Key Insights

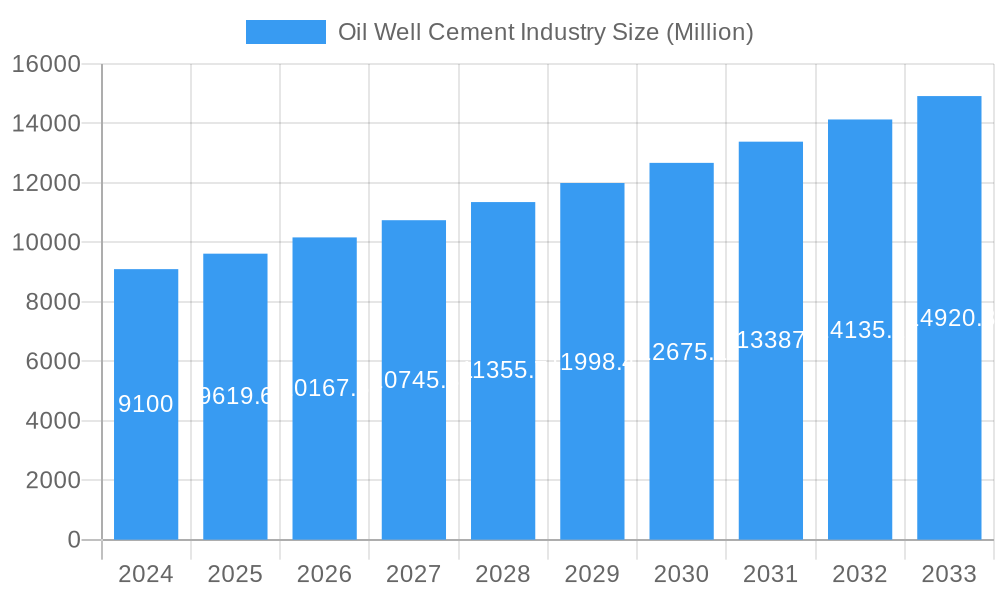

The global oil well cementing market is projected for robust expansion, with a market size of USD 9.1 billion in 2024, anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This sustained growth is largely propelled by the increasing global demand for oil and gas, necessitating continuous exploration and production activities. Key drivers include the persistent need for well integrity and zonal isolation, which are critical for safe and efficient hydrocarbon extraction. Furthermore, advancements in cementing technologies, such as the development of high-performance slurries and specialized additives, are enhancing operational efficiency and well longevity, further stimulating market demand. The industry is also witnessing a significant trend towards the development of environmentally friendly cementing solutions and sophisticated data analytics for predictive maintenance and performance optimization.

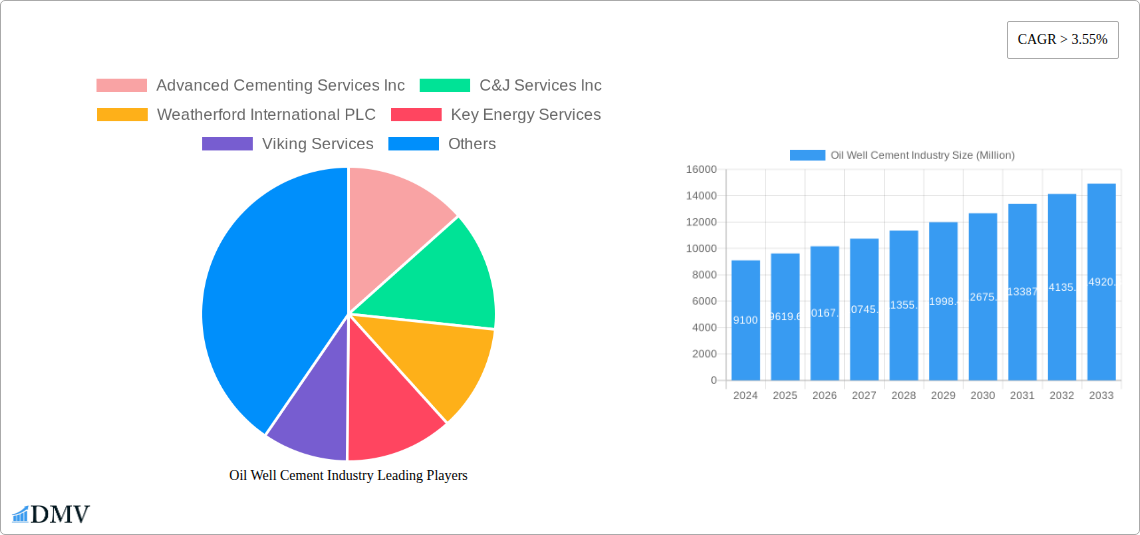

Oil Well Cement Industry Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints, including the fluctuating prices of crude oil, which can impact exploration and drilling budgets, thereby affecting demand for cementing services. Stringent environmental regulations regarding drilling waste disposal and emissions also present a challenge, demanding innovative and sustainable cementing practices. However, the inherent demand for maintaining existing well infrastructure, coupled with the ongoing exploration in both mature and frontier basins, ensures a steady market trajectory. The market is segmented by the location of deployment into onshore and offshore, with onshore activities currently dominating due to accessibility and cost-effectiveness, though offshore operations are expected to see significant growth driven by deepwater exploration. Key segments also include primary cementing and remedial cementing, with increasing emphasis on remedial services to extend the life of mature fields. Major players like Schlumberger, Halliburton, and Baker Hughes are actively investing in research and development to address these challenges and capitalize on emerging opportunities.

Oil Well Cement Industry Company Market Share

Here is an SEO-optimized, insightful report description for the Oil Well Cement Industry, incorporating your specified keywords, values, headings, and structural requirements.

Report Title: Global Oil Well Cement Industry Market Analysis 2024-2033: Trends, Innovations, and Future Outlook

Report Description:

Dive deep into the dynamic oil well cement industry with this comprehensive market analysis. Spanning 2019–2033, with a base year of 2025, this report provides unparalleled insights into the oil and gas cementing market. Understand the intricate market composition, evolving industry trends, and critical product innovations shaping the sector. Analyze growth drivers, market obstacles, and the immense future opportunities within this vital segment of the energy landscape. This report offers a granular look at onshore and offshore deployments, primary and remedial cementing types, and the strategic maneuvers of leading oilfield service companies. Essential for stakeholders seeking to capitalize on the oil and gas well construction and cementing solutions market, this study delivers actionable intelligence for robust strategic planning. The forecast period of 2025–2033 details projected market trajectories and investment potential, making this an indispensable resource for navigating the future of oil well cementing.

Oil Well Cement Industry Market Composition & Trends

The global oil well cement industry exhibits a moderately concentrated market, with major players like Halliburton Company and Schlumberger Limited dominating a significant portion of market share, estimated to be in the range of 30-40 billion. Innovation remains a key catalyst, driven by the demand for advanced cementing solutions that enhance well integrity and reduce environmental impact. Regulatory landscapes are increasingly favoring sustainable practices, pushing companies towards developing reduced Portland cement systems and environmentally friendly additives. Substitute products are limited due to the critical role of cement in well construction, but advancements in alternative sealing technologies are being closely monitored. End-user profiles span major national oil companies (NOCs) and international oil companies (IOCs) requiring robust oilfield services. Merger and acquisition (M&A) activities are sporadic but strategically significant, often aimed at consolidating market share or acquiring specialized technologies, with recent deal values estimated to range between 500 million to 1 billion.

- Market Concentration: Dominated by key players, with a significant portion of market share held by the top 5 companies.

- Innovation Catalysts: Demand for enhanced well integrity, improved operational efficiency, and sustainable cementing materials.

- Regulatory Landscapes: Increasing focus on environmental regulations and safety standards influencing product development.

- Substitute Products: Limited direct substitutes for primary cementing functions, but ongoing research into alternative wellbore integrity solutions.

- End-User Profiles: Major NOCs and IOCs, independent exploration and production (E&P) companies.

- M&A Activities: Strategic acquisitions to enhance technological capabilities and market reach.

Oil Well Cement Industry Industry Evolution

The oil well cement industry has undergone a significant transformation over the historical period of 2019–2024, characterized by evolving market growth trajectories and a steady stream of technological advancements. Initially, the market experienced fluctuations tied to global crude oil prices and drilling activity. However, the increasing complexity of exploration in challenging environments, such as deepwater offshore and unconventional onshore formations, has spurred demand for high-performance cementing services. The adoption of advanced cementing additives, such as dispersants, fluid loss control agents, and retarders, has become standard practice to ensure optimal cement slurries tailored for specific well conditions. The base year of 2025 sees the market poised for sustained growth, with projected annual growth rates of approximately 3-5%. This growth is further fueled by advancements in cementing technology aimed at improving zonal isolation, preventing casing corrosion, and enhancing the overall lifespan of oil and gas wells. The shift towards more environmentally conscious practices has also driven innovation in low-density cement formulations and the development of specialized cements for depleted reservoirs or wells with high-pressure, high-temperature (HPHT) conditions. Consumer demand, driven by the imperative for safe and efficient well construction and abandonment, continues to shape the industry's evolution, pushing for greater reliability and reduced operational risks. The total market valuation is projected to reach over 15 billion in 2025.

Leading Regions, Countries, or Segments in Oil Well Cement Industry

The oil well cement industry is largely defined by its deployment location and the type of cementing operation. Within the Location of Deployment segment, Onshore operations currently hold the dominant market share, estimated to be around 60-65 billion in 2025. This dominance is attributed to the vast number of onshore wells drilled globally, particularly in established and emerging E&P regions. However, the Offshore segment is experiencing robust growth, driven by the exploration of deepwater reserves and the increasing focus on marginal fields. The Type of cementing operation also dictates market dynamics. Primary cementing, crucial for the initial construction of a wellbore to ensure zonal isolation and structural integrity, accounts for the largest share of the market, estimated at approximately 55-60 billion in 2025. Remedial cementing, which addresses issues like leaks, poor cement jobs, or wellbore damage, represents a smaller but critical segment, valued at around 10-15 billion in 2025. Other types, including those for specialized applications like well abandonment or intervention, contribute to the remaining market share.

Dominant Segment: Onshore Deployment

- Key Drivers: Extensive global drilling activity, presence of mature hydrocarbon basins, cost-effectiveness compared to offshore operations, and regulatory support for domestic resource development.

- In-depth Analysis: The sheer volume of conventional oil and gas extraction from onshore reservoirs, coupled with the ongoing development of unconventional resources like shale gas and tight oil, solidifies the onshore segment's lead. Infrastructure development and accessibility also contribute to its prevalence.

Growing Segment: Offshore Deployment

- Key Drivers: Exploration of deepwater reserves, enhanced oil recovery (EOR) projects in offshore fields, and the strategic importance of offshore production for energy security.

- In-depth Analysis: While more capital-intensive and technically challenging, offshore exploration continues to unlock significant hydrocarbon potential. Advancements in offshore drilling technology and floating production systems are making deeper waters more accessible, driving demand for specialized offshore cementing solutions.

Dominant Type: Primary Cementing

- Key Drivers: Essential for well integrity and production efficiency, regulatory requirements for wellbore sealing, and the foundational role in new well construction.

- In-depth Analysis: Every new oil and gas well necessitates primary cementing to isolate hydrocarbon and water zones, prevent fluid migration, and support the casing. The continuous drilling of new wells globally ensures a consistent and substantial demand for primary cementing services and materials.

Critical Type: Remedial Cementing

- Key Drivers: Addressing well integrity issues, enhancing production from existing wells, and extending the productive life of mature fields.

- In-depth Analysis: As wells age or encounter operational challenges, remedial cementing becomes vital for maintaining production and ensuring environmental compliance. This segment, though smaller, represents a recurring and often high-value service.

Oil Well Cement Industry Product Innovations

Recent product innovations in the oil well cement industry are significantly enhancing well integrity and operational efficiency. Halliburton Company's introduction of NeoCem E+ and EnviraCem cement barrier systems exemplifies this trend. These systems are designed as high-performance, reduced Portland cement alternatives, synergistically combining specialized materials with Portland cement. This innovative tailoring process results in lower-density systems that maintain high compressive strength and ductility, ultimately improving barrier reliability and reducing the environmental footprint. These advancements are critical for meeting the growing demand for sustainable and effective cementing solutions across diverse geological conditions.

Propelling Factors for Oil Well Cement Industry Growth

Several key factors are propelling the oil well cement industry forward.

- Increasing Global Energy Demand: Continued reliance on oil and gas necessitates ongoing exploration and production, driving the demand for well construction and cementing services.

- Technological Advancements: Innovations in cement slurries, additives, and application techniques are improving wellbore integrity, operational efficiency, and safety.

- Development of Unconventional Resources: The extraction of shale gas and tight oil requires specialized cementing solutions, expanding market opportunities.

- Focus on Well Integrity and Environmental Compliance: Stricter regulations and a growing emphasis on responsible resource development are driving the adoption of advanced and sustainable cementing technologies.

- Growth in Offshore Exploration: The pursuit of deepwater reserves and marginal fields creates demand for sophisticated offshore cementing expertise.

Obstacles in the Oil Well Cement Industry Market

Despite its growth, the oil well cement industry faces several obstacles.

- Volatility in Oil and Gas Prices: Fluctuations in crude oil prices can directly impact exploration and production budgets, leading to reduced drilling activity and, consequently, lower demand for cementing services.

- Stringent Environmental Regulations: Evolving environmental standards and the increasing scrutiny of carbon emissions can lead to higher compliance costs and necessitate the development of greener cementing solutions.

- Supply Chain Disruptions: Global supply chain issues, geopolitical instability, and raw material availability can impact the timely delivery of essential cementing materials and equipment.

- Skilled Labor Shortages: The industry requires a skilled workforce for complex cementing operations, and a lack of qualified personnel can hinder operational capacity.

- Competition from Alternative Technologies: While limited, ongoing advancements in alternative wellbore sealing and completion technologies pose a potential long-term challenge.

Future Opportunities in Oil Well Cement Industry

The oil well cement industry is poised for significant future opportunities.

- Growth in Emerging Markets: Increased exploration and production activities in regions like the Middle East, Asia-Pacific, and Africa present substantial growth potential for oilfield services and cementing solutions.

- Development of Low-Carbon and Sustainable Cementing: Growing demand for environmentally friendly practices will drive innovation and market penetration for reduced Portland cement systems and greener additives.

- Advanced Digitalization and Automation: Implementing AI, IoT, and automation in cementing operations can enhance efficiency, safety, and data-driven decision-making.

- Enhanced Oil Recovery (EOR) Techniques: The increasing focus on maximizing recovery from mature fields will drive demand for specialized cementing and stimulation services.

- Well Abandonment and Decommissioning: As older fields are retired, the growing need for secure and environmentally sound well abandonment will create a consistent market for specialized cementing expertise.

Major Players in the Oil Well Cement Industry Ecosystem

- Advanced Cementing Services Inc

- BJ Services Company

- Baker Hughes Company

- C&J Services Inc

- China Oilfield Services Limited

- Halliburton Company

- Key Energy Services

- NESR Energy Services (Included as per ADNOC agreement context)

- Schlumberger Limited

- Sanjel Energy Services

- Superior Oilfield Services Inc

- Trican Well Services Corporation

- Viking Services

- Weatherford International PLC

- Emirates Western Oil Well Drilling & Maintenance Co. (Included as per ADNOC agreement context)

- Emjel Oil Field Services (Included as per ADNOC agreement context)

Key Developments in Oil Well Cement Industry Industry

- November 2022: Halliburton Company introduced NeoCem E+ and EnviraCem cement barrier systems for oil and gas applications. These systems are part of its portfolio of high-performance, reduced Portland cement systems. They combine specialized materials with Portland cement to achieve synergies between their chemical and physical properties. These reduced Portland systems were engineered by Halliburton using an innovative tailoring process to deliver high performance, compressive strength, and ductility at a lower density than conventional systems, thus enhancing barrier reliability.

- March 2022: The Abu Dhabi National Oil Company (ADNOC) signed framework agreements worth USD 658 million for cementing. This decision was made to facilitate drilling growth and expand crude oil production. As a result of a competitive filtering process, framework agreements were awarded to Halliburton Worldwide Limited Abu Dhabi, Baker Middle East, Emirates Western Oil Well Drilling & Maintenance Co., NESR Energy Services, and Emjel Oil Field Services.

Strategic Oil Well Cement Industry Market Forecast

The oil well cement industry market is projected for robust growth driven by increasing global energy demand and the essential nature of well construction. Future opportunities lie in the development and adoption of sustainable, low-carbon cementing solutions, particularly reduced Portland cement systems, which align with evolving environmental regulations and corporate sustainability goals. Technological advancements in digitalization and automation will further enhance operational efficiency and safety, while the growing emphasis on maximizing recovery from mature fields through Enhanced Oil Recovery (EOR) techniques will sustain demand for specialized cementing services. The expansion of exploration activities in emerging markets and the critical need for well abandonment services will collectively contribute to a positive market outlook, with an estimated market valuation to exceed 20 billion by 2033.

Oil Well Cement Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Primary

- 2.2. Remedial

- 2.3. Other Types

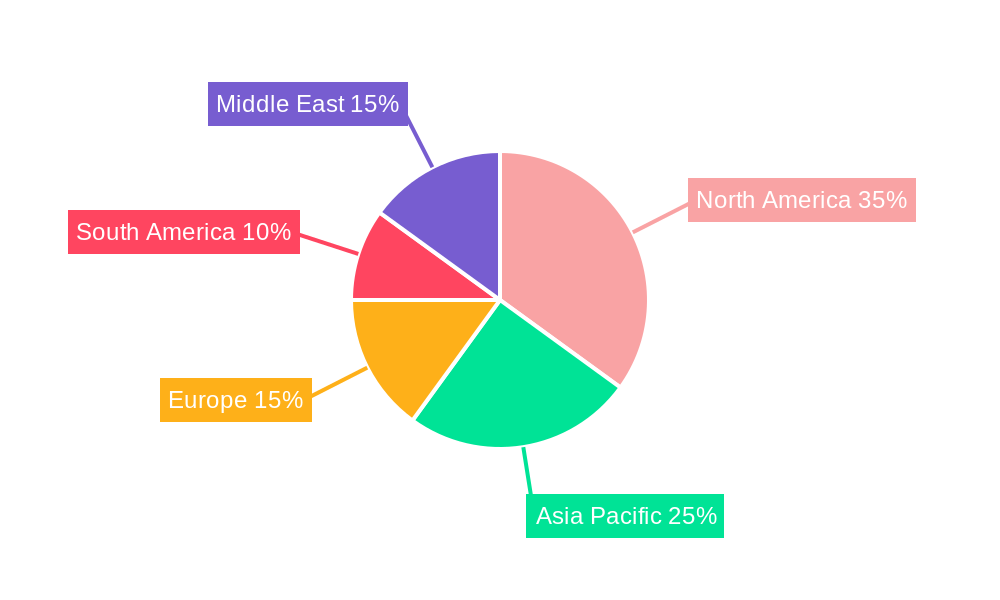

Oil Well Cement Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East

Oil Well Cement Industry Regional Market Share

Geographic Coverage of Oil Well Cement Industry

Oil Well Cement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Energy Demand4.; Government Support for Power Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Financial Viability

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Primary

- 5.2.2. Remedial

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Primary

- 6.2.2. Remedial

- 6.2.3. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Asia Pacific Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Primary

- 7.2.2. Remedial

- 7.2.3. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Primary

- 8.2.2. Remedial

- 8.2.3. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. South America Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Primary

- 9.2.2. Remedial

- 9.2.3. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Middle East Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Primary

- 10.2.2. Remedial

- 10.2.3. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Advanced Cementing Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 C&J Services Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weatherford International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Key Energy Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viking Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Oilfield Services Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halliburton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BJ Services Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Superior Oilfield Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanjel Energy Services*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Calfrac Well Services Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Trican Well Services Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Advanced Cementing Services Inc

List of Figures

- Figure 1: Global Oil Well Cement Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 3: North America Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 9: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 10: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 15: Europe Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: Europe Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 21: South America Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 22: South America Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 23: South America Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 27: Middle East Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 28: Middle East Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Oil Well Cement Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 5: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 11: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 14: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 17: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil Well Cement Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Oil Well Cement Industry?

Key companies in the market include Advanced Cementing Services Inc, C&J Services Inc, Weatherford International PLC, Key Energy Services, Viking Services, Baker Hughes Company, China Oilfield Services Limited, Halliburton Company, BJ Services Company, Schlumberger Limited, Superior Oilfield Services Inc, Sanjel Energy Services*List Not Exhaustive, Calfrac Well Services Ltd, Trican Well Services Corporation.

3. What are the main segments of the Oil Well Cement Industry?

The market segments include Location of Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Energy Demand4.; Government Support for Power Sector.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Financial Viability.

8. Can you provide examples of recent developments in the market?

November 2022: Halliburton Company introduced NeoCem E+ and EnviraCem cement barrier systems for oil and gas applications as part of its portfolio of high-performance, reduced Portland cement systems. These new systems combine specialized materials with Portland cement to achieve synergies between their chemical and physical properties. These reduced Portland systems were engineered by Halliburton using an innovative tailoring process to deliver high performance, compressive strength, and ductility at a lower density than conventional systems, thus enhancing barrier reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil Well Cement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil Well Cement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil Well Cement Industry?

To stay informed about further developments, trends, and reports in the Oil Well Cement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence