Key Insights

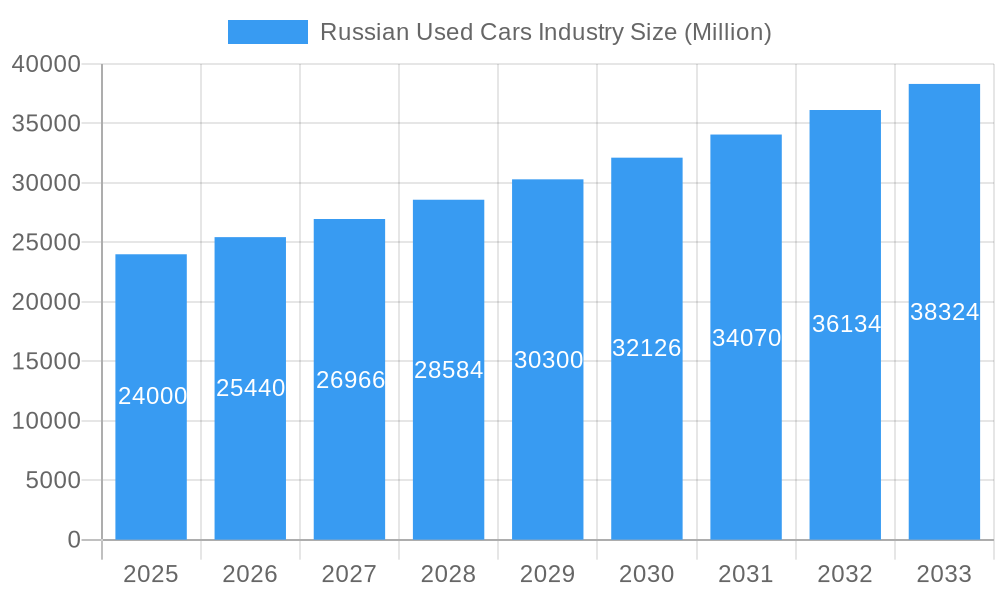

The Russian used car market is poised for robust growth, projected to reach a market size of approximately $30,000 million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 6.00%. This expansion is primarily driven by the increasing demand for affordable and reliable transportation solutions, coupled with a growing preference for pre-owned vehicles over new ones due to economic factors and evolving consumer sentiment. The market's growth is further fueled by several key trends, including the digitalization of the used car sales process, with online platforms and digital marketplaces gaining significant traction, offering greater transparency and convenience for buyers and sellers alike. Additionally, a rising interest in SUVs and sedans within the used car segment indicates a sustained demand for versatile and practical vehicle types. The penetration of electric vehicles (EVs) in the used market, though nascent, is also an emerging trend to watch, hinting at future shifts in propulsion preferences.

Russian Used Cars Industry Market Size (In Billion)

Despite the positive growth trajectory, certain restraints could influence the market's pace. Economic volatility and fluctuating disposable incomes may create headwinds, impacting purchasing power for used vehicles. Furthermore, concerns regarding the authenticity of vehicle history and maintenance records can deter some buyers, necessitating greater efforts in quality assurance and certification from vendors. The market is characterized by a dynamic vendor landscape, with both organized players like Inchcape plc and TrueCar Inc., and unorganized dealers contributing to market supply. Established automakers such as JSC AVTOVAZ are also significant participants. Geographically, Russia represents the primary focus for this market analysis, with a stable and growing demand across various car types and propulsion systems. The projected growth signifies a maturing yet dynamic market, offering opportunities for stakeholders who can effectively navigate economic conditions and leverage technological advancements.

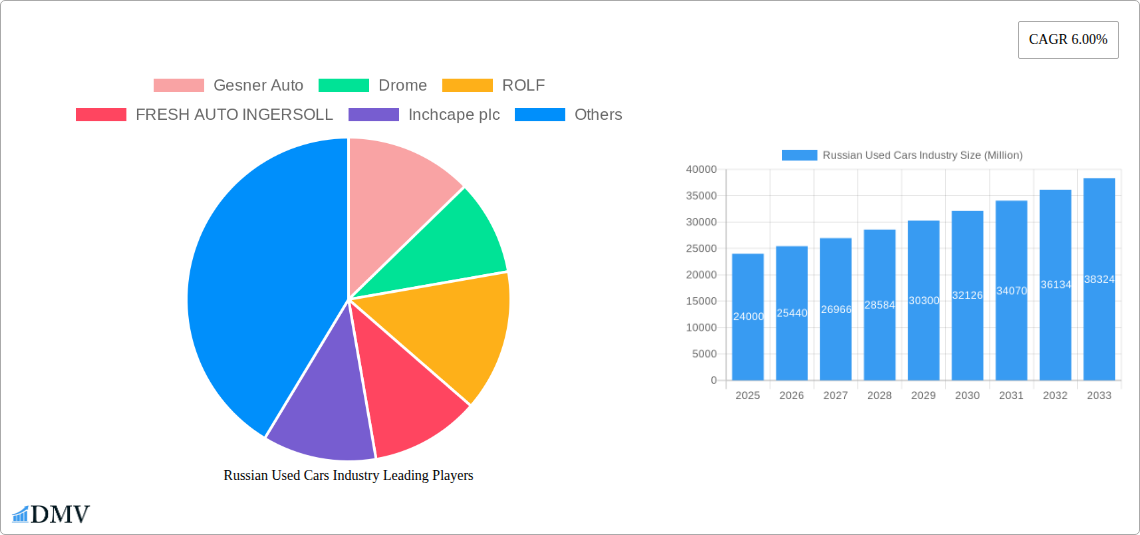

Russian Used Cars Industry Company Market Share

Unlock critical insights into the dynamic Russian used cars market with this in-depth report. Covering the historical period of 2019-2024 and projecting through 2033, with a base and estimated year of 2025, this analysis is your definitive guide to understanding market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Essential for stakeholders seeking to navigate the complexities of the Russian used car market, including key players like Gesner Auto, Drome, ROLF, FRESH AUTO INGERSOLL, Inchcape plc, JSC AVTOVAZ, Favorit Motors, and TrueCar Inc. This report leverages high-ranking keywords to ensure maximum visibility and provides actionable intelligence for strategic decision-making.

Russian Used Cars Industry Market Composition & Trends

The Russian used cars industry is characterized by a moderately concentrated market, with a significant presence of both organized and unorganized vendors. Innovation catalysts are primarily driven by technological advancements in vehicle diagnostics and online sales platforms, facilitating greater transparency and accessibility. The regulatory landscape, while evolving, presents both opportunities and challenges for market participants. Substitute products, such as new car financing schemes and public transportation, influence consumer choices. End-user profiles span a broad demographic, from budget-conscious individuals seeking value for money to those prioritizing specific vehicle types like Hatchbacks, Sedans, and SUVs. Mergers and acquisitions (M&A) activity, while not at peak levels, plays a crucial role in market consolidation. For instance, the sale of ROLF to KlyuchAvto for an estimated USD 400 Million - USD 500 Million in December 2021 underscores significant M&A trends within the sector.

- Market Concentration: Moderate, with a mix of large dealerships and independent sellers.

- Innovation Catalysts: Digitalization of sales, enhanced vehicle inspection technologies, financing solutions.

- Regulatory Landscape: Evolving standards for vehicle quality, emissions, and dealership operations.

- Substitute Products: New vehicle offerings, ride-sharing services, public transport.

- End-User Profiles: Diverse, with strong demand for affordable and reliable transportation.

- M&A Activities: Key consolidation events shaping the competitive landscape.

- Market Share Distribution: Analysis of key players' presence in organized vs. unorganized sectors.

- M&A Deal Values: Tracking significant transactions impacting market structure, such as the ROLF sale.

Russian Used Cars Industry Industry Evolution

The Russian used cars industry has undergone a significant transformation over the historical period of 2019-2024, driven by dynamic market growth trajectories, rapid technological advancements, and evolving consumer demands. Initially, the market was heavily dominated by unorganized sellers and informal transactions, leading to a perception of lower transparency and higher risk for consumers. However, the emergence and growth of organized dealerships and online platforms have gradually shifted this dynamic. Technological advancements, including sophisticated vehicle inspection tools, online valuation services, and digital marketplaces, have fostered greater trust and convenience. Consumer demand has also evolved, with a growing preference for certified pre-owned vehicles offering warranties and a wider selection of car types, including Hatchbacks, Sedans, and SUVs. The increasing affordability of used cars compared to new ones, especially for Internal Combustion Engine (ICE) vehicles, has consistently fueled demand. Furthermore, the nascent but growing interest in Electric Vehicles (EVs), though still a small segment in the used market, indicates a future shift in consumer preferences. The overall market growth rate, while subject to economic fluctuations and geopolitical events, has demonstrated resilience, with projected steady expansion during the forecast period of 2025-2033. Adoption metrics for online car-buying platforms have seen a substantial surge, indicating a paradigm shift in how consumers research and purchase used vehicles. This evolution is not just about transaction volumes but also about the increasing professionalization of the industry and the adoption of best practices mirroring global trends.

Leading Regions, Countries, or Segments in Russian Used Cars Industry

The Russian used cars industry exhibits a distinct regional dominance and segmentation, primarily driven by population density, economic activity, and consumer preferences. Moscow and St. Petersburg consistently emerge as leading regions, owing to their larger populations, higher disposable incomes, and a greater concentration of organized dealerships. Within the Car Type segment, SUVs have witnessed a surge in popularity across Russia, driven by their versatility and suitability for diverse road conditions. Sedans remain a strong contender, particularly in urban areas and among traditional buyers. Hatchbacks continue to be a significant segment, appealing to younger demographics and those seeking fuel-efficient and compact options. In terms of Propulsion, Internal Combustion Engine (ICE) vehicles overwhelmingly dominate the used car market due to widespread availability, established refueling infrastructure, and lower initial purchase costs compared to their electric counterparts. The Electric vehicle segment in the used market is still nascent, facing challenges related to battery degradation, charging infrastructure, and higher upfront costs, though it is expected to grow in the long term. The Vendor Type landscape is bifurcated. The Organized sector, comprising franchised dealerships and large independent used car retailers, offers greater trust, warranty options, and standardized services, attracting a significant portion of buyers willing to pay a premium for peace of mind. Conversely, the Unorganized sector, consisting of smaller independent dealers and private sellers, caters to the budget-conscious segment, offering lower prices but often with higher inherent risks. Investment trends are heavily skewed towards optimizing online platforms and improving inspection processes within the organized sector, while regulatory support for smaller, unorganized players remains a key factor influencing their sustainability and growth.

- Dominant Regions: Moscow and St. Petersburg lead in terms of transaction volumes and dealership presence.

- Leading Car Type: SUVs are increasingly popular, followed by Sedans and Hatchbacks.

- Propulsion Dominance: Internal Combustion Engine (ICE) vehicles constitute the vast majority of the market.

- Electric Vehicle Segment: Nascent but with potential for future growth.

- Vendor Type Dynamics: A clear divide between the structured, trust-driven organized sector and the price-competitive unorganized sector.

- Key Drivers for Organized Sector: Consumer demand for reliability, warranties, and professional services.

- Key Drivers for Unorganized Sector: Affordability and accessibility for budget-conscious buyers.

- Investment Trends: Focus on digitalization and service enhancement in the organized sector.

- Regulatory Support: Influencing the operational landscape for both organized and unorganized vendors.

Russian Used Cars Industry Product Innovations

Product innovations in the Russian used cars industry are primarily focused on enhancing the buyer and seller experience, rather than groundbreaking new vehicle technologies, as the market predominantly deals with pre-owned vehicles. Key innovations include advanced online appraisal tools that provide instant, data-driven valuations for used cars, leveraging AI and vast datasets. Digital platforms are increasingly offering virtual showrooms and augmented reality (AR) features, allowing potential buyers to explore vehicles remotely and in detail. Enhanced vehicle inspection reports, incorporating detailed diagnostics and video walkarounds, are becoming standard, boosting transparency and trust. Furthermore, the development of integrated financing and insurance solutions directly within online marketplaces streamlines the purchasing process. These innovations aim to bridge the gap between traditional dealership experiences and the convenience of e-commerce, making the used car buying journey more efficient, secure, and personalized. The performance metrics of these innovations are measured by increased customer satisfaction, reduced transaction times, and higher conversion rates.

Propelling Factors for Russian Used Cars Industry Growth

Several key factors are propelling the growth of the Russian used cars industry. Economically, the continued affordability of used cars compared to new models remains a primary driver, especially for a significant segment of the population. Technological advancements in vehicle diagnostics and online sales platforms are fostering greater trust and accessibility, thereby expanding the market reach. Furthermore, government initiatives aimed at supporting the automotive sector, including potential incentives for vehicle upgrades and financing schemes, indirectly benefit the used car market. The increasing availability of well-maintained vehicles from the growing new car market of previous years also feeds into the used car supply. The desire for personal mobility, coupled with the practicalities of owning a car in Russia, continues to underpin demand across various vehicle segments.

Obstacles in the Russian Used Cars Industry Market

The Russian used cars industry faces several significant obstacles. Regulatory challenges, including potential shifts in import duties and emissions standards, can create uncertainty and impact vehicle pricing. Supply chain disruptions, though lessening, can still affect the availability of specific parts for repairs and maintenance, impacting the resale value and appeal of certain vehicles. Intense competition from numerous dealers, both organized and unorganized, can lead to price wars and squeezed profit margins. Moreover, consumer concerns regarding vehicle history, mileage discrepancies, and hidden defects persist, requiring ongoing efforts to build trust and transparency. The geographical vastness of Russia also presents logistical challenges for efficient nationwide distribution and servicing.

Future Opportunities in Russian Used Cars Industry

The Russian used cars industry is ripe with future opportunities. The growing demand for Electric Vehicles (EVs), while currently small in the used market, presents a nascent but significant opportunity as early EVs reach the pre-owned stage. Developing specialized financing and warranty programs for EVs will be crucial. The expansion of digital platforms to reach more remote regions of Russia will unlock new customer bases. Furthermore, the increasing focus on sustainability and circular economy principles could lead to growth in certified pre-owned programs and refurbishment services. Partnerships between technology providers and dealerships can further enhance customer experience and operational efficiency.

Major Players in the Russian Used Cars Industry Ecosystem

- Gesner Auto

- Drome

- ROLF

- FRESH AUTO INGERSOLL

- Inchcape plc

- JSC AVTOVAZ

- Favorit Motors

- TrueCar Inc

Key Developments in Russian Used Cars Industry Industry

- December 2021: Russia's largest car dealer, ROLF, was sold to rival KlyuchAvto for an undisclosed amount, financed by Alfa Bank. Unnamed sources valued the deal at USD 400 Million - USD 500 Million, significantly less than the initial planned valuation. This marked a significant consolidation event within the industry.

- March 2022: Inchcape plc announced its withdrawal from the Russian market due to the ongoing conflict in Ukraine, citing the untenable nature of its business interests in the country under the prevailing circumstances. This represented a major exit by an international player, impacting market dynamics and potentially opening opportunities for domestic competitors.

Strategic Russian Used Cars Industry Market Forecast

The strategic forecast for the Russian used cars industry indicates continued robust growth driven by persistent demand for affordable personal transportation and the increasing professionalization of the market. The forecast period of 2025–2033 anticipates a steady expansion, fueled by technological advancements in online sales and vehicle assessment, which are enhancing trust and accessibility. Emerging opportunities in the used Electric Vehicle (EV) segment, coupled with innovative financing and warranty solutions, will likely contribute to market diversification. The consolidation and maturation of the organized dealership sector, alongside the adaptation of unorganized players to digital tools, will create a more efficient and consumer-friendly marketplace. Key growth catalysts include the inherent value proposition of used cars against new models, increasing consumer confidence through transparent transactions, and the ongoing development of digital infrastructure across the vast Russian landscape.

Russian Used Cars Industry Segmentation

-

1. Car Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric

-

3. Vendor Type

- 3.1. Organized

- 3.2. Unorganized

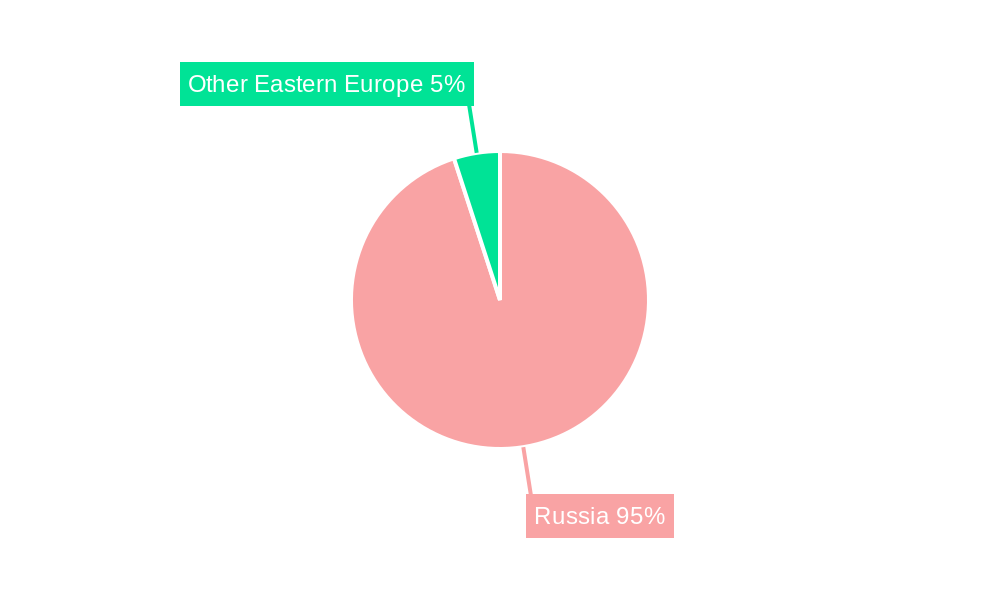

Russian Used Cars Industry Segmentation By Geography

- 1. Russia

Russian Used Cars Industry Regional Market Share

Geographic Coverage of Russian Used Cars Industry

Russian Used Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Hatchback and Sedan Used Car Sales to Witness Surge During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gesner Auto

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Drome

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ROLF

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FRESH AUTO INGERSOLL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inchcape plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSC AVTOVAZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Favorit Motors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TrueCar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Gesner Auto

List of Figures

- Figure 1: Russian Used Cars Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russian Used Cars Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Used Cars Industry Revenue Million Forecast, by Car Type 2020 & 2033

- Table 2: Russian Used Cars Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Russian Used Cars Industry Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 4: Russian Used Cars Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Russian Used Cars Industry Revenue Million Forecast, by Car Type 2020 & 2033

- Table 6: Russian Used Cars Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 7: Russian Used Cars Industry Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: Russian Used Cars Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Used Cars Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Russian Used Cars Industry?

Key companies in the market include Gesner Auto, Drome, ROLF, FRESH AUTO INGERSOLL, Inchcape plc, JSC AVTOVAZ, Favorit Motors, TrueCar Inc.

3. What are the main segments of the Russian Used Cars Industry?

The market segments include Car Type, Propulsion, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Hatchback and Sedan Used Car Sales to Witness Surge During Forecast Period.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In March 2022, Inchcape announced that it is pulling out of the Russian market as a result of the ongoing conflict in Ukraine. The company stated that in light of the current circumstances, they have concluded that the Group's ownership of its business interests in Russia is no longer tenable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Used Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Used Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Used Cars Industry?

To stay informed about further developments, trends, and reports in the Russian Used Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence