Key Insights

The MTBE (Methyl tert-butyl ether) industry, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024, is poised for continued expansion through 2033. This growth is fueled by several key drivers. The increasing demand for high-octane gasoline additives, driven by stricter emission regulations globally, remains a primary factor. The MTBE market benefits from its established role as an effective oxygenate, enhancing fuel combustion efficiency and reducing harmful emissions. Furthermore, expanding petrochemical production capacities in regions like Asia-Pacific and the Middle East are contributing to increased MTBE supply. However, the industry faces challenges. Growing environmental concerns surrounding MTBE's potential groundwater contamination are leading to regulations restricting its use in some regions, thus creating a need for innovative solutions and sustainable alternatives. This necessitates a shift towards cleaner fuel additives and increased focus on responsible production and distribution practices by major players like CNPC, Eni S.p.A., and Reliance Industries. The segmentation of the market likely includes various grades of MTBE based on purity and intended application, further influencing price points and market dynamics. Overall, while regulatory hurdles exist, the long-term outlook for the MTBE market remains positive, driven by persistent demand from the transportation sector and ongoing technological advancements aimed at mitigating environmental concerns. A deeper understanding of regional variations in regulations and consumer preferences is crucial for effective market penetration and strategic planning within this dynamic industry.

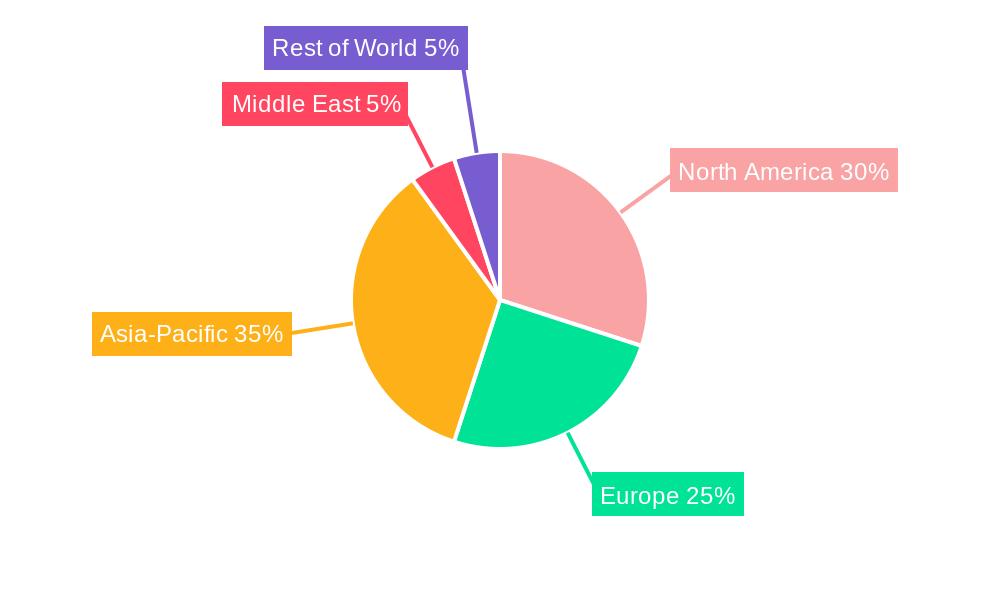

The competitive landscape is dominated by a mix of large integrated oil and gas companies and specialized chemical manufacturers. While a detailed regional breakdown is absent, we can infer strong presence in North America, Europe, and Asia-Pacific given the mentioned companies' operational footprints. The considerable presence of companies such as CNPC, Gazprom Neft, and SABIC suggests a significant market in Asia and the Middle East. The forecast period of 2025-2033 indicates continued growth, though the rate may fluctuate based on evolving environmental regulations and the adoption of alternative fuel additives. Market size estimations for future years require a more granular understanding of regional trends and consumption patterns but the existing CAGR and market drivers strongly suggest a consistently expanding market. Therefore, strategic investment and technological innovation remain key to maintaining competitiveness within this evolving industry landscape.

MTBE Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the MTBE industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to forecast market performance from 2025 to 2033, building upon historical data from 2019 to 2024. This report is crucial for stakeholders seeking to understand the current dynamics and future trajectory of the MTBE market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

MTBE Industry Market Composition & Trends

This section offers a comprehensive analysis of the MTBE market's competitive landscape. We delve into market concentration, identifying key players and their market share. Crucial innovation drivers are explored, alongside the significant impact of evolving regulatory influences and the competitive pressure from substitute products like ethanol. End-user profiles are detailed, highlighting their specific needs and consumption patterns. Furthermore, recent merger and acquisition (M&A) activities are scrutinized to understand industry consolidation and strategic movements. The global MTBE market is characterized by a moderately concentrated structure, with a few dominant players holding substantial market share. Our analysis of market share distribution across major segments reveals that a select group of key players collectively account for approximately [Insert %] of the total market revenue in 2025.

- Market Concentration: In 2025, the top 5 players commanded an estimated [Insert %] of the market share.

- Innovation Catalysts: Increasingly stringent emission regulations globally are a primary driver for innovation in MTBE production technologies, pushing for cleaner and more efficient processes.

- Regulatory Landscape: The market's growth and production methodologies are significantly shaped by a diverse and evolving regulatory framework across different geographical regions.

- Substitute Products: The demand for MTBE is dynamically influenced by the availability and pricing of alternative oxygenates, most notably ethanol, which presents ongoing competition.

- End-User Profiles: The primary consumers of MTBE are the refining and petrochemical industries, where it is utilized as a fuel additive.

- M&A Activities: Over the past five years, the MTBE sector has seen significant consolidation, with approximately [Insert Value] worth of M&A deals, reflecting strategic efforts to expand market reach and operational synergies. Notable transactions include: [Insert 2-3 examples of notable M&A activity with deal values where possible, e.g., 'Acquisition of X company by Y company for $Z million', 'Merger between A and B firms to create C entity valued at $D million'].

MTBE Industry Industry Evolution

This section delves into the historical and projected evolution of the MTBE market, analyzing market growth trajectories, technological advancements, and evolving consumer demands. The MTBE market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven primarily by increased gasoline demand in developing economies. Technological advancements, such as the implementation of Lummus' CDEtherol technology, are enhancing production efficiency and lowering costs. Shifting consumer preferences towards cleaner fuels is also influencing the market, driving the demand for higher-quality MTBE. The forecast period (2025-2033) anticipates a CAGR of xx%, propelled by [Mention specific factors like increased infrastructure investment, government policies].

Leading Regions, Countries, or Segments in MTBE Industry

This section identifies the dominant regions and segments within the MTBE market. Analysis shows that [Region Name], [Country Name] and the [Segment Name] segment are currently leading the market, contributing to a significant portion of the global revenue.

- Key Drivers for [Region Name]: Robust infrastructure investment, favorable government policies, and high gasoline demand.

- Key Drivers for [Country Name]: Significant domestic consumption and strategic geographical location.

- Key Drivers for [Segment Name] Segment: High demand from [Specific application(s)], cost-effectiveness, and superior performance metrics compared to alternatives.

The dominance of these regions and segments is attributed to factors such as established refining capacities, supportive government policies, and growing downstream demand in key sectors. Further analysis identifies specific growth opportunities within each dominant region/segment, outlining detailed future expansion plans and projected revenue increases.

MTBE Industry Product Innovations

Recent technological advancements in MTBE production are strategically focused on enhancing operational efficiency, minimizing environmental impact, and elevating product quality. Key innovations include the development and implementation of more effective catalysts that improve reaction yields and selectivity. Furthermore, there's a growing trend towards integrated production processes, which optimize resource utilization and reduce waste. The integration of advanced process control systems is also playing a crucial role in fine-tuning operations for improved performance. These innovations collectively contribute to higher product yields, reduced production costs, and a significant decrease in harmful emissions. The unique selling propositions emerging from these advancements include enhanced product purity, superior blending characteristics for fuel applications, and a demonstrably greater environmental friendliness compared to older methods.

Propelling Factors for MTBE Industry Growth

Several factors contribute to the growth of the MTBE industry. Firstly, the rising global demand for gasoline, especially in emerging markets, fuels the need for high-octane blending components like MTBE. Secondly, stringent environmental regulations mandating the use of oxygenates in gasoline are pushing MTBE adoption. Finally, ongoing technological advancements, like the use of Lummus' CDEtherol technology, boost production efficiency and competitiveness.

Obstacles in the MTBE Industry Market

The MTBE market navigates several significant challenges that influence its trajectory. Stringent environmental regulations in various regions continue to impose production restrictions and, in some cases, lead to considerations for phase-outs, creating market uncertainty. Supply chain disruptions, particularly concerning the availability of key raw materials and the impact of geopolitical instability, pose considerable risks to market stability and consistent supply. Moreover, robust competition from substitute oxygenates, with ethanol being a prominent example, remains a persistent challenge that affects MTBE's market share and pricing power. These multifaceted factors collectively exert considerable influence on overall market growth dynamics and pricing strategies.

Future Opportunities in MTBE Industry

Future growth opportunities in the MTBE industry are primarily linked to expanding into new markets, particularly in developing economies experiencing rapid automotive sector growth. Advancements in production technology, focused on sustainability and efficiency, will also unlock new market potential. Moreover, exploring new applications for MTBE beyond gasoline blending could open up additional revenue streams.

Major Players in the MTBE Industry Ecosystem

- China National Petroleum Corporation (CNPC)

- Eni S.p.A.

- Emirates National Oil Company (ENOC)

- Enterprise Product Partners L.P.

- Evonik Industries AG

- Formosa Plastics Corporation U.S.A.

- Gazprom Neft PJSC

- LUKOIL

- LyondellBasell Industries Holdings B.V.

- Qatar Fuel Additives Company (QAFAC)

- Reliance Industries Ltd.

- Saudi Basic Industries Corporation (SABIC)

- SIBUR International GmbH

- Vinati Organics Limited

- *List Not Exhaustive

Key Developments in MTBE Industry Industry

- October 2022: Reliance Industries Ltd. receives approval to expand its MTBE plant in Gujarat, India.

- January 2022: LUKOIL licenses Lummus Technology's CDEtherol technology for a new MTBE plant in Perm, Russia.

Strategic MTBE Industry Market Forecast

The MTBE market is projected to experience sustained growth, propelled by the escalating global demand for gasoline, increasingly stringent emission regulations mandating cleaner fuels, and continuous advancements in production technologies. Emerging markets are identified as key areas offering significant expansion opportunities, while ongoing innovation in production processes promises to enhance both efficiency and sustainability. The overall trajectory for the MTBE market is anticipated to remain positive, with substantial growth potential across diverse market segments and geographical regions.

MTBE Industry Segmentation

-

1. Application

- 1.1. Gasoline Additives

- 1.2. Isobutene

- 1.3. Solvents

- 1.4. Other Applications

MTBE Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

MTBE Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Use as an Anti-knocking Agent and as an Octane Booster in Fuel for Gasoline Engines; Increasing Use in the Production of Pure Isobutene

- 3.3. Market Restrains

- 3.3.1. Demand for Use as an Anti-knocking Agent and as an Octane Booster in Fuel for Gasoline Engines; Increasing Use in the Production of Pure Isobutene

- 3.4. Market Trends

- 3.4.1. Gasoline Additives Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Gasoline Additives

- 5.1.2. Isobutene

- 5.1.3. Solvents

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Gasoline Additives

- 6.1.2. Isobutene

- 6.1.3. Solvents

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Gasoline Additives

- 7.1.2. Isobutene

- 7.1.3. Solvents

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Gasoline Additives

- 8.1.2. Isobutene

- 8.1.3. Solvents

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Gasoline Additives

- 9.1.2. Isobutene

- 9.1.3. Solvents

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa MTBE Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Gasoline Additives

- 10.1.2. Isobutene

- 10.1.3. Solvents

- 10.1.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CNPC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eni S p A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ENOC Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enterprise Product Partners L P

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Formosa Plastics Corporation U S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gazprom Neft PJSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LUKOIL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LyondellBasell Industries Holdings B V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 QAFAC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Reliance Industries Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SABIC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SIBUR International GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vinati Organics Limited*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 CNPC

List of Figures

- Figure 1: Global MTBE Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific MTBE Industry Revenue (Million), by Application 2024 & 2032

- Figure 3: Asia Pacific MTBE Industry Revenue Share (%), by Application 2024 & 2032

- Figure 4: Asia Pacific MTBE Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific MTBE Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America MTBE Industry Revenue (Million), by Application 2024 & 2032

- Figure 7: North America MTBE Industry Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America MTBE Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America MTBE Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe MTBE Industry Revenue (Million), by Application 2024 & 2032

- Figure 11: Europe MTBE Industry Revenue Share (%), by Application 2024 & 2032

- Figure 12: Europe MTBE Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe MTBE Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America MTBE Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: South America MTBE Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: South America MTBE Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: South America MTBE Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa MTBE Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Middle East and Africa MTBE Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Middle East and Africa MTBE Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Middle East and Africa MTBE Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MTBE Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global MTBE Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global MTBE Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global MTBE Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global MTBE Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global MTBE Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global MTBE Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global MTBE Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa MTBE Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MTBE Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the MTBE Industry?

Key companies in the market include CNPC, Eni S p A, ENOC Company, Enterprise Product Partners L P, Evonik Industries AG, Formosa Plastics Corporation U S A, Gazprom Neft PJSC, LUKOIL, LyondellBasell Industries Holdings B V, QAFAC, Reliance Industries Ltd, SABIC, SIBUR International GmbH, Vinati Organics Limited*List Not Exhaustive.

3. What are the main segments of the MTBE Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Use as an Anti-knocking Agent and as an Octane Booster in Fuel for Gasoline Engines; Increasing Use in the Production of Pure Isobutene.

6. What are the notable trends driving market growth?

Gasoline Additives Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Demand for Use as an Anti-knocking Agent and as an Octane Booster in Fuel for Gasoline Engines; Increasing Use in the Production of Pure Isobutene.

8. Can you provide examples of recent developments in the market?

In October 2022, Reliance Industries Ltd. got a nod from the Expert Appraisal Committee under the Ministry of Environment, Forests, and Climate Change to expand the operations of its Hazira Manufacturing Division (HMD) in Gujarat. The company aims to expand the production capacities of various plants including the MTBE plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MTBE Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MTBE Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MTBE Industry?

To stay informed about further developments, trends, and reports in the MTBE Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence