enhanced airflow systems, ensuring more consistent and precise temperature control, crucial for sensitive pharmaceutical shipments and premium food products.

Propelling Factors for Middle East Refrigerated Truck Market Growth

Several key factors are propelling the growth of the Middle East refrigerated truck market. Economically, a growing population, rising disposable incomes, and increasing urbanization are driving demand for perishable goods. Technologically, advancements in refrigeration systems are leading to more efficient, reliable, and environmentally friendly solutions. Regulatory influences, such as stricter food safety and pharmaceutical cold chain regulations, mandate the use of specialized refrigerated transport. Furthermore, significant government investments in infrastructure development, including logistics hubs and cold storage facilities, are creating a favorable ecosystem for market expansion. The booming e-commerce sector and the increasing popularity of online grocery shopping are also significant growth catalysts, demanding efficient last-mile cold chain delivery.

Obstacles in the Middle East Refrigerated Truck Market Market

Despite robust growth, the Middle East refrigerated truck market faces several obstacles. High initial investment costs for advanced refrigerated trucks and cooling units can be a deterrent for smaller operators. Intense competition among manufacturers and service providers can lead to price pressures, impacting profit margins. Fluctuations in fuel prices and evolving emission standards pose ongoing challenges for operational costs and fleet management. Additionally, supply chain disruptions, including the availability of skilled technicians for maintenance and repair in remote areas, can impact the operational efficiency of fleets. Navigating diverse and evolving regulatory frameworks across different countries within the region can also present administrative hurdles.

Future Opportunities in Middle East Refrigerated Truck Market

Emerging opportunities in the Middle East refrigerated truck market are abundant. The rapid expansion of the pharmaceutical sector, particularly in the region's focus on vaccine distribution and biopharmaceutical logistics, presents a significant growth avenue. The increasing demand for organic and gourmet food products, coupled with the growth of cloud kitchens and meal delivery services, will fuel the need for specialized temperature-controlled transport. The development of smart cities and the focus on last-mile delivery optimization create opportunities for smaller, agile refrigerated LCVs and innovative delivery solutions. Furthermore, the growing emphasis on sustainability and the potential for wider adoption of electric and hydrogen-powered refrigerated trucks offer a significant long-term opportunity. Exploring untapped markets in countries with developing cold chain infrastructure also presents considerable potential for market expansion.

Major Players in the Middle East Refrigerated Truck Market Ecosystem

- Daikin

- Zanotti

- ISUZU

- Thermo King

- TSSC (Harwal Group)

- Schmitz Cargobull

- Carrier

- Frigoblock

- Carrier Transicold

- Foton Group

- KRONE

Key Developments in Middle East Refrigerated Truck Market Industry

- 2023: Daikin announced expansion plans for its Middle East operations, focusing on increased production and service capabilities for its refrigerated transport solutions.

- 2023: Thermo King (a division of Trane Technologies) launched a new generation of energy-efficient refrigeration units designed for the harsh Middle Eastern climate.

- 2024: Carrier Transicold secured a significant contract to supply refrigeration units for a major food distributor in Saudi Arabia, highlighting the growing demand in the kingdom.

- 2024: TSSC (Harwal Group) expanded its manufacturing facility in the UAE to meet the increasing local and regional demand for customized refrigerated truck bodies.

- 2024: Zanotti introduced new compact refrigeration units specifically designed for light commercial vehicles, catering to the growing last-mile delivery segment.

Strategic Middle East Refrigerated Truck Market Market Forecast

The strategic Middle East refrigerated truck market forecast indicates robust and sustained growth driven by a confluence of economic, technological, and demographic factors. The increasing investment in cold chain infrastructure, coupled with supportive government initiatives aimed at enhancing food security and healthcare logistics, will continue to be significant growth catalysts. The burgeoning e-commerce sector and the evolving consumer preferences for fresh, temperature-sensitive products will further amplify demand for reliable refrigerated transport solutions. Advancements in sustainable cooling technologies and the gradual adoption of electric and hybrid refrigerated trucks are expected to shape the future market landscape. The forecast anticipates a significant rise in the adoption of smart telematics for enhanced fleet management and cargo visibility, leading to more efficient and secure cold chain operations. Overall, the market presents a highly promising outlook for stakeholders positioned to capitalize on the region's dynamic growth.

Middle East Refrigerated Truck Market Segmentation

-

1. Vehicle Type

- 1.1. Light Commercial Vehicle (LCV)

- 1.2. Medium Commercial Vehicle (MCV)

- 1.3. Heavy Commercial Vehicle (HCV)

-

2. Tonnage Capacity

- 2.1. Less than 10 tons

- 2.2. 10-20 tons

- 2.3. More than 20 tons

-

3. End User

- 3.1. Food and Beverages

- 3.2. Agriculture

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Other End Users

Middle East Refrigerated Truck Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Refrigerated Truck Market Regional Market Share

Geographic Coverage of Middle East Refrigerated Truck Market

Middle East Refrigerated Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing food and pharmaceutical industries

- 3.3. Market Restrains

- 3.3.1. Limited awareness of advanced technology and specialized solutions

- 3.4. Market Trends

- 3.4.1. Heavy Commercial Vehicle (HCV) increase the Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Refrigerated Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light Commercial Vehicle (LCV)

- 5.1.2. Medium Commercial Vehicle (MCV)

- 5.1.3. Heavy Commercial Vehicle (HCV)

- 5.2. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.2.1. Less than 10 tons

- 5.2.2. 10-20 tons

- 5.2.3. More than 20 tons

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverages

- 5.3.2. Agriculture

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Daikin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zanotti

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ISUZU

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thermo King

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TSSC (Harwal Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schmitz Cargobull*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carrier

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Frigoblock

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carrier Transicold

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Foton Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRONE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Daikin

List of Figures

- Figure 1: Middle East Refrigerated Truck Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Refrigerated Truck Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Refrigerated Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Middle East Refrigerated Truck Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 3: Middle East Refrigerated Truck Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Middle East Refrigerated Truck Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Refrigerated Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Middle East Refrigerated Truck Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 7: Middle East Refrigerated Truck Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Middle East Refrigerated Truck Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East Refrigerated Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Refrigerated Truck Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Middle East Refrigerated Truck Market?

Key companies in the market include Daikin, Zanotti, ISUZU, Thermo King, TSSC (Harwal Group), Schmitz Cargobull*List Not Exhaustive, Carrier, Frigoblock, Carrier Transicold, Foton Group, KRONE.

3. What are the main segments of the Middle East Refrigerated Truck Market?

The market segments include Vehicle Type, Tonnage Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing food and pharmaceutical industries.

6. What are the notable trends driving market growth?

Heavy Commercial Vehicle (HCV) increase the Demand in the Market.

7. Are there any restraints impacting market growth?

Limited awareness of advanced technology and specialized solutions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Refrigerated Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Refrigerated Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Refrigerated Truck Market?

To stay informed about further developments, trends, and reports in the Middle East Refrigerated Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence