Key Insights

Germany's high-performance electric vehicle (EV) market is set for substantial growth, projected to reach $15.5 billion by 2025. This is driven by a remarkable Compound Annual Growth Rate (CAGR) of over 45% from 2025 to 2033. Key growth factors include supportive government incentives, stringent emission regulations encouraging electrification, and increasing consumer demand for sustainable, exhilarating driving. Advances in battery technology, improving range and charging times, coupled with sophisticated electric powertrains offering instant torque and superior acceleration, are also significant contributors. The sector is seeing a rise in performance-oriented EVs across passenger and commercial segments, challenging traditional internal combustion engine (ICE) vehicles.

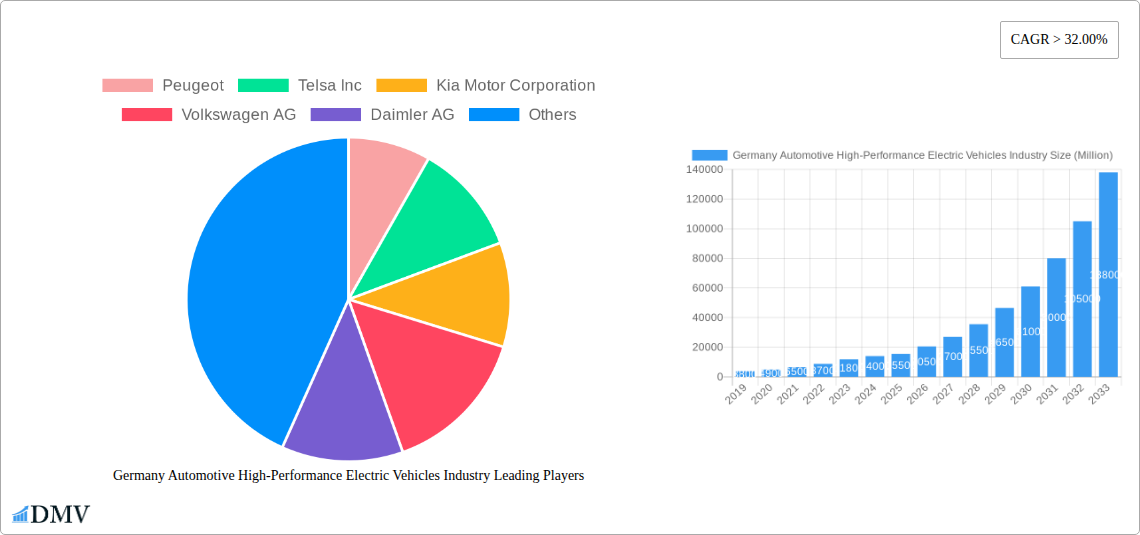

Germany Automotive High-Performance Electric Vehicles Industry Market Size (In Billion)

Challenges to market expansion include the high initial cost of premium performance EVs and the ongoing need for robust high-speed charging infrastructure. Supply chain vulnerabilities related to raw materials for battery production may also pose constraints. The market features strong adoption of both Plug-in Hybrid Electric Vehicles (PHEVs) and Battery Electric Vehicles (BEVs). Leading automotive manufacturers such as Volkswagen AG, BMW Group, and Daimler AG, alongside innovators like Tesla Inc. and Rimac Automobili, are making substantial investments, fostering competition and innovation. Germany, a global automotive leader with a strong commitment to innovation and sustainability, is expected to spearhead this high-performance EV revolution.

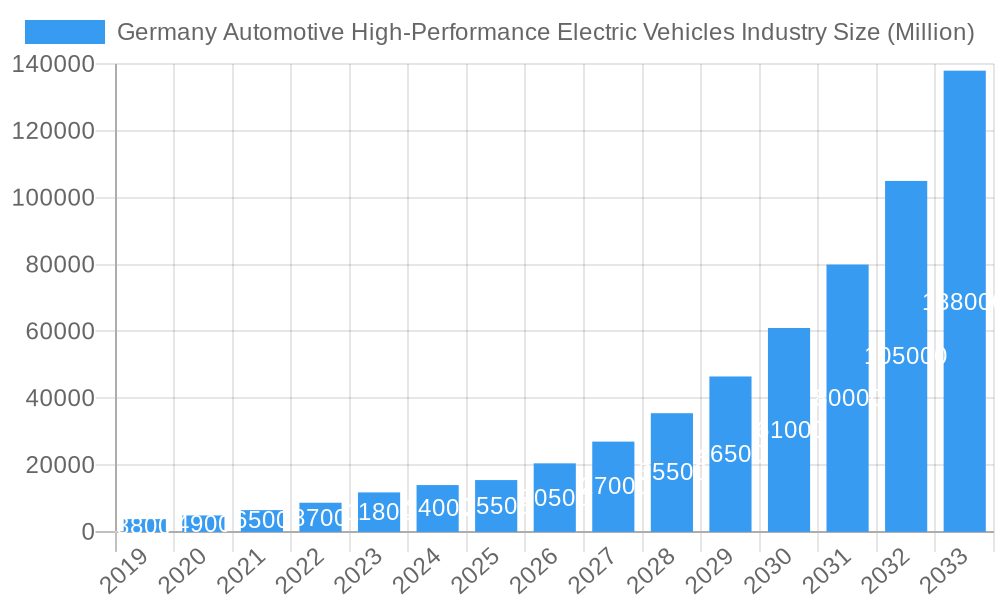

Germany Automotive High-Performance Electric Vehicles Industry Company Market Share

Unlocking the Future: Germany's High-Performance Electric Vehicles Industry Market Analysis & Forecast (2019-2033)

This comprehensive report delves deep into the dynamic German Automotive High-Performance Electric Vehicles Industry, offering an in-depth analysis of its current landscape, historical evolution, and a robust 5-year forecast from 2025 to 2033. We dissect key market segments, explore groundbreaking product innovations, and identify the critical drivers and obstacles shaping this rapidly expanding sector. With a focus on premium, performance-oriented electric mobility, this report is an essential resource for manufacturers, suppliers, investors, policymakers, and automotive enthusiasts seeking to understand and capitalize on the future of high-performance EVs in Germany.

Germany Automotive High-Performance Electric Vehicles Industry Market Composition & Trends

The German Automotive High-Performance Electric Vehicles Industry is characterized by a moderately concentrated market with a strong emphasis on innovation and premium offerings. Key players are investing heavily in research and development to meet stringent environmental regulations and evolving consumer demands for sustainable yet exhilarating driving experiences. The regulatory landscape, driven by the EU's ambitious emissions targets, acts as a significant catalyst for the adoption of high-performance EVs. Substitute products, primarily traditional internal combustion engine (ICE) vehicles and lower-performance EVs, are steadily losing ground as technological advancements close the performance gap and improve battery efficiency. End-user profiles are increasingly skewed towards affluent consumers and fleet operators prioritizing cutting-edge technology, superior performance, and environmental consciousness. Mergers and acquisitions (M&A) activity is present, albeit strategic, focusing on acquiring specialized technologies or expanding market reach within niche segments, with deal values often in the hundreds of millions of Euros.

- Market Share Distribution: Dominated by established German luxury automakers, with increasing contributions from specialized EV manufacturers and international players.

- M&A Deal Values: Indicative of strategic acquisitions to bolster technological capabilities, often in the range of €100-€500 Million.

Germany Automotive High-Performance Electric Vehicles Industry Industry Evolution

The evolution of the German Automotive High-Performance Electric Vehicles Industry is a compelling narrative of technological leapfrogging and strategic adaptation. From the historical period of 2019-2024, we witnessed initial forays into performance-oriented electric powertrains, often as niche offerings within larger portfolios. The base year of 2025 marks a significant inflection point, with an anticipated market growth trajectory exceeding 15% annually. This surge is fueled by continuous technological advancements, particularly in battery energy density, charging speeds, and electric motor efficiency. Consumer demand has shifted dramatically, with an increasing appreciation for the instant torque, quiet operation, and advanced digital integration offered by high-performance EVs. Early adoption metrics reveal a strong preference for Battery or Pure Electric variants, reflecting advancements in range and charging infrastructure. The industry's growth trajectory is further propelled by substantial investments in advanced manufacturing processes and the development of sophisticated software for vehicle management and driver assistance systems. The historical period saw a CAGR of approximately 8-10%, projecting a substantial acceleration in the forecast period.

Leading Regions, Countries, or Segments in Germany Automotive High-Performance Electric Vehicles Industry

Within the German Automotive High-Performance Electric Vehicles Industry, the Battery or Pure Electric (BEV) drive type segment exhibits unparalleled dominance. This leadership is underpinned by a confluence of factors, including substantial government incentives, a robust charging infrastructure network, and a clear consumer preference for zero-emission mobility that doesn't compromise on exhilaration. The Passenger Cars vehicle type also reigns supreme, catering to the premium segment's demand for performance, luxury, and advanced technology. While Plug-in Hybrids (PHEVs) offer a transitional solution, the long-term vision and investment are overwhelmingly directed towards fully electric powertrains. Commercial Vehicles are seeing burgeoning interest in high-performance electric applications, driven by efficiency gains and evolving corporate sustainability goals, but currently trail significantly behind passenger cars in terms of market penetration and development within the high-performance niche.

- Dominant Segment - Drive Type: Battery or Pure Electric (BEV)

- Key Drivers:

- Aggressive government subsidies and tax breaks for EV purchases.

- Rapid expansion of public and private charging infrastructure.

- Advancements in battery technology leading to increased range and reduced charging times.

- Growing environmental consciousness among consumers.

- Key Drivers:

- Dominant Segment - Vehicle Type: Passenger Cars

- Key Drivers:

- Established premium automotive brands focusing on high-performance electric sedans, coupes, and SUVs.

- Targeting affluent demographics seeking cutting-edge technology and unparalleled driving dynamics.

- Integration of advanced autonomous driving and connectivity features.

- Key Drivers:

- Emerging Segment: Commercial Vehicles (especially for last-mile delivery and specialized applications)

- Factors Driving Growth:

- Total cost of ownership advantages due to lower running costs.

- Corporate ESG (Environmental, Social, and Governance) mandates.

- Development of specialized high-torque electric drivetrains for commercial use.

- Factors Driving Growth:

Germany Automotive High-Performance Electric Vehicles Industry Product Innovations

Product innovation in the German high-performance electric vehicles sector is at the forefront of automotive engineering. Manufacturers are pushing boundaries with advancements in lightweight materials, aerodynamic designs, and sophisticated powertrain management systems to maximize performance and efficiency. Key innovations include the development of higher-density battery cells, such as Mercedes-Benz's new HPB 150, enabling increased range and faster charging capabilities. MAHLE's development of a superior continuous torque (SCT) E-motor, capable of indefinite high-performance operation, signifies a significant leap for both passenger and commercial vehicles. Furthermore, the integration of 800V electrical architectures, as seen with Mahle's new electric compressor, promises faster charging times and improved thermal management, crucial for sustained high-performance outputs. These innovations are not just about raw power but also about intelligent energy management and the seamless integration of electric drivetrains with advanced vehicle dynamics control systems.

Propelling Factors for Germany Automotive High-Performance Electric Vehicles Industry Growth

The growth of the German Automotive High-Performance Electric Vehicles Industry is propelled by a powerful synergy of factors. Technologically, breakthroughs in battery technology (increased energy density, faster charging), advanced electric motor design (higher efficiency, superior torque), and sophisticated power electronics are enabling unprecedented performance levels. Economically, favorable government incentives, tax credits, and a growing understanding of lower total cost of ownership for EVs, including reduced maintenance and fuel costs, are making high-performance electric options increasingly attractive. Regulatory influences, such as the EU's stringent CO2 emission targets and Germany's national climate goals, are actively pushing manufacturers to accelerate their transition to electric mobility, particularly in the premium and performance segments where innovation can be showcased. The increasing consumer demand for sustainable luxury and cutting-edge technology further fuels this expansion.

Obstacles in the Germany Automotive High-Performance Electric Vehicles Industry Market

Despite its robust growth, the Germany Automotive High-Performance Electric Vehicles Industry faces several significant obstacles. Regulatory hurdles, while driving adoption, can also create complexities in homologation and certification for highly specialized performance components. Supply chain disruptions, particularly for critical raw materials like lithium and cobalt, can impact production volumes and cost stability. The high initial purchase price of premium performance EVs remains a barrier for some segments of the market, despite long-term cost benefits. Furthermore, the continued reliance on specific components and raw materials from a limited number of global suppliers creates geopolitical and logistical risks. Intense competitive pressures from both established OEMs and emerging EV startups necessitate continuous innovation and cost management.

Future Opportunities in Germany Automotive High-Performance Electric Vehicles Industry

The future of the German Automotive High-Performance Electric Vehicles Industry is brimming with opportunity. Emerging markets for advanced driver-assistance systems (ADAS) and autonomous driving technologies, seamlessly integrated with high-performance electric powertrains, present a significant growth avenue. The development of solid-state batteries promises further breakthroughs in energy density, charging speed, and safety, unlocking new performance potentials. The growing demand for electrification in niche segments like high-performance electric sports cars, luxury SUVs, and even specialized commercial vehicles opens up new product lines and revenue streams. Furthermore, advancements in vehicle-to-grid (V2G) technology and sustainable charging solutions offer opportunities for businesses to explore new service models and contribute to grid stability. The increasing focus on circular economy principles within the automotive sector also presents opportunities for innovation in battery recycling and sustainable material sourcing.

Major Players in the Germany Automotive High-Performance Electric Vehicles Industry Ecosystem

- Peugeot

- Tesla Inc.

- Kia Motor Corporation

- Volkswagen AG

- Daimler AG

- Nissan Motor Company Ltd

- Renault

- BMW Group

- Mitsubishi Motors Corporation

- Rimac Automobili

- Ford Motor Company

Key Developments in Germany Automotive High-Performance Electric Vehicles Industry Industry

- December 2022: Mahle Holding Co., Ltd. announced new orders for its 800V electric compressor from international customers, including Germany. This component is designated for high-end intelligent electric vehicle (EV) and high-performance EV brands, with mass production anticipated in 2023 and 2024.

- December 2022: Mercedes-Benz unveiled the Mercedes-AMG S 63 E PERFORMANCE, a vehicle featuring an AMG 4.0 l V8 bi-turbo engine, an AMG-specific hybrid powertrain, and a new AMG high-performance battery expansion stage (HPB 150).

- July 2022: MAHLE GmbH (MAHLE) announced the development of a superior continuous torque (SCT) E-motor, designed for sustained high performance in both passenger and commercial vehicles.

- May 2022: Meritor, Inc. (Meritor) agreed to acquire Siemens' Commercial Vehicles business for approximately EUR 190 Million (USD 203.3 Million). Siemens Commercial Vehicles specializes in the development, design, and manufacturing of high-performance electric drive systems.

Strategic Germany Automotive High-Performance Electric Vehicles Industry Market Forecast

The strategic forecast for the Germany Automotive High-Performance Electric Vehicles Industry indicates sustained and accelerated growth driven by continued technological innovation and supportive regulatory frameworks. The increasing consumer appetite for performance-oriented, sustainable mobility solutions will remain a primary growth catalyst. Investments in advanced battery technology, charging infrastructure, and intelligent electric powertrains will further solidify Germany's position as a leader in this domain. Emerging opportunities in autonomous driving integration, specialized vehicle segments, and new service models will unlock substantial market potential. The industry is poised to see significant market expansion, with a projected CAGR of over 12% in the forecast period, driven by both domestic demand and export potential for cutting-edge German engineering in electric performance.

Germany Automotive High-Performance Electric Vehicles Industry Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid

- 1.2. Battery or Pure Electric

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

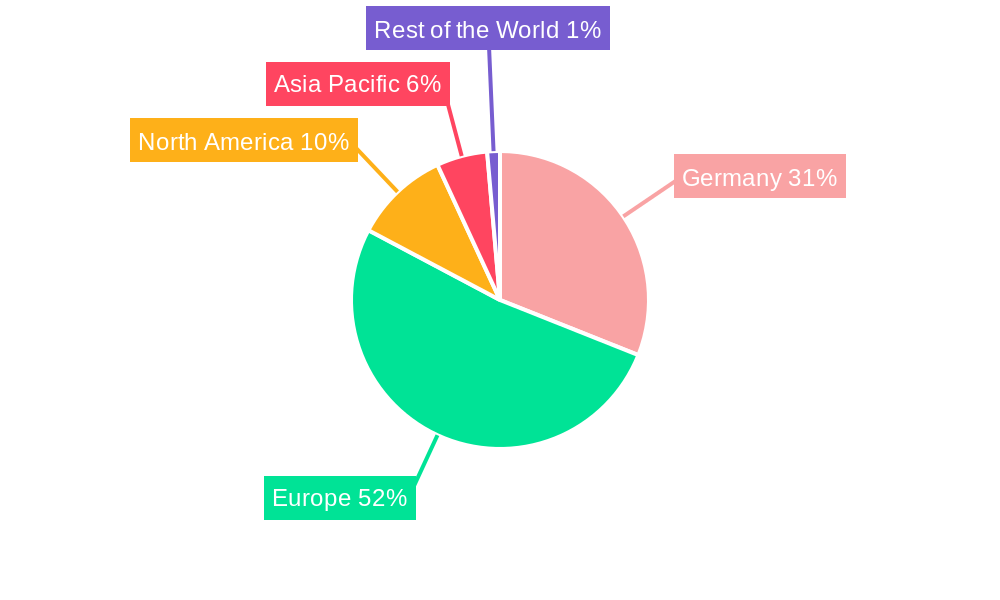

Germany Automotive High-Performance Electric Vehicles Industry Segmentation By Geography

- 1. Germany

Germany Automotive High-Performance Electric Vehicles Industry Regional Market Share

Geographic Coverage of Germany Automotive High-Performance Electric Vehicles Industry

Germany Automotive High-Performance Electric Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Commercial Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Electric Vehicles in Germany will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive High-Performance Electric Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid

- 5.1.2. Battery or Pure Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peugeot

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telsa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kia Motor Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nissan Motor Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renault

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BMW Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Motors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rimac Automobili

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Peugeot

List of Figures

- Figure 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive High-Performance Electric Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 2: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 5: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive High-Performance Electric Vehicles Industry?

The projected CAGR is approximately 45%.

2. Which companies are prominent players in the Germany Automotive High-Performance Electric Vehicles Industry?

Key companies in the market include Peugeot, Telsa Inc, Kia Motor Corporation, Volkswagen AG, Daimler AG, Nissan Motor Company Ltd, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, Ford Motor Company.

3. What are the main segments of the Germany Automotive High-Performance Electric Vehicles Industry?

The market segments include Drive Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Commercial Vehicle Sales.

6. What are the notable trends driving market growth?

Increasing Popularity of Electric Vehicles in Germany will Drive the Market.

7. Are there any restraints impacting market growth?

The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Mahle Holding Co., Ltd. announced that it had received new orders for its 800V electric compressor from multiple international customers (including Germany). It will be applied to high-end intelligent electric vehicle (EV) and high-performance EV brands and is expected to reach mass production in 2023 and 2024, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive High-Performance Electric Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive High-Performance Electric Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive High-Performance Electric Vehicles Industry?

To stay informed about further developments, trends, and reports in the Germany Automotive High-Performance Electric Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence