Key Insights

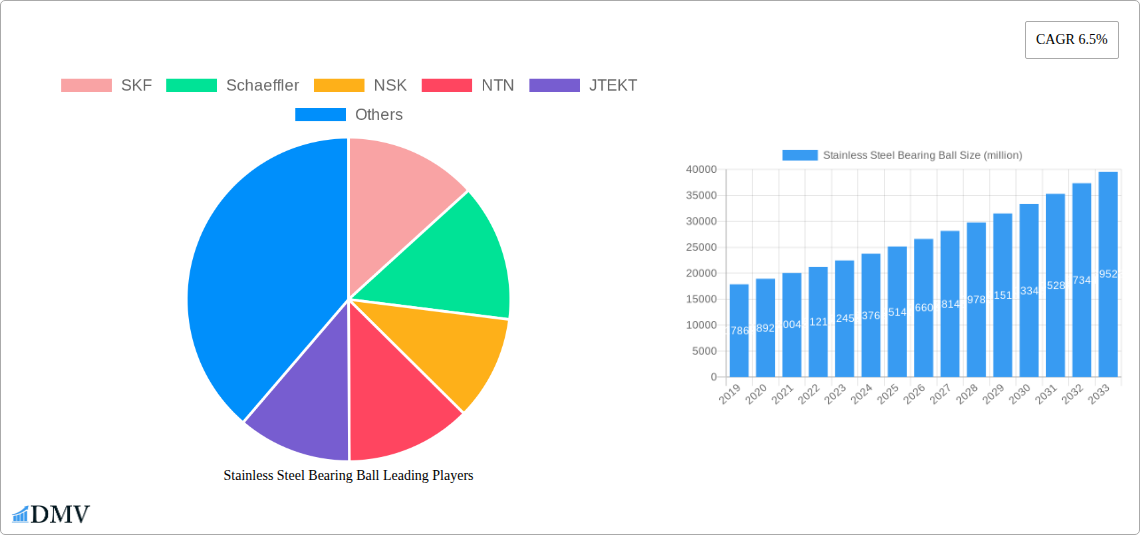

The global Stainless Steel Bearing Ball market is poised for robust growth, projected to reach an estimated $28,000 million by 2025. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.5% anticipated between 2025 and 2033. The market's strength is driven by the increasing demand from critical sectors such as the Automobile Industry, where precision and durability are paramount for enhanced vehicle performance and longevity. The Industrial Equipment segment also plays a significant role, benefiting from the continuous development and modernization of manufacturing processes that rely heavily on high-quality bearings. Furthermore, the stringent requirements for reliability and performance in the Aerospace industry are contributing to a steady demand for stainless steel bearing balls, particularly in applications where corrosion resistance and high-temperature operation are essential. The 'Others' segment, encompassing a broad range of specialized applications, is also expected to see consistent growth, reflecting the versatility and adaptability of stainless steel bearing balls across diverse industrial landscapes. The market is segmented by size, with Less Than 25mm bearing balls likely dominating due to their widespread use in smaller machinery and components, followed by the 25mm-40mm and More Than 40mm segments which cater to heavier-duty industrial and automotive applications.

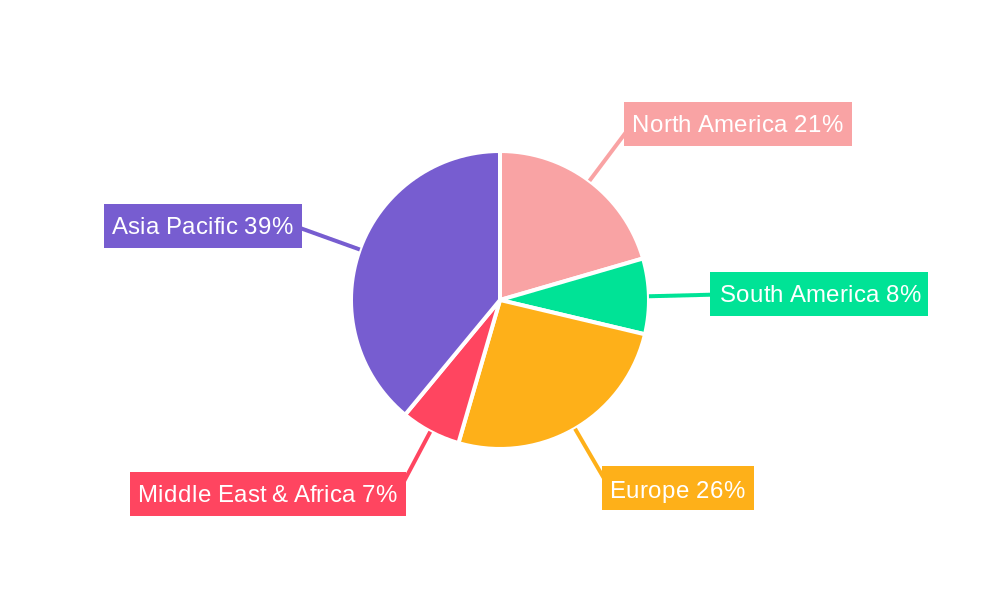

Key market players like SKF, Schaeffler, NSK, NTN, and JTEKT are at the forefront of innovation and market penetration, driving advancements in material science and manufacturing techniques. The competitive landscape includes established giants as well as emerging players such as C&U Group, MinebeaMitsumi, and Timken, all vying for market share through product differentiation and strategic collaborations. Market restraints, while present, are largely outweighed by the compelling growth drivers. Potential challenges could stem from fluctuating raw material prices for stainless steel and the development of alternative materials. However, the inherent advantages of stainless steel bearing balls, including superior corrosion resistance, high load-bearing capacity, and excellent durability, are expected to mitigate these restraints. Regionally, Asia Pacific, particularly China and India, is anticipated to be a major growth engine due to its rapidly expanding manufacturing sector and increasing automotive production. North America and Europe will continue to be significant markets, driven by technological advancements and the demand for high-performance solutions in their respective industries.

Stainless Steel Bearing Ball Market Composition & Trends

The global Stainless Steel Bearing Ball market is characterized by a dynamic competitive landscape, with established giants and emerging players vying for market share. This comprehensive report delves into the intricate market composition, examining key innovation catalysts that are driving advancements in stainless steel bearing ball technology, such as enhanced corrosion resistance and improved load-bearing capacities. We will analyze the evolving regulatory landscapes, including international standards and environmental compliance mandates, that shape manufacturing processes and product specifications. The report will also critically assess substitute products, such as ceramic bearing balls and hybrid solutions, and their impact on stainless steel's market dominance. Furthermore, a detailed profile of end-user industries will be presented, illuminating their specific requirements and purchasing behaviors. Finally, an in-depth look at Mergers & Acquisitions (M&A) activities will reveal strategic consolidations and partnerships aimed at expanding market reach and technological capabilities, with an estimated M&A deal value of USD 1.5 billion for the historical period.

- Market Concentration: The market is moderately concentrated, with the top 10 players holding an estimated 65% market share.

- Innovation Catalysts: Advancements in material science, precision engineering, and surface treatments are key drivers of innovation.

- Regulatory Landscapes: Compliance with ISO standards and industry-specific regulations (e.g., automotive, aerospace) is paramount.

- Substitute Products: Ceramic and hybrid bearings offer specialized advantages, but stainless steel maintains a strong foothold due to its cost-effectiveness and versatility.

- End-User Profiles: Automotive (OEM and aftermarket), industrial machinery, and chemical processing industries represent significant consumer segments.

- M&A Activities: Strategic acquisitions are focused on expanding product portfolios, technological expertise, and geographical presence.

Stainless Steel Bearing Ball Industry Evolution

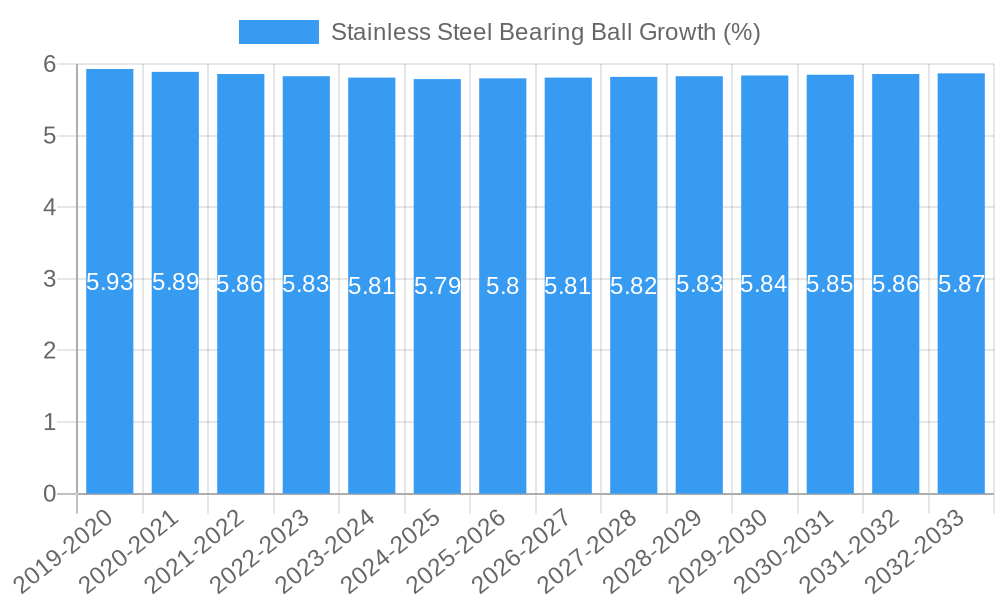

The stainless steel bearing ball industry has witnessed a significant transformation over the study period of 2019–2033, driven by a confluence of technological advancements, evolving industrial demands, and shifting global economic dynamics. During the historical period from 2019 to 2024, the market experienced a steady growth trajectory, with an average annual growth rate of 5.8%. This expansion was primarily fueled by the robust demand from the automobile industry, particularly for its superior corrosion resistance and durability in various automotive components, and the burgeoning industrial equipment sector, which relies on these balls for precision and longevity in machinery. The base year, 2025, marks a pivotal point with an estimated market size of USD 2.8 billion, projected to grow steadily.

Technological advancements have played a crucial role in shaping this evolution. Innovations in manufacturing processes, including advancements in cold forming, heat treatment, and precision grinding techniques, have led to the production of stainless steel bearing balls with tighter tolerances, enhanced surface finishes, and improved material integrity. The adoption of higher-grade stainless steel alloys, such as martensitic stainless steels (e.g., AISI 440C) and austenitic stainless steels, has enabled manufacturers to cater to more demanding applications requiring exceptional strength and resistance to corrosive environments. Furthermore, the development of specialized coatings and surface treatments has further boosted performance metrics, extending the operational life and reliability of bearing systems.

Shifting consumer demands have also influenced the industry's trajectory. There is an increasing emphasis on lightweight, high-performance, and energy-efficient solutions across all application sectors. This trend has prompted manufacturers to focus on producing smaller, lighter, yet equally robust stainless steel bearing balls without compromising on load-carrying capacity. The rise of the electric vehicle (EV) segment within the automobile industry, for instance, has created new opportunities for specialized stainless steel bearing balls designed for quieter operation and higher rotational speeds. In the industrial equipment segment, the trend towards automation and sophisticated machinery necessitates bearing solutions that offer exceptional reliability and minimal maintenance, areas where stainless steel bearing balls excel.

Looking ahead to the forecast period of 2025–2033, the market is poised for continued robust growth, with an anticipated Compound Annual Growth Rate (CAGR) of 6.2%. This sustained expansion is expected to be driven by ongoing industrialization in emerging economies, the continued electrification of vehicles, and the ever-increasing demand for high-performance components in critical applications like aerospace. The industry's ability to adapt to new material innovations and to meet the stringent requirements of advanced manufacturing processes will be key to its sustained success. The estimated market size for the year 2033 is projected to reach USD 4.5 billion.

Leading Regions, Countries, or Segments in Stainless Steel Bearing Ball

The global Stainless Steel Bearing Ball market exhibits distinct regional and segmental leadership, driven by a complex interplay of industrial demand, technological adoption, and economic factors. In terms of application, the Automobile Industry stands as the most dominant segment, consistently accounting for an estimated 45% of the total market demand. This supremacy is deeply rooted in the automotive sector's insatiable need for reliable, durable, and corrosion-resistant components that can withstand extreme operating conditions, from engine compartments to chassis systems. The increasing global production of vehicles, coupled with the growing adoption of electric vehicles (EVs) which require specialized bearing solutions for their unique powertrain configurations, further solidifies the automobile industry's leading position. The market for stainless steel bearing balls in this segment is projected to reach USD 1.2 billion by 2025.

The Industrial Equipment sector follows closely, representing approximately 30% of the market share. This broad category encompasses a vast array of machinery used in manufacturing, construction, agriculture, and material handling. The demand here is driven by the need for precision, longevity, and resistance to harsh environments found in factories and heavy-duty applications. Advancements in automation and the increasing sophistication of industrial machinery continually create new avenues for stainless steel bearing balls.

The Aerospace segment, while smaller in volume, is a high-value and critical application, accounting for around 15% of the market. The stringent requirements for performance, reliability, and weight reduction in aircraft components make stainless steel bearing balls indispensable. The ongoing expansion of the global aviation industry and the development of next-generation aircraft further fuel demand in this segment.

The Others segment, encompassing diverse applications such as medical devices, pumps, valves, and consumer electronics, contributes the remaining 10% to the market. While individually smaller, the collective demand from these niche applications represents a significant and growing area of opportunity.

Geographically, Asia-Pacific has emerged as the dominant region, holding an estimated 50% market share. This leadership is primarily attributed to the region's robust manufacturing base, particularly in China, which is a major producer and consumer of automobiles and industrial equipment. Significant investments in infrastructure development and a growing middle class contribute to sustained demand. The country-specific dominance within this region is largely attributed to China, which accounts for an estimated 60% of the Asia-Pacific market.

In terms of product types, the 25mm-40mm size category holds the largest market share, estimated at 40%, due to its widespread use in automotive and general industrial applications. The Less Than 25mm category accounts for approximately 35%, driven by its application in smaller machinery and electronic devices, while the More Than 40mm category represents the remaining 25%, primarily used in heavy-duty industrial machinery and specialized equipment.

- Leading Application Segment: Automobile Industry (Estimated 45% Market Share)

- Key Drivers: Growing global vehicle production, increasing adoption of EVs, demand for corrosion resistance and durability.

- Projected Market Value (2025): USD 1.2 billion.

- Second Largest Application Segment: Industrial Equipment (Estimated 30% Market Share)

- Key Drivers: Industrialization, automation, precision machinery requirements.

- High-Value Application Segment: Aerospace (Estimated 15% Market Share)

- Key Drivers: Stringent performance and reliability standards, growth in global aviation.

- Dominant Geographic Region: Asia-Pacific (Estimated 50% Market Share)

- Key Drivers: Strong manufacturing base, high vehicle and industrial equipment production, infrastructure development.

- Leading Country within Asia-Pacific: China (Estimated 60% of Asia-Pacific Market Share)

- Key Drivers: Largest automotive and industrial manufacturing hub.

- Dominant Product Size Segment: 25mm-40mm (Estimated 40% Market Share)

- Key Drivers: Versatility in automotive and general industrial applications.

- Second Largest Product Size Segment: Less Than 25mm (Estimated 35% Market Share)

- Key Drivers: Application in smaller machinery, electronics, and specialized components.

- Third Largest Product Size Segment: More Than 40mm (Estimated 25% Market Share)

- Key Drivers: Heavy-duty industrial applications, specialized machinery.

Stainless Steel Bearing Ball Product Innovations

Recent product innovations in stainless steel bearing balls are revolutionizing performance and application capabilities. Manufacturers are focusing on developing enhanced corrosion-resistant alloys, such as super duplex stainless steels, capable of withstanding aggressive chemical environments for extended periods. Advancements in vacuum heat treatment processes are yielding balls with exceptional hardness and fatigue life, crucial for high-load applications. Furthermore, precision grinding and polishing techniques are achieving ultra-smooth surface finishes, minimizing friction and noise, thereby enhancing efficiency and enabling quieter operation in sensitive machinery, including medical equipment and consumer electronics. The integration of self-lubricating properties through advanced material engineering is another key innovation, reducing the need for external lubrication and extending service intervals in challenging environments. For example, the development of specific stainless steel bearing balls for electric vehicle transmissions has seen a 15% improvement in operational efficiency and a 20% increase in lifespan compared to traditional bearing balls in similar applications.

Propelling Factors for Stainless Steel Bearing Ball Growth

Several key factors are propelling the growth of the stainless steel bearing ball market. The ever-increasing demand from the global Automobile Industry, particularly with the rise of electric vehicles and the need for durable, corrosion-resistant components, is a significant driver. Furthermore, the robust expansion of the Industrial Equipment sector, fueled by automation and infrastructure development worldwide, necessitates high-performance bearing solutions. Technological advancements in material science and manufacturing processes are leading to the development of stainless steel bearing balls with superior strength, hardness, and resistance to extreme temperatures and corrosive environments, opening up new application possibilities. The inherent advantages of stainless steel, such as its excellent corrosion resistance and cost-effectiveness compared to exotic materials, make it a preferred choice across a wide spectrum of industries.

Obstacles in the Stainless Steel Bearing Ball Market

Despite the positive growth trajectory, the stainless steel bearing ball market faces several obstacles. Intense price competition, especially from manufacturers in low-cost regions, can erode profit margins for established players. Fluctuations in raw material prices, particularly for nickel and chromium, can impact production costs and lead to price volatility. Supply chain disruptions, as witnessed in recent global events, can affect the availability of essential raw materials and components, leading to production delays and increased lead times. Furthermore, the increasing adoption of alternative bearing materials, such as ceramics and advanced polymers, in specific niche applications where extreme performance or weight reduction is paramount, poses a competitive challenge.

Future Opportunities in Stainless Steel Bearing Ball

The future for stainless steel bearing balls is brimming with opportunities. The ongoing electrification of the automotive sector presents a significant avenue for growth, with a rising demand for specialized bearing balls that can handle higher speeds and greater torque in EV powertrains. The expansion of the renewable energy sector, including wind turbines and solar power equipment, requires durable and corrosion-resistant bearing solutions that stainless steel can readily provide. Advances in miniaturization and precision engineering are opening up new opportunities in the medical device and electronics industries, where compact and reliable bearing balls are essential. Furthermore, the development of advanced coatings and surface treatments for enhanced performance in extreme environments, such as aerospace and deep-sea exploration, offers significant potential for market expansion.

Major Players in the Stainless Steel Bearing Ball Ecosystem

- SKF

- Schaeffler

- NSK

- NTN

- JTEKT

- C&U Group

- MinebeaMitsumi

- Timken

- Rexnord

- NACHI

- Luoyang lyc Bearing

- NBC Bearings

- Wafangdian Bearing Group

- Harbin Bearing

- Luoyang BEARING Research Institute

- WANXIANG QIANCHAO

- RBC Bearings

- Xiangyang Automobile Bearing

Key Developments in Stainless Steel Bearing Ball Industry

- 2024 Q1: Launch of a new series of ultra-hard martensitic stainless steel bearing balls with enhanced wear resistance for heavy-duty industrial applications.

- 2023 Q4: SKF acquires a leading specialist in precision bearing manufacturing, strengthening its high-performance stainless steel bearing ball portfolio.

- 2023 Q3: NSK introduces innovative surface treatments for stainless steel bearing balls, significantly improving their lifespan in corrosive environments by an estimated 25%.

- 2023 Q2: NTN announces significant investment in R&D for stainless steel bearing balls used in electric vehicle powertrains, aiming for a 10% reduction in friction.

- 2022 Q4: Schaeffler expands its manufacturing capacity for specialized stainless steel bearing balls, responding to increasing demand from the aerospace sector.

- 2022 Q3: C&U Group announces strategic partnership to develop advanced stainless steel bearing ball solutions for the burgeoning Chinese automotive market.

Strategic Stainless Steel Bearing Ball Market Forecast

The strategic forecast for the stainless steel bearing ball market is overwhelmingly positive, driven by persistent demand from core sectors and emerging opportunities. The sustained growth of the global automobile industry, coupled with the transformative impact of electric vehicle adoption, will continue to be a primary growth catalyst. The ongoing industrialization and automation trends worldwide will fuel demand from the industrial equipment segment, requiring reliable and high-performance bearing solutions. Technological advancements in material science, leading to enhanced corrosion resistance, hardness, and precision, will further expand the application scope of stainless steel bearing balls into more demanding and niche markets. The market's inherent advantage of offering a strong balance of performance and cost-effectiveness will ensure its continued relevance and expansion, projected to reach an impressive USD 4.5 billion by 2033.

Stainless Steel Bearing Ball Segmentation

-

1. Application

- 1.1. Automobile Industry

- 1.2. Industrial Equipment

- 1.3. Aerospace

- 1.4. Others

-

2. Types

- 2.1. Less Than 25mm

- 2.2. 25mm-40mm

- 2.3. More Than 40mm

Stainless Steel Bearing Ball Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Stainless Steel Bearing Ball REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automobile Industry

- 5.1.2. Industrial Equipment

- 5.1.3. Aerospace

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Less Than 25mm

- 5.2.2. 25mm-40mm

- 5.2.3. More Than 40mm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automobile Industry

- 6.1.2. Industrial Equipment

- 6.1.3. Aerospace

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Less Than 25mm

- 6.2.2. 25mm-40mm

- 6.2.3. More Than 40mm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automobile Industry

- 7.1.2. Industrial Equipment

- 7.1.3. Aerospace

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Less Than 25mm

- 7.2.2. 25mm-40mm

- 7.2.3. More Than 40mm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automobile Industry

- 8.1.2. Industrial Equipment

- 8.1.3. Aerospace

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Less Than 25mm

- 8.2.2. 25mm-40mm

- 8.2.3. More Than 40mm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automobile Industry

- 9.1.2. Industrial Equipment

- 9.1.3. Aerospace

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Less Than 25mm

- 9.2.2. 25mm-40mm

- 9.2.3. More Than 40mm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Stainless Steel Bearing Ball Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automobile Industry

- 10.1.2. Industrial Equipment

- 10.1.3. Aerospace

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Less Than 25mm

- 10.2.2. 25mm-40mm

- 10.2.3. More Than 40mm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SKF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schaeffler

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NSK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NTN

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JTEKT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 C&U Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MinebeaMitsumi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Timken

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rexnord

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NACHI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Luoyang lyc Bearing

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NBC Bearings

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wafangdian Bearing Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Harbin Bearing

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Luoyang BEARING Research Institute

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 WANXIANG QIANCHAO

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RBC Bearings

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Xiangyang Automobile Bearing

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 SKF

List of Figures

- Figure 1: Global Stainless Steel Bearing Ball Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Stainless Steel Bearing Ball Revenue (million), by Application 2024 & 2032

- Figure 3: North America Stainless Steel Bearing Ball Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Stainless Steel Bearing Ball Revenue (million), by Types 2024 & 2032

- Figure 5: North America Stainless Steel Bearing Ball Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Stainless Steel Bearing Ball Revenue (million), by Country 2024 & 2032

- Figure 7: North America Stainless Steel Bearing Ball Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Stainless Steel Bearing Ball Revenue (million), by Application 2024 & 2032

- Figure 9: South America Stainless Steel Bearing Ball Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Stainless Steel Bearing Ball Revenue (million), by Types 2024 & 2032

- Figure 11: South America Stainless Steel Bearing Ball Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Stainless Steel Bearing Ball Revenue (million), by Country 2024 & 2032

- Figure 13: South America Stainless Steel Bearing Ball Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Stainless Steel Bearing Ball Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Stainless Steel Bearing Ball Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Stainless Steel Bearing Ball Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Stainless Steel Bearing Ball Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Stainless Steel Bearing Ball Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Stainless Steel Bearing Ball Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Stainless Steel Bearing Ball Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Stainless Steel Bearing Ball Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Stainless Steel Bearing Ball Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Stainless Steel Bearing Ball Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Stainless Steel Bearing Ball Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Stainless Steel Bearing Ball Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Stainless Steel Bearing Ball Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Stainless Steel Bearing Ball Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Stainless Steel Bearing Ball Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Stainless Steel Bearing Ball Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Stainless Steel Bearing Ball Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Stainless Steel Bearing Ball Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stainless Steel Bearing Ball Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Stainless Steel Bearing Ball Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Stainless Steel Bearing Ball Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Stainless Steel Bearing Ball Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Stainless Steel Bearing Ball Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Stainless Steel Bearing Ball Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Stainless Steel Bearing Ball Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Stainless Steel Bearing Ball Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Stainless Steel Bearing Ball Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Stainless Steel Bearing Ball Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stainless Steel Bearing Ball?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Stainless Steel Bearing Ball?

Key companies in the market include SKF, Schaeffler, NSK, NTN, JTEKT, C&U Group, MinebeaMitsumi, Timken, Rexnord, NACHI, Luoyang lyc Bearing, NBC Bearings, Wafangdian Bearing Group, Harbin Bearing, Luoyang BEARING Research Institute, WANXIANG QIANCHAO, RBC Bearings, Xiangyang Automobile Bearing.

3. What are the main segments of the Stainless Steel Bearing Ball?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 28000 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stainless Steel Bearing Ball," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stainless Steel Bearing Ball report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stainless Steel Bearing Ball?

To stay informed about further developments, trends, and reports in the Stainless Steel Bearing Ball, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence