Key Insights

Brazil's Airbag Systems Market is projected for substantial growth, reaching an estimated 42368 million by 2025, with a Compound Annual Growth Rate (CAGR) of 8.1% through 2033. This expansion is driven by stringent automotive safety mandates from the Brazilian government, requiring advanced airbag integration across vehicle types. Increased consumer safety awareness and rising disposable incomes, facilitating the acquisition of more equipped vehicles, further bolster market demand. The growing production of passenger and commercial vehicles also escalates the need for sophisticated airbag solutions. Leading manufacturers are investing in research and development to offer a comprehensive range of airbag technologies, including front, side, curtain, and knee airbags, catering to Original Equipment Manufacturers (OEMs) and the aftermarket.

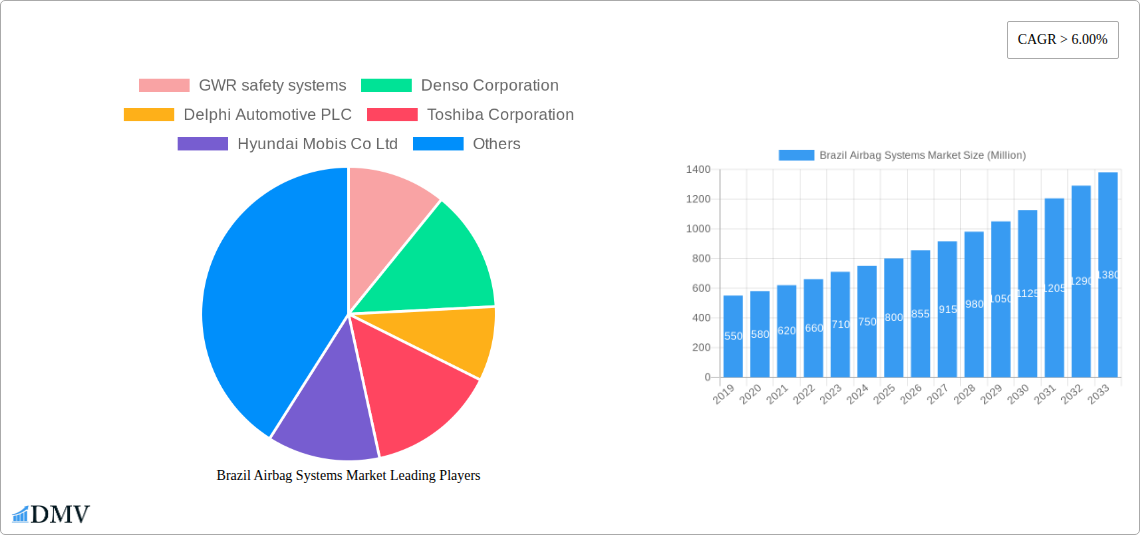

Brazil Airbag Systems Market Market Size (In Billion)

Key challenges for the Brazil Airbag Systems Market include the high cost of advanced airbag technologies and Brazil's economic volatility, which may impede adoption in entry-level vehicles. The aftermarket segment's growth is contingent on the automotive repair industry's health and skilled technician availability. Nevertheless, the unwavering focus on vehicle safety, propelled by regulatory pressures and consumer preferences, is expected to overcome these obstacles. The market is evolving towards intelligent airbags adaptable to occupant characteristics and the integration of advanced sensor technologies. The proliferation of connected car technologies also presents avenues for future airbag system innovations.

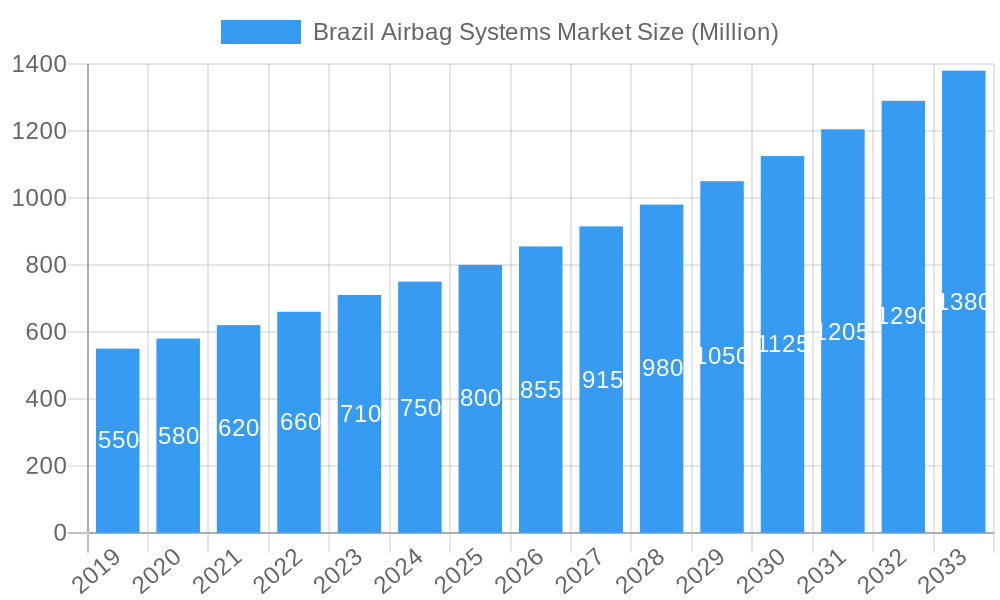

Brazil Airbag Systems Market Company Market Share

Gain actionable intelligence on the Brazil Airbag Systems Market with this comprehensive report. Analyzing the period from 2019 to 2033, with 2025 as the base and estimated year, this study details market segmentation, industry trends, key segments, product advancements, growth catalysts, restraints, and future prospects. Utilize our expert projections to inform strategic planning and capitalize on the increasing demand for advanced automotive safety solutions in Brazil. This report is crucial for OEMs, aftermarket suppliers, component manufacturers, and investors navigating this dynamic market.

Brazil Airbag Systems Market Market Composition & Trends

The Brazil Airbag Systems Market is characterized by a moderate level of concentration, with a few dominant players like Autoliv Inc., Robert Bosch GmbH, and Continental AG holding significant market share. Innovation remains a key catalyst, driven by stringent government mandates and increasing consumer awareness regarding automotive safety. Brazil's regulatory landscape, particularly the mandatory adoption of advanced airbag systems in newer vehicle models, plays a pivotal role in shaping market trends. The persistent demand for enhanced occupant protection is pushing the boundaries of airbag technology, leading to the development of more sophisticated systems. Substitute products, while present in older vehicle generations, are rapidly being phased out as safety standards evolve. End-user profiles are diverse, encompassing both Original Equipment Manufacturers (OEMs) seeking integrated safety solutions and the burgeoning aftermarket segment catering to vehicle upgrades and repairs. Mergers and acquisitions (M&A) activity, though not extensively documented publicly in terms of specific deal values in Brazil for this niche, is a strategic avenue for market players to expand their footprint, acquire technological capabilities, and consolidate their positions. Market share distribution is heavily influenced by production volumes of passenger vehicles and trucks, with front airbags currently dominating, but curtain and knee airbags showing significant growth potential.

- Market Concentration: Moderate, with key global players actively participating.

- Innovation Catalysts: Regulatory mandates, rising consumer safety consciousness, OEM R&D investments.

- Regulatory Landscape: Increasingly stringent safety standards driving adoption of advanced airbag technologies.

- Substitute Products: Largely limited to older vehicle models; declining relevance.

- End-User Profiles: OEMs, After-Market service providers.

- M&A Activities: Strategic consolidation and technology acquisition are anticipated trends.

Brazil Airbag Systems Market Industry Evolution

The Brazil Airbag Systems Market has witnessed a remarkable evolution, fueled by a confluence of factors including technological advancements, shifting consumer preferences, and supportive government policies. The historical period (2019–2024) saw a steady increase in airbag penetration, driven by safety regulations and a growing consumer demand for safer vehicles. The base year of 2025 marks a significant inflection point, with the market poised for accelerated growth in the forecast period of 2025–2033. Technological advancements have been a primary driver, with the introduction of multi-stage airbags, reactive restraint systems, and intelligent airbag deployment systems that adapt to the severity of a collision and occupant size. These innovations not only enhance safety but also contribute to a more sophisticated in-cabin experience. Consumer demand for automotive safety has shifted from a passive expectation to an active preference, with consumers increasingly factoring safety features into their purchasing decisions. This is evident in the growing adoption rates of vehicles equipped with a comprehensive suite of airbags, including front, side, curtain, and knee airbags. The growth trajectory of the Brazil Airbag Systems Market is projected to be robust, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is underpinned by rising vehicle production, an aging vehicle parc requiring aftermarket safety solutions, and continuous innovation by market players. The industry is also responding to demands for lighter and more cost-effective airbag solutions without compromising on performance.

Leading Regions, Countries, or Segments in Brazil Airbag Systems Market

The dominance within the Brazil Airbag Systems Market is primarily observed in the Passenger Vehicles segment of Automobile Type and the OEMs segment of Market End Consumer. This dominance is a direct consequence of the sheer volume of passenger car production and sales in Brazil, which far surpasses that of commercial vehicles, buses, and trucks. OEMs are the primary procurers of airbag systems, integrating them as standard safety features during the vehicle manufacturing process. The Front Airbag type currently holds the largest market share due to its mandatory inclusion in virtually all new passenger vehicles. However, significant growth is anticipated in Curtain Airbags and Knee Airbags, driven by evolving safety standards and consumer awareness of their protective benefits in various collision scenarios.

- Dominant Automobile Type: Passenger Vehicles

- Drivers: High production volumes, extensive consumer demand, comprehensive safety feature integration.

- Analysis: The passenger vehicle segment forms the bedrock of the Brazilian automotive industry. OEMs prioritize passenger vehicle safety to meet regulatory requirements and consumer expectations, making it the largest consumer of airbag systems.

- Dominant Market End Consumer: OEMs

- Drivers: Primary integrators of safety features, driven by new vehicle sales and production targets.

- Analysis: OEMs are crucial to the airbag market as they are the direct customers for bulk purchases of airbag modules and components. Their demand dictates the overall market volume.

- Dominant Airbag Type: Front Airbags

- Drivers: Mandatory safety regulations for frontal impact protection.

- Analysis: Frontal airbags are universally mandated and have been a standard safety feature for decades, ensuring their continued market leadership.

- Emerging Airbag Types: Curtain Airbags, Knee Airbags

- Drivers: Enhanced side-impact and lower-extremity protection, increasing safety awareness, regulatory pushes for comprehensive safety.

- Analysis: The market is witnessing a growing demand for these airbags as consumers and manufacturers recognize their critical role in providing holistic occupant protection. Investment trends in advanced safety technologies are directly supporting the growth of these segments.

Brazil Airbag Systems Market Product Innovations

Product innovations in the Brazil Airbag Systems Market are continuously pushing the boundaries of automotive safety. Manufacturers are focusing on developing lighter, more compact, and highly efficient airbag modules that seamlessly integrate into vehicle interiors without compromising on space or aesthetics. Advancements include the deployment of adaptive airbags that adjust inflation force based on occupant size, seating position, and impact severity, utilizing sophisticated sensor technology. Furthermore, innovations in materials science are leading to the development of more durable and reliable airbag fabrics and inflator technologies, enhancing system performance and lifespan. The integration of smart technologies, enabling airbags to communicate with other vehicle safety systems for predictive deployment, is also a significant area of development. These innovations aim to not only meet but exceed stringent safety standards, offering unparalleled protection to occupants.

Propelling Factors for Brazil Airbag Systems Market Growth

The Brazil Airbag Systems Market is propelled by a potent combination of factors. Stringent Automotive Safety Regulations are a primary driver, mandating the inclusion of advanced airbag systems in new vehicles. Increasing Consumer Awareness regarding the importance of occupant safety translates into a higher demand for vehicles equipped with comprehensive airbag configurations. Furthermore, the Growth of the Automotive Production in Brazil, particularly in the passenger vehicle segment, directly fuels the demand for airbags. Technological advancements by leading manufacturers, such as Robert Bosch GmbH and Autoliv Inc., introducing smarter and more effective airbag systems, also stimulate market expansion. Economic factors, including rising disposable incomes, contribute to increased vehicle sales, further bolstering the market.

Obstacles in the Brazil Airbag Systems Market Market

Despite robust growth, the Brazil Airbag Systems Market faces several obstacles. High Manufacturing Costs associated with advanced airbag technologies can impact affordability, especially for entry-level vehicles. Supply Chain Disruptions, as experienced globally, can affect the availability and cost of critical components. Economic Instability within Brazil can lead to fluctuations in vehicle sales, consequently impacting airbag demand. Complex Regulatory Compliance for new and evolving safety standards can pose challenges for smaller manufacturers. Intense Competition among established players and the threat of counterfeit parts in the aftermarket also present hurdles to consistent market growth.

Future Opportunities in Brazil Airbag Systems Market

Emerging opportunities in the Brazil Airbag Systems Market lie in the increasing adoption of Advanced Driver-Assistance Systems (ADAS), which often integrate with airbag control units, creating synergistic safety solutions. The growing demand for Connected Car Technologies presents avenues for airbags to become smarter and more responsive, communicating with external data sources. The Expanding Aftermarket Segment, driven by an aging vehicle parc and the need for replacement parts, offers significant growth potential. Furthermore, the development of Innovative Airbag Designs, such as those for electric vehicles with unique structural considerations, and the exploration of New Market Segments like specialized commercial vehicles, present promising avenues for future expansion and innovation.

Major Players in the Brazil Airbag Systems Market Ecosystem

- Autoliv Inc.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Hyundai Mobis Co Ltd

- Delphi Automotive PLC

- GWR safety systems

- Key Safety Systems

- Toshiba Corporation

Key Developments in Brazil Airbag Systems Market Industry

- 2023/01: Autoliv Inc. announces enhanced production capabilities in Brazil to meet growing demand for advanced airbag systems.

- 2022/07: Robert Bosch GmbH showcases new pedestrian protection airbag technology at a leading automotive trade show in São Paulo.

- 2021/11: Continental AG partners with a major Brazilian OEM to integrate their latest generation of curtain airbags into new passenger vehicle models.

- 2020/04: The Brazilian government reinforces vehicle safety regulations, mandating stricter requirements for side and curtain airbags.

- 2019/09: Denso Corporation expands its R&D focus on intelligent airbag deployment systems for the South American market.

Strategic Brazil Airbag Systems Market Market Forecast

The strategic outlook for the Brazil Airbag Systems Market is highly positive, driven by a clear trajectory of increasing safety consciousness and regulatory mandates. The forecast period (2025–2033) will witness sustained growth, primarily fueled by the continuous integration of advanced airbag technologies, such as adaptive and multi-stage systems, into an ever-larger proportion of new vehicle production. The expanding aftermarket, coupled with evolving consumer preferences for comprehensive safety features, will further contribute to this upward trend. Innovations in lightweight and cost-effective solutions will be crucial for market players to capture a wider market share. The market potential remains substantial, offering significant opportunities for companies to expand their offerings and solidify their presence in this vital automotive safety sector.

Brazil Airbag Systems Market Segmentation

-

1. Airbag Type

- 1.1. Curtain

- 1.2. Front

- 1.3. Knee

- 1.4. Sire

- 1.5. Others

-

2. Automobile Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

- 2.3. Busses

- 2.4. Truck

-

3. Market End Consumer

- 3.1. OEMs

- 3.2. After-Market

Brazil Airbag Systems Market Segmentation By Geography

- 1. Brazil

Brazil Airbag Systems Market Regional Market Share

Geographic Coverage of Brazil Airbag Systems Market

Brazil Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others

- 3.3. Market Restrains

- 3.3.1. RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others

- 3.4. Market Trends

- 3.4.1. Raising demand for safety will fuel market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Curtain

- 5.1.2. Front

- 5.1.3. Knee

- 5.1.4. Sire

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Automobile Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.2.3. Busses

- 5.2.4. Truck

- 5.3. Market Analysis, Insights and Forecast - by Market End Consumer

- 5.3.1. OEMs

- 5.3.2. After-Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GWR safety systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delphi Automotive PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Mobis Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Key Safety Systems*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autoliv Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friendrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GWR safety systems

List of Figures

- Figure 1: Brazil Airbag Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Airbag Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Airbag Systems Market Revenue million Forecast, by Airbag Type 2020 & 2033

- Table 2: Brazil Airbag Systems Market Revenue million Forecast, by Automobile Type 2020 & 2033

- Table 3: Brazil Airbag Systems Market Revenue million Forecast, by Market End Consumer 2020 & 2033

- Table 4: Brazil Airbag Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Brazil Airbag Systems Market Revenue million Forecast, by Airbag Type 2020 & 2033

- Table 6: Brazil Airbag Systems Market Revenue million Forecast, by Automobile Type 2020 & 2033

- Table 7: Brazil Airbag Systems Market Revenue million Forecast, by Market End Consumer 2020 & 2033

- Table 8: Brazil Airbag Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Airbag Systems Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Brazil Airbag Systems Market?

Key companies in the market include GWR safety systems, Denso Corporation, Delphi Automotive PLC, Toshiba Corporation, Hyundai Mobis Co Ltd, Continental AG, Key Safety Systems*List Not Exhaustive, Autoliv Inc, Robert Bosch GmbH, ZF Friendrichshafen AG.

3. What are the main segments of the Brazil Airbag Systems Market?

The market segments include Airbag Type, Automobile Type, Market End Consumer.

4. Can you provide details about the market size?

The market size is estimated to be USD 42368 million as of 2022.

5. What are some drivers contributing to market growth?

ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others.

6. What are the notable trends driving market growth?

Raising demand for safety will fuel market growth.

7. Are there any restraints impacting market growth?

RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Airbag Systems Market?

To stay informed about further developments, trends, and reports in the Brazil Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence