Key Insights

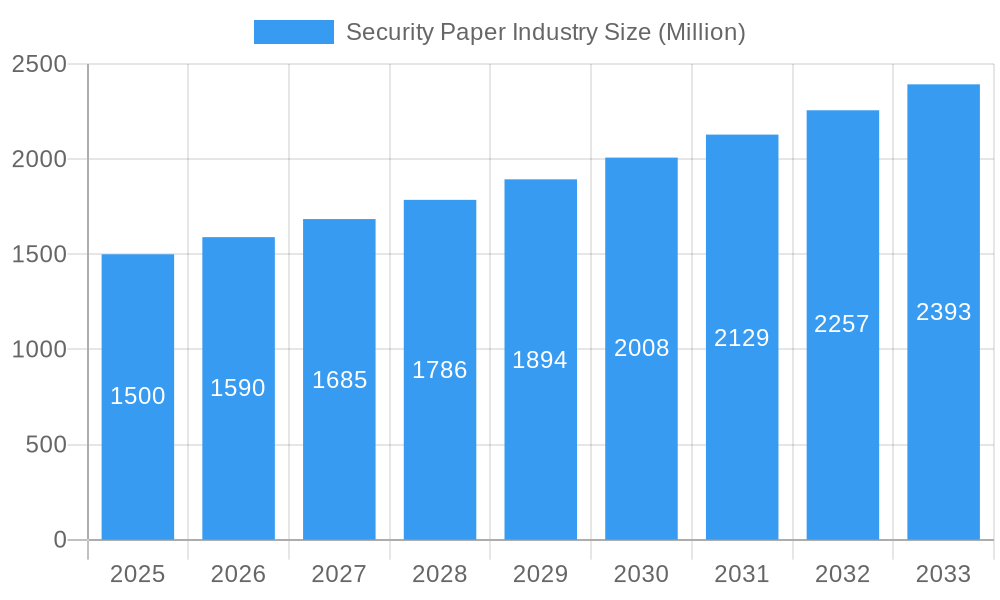

The global security paper market, valued at approximately 14.48 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2033. Key growth drivers include the escalating demand for secure documentation across banking, government, and specialized sectors, coupled with heightened concerns over counterfeiting and fraud. Technological innovations in security printing, such as watermarks and holograms, are also propelling market expansion. While North America and Europe currently dominate, the Asia-Pacific region is poised for significant growth due to economic development and increasing demand for secure documents.

Security Paper Industry Market Size (In Billion)

Market restraints include raw material price volatility and the increasing adoption of digital alternatives. Stringent regulations also present complexities. Despite these challenges, the security paper market's outlook remains robust, driven by the persistent need for tamper-proof documentation and ongoing innovation in security features.

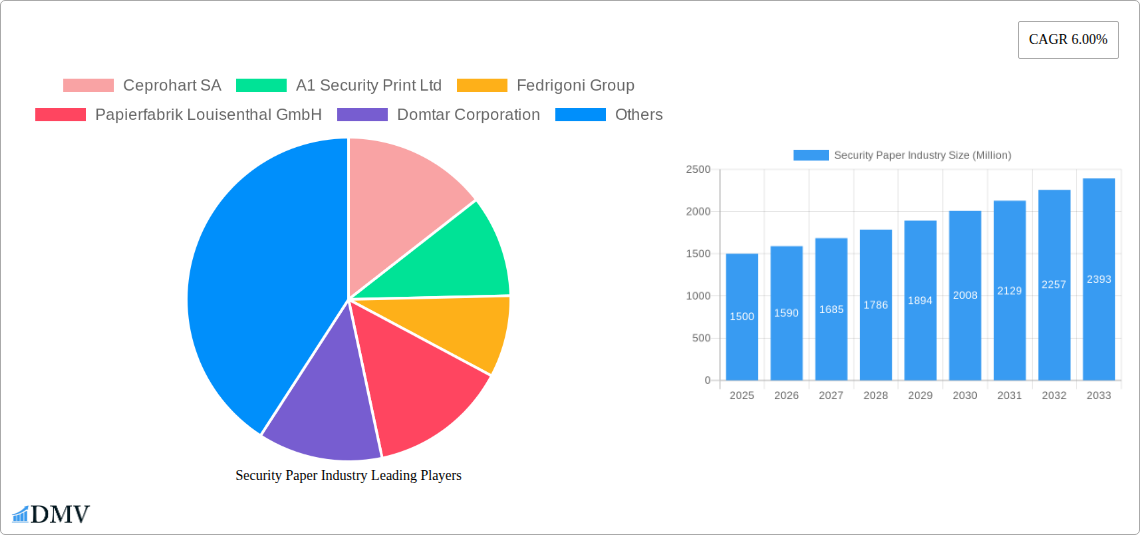

Security Paper Industry Company Market Share

Security Paper Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Security Paper Industry, offering invaluable insights for stakeholders seeking to understand market trends, growth opportunities, and competitive dynamics. The study covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report leverages extensive data analysis and industry expertise to paint a clear picture of this crucial sector, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Security Paper Industry Market Composition & Trends

This section delves into the intricacies of the security paper market, examining market concentration, innovation drivers, and regulatory influences. We analyze the competitive landscape, including market share distribution among key players like Fedrigoni Group, Giesecke+Devrient Currency Technology GmbH, Domtar Corporation, Papierfabrik Louisenthal GmbH, and others. The report also explores the impact of mergers and acquisitions (M&A) activities, evaluating deal values and their influence on market consolidation.

- Market Concentration: The market exhibits a [Describe level of concentration, e.g., moderately concentrated] structure, with the top five players holding an estimated [xx]% market share in 2025.

- Innovation Catalysts: Advancements in [mention specific technologies, e.g., microprinting, watermarking, and holographic technologies] are driving innovation and product differentiation.

- Regulatory Landscape: Stringent government regulations concerning [mention specific regulations, e.g., counterfeiting and fraud prevention] significantly shape industry practices and product development.

- Substitute Products: The emergence of [mention substitutes e.g., digital security solutions] presents a challenge, but the demand for physical security documents remains substantial.

- End-User Profiles: The report segments end-users across key applications, analyzing their specific needs and purchasing patterns.

- M&A Activities: Significant M&A activity, with total deal values exceeding xx Million in the historical period (2019-2024), has reshaped the competitive landscape.

Security Paper Industry Evolution

This section meticulously analyzes the historical and projected growth trajectories of the security paper industry. We explore the impact of technological advancements, shifting consumer preferences, and evolving security needs. Detailed analysis reveals the market's growth rate from 2019 to 2024, and presents a forecast from 2025 to 2033, highlighting key factors driving growth and potential shifts in market dynamics. The adoption rate of new security features is also assessed, providing insights into consumer acceptance and industry responsiveness. The analysis incorporates detailed data points illustrating market growth rates and adoption metrics for specific technologies and applications.

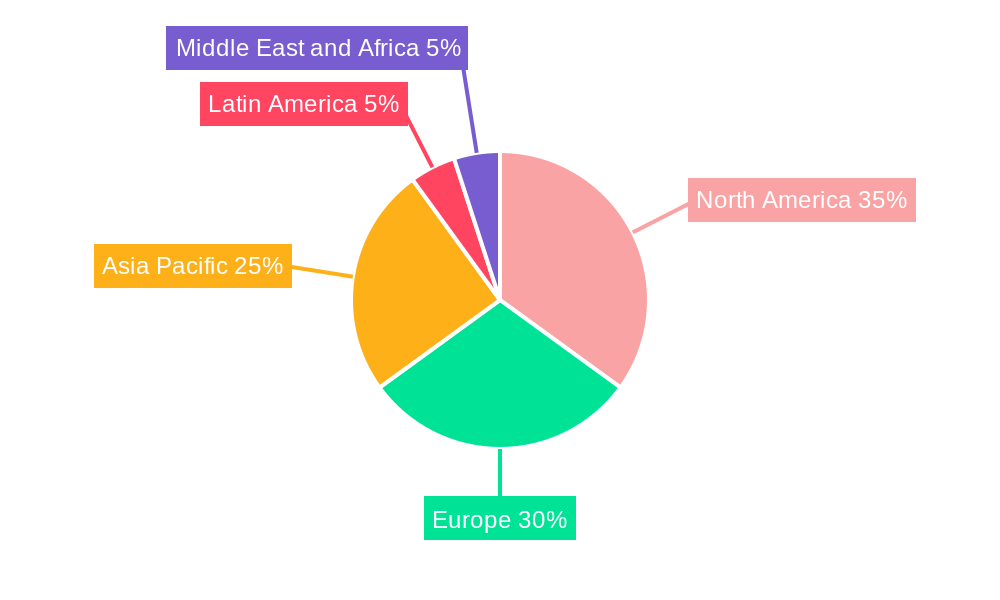

Leading Regions, Countries, or Segments in Security Paper Industry

This section identifies the dominant regions, countries, and application segments within the security paper industry. Detailed analysis is provided for each leading area, highlighting the key drivers contributing to its dominance. We focus on regions with the highest market share and value and explore growth potential in underpenetrated markets.

- Currency Paper/Bank Notes: This segment is currently dominant, driven by [mention factors e.g., increasing government spending on currency production and anti-counterfeiting measures].

- Payment Cards: Growth in this segment is propelled by [mention factors e.g., increasing card payments and digital transactions].

- Other Applications: This category encompasses [mention applications e.g., Ticketing, Stamp Paper, Personal ID and other niche applications] and its growth is influenced by [mention drivers e.g., government initiatives and technological advancements].

- Key Drivers: Investment trends, government support, and increasing security concerns are pivotal factors in driving growth across various segments and geographic locations.

Security Paper Industry Product Innovations

Recent years have witnessed significant innovations in security paper technology. Companies are introducing advanced features such as [mention specific features e.g., enhanced microprinting, dynamic watermarks, and embedded security threads] to enhance document security and prevent counterfeiting. These innovations offer improved performance metrics, including increased durability, enhanced security features, and greater resistance to tampering. Unique selling propositions (USPs) are emphasized, highlighting the competitive advantages these new products offer.

Propelling Factors for Security Paper Industry Growth

The growth of the security paper industry is primarily fueled by several key factors. Technological advancements, such as the development of sophisticated security features, drive innovation and meet evolving security needs. Economic factors, such as increasing government spending on security infrastructure and rising disposable income in developing economies, contribute to market expansion. Finally, regulatory changes and initiatives, such as stricter anti-counterfeiting regulations, create a demand for enhanced security solutions.

Obstacles in the Security Paper Industry Market

Despite promising growth prospects, the security paper industry faces significant challenges. Stringent regulatory compliance requirements can increase production costs and complexity. Supply chain disruptions, particularly concerning raw materials, can impact production capacity and pricing. Furthermore, increasing competitive pressures from digital alternatives and other substitute technologies pose a constant threat to market share.

Future Opportunities in Security Paper Industry

Emerging opportunities exist in expanding into new markets, such as developing economies with a growing demand for secure documents. The adoption of new technologies, such as [mention technologies e.g., blockchain and IoT], could enhance security features and create new market niches. Furthermore, evolving consumer trends, including a preference for environmentally friendly products, create opportunities for sustainable security paper solutions.

Major Players in the Security Paper Industry Ecosystem

- Ceprohart SA

- A1 Security Print Ltd

- Fedrigoni Group

- Papierfabrik Louisenthal GmbH

- Domtar Corporation

- Simpson Security Papers

- Giesecke+Devrient Currency Technology GmbH

- Drewsen Specialty Papers GmbH & Co KG

- Ciotola SRL

- Infinity Security Papers Limited

Key Developments in Security Paper Industry Industry

- [Month, Year]: [Company Name] launched a new security paper with [describe feature, e.g., enhanced holographic security features]. This launch significantly impacted the market by [mention impact e.g., increasing competition and driving innovation].

- [Month, Year]: [Company Name] and [Company Name] announced a merger, resulting in a [mention result e.g., larger market share and increased production capacity]. This development consolidated market power and changed the competitive dynamics.

- [Add more bullet points with specific dates and relevant details as needed]

Strategic Security Paper Industry Market Forecast

The security paper industry is poised for continued growth, driven by sustained demand for secure documents and ongoing technological advancements. The market will benefit from increasing government spending on security infrastructure, as well as rising adoption of advanced security features. While competition from digital alternatives remains, the inherent need for physical security documents ensures significant long-term market potential. The projected growth rate from 2025-2033 indicates a robust and expanding market offering substantial opportunities for established and new players alike.

Security Paper Industry Segmentation

-

1. Application

- 1.1. Currency Paper/Bank Notes,

- 1.2. Payment Cards

- 1.3. Cheques

- 1.4. Personal ID

- 1.5. Ticketing

- 1.6. Stamp Paper

- 1.7. Other Applications

Security Paper Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Security Paper Industry Regional Market Share

Geographic Coverage of Security Paper Industry

Security Paper Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Cases of Fraud and Counterfeiting; Growth in Tourism Increases the Demand for Visas and Passports

- 3.3. Market Restrains

- 3.3.1. ; Growth in Digitization

- 3.4. Market Trends

- 3.4.1. Currency to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Currency Paper/Bank Notes,

- 5.1.2. Payment Cards

- 5.1.3. Cheques

- 5.1.4. Personal ID

- 5.1.5. Ticketing

- 5.1.6. Stamp Paper

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Currency Paper/Bank Notes,

- 6.1.2. Payment Cards

- 6.1.3. Cheques

- 6.1.4. Personal ID

- 6.1.5. Ticketing

- 6.1.6. Stamp Paper

- 6.1.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Currency Paper/Bank Notes,

- 7.1.2. Payment Cards

- 7.1.3. Cheques

- 7.1.4. Personal ID

- 7.1.5. Ticketing

- 7.1.6. Stamp Paper

- 7.1.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Currency Paper/Bank Notes,

- 8.1.2. Payment Cards

- 8.1.3. Cheques

- 8.1.4. Personal ID

- 8.1.5. Ticketing

- 8.1.6. Stamp Paper

- 8.1.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Currency Paper/Bank Notes,

- 9.1.2. Payment Cards

- 9.1.3. Cheques

- 9.1.4. Personal ID

- 9.1.5. Ticketing

- 9.1.6. Stamp Paper

- 9.1.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Currency Paper/Bank Notes,

- 10.1.2. Payment Cards

- 10.1.3. Cheques

- 10.1.4. Personal ID

- 10.1.5. Ticketing

- 10.1.6. Stamp Paper

- 10.1.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceprohart SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A1 Security Print Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fedrigoni Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Papierfabrik Louisenthal GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domtar Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Simpson Security Papers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Giesecke+Devrient Currency Technology GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Drewsen Specialty Papers GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ciotola SRL*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Infinity Security Papers Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ceprohart SA

List of Figures

- Figure 1: Global Security Paper Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Security Paper Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Security Paper Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: UK Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: India Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Paper Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Security Paper Industry?

Key companies in the market include Ceprohart SA, A1 Security Print Ltd, Fedrigoni Group, Papierfabrik Louisenthal GmbH, Domtar Corporation, Simpson Security Papers, Giesecke+Devrient Currency Technology GmbH, Drewsen Specialty Papers GmbH & Co KG, Ciotola SRL*List Not Exhaustive, Infinity Security Papers Limited.

3. What are the main segments of the Security Paper Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.48 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Cases of Fraud and Counterfeiting; Growth in Tourism Increases the Demand for Visas and Passports.

6. What are the notable trends driving market growth?

Currency to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Growth in Digitization.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Paper Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Paper Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Paper Industry?

To stay informed about further developments, trends, and reports in the Security Paper Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence