Key Insights

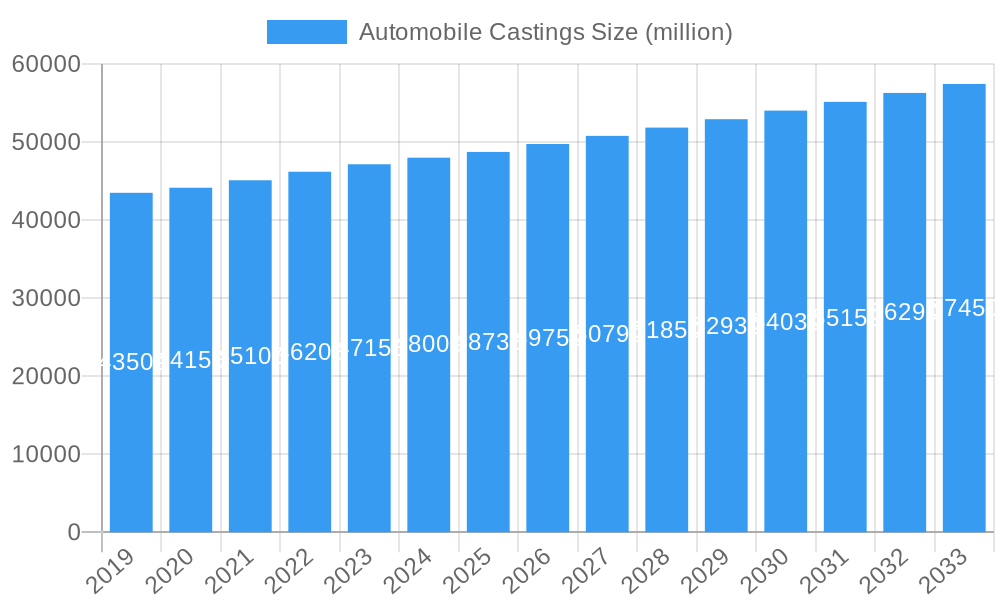

The global automobile castings market is poised for steady growth, estimated at USD 48,730 million in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 2.1% through 2033. This consistent expansion is driven by the increasing global vehicle production, a growing demand for lightweight and durable components to enhance fuel efficiency and safety, and advancements in casting technologies. The commercial vehicle segment is expected to be a significant contributor, fueled by the expansion of logistics and transportation networks worldwide. Family vehicles continue to represent a substantial portion of the market, with evolving consumer preferences for enhanced performance and aesthetics. Specialized vehicles, including electric and hybrid models, are also emerging as key growth areas, necessitating innovative casting solutions. The market encompasses a diverse range of casting types, from traditional Gray Cast Iron and Ductile Iron to advanced Steel and Aluminum Castings, each catering to specific performance requirements and cost considerations.

Automobile Castings Market Size (In Billion)

The market's trajectory is influenced by several key trends. The ongoing shift towards electric vehicles (EVs) is a significant catalyst, creating demand for specialized castings for battery enclosures, motor housings, and structural components that prioritize weight reduction and thermal management. The adoption of advanced manufacturing techniques like additive manufacturing (3D printing) in casting processes is also gaining traction, enabling the creation of more complex geometries and customized parts, thereby optimizing performance and reducing material waste. However, the market faces certain restraints, including the volatility of raw material prices, particularly for metals like aluminum and iron, which can impact manufacturing costs. Stringent environmental regulations concerning emissions and waste management in the manufacturing process also present challenges, pushing manufacturers towards sustainable and eco-friendly production methods. Despite these hurdles, the persistent demand for high-quality, reliable, and increasingly sophisticated automotive components suggests a resilient and evolving market landscape.

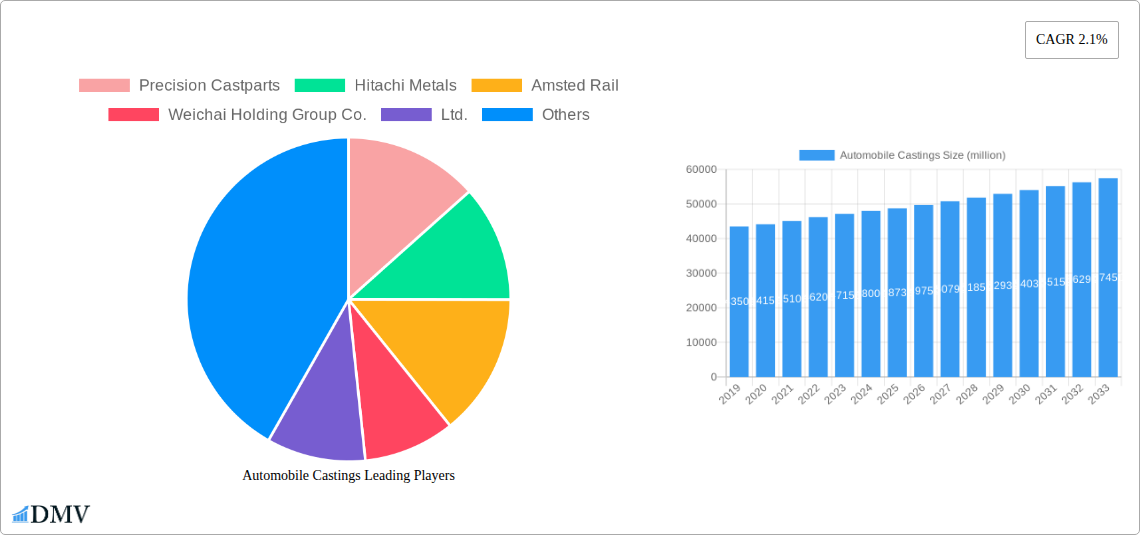

Automobile Castings Company Market Share

Here is an SEO-optimized and insightful report description for Automobile Castings, incorporating the specified details and adhering to all formatting and content requirements.

Automobile Castings Market Composition & Trends

This comprehensive report delves into the intricate composition and dynamic trends shaping the global automobile castings market. We meticulously analyze market concentration, revealing the dominant players and the competitive landscape, with key players like Precision Castparts, Hitachi Metals, Amsted Rail, Weichai Holding Group Co.,Ltd., Ryobi, Doosan Heavy Industries & Construction, CITIC, Nemak, Alcoa, Kobe Steel, ME Elecmetal, Hua Xiang Group, FAW Group, Gibbs Die Casting, Endurance, CHALCO, China Hongqiao, HongTeo, and Wencan holding significant sway. Innovation catalysts are thoroughly examined, highlighting the breakthroughs driving automotive lightweighting and electric vehicle (EV) component development. The report navigates the complex regulatory landscapes impacting foundry operations and emission standards, alongside an evaluation of substitute products and their potential to disrupt traditional metal casting markets. End-user profiles for commercial vehicle castings, family vehicle castings, and special vehicle castings are profiled, detailing their specific needs and purchasing behaviors. Furthermore, M&A activities are scrutinized, including estimated deal values and their strategic implications for market consolidation. The study identifies key trends such as the increasing demand for high-performance castings and the growing adoption of advanced manufacturing technologies in the automotive industry.

- Market Share Distribution: Analysis of leading companies' market share, with significant revenue streams generated by major players.

- M&A Deal Values: Quantifiable insights into merger and acquisition activities, with estimated total deal values reaching in the billions of dollars annually.

- Innovation Focus: Emphasis on research and development in aluminum casting and steel casting for enhanced fuel efficiency and safety.

- Regulatory Impact: Assessment of how evolving environmental regulations influence production methods and material choices.

Automobile Castings Industry Evolution

The automobile castings industry has undergone a remarkable evolution, driven by persistent technological advancements and the ever-changing demands of the global automotive sector. Over the study period of 2019–2033, and particularly within the historical period of 2019–2024, we've witnessed a significant shift towards lighter, stronger, and more complex castings. The base year of 2025 serves as a critical juncture, with the estimated year of 2025 and the forecast period of 2025–2033 poised for unprecedented growth. This evolution is intrinsically linked to the burgeoning electric vehicle market, which necessitates specialized EV battery casings, motor housing castings, and power electronics components. Traditional internal combustion engine vehicles continue to demand sophisticated engine block castings, cylinder head castings, and transmission components, albeit with an increasing emphasis on material efficiency and reduced emissions. The adoption of advanced manufacturing techniques, such as 3D printing for casting prototypes and advanced simulation software, has revolutionized design and production, enabling shorter lead times and greater design freedom. Growth rates for specific casting types, such as aluminum casting, have surged due to its lightweight properties, contributing significantly to overall fleet fuel economy. Conversely, the demand for gray iron casting and ductile iron casting remains robust for specific applications requiring high strength and durability, particularly in commercial vehicles. The increasing complexity of automotive designs, driven by the pursuit of aerodynamic efficiency and integrated functionalities, has pushed the boundaries of casting technologies, demanding higher precision and tighter tolerances. Consumer preferences are also a powerful catalyst, with a growing demand for safer, more fuel-efficient, and technologically advanced vehicles directly influencing the types and quality of castings required. This dynamic interplay between technological innovation, evolving vehicle architectures, and consumer expectations forms the bedrock of the automobile castings industry's continuous transformation, projecting a trajectory of sustained growth and innovation through to 2033.

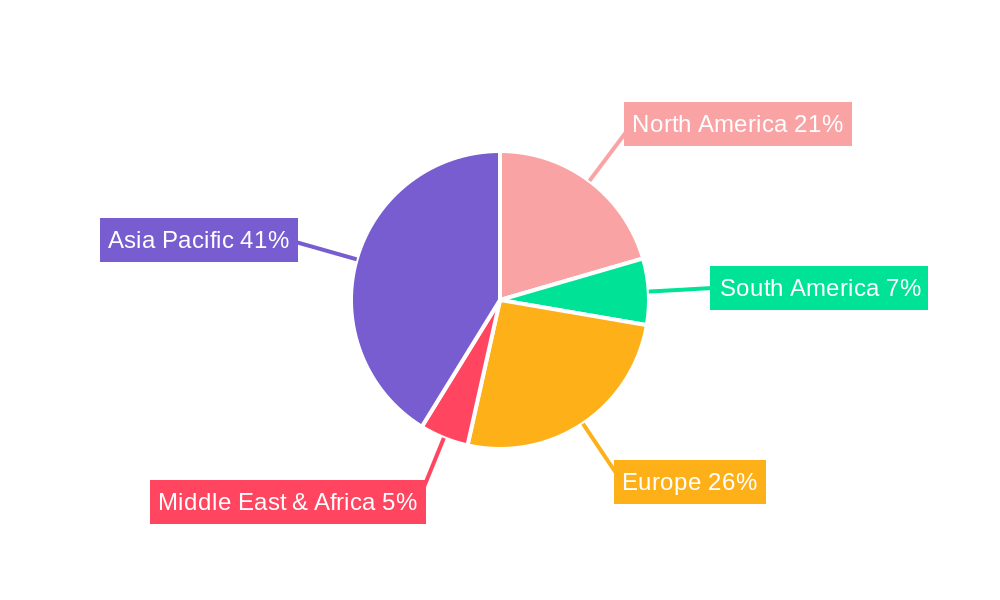

Leading Regions, Countries, or Segments in Automobile Castings

The global automobile castings market exhibits distinct regional dominance and segment leadership, driven by a confluence of factors including robust automotive manufacturing bases, supportive government policies, and significant investment trends. Asia Pacific, particularly China, stands as the undisputed leader in this domain. This dominance is fueled by its unparalleled position as the world's largest automotive manufacturing hub, encompassing both family vehicle and commercial vehicle production. The region's commitment to adopting advanced manufacturing technologies, coupled with substantial government incentives for the automotive industry, has fostered an environment conducive to casting innovation and large-scale production. Within this region, Gray Cast Iron Casting and Ductile Iron Casting remain foundational, supplying critical components for a vast array of vehicles. However, the rapid growth of aluminum casting is a defining trend, directly attributable to the imperative for lightweighting vehicles to improve fuel efficiency and comply with stringent emission standards. The increasing demand for electric vehicle (EV) components, such as battery enclosures and motor housings, further amplifies the importance of aluminum casting and emerging lightweight alloys.

- Dominant Region: Asia Pacific, with China leading in production volume and market share.

- Key Drivers: Massive domestic automotive market, strong OEM presence, government support for manufacturing and EV adoption, extensive foundry infrastructure.

- Dominant Application Segment: Commercial Vehicle and Family Vehicle segments collectively represent the largest demand for automobile castings.

- Key Drivers: High production volumes of passenger cars and light commercial vehicles, demand for engine, chassis, and structural components.

- Dominant Type Segment: While Gray Cast Iron Casting and Ductile Iron Casting hold significant market share, Aluminum Casting is experiencing the fastest growth.

- Key Drivers: Lightweighting initiatives for fuel efficiency and EV range, increasing adoption of aluminum alloys in structural components, engine parts, and EV battery casings.

- Investment Trends: Substantial investments in advanced casting technologies, automation, and R&D are concentrated in leading regions.

- Regulatory Support: Favorable policies promoting automotive manufacturing, EV subsidies, and emissions reduction targets indirectly benefit the casting industry. The proliferation of special vehicle castings for niche applications also contributes to market diversification.

Automobile Castings Product Innovations

Product innovations in the automobile castings market are primarily driven by the relentless pursuit of lightweighting, enhanced performance, and cost-effectiveness. Manufacturers are increasingly developing advanced aluminum casting alloys with superior strength-to-weight ratios for critical structural components, contributing to improved fuel economy and electric vehicle range. Innovations in steel casting focus on high-strength, low-alloy (HSLA) steels for chassis and suspension parts, offering a balance of durability and weight reduction. The development of intricate ductile iron castings with optimized designs allows for greater integration of functions, reducing the number of individual components and assembly time. Furthermore, advancements in casting simulation software and additive manufacturing are enabling the rapid prototyping and production of highly complex, optimized castings with unique selling propositions, such as improved thermal management in EV powertrains and enhanced crashworthiness in passenger vehicles.

Propelling Factors for Automobile Castings Growth

The automobile castings market is experiencing robust growth propelled by several key factors. The escalating global demand for vehicles, particularly in emerging economies, directly translates to increased consumption of automotive castings. The ongoing electric vehicle revolution is a major catalyst, driving the need for specialized, lightweight castings for battery systems, electric motors, and power electronics. Furthermore, stringent government regulations mandating improved fuel efficiency and reduced emissions are pushing automakers to adopt lightweight materials, with aluminum casting and advanced steel casting technologies playing a pivotal role. Continuous technological advancements in casting processes, such as precision casting and die casting, are enhancing product quality, reducing manufacturing costs, and enabling the production of more complex components.

Obstacles in the Automobile Castings Market

Despite its growth trajectory, the automobile castings market faces several significant obstacles. Volatile raw material prices, particularly for aluminum and iron, can significantly impact production costs and profitability. Stringent environmental regulations and the associated compliance costs for foundries, including waste management and emission control, present a considerable challenge. Intense competition within the market, coupled with price pressures from automotive manufacturers, can erode profit margins. Furthermore, supply chain disruptions, as witnessed in recent global events, can lead to material shortages and production delays, impacting delivery timelines and customer satisfaction. The high capital investment required for advanced casting technologies and automation can also be a barrier for smaller players.

Future Opportunities in Automobile Castings

The automobile castings market is rife with future opportunities, driven by evolving automotive trends and technological frontiers. The continued expansion of the electric vehicle market will create substantial demand for specialized castings, including lightweight battery enclosures, advanced motor housings, and thermal management components. The growing adoption of autonomous driving technology will necessitate new types of castings for sensor integration and advanced structural components. Emerging markets in developing nations represent significant untapped potential for commercial vehicle castings and family vehicle castings. Furthermore, innovations in material science and casting simulation technologies will unlock opportunities for developing novel, high-performance castings with enhanced properties and functionalities, contributing to the next generation of vehicles.

Major Players in the Automobile Castings Ecosystem

- Precision Castparts

- Hitachi Metals

- Amsted Rail

- Weichai Holding Group Co.,Ltd.

- Ryobi

- Doosan Heavy Industries & Construction

- CITIC

- Nemak

- Alcoa

- Kobe Steel

- ME Elecmetal

- Hua Xiang Group

- FAW Group

- Gibbs Die Casting

- Endurance

- CHALCO

- China Hongqiao

- HongTeo

- Wencan

Key Developments in Automobile Castings Industry

- 2023/10: Introduction of advanced aluminum alloy castings for EV battery casings by Nemak, enhancing thermal conductivity and structural integrity.

- 2024/01: Precision Castparts announces a significant investment in expanding its steel casting capacity to meet the growing demand for commercial vehicle components.

- 2024/03: Hitachi Metals showcases its innovative ductile iron casting solutions for next-generation engine designs, focusing on weight reduction and emissions control.

- 2024/05: Weichai Holding Group Co.,Ltd. collaborates with an international partner to develop high-performance castings for heavy-duty commercial vehicles.

- 2024/07: Ryobi expands its die casting capabilities for complex automotive components, focusing on precision and high-volume production.

- 2025/02: Alcoa partners with an OEM to develop lightweight aluminum castings for advanced EV architectures.

Strategic Automobile Castings Market Forecast

The strategic automobile castings market forecast indicates a period of sustained and dynamic growth through 2033. This expansion will be significantly fueled by the accelerating global adoption of electric vehicles, necessitating a surge in demand for specialized lightweight aluminum castings and high-strength steel castings. The continuous push for fuel efficiency and emissions reduction in conventional vehicles will maintain a strong demand for optimized gray iron castings and ductile iron castings. Emerging economies represent substantial untapped potential, while ongoing technological advancements in casting processes, including automation and simulation, will drive innovation and improve cost-effectiveness. The market is poised for strategic collaborations and mergers, consolidating the industry and fostering advancements in automotive lightweighting and component integration.

Automobile Castings Segmentation

-

1. Application

- 1.1. Commercial Vehicle

- 1.2. Family Vehicle

- 1.3. Special Vehicle

-

2. Type

- 2.1. Gray Cast Iron Casting

- 2.2. Ductile Iron Casting

- 2.3. Steel Casting

- 2.4. Aluminum Casting

- 2.5. Others

Automobile Castings Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automobile Castings Regional Market Share

Geographic Coverage of Automobile Castings

Automobile Castings REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicle

- 5.1.2. Family Vehicle

- 5.1.3. Special Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gray Cast Iron Casting

- 5.2.2. Ductile Iron Casting

- 5.2.3. Steel Casting

- 5.2.4. Aluminum Casting

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicle

- 6.1.2. Family Vehicle

- 6.1.3. Special Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Gray Cast Iron Casting

- 6.2.2. Ductile Iron Casting

- 6.2.3. Steel Casting

- 6.2.4. Aluminum Casting

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicle

- 7.1.2. Family Vehicle

- 7.1.3. Special Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Gray Cast Iron Casting

- 7.2.2. Ductile Iron Casting

- 7.2.3. Steel Casting

- 7.2.4. Aluminum Casting

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicle

- 8.1.2. Family Vehicle

- 8.1.3. Special Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Gray Cast Iron Casting

- 8.2.2. Ductile Iron Casting

- 8.2.3. Steel Casting

- 8.2.4. Aluminum Casting

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicle

- 9.1.2. Family Vehicle

- 9.1.3. Special Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Gray Cast Iron Casting

- 9.2.2. Ductile Iron Casting

- 9.2.3. Steel Casting

- 9.2.4. Aluminum Casting

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automobile Castings Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicle

- 10.1.2. Family Vehicle

- 10.1.3. Special Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Gray Cast Iron Casting

- 10.2.2. Ductile Iron Casting

- 10.2.3. Steel Casting

- 10.2.4. Aluminum Casting

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Precision Castparts

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi Metals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amsted Rail

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weichai Holding Group Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ryobi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Heavy Industries & Construction

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CITIC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nemak

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alcoa

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kobe Steel

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ME Elecmetal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hua Xiang Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 FAW Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Gibbs Die Casting

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Endurance

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CHALCO

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 China Hongqiao

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 HongTeo

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Wencan

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Precision Castparts

List of Figures

- Figure 1: Global Automobile Castings Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Automobile Castings Revenue (million), by Application 2025 & 2033

- Figure 3: North America Automobile Castings Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Automobile Castings Revenue (million), by Type 2025 & 2033

- Figure 5: North America Automobile Castings Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Automobile Castings Revenue (million), by Country 2025 & 2033

- Figure 7: North America Automobile Castings Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Automobile Castings Revenue (million), by Application 2025 & 2033

- Figure 9: South America Automobile Castings Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Automobile Castings Revenue (million), by Type 2025 & 2033

- Figure 11: South America Automobile Castings Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Automobile Castings Revenue (million), by Country 2025 & 2033

- Figure 13: South America Automobile Castings Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Automobile Castings Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Automobile Castings Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Automobile Castings Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Automobile Castings Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Automobile Castings Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Automobile Castings Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Automobile Castings Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Automobile Castings Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Automobile Castings Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Automobile Castings Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Automobile Castings Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Automobile Castings Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Automobile Castings Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Automobile Castings Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Automobile Castings Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Automobile Castings Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Automobile Castings Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automobile Castings Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Automobile Castings Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Automobile Castings Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Automobile Castings Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Automobile Castings Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Automobile Castings Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Automobile Castings Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Automobile Castings Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Automobile Castings Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Automobile Castings Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automobile Castings?

The projected CAGR is approximately 2.1%.

2. Which companies are prominent players in the Automobile Castings?

Key companies in the market include Precision Castparts, Hitachi Metals, Amsted Rail, Weichai Holding Group Co., Ltd., Ryobi, Doosan Heavy Industries & Construction, CITIC, Nemak, Alcoa, Kobe Steel, ME Elecmetal, Hua Xiang Group, FAW Group, Gibbs Die Casting, Endurance, CHALCO, China Hongqiao, HongTeo, Wencan.

3. What are the main segments of the Automobile Castings?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48730 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automobile Castings," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automobile Castings report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automobile Castings?

To stay informed about further developments, trends, and reports in the Automobile Castings, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence