Key Insights

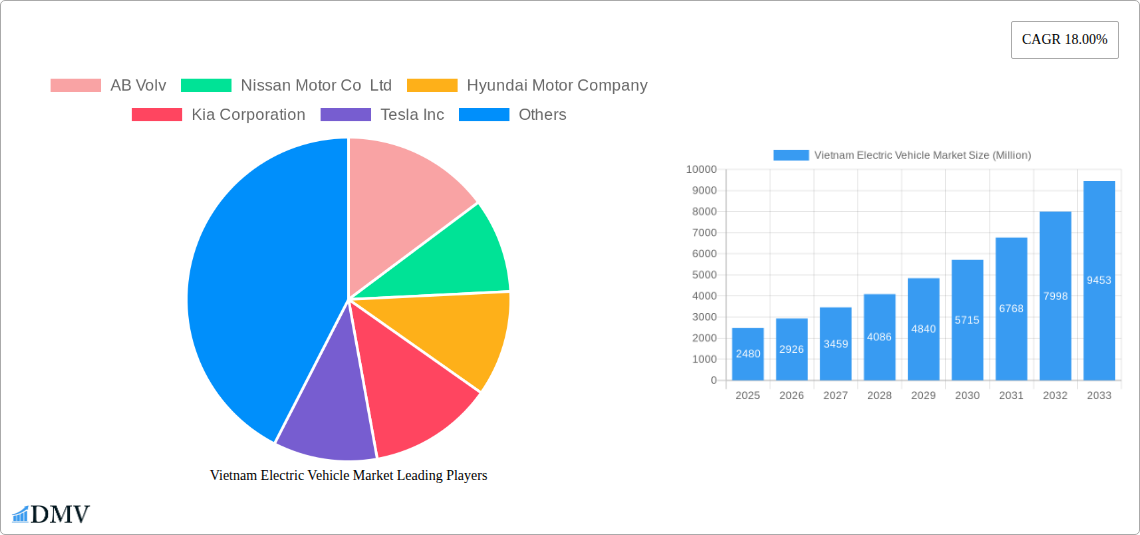

The Vietnam Electric Vehicle (EV) market is poised for explosive growth, driven by a confluence of favorable government policies, increasing consumer environmental consciousness, and the rapid expansion of charging infrastructure. With an estimated market size of USD 2.48 billion in 2025, the sector is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 18.00% through 2033. This robust expansion will be fueled by strong demand for both passenger cars and commercial vehicles, with battery electric vehicles (BEVs) expected to dominate the propulsion segment due to advancements in battery technology and decreasing costs. The Vietnamese government's commitment to promoting green transportation, including incentives for EV adoption and investment in charging networks, acts as a significant catalyst, creating a fertile ground for manufacturers and consumers alike.

Vietnam Electric Vehicle Market Market Size (In Billion)

Key trends shaping this dynamic market include the increasing availability of affordable EV models, the growing network of charging stations across major cities and highways, and a rising consumer preference for sustainable mobility solutions. Leading automotive players like Hyundai, Kia, VinFast, and Toyota are actively investing in expanding their EV portfolios in Vietnam, introducing a wider range of vehicles to cater to diverse consumer needs and price points. While the market is experiencing significant momentum, potential restraints such as the initial higher purchase price of some EV models compared to internal combustion engine (ICE) vehicles and the need for continued expansion of charging infrastructure in less urbanized areas remain considerations. However, the overall outlook for the Vietnam EV market is exceptionally bright, indicating a transformative shift towards electric mobility in the coming years.

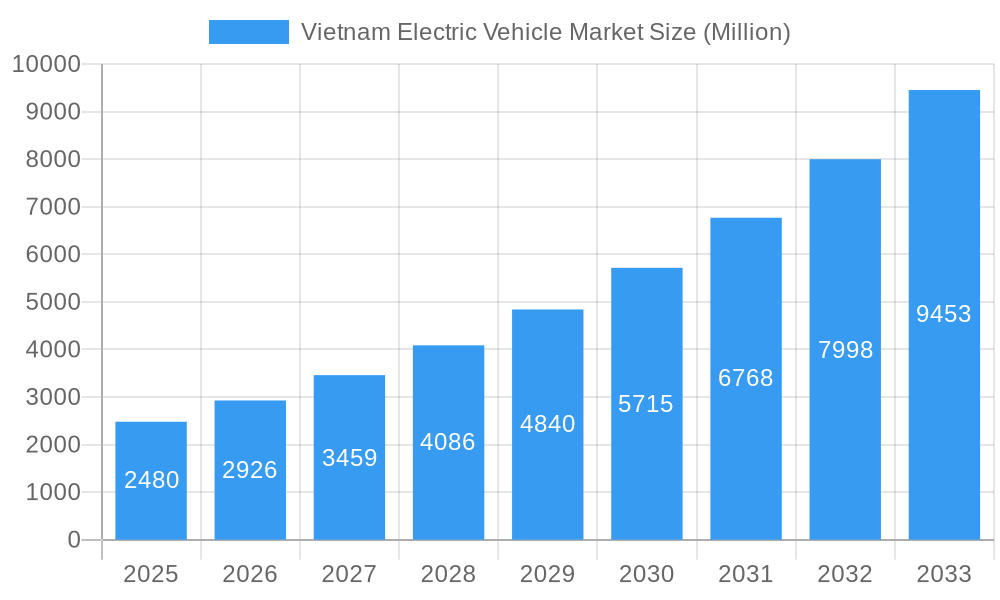

Vietnam Electric Vehicle Market Company Market Share

Unlock the immense potential of Vietnam's burgeoning electric vehicle (EV) market with this in-depth, SEO-optimized report. Covering a comprehensive study period from 2019 to 2033, with a detailed analysis of the Base Year 2025 and an extensive Forecast Period of 2025-2033, this report provides stakeholders with actionable insights into market dynamics, key players, and future growth trajectories. Delve into the strategic landscape, understand critical industry developments, and equip your business for success in this transformative sector.

Vietnam Electric Vehicle Market Market Composition & Trends

The Vietnam electric vehicle market is experiencing dynamic shifts, characterized by increasing EV adoption rates and evolving consumer preferences. Market concentration analysis reveals a landscape actively shaped by both established global automotive giants and innovative local players. Government incentives for EVs and favorable regulatory frameworks are acting as significant catalysts for innovation, driving forward the development of sustainable transportation solutions. While the threat of substitute products, such as highly efficient internal combustion engine (ICE) vehicles, persists, the compelling advantages of electric mobility are gaining traction. End-user profiles are diversifying, encompassing environmentally conscious individuals, fleet operators seeking cost efficiencies, and businesses aiming to bolster their ESG credentials. Mergers, acquisitions, and strategic partnerships are becoming increasingly prevalent, reflecting a competitive yet collaborative environment. For instance, recent automotive investment trends indicate substantial capital inflows aimed at expanding EV production and charging infrastructure. The market share distribution is projected to see significant shifts as new models enter the fray and consumer awareness grows. The total M&A deal value is estimated to be in the hundreds of millions of dollars, underscoring the strategic importance of this sector.

Vietnam Electric Vehicle Market Industry Evolution

The Vietnam electric vehicle industry is on an accelerated growth trajectory, transforming the nation's automotive landscape. From 2019 to 2024, the historical period has witnessed a foundational build-up of infrastructure and early adoption, setting the stage for the current expansion. The base year of 2025 marks a pivotal point, with projected EV sales in Vietnam expected to surge as new models become accessible and charging networks expand. Technological advancements are at the forefront, with continuous improvements in battery technology, charging speed, and vehicle performance. Battery Electric Vehicles (BEVs) are leading this charge, driven by increasing battery range and decreasing costs. However, Plug-in Hybrid Electric Vehicles (PHEVs) are also carving out a significant niche, offering a transitional solution for consumers wary of range anxiety. The market is witnessing a palpable shift in consumer demands, moving beyond just price to prioritize factors like environmental impact, advanced features, and overall driving experience. Growth rates are anticipated to be robust, with compound annual growth rate (CAGR) projections indicating a significant upward trend throughout the forecast period. Adoption metrics are steadily climbing, reflecting growing consumer confidence and a widening array of choices.

Leading Regions, Countries, or Segments in Vietnam Electric Vehicle Market

Within the Vietnam electric vehicle market, Passenger Cars currently represent the dominant segment in terms of sales volume and market share. This dominance is fueled by a growing middle class, increasing disposable incomes, and a rising awareness of the environmental benefits associated with EVs. The Battery Electric Vehicle (BEV) propulsion type is also spearheading the market's advancement, benefiting from significant advancements in battery technology and a widening availability of charging infrastructure.

Key Drivers for Passenger Car Dominance:

- Increasing Urbanization: A larger urban population in major cities like Hanoi and Ho Chi Minh City translates to higher demand for personal transportation.

- Government Policies and Incentives: Tax exemptions and subsidies for EV purchases are directly stimulating demand for passenger EVs.

- Brand Appeal and Lifestyle Choices: Many consumers associate EVs with modern technology and a sustainable lifestyle, influencing purchasing decisions.

- Expanding Charging Infrastructure: The gradual build-out of public and private charging stations is alleviating range anxiety for passenger car owners.

Dominance of Battery Electric Vehicles (BEVs):

- Technological Advancements: Continuous improvements in battery energy density and reduced manufacturing costs are making BEVs more competitive.

- Zero Emissions Appeal: The environmental consciousness among Vietnamese consumers is a significant factor driving BEV adoption.

- Lower Running Costs: Reduced electricity costs compared to gasoline or diesel translate to attractive long-term savings for BEV owners.

- Growing Model Availability: A wider array of BEV models across different price points is catering to a broader consumer base.

While Commercial Vehicles are gaining traction, particularly for logistics and public transportation due to their operational cost savings, and Fuel Cell Electric Vehicles (FCEVs) represent a nascent but promising segment for the future, Passenger Cars and BEVs are the current powerhouses shaping the immediate evolution of electric mobility in Vietnam.

Vietnam Electric Vehicle Market Product Innovations

The Vietnam electric vehicle market is witnessing a surge in product innovations, with manufacturers focusing on enhancing performance, extending range, and integrating smart technologies. For instance, VinFast Auto Ltd's November 2023 introduction of the VF 7, a smart electric SUV featuring a 75.3 kWh battery pack and an impressive range of up to 431 km, exemplifies this trend towards practical and appealing EV offerings. Similarly, the October 2023 launch of the VF 6 EV, with its Base and Plus variants equipped with a 59.6 kW LFP battery providing ranges of 399 km and 381 km respectively, highlights VinFast's commitment to diverse EV segments. These innovations are not just about technological prowess; they are about addressing consumer needs for efficiency, sustainability, and a seamless driving experience, setting new benchmarks for performance metrics and unique selling propositions in the Vietnamese automotive sector.

Propelling Factors for Vietnam Electric Vehicle Market Growth

The Vietnam electric vehicle market growth is being propelled by a confluence of powerful factors. Government support, including tax incentives and subsidies, is significantly reducing the upfront cost barrier for consumers. Rapid advancements in battery technology are leading to longer ranges and faster charging times, alleviating range anxiety. Growing environmental consciousness among the Vietnamese population is creating a strong demand for sustainable transportation options. Furthermore, the increasing availability of charging infrastructure, coupled with the lower operational costs of EVs compared to traditional vehicles, makes them an economically attractive choice for both individual consumers and fleet operators. The strategic investments by both local and international automotive companies are further accelerating market development and product diversification.

Obstacles in the Vietnam Electric Vehicle Market Market

Despite the promising outlook, the Vietnam electric vehicle market faces several hurdles. The initial high purchase price of EVs remains a significant barrier for a substantial portion of the consumer base. The limited and uneven distribution of charging infrastructure, particularly outside major urban centers, poses a challenge for widespread adoption. Supply chain disruptions for critical EV components, such as batteries, can lead to production delays and increased costs. Furthermore, a lack of widespread consumer awareness and understanding regarding EV technology, maintenance, and benefits can foster hesitancy. Regulatory complexities and the need for standardized charging protocols also present ongoing challenges that require proactive government intervention.

Future Opportunities in Vietnam Electric Vehicle Market

The Vietnam electric vehicle market presents numerous future opportunities. The expansion of charging infrastructure, including public charging stations and home charging solutions, offers substantial investment potential. The development of localized battery manufacturing and recycling facilities can enhance supply chain resilience and reduce costs. Emerging trends in smart mobility, such as connected car technologies and autonomous driving features integrated into EVs, will attract tech-savvy consumers. The growing demand for electric two-wheelers and commercial vehicles also represents a significant untapped market. Furthermore, the potential for vehicle-to-grid (V2G) technology integration could unlock new revenue streams and grid management solutions.

Major Players in the Vietnam Electric Vehicle Market Ecosystem

- AB Volvo

- Nissan Motor Co Ltd

- Hyundai Motor Company

- Kia Corporation

- Tesla Inc

- Mercedes-Benz Group AG

- Great Wall Motors (Haval Brand)

- Toyota Motor Corporation

- Vinfast Motor Ltd

- Honda Motor Co Ltd

Key Developments in Vietnam Electric Vehicle Market Industry

- November 2023: VinFast Auto Ltd introduced the VF 7, the 6th smart electric SUV in Vietnam. The VF7 is equipped with a 75.3 kWh battery pack and has a range of up to 431 km on a single charge.

- October 2023: VinFast Auto Ltd launched two variants of the VF 6 EV in Vietnam, including Base and Plus. The vehicle is equipped with a 59.6 kW LFP battery that provides a range of 399 km for the Base variant and 381 km for the Plus variant.

Strategic Vietnam Electric Vehicle Market Market Forecast

The strategic Vietnam electric vehicle market forecast anticipates robust growth driven by increasing government support, technological advancements, and a growing consumer appetite for sustainable transportation. The estimated year of 2025 marks a significant inflection point, with accelerating adoption rates and a broadening range of EV models across various segments. Future opportunities lie in the expansion of charging infrastructure, the localization of battery production, and the integration of smart mobility solutions. The market is poised for a transformative period, with Vietnam EV sales expected to reach unprecedented levels by the end of the forecast period of 2025–2033. This growth will be sustained by favorable economic conditions, declining battery costs, and an unwavering commitment to environmental sustainability.

Vietnam Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion

- 2.1. Battery Electric Vehicles

- 2.2. Plug-in Hybrid Electric Vehicles

- 2.3. Fuel Cell Electric Vehicles

Vietnam Electric Vehicle Market Segmentation By Geography

- 1. Vietnam

Vietnam Electric Vehicle Market Regional Market Share

Geographic Coverage of Vietnam Electric Vehicle Market

Vietnam Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Expected to Enhance the Electric Vehicle Sale

- 3.3. Market Restrains

- 3.3.1. Lack of Charging Stations

- 3.4. Market Trends

- 3.4.1. The Battery Electric Vehicles Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Battery Electric Vehicles

- 5.2.2. Plug-in Hybrid Electric Vehicles

- 5.2.3. Fuel Cell Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Volv

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kia Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tesla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Great Wall Motors (Haval Brand)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vinfast Motor Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honda Motor Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Volv

List of Figures

- Figure 1: Vietnam Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Electric Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Vietnam Electric Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 6: Vietnam Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Electric Vehicle Market?

The projected CAGR is approximately 18.00%.

2. Which companies are prominent players in the Vietnam Electric Vehicle Market?

Key companies in the market include AB Volv, Nissan Motor Co Ltd, Hyundai Motor Company, Kia Corporation, Tesla Inc, Mercedes-Benz Group AG, Great Wall Motors (Haval Brand), Toyota Motor Corporation, Vinfast Motor Ltd, Honda Motor Co Ltd.

3. What are the main segments of the Vietnam Electric Vehicle Market?

The market segments include Vehicle Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Expected to Enhance the Electric Vehicle Sale.

6. What are the notable trends driving market growth?

The Battery Electric Vehicles Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Charging Stations.

8. Can you provide examples of recent developments in the market?

November 2023: VinFast Auto Ltd introduced the VF 7, the 6th smart electric SUV in Vietnam. The VF7 is equipped with a 75.3 kWh battery pack and has a range of up to 431 km on a single charge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Vietnam Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence