Key Insights

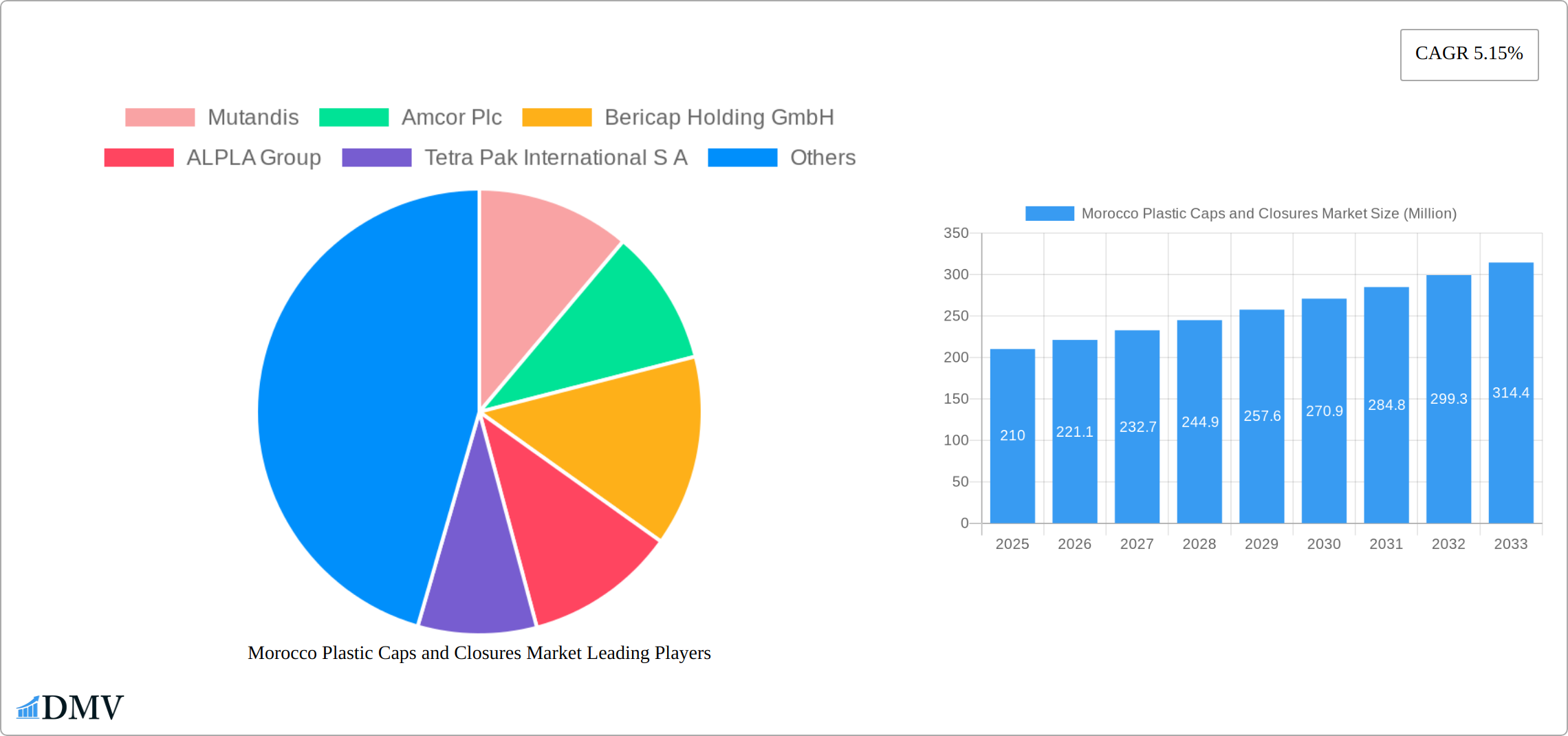

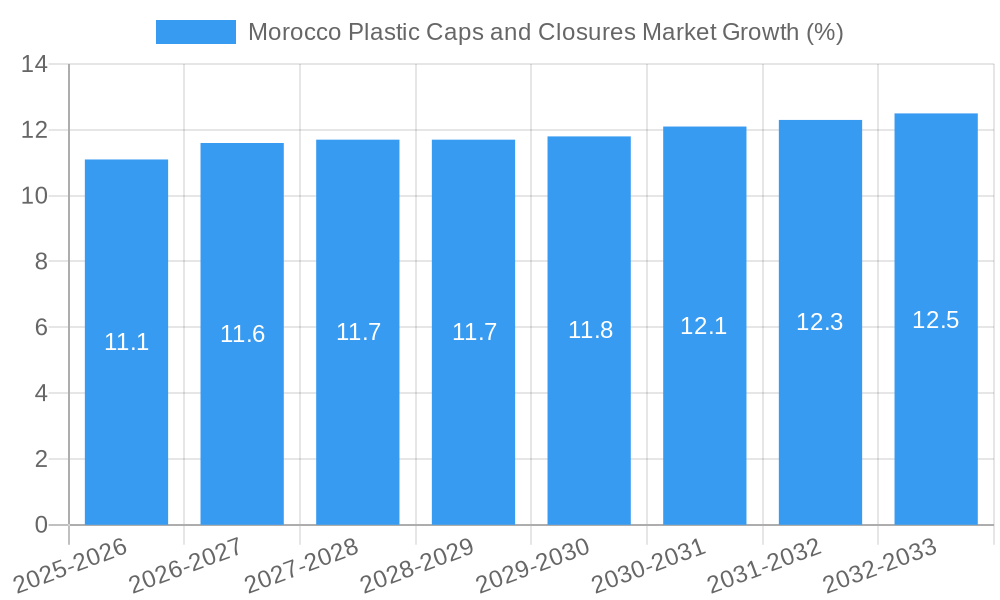

The Morocco plastic caps and closures market, valued at $210 million in 2025, is projected to experience robust growth, driven by a burgeoning beverage industry, increasing demand for packaged food products, and a rising consumer preference for convenient packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 5.15% from 2025 to 2033 indicates a steady expansion, fueled by factors such as rising disposable incomes, population growth, and the adoption of advanced packaging technologies. Key players like Mutandis, Amcor Plc, Bericap Holding GmbH, ALPLA Group, Tetra Pak International S A, and Sacmi Imola S C are actively contributing to this growth through product innovation and strategic investments. However, environmental concerns regarding plastic waste and stringent government regulations regarding plastic usage are likely to present challenges, potentially impacting market expansion in the long term. The market segmentation will likely be driven by material type (PET, HDPE, PP, etc.), closure type (screw caps, flip-tops, etc.), and application (beverages, food, pharmaceuticals, etc.). Growth within the food and beverage sectors is expected to be particularly significant, given the increasing consumption of packaged goods in Morocco.

The forecast period from 2025 to 2033 will witness a gradual expansion of the market, with growth likely to be more pronounced in the initial years. This is expected due to increased investments in infrastructure and manufacturing capacity within the packaging industry. While challenges related to sustainability and regulation are anticipated, innovations in sustainable packaging materials, such as biodegradable plastics and recycled content, will likely mitigate these concerns to some extent. Market players are expected to invest further in research and development to offer more eco-friendly options, influencing consumer choices and overall market growth. Regional variations in market growth are expected, with urban areas witnessing faster adoption of packaged goods compared to rural areas.

Morocco Plastic Caps and Closures Market Market Composition & Trends

The Morocco plastic caps and closures market is characterized by a moderate level of concentration with key players such as Mutandis, Amcor Plc, Bericap Holding GmbH, ALPLA Group, Tetra Pak International S.A, and Sacmi Imola S.C. dominating the landscape. These companies collectively hold approximately 60% of the market share, with Mutandis leading with a 20% share. The market is driven by continuous innovation, spurred by the need for sustainable and user-friendly packaging solutions. Regulatory frameworks in Morocco are increasingly favoring environmentally friendly materials, pushing manufacturers to innovate with biodegradable and recyclable plastics.

- Innovation Catalysts: The demand for innovative caps and closures stems from the food and beverage industry's shift towards sustainability. Advances in material science have enabled the development of lighter, more durable, and eco-friendly products.

- Regulatory Landscape: Moroccan regulations are aligning with international standards, promoting the use of recycled materials in packaging. This has led to increased R&D investments by major companies.

- Substitute Products: Glass and metal closures are alternatives, but plastic remains preferred due to its cost-effectiveness and versatility.

- End-User Profiles: The primary end-users are in the beverage, food, and pharmaceutical sectors, with beverages accounting for 50% of the market demand.

- M&A Activities: Recent mergers and acquisitions, such as Bericap's acquisition of a local manufacturer for $15 Million, aim to consolidate market positions and expand product portfolios.

Morocco Plastic Caps and Closures Market Industry Evolution

The evolution of the Morocco plastic caps and closures market has been marked by significant growth and technological advancements. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of 5%, driven by the expansion of the beverage sector and increasing consumer awareness about product safety. Technological innovations, such as the introduction of tamper-evident and child-resistant closures, have enhanced product offerings. The adoption of smart packaging solutions, integrating RFID technology for tracking and authentication, is projected to increase by 10% annually from 2025 to 2033.

Consumer demands have shifted towards sustainability, prompting companies to invest in biodegradable materials. The market is expected to continue its growth trajectory, with a forecasted CAGR of 6% from 2025 to 2033, fueled by the rise in packaged goods consumption and the expansion of retail sectors. The integration of advanced manufacturing technologies, such as 3D printing for custom closures, is set to revolutionize the industry further, catering to niche markets and bespoke requirements.

Leading Regions, Countries, or Segments in Morocco Plastic Caps and Closures Market

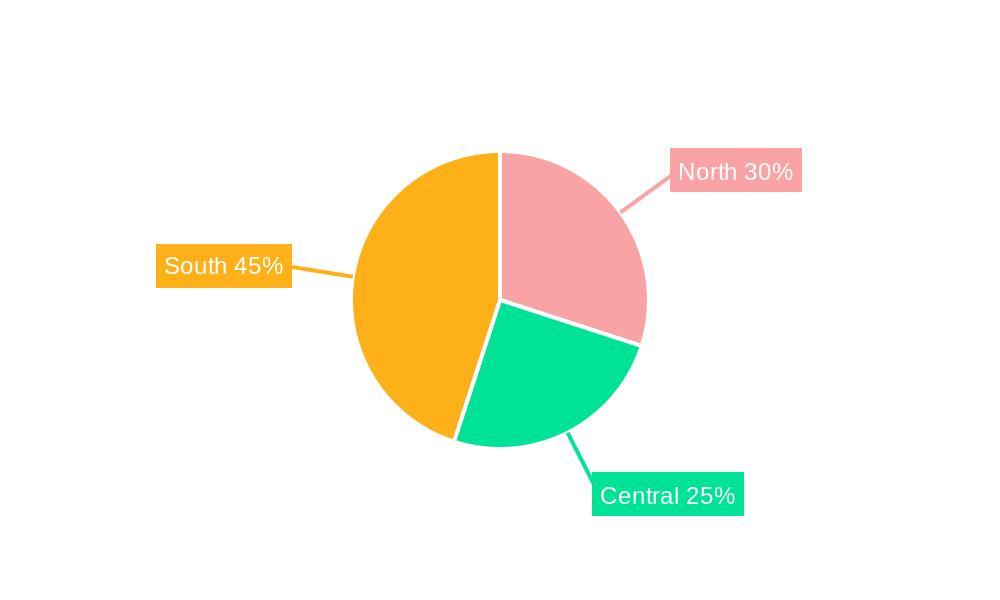

The Casablanca-Settat region stands as the undisputed leader in the Morocco plastic caps and closures market, accounting for approximately 40% of the national market share. This dominance is fueled by a strategic concentration of advanced manufacturing facilities, proximity to key consumer bases, and a favorable investment climate. The region benefits from robust investment trends in modern manufacturing infrastructure and technology, attracting both domestic and international players. Furthermore, supportive governmental initiatives aimed at fostering industrial advancement and promoting sustainable practices significantly contribute to Casablanca-Settat's growth trajectory. Its strategic location is pivotal for establishing efficient distribution networks and ensuring reliable access to essential raw materials. The region's economic policies actively encourage foreign direct investment, further solidifying its market leadership. Within Casablanca-Settat, the beverage segment is particularly buoyant, commanding an impressive 55% market share. This is a direct consequence of the escalating demand for bottled beverages and the presence of major, established beverage manufacturers.

- Investment Trends: Substantial investments in upgrading manufacturing infrastructure and adopting cutting-edge technologies have transformed Casablanca-Settat into a prime destination for companies seeking to establish or expand their presence in the plastic caps and closures sector.

- Regulatory Support: The Moroccan government's proactive stance in promoting industrial development and advocating for sustainable production methods has created an enabling environment for the region's continued expansion and innovation.

Morocco Plastic Caps and Closures Market Product Innovations

The Morocco plastic caps and closures market is witnessing a surge in innovation, with a strong emphasis on developing eco-friendly materials and advanced smart packaging solutions. Leading companies, such as ALPLA Group, are at the forefront, introducing closures crafted from 100% recycled PET. This significant stride dramatically minimizes the environmental footprint associated with plastic packaging. Another transformative innovation involves the integration of RFID technology, which enhances product authentication and traceability. This technological advancement instills greater consumer confidence and ensures the integrity of products throughout the supply chain. These innovations are not merely about meeting stringent regulatory demands; they are also a direct response to the escalating consumer preference for packaging that is both environmentally responsible and highly secure.

Propelling Factors for Morocco Plastic Caps and Closures Market Growth

The Morocco plastic caps and closures market is experiencing robust growth, propelled by a confluence of influential factors. Technological advancements, particularly the adoption of smart packaging solutions, are instrumental in elevating product offerings and fulfilling consumer desires for enhanced safety and convenience. From an economic perspective, the sustained expansion of the beverage and food sectors, coupled with a projected increase in the consumption of packaged goods, serves as a significant market driver. Furthermore, favorable regulatory influences, including government incentives designed to encourage sustainable manufacturing practices, are actively motivating companies to pursue innovative solutions, thereby accelerating overall market growth.

Obstacles in the Morocco Plastic Caps and Closures Market Market

Despite its growth, the Morocco plastic caps and closures market encounters several considerable challenges. Regulatory hurdles, particularly the implementation of stringent environmental regulations, can lead to increased production costs and may necessitate significant investments in compliance. Supply chain disruptions, especially concerning the consistent availability of raw materials, have impacted production efficiency, with some reports indicating a decrease. Moreover, the intensifying competitive landscape, marked by the entry of international players, has led to heightened price competition and can result in margin erosion for local manufacturers who may lack the economies of scale of global giants.

Future Opportunities in Morocco Plastic Caps and Closures Market

Emerging opportunities in the Morocco plastic caps and closures market include the exploration of new markets, such as the growing pharmaceutical sector, which is expected to increase demand for specialized closures. Technological advancements, like the use of 3D printing for custom solutions, offer potential for niche market penetration. Consumer trends towards sustainability and personalized packaging present avenues for innovation and market expansion.

Major Players in the Morocco Plastic Caps and Closures Market Ecosystem

Key Developments in Morocco Plastic Caps and Closures Market Industry

- May 2024: The UK debut of Sahara, a sophisticated and contemporary spirit inspired by Mahia, Morocco's traditional fig and aniseed liqueur, marks a significant cultural export. Infused with notes of apricot, almond, honey, and cinnamon, Sahara offers a premium, distinctly Moroccan sensory experience. This launch, deeply rooted in the essence of Morocco's diverse geography, honors its people, culture, and rich history. The introduction of such premium, culturally resonant products could stimulate demand for specialized, high-quality caps and closures that align with the brand's sophisticated positioning.

- January 2024: The Moroccan retail sector is witnessing a dynamic shift with the entry of Egyptian hard discounter Kazyon in October 2023, directly challenging its Turkish competitor, BIM. While BIM initially held a lead, Kazyon has demonstrated remarkable growth in store count, surpassing 800 outlets in Egypt, whereas BIM's network expansion has been more modest in recent years. Kazyon has ambitious plans for Morocco, targeting 200 outlets by the end of 2025 and a substantial goal of 600 stores by 2027, with its current Moroccan presence concentrated in Casablanca with 12 stores. The rapid expansion of supermarket chains like Kazyon and BIM is likely to generate increased demand for a wide array of plastic caps and closures to cater to the growing volume of packaged consumer goods.

Strategic Morocco Plastic Caps and Closures Market Market Forecast

The Morocco plastic caps and closures market is poised for significant growth, with a forecasted CAGR of 6% from 2025 to 2033. The market's potential is driven by increasing demand for sustainable packaging solutions and the expansion of the beverage and food sectors. Future opportunities lie in the adoption of smart packaging technologies and the exploration of new markets, such as pharmaceuticals, which will further enhance the market's growth trajectory.

Morocco Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-resistant

-

3. End-User Industry

- 3.1. Food

-

3.2. Bevrage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices & Energy Drinks

- 3.2.5. Others

- 3.3. Personal Care & Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-use Industries

Morocco Plastic Caps and Closures Market Segmentation By Geography

- 1. Morocco

Morocco Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Recyclable Plastics to Push the Market Growth

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Recyclable Plastics to Push the Market Growth

- 3.4. Market Trends

- 3.4.1. Polypropylene Resin is Expected to Push the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Bevrage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices & Energy Drinks

- 5.3.2.5. Others

- 5.3.3. Personal Care & Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mutandis

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bericap Holding GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALPLA Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tetra Pak International S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sacmi Imola S C

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Mutandis

List of Figures

- Figure 1: Morocco Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco Plastic Caps and Closures Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 4: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2019 & 2032

- Table 5: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 7: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 12: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2019 & 2032

- Table 13: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 15: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: Morocco Plastic Caps and Closures Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Morocco Plastic Caps and Closures Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Plastic Caps and Closures Market?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the Morocco Plastic Caps and Closures Market?

Key companies in the market include Mutandis, Amcor Plc, Bericap Holding GmbH, ALPLA Group, Tetra Pak International S A, Sacmi Imola S C.

3. What are the main segments of the Morocco Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Recyclable Plastics to Push the Market Growth.

6. What are the notable trends driving market growth?

Polypropylene Resin is Expected to Push the Market Growth.

7. Are there any restraints impacting market growth?

Growing Demand for Recyclable Plastics to Push the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2024 - Sahara, a refined, contemporary blend inspired by Mahia, a traditional Moroccan fig and aniseed spirit, debuted in the UK. Infused with apricots, almonds, honey, and cinnamon, Sahara promises a premium, distinctly Moroccan experience. Rooted in the essence of Morocco's diverse landscape, the Sahara pays homage to the nation's people, culture, and history.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the Morocco Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence