Key Insights

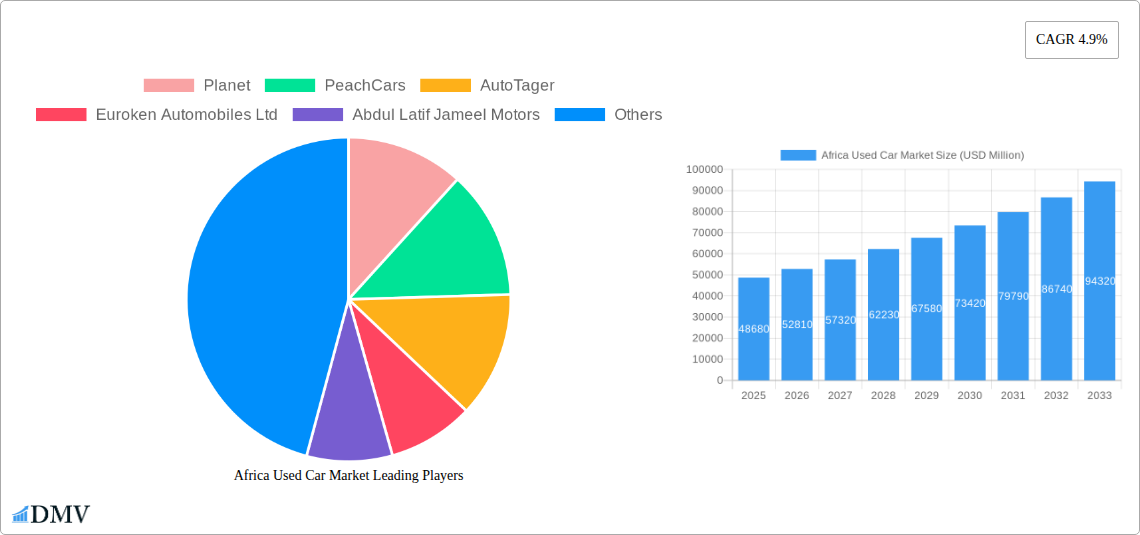

The Africa Used Car Market is poised for robust expansion, projected to reach USD 48.68 billion in 2025, with an impressive CAGR of 8.65% anticipated through 2033. This growth is fueled by a confluence of factors, most notably the increasing disposable incomes across key African nations and a burgeoning middle class actively seeking affordable and reliable personal transportation. The demand for pre-owned vehicles is further amplified by the limited availability and high cost of new cars, making used cars a more accessible option for a wider segment of the population. Key drivers include government initiatives aimed at improving road infrastructure, which enhances the usability and appeal of vehicles, and a growing awareness and trust in the organized used car vendor segment, which offers greater transparency, warranty options, and financing solutions. The market also benefits from the increasing penetration of digital platforms and online marketplaces that connect buyers and sellers more efficiently, streamlining the purchase process.

Africa Used Car Market Market Size (In Billion)

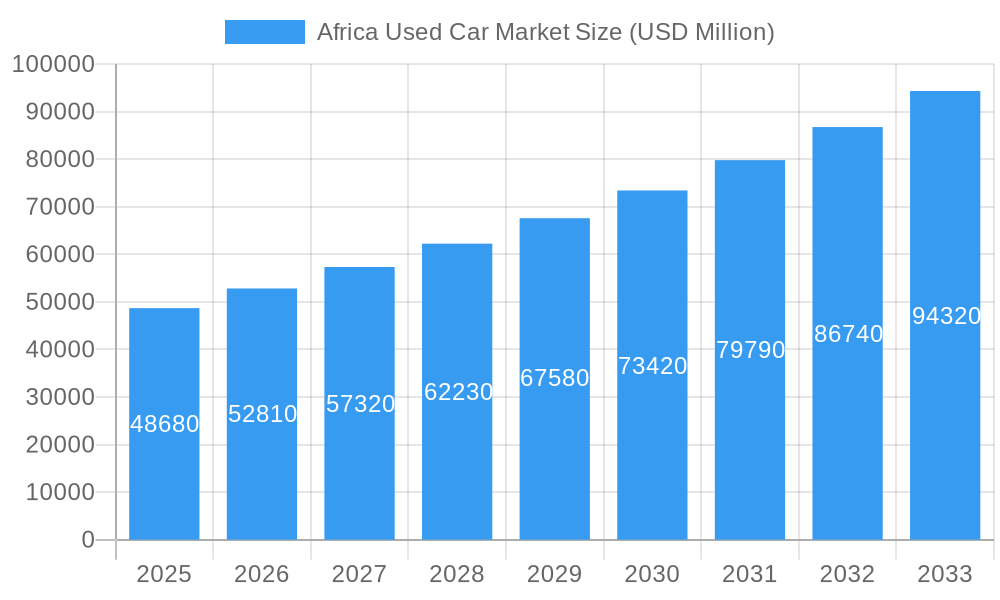

The market's dynamism is further shaped by evolving consumer preferences and technological advancements. Vehicle types like SUVs and sedans are seeing sustained demand due to their versatility and comfort, catering to both urban commuting and family needs. While the used car market presents a compelling value proposition, challenges persist, including concerns about vehicle quality and maintenance history, and the prevalence of informal transactions. However, the growth of organized vendors like Autochek Africa, AutoTager, and Carzami, alongside established players like Planet and PeachCars, is actively addressing these concerns, fostering greater consumer confidence. Regional growth is led by economic powerhouses such as Nigeria, South Africa, and Egypt, with significant contributions also expected from Kenya, Ethiopia, and Morocco. The increasing adoption of online sales models and the emergence of innovative financing options are set to further accelerate market penetration across the continent, creating a more mature and trustworthy used car ecosystem.

Africa Used Car Market Company Market Share

Dive deep into the burgeoning Africa used car market, a rapidly evolving landscape projected to reach multi-billion dollar valuations by 2033. This in-depth report offers an unparalleled analysis of market dynamics, key players, and future trajectories. Covering the historical period (2019-2024), base year (2025), estimated year (2025), and an extensive forecast period (2025-2033), this report is an indispensable resource for stakeholders seeking to capitalize on the continent's massive automotive potential. Explore the dominance of used SUVs, the rise of organized vendors, and the impact of digitalization on one of the world's fastest-growing pre-owned vehicle markets.

Africa Used Car Market Market Composition & Trends

The Africa used car market exhibits a dynamic composition characterized by a growing concentration of organized players leveraging technology to enhance transparency and efficiency. Innovation is catalyzed by the increasing adoption of digital platforms for listings, inspections, and financing, directly impacting market share distribution across various vehicle types including hatchbacks, sedans, Sports Utility Vehicles (SUVs), and Multi-Purpose Vehicles (MPVs). Regulatory landscapes are gradually maturing, fostering trust and encouraging investment, though significant regional variations persist. Substitute products, while present, are increasingly challenged by the convenience and verifiable quality offered by reputable used car dealers. End-user profiles are diversifying, with a growing middle class and young demographic driving demand for affordable and reliable transportation. Mergers and acquisitions (M&A) are shaping the market, with significant deals, potentially reaching hundreds of billions in value, consolidating market power and expanding reach. The unorganized sector, while still substantial, is facing increasing pressure from organized entities that offer greater consumer protection and a wider selection of inspected vehicles.

- Market Concentration: A steady shift towards organized vendors, driven by technological integration and a focus on quality assurance.

- Innovation Catalysts: Digital marketplaces, AI-powered inspection tools, and fintech solutions for vehicle financing.

- Regulatory Landscapes: Evolving frameworks aimed at increasing consumer protection and standardizing vehicle inspections across key African economies.

- Substitute Products: While traditional informal channels exist, their market share is being eroded by formalized and transparent online platforms.

- End-User Profiles: Expanding to include younger demographics, first-time buyers, and small businesses seeking cost-effective transportation solutions.

- M&A Activities: Key acquisitions and partnerships are consolidating market leadership and driving expansion into new regions, with deal values projected to reach hundreds of billions.

Africa Used Car Market Industry Evolution

The Africa used car market has undergone a significant transformation over the historical period (2019-2024) and is poised for exponential growth throughout the forecast period (2025-2033). Driven by a confluence of demographic shifts, economic development, and rapid technological adoption, the market's growth trajectory is characterized by increasing accessibility and a growing appetite for pre-owned vehicles across the continent. Technological advancements have been pivotal, with the proliferation of online marketplaces and mobile applications revolutionizing how consumers discover, inspect, and purchase used cars. This digitalization has not only streamlined the buying process but also injected much-needed transparency into a previously opaque market. The adoption of advanced vehicle inspection technologies and digital vehicle history reports has significantly boosted consumer confidence, a critical factor for sustained market expansion. Shifting consumer demands are also playing a crucial role; as disposable incomes rise in various African nations, there's a burgeoning demand for reliable and affordable personal mobility solutions. This is particularly evident in the increasing preference for Sports Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs), reflecting changing lifestyle needs and family sizes. Furthermore, the growing awareness and demand for electric and hybrid used vehicles, though still nascent, represents a significant future trend. The growth rate of the Africa used car market is expected to consistently outpace that of new car sales, with projected annual growth rates in the high single digits to low double digits. This robust expansion is fueled by a young and growing population, a burgeoning middle class, and increasing urbanization, all of which contribute to a sustained demand for vehicular transportation. The entry of established automotive players and the emergence of agile local startups are further intensifying competition and innovation within the sector. The unorganized sector, while still a significant part of the market, is gradually being formalized, with many independent dealers integrating digital tools and adopting more professional sales practices. This evolution is crucial for building a sustainable and trustworthy used car ecosystem across Africa. The overall industry evolution is marked by increasing sophistication, customer-centricity, and a growing emphasis on sustainability and technological integration, setting the stage for unprecedented growth in the coming decade.

Leading Regions, Countries, or Segments in Africa Used Car Market

The Africa used car market is experiencing robust growth across various regions and segments, with distinct leaders emerging due to a combination of economic strength, demographic trends, and strategic investment. Among the Vehicle Types, Sports Utility Vehicles (SUVs) are demonstrably leading the market share. Their popularity is driven by the diverse African terrain, the growing need for family-oriented transportation, and aspirational consumer trends mirroring global preferences. The robustness and versatility of SUVs make them ideal for both urban commuting and off-road capabilities, a critical factor in many African countries. Following closely are Sedans and Hatchbacks, which continue to command significant demand, particularly in densely populated urban centers where fuel efficiency and maneuverability are paramount. Multi-Purpose Vehicles (MPVs) also hold a substantial share, catering to larger families and commercial transport needs.

In terms of Vendor types, the Organized sector is rapidly gaining dominance. This shift is propelled by significant investments from both local and international entities, leading to the establishment of professional dealerships, online marketplaces, and certified pre-owned programs. These organized players offer greater transparency, standardized inspection processes, warranty options, and easier financing solutions, which are increasingly valued by consumers. The Unorganized sector, while still prevalent, is facing increasing pressure to adapt to these evolving market standards.

Geographically, North Africa and Sub-Saharan Africa, particularly countries like Nigeria, South Africa, Egypt, Kenya, and Ghana, are leading the charge. These regions benefit from larger populations, growing middle classes, and a more established automotive infrastructure.

Dominant Vehicle Type Drivers (SUVs):

- Favorable Terrain: Adaptability to varied road conditions across the continent.

- Growing Middle Class: Increased disposable income enabling purchase of aspirational vehicle types.

- Family Needs: Larger capacity and safety features appealing to growing families.

- Lifestyle Trends: Influence of global automotive preferences and a desire for versatile vehicles.

Leading Vendor Drivers (Organized):

- Technological Integration: Adoption of digital platforms for sales, marketing, and customer service.

- Increased Transparency: Certified inspection processes and vehicle history reports build consumer trust.

- Financing Accessibility: Partnerships with financial institutions to offer tailored loan and leasing options.

- Brand Reputation & Trust: Professionalism and established brands instill confidence in buyers.

- Investment Influx: Significant capital injection from venture capitalists and established automotive groups.

Key Country/Regional Drivers:

- Large and Young Population: A demographic dividend translating into sustained demand for mobility.

- Economic Growth: Rising disposable incomes and expanding economies fuel vehicle purchases.

- Urbanization: Concentration of population in cities increases demand for personal transportation.

- Regulatory Support: Evolving policies that encourage investment and standardize the used car market.

- Infrastructure Development: Improvements in road networks facilitate vehicle accessibility and usability.

Africa Used Car Market Product Innovations

The Africa used car market is witnessing a surge in product innovations aimed at enhancing customer trust, streamlining the buying experience, and expanding accessibility. Digital inspection platforms are a prime example, utilizing advanced imaging and diagnostic tools to provide detailed reports on vehicle condition, thereby mitigating the risk of purchasing a faulty vehicle. Many platforms now offer augmented reality (AR) features, allowing potential buyers to virtually explore vehicles from the comfort of their homes. The integration of artificial intelligence (AI) in pricing algorithms ensures competitive and transparent pricing, while AI-powered recommendation engines help match buyers with suitable vehicles based on their preferences and budget. Performance metrics are increasingly tied to the quality of inspection, the comprehensiveness of digital reports, and the ease of online transactions. Unique selling propositions often revolve around guaranteed warranties on inspected vehicles, doorstep delivery services, and seamless financing options facilitated through partnerships with fintech companies. Technological advancements are also focusing on the development of pre-owned electric vehicle (EV) markets, with specialized inspection protocols for battery health and performance.

Propelling Factors for Africa Used Car Market Growth

The Africa used car market is propelled by a robust combination of demographic, economic, and technological factors. A young and rapidly growing population, coupled with increasing urbanization, creates a sustained demand for affordable personal transportation. Economic growth across several African nations is leading to a rising middle class with enhanced purchasing power, many of whom opt for reliable used vehicles as a cost-effective entry into car ownership. Technological advancements, particularly the proliferation of mobile internet and sophisticated online marketplaces, are democratizing access to used cars, increasing transparency, and simplifying the buying process. Government initiatives aimed at promoting local automotive industries and improving road infrastructure also indirectly support the used car market by enhancing vehicle availability and usability.

- Demographic Dividend: A large youth population entering the workforce and requiring mobility solutions.

- Economic Expansion: Rising disposable incomes and a burgeoning middle class.

- Digital Revolution: Widespread mobile penetration and advanced e-commerce platforms.

- Urbanization: Increased need for personal and commercial transport in growing cities.

- Cost-Effectiveness: Used cars offer a more accessible entry point to vehicle ownership compared to new ones.

Obstacles in the Africa Used Car Market Market

Despite its immense potential, the Africa used car market faces several significant obstacles. Regulatory inconsistencies and a lack of standardized inspection protocols across different countries can lead to consumer distrust and hinder cross-border trade. Supply chain disruptions, exacerbated by global economic volatility and logistical challenges unique to the continent, can impact the availability and pricing of vehicles. Intense competition from both organized and unorganized players, coupled with the prevalence of informal sales channels, can create pricing pressures and make it challenging for legitimate businesses to gain market share. Furthermore, limited access to affordable financing options for many consumers remains a substantial barrier, restricting purchasing power. The presence of fraudulent practices and the difficulty in verifying vehicle history in certain markets also continue to erode consumer confidence.

- Regulatory Fragmentation: Inconsistent standards for vehicle inspection and sales across regions.

- Logistical Challenges: Inefficient transportation networks and import/export complexities.

- Informal Market Dominance: Difficulty in formalizing transactions and ensuring fair pricing.

- Financing Gaps: Limited access to credit for a large segment of potential buyers.

- Trust Deficit: Concerns about vehicle condition, mileage tampering, and fraudulent listings.

Future Opportunities in Africa Used Car Market

The Africa used car market is ripe with future opportunities, driven by evolving consumer trends and technological advancements. The burgeoning demand for pre-owned electric vehicles (EVs) presents a significant untapped market, requiring specialized inspection and sales infrastructure. The expansion of digital financing solutions and partnerships with fintech companies will further unlock purchasing power for a wider demographic. Increased investment in vehicle refurbishment and certification programs can elevate the perceived value and reliability of used cars. Furthermore, exploring opportunities in emerging markets within Africa, alongside developing robust cross-border trade frameworks, can unlock substantial growth potential. The growing demand for fleet management solutions for businesses also presents a niche opportunity for organized used car providers.

- Pre-Owned EV Market: Catering to the growing interest in sustainable transportation.

- Digital Financing Expansion: Leveraging fintech for accessible and innovative loan products.

- Vehicle Refurbishment & Certification: Enhancing the quality and appeal of used vehicles.

- Emerging Market Penetration: Tapping into markets with nascent but rapidly growing automotive needs.

- Fleet Management Services: Providing cost-effective vehicle solutions for businesses.

Major Players in the Africa Used Car Market Ecosystem

- Planet

- PeachCars

- AutoTager

- Euroken Automobiles Ltd

- Abdul Latif Jameel Motors

- Cars 4 Africa

- Cardealers africa

- Global Cars Trading FZ LLC

- cars2africa

- Autochek Africa

- AutoTrader South Africa

- Cars

- KIFAL Auto

- Abi Sayara

- Al-Futtaim Group

- Mogo Auto LTD

- Schulenburg Motors

- We Buy Cars (Pty) Ltd

- Yallamotor

- Carzami

- OLX Group

- CarMax East Africa Lt

- Sylndr

Key Developments in Africa Used Car Market Industry

- May 2023: Nigeria-based Cars45 and Jiji signed a new deal with Suzuki. This collaboration aims to revolutionize used car buying and selling by combining the strengths of all three players. Suzuki is utilizing the expertise and resources of Cars45 and Jiji to enhance market growth. Additionally, inspected and verified Suzuki used cars will be showcased on the Cars45 platform.

- May 2022: Autochek Africa, an online marketplace for new and used cars company based in Nigeria, has acquired Morocco's KIFAL Auto, a leading auto marketplace, for an undisclosed amount, marking the entry of the vehicle marketplace into North Africa and aim to expand Autochek's business in the North Africa region.

Strategic Africa Used Car Market Market Forecast

The strategic forecast for the Africa used car market is overwhelmingly positive, driven by sustained demand from a young, growing population and accelerating economic development. Key growth catalysts include the continued digitalization of the sales process, enhancing transparency and accessibility, and the increasing adoption of innovative financing solutions that empower a wider segment of consumers. The rising popularity of SUVs and other versatile vehicle types, coupled with nascent but promising growth in the pre-owned EV sector, indicates a dynamic shift in consumer preferences. Investments in infrastructure and evolving regulatory frameworks are further solidifying the market's potential. The Africa used car market is poised for substantial expansion, offering significant opportunities for stakeholders who can effectively navigate its unique challenges and capitalize on its immense growth prospects over the forecast period of 2025-2033.

Africa Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Africa Used Car Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Used Car Market Regional Market Share

Geographic Coverage of Africa Used Car Market

Africa Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Investments by Several Companies is Likely to Strengthen the Demand Trajectory for Used Car Market -

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Planet

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PeachCars

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AutoTager

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Euroken Automobiles Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abdul Latif Jameel Motors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cars 4 Africa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cardealers africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Global Cars Trading FZ LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 cars2africa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autochek Africa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AutoTrader South Africa

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cars

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 KIFAL Auto

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Abi Sayara

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Al-Futtaim Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Mogo Auto LTD

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Schulenburg Motors

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 We Buy Cars (Pty) Ltd

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Yallamotor

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Carzami

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 OLX Group

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 CarMax East Africa Lt

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Sylndr

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 Planet

List of Figures

- Figure 1: Africa Used Car Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Used Car Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Africa Used Car Market Revenue undefined Forecast, by Vendor 2020 & 2033

- Table 3: Africa Used Car Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Africa Used Car Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Africa Used Car Market Revenue undefined Forecast, by Vendor 2020 & 2033

- Table 6: Africa Used Car Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Used Car Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Used Car Market?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Africa Used Car Market?

Key companies in the market include Planet, PeachCars, AutoTager, Euroken Automobiles Ltd, Abdul Latif Jameel Motors, Cars 4 Africa, Cardealers africa, Global Cars Trading FZ LLC, cars2africa, Autochek Africa, AutoTrader South Africa, Cars, KIFAL Auto, Abi Sayara, Al-Futtaim Group, Mogo Auto LTD, Schulenburg Motors, We Buy Cars (Pty) Ltd, Yallamotor, Carzami, OLX Group, CarMax East Africa Lt, Sylndr.

3. What are the main segments of the Africa Used Car Market?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others.

6. What are the notable trends driving market growth?

Increasing Investments by Several Companies is Likely to Strengthen the Demand Trajectory for Used Car Market -.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Nigeria-based Cars45 and Jiji signed a new deal with Suzuki. This collaboration aims to revolutionize used car buying and selling by combining the strengths of all three players. Suzuki is utilizing the expertise and resources of Cars45 and Jiji to enhance market growth. Additionally, inspected and verified Suzuki used cars will be showcased on the Cars45 platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Used Car Market?

To stay informed about further developments, trends, and reports in the Africa Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence