Key Insights

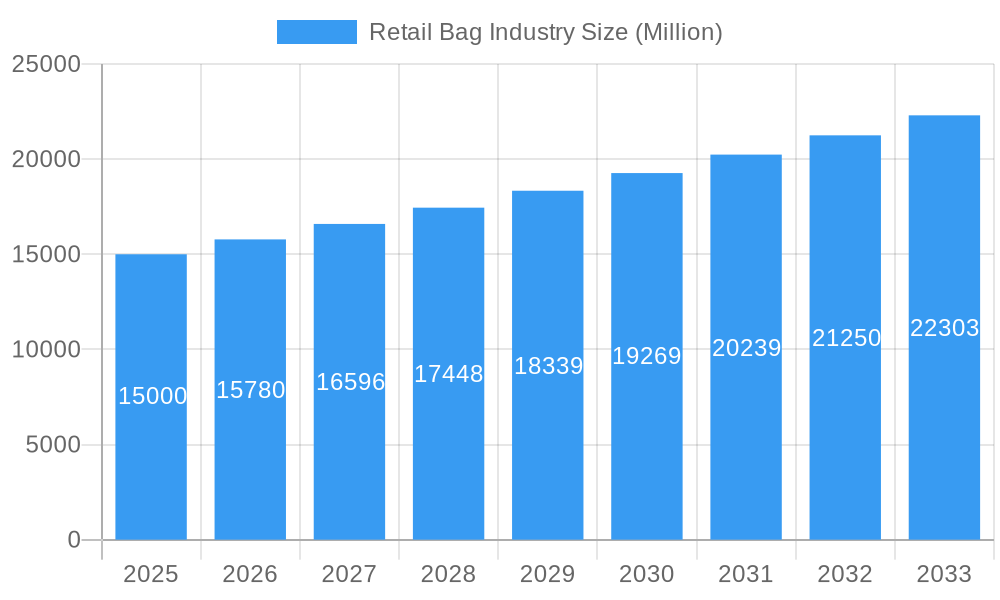

The global retail bag market, projected to reach $18.97 billion by 2025, is set to grow at a compound annual growth rate (CAGR) of 5.66% between 2025 and 2033. This expansion is propelled by the burgeoning e-commerce sector, demanding efficient and protective packaging. Simultaneously, increasing environmental consciousness is driving demand for sustainable options, including paper, reusable bags, and recycled plastics (rPET). Challenges include fluctuating raw material costs and evolving regulations on plastic usage. Plastic bags, particularly PET and polyester, currently lead the market, with paper bags gaining traction. Grocery and food service sectors are the primary end-users. North America and Europe hold significant shares, while Asia-Pacific is anticipated for substantial growth.

Retail Bag Industry Market Size (In Billion)

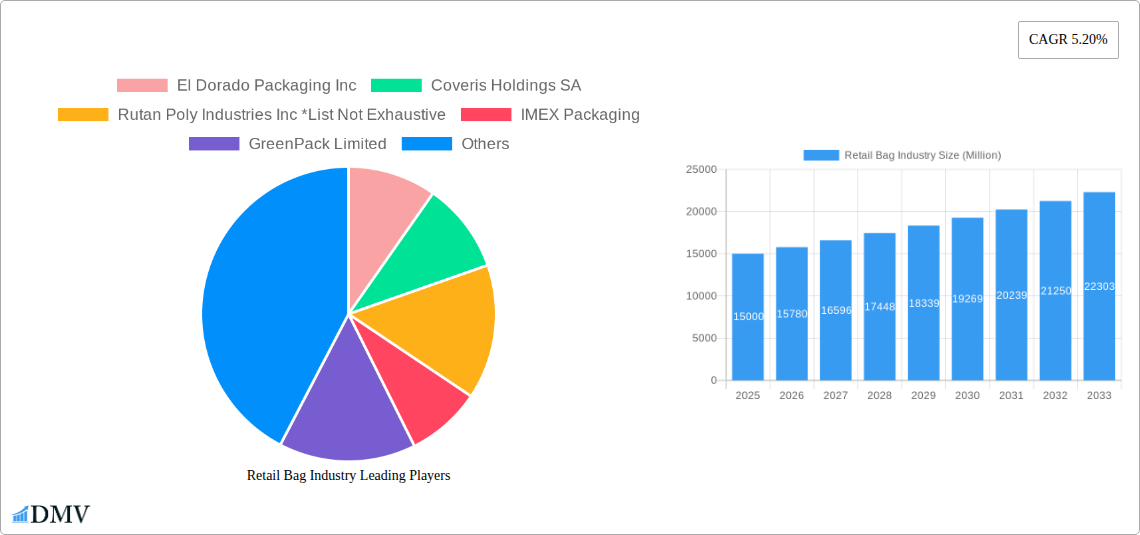

The competitive arena features established multinational corporations and agile regional players. Leading entities such as Smurfit Kappa Group PLC, Mondi Group PLC, and Novolex Holdings Inc. utilize their extensive networks and brand recognition. Emerging companies focused on sustainable and innovative designs are also gaining traction. The market's future success depends on balancing economic viability, environmental responsibility, and consumer preferences, with material innovation and robust recycling infrastructure being key.

Retail Bag Industry Company Market Share

Retail Bag Market Analysis: Size, CAGR, and Forecast (2025-2033)

This report offers a comprehensive analysis of the global retail bag market, covering size, growth dynamics, competitive landscape, and future projections from 2025 to 2033. The base year for analysis is 2025. The study examines key segments including plastic (PET, Polyester, rPET), paper, and alternative materials (jute, cotton, canvas) across various end-users such as grocery stores and food service. Profiles of key industry players are included, detailing their strategic approaches. Findings are derived from extensive market research and data analysis, providing actionable insights for strategic planning. The total market value is projected to reach $18.97 billion by 2025.

Retail Bag Industry Market Composition & Trends

The retail bag market is characterized by moderate concentration, with several major players holding significant market share. However, the landscape is dynamic, influenced by continuous innovation in materials and manufacturing processes. Stringent environmental regulations are driving a shift towards sustainable and eco-friendly alternatives, while the rise of e-commerce fuels demand for specialized packaging solutions. Substitute products, such as reusable bags, pose a competitive challenge. The market exhibits varied end-user profiles, with grocery stores and food service segments leading the demand. Mergers and acquisitions (M&A) are common, reflecting industry consolidation and expansion strategies.

- Market Share Distribution (2024): Top 5 players hold approximately 40% of the market share. Precise distribution unavailable, requires further investigation.

- M&A Activity (2019-2024): Over xx Million in deals were concluded, with average deal value at xx Million. Specific details unavailable.

- Innovation Catalysts: Biodegradable materials, recyclable options, and improved printing technologies are key drivers.

- Regulatory Landscape: Growing emphasis on reducing plastic waste is shaping industry practices.

Retail Bag Industry Industry Evolution

The retail bag industry has witnessed significant transformation, marked by a steady growth trajectory fueled by expanding retail sectors globally. Technological advancements, such as automation in manufacturing and improved material science, have enhanced efficiency and product quality. Consumer demand is increasingly shifting towards sustainable and convenient packaging options, pushing manufacturers to offer eco-friendly alternatives. The industry growth rate from 2019 to 2024 averaged approximately xx%, with projections indicating a continued growth rate of xx% from 2025 to 2033. Adoption of sustainable packaging materials is gradually increasing, reaching xx% in 2024, expected to rise to xx% by 2033. Shifting consumer preferences towards eco-friendly solutions and increasing regulations against non-biodegradable materials are two key factors driving this change.

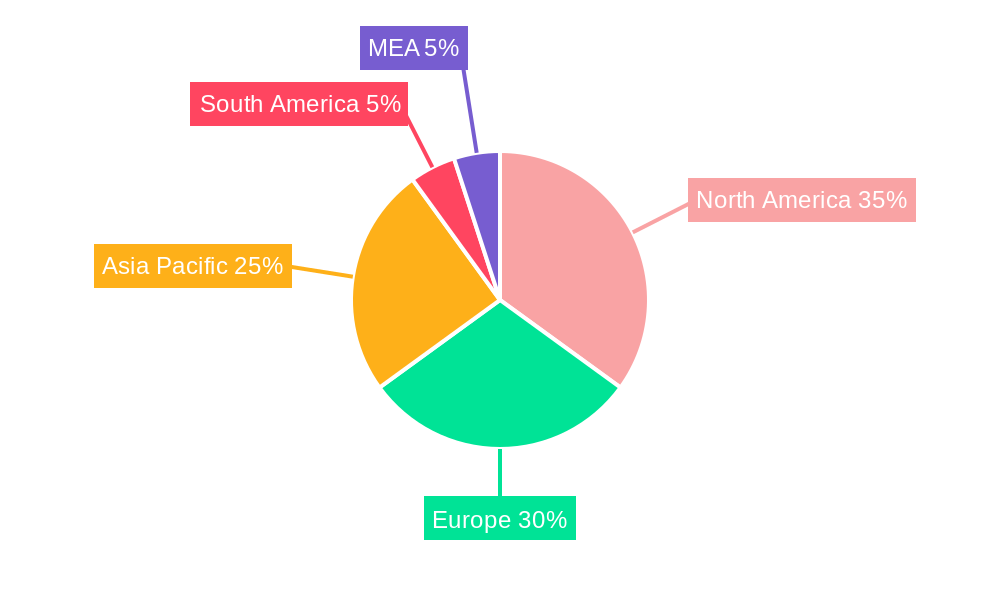

Leading Regions, Countries, or Segments in Retail Bag Industry

The retail bag industry displays regional variations in dominance, with North America and Europe currently leading the market. Within segments, plastic bags maintain a significant share, particularly in developing economies. However, the paper and other material segments are demonstrating substantial growth, driven by sustainability concerns.

- Key Drivers:

- North America: Strong retail sector, high consumer spending, and stringent environmental regulations.

- Europe: High environmental awareness and supportive government policies promoting sustainable packaging.

- Asia-Pacific: Rapid economic growth and increasing demand from emerging markets.

- Plastic Bags: Cost-effectiveness and widespread usage in various sectors.

- Paper Bags: Growing consumer preference for eco-friendly alternatives and increased regulatory pressure.

Retail Bag Industry Product Innovations

Recent innovations focus on eco-friendly materials like biodegradable plastics and recycled paper. Improved printing techniques allow for enhanced branding and customization. The focus is on lightweight, strong, and reusable bags that meet both functionality and sustainability needs. Unique selling propositions include incorporating recycled content, compostable features, and improved durability.

Propelling Factors for Retail Bag Industry Growth

The industry's growth is propelled by several factors. The expansion of e-commerce necessitates increased packaging needs, while rising disposable incomes drive consumer spending on goods requiring packaging. Government regulations promoting sustainability and reducing plastic waste further stimulate demand for eco-friendly alternatives. Technological advancements, like automation, improve manufacturing efficiency and product quality.

Obstacles in the Retail Bag Industry Market

Challenges include fluctuating raw material prices, supply chain disruptions, and intense competition. Strict environmental regulations can increase production costs. Consumer resistance to price increases for sustainable options presents another hurdle. The overall impact of these obstacles is estimated to reduce the industry growth rate by approximately xx% annually.

Future Opportunities in Retail Bag Industry

Future opportunities lie in expanding into emerging markets, developing innovative biodegradable materials, and catering to the growing demand for customized, reusable bags. Technological advancements in printing and material science offer scope for further innovation. The rising emphasis on circular economy models presents new opportunities for businesses focusing on recycling and waste reduction.

Major Players in the Retail Bag Industry Ecosystem

- El Dorado Packaging Inc

- Coveris Holdings SA

- Rutan Poly Industries Inc

- IMEX Packaging

- GreenPack Limited

- American Packaging Corporation

- Atlantic Poly Inc

- Rainbow Packaging Inc

- Global-Pak Inc

- Novolex Holdings Inc

- Mondi Group PLC

- International Paper Company

- Smurfit Kappa Group PLC

- BioPak Pty Ltd

- Welton Bibby And Baron Limited

- The Carry Bag Company

- Attwoods Packaging Company

Key Developments in Retail Bag Industry Industry

- June 2021: Mondi Group PLC announced plans to expand its paper-based MailerBAG range, emphasizing sustainability and recyclability within e-commerce. This move significantly impacts market dynamics by promoting the adoption of eco-friendly alternatives to plastic packaging.

- May 2021: Coveris Holdings SA acquired Four 04 Packaging, expanding its biodegradable bag offerings for fresh food and produce. This acquisition strengthens its market position, enhances manufacturing capabilities, and broadens product portfolio.

Strategic Retail Bag Industry Market Forecast

The retail bag market is poised for continued growth, driven by increasing e-commerce activity, growing consumer awareness of sustainability, and supportive regulatory frameworks. The shift towards eco-friendly materials presents significant opportunities for innovation and market expansion. The predicted market value is expected to reach xx Million by 2033, showcasing robust growth potential despite existing market challenges.

Retail Bag Industry Segmentation

-

1. Material Type

-

1.1. Plastic

- 1.1.1. Polyethylene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 1.2. Paper

- 1.3. Other Material Types (Jute, Cotton, Canvas)

-

1.1. Plastic

-

2. End-User

- 2.1. Grocery Stores

- 2.2. Food Service

- 2.3. Other End-Users

Retail Bag Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Bag Industry Regional Market Share

Geographic Coverage of Retail Bag Industry

Retail Bag Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Preference for Paper Bags Globally; Rising Consumption of Personal Care Products and Cosmetics

- 3.3. Market Restrains

- 3.3.1. Restrictions on Using Plastic Retail Bags

- 3.4. Market Trends

- 3.4.1. Paper Material Segment to Have a Dominant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 5.1.2. Paper

- 5.1.3. Other Material Types (Jute, Cotton, Canvas)

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Grocery Stores

- 5.2.2. Food Service

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.1.1. Polyethylene (PE)

- 6.1.1.2. Polypropylene (PP)

- 6.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 6.1.2. Paper

- 6.1.3. Other Material Types (Jute, Cotton, Canvas)

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Grocery Stores

- 6.2.2. Food Service

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.1.1. Polyethylene (PE)

- 7.1.1.2. Polypropylene (PP)

- 7.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 7.1.2. Paper

- 7.1.3. Other Material Types (Jute, Cotton, Canvas)

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Grocery Stores

- 7.2.2. Food Service

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.1.1. Polyethylene (PE)

- 8.1.1.2. Polypropylene (PP)

- 8.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 8.1.2. Paper

- 8.1.3. Other Material Types (Jute, Cotton, Canvas)

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Grocery Stores

- 8.2.2. Food Service

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.1.1. Polyethylene (PE)

- 9.1.1.2. Polypropylene (PP)

- 9.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 9.1.2. Paper

- 9.1.3. Other Material Types (Jute, Cotton, Canvas)

- 9.1.1. Plastic

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Grocery Stores

- 9.2.2. Food Service

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Retail Bag Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.1.1. Polyethylene (PE)

- 10.1.1.2. Polypropylene (PP)

- 10.1.1.3. Other Plastic Types (PET, Polyester, rPET)

- 10.1.2. Paper

- 10.1.3. Other Material Types (Jute, Cotton, Canvas)

- 10.1.1. Plastic

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Grocery Stores

- 10.2.2. Food Service

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 El Dorado Packaging Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coveris Holdings SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rutan Poly Industries Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IMEX Packaging

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GreenPack Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American Packaging Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Atlantic Poly Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rainbow Packaging Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Global-Pak Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Novolex Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mondi Group PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 International Paper Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Smurfit Kappa Group PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BioPak Pty Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Welton Bibby And Baron Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 The Carry Bag Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Attwoods Packaging Company

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 El Dorado Packaging Inc

List of Figures

- Figure 1: Global Retail Bag Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Bag Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Retail Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Retail Bag Industry Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Retail Bag Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Retail Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Retail Bag Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 9: Europe Retail Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Europe Retail Bag Industry Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe Retail Bag Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Retail Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Retail Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Retail Bag Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 15: Asia Pacific Retail Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Asia Pacific Retail Bag Industry Revenue (billion), by End-User 2025 & 2033

- Figure 17: Asia Pacific Retail Bag Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Retail Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Retail Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Retail Bag Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 21: Latin America Retail Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Latin America Retail Bag Industry Revenue (billion), by End-User 2025 & 2033

- Figure 23: Latin America Retail Bag Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Latin America Retail Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Retail Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Retail Bag Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Retail Bag Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Retail Bag Industry Revenue (billion), by End-User 2025 & 2033

- Figure 29: Middle East and Africa Retail Bag Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Middle East and Africa Retail Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Retail Bag Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Retail Bag Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Retail Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 8: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Global Retail Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 11: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Retail Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global Retail Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Retail Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 17: Global Retail Bag Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global Retail Bag Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Bag Industry?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Retail Bag Industry?

Key companies in the market include El Dorado Packaging Inc, Coveris Holdings SA, Rutan Poly Industries Inc *List Not Exhaustive, IMEX Packaging, GreenPack Limited, American Packaging Corporation, Atlantic Poly Inc, Rainbow Packaging Inc, Global-Pak Inc, Novolex Holdings Inc, Mondi Group PLC, International Paper Company, Smurfit Kappa Group PLC, BioPak Pty Ltd, Welton Bibby And Baron Limited, The Carry Bag Company, Attwoods Packaging Company.

3. What are the main segments of the Retail Bag Industry?

The market segments include Material Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Preference for Paper Bags Globally; Rising Consumption of Personal Care Products and Cosmetics.

6. What are the notable trends driving market growth?

Paper Material Segment to Have a Dominant Share in the Market.

7. Are there any restraints impacting market growth?

Restrictions on Using Plastic Retail Bags.

8. Can you provide examples of recent developments in the market?

June 2021 - Mondi Group Inc. announced plans for increasing its paper-based MailerBAG range to further replace plastic packaging in e-commerce with a recyclable solution made of responsibly sourced renewable materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Bag Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Bag Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Bag Industry?

To stay informed about further developments, trends, and reports in the Retail Bag Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence