Key Insights

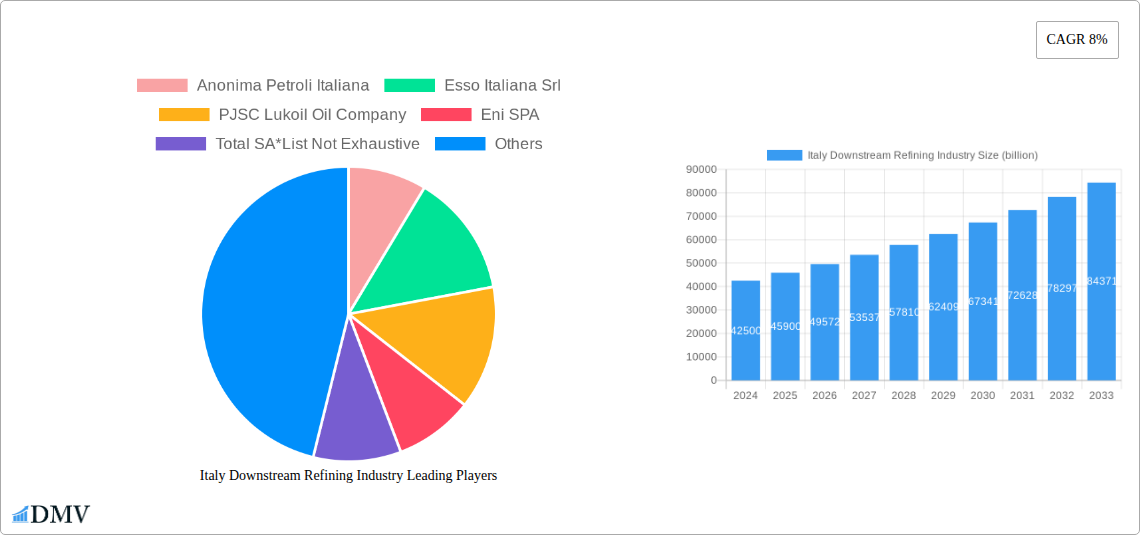

The Italian downstream refining industry is poised for robust growth, projected to reach an estimated USD 42.5 billion in 2024, expanding at a Compound Annual Growth Rate (CAGR) of 8% through to 2033. This significant market expansion is primarily driven by an increasing demand for refined petroleum products, fueled by industrial activity and a gradually recovering transportation sector post-pandemic. Investments in upgrading existing infrastructure to meet stringent environmental regulations and enhance operational efficiency are also key contributors. Furthermore, the pipeline of new projects, both in refineries and petrochemical plants, signals a commitment to modernization and capacity expansion, anticipating future energy needs and value-added product development. The strategic focus on increasing the output of high-value petrochemicals from existing refining streams will further bolster market value.

Italy Downstream Refining Industry Market Size (In Billion)

Despite the positive outlook, the industry faces certain restraints, notably the ongoing global energy transition towards renewables, which presents a long-term challenge to fossil fuel dependence. Stringent environmental regulations and the associated compliance costs can also impact profitability and investment decisions. However, the market is adapting by focusing on cleaner refining processes and producing more specialized products. Key players are strategically investing in expanding their petrochemical segments, leveraging refinery outputs for higher-margin chemical production. The market is segmented into Refineries and Petrochemicals Plants, with both categories encompassing existing infrastructure, projects in the pipeline, and upcoming projects, indicating a comprehensive approach to market development across Italy.

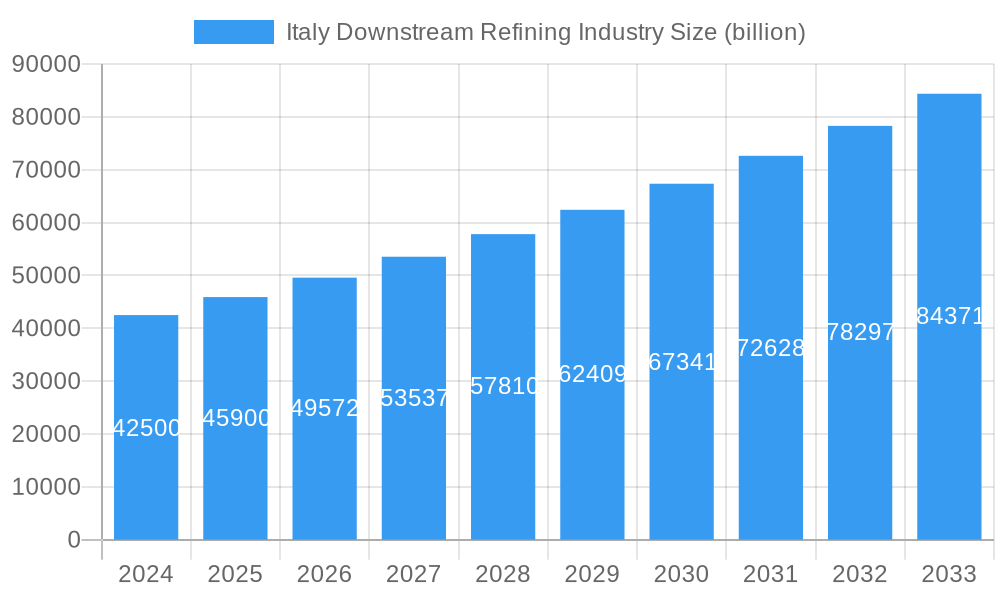

Italy Downstream Refining Industry Company Market Share

Italy Downstream Refining Industry Market Composition & Trends

The Italian downstream refining industry, a critical component of the nation's energy infrastructure, is characterized by a moderate to high market concentration with a few dominant players shaping its landscape. This report delves into the intricate market dynamics from 2019 to 2033, with a base year of 2025, examining how innovation catalysts, such as advancements in catalytic cracking and hydrotreating technologies, are driving operational efficiencies and product quality. We critically assess the regulatory landscapes, including the impact of the EU's Green Deal and national emissions standards, which are increasingly influencing investment decisions and operational strategies. The report also scrutinizes the substitute products emerging from the renewable energy sector and their evolving penetration into the traditional fuel markets. Understanding the end-user profiles, from transportation fuels to feedstock for petrochemicals, is crucial for identifying current demand patterns and future shifts. Furthermore, Mergers & Acquisitions (M&A) activities are analyzed, revealing strategic consolidations and divestments aimed at optimizing asset portfolios and enhancing competitiveness. For instance, the M&A deal values in the historical period (2019-2024) are estimated to be in the range of several billion euros, reflecting significant strategic realignments. Key trends include an increased focus on biofuels integration, advanced refining techniques, and digitalization of operations.

- Market Share Distribution: Analysis of market share held by major refining companies.

- M&A Deal Values: Quantified impact of mergers and acquisitions on market structure.

- Innovation Catalysts: Technological advancements driving efficiency and product diversification.

- Regulatory Impact: Influence of environmental policies on industry operations and investments.

Italy Downstream Refining Industry Industry Evolution

The evolution of the Italian downstream refining industry, spanning the historical period of 2019-2024 and projecting to 2033, showcases a fascinating trajectory influenced by both global energy transitions and localized industrial imperatives. Throughout the study period, the industry has grappled with fluctuating crude oil prices, geopolitical uncertainties, and a growing societal demand for sustainable energy solutions. Market growth trajectories have been characterized by periods of stagnation and subsequent recovery, driven by shifts in transportation patterns and industrial feedstock requirements. For instance, the historical growth rate from 2019 to 2024 averaged around 0.5% annually, primarily supported by the demand for traditional fuels. However, projections for the forecast period (2025-2033) anticipate a more nuanced picture, with potential moderate growth in specific segments like petrochemicals, offset by a decline in conventional fuel demand. Technological advancements have played a pivotal role in this evolution. Investments in upgrading refinery infrastructure to enhance flexibility and process heavier, more sour crudes have been significant, estimated in the billions of euros. Furthermore, the integration of digitalization and automation, including AI-driven process optimization and predictive maintenance, has become a key differentiator, improving operational efficiency and safety. Shifting consumer demands are perhaps the most potent force reshaping the industry. The increasing preference for electric vehicles, coupled with a greater emphasis on recycled and bio-based materials in manufacturing, is fundamentally altering the demand profile for refined products. This necessitates a strategic pivot for Italian refiners, moving beyond traditional fuel production towards higher-value petrochemicals and specialty chemicals. Adoption metrics for sustainable fuels, such as biofuels, have seen a steady increase, with their market penetration projected to reach XX% by 2033. The industry is actively exploring co-processing of biomass and waste streams, signifying a proactive approach to adapting to the evolving energy landscape. This transformative journey underscores the industry's resilience and its capacity for adaptation in the face of profound global shifts.

Leading Regions, Countries, or Segments in Italy Downstream Refining Industry

Within the Italian downstream refining industry, the refining segment undeniably commands the most significant influence and investment, particularly in terms of existing infrastructure and projects in pipeline. While petrochemical plants are integral to the value chain, their scale and immediate impact on the overall refining capacity are often secondary. The dominance of refineries is rooted in their foundational role in processing crude oil into a wide array of essential fuels and feedstocks. Italy boasts a network of strategically located refineries, with key operational hubs concentrated in regions like Lombardy, Liguria, and Sicily. These regions benefit from proximity to major ports for crude oil import and product distribution, as well as established industrial clusters that drive demand for refined products.

Refineries: Overview

- Existing Infrastructure: Italy's refinery infrastructure comprises a substantial capacity, with numerous operational facilities capable of processing millions of barrels per day. These refineries are equipped with advanced technologies, including sophisticated distillation units, fluid catalytic crackers (FCC), hydrocrackers, and reformers, enabling them to produce a diverse range of refined products such as gasoline, diesel, jet fuel, and fuel oil, alongside vital petrochemical feedstocks like naphtha and LPG. The total refining capacity is estimated to be around 1.2 billion barrels per annum.

- Projects in Pipeline: Significant investments are anticipated in modernizing and optimizing existing refinery assets to meet stricter environmental regulations and enhance their ability to process lighter, more sustainable crude sources. These projects aim to improve energy efficiency, reduce emissions, and increase the yield of higher-value products, with total investment expected to reach billions of euros over the forecast period.

- Upcoming Projects: While new greenfield refinery projects are scarce due to market saturation and regulatory hurdles, there is a discernible trend towards expanding and upgrading existing facilities, particularly in areas focusing on specialized refining and petrochemical integration. These projects are strategically aligned with the increasing demand for petrochemical derivatives and cleaner fuel alternatives.

Petrochemicals Plants: Overview

- Existing Infrastructure: A considerable number of integrated petrochemical facilities operate alongside refineries, leveraging refinery-produced feedstocks. These plants are crucial for producing polymers, plastics, synthetic fibers, and other chemical intermediates that are vital for various industrial sectors, contributing an estimated XX billion in value addition annually.

- Projects in Pipeline: Investments in petrochemical expansion are robust, driven by the growing demand for specialty chemicals and polymers, both domestically and internationally. Projects are focused on enhancing the production of high-margin products and incorporating more sustainable production methods, with planned investments in the billions of euros.

- Upcoming Projects: The focus is on developing advanced petrochemical facilities that utilize innovative catalytic processes and renewable feedstocks, aligning with circular economy principles and reducing reliance on fossil fuels.

The dominance of the refinery segment is a direct consequence of its position at the beginning of the downstream value chain. Investment trends are heavily skewed towards maintaining and upgrading this core infrastructure, ensuring its efficiency and compliance. Regulatory support, while stringent on emissions, often encourages technological upgrades that benefit refinery operations. The key drivers of dominance for refineries include their established infrastructure, the essential nature of their products for transportation and industry, and the substantial capital investments required for their operation and modernization, making them the undeniable focal point of the Italian downstream sector.

Italy Downstream Refining Industry Product Innovations

The Italian downstream refining industry is witnessing significant product innovations aimed at enhancing efficiency, sustainability, and market competitiveness. Refineries are increasingly focusing on producing ultra-low sulfur diesel (ULSD) and low-volatility gasoline, meeting stringent Euro 7 emission standards and consumer demand for cleaner fuels. Innovations in catalytic technologies are enabling the conversion of heavier crude fractions into higher-value light olefins and aromatics, crucial feedstocks for the burgeoning petrochemical sector. Furthermore, the integration of bio-based feedstocks and the co-processing of waste materials are leading to the development of sustainable aviation fuels (SAF) and renewable diesel, offering significant reductions in carbon footprints. Performance metrics for these advanced products show improved combustion characteristics and reduced particulate matter emissions, crucial for meeting environmental targets. The unique selling propositions lie in their contribution to decarbonization efforts and their alignment with circular economy principles, driven by a commitment to technological advancement.

Propelling Factors for Italy Downstream Refining Industry Growth

Several key growth drivers are propelling the Italian downstream refining industry forward. Firstly, technological advancements in refining processes, such as advanced hydrocracking and catalytic reforming, enable the production of higher-value products and improve energy efficiency, estimated to contribute billions in operational savings. Secondly, the robust demand for petrochemical feedstocks, driven by the plastics, automotive, and construction industries, provides a stable revenue stream and encourages investment in integrated refining and petrochemical complexes. Thirdly, government initiatives and EU mandates promoting energy security and the transition to cleaner fuels, including incentives for biofuels and SAF production, are creating new market opportunities. For example, tax incentives for renewable fuel blending are projected to boost demand by billions of liters. Finally, strategic M&A activities are consolidating the market, leading to optimized operations and increased investment capacity.

Obstacles in the Italy Downstream Refining Industry Market

Despite its potential, the Italy downstream refining industry faces significant obstacles. Stringent environmental regulations, including ambitious decarbonization targets and emissions limits, necessitate substantial capital investment for compliance, potentially impacting profitability. The volatility of crude oil prices and geopolitical uncertainties create inherent risks in feedstock procurement and product pricing. Supply chain disruptions, as witnessed in recent years, can significantly impede operations and increase logistical costs. Furthermore, increasing competition from imported refined products and the growing adoption of electric vehicles, which directly reduces demand for traditional transportation fuels, present long-term challenges to market share and revenue. The transition to a low-carbon economy also presents a fundamental challenge to the long-term viability of purely fossil fuel-based refining operations.

Future Opportunities in Italy Downstream Refining Industry

The Italian downstream refining industry is poised to capitalize on several emerging opportunities. The growing demand for specialized petrochemicals and high-performance polymers presents a significant avenue for value creation, moving beyond commodity fuels. The expansion of sustainable aviation fuel (SAF) and biofuel production offers a critical pathway for decarbonizing hard-to-abate sectors, with projected market growth in the billions. Furthermore, the development of circular economy initiatives, focusing on chemical recycling of plastics and waste-to-chemicals technologies, can unlock new feedstock sources and product lines. Investing in digitalization and advanced analytics can further optimize refinery operations, reduce costs, and enhance resilience. Finally, leveraging existing infrastructure for the production of hydrogen and other low-carbon energy carriers represents a strategic pivot towards future energy systems.

Major Players in the Italy Downstream Refining Industry Ecosystem

- Anonima Petroli Italiana

- Esso Italiana Srl

- PJSC Lukoil Oil Company

- Eni SPA

- Total SA

Key Developments in Italy Downstream Refining Industry Industry

- 2023/08: Eni SPA announces significant investment in its Gela refinery for the production of advanced biofuels and renewable chemicals.

- 2023/11: Total SA completes the upgrade of its refinery in Sicily, enhancing its capacity for producing low-sulfur fuels.

- 2024/01: Anonima Petroli Italiana (API) explores strategic partnerships for integrating renewable energy sources into its refining operations.

- 2024/03: Esso Italiana Srl invests in digitalization to optimize refinery efficiency and predictive maintenance, aiming for billions in operational cost savings.

- 2024/05: PJSC Lukoil Oil Company assesses opportunities for expanding its petrochemical output from its Italian refining assets.

Strategic Italy Downstream Refining Industry Market Forecast

The strategic forecast for the Italy downstream refining industry highlights a paradigm shift towards sustainability and value-added products. Growth catalysts are primarily driven by the increasing demand for petrochemical derivatives and the imperative to develop cleaner fuels, such as biofuels and sustainable aviation fuels, with market potential estimated in the billions. Investments will increasingly focus on upgrading existing facilities to enhance efficiency, reduce emissions, and enable the processing of a wider range of feedstocks, including recycled materials. The industry is expected to pivot from a primary focus on transportation fuels towards a more diversified portfolio, leveraging its expertise in complex chemical transformations. This strategic evolution will be crucial for maintaining competitiveness and contributing to Italy's broader energy transition goals.

Italy Downstream Refining Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Italy Downstream Refining Industry Segmentation By Geography

- 1. Italy

Italy Downstream Refining Industry Regional Market Share

Geographic Coverage of Italy Downstream Refining Industry

Italy Downstream Refining Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Downstream Refining Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anonima Petroli Italiana

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esso Italiana Srl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PJSC Lukoil Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total SA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Anonima Petroli Italiana

List of Figures

- Figure 1: Italy Downstream Refining Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Downstream Refining Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Downstream Refining Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 2: Italy Downstream Refining Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 3: Italy Downstream Refining Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Downstream Refining Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 5: Italy Downstream Refining Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 6: Italy Downstream Refining Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Downstream Refining Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Italy Downstream Refining Industry?

Key companies in the market include Anonima Petroli Italiana, Esso Italiana Srl, PJSC Lukoil Oil Company, Eni SPA, Total SA*List Not Exhaustive.

3. What are the main segments of the Italy Downstream Refining Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Downstream Refining Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Downstream Refining Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Downstream Refining Industry?

To stay informed about further developments, trends, and reports in the Italy Downstream Refining Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence