Key Insights

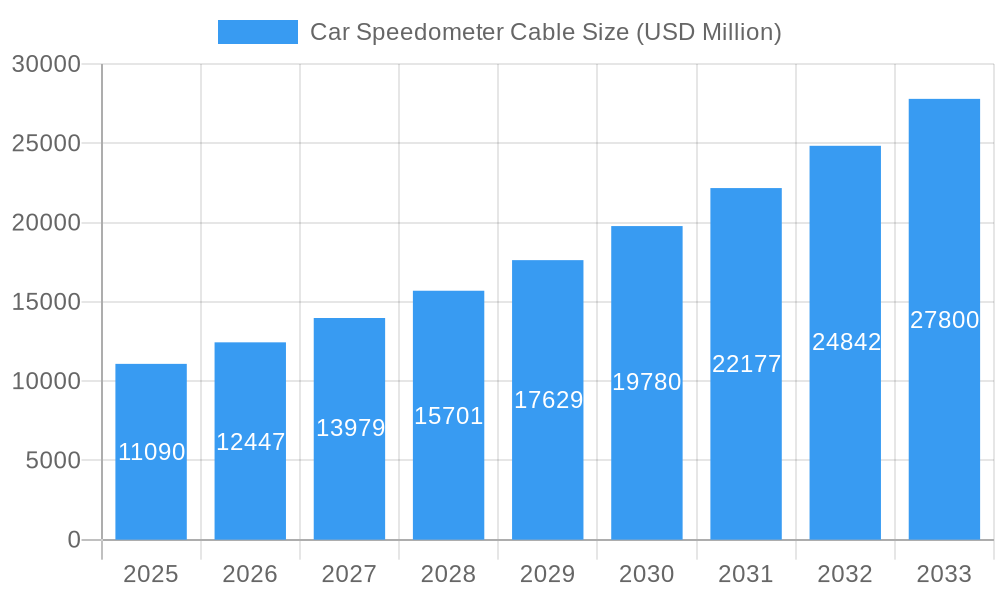

The global Car Speedometer Cable market is poised for significant expansion, projected to reach USD 11.09 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 11.52%. This growth trajectory is fueled by several key drivers, including the continuous increase in the global automotive fleet, particularly in emerging economies, and the sustained demand for reliable and accurate speedometer functionality in both new vehicles and the aftermarket. The persistent need for vehicle maintenance and repair, coupled with an aging vehicle parc, directly translates to a strong aftermarket segment for replacement speedometer cables. Furthermore, advancements in automotive technology, while leading to the integration of digital solutions, still necessitate robust mechanical cable systems in many vehicle types. The increasing production of passenger cars, commercial vehicles, and special purpose vehicles globally underpins the consistent demand for these essential components.

Car Speedometer Cable Market Size (In Billion)

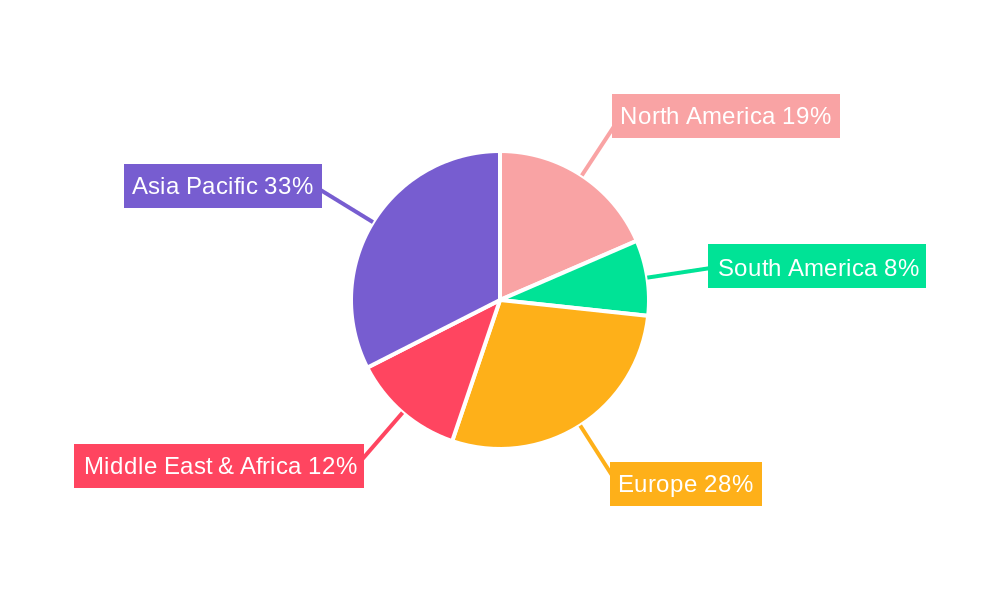

The market's expansion is further supported by prevailing trends such as the growing emphasis on vehicle safety and performance monitoring, where accurate speed readings are paramount. While the increasing adoption of digital dashboards and electronic speed sensors in higher-end and newer models presents a potential restraint, the sheer volume of existing vehicles reliant on mechanical speedometer cables, especially in developing regions, ensures sustained market relevance. The market is segmented by application into OEM and Aftermarket, with both segments exhibiting healthy growth potential. By type, Stainless Steel Material, Rubber Material, and Plastic Material cables cater to diverse automotive needs and performance requirements. Key regions like Asia Pacific, driven by high automotive production and consumption in China and India, and Europe, with its mature automotive market and strong aftermarket, are expected to be major contributors to market value.

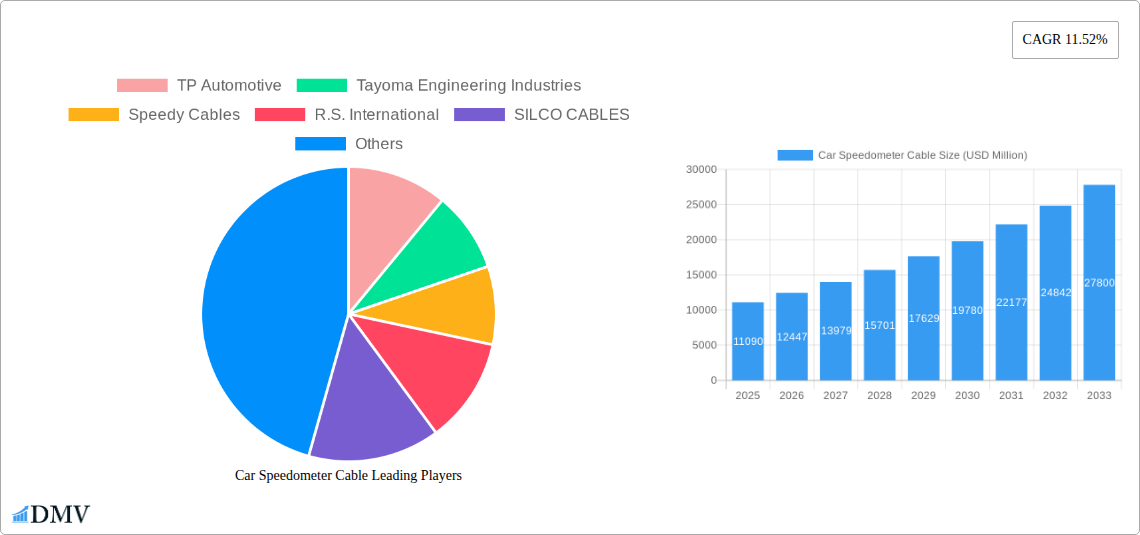

Car Speedometer Cable Company Market Share

Car Speedometer Cable Market Research Report: 2019-2033

This comprehensive Car Speedometer Cable Market Research Report, spanning the Study Period of 2019–2033 with a Base Year of 2025, provides an in-depth analysis of the global automotive speedometer cable industry. Leveraging a Base Year of 2025 for precise market valuation and an Estimated Year of 2025, this report meticulously forecasts market trajectories through the Forecast Period of 2025–2033, building upon robust Historical Period data from 2019–2024. The report identifies key trends, growth drivers, obstacles, and opportunities shaping the market, with a particular focus on leading companies and strategic developments. This indispensable resource is designed to equip automotive manufacturers, aftermarket suppliers, investors, and industry stakeholders with actionable insights for strategic decision-making and sustained competitive advantage in the burgeoning automotive components sector. The report's valuation across all metrics will be presented in billions.

Car Speedometer Cable Market Composition & Trends

The Car Speedometer Cable market exhibits a moderate level of concentration, with key players like TP Automotive, Tayoma Engineering Industries, and Speedy Cables holding significant market shares estimated at a combined billion in market share. Innovation remains a primary catalyst, driven by advancements in material science and manufacturing processes, particularly in the development of durable and high-performance stainless steel material and rubber material speedometer cables. The regulatory landscape, while not overly restrictive, emphasizes safety and emission standards, indirectly influencing the demand for reliable and precise speedometer cable systems. Substitute products, such as digital speedometers and electronic sensors, pose a growing challenge, yet traditional mechanical speedometer cables maintain strong market penetration, especially in the Aftermarket segment due to cost-effectiveness and widespread compatibility. End-user profiles are diverse, encompassing both OEM vehicle manufacturers seeking integrated solutions and independent repair shops catering to the vast global vehicle parc. Mergers and acquisition activities have been observed, with deal values estimated in the billions, indicating strategic consolidation and a pursuit of expanded market reach and technological integration.

- Market Concentration: Moderate, with a few key players dominating.

- Innovation Catalysts: Material science advancements, manufacturing efficiency.

- Regulatory Landscapes: Focus on vehicle safety and emission standards.

- Substitute Products: Digital speedometers, electronic sensors.

- End-User Profiles: OEMs and aftermarket service providers.

- M&A Activities: Strategic consolidation and market expansion valued in billions.

Car Speedometer Cable Industry Evolution

The Car Speedometer Cable industry has undergone a significant evolution throughout the Historical Period (2019–2024) and is poised for continued growth and transformation during the Forecast Period (2025–2033). The market's growth trajectory has been characterized by a steady upward trend, with the global market size for automotive speedometer cables estimated to reach billions by 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This growth is intrinsically linked to the increasing global automotive production, particularly in emerging economies, and the sustained demand for aftermarket replacement parts. Technological advancements have played a pivotal role, with manufacturers continuously refining production techniques to enhance cable durability, flexibility, and resistance to environmental factors. The adoption of stainless steel material and advanced rubber material formulations has been crucial in improving performance metrics, such as tensile strength and longevity, thereby reducing failure rates and enhancing driver safety. Furthermore, the increasing complexity of vehicle architectures and the integration of sophisticated electronic systems have necessitated the development of highly reliable and precise mechanical components. Consumer demands have shifted towards greater vehicle longevity and reduced maintenance costs, further fueling the need for high-quality, long-lasting speedometer cables. The evolution of plastic material applications also offers lighter and more cost-effective solutions for specific vehicle segments. This dynamic evolution underscores the industry's resilience and adaptability in meeting the ever-changing requirements of the automotive sector.

Leading Regions, Countries, or Segments in Car Speedometer Cable

The Aftermarket segment is projected to be the dominant force within the global Car Speedometer Cable market throughout the forecast period. This dominance is propelled by a confluence of factors including the vast global vehicle parc, the increasing average age of vehicles, and the cost-consciousness of consumers in seeking affordable replacement parts. The OEM segment, while significant, is subject to longer development cycles and evolving integration with digital systems.

In terms of regional dominance, Asia-Pacific is expected to lead, driven by its status as a global automotive manufacturing hub and a rapidly expanding vehicle fleet. China, India, and Southeast Asian nations contribute significantly to both production and consumption of automotive components.

Within the Type segmentation, Rubber Material based speedometer cables are anticipated to maintain a substantial market share due to their inherent flexibility, shock absorption properties, and cost-effectiveness, making them ideal for a wide range of passenger vehicles. Stainless Steel Material cables, known for their superior strength and corrosion resistance, are increasingly favored in heavy-duty applications and performance vehicles, contributing to a growing, albeit smaller, market share. Plastic Material cables are emerging as a cost-effective alternative for certain applications, particularly in lower-segment vehicles and specific components.

- Dominant Segment (Application): Aftermarket, driven by vehicle parc age and cost-efficiency.

- Dominant Region: Asia-Pacific, owing to extensive automotive manufacturing and growing vehicle ownership.

- Key Drivers in Asia-Pacific: Robust manufacturing infrastructure, increasing disposable incomes, supportive government policies for the automotive sector.

- Dominant Type (Material): Rubber Material, favored for its versatility and affordability.

- Growing Type: Stainless Steel Material, for enhanced durability and performance.

- Emerging Type: Plastic Material, offering cost-effective solutions.

Car Speedometer Cable Product Innovations

Product innovation in the Car Speedometer Cable market centers on enhancing durability, reducing friction, and improving resistance to extreme temperatures and environmental degradation. Manufacturers are increasingly employing advanced stainless steel material alloys and specialized rubber material compounds to extend cable lifespan and ensure consistent performance. Innovations include multi-layer cable constructions for improved flexibility and kink resistance, alongside enhanced sealing mechanisms to prevent contamination. The development of lighter-weight and more compact designs, potentially incorporating plastic material components where feasible, aims to contribute to overall vehicle fuel efficiency. These advancements directly translate to improved driver experience through accurate speed readings and reduced maintenance needs, making them key selling propositions in both OEM and aftermarket channels.

Propelling Factors for Car Speedometer Cable Growth

Several key factors are propelling the growth of the Car Speedometer Cable market. Firstly, the sheer volume of vehicles on the road globally, coupled with the natural wear and tear of components, creates a consistent demand for replacement parts in the Aftermarket. Secondly, the ongoing production of new vehicles in the OEM segment ensures sustained demand for these essential components. Thirdly, advancements in material science, leading to more robust and durable stainless steel material and rubber material cables, improve product reliability and customer satisfaction. Economic factors such as rising disposable incomes in developing nations are also contributing to increased vehicle ownership, thereby expanding the overall market. Finally, regulatory mandates concerning vehicle safety and maintenance indirectly support the demand for high-quality, reliable speedometer cables.

Obstacles in the Car Speedometer Cable Market

Despite robust growth, the Car Speedometer Cable market faces several obstacles. The increasing integration of electronic speed sensors and digital dashboards in modern vehicles poses a significant long-term threat to traditional mechanical speedometer cables, particularly in the OEM segment. Supply chain disruptions, exacerbated by geopolitical events and global trade fluctuations, can impact the availability and cost of raw materials like stainless steel material and specialized rubber compounds. Intense competition among numerous manufacturers, including established players and emerging entrants, leads to price pressures and necessitates continuous investment in cost optimization. Furthermore, stringent quality control standards and potential recalls due to component failures can result in substantial financial and reputational damage for manufacturers.

Future Opportunities in Car Speedometer Cable

The Car Speedometer Cable market is ripe with future opportunities. The burgeoning Aftermarket in emerging economies, driven by a growing vehicle parc and increasing demand for affordable repairs, presents significant expansion potential. Technological advancements in material science offer opportunities to develop even more durable, lighter, and cost-effective cables using specialized rubber material and plastic material composites. The development of hybrid solutions, where mechanical cables are integrated with electronic signaling for diagnostic purposes, could also open new avenues. Furthermore, focusing on niche markets such as classic car restoration and specialized vehicle applications requiring high-performance stainless steel material cables presents an opportunity for differentiation and premium pricing.

Major Players in the Car Speedometer Cable Ecosystem

- TP Automotive

- Tayoma Engineering Industries

- Speedy Cables

- R.S. International

- SILCO CABLES

- H.S. Taiwan Cable

- COFLE

- ABS

- Hans Pries

- JP Group

- Metzger

- Febi Bilstein

- Freudenberg Group

Key Developments in Car Speedometer Cable Industry

- 2023 Q4: TP Automotive launched a new line of high-durability rubber material speedometer cables with enhanced UV resistance, targeting the aftermarket segment.

- 2024 Q1: Tayoma Engineering Industries expanded its manufacturing capacity for stainless steel material speedometer cables, anticipating increased demand from OEM clients.

- 2024 Q2: Speedy Cables announced a strategic partnership with an e-commerce platform to broaden its Aftermarket reach, projecting billions in incremental sales.

- 2024 Q3: R.S. International invested heavily in R&D for advanced plastic material speedometer cable solutions, aiming for lighter and more cost-effective alternatives.

- 2024 Q4: SILCO CABLES received ISO certification for its advanced manufacturing processes, emphasizing quality and reliability in its product offerings.

Strategic Car Speedometer Cable Market Forecast

The strategic Car Speedometer Cable market forecast indicates sustained growth driven by the robust Aftermarket demand and the continuous production of new vehicles. Emerging economies, particularly in Asia-Pacific, will be key growth regions. Innovations in material science, focusing on enhanced durability and cost-effectiveness through advanced rubber material and plastic material solutions, will be critical for market leaders. While the shift towards electronic systems presents a long-term challenge, the established vehicle parc ensures continued relevance for mechanical speedometer cables. Companies that prioritize quality, supply chain efficiency, and adapt to evolving consumer preferences for reliable and affordable components are well-positioned for future success, with market valuations expected to reach billions.

Car Speedometer Cable Segmentation

-

1. Application

- 1.1. OEM

- 1.2. Aftermarket

-

2. Type

- 2.1. Stainless Steel Material

- 2.2. Rubber Material

- 2.3. Plastic Material

Car Speedometer Cable Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Car Speedometer Cable Regional Market Share

Geographic Coverage of Car Speedometer Cable

Car Speedometer Cable REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. OEM

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stainless Steel Material

- 5.2.2. Rubber Material

- 5.2.3. Plastic Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. OEM

- 6.1.2. Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stainless Steel Material

- 6.2.2. Rubber Material

- 6.2.3. Plastic Material

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. OEM

- 7.1.2. Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stainless Steel Material

- 7.2.2. Rubber Material

- 7.2.3. Plastic Material

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. OEM

- 8.1.2. Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stainless Steel Material

- 8.2.2. Rubber Material

- 8.2.3. Plastic Material

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. OEM

- 9.1.2. Aftermarket

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stainless Steel Material

- 9.2.2. Rubber Material

- 9.2.3. Plastic Material

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Car Speedometer Cable Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. OEM

- 10.1.2. Aftermarket

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Stainless Steel Material

- 10.2.2. Rubber Material

- 10.2.3. Plastic Material

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TP Automotive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tayoma Engineering Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Speedy Cables

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 R.S. International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SILCO CABLES

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 H.S. Taiwan Cable

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 COFLE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ABS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hans Pries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JP Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Metzger

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Febi Bilstein

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Freudenberg Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 TP Automotive

List of Figures

- Figure 1: Global Car Speedometer Cable Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Car Speedometer Cable Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Car Speedometer Cable Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Car Speedometer Cable Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Car Speedometer Cable Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Car Speedometer Cable Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Car Speedometer Cable Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Car Speedometer Cable Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Car Speedometer Cable Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Car Speedometer Cable Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Car Speedometer Cable Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Car Speedometer Cable Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Car Speedometer Cable Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Car Speedometer Cable Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Car Speedometer Cable Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Car Speedometer Cable Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Car Speedometer Cable Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Car Speedometer Cable Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Car Speedometer Cable Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Car Speedometer Cable Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Car Speedometer Cable Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Car Speedometer Cable Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Car Speedometer Cable Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Car Speedometer Cable Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Car Speedometer Cable Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Car Speedometer Cable Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Car Speedometer Cable Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Car Speedometer Cable Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Car Speedometer Cable Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Car Speedometer Cable Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Car Speedometer Cable Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Car Speedometer Cable Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Car Speedometer Cable Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Car Speedometer Cable Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Car Speedometer Cable Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Car Speedometer Cable Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Car Speedometer Cable Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Car Speedometer Cable Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Car Speedometer Cable Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Car Speedometer Cable Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Speedometer Cable?

The projected CAGR is approximately 11.52%.

2. Which companies are prominent players in the Car Speedometer Cable?

Key companies in the market include TP Automotive, Tayoma Engineering Industries, Speedy Cables, R.S. International, SILCO CABLES, H.S. Taiwan Cable, COFLE, ABS, Hans Pries, JP Group, Metzger, Febi Bilstein, Freudenberg Group.

3. What are the main segments of the Car Speedometer Cable?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Speedometer Cable," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Speedometer Cable report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Speedometer Cable?

To stay informed about further developments, trends, and reports in the Car Speedometer Cable, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence