Key Insights

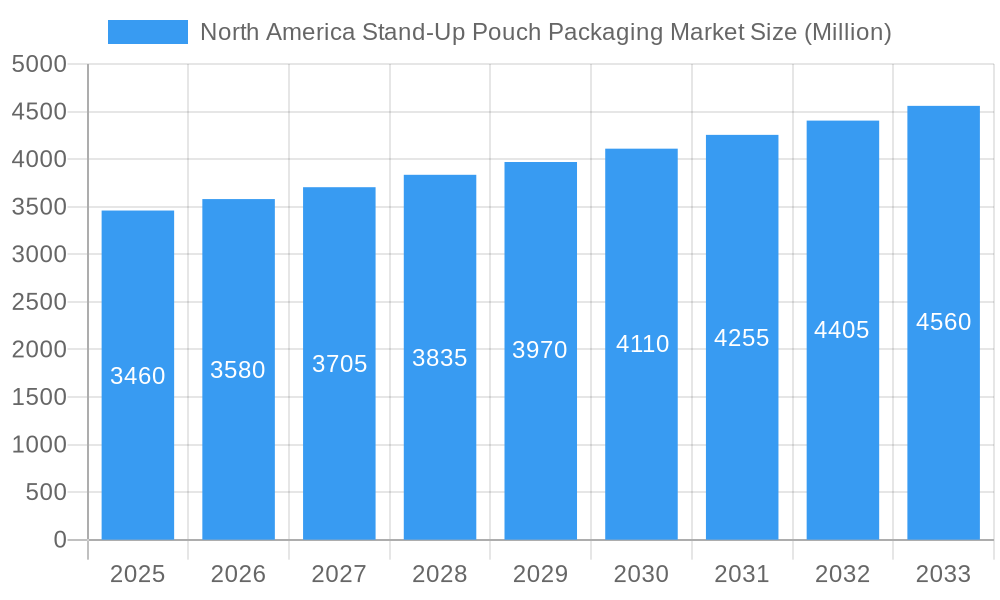

The North American stand-up pouch packaging market, valued at $3.46 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for convenient and sustainable packaging solutions across various end-use sectors, including food, beverages, and personal care, is a significant contributor to market expansion. Consumer preference for single-serve and resealable packaging formats aligns perfectly with the stand-up pouch's inherent attributes, fueling its adoption. Furthermore, advancements in material science, particularly the development of eco-friendly bio-plastics, are creating new opportunities within the market. The rise of e-commerce and the associated need for lightweight, durable, and easily shippable packaging are also bolstering market growth. While potential restraints like fluctuating raw material prices and environmental concerns related to plastic waste exist, innovation in sustainable materials and improved recycling infrastructure are mitigating these challenges. The market segmentation reveals a strong preference for plastic pouches due to their cost-effectiveness and versatility, followed by paper and metal/foil options based on specific product requirements. The dominance of the food and beverage sector highlights the significant role of stand-up pouches in preserving product freshness and extending shelf life. The United States constitutes the largest market share within North America, fueled by a large and diverse consumer base, followed by Canada and Mexico. Looking ahead, a projected CAGR of 3.48% from 2025 to 2033 indicates a positive trajectory for the market, with continued growth expected across all segments and regions.

North America Stand-Up Pouch Packaging Market Market Size (In Billion)

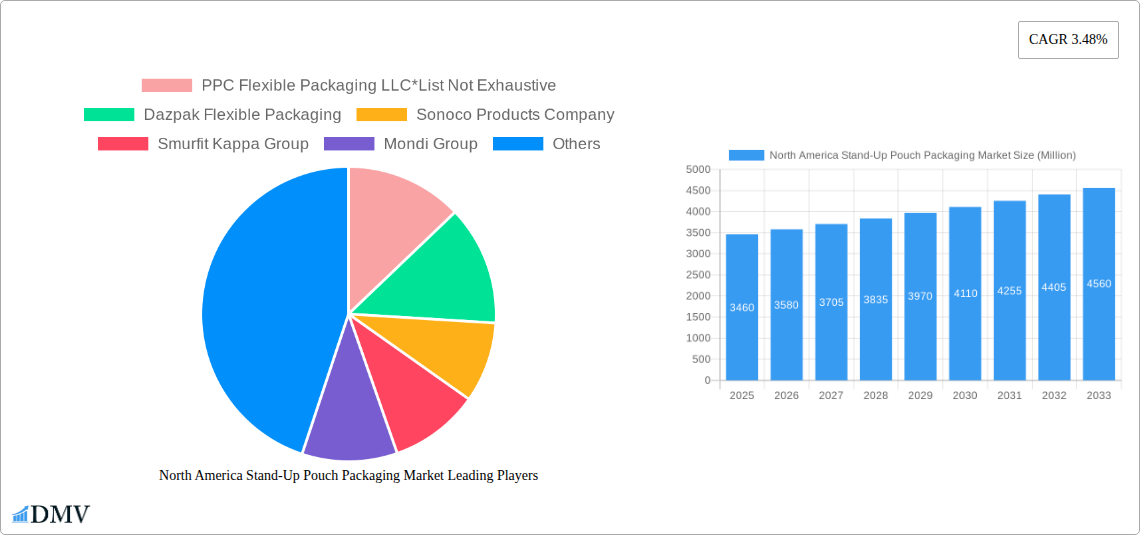

The competitive landscape is characterized by a mix of established multinational players and regional companies. Major players like Amcor PLC, Mondi Group, and Smurfit Kappa Group are leveraging their extensive manufacturing capabilities and global reach to capitalize on market opportunities. Smaller, specialized companies are focusing on niche applications and innovative packaging solutions to gain a competitive edge. Strategic partnerships and mergers and acquisitions are anticipated to shape the market dynamics in the coming years, leading to further consolidation and innovation. The North American market is expected to witness significant investment in automation and technological advancements within packaging manufacturing processes to improve efficiency and meet the growing demands of the market. The focus on sustainable and eco-friendly packaging solutions will continue to influence the choice of materials and manufacturing practices adopted by market players.

North America Stand-Up Pouch Packaging Market Company Market Share

North America Stand-Up Pouch Packaging Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America stand-up pouch packaging market, offering valuable data and projections for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market size, segmentation, competitive landscape, and future growth opportunities. The market is poised for significant expansion, driven by consumer demand for convenient and sustainable packaging solutions. This report is essential for businesses seeking to understand the market dynamics and strategize for future success. The estimated market value in 2025 is expected to reach xx Million.

North America Stand-Up Pouch Packaging Market Market Composition & Trends

This section analyzes the North American stand-up pouch packaging market's competitive intensity, innovation drivers, regulatory environment, substitute products, end-user preferences, and mergers & acquisitions (M&A) activity. The market is moderately concentrated, with several key players holding significant market share. However, the presence of numerous smaller companies fosters competition and innovation.

Market Concentration & M&A Activity:

- Market share distribution: Amcor PLC and Sonoco Products Company hold a combined estimated xx% of the market share in 2025, while other major players such as ProAmpac LLC and Smurfit Kappa Group each hold approximately xx% respectively. The remaining xx% is shared among smaller players and emerging enterprises.

- M&A Deal Values: Recent acquisitions, such as PPC Flexible Packaging's acquisition of StePac in February 2023, demonstrate a trend toward consolidation and expansion within the market. These acquisitions' total value is estimated to be in the range of xx Million.

Innovation & Regulatory Landscape:

- Sustainable packaging is a key innovation driver, with increased demand for recyclable and PCR (Post-Consumer Recycled) materials. Stringent environmental regulations across North America are further pushing this trend.

- Substitute products, such as rigid plastic containers and other flexible packaging formats, pose a competitive threat. However, stand-up pouches’ versatility and convenience maintain their market dominance.

- End-user preferences heavily influence market dynamics. The Food and Beverage sectors remain the largest end-users of stand-up pouches in North America.

North America Stand-Up Pouch Packaging Market Industry Evolution

The North American stand-up pouch packaging market has witnessed significant growth over the past few years, driven by factors such as increasing consumer demand for convenient packaging and advancements in packaging technology. This section provides a detailed overview of the market's growth trajectory and transformation, supported by specific data points.

From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of approximately xx%, reaching an estimated value of xx Million by 2024. The forecasted CAGR for the period 2025-2033 is projected at xx%, indicating continued market expansion. This growth is attributable to several factors, including the rising popularity of ready-to-eat meals, increased demand for sustainable packaging options, and continuous improvements in pouch materials and design. Technological advancements like enhanced barrier properties and improved printing techniques also contribute to this market's expansion. Consumer preferences are shifting towards more convenient and environmentally responsible packaging options, which is directly fueling the growth of the stand-up pouch market. The increasing adoption of e-commerce also plays a pivotal role, as stand-up pouches are well-suited for online retail and shipping.

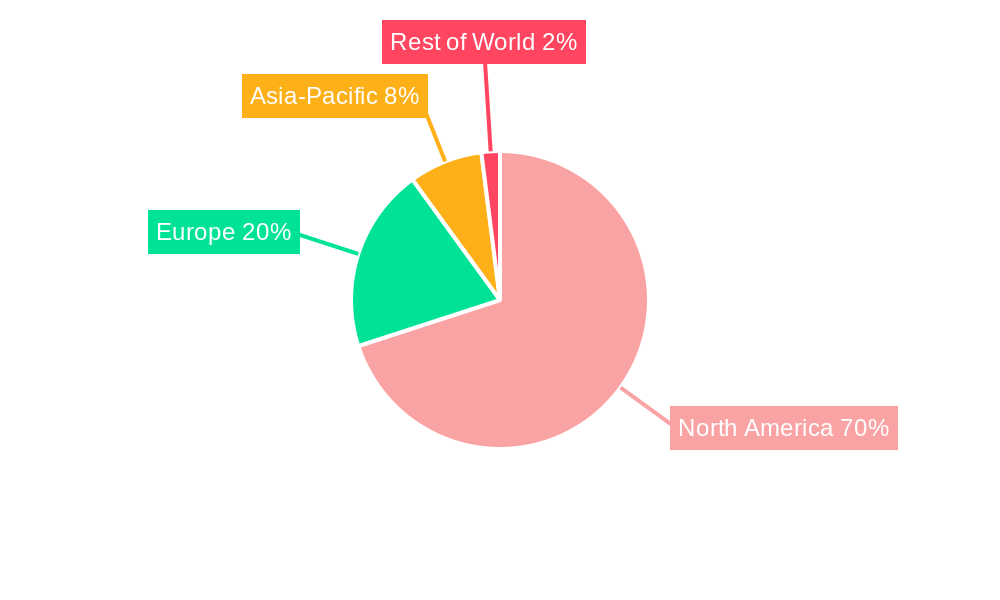

Leading Regions, Countries, or Segments in North America Stand-Up Pouch Packaging Market

The United States constitutes the largest segment of the North American stand-up pouch packaging market, accounting for approximately xx% of the total market share in 2025. Canada follows as the second largest market.

Key Drivers:

United States: Strong consumer demand for convenient food and beverage packaging, robust e-commerce growth, significant investments in advanced packaging technology, and supportive government regulations related to sustainable packaging are major drivers of the US market.

Canada: Growing popularity of ready-to-eat meals, increasing disposable incomes leading to higher spending on packaged goods, and increased focus on environmental sustainability drive the Canadian market.

Dominance Factors:

The dominance of the United States is primarily attributed to its larger population base, higher disposable incomes, established food and beverage industry, and higher adoption rate of e-commerce compared to Canada. The presence of several major packaging companies further solidifies its position as the leading market.

By Segment:

- Pack Type: The standard stand-up pouch segment is the largest, accounting for over xx% of the market due to its affordability and wide range of applications. The retort pouch segment demonstrates faster growth due to the increased demand for shelf-stable foods.

- Material Type: Plastic remains the dominant material, particularly PE, PP, and EVOH, owing to their cost-effectiveness and barrier properties. However, a growing preference for sustainable alternatives, such as bio-plastics and paper-based pouches, is observed.

- End-User: Food and beverage continues to be the largest end-use sector, with significant demand from the ready-to-eat meals and snack segments. The medical and pharmaceutical sectors are also contributing to significant growth due to the increased need for safe and sterile packaging.

North America Stand-Up Pouch Packaging Market Product Innovations

The North American stand-up pouch packaging market is experiencing a dynamic phase of innovation, driven by a strong commitment to both performance and sustainability. A prime example is ProAmpac's introduction of their ProActive PCR retort pouches in November 2023. These advanced pouches significantly integrate up to 30% post-consumer recycled (PCR) material, directly addressing the escalating consumer and industry demand for eco-friendly packaging. Crucially, these innovations do not compromise on essential functionalities; the ProActive PCR pouches maintain the stringent barrier properties and robust heat resistance vital for shelf-stable ready-to-eat products. Beyond this specific advancement, the market is witnessing a surge in the exploration and integration of novel materials. This includes the incorporation of biodegradable polymers that offer a reduced environmental footprint and the development of enhanced barrier technologies utilizing materials like EVOH and specialized coatings. These advancements collectively contribute to improved product shelf life, ensuring that product quality is preserved and contributing to a significant reduction in food waste across the supply chain.

Propelling Factors for North America Stand-Up Pouch Packaging Market Growth

The North American stand-up pouch packaging market is fueled by a confluence of powerful growth drivers. The undeniable rise in the popularity of convenient ready-to-eat meals and single-serve product formats is a primary catalyst, aligning perfectly with modern consumer lifestyles. Simultaneously, there is an intensified and growing demand for sustainable and environmentally responsible packaging solutions, pushing manufacturers to adopt greener alternatives. The relentless pace of advancement in flexible packaging technology, offering improved functionality, aesthetics, and cost-effectiveness, continues to propel the market forward. Furthermore, proactive government regulations and initiatives encouraging the use of eco-friendly and recyclable materials are providing a significant impetus for market expansion. The burgeoning e-commerce sector, with its unique packaging demands, and the increasing consumer preference for on-the-go consumption further solidify and amplify the growth trajectory of this dynamic market.

Obstacles in the North America Stand-Up Pouch Packaging Market Market

Despite its growth potential, the market faces challenges. Fluctuations in raw material prices (particularly plastics) and supply chain disruptions can significantly impact production costs and profitability. Furthermore, stringent environmental regulations and the increasing need for sustainable packaging solutions require continuous innovation and investment. Intense competition among established players and new entrants adds further pressure on profit margins.

Future Opportunities in North America Stand-Up Pouch Packaging Market

The future of the North American stand-up pouch packaging market is brimming with promising opportunities, largely centered around innovation and strategic market expansion. A significant avenue lies in the continued development and widespread adoption of novel, sustainable packaging materials and designs that offer enhanced performance and a reduced environmental impact. Expanding the reach into diverse and growing niche markets, such as the rapidly evolving pet food sector and the substantial home care products segment, presents considerable potential for market players. A strong emphasis on increased investment in research and development of advanced barrier technologies is crucial. These investments will unlock the creation of more effective, longer-lasting packaging solutions that further extend product shelf life and minimize waste. Additionally, tailoring packaging designs specifically for the demands of the burgeoning e-commerce channel, focusing on protection, branding, and ease of delivery, will be a key opportunity to capitalize on the expanding online retail landscape.

Major Players in the North America Stand-Up Pouch Packaging Market Ecosystem

- PPC Flexible Packaging LLC

- Dazpak Flexible Packaging

- Sonoco Products Company

- Smurfit Kappa Group

- Mondi Group

- Amcor PLC

- Clondalkin Group

- Glenroy Inc

- ProAmpac LLC

- Sealed Air Corporation

- Huhtamaki Oyj

Key Developments in North America Stand-Up Pouch Packaging Market Industry

November 2023: ProAmpac solidified its commitment to sustainability with the launch of its ProActive PCR retort pouches. This innovative product line incorporates up to 30% post-consumer recycled (PCR) material, marking a significant step forward for sustainable packaging solutions within the retort pouch segment. This development is anticipated to accelerate the adoption of PCR materials across the broader industry.

February 2023: PPC Flexible Packaging strategically expanded its market presence and product offerings through the acquisition of StePac. This move significantly strengthened PPC Flexible Packaging's position within the sustainable packaging segment and highlights a notable consolidation trend occurring within the industry.

Strategic North America Stand-Up Pouch Packaging Market Forecast

The North American stand-up pouch packaging market is projected to experience substantial growth over the forecast period (2025-2033). Key growth catalysts include the ongoing demand for convenient and sustainable packaging options, continuous advancements in materials science, and the expansion of e-commerce. The market's potential is significant, with ample opportunities for players to capitalize on innovations and meet the evolving needs of consumers and brands. The increasing emphasis on eco-friendly packaging will propel the market toward greater adoption of recycled and biodegradable materials. The projected market value in 2033 is estimated to be xx Million, highlighting its substantial growth potential.

North America Stand-Up Pouch Packaging Market Segmentation

-

1. Pack Type

- 1.1. Standard

- 1.2. Aseptic

- 1.3. Retort

- 1.4. Other Pack Types

-

2. Material Type

- 2.1. Plastic (PE, PP, PVC, EVOH, Bio-Plastics)

- 2.2. Metal/Foil

- 2.3. Paper

-

3. End User

- 3.1. Food

- 3.2. Beverages

- 3.3. Medical and Pharmaceutical

- 3.4. Pet Food

- 3.5. Home and Personal Care

- 3.6. Other End Users

North America Stand-Up Pouch Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Stand-Up Pouch Packaging Market Regional Market Share

Geographic Coverage of North America Stand-Up Pouch Packaging Market

North America Stand-Up Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Demand for Food and Beverage Expected to Grow in North America

- 3.2.2 thereby Contributing to the Market Growth; Standard Pouches Offer a High Level of Convenience (Available in Zipper

- 3.2.3 Slider

- 3.2.4 Spout Packs

- 3.2.5 Etc.) and Require Less Material Volumes as Compared to Alternative

- 3.3. Market Restrains

- 3.3.1. Addition of Sealing Process that Consumes Space and Resources

- 3.4. Market Trends

- 3.4.1. Standard Pack Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stand-Up Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pack Type

- 5.1.1. Standard

- 5.1.2. Aseptic

- 5.1.3. Retort

- 5.1.4. Other Pack Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic (PE, PP, PVC, EVOH, Bio-Plastics)

- 5.2.2. Metal/Foil

- 5.2.3. Paper

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Pet Food

- 5.3.5. Home and Personal Care

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Pack Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PPC Flexible Packaging LLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dazpak Flexible Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Smurfit Kappa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clondalkin Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Glenroy Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ProAmpac LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huhtamaki Oyj

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 PPC Flexible Packaging LLC*List Not Exhaustive

List of Figures

- Figure 1: North America Stand-Up Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Stand-Up Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Pack Type 2020 & 2033

- Table 2: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Pack Type 2020 & 2033

- Table 6: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stand-Up Pouch Packaging Market?

The projected CAGR is approximately 3.48%.

2. Which companies are prominent players in the North America Stand-Up Pouch Packaging Market?

Key companies in the market include PPC Flexible Packaging LLC*List Not Exhaustive, Dazpak Flexible Packaging, Sonoco Products Company, Smurfit Kappa Group, Mondi Group, Amcor PLC, Clondalkin Group, Glenroy Inc, ProAmpac LLC, Sealed Air Corporation, Huhtamaki Oyj.

3. What are the main segments of the North America Stand-Up Pouch Packaging Market?

The market segments include Pack Type, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Food and Beverage Expected to Grow in North America. thereby Contributing to the Market Growth; Standard Pouches Offer a High Level of Convenience (Available in Zipper. Slider. Spout Packs. Etc.) and Require Less Material Volumes as Compared to Alternative.

6. What are the notable trends driving market growth?

Standard Pack Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Addition of Sealing Process that Consumes Space and Resources.

8. Can you provide examples of recent developments in the market?

November 2023 - ProAmpac launched its ProActive PCR retort pouches, a sustainable alternative to conventional retort options. ProActive PCR Retort pouches are designed to reduce virgin plastics usage and contain up to 30% post-consumer recycled (PCR) material by mass. ProActive PCR Retort pouches are specifically designed for products such as shelf-stable ready-to-eat proteins, which demand ultra-high barrier and high-heat resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stand-Up Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stand-Up Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stand-Up Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the North America Stand-Up Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence