Key Insights

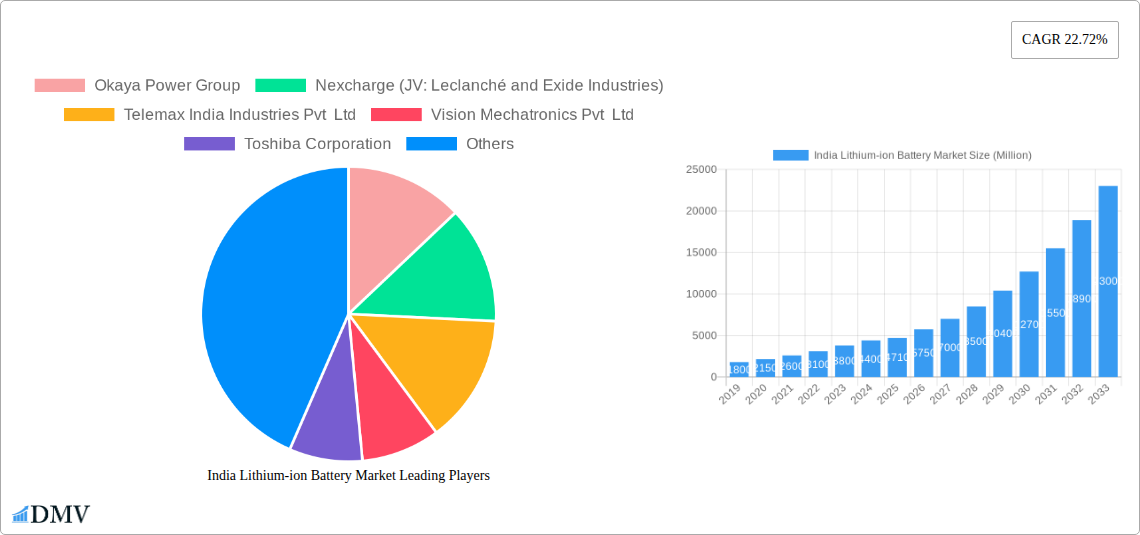

The Indian Lithium-ion Battery Market is poised for explosive growth, projecting a current market size of INR 4,710 Million and an impressive Compound Annual Growth Rate (CAGR) of 22.72% over the forecast period of 2025-2033. This remarkable expansion is fueled by a confluence of powerful drivers, predominantly the escalating adoption of electric vehicles (EVs) across the nation, driven by government incentives and a growing environmental consciousness among consumers. The increasing demand for energy storage solutions for renewable energy integration, coupled with the burgeoning consumer electronics sector, further solidifies the market's upward trajectory. Emerging trends indicate a strong push towards localization of manufacturing through initiatives like the Production Linked Incentive (PLI) scheme, aiming to reduce import dependency and foster domestic capabilities in battery production. Furthermore, advancements in battery technology, focusing on enhanced energy density, faster charging capabilities, and improved safety features, are anticipated to be key enablers of this growth.

India Lithium-ion Battery Market Market Size (In Billion)

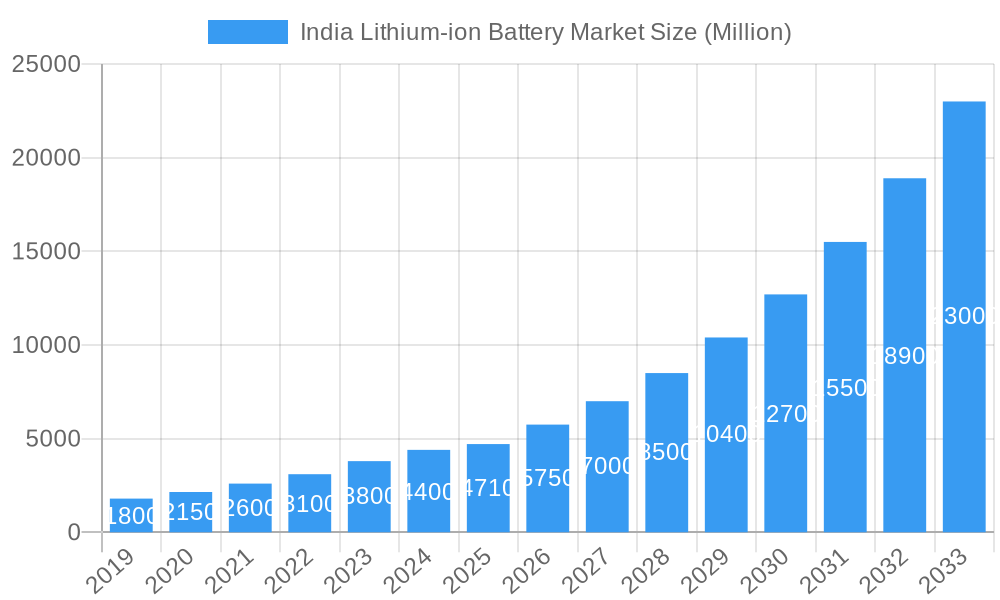

Despite the robust growth prospects, certain restraints could temper the market's full potential. These include the high initial cost of lithium-ion battery manufacturing and raw material procurement, which can pose a challenge for widespread adoption, especially in price-sensitive segments. Supply chain disruptions and the availability of critical raw materials like lithium and cobalt, often sourced internationally, represent a significant concern. Addressing these challenges through strategic partnerships, vertical integration, and investments in recycling infrastructure will be crucial for sustained and accelerated market expansion. The market is segmented across various applications, with 'Portable' devices and 'Automotive' sectors leading the demand. Key players like Okaya Power Group, Nexcharge (a JV between Leclanché and Exide Industries), and Toshiba Corporation are actively shaping the competitive landscape through innovation and capacity expansion, underscoring the dynamism and potential of the Indian lithium-ion battery ecosystem.

India Lithium-ion Battery Market Company Market Share

India Lithium-ion Battery Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

Unlock the immense potential of India's burgeoning Lithium-ion battery market with this in-depth, SEO-optimized report. Delve into critical market dynamics, technological breakthroughs, and strategic forecasts spanning 2019-2033. This report is your definitive guide to understanding the growth trajectory, competitive landscape, and investment opportunities within India's rapidly evolving energy storage sector. Designed for manufacturers, suppliers, investors, and policymakers, this analysis leverages high-ranking keywords such as "lithium-ion battery India," "EV battery market India," "energy storage India," "battery manufacturing India," and "gigafactory India" to ensure maximum visibility and impact.

India Lithium-ion Battery Market Market Composition & Trends

The Indian lithium-ion battery market is characterized by a dynamic blend of established players and emerging innovators, with market concentration gradually shifting as domestic manufacturing capabilities expand. Innovation catalysts are primarily driven by the escalating demand for electric vehicles (EVs) and renewable energy storage solutions, pushing for advancements in battery chemistries, safety features, and charging infrastructure. The regulatory landscape is becoming increasingly supportive, with government initiatives like the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage providing significant impetus for local production. Substitute products, while present in certain niche applications, are largely being superseded by lithium-ion technology due to its superior energy density and performance. End-user profiles are diverse, ranging from individual consumers driving EV adoption to large-scale industrial applications and grid storage projects. Mergers and acquisitions (M&A) activities are on the rise as companies seek to strengthen their market position, secure raw material access, and expand their manufacturing footprint. For instance, significant investment announcements and joint ventures underscore this consolidation trend. The market is segmented by application, with the automotive sector currently dominating, followed by portable electronics and other industrial uses. Understanding the interplay of these factors is crucial for navigating the competitive terrain and capitalizing on future growth.

India Lithium-ion Battery Market Industry Evolution

The evolution of the India lithium-ion battery market has been nothing short of transformative, fueled by a potent combination of supportive government policies, burgeoning end-user demand, and significant technological advancements. Over the historical period (2019-2024), the market witnessed a steady ascent, largely driven by the increasing penetration of portable electronics and the nascent stages of EV adoption. However, the real acceleration began to be observed as the government intensified its focus on electric mobility and renewable energy integration.

The base year, 2025, marks a pivotal point, signifying a significant inflection in market growth. The forecast period (2025-2033) is projected to see exponential expansion, with compound annual growth rates (CAGRs) anticipated to be among the highest globally. This surge is directly attributable to several key factors. Firstly, the automotive sector's transition towards electrification is a primary demand driver. As more electric two-wheelers, three-wheelers, and four-wheelers enter the market, the demand for lithium-ion battery packs and cells is set to skyrocket. Projections indicate that the automotive segment alone will constitute a substantial portion of the market share within the forecast period.

Technological advancements are another critical pillar of this evolution. We are seeing continuous improvements in lithium-ion battery chemistry, leading to higher energy densities, faster charging capabilities, enhanced safety, and extended lifecycles. Innovations in materials science, particularly in cathode and anode materials, are crucial in this regard. For example, the push towards domestically sourced lithium iron phosphate (LFP) for EV batteries is a testament to this trend. Furthermore, research and development efforts are focused on next-generation battery technologies that promise even greater performance and cost-effectiveness.

Shifting consumer demands are also playing a significant role. Increased environmental consciousness, coupled with rising fuel prices, is nudging consumers towards cleaner transportation alternatives. The convenience of charging at home and the growing availability of charging infrastructure are further reducing adoption barriers. The demand for reliable and long-lasting batteries in consumer electronics, such as smartphones and laptops, continues to be a steady contributor, albeit at a more mature growth rate compared to the EV segment.

The establishment of gigafactories is a tangible representation of this industrial evolution. The laying of foundations and the announcement of operational timelines for large-scale battery manufacturing facilities indicate a strong commitment to domestic production, reducing reliance on imports and fostering a robust indigenous ecosystem. This strategic shift is not only about meeting demand but also about building a self-sufficient and competitive battery industry. The industry's trajectory is clearly defined by this upward trend, driven by innovation, policy support, and evolving consumer preferences, positioning India as a key player in the global lithium-ion battery landscape.

Leading Regions, Countries, or Segments in India Lithium-ion Battery Market

The Automotive segment stands out as the undeniable leader and primary growth engine within the India lithium-ion battery market. This dominance is a direct consequence of the nation's ambitious electric mobility goals and the significant investments being poured into the EV ecosystem. The sheer volume of demand projected from two-wheelers, three-wheelers, and the rapidly growing four-wheeler EV segment is unparalleled.

- Automotive Segment Dominance: The transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs) is the principal driver. Government incentives, declining battery costs, and increasing consumer awareness regarding environmental benefits are accelerating EV adoption across all vehicle categories. The sheer scale of the Indian automotive market translates into a massive demand for battery packs and cells.

- Key Drivers for Automotive Dominance:

- Government Policy Support: Initiatives like the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme and the PLI scheme for ACC battery storage are providing substantial subsidies and incentives for EV manufacturing and battery production, making EVs more affordable and encouraging domestic manufacturing.

- Expanding EV Infrastructure: The continuous development of charging stations across urban and semi-urban areas is alleviating range anxiety, a major concern for potential EV buyers, thereby boosting sales.

- Declining Battery Costs: As manufacturing scales up and technological efficiencies improve, the cost of lithium-ion batteries is steadily decreasing, making EVs more economically viable and competitive with their ICE counterparts.

- Global Manufacturing Trends: Leading global automotive manufacturers are setting up or expanding their EV production facilities in India, which naturally drives the demand for locally sourced or manufactured lithium-ion batteries.

While the Portable segment, encompassing smartphones, laptops, and other personal electronic devices, continues to represent a consistent demand stream, its growth rate is relatively more mature compared to the automotive sector. The "Other Applications" segment, which includes industrial energy storage, renewable energy integration, and specialized defense applications, is also showing promising growth, driven by the increasing need for grid stability and the adoption of renewable energy sources. However, the sheer volume and aggressive growth targets within the automotive sector firmly establish it as the segment dictating the market's overall expansion and investment trends in the foreseeable future. The geographical landscape of dominance is also shifting towards regions actively investing in battery manufacturing hubs and catering to the automotive industry, with states like Gujarat, Tamil Nadu, and Telangana emerging as key players in attracting investment and fostering production.

India Lithium-ion Battery Market Product Innovations

Product innovations in the India lithium-ion battery market are heavily focused on enhancing energy density, improving safety, and accelerating charging speeds to meet the demands of the rapidly expanding electric vehicle (EV) sector and portable electronics. Advancements in cathode materials, such as the increased adoption of Nickel-Manganese-Cobalt (NMC) and Nickel-Cobalt-Aluminum (NCA) chemistries for higher energy storage, alongside the growing prominence of Lithium Iron Phosphate (LFP) for its superior safety and longevity, are key developments. Innovations also extend to battery management systems (BMS) that optimize performance, extend lifespan, and ensure user safety. Furthermore, research into solid-state batteries and alternative chemistries aims to address current limitations and pave the way for next-generation energy storage solutions with enhanced performance metrics and reduced environmental impact.

Propelling Factors for India Lithium-ion Battery Market Growth

The India lithium-ion battery market is experiencing robust growth fueled by a confluence of powerful factors. Government policies, particularly the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery manufacturing and the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, are providing significant financial and regulatory support, thereby encouraging domestic production and EV adoption. The rapidly expanding electric vehicle (EV) ecosystem, encompassing two-wheelers, three-wheelers, and passenger cars, is creating immense demand for battery cells and packs. Economic growth and a rising middle class are also contributing to increased consumer spending on portable electronics and, increasingly, EVs. Furthermore, the growing emphasis on renewable energy integration and energy storage solutions for grid stability is opening up new avenues for lithium-ion battery deployment. Technological advancements leading to improved battery performance, cost reduction, and enhanced safety are also critical growth enablers.

Obstacles in the India Lithium-ion Battery Market Market

Despite its promising growth trajectory, the India lithium-ion battery market faces several significant obstacles. A primary challenge is the reliance on imports for key raw materials like lithium, cobalt, and nickel, which creates supply chain vulnerabilities and price volatility. High initial manufacturing costs associated with setting up gigafactories and advanced production lines act as a barrier to entry for smaller players. Technological know-how and skilled workforce shortages in advanced battery manufacturing can impede the pace of domestic innovation and production. Inconsistent power supply and infrastructure development, especially in remote areas, can affect manufacturing operations and battery charging accessibility. Recycling and end-of-life management infrastructure for lithium-ion batteries is still in its nascent stages, posing environmental challenges. Finally, intense global competition from established battery manufacturers in East Asia exerts considerable pressure on pricing and market share.

Future Opportunities in India Lithium-ion Battery Market

The India lithium-ion battery market is ripe with future opportunities driven by evolving trends and unmet needs. The massive potential of the electric vehicle (EV) market, particularly in the two-wheeler and three-wheeler segments, presents a significant growth avenue. The increasing demand for renewable energy storage solutions, such as grid-scale batteries and residential energy storage systems, offers another substantial opportunity as India aims to bolster its renewable energy capacity. Development of a robust domestic battery recycling ecosystem presents both an environmental imperative and a commercial opportunity for sustainable resource management. Innovation in next-generation battery technologies, including solid-state batteries and alternative chemistries, will unlock new performance benchmarks and market niches. Furthermore, the "Make in India" initiative and government incentives are creating fertile ground for indigenous battery manufacturing and component production, fostering a self-reliant and globally competitive industry.

Major Players in the India Lithium-ion Battery Market Ecosystem

- Okaya Power Group

- Nexcharge (JV: Leclanché and Exide Industries)

- Telemax India Industries Pvt Ltd

- Vision Mechatronics Pvt Ltd

- Toshiba Corporation

- Amperex Technology Limited

- Future Hi-Tech Batteries

- Exicom Tele-Systems Limited

- iPower Batteries Pvt Ltd

- Trontek Group

- TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

- Inverted Energy Private Limited

- Bharat Electronics Limited (BEL)

Key Developments in India Lithium-ion Battery Market Industry

- March 2024: Panasonic Energy Co Ltd, a subsidiary of Panasonic Group, a Japan-based multinational electronics company, will form a joint venture with Maharatna PSU Indian Oil Corporation Ltd, the nation's biggest oil firm, to manufacture cylindrical lithium-ion batteries.

- January 2024: Automotive battery maker - Amara Raja Batteries Ltd announced its plans to operate a gigafactory before the end of 2025. In May 2023, the company laid the foundation stone for one of its first gigafactories in the Mahbubnagar district in Telangana, India, that is expected to produce Lithium Cell and Battery Packs with a capacity of up to 16 GWh and 5 GWh, respectively.

- December 2023: Himadri Speciality Chemical Ltd announced its plan to invest INR 48.00 billion (USD 576 million) over the next 5-6 years in setting up a plant that is likely to produce 2 lakh tonnes of lithium iron phosphate, a key material for making lithium-ion batteries used in electric vehicles.

Strategic India Lithium-ion Battery Market Market Forecast

The strategic forecast for the India lithium-ion battery market is exceptionally optimistic, driven by powerful growth catalysts that are expected to reshape the energy landscape. The sustained and accelerating adoption of electric vehicles, bolstered by government incentives and improving infrastructure, will continue to be the primary demand driver, ensuring a consistent and massive requirement for battery solutions. Concurrently, the imperative for grid stabilization and the widespread integration of renewable energy sources will propel the demand for large-scale energy storage systems, creating a dual-pronged growth opportunity. Investments in domestic manufacturing capabilities, including gigafactories and component production, will not only address the burgeoning demand but also foster technological self-reliance and cost efficiencies. The forecast indicates a transition towards localized supply chains, enhanced R&D in next-generation battery technologies, and a growing focus on sustainable practices, including battery recycling. This strategic outlook points towards India emerging as a significant global hub for lithium-ion battery production and innovation, with substantial market potential and investment opportunities across the entire value chain.

India Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Automotive

- 1.3. Other Applications

India Lithium-ion Battery Market Segmentation By Geography

- 1. India

India Lithium-ion Battery Market Regional Market Share

Geographic Coverage of India Lithium-ion Battery Market

India Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. The Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Automotive

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nexcharge (JV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Lithium-ion Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Lithium-ion Battery Market Share (%) by Company 2025

List of Tables

- Table 1: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: India Lithium-ion Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Lithium-ion Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: India Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Lithium-ion Battery Market?

The projected CAGR is approximately 22.72%.

2. Which companies are prominent players in the India Lithium-ion Battery Market?

Key companies in the market include Okaya Power Group, Nexcharge (JV: Leclanché and Exide Industries), Telemax India Industries Pvt Ltd, Vision Mechatronics Pvt Ltd, Toshiba Corporation, Amperex Technology Limited, Future Hi-Tech Batteries, Exicom Tele-Systems Limited, iPower Batteries Pvt Ltd *List Not Exhaustive 6 4 Market Ranking Analysi, Trontek Group, TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Inverted Energy Private Limited, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

The Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Energy Co Ltd, a subsidiary of Panasonic Group, a Japan-based multinational electronics company, will form a joint venture with Maharatna PSU Indian Oil Corporation Ltd, the nation's biggest oil firm, to manufacture cylindrical lithium-ion batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the India Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence