Key Insights

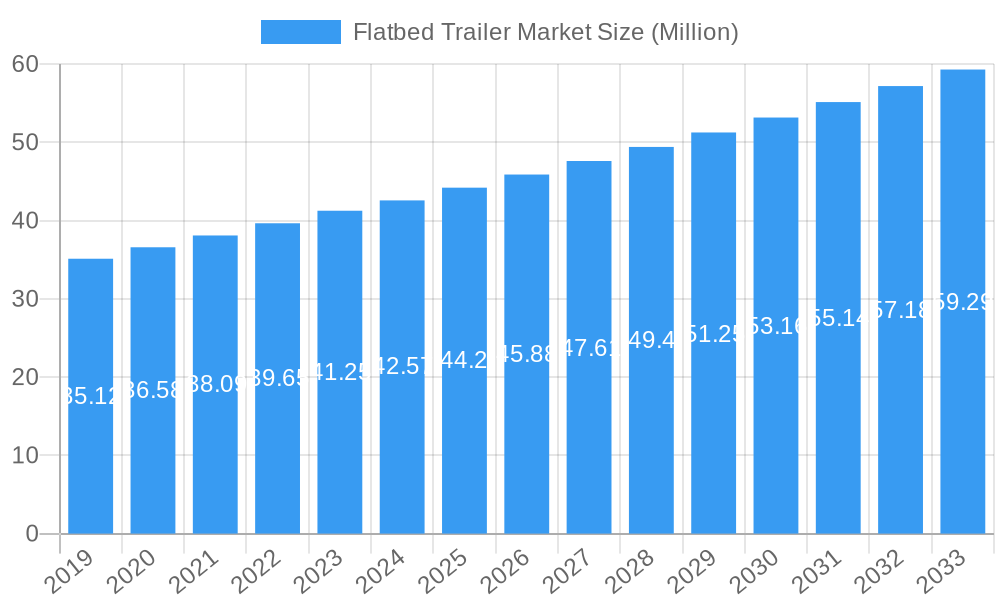

The global Flatbed Trailer Market is poised for robust expansion, projected to reach a substantial USD 42.57 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 3.95% anticipated through 2033. This growth is fueled by a confluence of factors, primarily the escalating demand for efficient and versatile transportation solutions across various industries. The surge in construction activities worldwide, particularly in developing economies, necessitates the movement of heavy machinery, raw materials, and oversized equipment, all of which are optimally transported using flatbed trailers. Furthermore, the increasing adoption of e-commerce and the subsequent rise in logistics and supply chain operations are creating a sustained need for these trailers to facilitate intermodal transportation and last-mile delivery. Technological advancements in trailer design, focusing on enhanced durability, reduced weight, and improved safety features, are also contributing to market expansion, attracting new investments and driving innovation.

Flatbed Trailer Market Market Size (In Million)

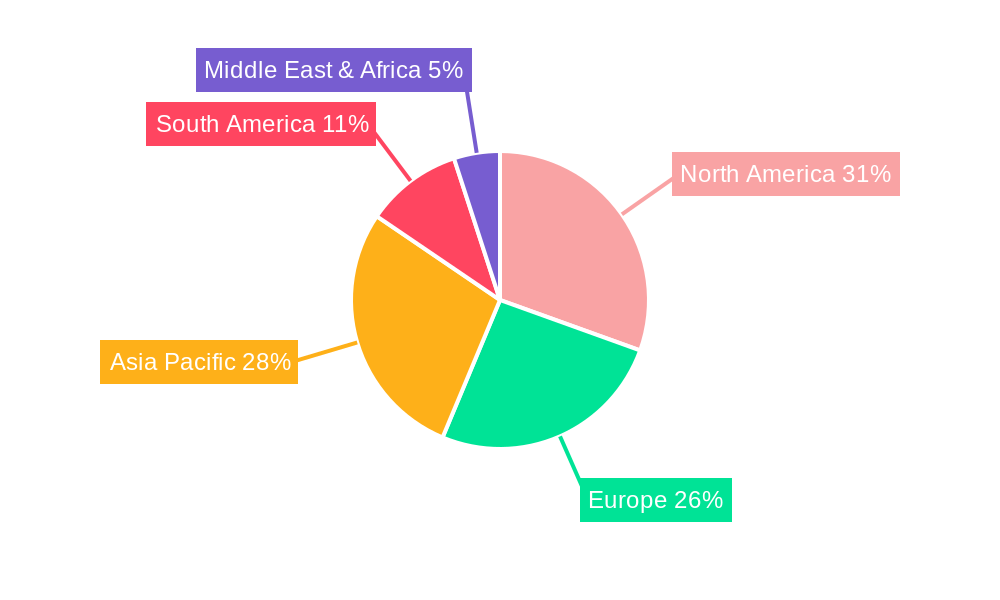

The market is segmented across diverse trailer types and tonnage capacities, offering tailored solutions for a wide array of logistical challenges. Lowboy trailers, step deck trailers, and stretch double drop trailers are crucial for transporting exceptionally tall or heavy loads, indicating a strong demand for specialized equipment. In terms of tonnage, the 51-100 Ton and Above 100 Ton segments are expected to witness significant traction, reflecting the increasing scale of infrastructure projects and industrial movements. Key regions like North America and Asia Pacific are anticipated to lead market growth, driven by their developed infrastructure, active construction sectors, and expanding manufacturing bases. Emerging economies within these regions, such as China and India, are particularly promising due to ongoing infrastructure development and a growing emphasis on optimizing their logistics networks. Despite the positive outlook, potential restraints such as fluctuating raw material prices and stringent regulatory frameworks related to vehicle emissions and safety standards could pose challenges, requiring manufacturers to continuously adapt and innovate to maintain competitiveness.

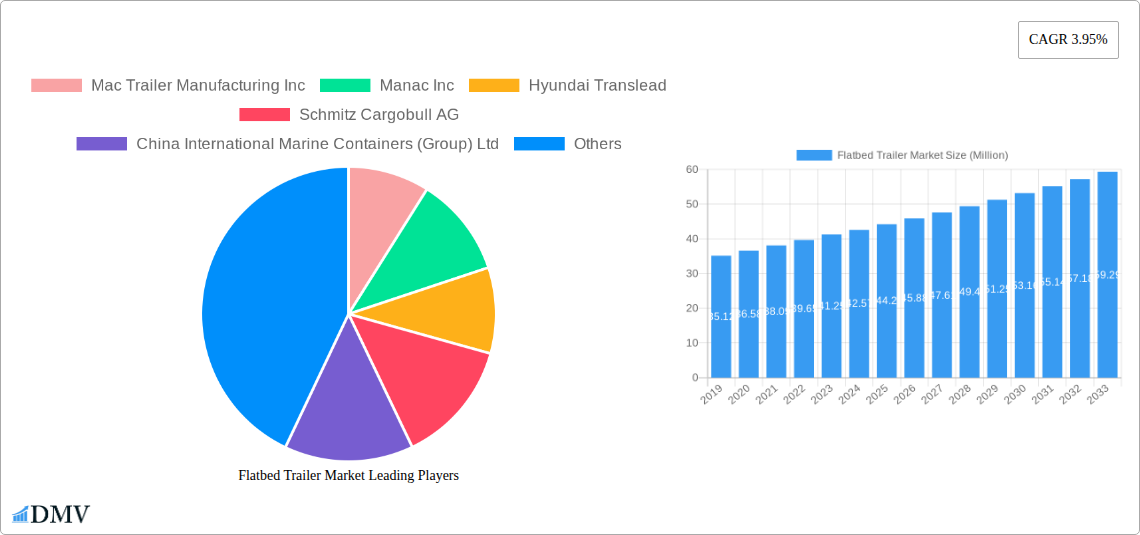

Flatbed Trailer Market Company Market Share

This comprehensive flatbed trailer market report delivers an in-depth analysis of global trends, segment performance, and future opportunities, empowering stakeholders with critical data for strategic decision-making. Spanning the study period of 2019–2033, with a base year of 2025, this report meticulously examines the flatbed trailer market size, flatbed trailer market share, and flatbed trailer market growth across diverse applications and tonnage capacities. Uncover key insights into the lowboy trailer market, step deck trailer market, stretch double drop trailer market, and other specialized segments, essential for optimizing your transportation equipment and logistics infrastructure investments.

Flatbed Trailer Market Market Composition & Trends

The global flatbed trailer market exhibits a dynamic and evolving composition, driven by a confluence of industrial expansion, technological innovation, and evolving regulatory frameworks. Market concentration is moderately fragmented, with key players vying for market dominance through strategic product development and geographical expansion. Innovation catalysts include the demand for enhanced load capacity, improved fuel efficiency, and advanced safety features, particularly in the heavy-duty flatbed trailer segment. Regulatory landscapes, such as recent revisions to trailer length regulations in the UK, are shaping market dynamics by permitting larger load capacities. Substitute products, while present in the form of specialized trailers, are largely unable to replicate the versatility of flatbeds for diverse hauling needs. End-user profiles are broad, encompassing construction, oil & gas, manufacturing, and logistics industries, each with specific requirements for flatbed trailer tonnage and flatbed trailer length. Merger and acquisition (M&A) activities, valued in the hundreds of millions, are observed as companies seek to consolidate market share and expand their product portfolios. For instance, the utility trailer manufacturing company sector often sees strategic acquisitions to enhance reach. The overall flatbed trailer market value is projected to see steady growth, supported by infrastructure development and global trade volumes. The flatbed trailer market analysis indicates a trend towards high-capacity, specialized trailers to meet the demands of transporting oversized and heavy equipment.

Flatbed Trailer Market Industry Evolution

The flatbed trailer industry has witnessed a remarkable evolution, characterized by consistent market growth trajectories and significant technological advancements. Over the historical period of 2019–2024, the market has been steadily expanding, fueled by a growing global economy and increasing demand for efficient freight transportation. The forecast period of 2025–2033 anticipates sustained growth, with an estimated annual growth rate of approximately 5-7%. This growth is intricately linked to the burgeoning construction sector, infrastructure development projects, and the expanding e-commerce landscape, which necessitates robust logistics and heavy-duty transportation solutions. Technological advancements have been instrumental in this evolution, with manufacturers continuously innovating to enhance trailer durability, payload capacity, and operational efficiency. The introduction of advanced materials, such as high-strength steel and aluminum alloys, has enabled the production of lighter yet stronger flatbed trailers, leading to improved fuel economy and increased hauling potential. Innovations in braking systems, suspension technologies, and trailer management software are further augmenting safety and performance metrics. Shifting consumer demands are also playing a pivotal role. Businesses are increasingly seeking flexible and adaptable hauling solutions, driving demand for a diverse range of flatbed trailer types, including lowboy trailers, step deck trailers, and stretch double drop trailers. The adoption of smart trailer technologies, offering real-time tracking, diagnostics, and load monitoring, is becoming a key differentiator, enhancing supply chain visibility and operational efficiency. As infrastructure projects continue to expand globally, the demand for specialized and high-capacity flatbed trailers is expected to surge, further propelling the industry's growth. The flatbed trailer market size is projected to reach multi-billion dollar valuations by the end of the forecast period, underscoring its critical role in the global supply chain.

Leading Regions, Countries, or Segments in Flatbed Trailer Market

The flatbed trailer market is dominated by several key regions and segments, each contributing significantly to the overall market value and growth trajectory. In terms of flatbed trailer tonnage, the 51 T-100 T and Above 100 T segments are experiencing robust demand, driven by heavy industries such as construction, mining, and energy, which require specialized equipment for transporting oversized loads like wind turbine components, heavy machinery, and large prefabricated structures. The lowboy trailer market, a crucial sub-segment within the heavy-duty category, is particularly strong in regions with extensive infrastructure development projects and a high concentration of industrial manufacturing.

Key drivers contributing to the dominance of certain segments include:

- Investment Trends: Significant government and private sector investments in infrastructure projects, such as road expansion, bridge construction, and energy exploration, directly translate into increased demand for heavy-capacity flatbed trailers. Regions with proactive investment policies often lead in this segment.

- Regulatory Support: Favorable regulations pertaining to the transport of oversized and overweight loads, including optimized permitting processes and adjusted road weight limits, significantly boost the market for heavy-tonnage and longer flatbed trailer length options. For example, the UK's recent legislation allowing longer HGV tractors and trailers is a testament to such supportive regulatory shifts.

- Industrial Specialization: The presence of specialized industries like oil and gas exploration, renewable energy (wind and solar farms), and large-scale manufacturing operations creates a sustained demand for specific types of flatbed trailers, such as stretch double drop trailers for extremely tall or long components.

- Economic Growth: Countries experiencing rapid economic expansion often witness a parallel surge in industrial activity and trade, necessitating a larger fleet of flatbed trailers for the efficient movement of goods and materials.

The Greater Than 45 Foot segment for flatbed trailer length is also gaining prominence, particularly with evolving regulations that permit increased overall vehicle lengths, enabling more efficient long-haul transportation and reducing the number of trips required for bulky cargo. The North American market, with its vast geographical expanse and significant industrial base, alongside emerging markets in Asia, are key contributors to the dominance of these high-tonnage and longer length segments. The step deck trailer market also holds a substantial share, offering a balance between standard flatbeds and lowboys, making them versatile for a wide array of loads. The continued industrialization and globalization are projected to further amplify the importance of these dominant segments within the global flatbed trailer market.

Flatbed Trailer Market Product Innovations

Product innovations in the flatbed trailer market are centered on enhancing payload capacity, improving durability, and increasing operational efficiency and safety. Manufacturers are developing lighter yet stronger trailers using advanced alloys and composite materials. Innovations in suspension systems, such as advanced air ride suspensions, are crucial for protecting sensitive cargo and reducing driver fatigue, contributing to the appeal of premium flatbed trailers. Furthermore, the integration of telematics and smart trailer technology is enabling real-time monitoring of trailer health, load status, and location, providing valuable data for fleet management and optimizing logistics. Unique selling propositions include modular designs that allow for customization to specific hauling needs and improved aerodynamic features to enhance fuel efficiency, a critical factor in the cost-conscious logistics industry. The performance metrics being optimized include load-bearing capacity, weight-to-strength ratio, and reduced maintenance requirements, all of which directly impact the total cost of ownership for fleet operators.

Propelling Factors for Flatbed Trailer Market Growth

Several key factors are propelling the growth of the flatbed trailer market. Economically, increasing global trade volumes and sustained infrastructure development projects worldwide are creating a consistent demand for efficient freight transportation. Technological advancements, such as the use of lightweight yet high-strength materials and sophisticated suspension systems, are enabling the development of more versatile and fuel-efficient trailers. Regulatory shifts, like the recent UK legislation increasing trailer length limits, are opening avenues for transporting larger loads, thereby boosting market demand. Furthermore, the growing e-commerce sector necessitates robust logistics networks, with flatbed trailers playing a crucial role in the movement of raw materials and finished goods. The expansion of industries such as construction, oil & gas, and renewable energy also directly fuels the need for specialized heavy-duty flatbed trailers.

Obstacles in the Flatbed Trailer Market Market

Despite robust growth, the flatbed trailer market faces several obstacles. Stringent and varied regulatory frameworks across different regions regarding load dimensions, weight limits, and emissions can create compliance challenges for manufacturers and fleet operators, particularly for cross-border logistics. Supply chain disruptions, exacerbated by geopolitical events and natural disasters, can lead to increased raw material costs and production delays, impacting the availability and pricing of flatbed trailers. Intense competition among established players and emerging manufacturers can lead to price wars, potentially squeezing profit margins. The high initial investment cost for advanced flatbed trailers can also be a barrier for smaller logistics companies.

Future Opportunities in Flatbed Trailer Market

Emerging opportunities within the flatbed trailer market are significant. The increasing adoption of sustainable transportation solutions presents an opportunity for manufacturers to develop and market electric or hybrid-powered flatbed trailers, aligning with global environmental goals. The growth of specialized industries, such as renewable energy (wind and solar power) and modular construction, will continue to drive demand for customized and high-capacity stretch double drop trailers and lowboy trailers. The expansion of e-commerce into new geographical markets will necessitate enhanced logistics infrastructure, creating demand for a wider array of flatbed trailer types to cater to diverse cargo needs. Furthermore, advancements in telematics and IoT integration offer opportunities to develop smarter, more connected trailers that enhance fleet management and optimize operational efficiency.

Major Players in the Flatbed Trailer Market Ecosystem

- Mac Trailer Manufacturing Inc

- Manac Inc

- Hyundai Translead

- Schmitz Cargobull AG

- China International Marine Containers (Group) Ltd

- Krone GmbH & Co KG

- Utility Trailer Manufacturing Company

- Kentucky Trailer

- Fahrzeugwerk Bernard KRONE GmbH & Co KG

- Wabash National

Key Developments in Flatbed Trailer Market Industry

- August 2023: Hendrickson, a global provider of suspensions and axles, introduced specialized air and mechanical suspensions and axles for trailer applications in the Indian market, aiming to enhance performance and durability in a key growth region.

- June 2023: XPO, a leading European transport and logistics provider, embraced revised trailer length regulations implemented in the UK on May 31, enabling them to optimize their fleet operations and carry larger loads.

- May 2023: Legislation passed allowing HGV tractors and trailers in the UK to be up to 18.55m (61ft) long, a significant increase that facilitates the transport of bulkier goods and improves logistical efficiency across the nation.

Strategic Flatbed Trailer Market Market Forecast

The strategic flatbed trailer market forecast indicates a robust expansion, driven by ongoing industrialization, global trade growth, and significant infrastructure development initiatives. The increasing demand for specialized trailers, particularly lowboy trailers and stretch double drop trailers capable of transporting oversized and heavy equipment for sectors like renewable energy and construction, will be a key growth catalyst. Furthermore, technological advancements in trailer design, materials, and telematics will continue to enhance efficiency, safety, and sustainability, driving adoption of premium and smart trailer solutions. Regulatory adjustments, such as the UK's recent trailer length legislation, are poised to further unlock market potential by enabling greater hauling capacities. The flatbed trailer market size is anticipated to witness a compound annual growth rate (CAGR) of approximately 6% during the forecast period, reaching substantial multi-billion dollar valuations.

Flatbed Trailer Market Segmentation

-

1. Type

- 1.1. Lowboy Trailers

- 1.2. Step Deck Trailers

- 1.3. Stretch Double Drop Trailers

- 1.4. Others

-

2. Tonnage

- 2.1. Below 25 T

- 2.2. 25 T-50 T

- 2.3. 51 T-100 T

- 2.4. Above 100 T

-

3. Length

- 3.1. 28-45 Foot

- 3.2. Greater Than 45 Foot

Flatbed Trailer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Flatbed Trailer Market Regional Market Share

Geographic Coverage of Flatbed Trailer Market

Flatbed Trailer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Infrastructure Development and Highway Construction Activities to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor May Hamper the Market Expansion

- 3.4. Market Trends

- 3.4.1. Lowboy Trailers is Dominating The Flatbed Trailer Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lowboy Trailers

- 5.1.2. Step Deck Trailers

- 5.1.3. Stretch Double Drop Trailers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Tonnage

- 5.2.1. Below 25 T

- 5.2.2. 25 T-50 T

- 5.2.3. 51 T-100 T

- 5.2.4. Above 100 T

- 5.3. Market Analysis, Insights and Forecast - by Length

- 5.3.1. 28-45 Foot

- 5.3.2. Greater Than 45 Foot

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lowboy Trailers

- 6.1.2. Step Deck Trailers

- 6.1.3. Stretch Double Drop Trailers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Tonnage

- 6.2.1. Below 25 T

- 6.2.2. 25 T-50 T

- 6.2.3. 51 T-100 T

- 6.2.4. Above 100 T

- 6.3. Market Analysis, Insights and Forecast - by Length

- 6.3.1. 28-45 Foot

- 6.3.2. Greater Than 45 Foot

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lowboy Trailers

- 7.1.2. Step Deck Trailers

- 7.1.3. Stretch Double Drop Trailers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Tonnage

- 7.2.1. Below 25 T

- 7.2.2. 25 T-50 T

- 7.2.3. 51 T-100 T

- 7.2.4. Above 100 T

- 7.3. Market Analysis, Insights and Forecast - by Length

- 7.3.1. 28-45 Foot

- 7.3.2. Greater Than 45 Foot

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lowboy Trailers

- 8.1.2. Step Deck Trailers

- 8.1.3. Stretch Double Drop Trailers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Tonnage

- 8.2.1. Below 25 T

- 8.2.2. 25 T-50 T

- 8.2.3. 51 T-100 T

- 8.2.4. Above 100 T

- 8.3. Market Analysis, Insights and Forecast - by Length

- 8.3.1. 28-45 Foot

- 8.3.2. Greater Than 45 Foot

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lowboy Trailers

- 9.1.2. Step Deck Trailers

- 9.1.3. Stretch Double Drop Trailers

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Tonnage

- 9.2.1. Below 25 T

- 9.2.2. 25 T-50 T

- 9.2.3. 51 T-100 T

- 9.2.4. Above 100 T

- 9.3. Market Analysis, Insights and Forecast - by Length

- 9.3.1. 28-45 Foot

- 9.3.2. Greater Than 45 Foot

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Flatbed Trailer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lowboy Trailers

- 10.1.2. Step Deck Trailers

- 10.1.3. Stretch Double Drop Trailers

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Tonnage

- 10.2.1. Below 25 T

- 10.2.2. 25 T-50 T

- 10.2.3. 51 T-100 T

- 10.2.4. Above 100 T

- 10.3. Market Analysis, Insights and Forecast - by Length

- 10.3.1. 28-45 Foot

- 10.3.2. Greater Than 45 Foot

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mac Trailer Manufacturing Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manac Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyundai Translead

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schmitz Cargobull AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China International Marine Containers (Group) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Krone GmbH & Co KG*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Utility Trailer Manufacturing Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kentucky Trailer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fahrzeugwerk Bernard KRONE GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wabash National

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mac Trailer Manufacturing Inc

List of Figures

- Figure 1: Flatbed Trailer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Flatbed Trailer Market Share (%) by Company 2025

List of Tables

- Table 1: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 3: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 4: Flatbed Trailer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 7: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 8: Flatbed Trailer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 14: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 15: Flatbed Trailer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: UK Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 24: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 25: Flatbed Trailer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: China Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 33: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 34: Flatbed Trailer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Flatbed Trailer Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Flatbed Trailer Market Revenue Million Forecast, by Tonnage 2020 & 2033

- Table 40: Flatbed Trailer Market Revenue Million Forecast, by Length 2020 & 2033

- Table 41: Flatbed Trailer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: UAE Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Flatbed Trailer Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flatbed Trailer Market?

The projected CAGR is approximately 3.95%.

2. Which companies are prominent players in the Flatbed Trailer Market?

Key companies in the market include Mac Trailer Manufacturing Inc, Manac Inc, Hyundai Translead, Schmitz Cargobull AG, China International Marine Containers (Group) Ltd, Krone GmbH & Co KG*List Not Exhaustive, Utility Trailer Manufacturing Company, Kentucky Trailer, Fahrzeugwerk Bernard KRONE GmbH & Co KG, Wabash National.

3. What are the main segments of the Flatbed Trailer Market?

The market segments include Type, Tonnage, Length.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Infrastructure Development and Highway Construction Activities to Drive the Market.

6. What are the notable trends driving market growth?

Lowboy Trailers is Dominating The Flatbed Trailer Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor May Hamper the Market Expansion.

8. Can you provide examples of recent developments in the market?

In August 2023, Hendrickson, a prominent worldwide provider of medium and heavy-duty mechanical, elastomeric, and air suspensions, as well as integrated and non-integrated axles, along with various commercial vehicle systems, introduced its air and mechanical suspensions and axles designed specifically for trailer applications in the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flatbed Trailer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flatbed Trailer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flatbed Trailer Market?

To stay informed about further developments, trends, and reports in the Flatbed Trailer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence