Key Insights

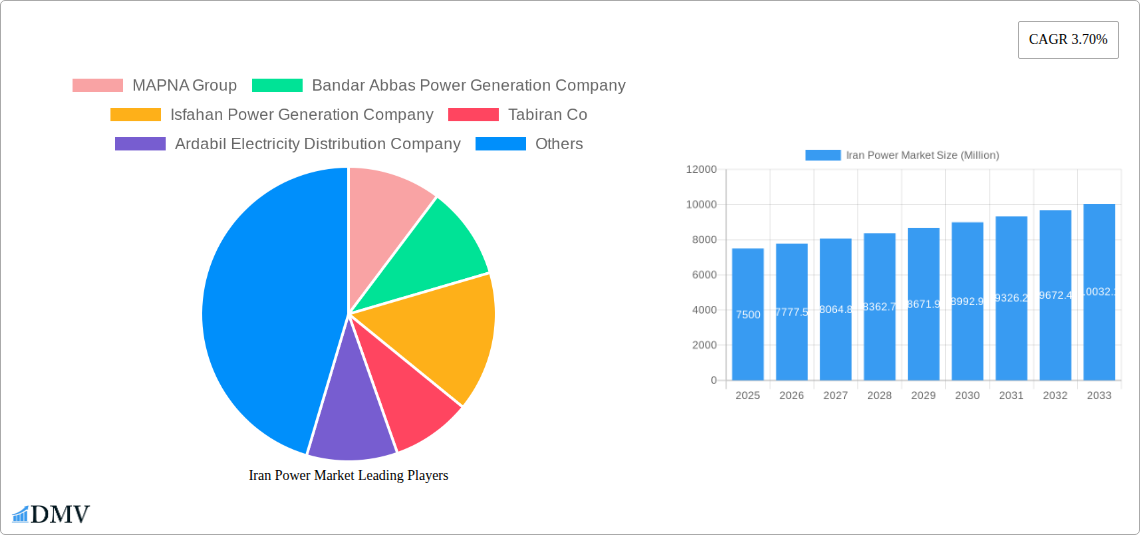

The Iran Power Market is projected for robust growth, with an estimated market size of $10.2 billion in 2024. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 11% through 2033. Key growth catalysts include significant investments in diversifying Iran's energy generation portfolio, with an accelerating adoption of renewable energy sources such as solar and wind power, alongside continued reliance on natural gas. This strategic pivot aims to reduce fossil fuel dependence, bolster energy security, and address environmental mandates. Furthermore, the implementation of smart grid technologies is pivotal for enhancing operational efficiency, reliability, and the seamless integration of diverse energy sources, thereby meeting escalating demand from residential, commercial, and industrial sectors as the nation pursues economic development and infrastructure modernization.

Iran Power Market Market Size (In Billion)

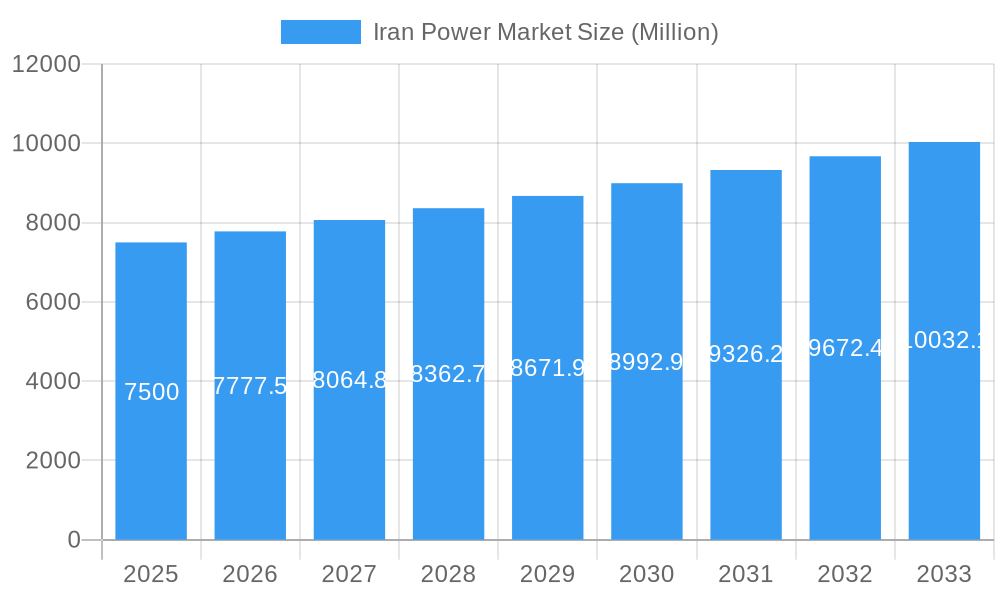

Challenges to market expansion include geopolitical complexities and international sanctions, which may limit access to advanced technologies and foreign capital. Additionally, the substantial capital required for upgrading aging transmission and distribution infrastructure presents a notable hurdle. Nevertheless, the fundamental demand for dependable and expanding power supply, coupled with government-led initiatives focused on energy independence and technological advancement, indicates a resilient market trajectory. Prominent market participants, including MAPNA Group and provincial power entities, highlight the dynamic and competitive landscape, with a distinct emphasis on modernization and sustainability.

Iran Power Market Company Market Share

Iran Power Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

Report Description:

This in-depth report provides an authoritative analysis of the Iran power market, offering critical insights into its composition, trends, and future trajectory from 2019 to 2033. Leveraging a robust study period of 15 years, with base year 2025 and forecast period 2025-2033, this report is essential for stakeholders seeking to understand the evolving dynamics of Iran's energy landscape. We meticulously examine key generation sources including Natural Gas, Oil, Renewables, Nuclear, and Other Generation Sources, alongside crucial transmission and distribution infrastructure, encompassing Transmission lines, Distribution networks, and the adoption of Smart grid technologies. Furthermore, the report delves into the end-user segments: Residential, Commercial, and Industrial, providing a holistic view of power consumption patterns.

For industry leaders, investors, and policymakers, this report illuminates the competitive landscape, regulatory frameworks, technological advancements, and the significant impact of energy transition initiatives. We identify leading market players, analyze M&A activities, and present actionable strategies for navigating challenges and capitalizing on burgeoning opportunities. Gain a competitive edge with our data-driven forecasts and expert analysis of the Iranian energy sector.

Iran Power Market Market Composition & Trends

The Iran power market exhibits a dynamic composition shaped by a blend of established generation sources and nascent renewable energy integration. Market concentration is influenced by a few dominant state-owned entities and a growing number of private sector players, particularly in the renewable energy domain. Innovation catalysts are primarily driven by the urgent need to address aging infrastructure, enhance grid efficiency, and meet rising energy demands. The regulatory landscape, while undergoing reforms, continues to play a pivotal role in market accessibility and investment attraction. Substitute products are limited within the power generation sphere, with energy efficiency measures and demand-side management emerging as key complementary strategies. End-user profiles reveal a significant reliance on industrial consumption, followed by residential and commercial sectors. Mergers & Acquisitions (M&A) activities are gradually increasing, particularly in the renewable energy sector, as companies seek to scale operations and acquire technological expertise.

- Market Share Distribution (Estimated):

- Natural Gas: XX%

- Oil: XX%

- Renewables: XX% (projected growth)

- Nuclear: XX%

- Other Generation Sources: XX%

- M&A Deal Values (Estimated): Historically low, with projected increase in the forecast period, especially for renewable energy projects. Specific deal values are proprietary and not publicly available.

Iran Power Market Industry Evolution

The Iran power market has undergone significant evolution, driven by consistent demand growth and a strategic imperative to diversify its energy mix. The industry's growth trajectory has been largely dictated by investments in capacity expansion, particularly in natural gas-fired power plants, which remain the backbone of the nation's electricity generation. However, a discernible shift is underway, propelled by international interest and domestic policy pushes towards renewable energy sources like solar and wind. Technological advancements have focused on improving the efficiency of existing thermal power plants and exploring the integration of smart grid technologies to enhance transmission and distribution network reliability. The adoption of advanced metering infrastructure and grid automation systems is gaining traction, aiming to reduce transmission losses and improve operational efficiency. Shifting consumer demands are becoming more pronounced, with an increasing awareness and desire for cleaner energy alternatives, although affordability remains a key consideration. The industrial sector continues to be the largest consumer of electricity, with a growing emphasis on energy-intensive industries like petrochemicals and metals. The residential sector's demand is influenced by population growth and increasing appliance penetration.

- Growth Rates (Estimated Annual Average):

- Overall Power Demand: XX% (2019-2024), XX% (2025-2033)

- Renewable Energy Capacity Addition: XX% (CAGR)

- Adoption Metrics:

- Smart Meter Penetration: XX% (2025), XX% (2033)

- Renewable Energy Integration Level: XX% of total generation by 2033

Leading Regions, Countries, or Segments in Iran Power Market

Within the Iran power market, the dominance of Generation Source: Natural Gas is undeniable, owing to the country's vast reserves of natural gas. This segment benefits from well-established infrastructure and consistent government support, making it the primary driver of electricity production. The Transmission and Distribution segment, particularly Transmission lines, is also a critical area of dominance, as it forms the backbone for delivering electricity across the nation's expansive geography. Efficient transmission networks are crucial for reducing losses and ensuring grid stability. Among the End User segments, the Industrial sector commands the largest share of power consumption, fueled by major industries such as petrochemicals, steel, and mining.

- Dominant Generation Source: Natural Gas

- Key Drivers: Abundant domestic reserves, existing infrastructure, cost-effectiveness, government policy prioritizing gas utilization.

- Analysis: Natural gas power plants currently account for the majority of Iran's installed capacity, providing baseload power and supporting industrial growth. Investments continue in optimizing these facilities for greater efficiency and reduced emissions.

- Dominant Transmission and Distribution Segment: Transmission Lines

- Key Drivers: Geographical vastness, need for long-distance power transfer, grid modernization efforts, infrastructure development.

- Analysis: The extensive network of high-voltage transmission lines is vital for connecting power generation sources to demand centers. Ongoing projects focus on upgrading and expanding these lines to accommodate increasing demand and integrate diverse energy sources.

- Dominant End User Segment: Industrial

- Key Drivers: Growth of energy-intensive industries, economic development initiatives, manufacturing sector expansion.

- Analysis: The industrial sector's substantial power requirements are a primary factor influencing market dynamics. Policies aimed at supporting industrial growth indirectly boost power demand and influence infrastructure development priorities.

Iran Power Market Product Innovations

The Iran power market is witnessing incremental product innovations focused on enhancing efficiency and sustainability. Advancements in turbine technology for natural gas power plants are improving fuel consumption and reducing emissions. In the renewable energy sector, innovations in solar photovoltaic (PV) panel efficiency and energy storage solutions, such as advanced battery technologies, are crucial for improving grid integration and reliability. The development of smart grid technologies, including advanced metering infrastructure (AMI) and demand response platforms, represents a significant area of innovation, enabling better load management and optimized energy distribution. These innovations aim to address challenges related to grid stability, intermittent renewable energy sources, and the need for more responsive power systems.

Propelling Factors for Iran Power Market Growth

Several key factors are propelling the Iran power market forward. The substantial growth in energy demand, driven by a young and growing population, coupled with expanding industrial activities, forms the bedrock of this growth. Government initiatives aimed at diversifying the energy mix and increasing the share of renewable energy sources, such as solar and wind power, are significant drivers. Investments in upgrading and expanding the existing transmission and distribution infrastructure are crucial to meet these growing demands and enhance grid reliability. Furthermore, the nation's abundant natural gas reserves continue to support the dominant role of gas-fired power generation, providing a reliable and cost-effective energy supply.

Obstacles in the Iran Power Market Market

Despite its growth potential, the Iran power market faces several significant obstacles. The impact of international sanctions has historically hindered access to advanced technologies and foreign investment, creating challenges for infrastructure modernization and capacity expansion. Regulatory uncertainties and bureaucratic hurdles can slow down project development and deter private sector participation. Furthermore, the reliance on aging infrastructure in some regions leads to transmission and distribution losses, impacting overall grid efficiency. Supply chain disruptions, particularly for specialized equipment and components, can also pose challenges to timely project execution. Competitive pressures, while present, are often influenced by the dominant role of state-owned entities.

Future Opportunities in Iran Power Market

The Iran power market presents numerous emerging opportunities for growth and development. The significant potential for renewable energy deployment, particularly in solar and wind, offers a pathway for diversification and reduced carbon emissions. Advancements in energy storage technologies present a key opportunity to integrate renewables more effectively into the grid. The ongoing need for grid modernization and the adoption of smart grid technologies create avenues for innovation and investment in areas like digitalization and grid automation. Expanding the transmission and distribution network to reach underserved areas and improve overall efficiency also represents a substantial opportunity. Finally, the growing demand from the industrial sector provides a consistent market for electricity, encouraging capacity expansion and efficiency improvements.

Major Players in the Iran Power Market Ecosystem

- MAPNA Group

- Bandar Abbas Power Generation Company

- Isfahan Power Generation Company

- Tabiran Co

- Ardabil Electricity Distribution Company

- KPV Solar Iran

- Besat Power Generation Management Company

- Zahedan Power Generation Company

- Azerbaijan Power Generation Company

- Fars Power Generation Company

Key Developments in Iran Power Market Industry

- 2023: Increased focus on renewable energy tenders and project announcements, signaling a government push towards diversification.

- 2023: Significant investments announced for upgrading and expanding natural gas power generation capacity to meet growing demand.

- 2023: Pilot projects for smart grid technologies and advanced metering infrastructure initiated in select regions.

- 2022: Completion of several key transmission line projects aimed at improving grid connectivity and reducing losses.

- 2022: Growing international interest in Iranian renewable energy projects, with preliminary discussions on potential collaborations.

- 2021: Implementation of new energy efficiency standards for industrial consumers.

- 2020: Focus on enhancing the operational efficiency of existing thermal power plants.

Strategic Iran Power Market Market Forecast

The strategic Iran power market forecast is shaped by a robust demand for electricity, driven by industrial expansion and population growth. Investments in transmission and distribution infrastructure are expected to be a key focus, ensuring grid stability and reliability. The continued dominance of natural gas as a primary generation source is projected, complemented by a significant, albeit growing, contribution from renewables. The increasing adoption of smart grid technologies will enhance operational efficiencies and empower consumers. Emerging opportunities in solar and wind energy, coupled with advancements in energy storage, will redefine the market's energy mix, creating a more sustainable and resilient power sector in the long term.

Iran Power Market Segmentation

-

1. Generation Source

- 1.1. Natural Gas

- 1.2. Oil

- 1.3. Renewables

- 1.4. Nuclear

- 1.5. Other Generation Sources

-

2. Transmission and Distribution

- 2.1. Transmission lines

- 2.2. Distribution networks

- 2.3. Smart grid technologies

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Iran Power Market Segmentation By Geography

- 1. Iran

Iran Power Market Regional Market Share

Geographic Coverage of Iran Power Market

Iran Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand4.; Growth of Renewables

- 3.3. Market Restrains

- 3.3.1. 4.; Unstable Political Scenario of the Country

- 3.4. Market Trends

- 3.4.1. Natural Gas Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 5.1.1. Natural Gas

- 5.1.2. Oil

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.5. Other Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.2.1. Transmission lines

- 5.2.2. Distribution networks

- 5.2.3. Smart grid technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MAPNA Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bandar Abbas Power Generation Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Isfahan Power Generation Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tabiran Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ardabil Electricity Distribution Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KPV Solar Iran

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Besat Power Generation Management Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zahedan Power Generation Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Azerbaijan Power Generation Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fars Power Generation Company*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Iran Power Market Share (%) by Company 2025

List of Tables

- Table 1: Iran Power Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 2: Iran Power Market Volume gigawatt Forecast, by Generation Source 2020 & 2033

- Table 3: Iran Power Market Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 4: Iran Power Market Volume gigawatt Forecast, by Transmission and Distribution 2020 & 2033

- Table 5: Iran Power Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Iran Power Market Volume gigawatt Forecast, by End User 2020 & 2033

- Table 7: Iran Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Iran Power Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 9: Iran Power Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 10: Iran Power Market Volume gigawatt Forecast, by Generation Source 2020 & 2033

- Table 11: Iran Power Market Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 12: Iran Power Market Volume gigawatt Forecast, by Transmission and Distribution 2020 & 2033

- Table 13: Iran Power Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Iran Power Market Volume gigawatt Forecast, by End User 2020 & 2033

- Table 15: Iran Power Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Iran Power Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Power Market?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Iran Power Market?

Key companies in the market include MAPNA Group, Bandar Abbas Power Generation Company, Isfahan Power Generation Company, Tabiran Co, Ardabil Electricity Distribution Company, KPV Solar Iran, Besat Power Generation Management Company, Zahedan Power Generation Company, Azerbaijan Power Generation Company, Fars Power Generation Company*List Not Exhaustive.

3. What are the main segments of the Iran Power Market?

The market segments include Generation Source, Transmission and Distribution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand4.; Growth of Renewables.

6. What are the notable trends driving market growth?

Natural Gas Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unstable Political Scenario of the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Power Market?

To stay informed about further developments, trends, and reports in the Iran Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence