Key Insights

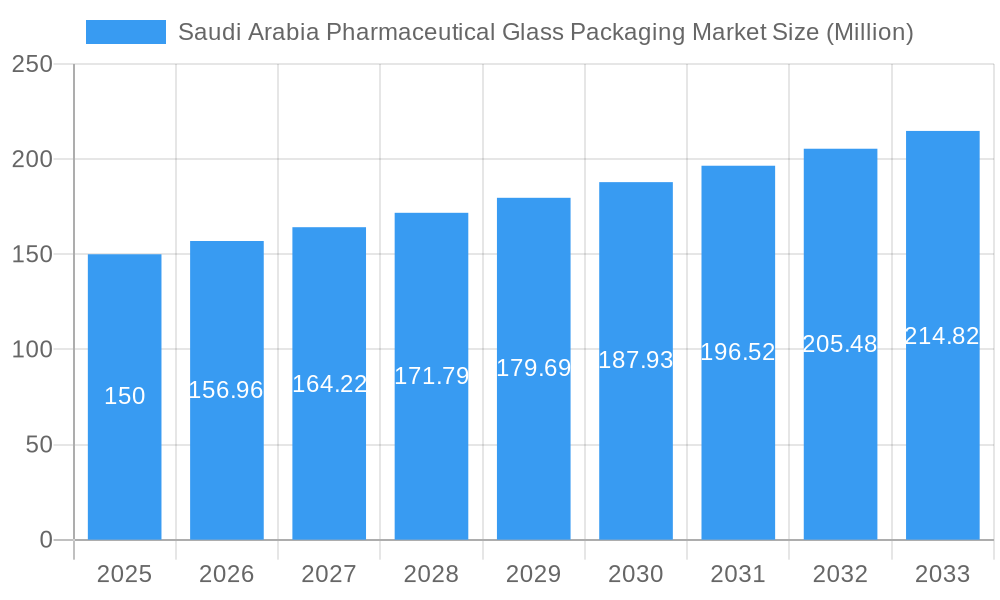

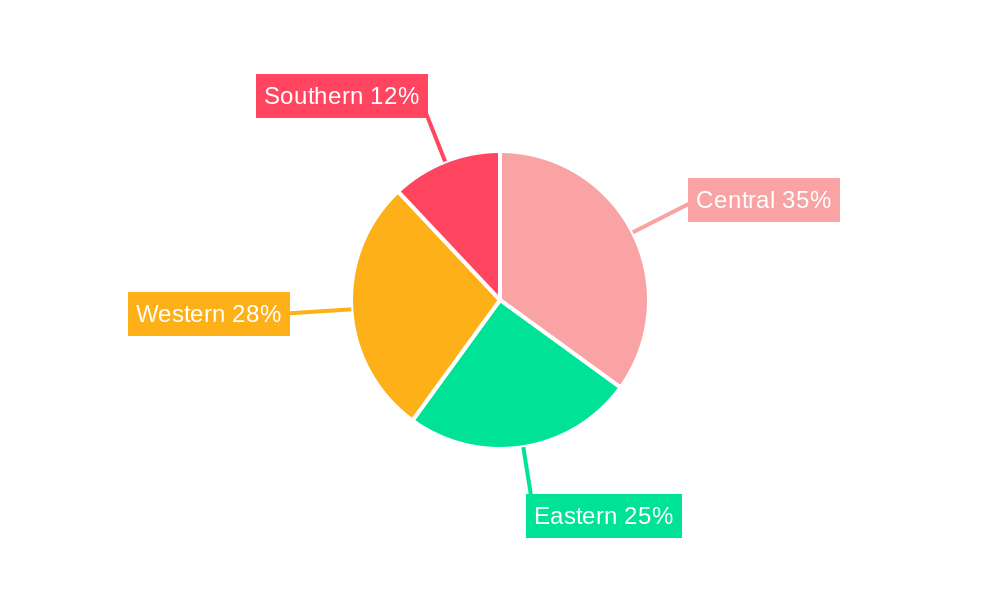

The Saudi Arabian pharmaceutical glass packaging market is poised for significant expansion, projected to reach 96.5 million by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.24% from 2025 to 2033. This growth is fueled by increasing chronic disease incidence, escalating pharmaceutical manufacturing in the Kingdom, and government initiatives to bolster healthcare infrastructure. Key market segments include glass types (Type I, II, III), product types (bottles, vials, ampoules, cartridges, syringes, etc.), and applications (branded, biological, generic pharmaceuticals). Enhanced demand for sterile and tamper-evident packaging to ensure product integrity, coupled with the adoption of advanced technologies like specialized coatings and barrier properties, further propels market growth. Leading companies such as DWK Life Sciences GmbH, Becton Dickinson, and Corning Incorporated are prominent contributors, offering diverse solutions for pharmaceutical firms. Regional market dynamics across Saudi Arabia's Central, Eastern, Western, and Southern regions are expected to vary based on population density and healthcare infrastructure, influencing distribution and growth trajectories.

Saudi Arabia Pharmaceutical Glass Packaging Market Market Size (In Million)

Market challenges include fluctuating raw material costs (silica sand, soda ash), potential shifts in regulatory packaging standards, and the increasing preference for alternative materials like plastics. Despite these restraints, the long-term outlook for the pharmaceutical glass packaging market remains optimistic, driven by sustained growth in the pharmaceutical sector. The burgeoning demand for injectable drugs and the expanding biopharmaceutical industry are expected to create substantial opportunities for market participants. Strategic collaborations, product innovation, and investment in research and development are vital for competitive success. Emphasizing sustainable and eco-friendly packaging solutions will also be critical for long-term market positioning.

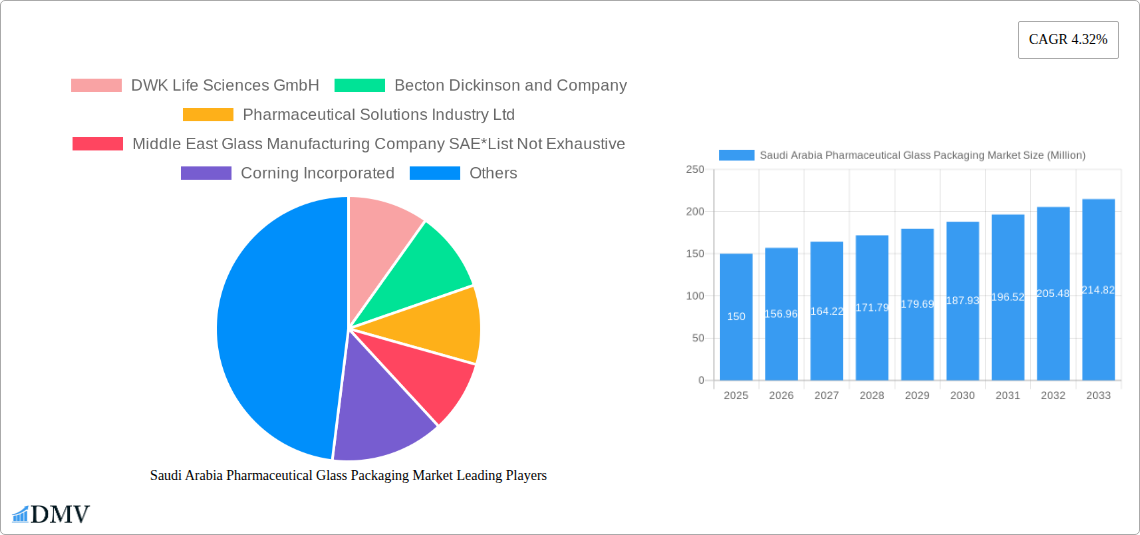

Saudi Arabia Pharmaceutical Glass Packaging Market Company Market Share

Saudi Arabia Pharmaceutical Glass Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Saudi Arabia pharmaceutical glass packaging market, offering a detailed overview of its current state, future trends, and growth opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the dynamic market landscape. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024.

Saudi Arabia Pharmaceutical Glass Packaging Market Composition & Trends

This section delves into the intricate composition and prevailing trends within the Saudi Arabia pharmaceutical glass packaging market. We analyze market concentration, revealing the market share distribution among key players. We also examine the innovative catalysts driving market evolution, including technological advancements and regulatory changes. The influence of substitute products and the evolving end-user profiles are thoroughly scrutinized. Finally, we explore mergers and acquisitions (M&A) activities, providing insights into deal values and their impact on market dynamics. The analysis includes a detailed examination of the competitive landscape, identifying key players such as DWK Life Sciences GmbH, Becton Dickinson and Company, Pharmaceutical Solutions Industry Ltd, Middle East Glass Manufacturing Company SAE, Corning Incorporated, and GlaxoSmithKline PLC (list not exhaustive). We explore the impact of recent investments, such as the SAR 272 Million (USD 73 Million) investment in a new Spimaco factory, on market competition and growth. The report also details the regulatory landscape, outlining its impact on market access and product approvals. The anticipated market size for 2025 is estimated at XX Million USD and projected to reach XX Million USD by 2033, exhibiting a CAGR of XX%.

- Market Concentration: The market is characterized by [Describe market concentration – e.g., high/low concentration, presence of dominant players, etc.]. Market share distribution is analyzed for key players.

- Innovation Catalysts: Key drivers of innovation include [list specific examples, e.g., advancements in glass types, automation in production, new packaging formats].

- Regulatory Landscape: [Describe the regulatory framework, including licensing requirements and quality standards].

- Substitute Products: [Discuss any substitute packaging materials and their impact on market share].

- End-User Profiles: [Analyze the characteristics of key end-users, such as pharmaceutical manufacturers and hospitals].

- M&A Activities: [Report on significant M&A deals, including their values and strategic implications].

Saudi Arabia Pharmaceutical Glass Packaging Market Industry Evolution

This section provides a comprehensive overview of the evolution of the Saudi Arabia pharmaceutical glass packaging market. The analysis tracks market growth trajectories over the historical period (2019-2024), highlighting periods of expansion and contraction. We detail technological advancements that have reshaped the industry, such as the introduction of new glass types and improved manufacturing processes. The analysis further examines the evolving needs and preferences of consumers and how these demands have influenced product development and market segmentation. Specific data points, including growth rates and adoption metrics for key technologies, are provided to support the analysis. The impact of government policies and regulations on market growth is also examined.

Leading Regions, Countries, or Segments in Saudi Arabia Pharmaceutical Glass Packaging Market

This section identifies the dominant regions, countries, and segments within the Saudi Arabia pharmaceutical glass packaging market. We analyze the market performance of various segments based on glass type (Type I, Type II, Type III), product type (bottles and containers, vials, ampoules, cartridges and syringes, other product types), and application type (branded, biological, generic).

- By Glass Type: [Detailed analysis of market share and growth drivers for each glass type. Identify the dominant type and reasons for its dominance].

- By Product Type: [Detailed analysis of market share and growth drivers for each product type. Identify the dominant type and reasons for its dominance].

- By Application Type: [Detailed analysis of market share and growth drivers for each application type. Identify the dominant type and reasons for its dominance].

Key Drivers:

- Investment Trends: [Analyze investment patterns in the pharmaceutical sector and their impact on demand for glass packaging].

- Regulatory Support: [Discuss the role of government regulations in promoting the growth of the pharmaceutical industry and its effect on packaging demand].

Saudi Arabia Pharmaceutical Glass Packaging Market Product Innovations

This section showcases recent product innovations in the Saudi Arabia pharmaceutical glass packaging market. We highlight advancements in glass types, closures, and other features aimed at enhancing product safety, durability, and aesthetics. The discussion includes the unique selling propositions (USPs) of innovative products and their performance metrics. Technological advancements, such as the use of advanced manufacturing techniques and materials, are also addressed.

Propelling Factors for Saudi Arabia Pharmaceutical Glass Packaging Market Growth

Several factors contribute to the growth of the Saudi Arabia pharmaceutical glass packaging market. Technological advancements lead to improved packaging materials and production processes, resulting in higher efficiency and lower costs. Economic growth drives increased healthcare spending, which in turn boosts demand for pharmaceutical products and their packaging. Favorable government regulations support the growth of the pharmaceutical industry, creating a positive environment for investment and expansion in the packaging sector. For instance, the November 2022 investment of SAR 272 million (USD 73 million) in a new Spimaco factory exemplifies the significant investment in the pharmaceutical sector, creating opportunities for glass packaging companies.

Obstacles in the Saudi Arabia Pharmaceutical Glass Packaging Market

Despite significant growth potential, several challenges hinder the Saudi Arabia pharmaceutical glass packaging market. Regulatory hurdles, including stringent quality and safety standards, can increase compliance costs and complicate market entry for new players. Supply chain disruptions, particularly those related to raw materials, can lead to production delays and increased costs. Intense competition among existing players puts pressure on prices and profit margins. These challenges could impact market growth if not effectively addressed.

Future Opportunities in Saudi Arabia Pharmaceutical Glass Packaging Market

The Saudi Arabia pharmaceutical glass packaging market presents several promising opportunities for growth. Expanding pharmaceutical production, driven by government initiatives to enhance healthcare infrastructure, creates significant demand for packaging solutions. The adoption of new technologies, such as advanced glass types and sustainable packaging options, presents opportunities for innovation and differentiation. Emerging consumer preferences towards convenience and safety could drive demand for specialized packaging solutions.

Major Players in the Saudi Arabia Pharmaceutical Glass Packaging Market Ecosystem

- DWK Life Sciences GmbH

- Becton Dickinson and Company

- Pharmaceutical Solutions Industry Ltd

- Middle East Glass Manufacturing Company SAE

- Corning Incorporated

- GlaxoSmithKline PLC

- List Not Exhaustive

Key Developments in Saudi Arabia Pharmaceutical Glass Packaging Market Industry

- November 2022: A total of SAR 272 million (USD 73 million) was invested in the construction of a new factory in the Qassim region by Saudi Pharmaceutical Industries & Medical Appliances Corporation (Spimaco), with support from AstraZeneca. This investment significantly boosts the pharmaceutical manufacturing capacity and consequently increases the demand for pharmaceutical glass packaging.

Strategic Saudi Arabia Pharmaceutical Glass Packaging Market Forecast

The Saudi Arabia pharmaceutical glass packaging market is poised for substantial growth in the coming years, driven by several key factors. Continued investment in the pharmaceutical sector, coupled with technological advancements and favorable government policies, will fuel market expansion. Growing demand for pharmaceutical products, driven by an expanding population and increased healthcare awareness, will also contribute to market growth. The market's potential for innovation, including sustainable packaging solutions, further strengthens its prospects for long-term expansion.

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation

-

1. Glass Type

- 1.1. Type I

- 1.2. Type II

- 1.3. Type III

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials

- 2.3. Ampoules

- 2.4. Cartridges and Syringes

- 2.5. Other Product Types

-

3. Application Type

- 3.1. Branded

- 3.2. Biological

- 3.3. Generic

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Pharmaceutical Glass Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Pharmaceutical Glass Packaging Market

Saudi Arabia Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass

- 3.3. Market Restrains

- 3.3.1. Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growth of the Pharmaceutical Sector in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 5.1.1. Type I

- 5.1.2. Type II

- 5.1.3. Type III

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials

- 5.2.3. Ampoules

- 5.2.4. Cartridges and Syringes

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Branded

- 5.3.2. Biological

- 5.3.3. Generic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DWK Life Sciences GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Becton Dickinson and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pharmaceutical Solutions Industry Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Middle East Glass Manufacturing Company SAE*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corning Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 DWK Life Sciences GmbH

List of Figures

- Figure 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Pharmaceutical Glass Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 2: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 6: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Saudi Arabia Pharmaceutical Glass Packaging Market?

Key companies in the market include DWK Life Sciences GmbH, Becton Dickinson and Company, Pharmaceutical Solutions Industry Ltd, Middle East Glass Manufacturing Company SAE*List Not Exhaustive, Corning Incorporated, GlaxoSmithKline PLC.

3. What are the main segments of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The market segments include Glass Type, Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass.

6. What are the notable trends driving market growth?

Growth of the Pharmaceutical Sector in the Country.

7. Are there any restraints impacting market growth?

Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: A total of SAR 272 million (USD 73 million) was invested in the construction of the new factory in the Qassim region by Saudi Pharmaceutical Industries & Medical Appliances Corporation (Spimaco), a market player in the Kingdom's pharmaceutical industries sector. AstraZeneca, a prominent worldwide pharmaceutical company, helped establish the new 2,800 square meter plant, producing many hazardous medications. The investment would provide opportunities to various glass packaging companies in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence