Key Insights

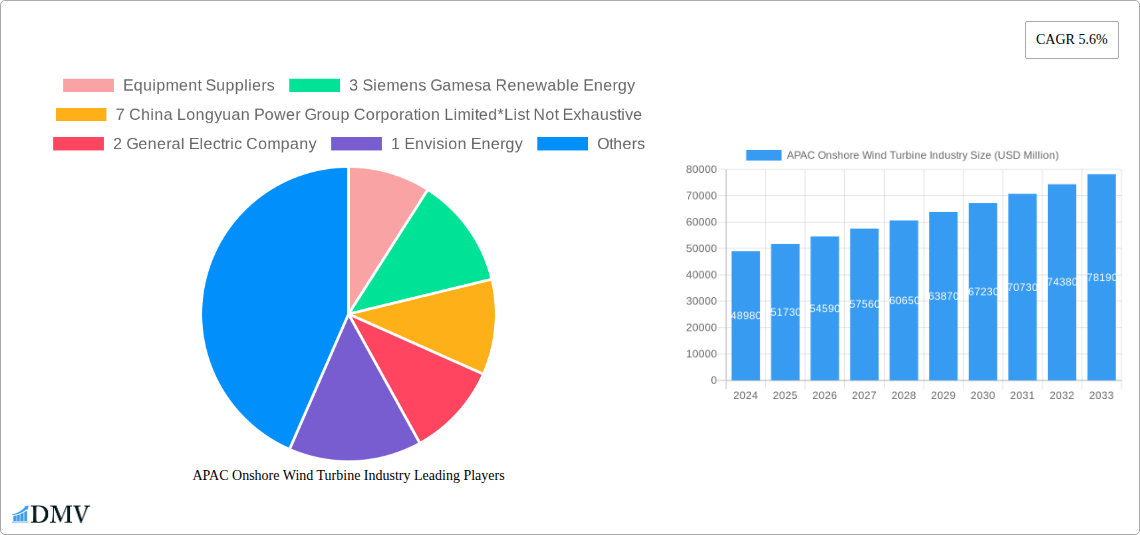

The APAC Onshore Wind Turbine Industry is poised for robust expansion, with a market size of USD 48.98 billion in 2024. This growth is propelled by a CAGR of 5.6% over the forecast period of 2025-2033, indicating sustained momentum. Key drivers fueling this upward trajectory include the escalating demand for clean energy solutions, supportive government policies and incentives aimed at renewable energy adoption, and significant investments in wind power infrastructure across the region. The push towards decarbonization and energy security, coupled with the declining cost of wind energy technology, are further accelerating market penetration. Major players like Vestas Wind Systems AS, Siemens Gamesa Renewable Energy, and Goldwind are actively investing in research and development, expanding manufacturing capabilities, and forging strategic partnerships to capture market share. The industry is witnessing a trend towards larger, more efficient wind turbines and the integration of advanced digital technologies for improved performance monitoring and predictive maintenance.

APAC Onshore Wind Turbine Industry Market Size (In Billion)

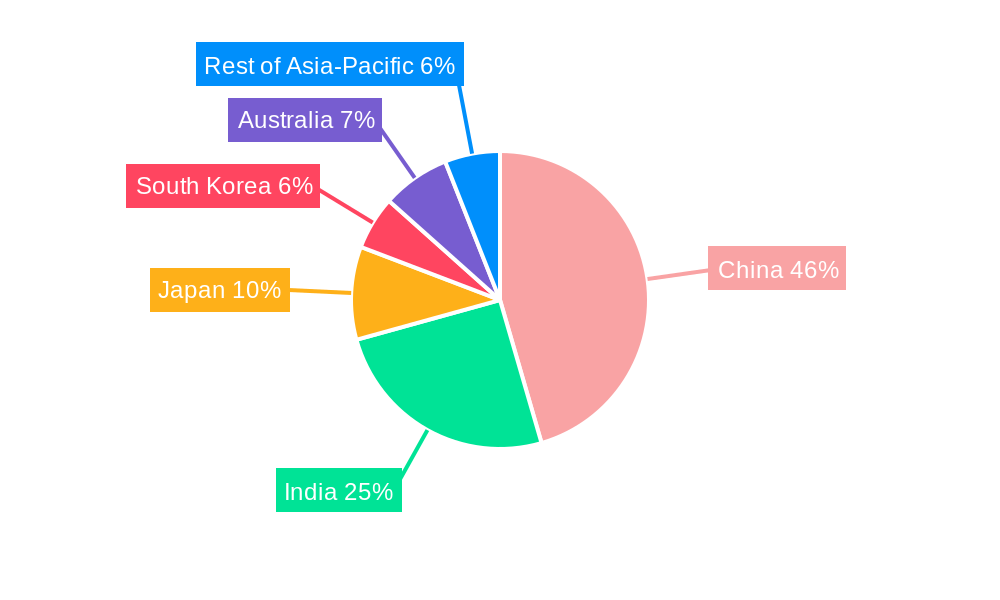

Despite the optimistic outlook, the APAC Onshore Wind Turbine Industry faces certain restraints. These include grid integration challenges, particularly in regions with underdeveloped power infrastructure, and the complexities associated with land acquisition and permitting processes. Supply chain disruptions and fluctuating raw material prices can also impact project timelines and costs. However, the inherent advantages of onshore wind energy, such as its mature technology and established operational track record, alongside the growing urgency to address climate change, are expected to outweigh these challenges. The market is segmented by location into onshore and offshore, with onshore operations dominating the current landscape. Geographically, China, India, Japan, South Korea, and Australia are key markets, with the "Rest of Asia-Pacific" also presenting significant untapped potential.

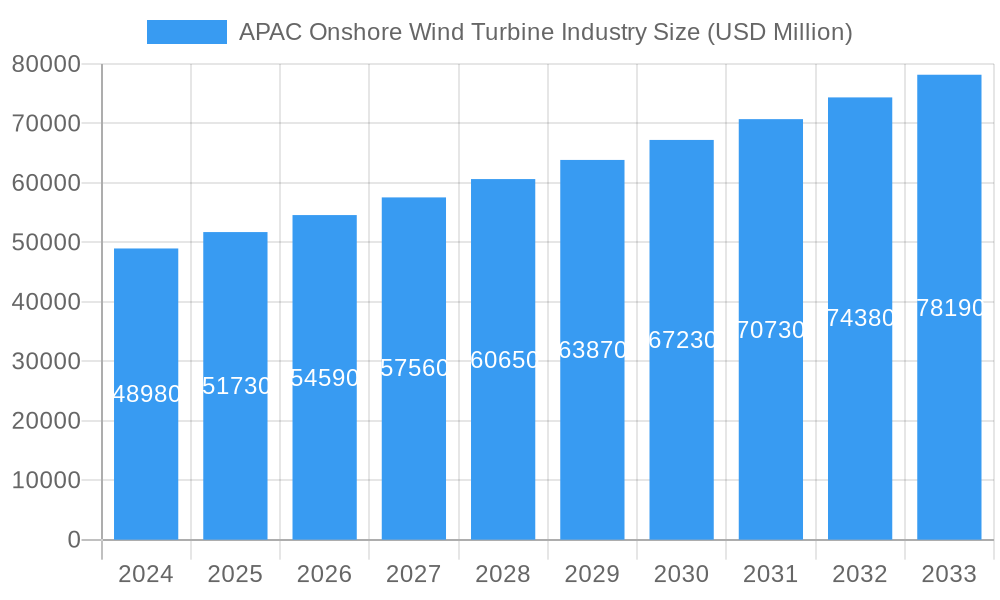

APAC Onshore Wind Turbine Industry Company Market Share

This comprehensive report provides an in-depth analysis of the APAC Onshore Wind Turbine Industry, a rapidly expanding sector poised for significant wind energy growth across the Asia-Pacific region. Covering the Study Period of 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this report delves into market dynamics, technological advancements, and strategic opportunities. It offers critical insights for wind farm operators, equipment suppliers, renewable energy investors, and policymakers seeking to capitalize on the burgeoning clean energy transition in China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific.

This analysis leverages the Historical Period of 2019–2024 to establish baseline trends and project future onshore wind power capacity expansion. The report's meticulous research and expert analysis make it an indispensable resource for understanding the competitive landscape, identifying key wind turbine manufacturers, and forecasting market performance in this dynamic Asia-Pacific wind market.

APAC Onshore Wind Turbine Industry Market Composition & Trends

The APAC Onshore Wind Turbine Industry is characterized by a dynamic and evolving market composition. Market concentration is influenced by the presence of global giants and emerging regional players, with Siemens Gamesa Renewable Energy, Vestas Wind Systems AS, and Xinjiang Goldwind Science & Technology Co Ltd (Goldwind) holding significant shares. Innovation catalysts are primarily driven by the urgent need for cost-effective and efficient wind power solutions, spurred by government incentives and the rising demand for sustainable energy. Regulatory landscapes are largely supportive, with ambitious renewable energy targets in key countries like China and India, fostering substantial investment in wind energy. Substitute products, such as solar PV and fossil fuels, are present, but the declining cost of wind turbine technology and increasing environmental concerns are diminishing their competitive edge. End-user profiles span large utility-scale wind farm operators like EDF SA and Orsted AS, as well as industrial consumers seeking to reduce their carbon footprint. Mergers and acquisitions (M&A) activities are expected to intensify as companies seek to expand their market reach, acquire new technologies, and consolidate their positions, with estimated M&A deal values potentially reaching tens of billions of dollars.

- Market Share Distribution: Dominated by a few key players, but with growing regional influence.

- M&A Deal Values: Projected to see significant increases as consolidation efforts accelerate.

- Regulatory Support: Crucial for market expansion, with policy frameworks promoting onshore wind development.

- Competitive Landscape: Increasingly competitive with a focus on technological differentiation and cost optimization.

APAC Onshore Wind Turbine Industry Industry Evolution

The APAC Onshore Wind Turbine Industry has undergone a remarkable evolution, driven by a confluence of technological breakthroughs, economic imperatives, and a global push towards decarbonization. Over the study period 2019–2033, the industry has witnessed substantial market growth trajectories, fueled by increasingly ambitious renewable energy policies and the undeniable economic viability of wind power generation. The Base Year of 2025 represents a critical juncture, with the Estimated Year of 2025 showing continued strong performance. The Forecast Period of 2025–2033 is anticipated to witness accelerated growth, with projected compound annual growth rates (CAGRs) exceeding xx% for onshore wind installations across the region.

Technological advancements have been a cornerstone of this evolution. We have seen a significant increase in the efficiency and reliability of wind turbines, with the average onshore wind turbine capacity rising steadily. Innovations in blade design, gearbox technology, and control systems have enabled turbines to capture more energy from lower wind speeds, making previously unviable sites economically feasible. The adoption of larger and more powerful wind turbines has also led to a reduction in the levelized cost of energy (LCOE) for wind, making it a highly competitive alternative to conventional power sources.

Shifting consumer demands, particularly the growing awareness and concern about climate change, have placed immense pressure on governments and corporations to transition to cleaner energy sources. This has translated into increased demand for green electricity and a greater willingness to invest in wind energy projects. Furthermore, the development of sophisticated grid integration technologies has addressed concerns about the intermittency of wind power, facilitating the seamless incorporation of large-scale wind farms into national power grids. The historical period of 2019–2024 laid the groundwork for this transformative phase, with early investments and policy frameworks setting the stage for the robust expansion seen in subsequent years. The trajectory indicates a sustained upward trend, solidifying the role of onshore wind power as a vital component of the APAC energy mix.

- Market Growth Trajectories: Significant upward trend in installed capacity and investment.

- Technological Advancements: Focus on larger, more efficient turbines and improved grid integration.

- Shifting Consumer Demands: Increasing demand for clean energy and sustainability.

- CAGR Projections: Strong double-digit growth anticipated in the forecast period.

- LCOE Reduction: Making onshore wind increasingly competitive.

Leading Regions, Countries, or Segments in APAC Onshore Wind Turbine Industry

Within the APAC Onshore Wind Turbine Industry, China stands out as the undisputed leader, commanding a dominant share in both installed capacity and new wind turbine deployments. This geographical dominance is a result of a multifaceted approach that combines aggressive government policy, substantial investment in wind energy, and a highly developed domestic manufacturing ecosystem. The sheer scale of China's commitment to renewable energy is unparalleled, with ambitious onshore wind targets driving continuous expansion across the nation. The country’s vast landmass offers immense potential for large-scale wind farm development, particularly in its northern and western regions.

India emerges as another crucial player, showcasing rapid growth in its onshore wind sector. Key drivers for India's success include strong regulatory support, such as favorable feed-in tariffs and renewable energy certificates, which incentivize wind power projects. The government's proactive stance on increasing the share of renewable energy in the national grid, aiming for xx gigawatts by 2030, is a significant catalyst. Moreover, a growing domestic wind turbine manufacturing base and increasing foreign investment are further propelling the market.

The Rest of Asia-Pacific, encompassing countries like Vietnam, South Korea, and Thailand, is also demonstrating promising onshore wind growth. These nations are increasingly recognizing the strategic importance of wind energy for energy security and climate change mitigation. Investment trends in these areas are on an upward trajectory, supported by evolving policy frameworks and a growing interest from international wind farm developers and equipment suppliers.

While offshore wind is gaining traction, the onshore segment remains the primary driver of wind energy capacity in the APAC region due to its established infrastructure, lower development costs, and widespread land availability. The geography of China alone contributes over xx% of the total APAC onshore wind market, highlighting its pivotal role.

- Dominant Region: China, due to scale of investment, policy support, and land availability.

- Key Drivers in China: Ambitious national targets, robust supply chain, technological advancements.

- Growth Drivers in India: Strong policy support, increasing private sector participation, declining wind turbine costs.

- Emerging Markets: Vietnam, South Korea, and Thailand showing significant potential.

- Segment Dominance: Onshore wind continues to lead due to cost-effectiveness and infrastructure.

APAC Onshore Wind Turbine Industry Product Innovations

Product innovations in the APAC Onshore Wind Turbine Industry are sharply focused on enhancing efficiency, reliability, and cost-effectiveness. Manufacturers are developing larger, more powerful wind turbines, with capacities exceeding xx megawatts, to maximize energy capture per unit and reduce the levelized cost of energy (LCOE). Advancements in aerodynamics for wind turbine blades, utilizing composite materials and optimized profiles, are crucial for increasing energy yield. Furthermore, innovations in direct-drive technology and advanced gearbox designs are improving turbine reliability and reducing maintenance requirements. Smart turbine control systems and predictive maintenance capabilities, leveraging AI and IoT, are also key areas of development, ensuring optimal performance and minimizing downtime. These innovations are directly impacting the performance metrics of onshore wind farms, leading to higher capacity factors and improved return on investment for wind energy projects.

Propelling Factors for APAC Onshore Wind Turbine Industry Growth

Several potent factors are propelling the APAC Onshore Wind Turbine Industry forward. Government support and favorable policies, including renewable energy targets and financial incentives, are paramount. The declining cost of wind energy due to technological advancements and economies of scale makes wind power increasingly competitive against fossil fuels. Growing concerns over climate change and the need for energy security are driving demand for clean energy solutions. Furthermore, significant foreign and domestic investment in renewable energy infrastructure and the development of robust supply chains are crucial enablers. Technological innovation, leading to more efficient and reliable wind turbines, also plays a vital role in accelerating market expansion.

- Policy and Regulatory Support: Ambitious national targets and incentives.

- Cost Competitiveness: Declining LCOE of wind energy.

- Environmental Concerns: Global push for decarbonization.

- Investment Flow: Increasing capital allocation to wind energy.

- Technological Advancements: Improved turbine efficiency and reliability.

Obstacles in the APAC Onshore Wind Turbine Industry Market

Despite its promising outlook, the APAC Onshore Wind Turbine Industry faces several obstacles. Grid integration challenges, particularly in regions with less developed power grids, can limit the deployment of large-scale wind farms. Land acquisition and permitting complexities can lead to project delays and increased development costs. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, pose a significant risk to project timelines and budgets. Intense competitive pressures among manufacturers can lead to price erosion, impacting profitability. Furthermore, environmental and social impact concerns, such as visual impact and noise pollution, can lead to public opposition and regulatory hurdles in some areas.

- Grid Infrastructure Limitations: Challenges in accommodating large-scale wind power.

- Permitting and Land Issues: Delays and cost overruns in project development.

- Supply Chain Volatility: Disruptions and price fluctuations of key components.

- Public Acceptance: Addressing environmental and social concerns.

- Financing Challenges: Securing long-term project finance in some markets.

Future Opportunities in APAC Onshore Wind Turbine Industry

The APAC Onshore Wind Turbine Industry is ripe with emerging opportunities. The vast untapped potential in developing nations within the region presents significant market expansion opportunities. Advancements in hybrid renewable energy systems, integrating wind with solar or storage, offer enhanced grid stability and reliability. The development of smart grid technologies will further facilitate the integration of more wind power capacity. Increased investment in offshore wind development, while distinct, can create synergies and technology spillover effects for the onshore sector. Furthermore, the growing demand for green hydrogen production, powered by renewable energy, opens up a new, substantial market for wind energy.

- Emerging Markets: Untapped potential in Southeast Asia and other developing economies.

- Hybrid Energy Solutions: Integration with solar and battery storage.

- Smart Grid Technologies: Enhanced grid integration and management.

- Green Hydrogen Production: A new, significant demand driver.

Major Players in the APAC Onshore Wind Turbine Industry Ecosystem

- Equipment Suppliers:

- Siemens Gamesa Renewable Energy

- China Longyuan Power Group Corporation Limited

- General Electric Company

- Envision Energy

- Orsted AS

- Suzlon Energy Limited

- Vestas Wind Systems AS

- Wind Farm Operators:

- EDF SA

- Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- Acciona Energia SA

Key Developments in APAC Onshore Wind Turbine Industry Industry

- April 2022: Hitachi Energy installed a unique transformer in China's first floating wind turbine, the Sanxia Yinling Hao wind turbine. This 5.5-megawatt wind turbine, installed off the coast of Guangdong Province, was installed in December 2021 at Yangjiang wind farm. Hitachi Energy specifically designs this transformer for floating wind turbines. It can handle high vibrations and can avoid oil spills due to dry operation.

- February 2022: Tata Power and German electricity generating company RWE agreed on a partnership to explore the potential for joint development of offshore wind power plants in India.

Strategic APAC Onshore Wind Turbine Industry Market Forecast

The strategic APAC Onshore Wind Turbine Industry Market Forecast for the period 2025–2033 indicates a period of robust and sustained growth, driven by compelling market forces. The continued decline in the cost of wind energy, coupled with ambitious government mandates for renewable energy adoption, will be the primary growth catalysts. Emerging technologies, such as larger and more efficient wind turbines, and enhanced grid integration solutions, will further bolster market expansion. Opportunities in new geographical markets and the burgeoning demand for green hydrogen present significant upside potential. Overall, the onshore wind sector in APAC is poised to become a cornerstone of the region's clean energy future, attracting substantial investment and driving significant economic development, with a projected market value reaching billions of dollars.

APAC Onshore Wind Turbine Industry Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Australia

- 2.6. Rest of Asia-Pacific

APAC Onshore Wind Turbine Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

APAC Onshore Wind Turbine Industry Regional Market Share

Geographic Coverage of APAC Onshore Wind Turbine Industry

APAC Onshore Wind Turbine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Australia

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. China APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Australia

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. India APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Australia

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Japan APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. South Korea APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Australia

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Australia APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Australia

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Location

- 11. Rest of Asia Pacific APAC Onshore Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Location

- 11.1.1. Onshore

- 11.1.2. Offshore

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Australia

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Location

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Equipment Suppliers

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 3 Siemens Gamesa Renewable Energy

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 7 China Longyuan Power Group Corporation Limited*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 2 General Electric Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 1 Envision Energy

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 2 Orsted AS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 4 Suzlon Energy Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Wind Farm Operators

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 3 EDF SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 5 Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 6 Vestas Wind Systems AS

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 1 Acciona Energia SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Equipment Suppliers

List of Figures

- Figure 1: APAC Onshore Wind Turbine Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: APAC Onshore Wind Turbine Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 2: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 5: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 8: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 11: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 14: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 17: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Location 2020 & 2033

- Table 20: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 21: APAC Onshore Wind Turbine Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Onshore Wind Turbine Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the APAC Onshore Wind Turbine Industry?

Key companies in the market include Equipment Suppliers, 3 Siemens Gamesa Renewable Energy, 7 China Longyuan Power Group Corporation Limited*List Not Exhaustive, 2 General Electric Company, 1 Envision Energy, 2 Orsted AS, 4 Suzlon Energy Limited, Wind Farm Operators, 3 EDF SA, 5 Xinjiang Goldwind Science & Technology Co Ltd (Goldwind), 6 Vestas Wind Systems AS, 1 Acciona Energia SA.

3. What are the main segments of the APAC Onshore Wind Turbine Industry?

The market segments include Location, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

April 2022: Hitachi Energy installed a unique transformer in China's first floating wind turbine, the Sanxia Yinling Hao wind turbine. This 5.5-megawatt wind turbine, installed off the coast of Guangdong Province, was installed in December 2021 at Yangjiang wind farm. Hitachi Energy specifically designs this transformer for floating wind turbines. It can handle high vibrations = and can avoid oil spills due to dry operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Onshore Wind Turbine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Onshore Wind Turbine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Onshore Wind Turbine Industry?

To stay informed about further developments, trends, and reports in the APAC Onshore Wind Turbine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence