Key Insights

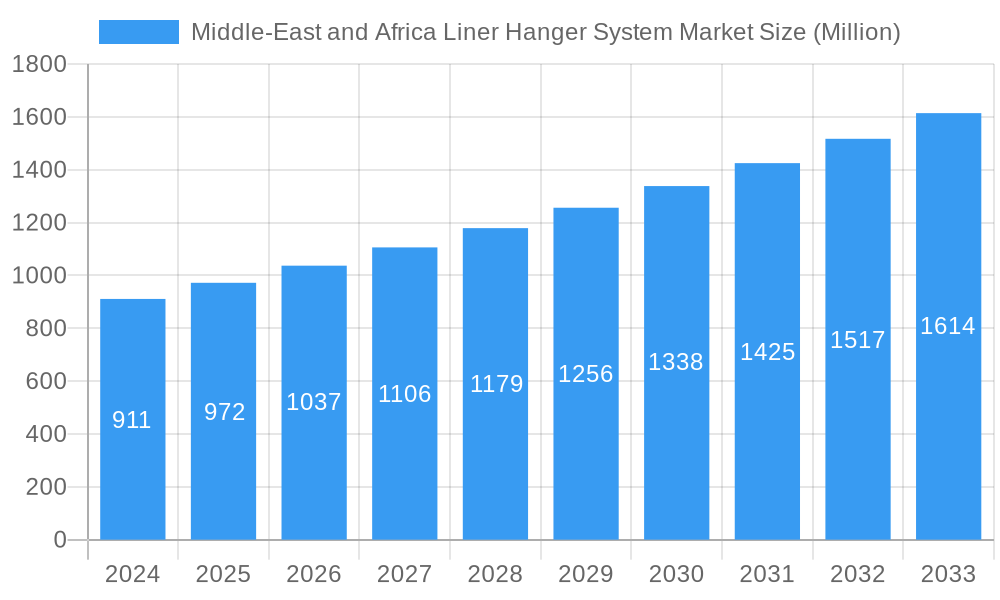

The Middle East and Africa (MEA) Liner Hanger System market is poised for significant growth, driven by increasing upstream oil and gas exploration and production activities across the region. With an estimated market size of $911 million in 2024, the sector is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 6.7% through 2033. This expansion is fueled by the ongoing need for efficient wellbore integrity and production optimization in both conventional and expandable liner hanger systems. Offshore deployments are a key focus, particularly in regions like the United Arab Emirates and Saudi Arabia, where major projects are underway to tap into vast hydrocarbon reserves. Onshore activities also remain a critical component, supported by the extensive existing infrastructure and continued development in countries such as Nigeria and other nations within the Middle East and Africa. The demand for advanced liner hanger solutions is further propelled by the pursuit of enhanced oil recovery techniques and the need to reduce operational downtime and costs associated with well construction and maintenance.

Middle-East and Africa Liner Hanger System Market Market Size (In Million)

The market's trajectory is also influenced by several key trends, including the adoption of intelligent and automated liner hanger systems that offer remote monitoring and control capabilities, thereby improving safety and efficiency. Furthermore, the increasing focus on maximizing resource extraction from mature fields and the development of challenging environments necessitate the use of sophisticated liner hanger technologies. While the market is experiencing strong tailwinds, certain restraints, such as fluctuating oil prices and stringent environmental regulations, could pose challenges. However, the inherent demand for reliable wellbore solutions in a region heavily reliant on its oil and gas sector ensures sustained growth. Key players like Schlumberger Limited, Baker Hughes Ltd, and Halliburton Company are at the forefront, innovating and competing to capture market share through technological advancements and strategic expansions, solidifying the MEA Liner Hanger System market as a dynamic and expanding segment of the global oilfield services industry.

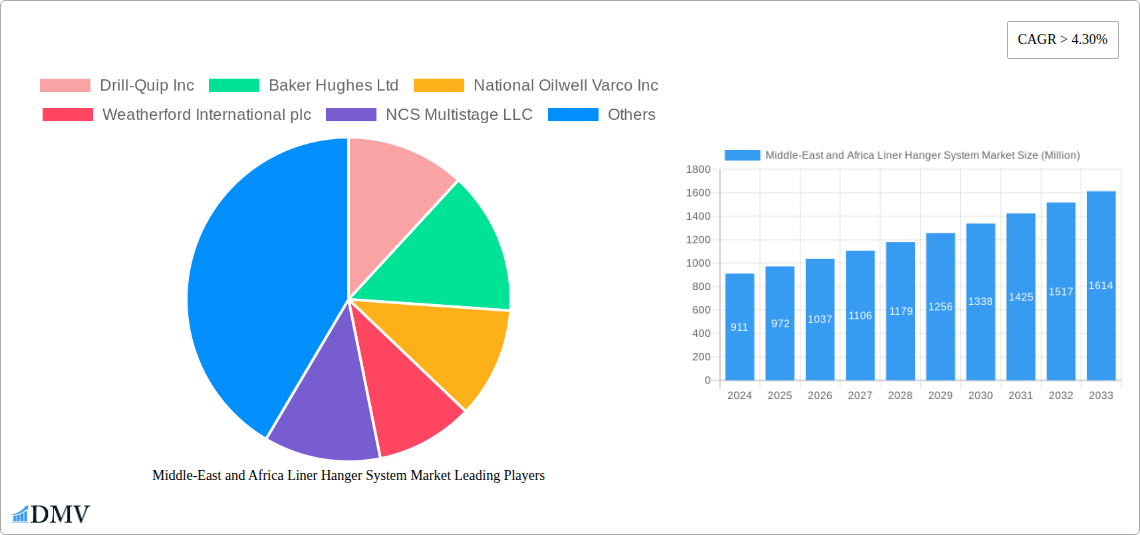

Middle-East and Africa Liner Hanger System Market Company Market Share

This in-depth market research report offers a definitive analysis of the Middle-East and Africa liner hanger system market, providing critical insights into its current landscape, historical performance, and future projections. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand the dynamics of oil and gas drilling, well construction, and subsurface completion solutions across the region. Discover market trends, technological advancements, key player strategies, and critical growth opportunities within this vital sector.

Middle-East and Africa Liner Hanger System Market Market Composition & Trends

The Middle-East and Africa liner hanger system market is characterized by a moderate to high concentration, with a few prominent players dominating the landscape. Innovation in the sector is primarily driven by the increasing demand for enhanced oil recovery (EOR) techniques and the development of more complex and challenging well structures, particularly in deepwater and unconventional reservoirs. Regulatory frameworks, while evolving, generally support the growth of the oil and gas industry, influencing the adoption of advanced drilling technologies. Substitute products are limited due to the specialized nature of liner hanger systems, but advancements in integrated wellbore construction could offer indirect competition. End-user profiles predominantly consist of national oil companies (NOCs) and major international oil companies (IOCs) with significant exploration and production (E&P) activities. Mergers and acquisitions (M&A) activities, while not a constant feature, are strategically employed by key companies to expand their service portfolios and geographic reach. The estimated market share distribution highlights the significant influence of key players in driving technological adoption and market growth. M&A deal values are typically substantial, reflecting the strategic importance of acquiring specialized well completion technologies and client relationships within the oilfield services sector.

Middle-East and Africa Liner Hanger System Market Industry Evolution

The Middle-East and Africa liner hanger system market has witnessed significant evolution, driven by the region's immense hydrocarbon reserves and the continuous pursuit of efficient and cost-effective oil and gas exploration and production. Over the historical period of 2019–2024, the market experienced steady growth, fueled by increased upstream investments and a persistent need for reliable wellbore integrity solutions. The base year of 2025 marks a pivotal point, with projected advancements expected to accelerate market expansion. Technological advancements have been a cornerstone of this evolution. The transition from traditional conventional liner hanger systems to more sophisticated and reliable expandable liner hanger systems has been a significant trend. Expandable systems offer superior zonal isolation, reduced operational time, and enhanced wellbore stability, making them increasingly preferred for complex well designs and challenging formations. This shift is supported by continuous research and development efforts aimed at improving material science, deployment mechanisms, and sealing technologies.

Shifting consumer demands, primarily from oil and gas operators, are placing a greater emphasis on solutions that minimize non-productive time (NPT), reduce operational costs, and enhance safety and environmental performance. This has spurred the development of integrated solutions and intelligent completions, where liner hanger systems play a crucial role in ensuring the integrity and functionality of the entire wellbore. Furthermore, the increasing complexity of offshore projects and the exploration of unconventional resources in regions like the Rest of Middle-East and Africa are creating new avenues for market growth. The adoption rate of advanced liner hanger technologies, such as those offering remote activation and real-time monitoring capabilities, is expected to rise considerably. Market growth trajectories are closely linked to global oil price fluctuations, government policies promoting foreign investment in the E&P sector, and the overall health of the global energy market.

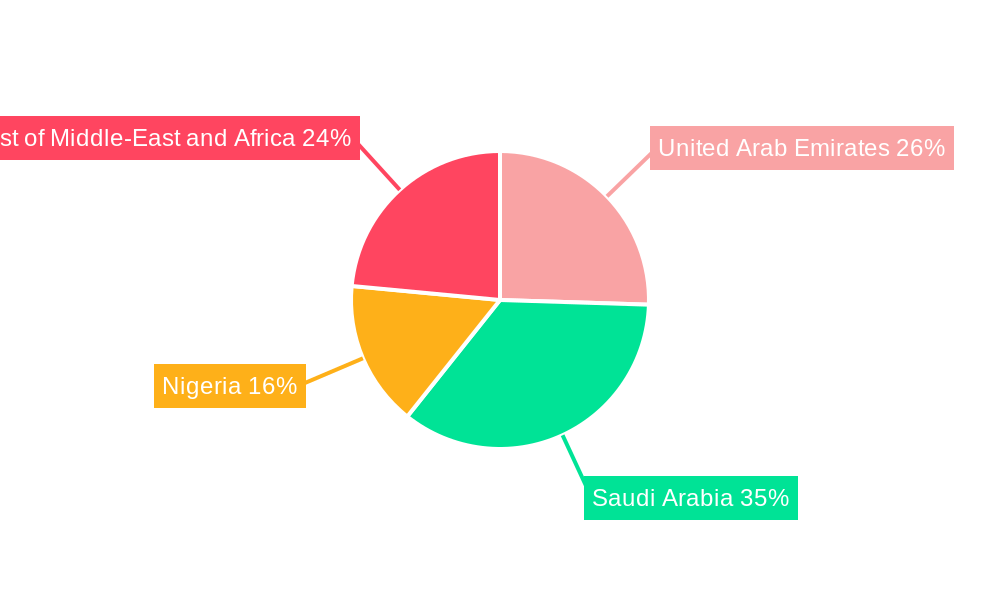

Leading Regions, Countries, or Segments in Middle-East and Africa Liner Hanger System Market

The Middle-East and Africa liner hanger system market is a dynamic landscape, with significant regional variations in demand and adoption. Among the specified geographies, Saudi Arabia stands out as a dominant force in the liner hanger system market. This leadership is attributed to its vast oil and gas reserves, consistent high levels of upstream investment by the national oil company, Saudi Aramco, and its commitment to maintaining and enhancing its production capacity. The country's extensive exploration and production activities necessitate a robust and reliable supply of advanced well completion technologies, including liner hangers.

Key drivers for Saudi Arabia's dominance include:

- Massive Oil Reserves and Production: As one of the world's largest oil producers, Saudi Arabia consistently requires a high volume of well interventions and new well constructions, directly translating into significant demand for liner hanger systems.

- Strategic Investments in Upstream: Saudi Aramco's continuous investment in enhancing production, exploring new fields, and maintaining existing infrastructure ensures a steady pipeline of projects requiring sophisticated wellbore completion equipment.

- Technological Adoption: The country is a key adopter of advanced drilling and completion technologies, including specialized liner hanger systems designed for challenging environments and extended well life.

- Government Support for the Oil and Gas Sector: Policies that prioritize the oil and gas industry provide a stable environment for growth and technological advancements.

In terms of segments, conventional liner hanger systems continue to hold a substantial market share due to their proven reliability and cost-effectiveness for a wide range of applications. However, the expandable liner hanger systems segment is experiencing rapid growth. This surge is driven by their superior performance in providing enhanced zonal isolation, enabling longer horizontal laterals, and improving overall wellbore integrity, especially in complex offshore and unconventional onshore plays. The onshore deployment location remains the largest segment by volume, reflecting the vast land-based oil and gas fields across the region. Nevertheless, the offshore segment is projected to witness higher growth rates, fueled by the increasing development of deepwater and ultra-deepwater reserves in the Persian Gulf and along the coastlines of Africa. The United Arab Emirates and Nigeria are also significant markets, each with their unique drivers for liner hanger system demand, including substantial offshore operations in the UAE and a mature onshore and developing offshore sector in Nigeria.

Middle-East and Africa Liner Hanger System Market Product Innovations

Product innovations in the Middle-East and Africa liner hanger system market are heavily focused on enhancing reliability, efficiency, and safety. Manufacturers are developing advanced materials for improved corrosion resistance and higher pressure-temperature ratings. Key innovations include self-setting and remotely activated liner hanger systems, which reduce operational risks and rig time by eliminating the need for mechanical manipulation. Furthermore, integrated liner hanger systems that combine multiple wellbore functions, such as cementing and stimulation, are gaining traction. These advancements directly impact performance metrics by ensuring superior zonal isolation, minimizing fluid migration, and extending the operational life of wells, thereby supporting improved oil and gas recovery rates.

Propelling Factors for Middle-East and Africa Liner Hanger System Market Growth

The Middle-East and Africa liner hanger system market is propelled by several key factors. Firstly, the region's vast proven hydrocarbon reserves continue to drive sustained investment in exploration and production (E&P) activities. Secondly, the increasing complexity of new well designs, including extended reach drilling and horizontal wells, necessitates the use of advanced liner hanger technologies for effective zonal isolation and wellbore integrity. Thirdly, favorable government policies and initiatives aimed at attracting foreign direct investment in the oil and gas sector across countries like Saudi Arabia and the United Arab Emirates create a conducive environment for market expansion. Lastly, the growing adoption of expandable liner hanger systems due to their efficiency and reliability in challenging well conditions is a significant growth catalyst.

Obstacles in the Middle-East and Africa Liner Hanger System Market Market

Despite robust growth, the Middle-East and Africa liner hanger system market faces certain obstacles. Geopolitical instability in some parts of the region can disrupt operations and deter investment. Fluctuations in global oil prices can impact E&P budgets, leading to reduced demand for drilling and completion equipment. Stringent environmental regulations and the increasing focus on sustainability are also driving the need for more environmentally friendly solutions, which may require significant R&D investment. Additionally, supply chain disruptions and logistical challenges in remote operational areas can lead to project delays and increased costs. Competition from established global players and emerging local manufacturers also exerts pressure on pricing and market share.

Future Opportunities in Middle-East and Africa Liner Hanger System Market

The Middle-East and Africa liner hanger system market is ripe with future opportunities. The ongoing development of deepwater and ultra-deepwater fields, particularly in the Persian Gulf, presents a significant avenue for growth. The increasing exploration and production of unconventional resources, such as shale gas, will also drive demand for specialized liner hanger systems. Furthermore, the trend towards integrated project management and digital oilfield solutions offers opportunities for suppliers to provide smart and connected liner hanger systems with real-time monitoring capabilities. The expanding infrastructure and downstream projects in the region also indirectly stimulate upstream activities, further boosting demand.

Major Players in the Middle-East and Africa Liner Hanger System Market Ecosystem

- Drill-Quip Inc

- Baker Hughes Ltd

- National Oilwell Varco Inc

- Weatherford International plc

- NCS Multistage LLC

- Halliburton Company

- National-Oilwell Varco Inc

- Schlumberger Limited

- Well Innovation AS

Key Developments in Middle-East and Africa Liner Hanger System Market Industry

- September 2022: Weatherford International plc secured a five-year framework agreement with Abu Dhabi National Oil Company (ADNOC) for directional drilling and logging-while-drilling services. This substantial contract, valued at over USD 400 million with an option for an additional two years, includes the deployment of conventional liner hangers, drill bits, drill pipes, and centrifuges, underscoring the ongoing demand for traditional solutions in major projects.

- March 2022: Saudi Aramco awarded a significant contract to Schlumberger for integrated drilling and well construction services in a gas drilling project. This comprehensive agreement encompasses drilling rigs, advanced technologies, and essential services, including drill bits, liner hanger systems, logging while drilling (LWD) and measurement while drilling (MWD), cementing, drilling fluids, and well completion, highlighting the integrated approach to well construction and the importance of reliable liner hanger systems.

Strategic Middle-East and Africa Liner Hanger System Market Market Forecast

The strategic forecast for the Middle-East and Africa liner hanger system market indicates a robust growth trajectory driven by continued upstream investments in the region's vast hydrocarbon reserves. The increasing demand for efficient wellbore integrity and zonal isolation, particularly in complex offshore and unconventional onshore projects, will fuel the adoption of advanced expandable liner hanger systems. Furthermore, technological innovations, including self-setting and integrated systems, coupled with favorable government policies promoting oil and gas exploration, are expected to be significant growth catalysts. The market is poised for substantial expansion as operators prioritize enhanced oil recovery and operational efficiency, making liner hanger systems a critical component of successful oil and gas production.

Middle-East and Africa Liner Hanger System Market Segmentation

-

1. Type

- 1.1. Conventional

- 1.2. Expandable

-

2. Location of Deployment

- 2.1. Offshore

- 2.2. Onshore

-

3. Geogrpahy

- 3.1. The United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Nigeria

- 3.4. Rest of Middle-East and Africa

Middle-East and Africa Liner Hanger System Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Liner Hanger System Market Regional Market Share

Geographic Coverage of Middle-East and Africa Liner Hanger System Market

Middle-East and Africa Liner Hanger System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Onshore Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Conventional

- 5.1.2. Expandable

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Offshore

- 5.2.2. Onshore

- 5.3. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.3.1. The United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Nigeria

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Drill-Quip Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Baker Hughes Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Oilwell Varco Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Weatherford International plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NCS Multistage LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Halliburton Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 National-Oilwell Varco Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schlumberger Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Well Innovation AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Drill-Quip Inc

List of Figures

- Figure 1: Middle-East and Africa Liner Hanger System Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Liner Hanger System Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 4: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 5: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 6: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 7: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 12: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Location of Deployment 2020 & 2033

- Table 13: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 14: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 15: Middle-East and Africa Liner Hanger System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Saudi Arabia Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Israel Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Qatar Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Qatar Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Kuwait Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Kuwait Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Oman Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Oman Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Bahrain Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Bahrain Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Jordan Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Jordan Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Lebanon Middle-East and Africa Liner Hanger System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Lebanon Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Liner Hanger System Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Middle-East and Africa Liner Hanger System Market?

Key companies in the market include Drill-Quip Inc, Baker Hughes Ltd, National Oilwell Varco Inc, Weatherford International plc, NCS Multistage LLC, Halliburton Company, National-Oilwell Varco Inc, Schlumberger Limited, Well Innovation AS.

3. What are the main segments of the Middle-East and Africa Liner Hanger System Market?

The market segments include Type, Location of Deployment, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region.

6. What are the notable trends driving market growth?

Onshore Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Weatherford International plc received a five-year framework agreement from Abu Dhabi National Oil Company to provide directional drilling and logging-while-drilling services. The drilling process includes the deployment of conventional line hangers, drill bits, drill pipes, centrifuges, etc. The contract is valued at over USD 400 million, and ADNOC has the option to extend the contract for an additional two years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Liner Hanger System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Liner Hanger System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Liner Hanger System Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Liner Hanger System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence