Key Insights

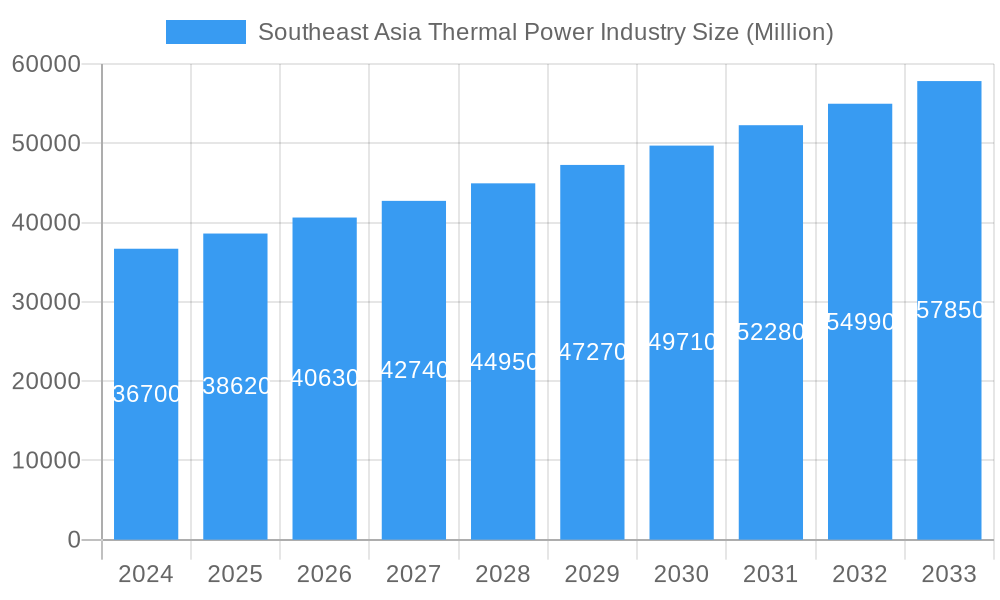

The Southeast Asia thermal power market is poised for robust expansion, driven by the region's escalating energy demands and ongoing industrialization. With an estimated market size of USD 36.7 billion in 2024, the sector is projected to witness a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This growth is primarily fueled by the indispensable role of thermal power in meeting the baseload energy requirements of rapidly developing economies. Key drivers include increasing electricity consumption by households and industries, supportive government policies promoting energy security and infrastructure development, and the need for reliable power generation to support economic growth. Natural gas is emerging as a dominant fuel source due to its cleaner burning profile compared to coal and its increasing availability, aligning with regional sustainability goals.

Southeast Asia Thermal Power Industry Market Size (In Billion)

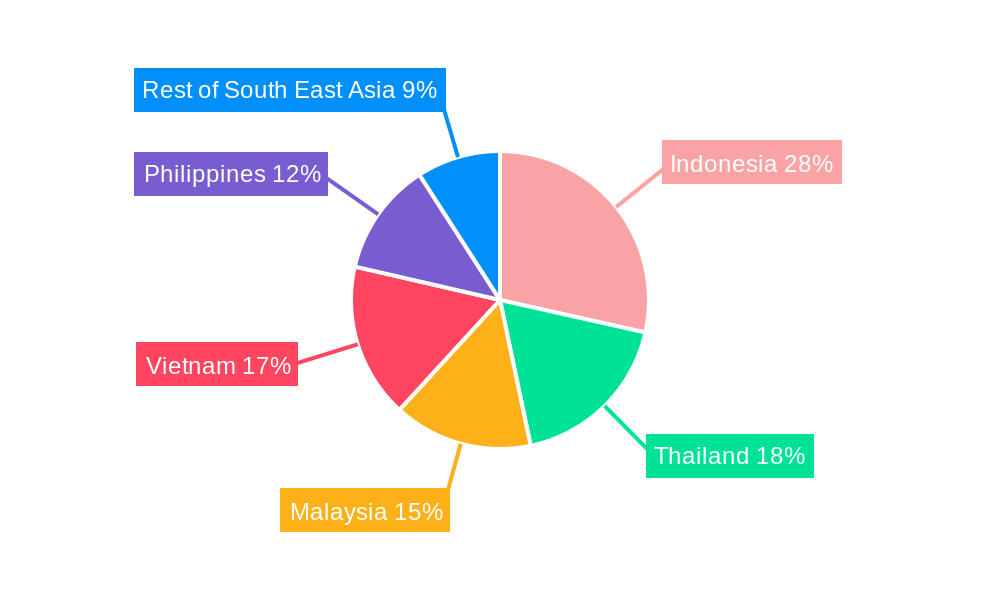

The market segmentation reveals a dynamic landscape. While coal continues to be a significant contributor, the shift towards natural gas is a prominent trend, reflecting a growing awareness of environmental impact and regulatory pressures. Bioenergy and nuclear power also represent burgeoning segments, offering diversified and potentially cleaner alternatives. In terms of operational cycles, open-cycle power plants are likely to see continued adoption for flexibility and rapid deployment, while closed-cycle systems will remain crucial for large-scale, efficient baseload generation. Geographically, Indonesia, Thailand, Malaysia, and Vietnam are expected to be major growth hubs, accounting for a substantial share of the market due to their large populations, developing industrial sectors, and increasing urbanization. Challenges such as stringent environmental regulations, the high capital investment required for new power plants, and the increasing competition from renewable energy sources will necessitate strategic adaptations within the industry.

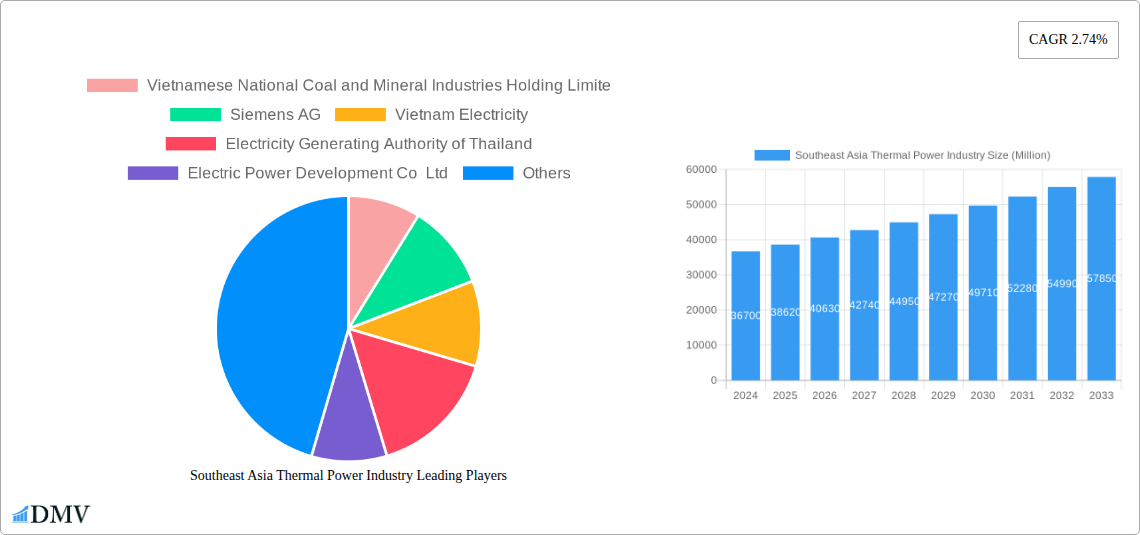

Southeast Asia Thermal Power Industry Company Market Share

Southeast Asia Thermal Power Industry: Market Analysis & Future Outlook (2019–2033)

This comprehensive report delves into the dynamic Southeast Asia thermal power industry, providing an in-depth analysis of market composition, trends, and future projections from 2019 to 2033. Covering key segments such as Oil, Natural Gas, Coal, and Other Sources (Bioenergy and Nuclear), and exploring both Open Cycle and Closed Cycle technologies across major geographies including Indonesia, Thailand, Malaysia, Vietnam, and the Philippines, this report is an essential resource for stakeholders seeking to understand the evolving energy landscape. With a base year of 2025 and a forecast period extending to 2033, this study meticulously examines market drivers, restraints, opportunities, and the competitive ecosystem.

Southeast Asia Thermal Power Industry Market Composition & Trends

The Southeast Asia thermal power industry is characterized by a moderate market concentration, with key players vying for market share. Innovation is primarily driven by the pursuit of greater efficiency and reduced emissions in coal-fired power plants, alongside the accelerating adoption of natural gas as a transitional fuel. Regulatory landscapes are becoming increasingly stringent, with governments across the region focusing on energy security and environmental sustainability. Substitute products, such as renewable energy sources like solar and wind power, are gaining traction, posing a growing challenge to traditional thermal power generation. End-user profiles are diverse, ranging from national utilities to large industrial consumers. Mergers and Acquisitions (M&A) activities are expected to continue as companies seek to consolidate their market positions and leverage technological advancements. The market share distribution is dynamic, with coal currently holding a significant portion, but natural gas witnessing robust growth. M&A deal values are projected to increase as larger entities acquire smaller players or engage in strategic alliances to expand their operational footprint and technological capabilities. The industry is witnessing a gradual shift towards cleaner thermal power technologies.

Southeast Asia Thermal Power Industry Industry Evolution

The Southeast Asia thermal power industry has undergone significant evolution, driven by a complex interplay of economic development, energy demand, technological advancements, and increasing environmental consciousness. Historically, the region has relied heavily on coal for power generation due to its abundance and cost-effectiveness, contributing to substantial industrial growth and improved living standards. However, concerns over air quality and greenhouse gas emissions have prompted a gradual but significant shift. The study period (2019–2033) highlights a discernible trend towards diversification of the energy mix.

Market growth trajectories have been robust, fueled by a burgeoning population and rapid industrialization across countries like Indonesia, Vietnam, and the Philippines. This sustained demand for electricity has underscored the continued importance of thermal power, even as renewable energy sources gain prominence. The base year (2025) serves as a crucial benchmark for understanding current market dynamics, while the forecast period (2025–2033) projects future growth patterns.

Technological advancements have been pivotal in shaping the industry. Modern thermal power plants are incorporating more efficient combustion technologies, advanced emission control systems, and digital monitoring solutions. The adoption of combined cycle gas turbine (CCGT) technology has accelerated, offering higher efficiency and lower emissions compared to older, open-cycle systems, particularly for natural gas-fired power plants. This transition is crucial for meeting stricter environmental regulations.

Furthermore, shifting consumer demands are increasingly influencing the industry. While reliable and affordable electricity remains paramount, there is a growing awareness and preference for cleaner energy sources. This has spurred investment in bioenergy and the exploration of other "other sources" technologies, even within the broader thermal power sector. The historical period (2019–2024) illustrates the initial phases of this transition, marked by significant investments in both new coal capacity and natural gas infrastructure. The industry's evolution is a continuous balancing act between meeting immediate energy needs and adapting to long-term sustainability goals.

Leading Regions, Countries, or Segments in Southeast Asia Thermal Power Industry

The dominance within the Southeast Asia thermal power industry is multifaceted, with distinct leaders emerging across different segments and geographies. Among the Sources, Coal has historically been the most dominant, particularly in countries with significant domestic reserves and established infrastructure. However, Natural Gas is rapidly gaining prominence as a cleaner and more flexible fuel source, especially for meeting peak demand and supporting intermittent renewable energy. The Geography of dominance is clearly defined:

Indonesia consistently leads in terms of overall thermal power generation capacity, largely due to its extensive coal reserves and substantial domestic energy demand. The nation's reliance on coal for power has been a cornerstone of its economic development, although recent policy shifts, like the coal export ban, underscore the evolving regulatory and supply dynamics.

- Key Drivers of Dominance:

- Abundant domestic coal reserves.

- High and growing energy demand from a large population and industrial base.

- Significant investments in coal-fired power plants historically.

- Government policies prioritizing energy security through domestic fuel utilization.

- Key Drivers of Dominance:

Thailand is emerging as a strong contender, particularly in the adoption of Natural Gas and advanced technologies. The country is actively investing in modern, efficient combined cycle gas turbine (CCGT) plants, driven by a strategic move towards cleaner energy and the need to diversify its fuel mix.

- Key Drivers of Dominance:

- Strategic focus on natural gas as a transitional fuel.

- Investment in state-of-the-art CCGT technology.

- Proactive approach to attracting foreign investment in power projects.

- Commitment to reducing reliance on imported coal.

- Key Drivers of Dominance:

Vietnam exhibits a substantial thermal power sector, with a significant contribution from both Coal and Natural Gas. The country's rapid economic growth has necessitated continuous expansion of its power generation capacity, making it a key market for thermal power technologies and fuels.

- Key Drivers of Dominance:

- Rapid industrialization and urbanization driving electricity demand.

- Government focus on expanding power generation capacity to support economic growth.

- Ongoing development of both coal and gas-fired power projects.

- Key Drivers of Dominance:

Within the Cycle segments, Closed Cycle power plants, particularly CCGT, are gaining traction due to their higher efficiency and lower environmental impact compared to Open Cycle systems, which are often used for peaking power. The trend is towards optimizing operational flexibility while meeting stringent emission standards.

Southeast Asia Thermal Power Industry Product Innovations

Product innovations in the Southeast Asia thermal power industry are primarily focused on enhancing efficiency, reducing environmental impact, and ensuring reliability. Advanced gas turbines, such as those capable of operating on hydrogen blends, are being developed to support decarbonization efforts. Improvements in boiler technology for coal-fired plants are aimed at optimizing fuel combustion and minimizing particulate matter emissions. Digitalization and AI are being integrated for predictive maintenance and real-time performance monitoring, leading to increased operational uptime and reduced maintenance costs. Furthermore, innovative emission control technologies, including advanced scrubbers and selective catalytic reduction (SCR) systems, are being deployed to meet increasingly stringent regulatory requirements. The unique selling proposition of these innovations lies in their ability to balance the region's growing energy needs with environmental stewardship.

Propelling Factors for Southeast Asia Thermal Power Industry Growth

The Southeast Asia thermal power industry's growth is propelled by several key factors.

- Robust Economic Growth and Industrialization: Rapid economic expansion across the region necessitates a continuous and reliable supply of electricity to power industries and meet rising consumer demand.

- Growing Energy Demand: A large and growing population, coupled with increasing urbanization, is driving unprecedented electricity consumption.

- Energy Security Concerns: Nations are prioritizing energy independence and reliability, leading to continued investment in domestic power generation capabilities, often relying on indigenous fuel sources like coal and natural gas.

- Technological Advancements: The development of more efficient, cleaner, and flexible thermal power technologies, such as advanced combined cycle gas turbines, makes thermal power a viable option even with increasing environmental scrutiny.

- Infrastructure Development: Significant investments in power transmission and distribution networks are essential to support the integration of new power generation capacity, including thermal power plants.

Obstacles in the Southeast Asia Thermal Power Industry Market

Despite its growth, the Southeast Asia thermal power industry faces significant obstacles.

- Stringent Environmental Regulations: Increasing global and regional pressure to reduce carbon emissions and air pollution is leading to stricter regulations for thermal power plants, necessitating costly upgrades or phased-out operations.

- Volatile Fuel Prices: Fluctuations in the global prices of coal and natural gas directly impact the operating costs and profitability of thermal power plants, creating financial uncertainty.

- Supply Chain Disruptions: Geopolitical events, trade disputes, and unexpected domestic policy changes (as seen with Indonesia's coal export ban) can disrupt the reliable supply of fuel, impacting plant operations.

- Competition from Renewables: The rapidly falling costs of solar and wind power, coupled with supportive government policies for renewables, present a significant competitive challenge to traditional thermal power generation.

- Financing Challenges: Securing long-term financing for new coal-fired power projects is becoming increasingly difficult due to environmental, social, and governance (ESG) concerns from investors and financial institutions.

Future Opportunities in Southeast Asia Thermal Power Industry

The Southeast Asia thermal power industry is poised for future opportunities, particularly in the realm of cleaner thermal technologies and the strategic utilization of existing infrastructure.

- Transition Fuels: The increasing role of natural gas as a bridge fuel offers significant opportunities for investment in modern, efficient CCGT plants that can provide reliable baseload power and complement intermittent renewables.

- Carbon Capture, Utilization, and Storage (CCUS): As decarbonization efforts intensify, the development and deployment of CCUS technologies for existing and new thermal power plants present a substantial long-term opportunity.

- Bioenergy Integration: The integration of bioenergy with conventional thermal power generation can help reduce the carbon footprint of existing assets and create new revenue streams.

- Modernization and Retrofitting: Opportunities exist to upgrade and retrofit older thermal power plants with more efficient and cleaner technologies, extending their operational life and improving environmental performance.

- Regional Grid Interconnection: Enhanced regional grid interconnections can facilitate the optimized dispatch of thermal power resources across Southeast Asia, improving overall grid stability and efficiency.

Major Players in the Southeast Asia Thermal Power Industry Ecosystem

- Vietnamese National Coal and Mineral Industries Holding Limited

- Siemens AG

- Vietnam Electricity

- Electricity Generating Authority of Thailand

- Electric Power Development Co Ltd

- Malakoff Corporation Berhad

- General Electric Company

- Indonesia Power PT

Key Developments in Southeast Asia Thermal Power Industry Industry

- January 2022: Indonesia banned the export of coal due to concerns that low supplies at domestic power plants could lead to widespread blackouts. The Indonesian Government justified the ban as it could lead almost 20 power plants with a power capacity of 10,850 megawatts to run out of coal.

- October 2022: The first of two 2.7-GW natural gas-fired combined cycle power plants located 130 kilometers southeast of Bangkok, Thailand, commenced operations. The Gulf SRC (GSRC) power plant is the first gas-fired independent power project built by the two companies under their joint venture, Independent Power Development Co. (IPD). Gulf Energy Development holds a 70.0% equity interest in IPD, while Mitsui holds 30%.

Strategic Southeast Asia Thermal Power Industry Market Forecast

The strategic forecast for the Southeast Asia thermal power industry indicates a period of transition and adaptation. While coal will continue to play a role, its dominance is expected to wane as natural gas and cleaner technologies gain traction. Significant investments will be directed towards modernizing existing infrastructure and developing new, more efficient power plants. The increasing focus on energy security and the economic imperative to meet growing electricity demands will underpin continued growth, albeit with a stronger emphasis on sustainability. Opportunities in CCUS and bioenergy integration will shape the future trajectory, making the region a key area for technological innovation and strategic investment in the global thermal power sector. The forecast points towards a more diversified and environmentally conscious thermal power landscape.

Southeast Asia Thermal Power Industry Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

- 1.4. Other Sources (Bioenergy and Nuclear)

-

2. Cycle

- 2.1. Open Cycle

- 2.2. Closed Cycle

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Malaysia

- 3.4. Vietnam

- 3.5. Philippines

- 3.6. Rest of South East Asia

Southeast Asia Thermal Power Industry Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Philippines

- 6. Rest of South East Asia

Southeast Asia Thermal Power Industry Regional Market Share

Geographic Coverage of Southeast Asia Thermal Power Industry

Southeast Asia Thermal Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Prominence of Gas in Power Generation4.; Increasing Investments in the Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil and Natural Gas Prices

- 3.4. Market Trends

- 3.4.1. Coal-Based Thermal Power Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.1.4. Other Sources (Bioenergy and Nuclear)

- 5.2. Market Analysis, Insights and Forecast - by Cycle

- 5.2.1. Open Cycle

- 5.2.2. Closed Cycle

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Malaysia

- 5.3.4. Vietnam

- 5.3.5. Philippines

- 5.3.6. Rest of South East Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Malaysia

- 5.4.4. Vietnam

- 5.4.5. Philippines

- 5.4.6. Rest of South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Indonesia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Oil

- 6.1.2. Natural Gas

- 6.1.3. Coal

- 6.1.4. Other Sources (Bioenergy and Nuclear)

- 6.2. Market Analysis, Insights and Forecast - by Cycle

- 6.2.1. Open Cycle

- 6.2.2. Closed Cycle

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Malaysia

- 6.3.4. Vietnam

- 6.3.5. Philippines

- 6.3.6. Rest of South East Asia

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Thailand Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Oil

- 7.1.2. Natural Gas

- 7.1.3. Coal

- 7.1.4. Other Sources (Bioenergy and Nuclear)

- 7.2. Market Analysis, Insights and Forecast - by Cycle

- 7.2.1. Open Cycle

- 7.2.2. Closed Cycle

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Malaysia

- 7.3.4. Vietnam

- 7.3.5. Philippines

- 7.3.6. Rest of South East Asia

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Malaysia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Oil

- 8.1.2. Natural Gas

- 8.1.3. Coal

- 8.1.4. Other Sources (Bioenergy and Nuclear)

- 8.2. Market Analysis, Insights and Forecast - by Cycle

- 8.2.1. Open Cycle

- 8.2.2. Closed Cycle

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Malaysia

- 8.3.4. Vietnam

- 8.3.5. Philippines

- 8.3.6. Rest of South East Asia

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Vietnam Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Oil

- 9.1.2. Natural Gas

- 9.1.3. Coal

- 9.1.4. Other Sources (Bioenergy and Nuclear)

- 9.2. Market Analysis, Insights and Forecast - by Cycle

- 9.2.1. Open Cycle

- 9.2.2. Closed Cycle

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Malaysia

- 9.3.4. Vietnam

- 9.3.5. Philippines

- 9.3.6. Rest of South East Asia

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Philippines Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Oil

- 10.1.2. Natural Gas

- 10.1.3. Coal

- 10.1.4. Other Sources (Bioenergy and Nuclear)

- 10.2. Market Analysis, Insights and Forecast - by Cycle

- 10.2.1. Open Cycle

- 10.2.2. Closed Cycle

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Malaysia

- 10.3.4. Vietnam

- 10.3.5. Philippines

- 10.3.6. Rest of South East Asia

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Rest of South East Asia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Source

- 11.1.1. Oil

- 11.1.2. Natural Gas

- 11.1.3. Coal

- 11.1.4. Other Sources (Bioenergy and Nuclear)

- 11.2. Market Analysis, Insights and Forecast - by Cycle

- 11.2.1. Open Cycle

- 11.2.2. Closed Cycle

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Malaysia

- 11.3.4. Vietnam

- 11.3.5. Philippines

- 11.3.6. Rest of South East Asia

- 11.1. Market Analysis, Insights and Forecast - by Source

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vietnamese National Coal and Mineral Industries Holding Limite

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vietnam Electricity

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Electricity Generating Authority of Thailand

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Electric Power Development Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Malakoff Corporation Berhad

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 General Electric Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Indonesia Power PT

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Vietnamese National Coal and Mineral Industries Holding Limite

List of Figures

- Figure 1: Southeast Asia Thermal Power Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Thermal Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 3: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 4: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 5: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 7: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 9: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 10: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 11: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 12: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 13: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 17: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 18: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 19: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 20: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 21: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 26: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 27: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 28: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 29: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 31: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 33: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 34: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 35: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 36: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 37: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 39: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 41: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 42: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 43: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 44: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 45: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 47: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

- Table 49: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 50: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2020 & 2033

- Table 51: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Cycle 2020 & 2033

- Table 52: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2020 & 2033

- Table 53: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 54: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2020 & 2033

- Table 55: Southeast Asia Thermal Power Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Thermal Power Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Southeast Asia Thermal Power Industry?

Key companies in the market include Vietnamese National Coal and Mineral Industries Holding Limite, Siemens AG, Vietnam Electricity, Electricity Generating Authority of Thailand, Electric Power Development Co Ltd, Malakoff Corporation Berhad, General Electric Company, Indonesia Power PT.

3. What are the main segments of the Southeast Asia Thermal Power Industry?

The market segments include Source, Cycle, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Prominence of Gas in Power Generation4.; Increasing Investments in the Sector.

6. What are the notable trends driving market growth?

Coal-Based Thermal Power Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil and Natural Gas Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, Indonesia banned the export of coal due to concerns that low supplies at domestic power plants could lead to widespread blackouts. The Indonesian Government justified the ban as it could lead almost 20 power plants with a power capacity of 10,850 megawatts to run out of coal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Thermal Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Thermal Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Thermal Power Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Thermal Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence