Key Insights

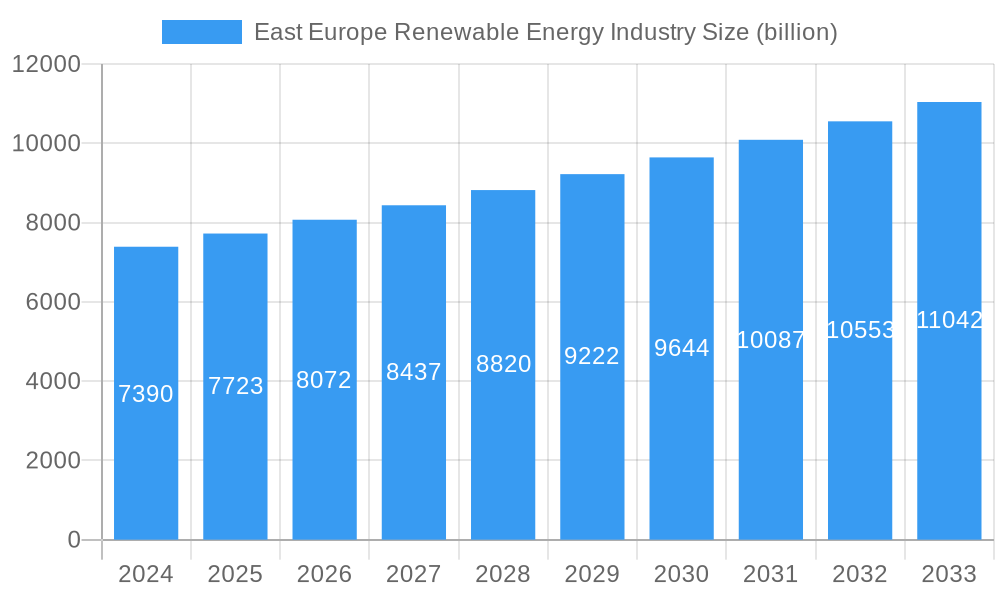

The East European renewable energy industry is poised for substantial growth, projected to reach a market size of $7.39 billion in 2024, with a robust Compound Annual Growth Rate (CAGR) of 4.5% throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of strategic initiatives and evolving market dynamics across the region. Key drivers include escalating government support for clean energy targets, significant investments in solar and hydropower infrastructure, and the growing demand for energy independence and security, particularly in light of recent geopolitical shifts. The ongoing transition away from fossil fuels, coupled with advancements in renewable energy technologies, is further accelerating adoption rates. Emerging trends such as the development of smart grids, increased integration of energy storage solutions, and the rise of distributed generation are shaping a more resilient and sustainable energy landscape. Furthermore, the continuous decline in the cost of solar photovoltaic (PV) and wind power technologies makes them increasingly competitive with conventional energy sources, driving further investment and market penetration.

East Europe Renewable Energy Industry Market Size (In Billion)

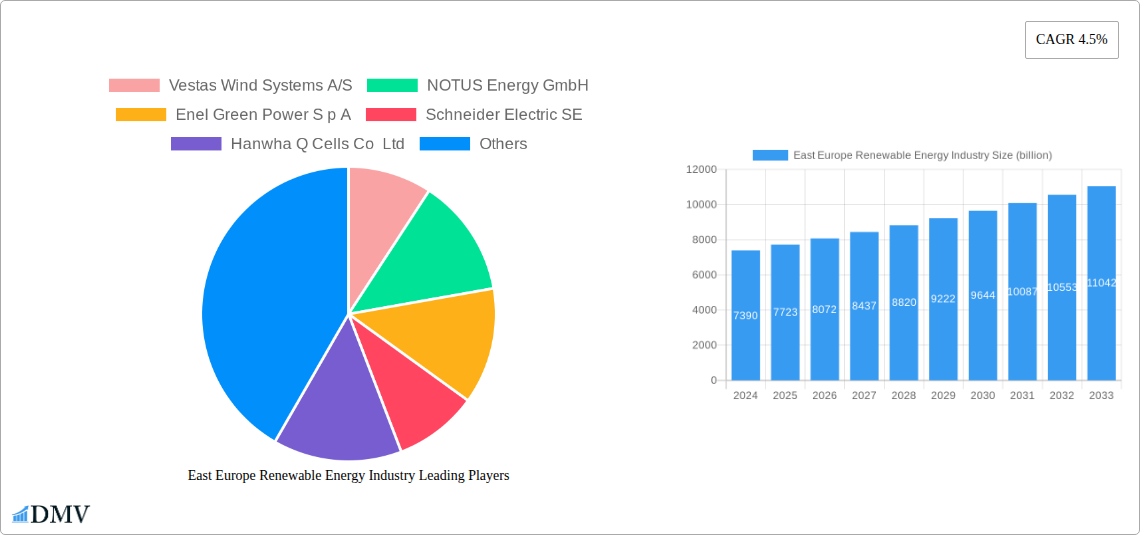

Despite the optimistic outlook, certain restraints could temper the pace of growth. These include the complexities of grid integration for variable renewable sources, the need for substantial upfront capital investment in new infrastructure, and potential regulatory hurdles that may vary across different East European nations. However, these challenges are being addressed through policy reforms and technological innovations. The market is segmented by type, with Hydropower and Solar dominating current installations and future investments, though a growing "Others" category, encompassing wind and biomass, is also showing significant promise. Geographically, Russia, Poland, and Ukraine represent key markets, with considerable untapped potential in other Eastern European countries. Leading companies like Vestas Wind Systems A/S, Enel Green Power S.p.A., and Hanwha Q Cells Co. Ltd. are actively involved in developing and deploying renewable energy solutions, indicating a dynamic and competitive market environment.

East Europe Renewable Energy Industry Company Market Share

East Europe Renewable Energy Industry: Comprehensive Market Analysis and Strategic Outlook (2019-2033)

This in-depth report provides a definitive analysis of the East Europe Renewable Energy Industry, offering critical insights into market dynamics, growth trajectories, and strategic opportunities. Covering the historical period from 2019 to 2024 and projecting to 2033, with a base and estimated year of 2025, this study is indispensable for investors, policymakers, and industry stakeholders seeking to navigate this rapidly expanding sector. We delve into the intricate composition of the market, dissecting technological advancements, regulatory frameworks, and the competitive landscape to equip you with actionable intelligence for informed decision-making. Our comprehensive coverage includes the dominant segments of Hydropower and Solar, alongside emerging "Others," and analyzes key geographical markets such as Russia, Poland, and Ukraine.

East Europe Renewable Energy Industry Market Composition & Trends

The East Europe Renewable Energy Industry is characterized by a dynamic market composition influenced by evolving regulatory landscapes and an increasing drive for energy independence. While market concentration varies across sub-segments, the presence of global giants like Vestas Wind Systems A/S and Enel Green Power S p A alongside regional players such as C&C Energy SRL indicates a blend of established expertise and localized growth. Innovation catalysts include government incentives, a growing awareness of climate change impacts, and the urgent need to diversify energy sources away from fossil fuels. Substitute products, primarily traditional fossil fuels, are gradually being displaced by the undeniable economic and environmental advantages of renewables. End-user profiles are diverse, ranging from large industrial consumers seeking cost savings and sustainability credentials to residential users motivated by lower energy bills and environmental responsibility. Mergers and acquisitions (M&A) activity is a significant indicator of market maturation and consolidation. For instance, the acquisition of smaller, specialized renewable energy developers by larger utility companies or investment funds is common, with reported M&A deal values in the multi-billion dollar range annually. Market share distribution is shifting, with solar power experiencing exponential growth, challenging the long-standing dominance of hydropower in certain regions.

- Market Concentration: Moderate to High, with leading global players and emerging regional entities.

- Innovation Catalysts: Government incentives, energy security concerns, climate action initiatives, technological advancements.

- Regulatory Landscapes: Increasingly supportive, with feed-in tariffs, renewable portfolio standards, and streamlined permitting processes.

- Substitute Products: Fossil fuels (coal, natural gas) – facing declining competitiveness.

- End-User Profiles: Industrial, Commercial, Residential, Utility-scale power generation.

- M&A Activity: Significant, with multi-billion dollar transactions reflecting market consolidation and strategic expansion.

- Key M&A Deal Values (Estimated): Over $5 billion annually across the forecast period.

East Europe Renewable Energy Industry Industry Evolution

The East Europe Renewable Energy Industry is undergoing a profound transformation, marked by robust growth trajectories, rapid technological advancements, and a noticeable shift in consumer and governmental demands. The historical period (2019-2024) has witnessed a sustained upward trend, driven by a confluence of factors including ambitious climate targets set by individual nations and the broader European Union, coupled with a concerted effort to reduce reliance on volatile energy imports. This evolution is vividly illustrated by the increasing investment in renewable energy infrastructure, which has seen billions of dollars channeled into new projects, especially in the solar and wind sectors. Technological breakthroughs have been pivotal, with advancements in solar photovoltaic (PV) efficiency and the development of more powerful and cost-effective wind turbines significantly lowering the levelized cost of electricity (LCOE) for renewable sources. This cost competitiveness is a primary driver for wider adoption. Consumer demand has also played a crucial role, with a growing public consciousness regarding environmental sustainability and a desire for greater energy independence influencing policy decisions and investment flows. As a result, adoption metrics for renewable energy installations have surged. For example, the installed capacity for solar power in key Eastern European countries has more than doubled between 2019 and 2024, with growth rates frequently exceeding 20% year-on-year in specific markets. Similarly, wind energy deployment, while facing some geographical limitations, has also seen substantial growth, supported by policy frameworks designed to attract foreign and domestic investment. The integration of renewable energy into existing grids is also evolving, with significant investments in smart grid technologies and energy storage solutions to address intermittency challenges. This integration is essential for maintaining grid stability as the share of renewables increases, and substantial billions are being allocated to modernizing grid infrastructure. The overall market growth trajectory is steep, with projections indicating a continuation of this expansion throughout the forecast period (2025-2033), driven by ongoing policy support, technological innovation, and the imperative for a sustainable energy future, with annual market growth rates consistently in the double digits, often exceeding 15%. The industry's evolution is not merely about increasing capacity; it's about building a more resilient, cleaner, and economically viable energy system for the region.

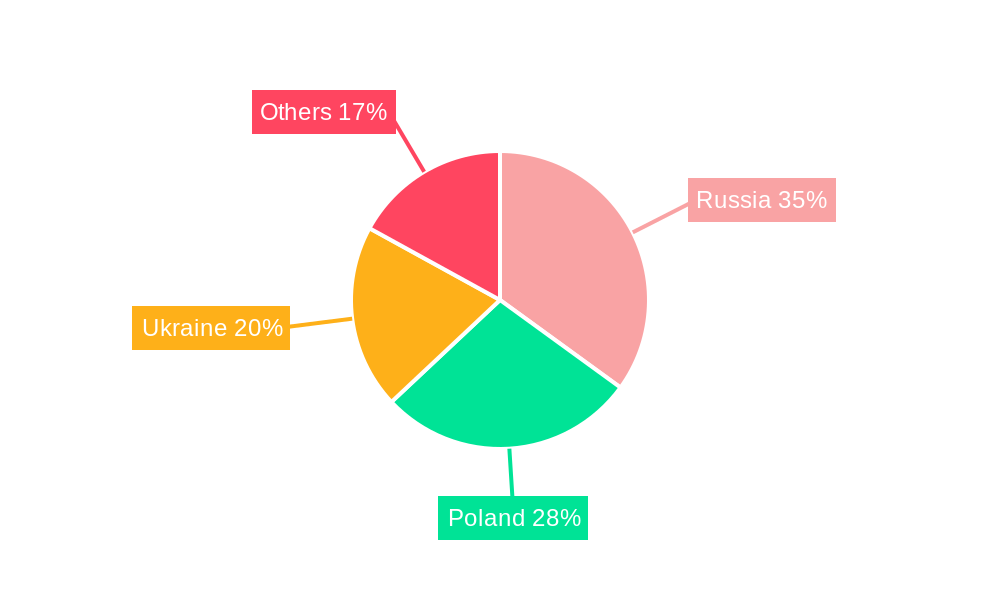

Leading Regions, Countries, or Segments in East Europe Renewable Energy Industry

The dominance within the East Europe Renewable Energy Industry is not monolithic, but rather a dynamic interplay between geographical focus and specific energy types, with Poland and Ukraine emerging as particularly influential countries, and Solar energy as the leading segment. Poland, in particular, has demonstrated a remarkable commitment to expanding its renewable energy portfolio, driven by a strong desire to decarbonize its energy sector and meet ambitious climate goals. This commitment translates into substantial investments, estimated in the billions of dollars annually, aimed at boosting both solar and wind power capacity. Regulatory support, including feed-in tariffs and auction mechanisms, has been instrumental in attracting developers and investors. Ukraine, despite ongoing geopolitical challenges, has also made significant strides in renewable energy, recognizing its strategic importance for energy security and economic development. Investments here, though impacted by external factors, remain substantial, with a focus on utility-scale solar and wind projects.

Solar energy has ascended to prominence due to its declining costs, modularity, and adaptability to various geographical and climatic conditions. The increasing efficiency of photovoltaic (PV) panels, coupled with advancements in inverter technology and mounting systems, has made solar power a highly competitive energy source. For instance, the installation of bifacial modules, as seen in Poland's recent floating PV array project, exemplifies this innovation, maximizing energy capture. The cost of solar power installations has fallen dramatically, making it an attractive option for both large-scale power plants and distributed generation.

Hydropower, while a mature technology with significant existing capacity, is also experiencing renewed interest, particularly for its dispatchability and role in grid stability. New investments are focused on modernization of existing facilities and smaller-scale run-of-river projects, adding billions to the infrastructure sector. The "Others" segment, encompassing biomass, geothermal, and emerging technologies, is also showing growth potential, driven by diversification strategies and niche applications. However, the sheer volume of investment and the pace of deployment firmly place Solar at the forefront of the region's renewable energy expansion.

- Dominant Countries: Poland, Ukraine, Russia.

- Leading Segment: Solar energy.

- Key Drivers for Poland: Ambitious decarbonization targets, supportive regulatory framework (feed-in tariffs, auctions), significant foreign and domestic investment (billions).

- Key Drivers for Ukraine: Energy security, economic development, solar and wind project deployment (billions in investment), resilience despite geopolitical challenges.

- Key Drivers for Solar Energy: Falling LCOE, technological advancements (e.g., bifacial modules), modularity, diverse application potential, strong policy support.

- Hydropower's Role: Grid stability, modernization of existing infrastructure, new smaller-scale projects (billions invested in upgrades).

- Emerging "Others" Segment: Diversification, niche applications, biomass, geothermal potential.

- Investment Trends: Billions of dollars consistently flowing into solar and wind infrastructure, with significant allocations for grid modernization.

East Europe Renewable Energy Industry Product Innovations

Product innovations in the East Europe Renewable Energy Industry are primarily centered around enhancing efficiency, reducing costs, and improving integration capabilities. In solar technology, advancements include higher-efficiency photovoltaic cells, such as perovskite-silicon tandems, and the development of bifacial modules that capture sunlight from both sides, significantly boosting energy yields. Floating solar PV arrays, as demonstrated in Poland, are emerging as a solution for land-scarce regions, minimizing water evaporation and increasing panel efficiency due to cooler operating temperatures. For wind energy, innovations focus on larger rotor diameters, advanced blade aerodynamics, and digital monitoring systems for predictive maintenance, leading to increased power output and reduced operational downtime. Energy storage solutions are also seeing rapid development, with improvements in battery chemistry, density, and lifespan, making grid-scale storage more viable for managing the intermittency of renewables, with substantial billions invested in R&D and pilot projects.

Propelling Factors for East Europe Renewable Energy Industry Growth

The East Europe Renewable Energy Industry's growth is propelled by a powerful combination of factors. Governmental support and ambitious renewable energy targets are paramount, with policies like feed-in tariffs and renewable energy auctions creating a predictable investment environment, attracting billions in capital. Technological advancements have drastically reduced the cost of renewable energy generation, making solar and wind power increasingly competitive with fossil fuels. The growing demand for energy independence and security, particularly in light of geopolitical events, is a significant driver for diversifying energy sources. Furthermore, increasing environmental awareness and climate change concerns are pushing both consumers and industries towards cleaner energy alternatives, further fueling market expansion with billions of dollars in projected investments.

- Supportive Policies & Targets: Feed-in tariffs, auctions, renewable portfolio standards.

- Cost Reduction: Declining LCOE for solar and wind power.

- Energy Security & Independence: Diversification away from volatile fossil fuel markets.

- Environmental Awareness: Climate change mitigation, corporate sustainability goals.

Obstacles in the East Europe Renewable Energy Industry Market

Despite its robust growth, the East Europe Renewable Energy Industry faces several significant obstacles. Grid integration challenges are a primary concern, as existing infrastructure in some countries may not be equipped to handle the fluctuating output of renewable sources, necessitating billions in upgrades. Complex and sometimes inconsistent regulatory frameworks can create uncertainty for investors, hindering project development. Supply chain disruptions, exacerbated by global events, can lead to increased component costs and project delays, impacting the billions planned for deployment. Finally, permitting processes can be lengthy and bureaucratic, further slowing down the pace of renewable energy deployment.

- Grid Infrastructure Limitations: Need for substantial upgrades and modernization (billions required).

- Regulatory Inconsistencies: Potential for policy shifts and bureaucratic hurdles.

- Supply Chain Volatility: Component availability, price fluctuations, and logistical challenges.

- Permitting Delays: Lengthy approval processes impacting project timelines.

Future Opportunities in East Europe Renewable Energy Industry

The future of the East Europe Renewable Energy Industry is brimming with opportunities. Emerging markets within the region are ripe for development, offering untapped potential for solar and wind installations, attracting billions in new investment. The rapid advancement of energy storage technologies presents a significant opportunity to address intermittency, making renewable energy more reliable and appealing, with substantial research and development leading to new solutions. Furthermore, the growing trend of corporate power purchase agreements (PPAs) offers a stable revenue stream for renewable energy projects, encouraging further private sector investment in the billions. The development of green hydrogen production, powered by renewables, is another burgeoning area with immense long-term potential for decarbonizing hard-to-abate sectors.

- Untapped Markets: New geographical areas with high renewable potential.

- Energy Storage Advancements: Enhanced grid stability and reliability.

- Corporate PPAs: Stable revenue streams and private sector investment.

- Green Hydrogen Production: Decarbonization of industrial sectors.

Major Players in the East Europe Renewable Energy Industry Ecosystem

- Vestas Wind Systems A/S

- NOTUS Energy GmbH

- Enel Green Power S p A

- Schneider Electric SE

- Hanwha Q Cells Co Ltd

- SGS SA

- Wärtsilä Oyj Abp

- Federal Hydro-Generating Co RusHydro PAO

- C&C Energy SRL

Key Developments in East Europe Renewable Energy Industry Industry

- November 2022: Investors submitted applications to Albania's Ministry of Infrastructure and Energy for the construction of three photovoltaic plants with a combined capacity of 151 MW, of which the largest one would have 93 MW. This development highlights the growing interest and investment in solar energy infrastructure within the Balkan region, signaling future capacity expansion worth hundreds of millions of dollars.

- November 2022: Poland started operating one of its first floating PV arrays on an artificial reservoir. The project features 110 bifacial modules with a total capacity of 49.5 kW. This innovative approach to solar deployment showcases a trend towards optimizing land use and leveraging existing water bodies, with potential for similar projects worth tens of millions of dollars across the region.

Strategic East Europe Renewable Energy Industry Market Forecast

The strategic forecast for the East Europe Renewable Energy Industry is exceptionally positive, driven by a clear imperative for a sustainable and diversified energy future. Continued supportive government policies and ambitious decarbonization targets will remain primary growth catalysts, ensuring a steady stream of investment in the billions. The ongoing reduction in the cost of renewable technologies, particularly solar and wind, will further accelerate adoption, making them the most economically viable options. Innovations in energy storage and grid modernization will be crucial for enhancing the reliability of renewable energy integration, unlocking new market potential. The region's increasing focus on energy independence will also spur further investment in domestic renewable resources. Emerging opportunities in green hydrogen and distributed energy systems present significant long-term growth prospects, positioning the East Europe Renewable Energy Industry for sustained expansion and a transformative role in the global energy transition, with projected market expansion in the tens of billions of dollars throughout the forecast period.

East Europe Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Hydropower

- 1.2. Solar

- 1.3. Others

-

2. Geography

- 2.1. Russia

- 2.2. Poland

- 2.3. Ukraine

- 2.4. Others

East Europe Renewable Energy Industry Segmentation By Geography

- 1. Russia

- 2. Poland

- 3. Ukraine

- 4. Others

East Europe Renewable Energy Industry Regional Market Share

Geographic Coverage of East Europe Renewable Energy Industry

East Europe Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in Upcoming Wind Power Projects4.; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Adoption of Alternative Energy Sources Such as Gas-Based Power

- 3.4. Market Trends

- 3.4.1. Hydropower Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. East Europe Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydropower

- 5.1.2. Solar

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Russia

- 5.2.2. Poland

- 5.2.3. Ukraine

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Poland

- 5.3.3. Ukraine

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Russia East Europe Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydropower

- 6.1.2. Solar

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Russia

- 6.2.2. Poland

- 6.2.3. Ukraine

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Poland East Europe Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydropower

- 7.1.2. Solar

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Russia

- 7.2.2. Poland

- 7.2.3. Ukraine

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Ukraine East Europe Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydropower

- 8.1.2. Solar

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Russia

- 8.2.2. Poland

- 8.2.3. Ukraine

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Others East Europe Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydropower

- 9.1.2. Solar

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Russia

- 9.2.2. Poland

- 9.2.3. Ukraine

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vestas Wind Systems A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NOTUS Energy GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Enel Green Power S p A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hanwha Q Cells Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SGS SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wärtsilä Oyj Abp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Federal Hydro-Generating Co RusHydro PAO*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 C&C Energy SRL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: East Europe Renewable Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: East Europe Renewable Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: East Europe Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Type 2020 & 2033

- Table 3: East Europe Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 5: East Europe Renewable Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 7: East Europe Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Type 2020 & 2033

- Table 9: East Europe Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 11: East Europe Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 13: East Europe Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Type 2020 & 2033

- Table 15: East Europe Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 17: East Europe Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 19: East Europe Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Type 2020 & 2033

- Table 21: East Europe Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 23: East Europe Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 25: East Europe Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Type 2020 & 2033

- Table 27: East Europe Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 29: East Europe Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: East Europe Renewable Energy Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Europe Renewable Energy Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the East Europe Renewable Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, NOTUS Energy GmbH, Enel Green Power S p A, Schneider Electric SE, Hanwha Q Cells Co Ltd, SGS SA, Wärtsilä Oyj Abp, Federal Hydro-Generating Co RusHydro PAO*List Not Exhaustive, C&C Energy SRL.

3. What are the main segments of the East Europe Renewable Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.39 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in Upcoming Wind Power Projects4.; Favorable Government Policies.

6. What are the notable trends driving market growth?

Hydropower Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Adoption of Alternative Energy Sources Such as Gas-Based Power.

8. Can you provide examples of recent developments in the market?

November 2022: investors submitted applications to Albania's Ministry of Infrastructure and Energy for the construction of three photovoltaic plants with a combined capacity of 151 MW, of which the largest one would have 93 MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Europe Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Europe Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Europe Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the East Europe Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence