Key Insights

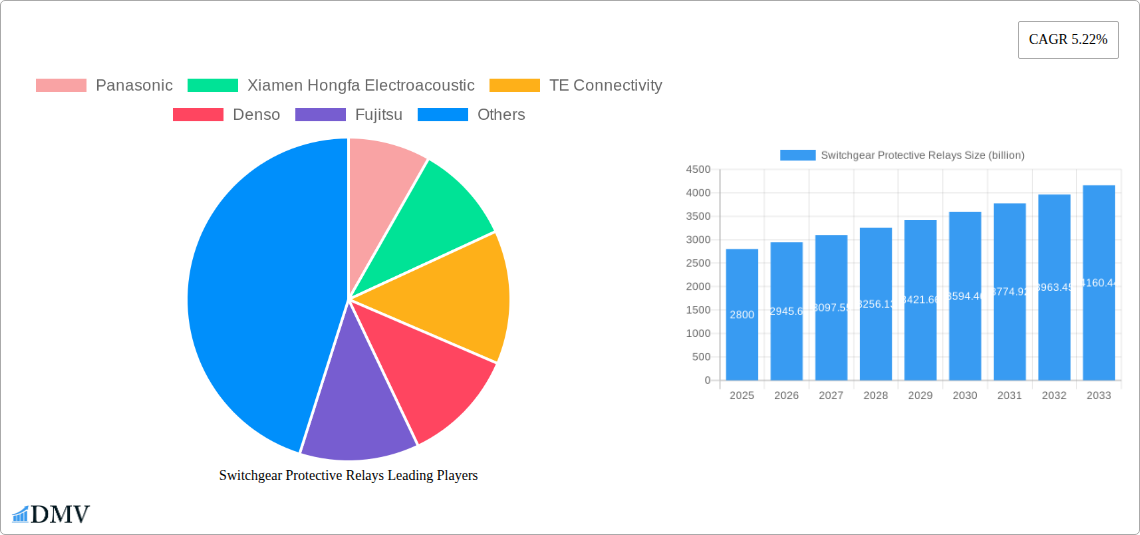

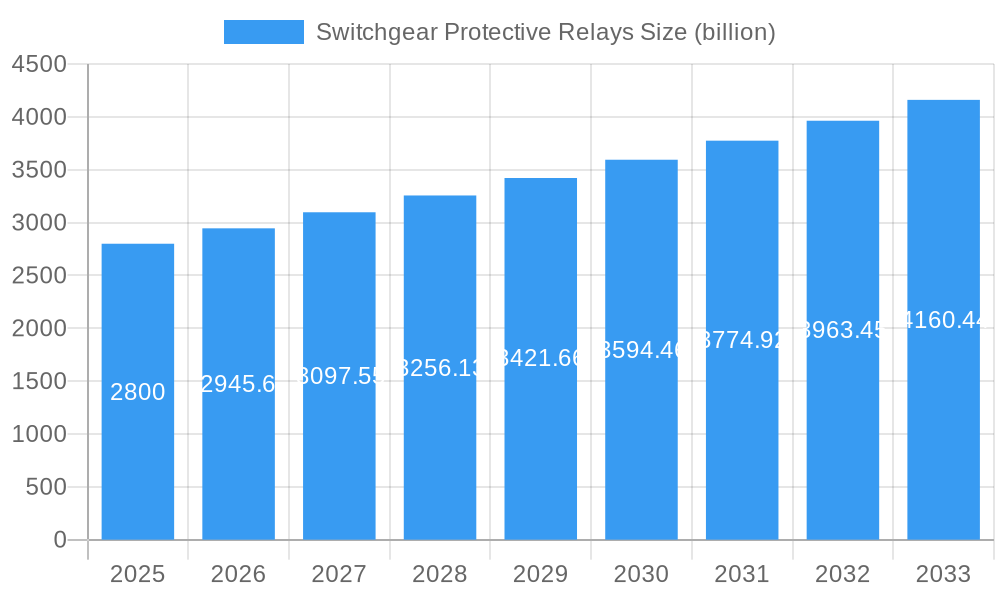

The global Switchgear Protective Relays market is poised for significant expansion, with an estimated market size of USD 2.8 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.22% through 2033. This robust growth is driven by increasing investments in upgrading aging power infrastructure, the burgeoning demand for reliable electricity supply across residential, commercial, and industrial sectors, and the rapid adoption of smart grid technologies. The expanding renewable energy landscape, with its inherent intermittency and distributed generation characteristics, further necessitates advanced protective relay solutions to ensure grid stability and safety. Emerging economies, in particular, are witnessing substantial infrastructure development, fueling the demand for these essential components. The market is characterized by continuous innovation, with manufacturers focusing on developing sophisticated relays with enhanced functionalities such as digital communication capabilities, advanced fault detection algorithms, and integration with SCADA systems for remote monitoring and control.

Switchgear Protective Relays Market Size (In Billion)

The market is segmented by application, encompassing power generation, transmission and distribution, industrial, and commercial sectors, each presenting unique growth opportunities. By type, the market includes electromechanical, static, and numerical relays, with numerical relays experiencing the highest adoption rates due to their superior performance, flexibility, and advanced features. Key players like Siemens, ABB, Eaton, and Schneider Electric are at the forefront of this market, continually investing in research and development to introduce cutting-edge solutions. Restraints to growth may include the high initial cost of advanced protective relay systems and the need for skilled personnel for installation and maintenance. However, the growing emphasis on grid modernization, cybersecurity concerns, and the increasing complexity of power systems are expected to outweigh these challenges, paving the way for sustained market expansion.

Switchgear Protective Relays Company Market Share

Switchgear Protective Relays Market Composition & Trends

The global Switchgear Protective Relays market, projected to reach a valuation of over XXX billion by 2033, exhibits a moderate to high concentration, driven by a handful of established players and a growing number of specialized innovators. The study period, from 2019 to 2033, encompassing historical data (2019-2024), a base year (2025), an estimated year (2025), and a forecast period (2025-2033), reveals dynamic shifts in market dynamics. Innovation catalysts include the increasing demand for smart grid technologies, the integration of renewable energy sources, and the persistent need for enhanced power system reliability and safety. Regulatory landscapes, particularly concerning grid modernization and cybersecurity, are increasingly shaping the market. Substitute products, while nascent, are being explored in the form of advanced software-based protection schemes and integrated digital solutions, though their widespread adoption is yet to rival the established reliability of physical relays. End-user profiles span utilities, industrial facilities, data centers, and transportation infrastructure, all prioritizing uninterrupted power supply and fault mitigation. Mergers and acquisitions (M&A) activity is anticipated to remain robust, with significant deal values estimated to exceed XXX billion in the forecast period, driven by consolidation strategies and the acquisition of cutting-edge technologies. Key M&A activities are expected to focus on companies possessing expertise in digital relay technology, IoT integration, and AI-driven analytics for predictive maintenance.

- Market Share Distribution: Leading players like ABB, Siemens, and Eaton are expected to collectively hold over XX% of the market share by 2033.

- M&A Deal Values: The total value of M&A deals is projected to surpass XXX billion during the forecast period, indicating significant consolidation.

- Innovation Catalysts: Smart grid deployment, renewable energy integration, and stringent safety regulations are primary drivers.

- Substitute Products: Software-defined protection and advanced digital integrated systems are emerging alternatives.

- End-User Segments: Utilities, heavy industries, and critical infrastructure are key consumers.

Switchgear Protective Relays Industry Evolution

The Switchgear Protective Relays industry has witnessed a profound evolution throughout the study period, transforming from electro-mechanical devices to sophisticated digital and intelligent solutions. This evolution is intrinsically linked to the growing complexity and demands of modern power grids. Historically, the market was dominated by basic overcurrent and overvoltage protection relays, primarily serving the needs of conventional power generation and distribution. However, the influx of renewable energy sources such as solar and wind, which exhibit intermittent generation patterns, necessitated the development of more agile and sophisticated protection schemes. This shift has propelled market growth trajectories, with an estimated Compound Annual Growth Rate (CAGR) of XX% from 2019 to 2033. Technological advancements have been the cornerstone of this transformation. The advent of micro-processor-based relays revolutionized the industry by offering enhanced precision, programmability, and communication capabilities. These digital relays allow for more granular monitoring of power system parameters and enable remote configuration and diagnostics, significantly reducing operational costs for utilities. The adoption of IEC 61850 communication standards has further accelerated this trend, facilitating seamless interoperability between different substation devices and ushering in the era of the smart grid. Consumer demands have also evolved, with a strong emphasis now placed on reliability, resilience, and cybersecurity. End-users are increasingly seeking protective relay solutions that can not only detect and isolate faults swiftly but also provide advanced diagnostics, predictive maintenance capabilities, and robust protection against cyber threats. This has led to the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms within protective relays, enabling them to learn from historical data and proactively identify potential equipment failures or anomalies. The market size for switchgear protective relays is estimated to be over XXX billion in the base year 2025, with projections reaching over XXX billion by 2033. Adoption metrics for digital relays have surged, now accounting for over XX% of new installations, a significant jump from the XX% observed in 2019. The increasing integration of distributed energy resources (DERs) and the need for grid stability in the face of these dynamic changes are further fueling the demand for advanced protective relay solutions.

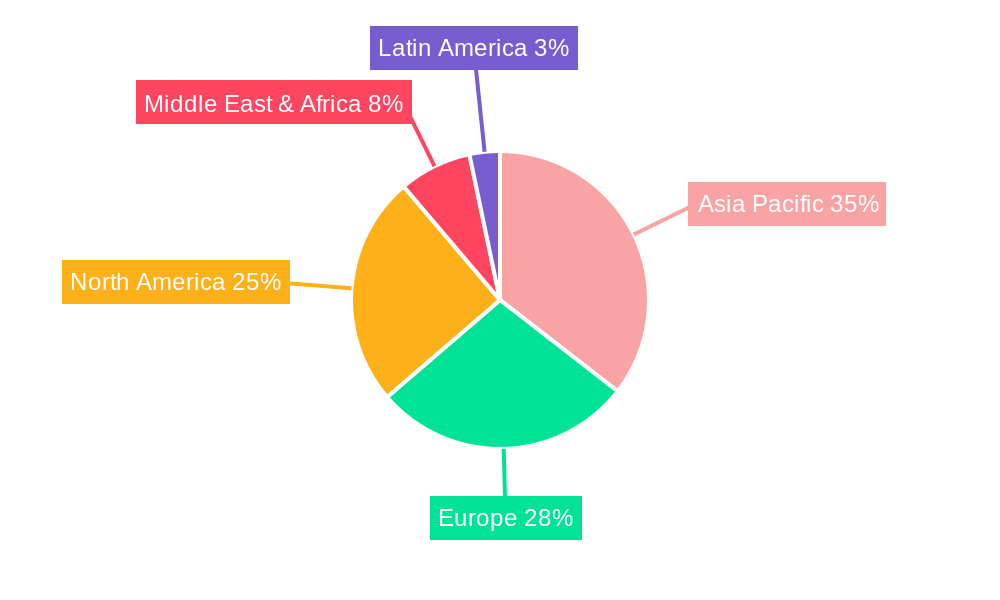

Leading Regions, Countries, or Segments in Switchgear Protective Relays

North America is poised to maintain its dominance in the global Switchgear Protective Relays market throughout the forecast period, driven by substantial investments in grid modernization, the expansion of smart grid infrastructure, and stringent regulatory mandates for power system reliability. The region's well-established utility sector and its proactive adoption of advanced technologies, including digital substations and smart metering, are key factors contributing to this leadership. The United States, in particular, represents a significant market within North America, fueled by government initiatives aimed at upgrading aging power infrastructure and enhancing grid resilience against natural disasters and cyber threats. Investment trends in North America are heavily skewed towards technologies that improve grid flexibility and efficiency, directly benefiting the demand for intelligent protective relays. Regulatory support, such as incentives for smart grid deployment and cybersecurity standards, further solidifies the region's position.

In terms of Application, the Transmission and Distribution (T&D) segment is expected to command the largest market share. This is primarily due to the vast and complex networks requiring robust protection against faults, overloads, and voltage fluctuations. The continuous need to ensure a stable and reliable power supply from generation to end-users necessitates advanced protective relaying at every stage of the T&D process. The increasing integration of renewable energy sources into the grid, often located in remote areas, further amplifies the importance of sophisticated T&D protection.

The Type segment is witnessing a strong surge in demand for Numerical Relays. These advanced relays, powered by microprocessors, offer superior accuracy, flexibility, and communication capabilities compared to their traditional electro-mechanical and static counterparts. Their ability to integrate multiple protection functions, log data, and communicate with SCADA systems makes them indispensable for modern smart grids. The increasing focus on condition monitoring and predictive maintenance further fuels the adoption of numerical relays, which can provide detailed insights into equipment health.

- Dominant Region (North America):

- Key Drivers: Grid modernization initiatives, smart grid expansion, stringent reliability standards.

- Investment Trends: Significant capital expenditure on upgrading T&D infrastructure and deploying smart technologies.

- Regulatory Support: Government incentives for smart grid adoption and robust cybersecurity mandates.

- Dominant Application (Transmission & Distribution):

- Market Share: Expected to account for over XX% of the global market by 2033.

- Drivers: Extensive network infrastructure, need for reliable power flow, integration of remote renewable energy sources.

- Dominant Type (Numerical Relays):

- Adoption Rate: Projected to reach over XX% of the market by 2033.

- Unique Selling Propositions: High accuracy, programmability, data logging, communication capabilities, integration with SCADA.

- Impact of Smart Grids: Essential for managing bidirectional power flow and distributed generation.

Switchgear Protective Relays Product Innovations

Recent product innovations in Switchgear Protective Relays are significantly enhancing grid reliability and operational efficiency. Companies are developing advanced numerical relays with embedded artificial intelligence and machine learning capabilities, enabling predictive maintenance and anomaly detection. These intelligent relays offer enhanced cybersecurity features to protect against cyber-physical threats, a critical concern for modern power grids. Furthermore, there's a growing trend towards modular and flexible relay designs that can be easily upgraded and adapted to evolving grid requirements. Performance metrics are seeing significant improvements, with faster fault detection times, reduced false tripping rates, and enhanced diagnostic capabilities becoming standard. These innovations directly address the growing complexity of power systems, driven by renewable energy integration and the expansion of smart grid technologies.

Propelling Factors for Switchgear Protective Relays Growth

The Switchgear Protective Relays market is being propelled by a confluence of powerful factors. The accelerating integration of renewable energy sources like solar and wind power necessitates more sophisticated protection to manage grid stability and bidirectional power flows, driving demand for advanced relay technologies. Global initiatives towards smart grid development and modernization are a significant catalyst, requiring intelligent and communicative protective relays for enhanced control and monitoring. Furthermore, the increasing emphasis on grid reliability and safety, driven by regulatory mandates and the growing impact of power outages on economies, compels utilities and industries to invest in state-of-the-art protective solutions. The ongoing industrial automation and the expansion of critical infrastructure such as data centers and electric vehicle charging networks also contribute to sustained market growth.

Obstacles in the Switchgear Protective Relays Market

Despite robust growth prospects, the Switchgear Protective Relays market faces certain obstacles. The high initial cost of advanced digital and intelligent relays can be a deterrent for smaller utilities or in regions with limited capital expenditure budgets. Cybersecurity concerns associated with interconnected relay systems pose a significant challenge, requiring continuous investment in robust security protocols and constant vigilance against evolving threats. The complex nature of these sophisticated systems also necessitates highly skilled personnel for installation, configuration, and maintenance, leading to potential skill gaps in certain regions. Furthermore, the long replacement cycles of existing electro-mechanical relays in established power infrastructure can slow down the adoption of newer technologies.

Future Opportunities in Switchgear Protective Relays

The future of the Switchgear Protective Relays market is brimming with opportunities. The ongoing expansion of smart cities and the increasing adoption of electric vehicles will create new demand centers for reliable and intelligent power distribution protection. The growing trend of decentralized power generation and microgrids presents a significant avenue for specialized protective relay solutions tailored to these localized energy systems. Furthermore, the integration of IoT and cloud-based analytics for remote monitoring and predictive maintenance of relays will unlock new service-based revenue streams. Opportunities also lie in developing highly resilient and cyber-secure relays for critical infrastructure, such as defense installations and major industrial complexes.

Major Players in the Switchgear Protective Relays Ecosystem

- ABB

- Siemens

- Eaton

- Schneider Electric

- GE (General Electric)

- Mitsubishi Electric

- Littelfuse

- Xiamen Hongfa Electroacoustic

- Panasonic

- TE Connectivity

- Denso

- Fujitsu

- Gigavac (Sensata)

- Song Chuan Precision

- Woodward

- CG Power and Industrial Solutions

Key Developments in Switchgear Protective Relays Industry

- 2023/09: ABB launches a new suite of intelligent relays with advanced cybersecurity features for smart grid applications, enhancing protection against evolving cyber threats.

- 2023/05: Siemens introduces a modular numerical relay platform offering unprecedented flexibility for substation automation, catering to diverse grid configurations.

- 2022/11: Eaton acquires a leading provider of grid analytics software, aiming to integrate advanced diagnostic and predictive maintenance capabilities into its relay offerings.

- 2022/07: Littelfuse expands its portfolio of protection relays with a focus on renewable energy integration, offering solutions for solar and wind farm substations.

- 2021/04: Schneider Electric announces strategic partnerships to accelerate the development of AI-powered protective relays for enhanced grid resilience.

- 2020/10: Mitsubishi Electric unveils a new generation of high-speed protective relays designed for critical infrastructure, ensuring rapid fault detection and isolation.

- 2019/12: CG Power and Industrial Solutions announces significant investment in R&D for digital substation technologies, including advanced protective relay solutions.

Strategic Switchgear Protective Relays Market Forecast

The strategic Switchgear Protective Relays market forecast indicates sustained and robust growth, propelled by the unstoppable march towards smarter, more resilient, and cleaner energy grids. The increasing decentralization of power generation, driven by renewables, and the growing demand for uninterrupted power supply in critical sectors are creating a fertile ground for advanced protective relay solutions. Innovations in AI, IoT, and cybersecurity will continue to redefine the capabilities of these essential devices, leading to enhanced operational efficiencies and reduced downtime. Strategic investments in research and development, coupled with a focus on providing integrated protection and control solutions, will be crucial for players looking to capitalize on the evolving market landscape and meet the complex demands of the future power infrastructure.

Switchgear Protective Relays Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Switchgear Protective Relays Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Switchgear Protective Relays Regional Market Share

Geographic Coverage of Switchgear Protective Relays

Switchgear Protective Relays REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Switchgear Protective Relays Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Xiamen Hongfa Electroacoustic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TE Connectivity

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Denso

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gigavac(Sensata)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Song Chuan Precision

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Woodward

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CG Power and Industrial Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Littelfuse

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Siemens

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mitsubishi Electric

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Switchgear Protective Relays Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: undefined Switchgear Protective Relays Revenue (billion), by Application 2025 & 2033

- Figure 3: undefined Switchgear Protective Relays Revenue Share (%), by Application 2025 & 2033

- Figure 4: undefined Switchgear Protective Relays Revenue (billion), by Type 2025 & 2033

- Figure 5: undefined Switchgear Protective Relays Revenue Share (%), by Type 2025 & 2033

- Figure 6: undefined Switchgear Protective Relays Revenue (billion), by Country 2025 & 2033

- Figure 7: undefined Switchgear Protective Relays Revenue Share (%), by Country 2025 & 2033

- Figure 8: undefined Switchgear Protective Relays Revenue (billion), by Application 2025 & 2033

- Figure 9: undefined Switchgear Protective Relays Revenue Share (%), by Application 2025 & 2033

- Figure 10: undefined Switchgear Protective Relays Revenue (billion), by Type 2025 & 2033

- Figure 11: undefined Switchgear Protective Relays Revenue Share (%), by Type 2025 & 2033

- Figure 12: undefined Switchgear Protective Relays Revenue (billion), by Country 2025 & 2033

- Figure 13: undefined Switchgear Protective Relays Revenue Share (%), by Country 2025 & 2033

- Figure 14: undefined Switchgear Protective Relays Revenue (billion), by Application 2025 & 2033

- Figure 15: undefined Switchgear Protective Relays Revenue Share (%), by Application 2025 & 2033

- Figure 16: undefined Switchgear Protective Relays Revenue (billion), by Type 2025 & 2033

- Figure 17: undefined Switchgear Protective Relays Revenue Share (%), by Type 2025 & 2033

- Figure 18: undefined Switchgear Protective Relays Revenue (billion), by Country 2025 & 2033

- Figure 19: undefined Switchgear Protective Relays Revenue Share (%), by Country 2025 & 2033

- Figure 20: undefined Switchgear Protective Relays Revenue (billion), by Application 2025 & 2033

- Figure 21: undefined Switchgear Protective Relays Revenue Share (%), by Application 2025 & 2033

- Figure 22: undefined Switchgear Protective Relays Revenue (billion), by Type 2025 & 2033

- Figure 23: undefined Switchgear Protective Relays Revenue Share (%), by Type 2025 & 2033

- Figure 24: undefined Switchgear Protective Relays Revenue (billion), by Country 2025 & 2033

- Figure 25: undefined Switchgear Protective Relays Revenue Share (%), by Country 2025 & 2033

- Figure 26: undefined Switchgear Protective Relays Revenue (billion), by Application 2025 & 2033

- Figure 27: undefined Switchgear Protective Relays Revenue Share (%), by Application 2025 & 2033

- Figure 28: undefined Switchgear Protective Relays Revenue (billion), by Type 2025 & 2033

- Figure 29: undefined Switchgear Protective Relays Revenue Share (%), by Type 2025 & 2033

- Figure 30: undefined Switchgear Protective Relays Revenue (billion), by Country 2025 & 2033

- Figure 31: undefined Switchgear Protective Relays Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Switchgear Protective Relays Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Switchgear Protective Relays Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Switchgear Protective Relays Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Switchgear Protective Relays Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Switchgear Protective Relays Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Switchgear Protective Relays Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Switchgear Protective Relays Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Switchgear Protective Relays Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switchgear Protective Relays?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the Switchgear Protective Relays?

Key companies in the market include Panasonic, Xiamen Hongfa Electroacoustic, TE Connectivity, Denso, Fujitsu, Gigavac(Sensata), Song Chuan Precision, Woodward, ABB, CG Power and Industrial Solutions, Littelfuse, Eaton, Siemens, Mitsubishi Electric.

3. What are the main segments of the Switchgear Protective Relays?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switchgear Protective Relays," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switchgear Protective Relays report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switchgear Protective Relays?

To stay informed about further developments, trends, and reports in the Switchgear Protective Relays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence