Key Insights

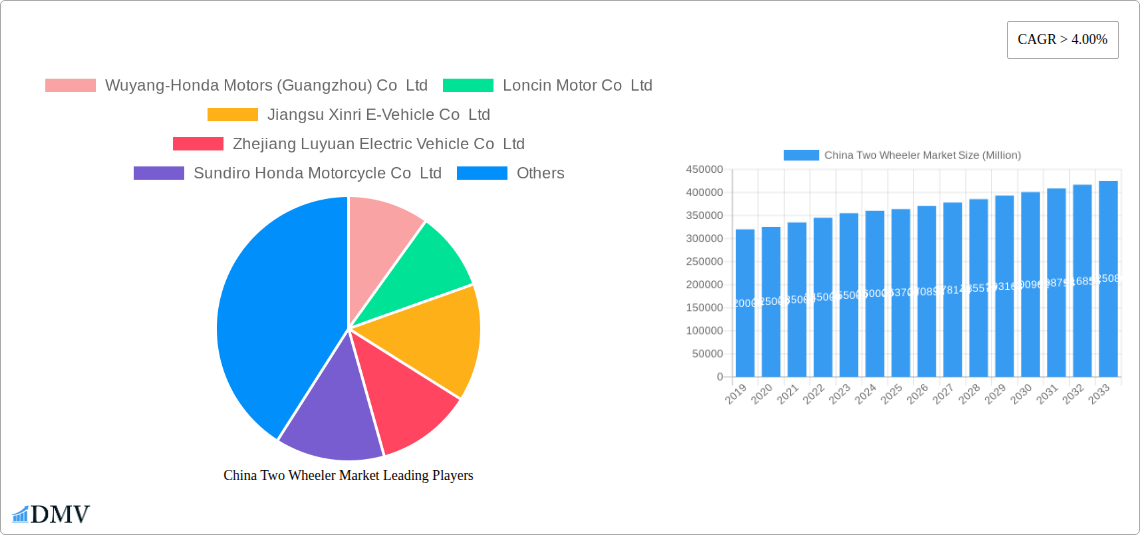

The China Two-Wheeler Market is poised for steady growth, with an estimated market size of $363.7 billion in 2025, driven by a Compound Annual Growth Rate (CAGR) of 1.97% through 2033. This growth is underpinned by an increasing demand for personal mobility solutions, particularly in urban and peri-urban areas, where two-wheelers offer a cost-effective and efficient mode of transportation. The rising disposable incomes and a growing middle class are further fueling this demand. While Internal Combustion Engine (ICE) vehicles continue to hold a significant share, the market is witnessing a pronounced shift towards eco-friendly alternatives. The integration of advanced technologies, improved battery performance, and government incentives supporting electric vehicle adoption are key catalysts for the expansion of the hybrid and electric two-wheeler segment. This transition is not only driven by environmental consciousness but also by the increasing need to alleviate traffic congestion and reduce emissions in densely populated cities.

China Two Wheeler Market Market Size (In Billion)

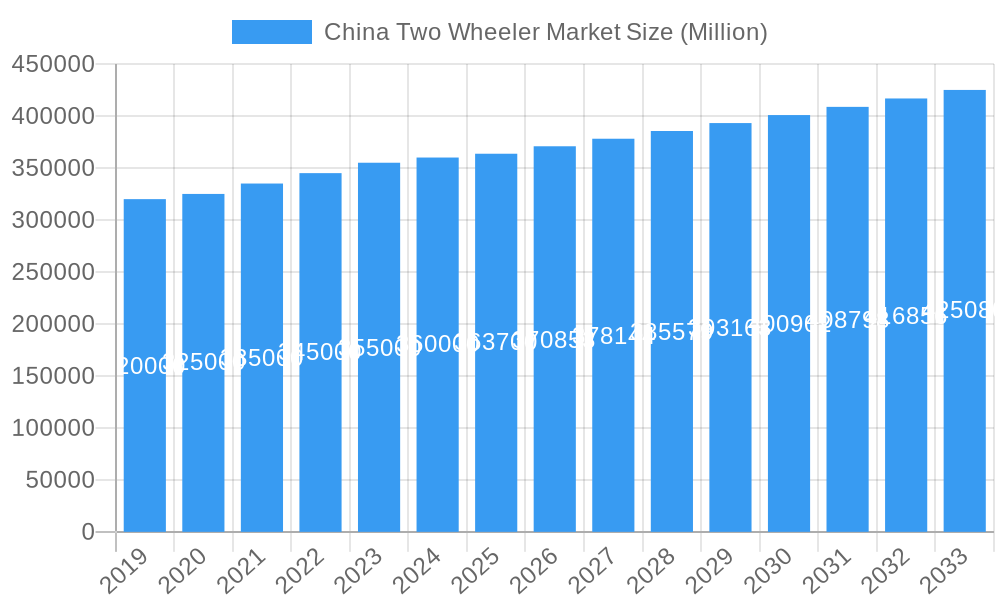

The market dynamics are further shaped by the evolving consumer preferences and stringent emission regulations being implemented across China. Companies like Wuyang-Honda Motors, Loncin Motor, and Jiangsu Xinri E-Vehicle are at the forefront of this transformation, innovating and expanding their product portfolios to cater to diverse market needs. The focus on lightweight designs, enhanced safety features, and smart connectivity in two-wheelers is also a significant trend. However, the market faces certain restraints, including the upfront cost of electric two-wheelers compared to their ICE counterparts, though this gap is narrowing. Infrastructure development for charging stations and battery swapping facilities, especially outside major metropolitan areas, remains a crucial factor for wider electric two-wheeler adoption. Despite these challenges, the overall outlook for the China Two-Wheeler Market remains positive, with continuous innovation and a strong underlying demand for accessible and sustainable personal transportation.

China Two Wheeler Market Company Market Share

This in-depth report provides a critical analysis of the China two-wheeler market, offering invaluable insights for stakeholders seeking to navigate this dynamic and rapidly evolving landscape. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study dissects market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Discover the strategic advantages and challenges shaping the Chinese motorcycle market and electric scooter market, and gain a competitive edge with data-driven forecasts.

China Two Wheeler Market Market Composition & Trends

The China two-wheeler market exhibits a moderate to high concentration, with a few dominant players vying for significant market share, estimated to be in the tens of billions of USD. Innovation is primarily driven by advancements in battery technology for electric vehicles (EVs) and the integration of smart features in both ICE and EV segments. The regulatory landscape is increasingly favoring cleaner propulsion types, with government incentives and stricter emission norms influencing production and consumption patterns. Substitute products, such as electric bicycles and three-wheelers, offer alternative mobility solutions, particularly in specific urban and rural settings. End-user profiles are diverse, ranging from daily commuters in densely populated cities to agricultural workers in rural areas, each with distinct preferences for performance, cost, and sustainability. Mergers and acquisitions (M&A) activities, though not extensively documented with public figures, are likely to shape market consolidation as companies seek to expand their technological capabilities and market reach.

- Market Share Distribution: Dominated by a blend of established ICE manufacturers and rapidly growing EV players.

- Innovation Catalysts: Battery technology (including sodium-ion), smart connectivity, and lightweight materials.

- Regulatory Landscape: Increasing support for EVs, stricter emission controls for ICE vehicles.

- Substitute Products: Electric bicycles, e-rickshaws, and public transportation.

- End-User Profiles: Urban commuters, rural inhabitants, delivery services.

- M&A Activities: Expected to increase for technology acquisition and market expansion, with potential deal values in the hundreds of millions of USD.

China Two Wheeler Market Industry Evolution

The China two-wheeler market has undergone a significant transformation throughout the historical period (2019-2024) and is poised for accelerated evolution in the forecast period (2025-2033). Initially dominated by Internal Combustion Engine (ICE) motorcycles and scooters, the industry has witnessed a pronounced shift towards electric two-wheelers, driven by government initiatives, environmental concerns, and technological breakthroughs. The market growth trajectory has been impressive, with the overall two-wheeler market valued at over several hundred billion USD. Technological advancements have been a key enabler, with improvements in battery energy density, charging speeds, and motor efficiency making electric options increasingly viable and attractive. Electric scooter sales have surged, becoming a dominant force in urban mobility, while hybrid two-wheelers are emerging as a niche segment bridging the gap between ICE and pure electric. Consumer demand is evolving rapidly, with a growing preference for sustainable transportation, connected features, and enhanced rider safety. The adoption rate of electric vehicles has been steadily increasing, surpassing xx% of the total two-wheeler market in recent years and projected to reach xx% by 2025. This evolution reflects a conscious move towards greener mobility solutions, supported by robust policy frameworks that incentivize EV adoption and penalize polluting technologies. The resilience of the China two-wheeler industry is evident in its ability to adapt to these changing dynamics, with manufacturers investing heavily in R&D to stay ahead of the curve and capture a larger share of this burgeoning market. The forecast period (2025-2033) is expected to see continued exponential growth in the electric segment, with ICE vehicles facing increasing pressure, though they will likely retain a significant presence in specific sub-segments and regions.

Leading Regions, Countries, or Segments in China Two Wheeler Market

The China two-wheeler market is dominated by the Electric Vehicles (Hybrid and Electric Vehicles) segment, which is experiencing robust growth and is projected to hold the largest market share throughout the forecast period. While specific regional dominance can fluctuate, key economic hubs and densely populated provinces in Eastern and Southern China, such as Jiangsu, Zhejiang, and Guangdong, consistently lead in terms of sales volume and adoption rates. These regions benefit from strong government support for EVs, higher disposable incomes, and a greater emphasis on environmental sustainability. The dominance of the electric segment is driven by a confluence of factors.

- Regulatory Support: Central and local governments have implemented favorable policies, including subsidies for EV purchases, tax exemptions, and the establishment of extensive charging infrastructure networks. This regulatory push is a critical catalyst for the widespread adoption of electric scooters and electric motorcycles.

- Environmental Consciousness: Growing awareness of air pollution and climate change among consumers is fueling demand for cleaner transportation alternatives.

- Technological Advancements: Innovations in battery technology, leading to longer ranges and faster charging, have addressed key consumer concerns regarding EV practicality. The introduction of sodium-ion battery technology by manufacturers like SUNRA further democratizes EV accessibility.

- Cost-Effectiveness: While initial purchase prices for EVs can be higher, lower running costs (electricity versus gasoline) and reduced maintenance needs make them an attractive long-term investment for many consumers.

- Urban Mobility Needs: In congested urban environments, the agility and zero-emission nature of electric two-wheelers make them ideal for navigating traffic and reducing urban pollution.

While the ICE (Internal Combustion Engine) segment will continue to hold a significant market share, particularly in rural areas and for performance-oriented segments, its growth is expected to be outpaced by the electric segment due to increasingly stringent emission standards and the growing appeal of electric alternatives.

China Two Wheeler Market Product Innovations

Product innovations in the China two-wheeler market are rapidly transforming the landscape. Manufacturers are focusing on developing lightweight and durable materials, enhancing battery performance with longer ranges and faster charging capabilities, and integrating smart technologies for improved connectivity and rider experience. The recent launch of mass-produced two-wheeled EVs with sodium-ion batteries by SUNRA exemplifies this trend, offering a more sustainable and potentially cost-effective battery solution. Furthermore, advancements in autonomous features and intelligent self-balancing technologies, as seen in the cooperation between Loncin GM and Lingyun Intelligent, are pushing the boundaries of two-wheeler functionality and safety, creating unique selling propositions.

Propelling Factors for China Two Wheeler Market Growth

The China two-wheeler market is experiencing robust growth propelled by several key factors. Government policies promoting green transportation, including subsidies and favorable regulations for electric vehicles (EVs), are a significant driver. Technological advancements in battery technology, leading to increased range and faster charging for electric scooters and motorcycles, are enhancing consumer adoption. The expanding urban population and the increasing demand for efficient and affordable personal mobility solutions in congested cities further fuel market expansion. Economic growth, leading to higher disposable incomes, also contributes to increased purchasing power for new two-wheelers, both ICE and EV.

Obstacles in the China Two Wheeler Market Market

Despite its growth, the China two-wheeler market faces several obstacles. The lack of widespread and standardized charging infrastructure for electric vehicles remains a challenge in some regions. Fluctuations in raw material prices, particularly for battery components like lithium and cobalt, can impact manufacturing costs and pricing strategies. Regulatory hurdles, including evolving safety standards and urban driving restrictions for certain types of two-wheelers, can also pose challenges for manufacturers and consumers. Intense competition within the market, with numerous domestic and international players, can lead to price wars and pressure on profit margins.

Future Opportunities in China Two Wheeler Market

The China two-wheeler market presents numerous future opportunities. The continued shift towards electric mobility will drive demand for advanced battery technologies, charging solutions, and related infrastructure development. The integration of smart features, connectivity, and autonomous driving capabilities in two-wheelers opens up new avenues for product differentiation and value-added services. Emerging markets within China, particularly in less developed provinces, offer significant untapped potential for market penetration. Furthermore, the global export market for Chinese-manufactured two-wheelers, especially electric models, is expected to grow substantially.

Major Players in the China Two Wheeler Market Ecosystem

- Wuyang-Honda Motors (Guangzhou) Co Ltd

- Loncin Motor Co Ltd

- Jiangsu Xinri E-Vehicle Co Ltd

- Zhejiang Luyuan Electric Vehicle Co Ltd

- Sundiro Honda Motorcycle Co Ltd

- Zongshen Industrial Group Co Ltd

- Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd )

- Luoyang Northern Enterprises Group Co Ltd

- Lifan Technology (Group) Co Ltd

- JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd )

- Guangzhou Dayun Motorcycle Co Ltd

Key Developments in China Two Wheeler Market Industry

- August 2023: Multi-matrix Publicity Activities Deepen the Global Deployment of SUNRA Electric Vehicles.

- August 2023: Win-win cooperation丨Loncin GM and Lingyun Intelligent jointly create intelligent self-balancing motorcycle products.

- July 2023: Recently, Sunra, a Chinese electric vehicle manufacturer, launched the mass-produced two-wheeled EV with sodium-ion batteries, bringing the concept to reality.

Strategic China Two Wheeler Market Market Forecast

The China two-wheeler market is projected for sustained and significant growth, primarily driven by the accelerating adoption of electric vehicles. Continued government support for green transportation, coupled with ongoing technological advancements in battery and smart systems, will solidify the dominance of electric scooters and electric motorcycles. The market's expansion will also be propelled by increasing urbanization and the inherent advantages of two-wheelers in navigating dense traffic efficiently and affordably. This strategic forecast indicates a robust future, where innovation in electric propulsion and connectivity will define market leadership, creating substantial opportunities for stakeholders who can adapt to these evolving trends and cater to the growing demand for sustainable and intelligent mobility solutions.

China Two Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

China Two Wheeler Market Segmentation By Geography

- 1. China

China Two Wheeler Market Regional Market Share

Geographic Coverage of China Two Wheeler Market

China Two Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Two Wheeler Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Loncin Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jiangsu Xinri E-Vehicle Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zhejiang Luyuan Electric Vehicle Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sundiro Honda Motorcycle Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zongshen Industrial Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Luoyang Northern Enterprises Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lifan Technology (Group) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guangzhou Dayun Motorcycle Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

List of Figures

- Figure 1: China Two Wheeler Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Two Wheeler Market Share (%) by Company 2025

List of Tables

- Table 1: China Two Wheeler Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 2: China Two Wheeler Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: China Two Wheeler Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 4: China Two Wheeler Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Two Wheeler Market?

The projected CAGR is approximately 1.97%.

2. Which companies are prominent players in the China Two Wheeler Market?

Key companies in the market include Wuyang-Honda Motors (Guangzhou) Co Ltd, Loncin Motor Co Ltd, Jiangsu Xinri E-Vehicle Co Ltd, Zhejiang Luyuan Electric Vehicle Co Ltd, Sundiro Honda Motorcycle Co Ltd, Zongshen Industrial Group Co Ltd, Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd ), Luoyang Northern Enterprises Group Co Ltd, Lifan Technology (Group) Co Ltd, JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd ), Guangzhou Dayun Motorcycle Co Ltd.

3. What are the main segments of the China Two Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

August 2023: Multi-matrix Publicity Activities Deepen the Global Deployment of SUNRA Electric VehiclesAugust 2023: Win-win cooperation丨Loncin GM and Lingyun Intelligent jointly create intelligent self-balancing motorcycle products.July 2023: Recently, Sunra, a Chinese electric vehicle manufacturer, launched the mass-produced two-wheeled EV with sodium-ion batteries, bringing the concept to reality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Two Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Two Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Two Wheeler Market?

To stay informed about further developments, trends, and reports in the China Two Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence