Key Insights

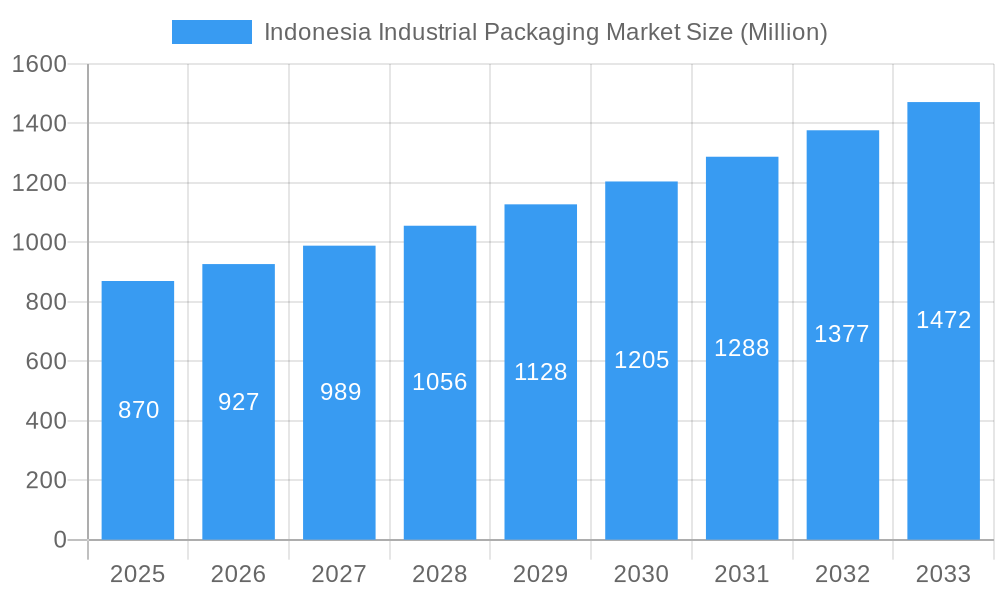

The Indonesia Industrial Packaging Market, valued at $870 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.65% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning manufacturing sector in Indonesia, particularly in industries like food and beverage, pharmaceuticals, and consumer goods, is driving significant demand for diverse packaging solutions. Increased e-commerce activity is also contributing to growth, necessitating efficient and reliable packaging for online deliveries. Furthermore, rising consumer awareness regarding product safety and preservation is prompting a shift towards higher-quality, more durable packaging materials. This trend benefits manufacturers offering sustainable and innovative packaging options. Companies are increasingly investing in advanced technologies to enhance packaging efficiency and reduce environmental impact, creating opportunities for growth in specialized segments.

Indonesia Industrial Packaging Market Market Size (In Million)

However, the market's growth is not without challenges. Fluctuations in raw material prices, particularly for plastics and paper, pose a significant constraint. Government regulations concerning environmental sustainability and waste management also present both opportunities and challenges for businesses. Adapting to evolving regulations while maintaining cost-competitiveness requires strategic planning and investment in sustainable practices. Competition within the market is relatively high, with both established multinational corporations and smaller domestic players vying for market share. Companies are differentiating themselves through product innovation, customized solutions, and strong supply chain management. The market is segmented by packaging type (e.g., corrugated boxes, flexible packaging, plastic containers), material, and end-use industry, offering opportunities for specialized players to focus on niche segments. Future success will depend on embracing sustainable practices, investing in technological advancements, and adapting to evolving consumer and regulatory demands.

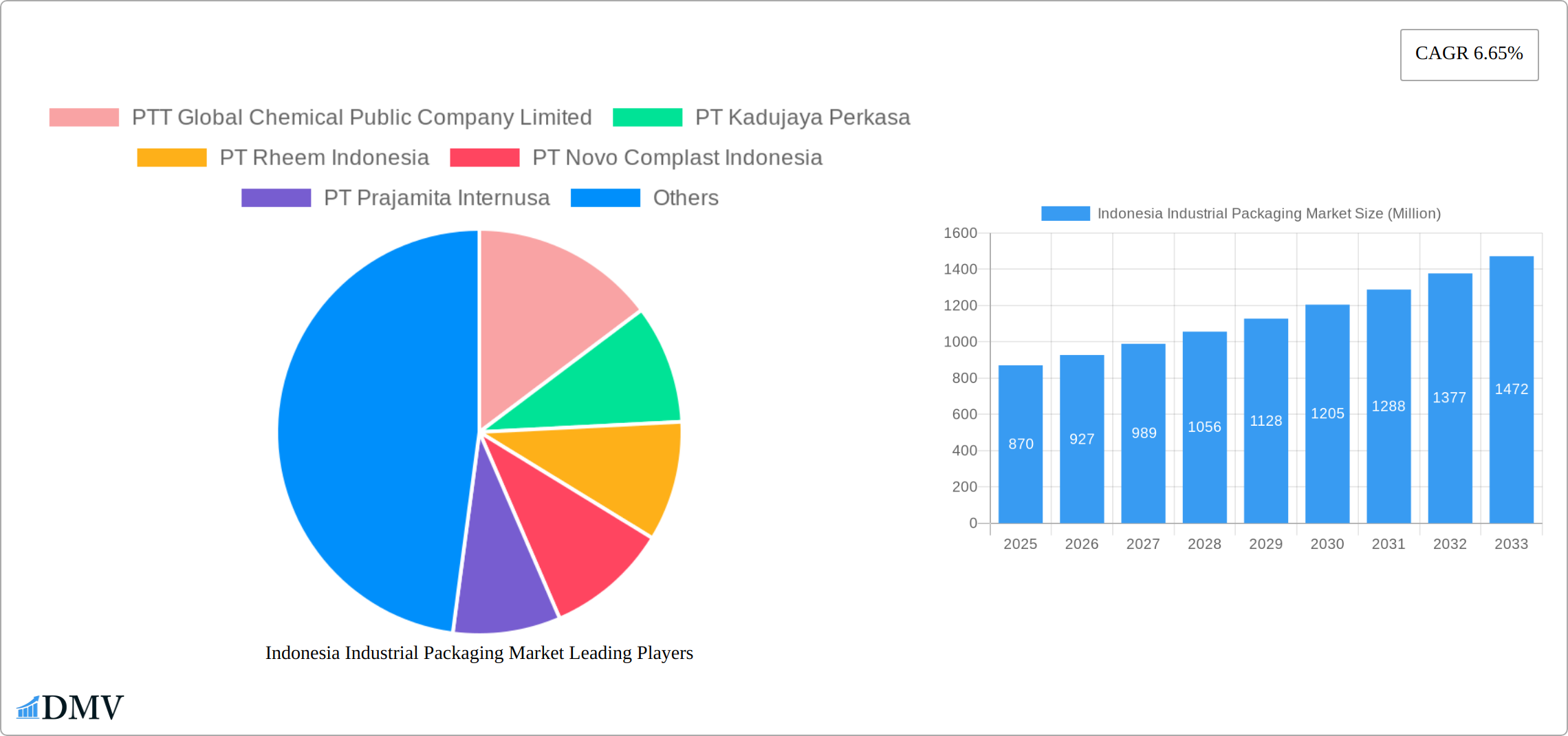

Indonesia Industrial Packaging Market Company Market Share

Indonesia Industrial Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Indonesia Industrial Packaging Market, offering a detailed overview of market trends, key players, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The report leverages extensive data analysis to provide a robust understanding of the Indonesian industrial packaging landscape, covering everything from market size and growth projections to competitive analysis and emerging trends. The total market value in 2024 is estimated at xx Million. Expect to find actionable insights and strategic recommendations to inform your business decisions.

Indonesia Industrial Packaging Market Composition & Trends

The Indonesian industrial packaging market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Market concentration is expected to remain relatively stable in the forecast period. Innovation is driven by the increasing demand for sustainable and efficient packaging solutions, fueled by government regulations promoting environmental responsibility and evolving consumer preferences. The regulatory landscape is becoming increasingly stringent, pushing companies to adopt eco-friendly materials and processes. Substitute products, such as reusable containers and alternative packaging materials, are gaining traction, although their penetration rate remains relatively low. End-user industries include food & beverage, pharmaceuticals, electronics, and construction, with the food and beverage sector currently dominating. M&A activity in the Indonesian industrial packaging market has been moderate in recent years, with deal values averaging approximately xx Million per transaction during 2019-2024.

- Market Share Distribution (2024): The top 5 players account for approximately xx% of the market.

- M&A Deal Value (2019-2024): Total estimated value: xx Million.

- Key End-User Industries: Food & Beverage, Pharmaceuticals, Electronics, Construction.

- Emerging Trends: Sustainable packaging, automation, and e-commerce packaging solutions.

Indonesia Industrial Packaging Market Industry Evolution

The Indonesian industrial packaging market has experienced dynamic and sustained growth over the past five years, significantly propelled by the burgeoning expansion of key end-user sectors, most notably manufacturing and the rapidly evolving e-commerce landscape. The market demonstrated a robust Compound Annual Growth Rate (CAGR) of [Insert Historical CAGR]% during the historical period (2019-2024). Looking ahead, it is projected to sustain this healthy growth trajectory with an anticipated CAGR of [Insert Forecast CAGR]% during the forecast period (2025-2033), ultimately reaching an estimated market valuation of [Insert Market Value in Million] Million by 2033.

This evolution is underscored by significant technological advancements. The widespread adoption of automated packaging systems has streamlined operations, enhancing efficiency and contributing to substantial cost reductions. Simultaneously, the strategic utilization of lightweight yet high-performance materials is revolutionizing product protection and logistics. Furthermore, a palpable shift in consumer preferences towards environmentally conscious and convenient packaging solutions is compelling manufacturers to prioritize innovation and agile adaptation. The undeniable surge in e-commerce penetration has, in turn, fueled a growing demand for highly specialized packaging solutions meticulously engineered to ensure product integrity throughout the complex transit journey.

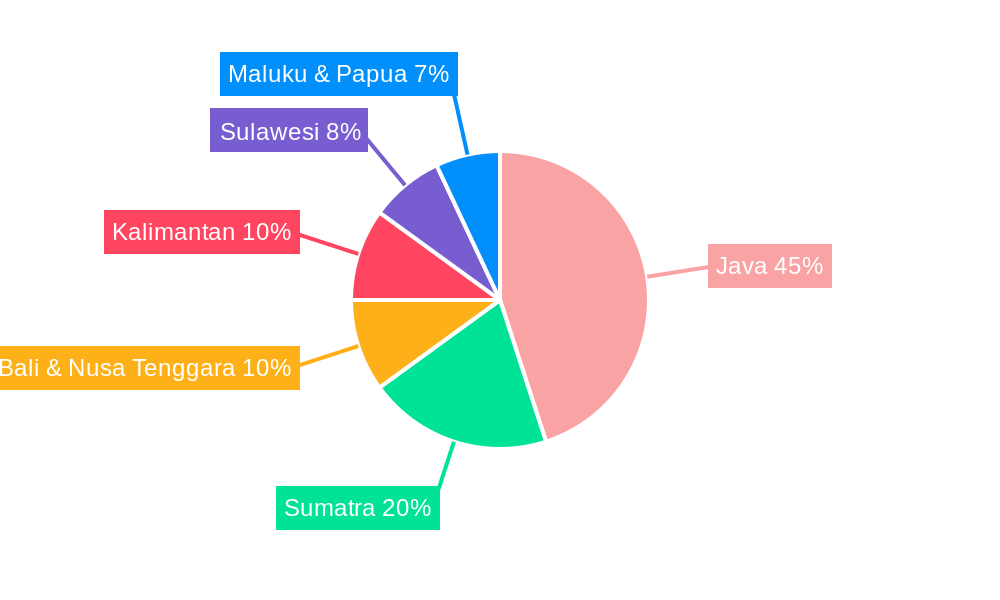

Leading Regions, Countries, or Segments in Indonesia Industrial Packaging Market

The Java island region currently dominates the Indonesian industrial packaging market due to its high concentration of manufacturing and industrial activities. The strong presence of key players and supportive government infrastructure significantly contribute to this dominance. Other regions are catching up, but Java remains the key market for players operating in this sector.

- Key Drivers for Java's Dominance:

- High concentration of manufacturing and industrial activity.

- Well-developed infrastructure and logistics networks.

- Significant investments in industrial zones and special economic zones.

- Strong presence of established industrial packaging companies.

- Supportive government policies promoting industrial development.

The continued growth of manufacturing and industrial sectors, along with governmental initiatives promoting sustainable packaging and ease of doing business, are expected to further propel this region's dominance in the coming years.

Indonesia Industrial Packaging Market Product Innovations

Recent product innovations focus on sustainable materials, such as recycled plastics and biodegradable alternatives, alongside enhanced packaging designs that improve product protection and reduce waste. These innovations often incorporate advanced features such as tamper-evident seals, improved barrier properties, and lightweight construction to enhance efficiency across the supply chain. The emphasis is on value-added features that offer superior protection and reduce environmental impact, aligning with growing consumer and regulatory demands.

Propelling Factors for Indonesia Industrial Packaging Market Growth

Several factors are driving the expansion of the Indonesian industrial packaging market. Rapid industrialization and urbanization are fueling demand for packaging solutions across various sectors. Economic growth is boosting consumer spending and increasing the volume of goods requiring packaging. The government's initiatives to support the manufacturing and logistics sectors are creating a favorable environment for market expansion. Technological advancements, such as automation and smart packaging, are also contributing to higher efficiency and reduced costs within the industry.

Obstacles in the Indonesia Industrial Packaging Market

Despite its promising growth, the Indonesian industrial packaging market navigates a complex landscape of challenges. Volatility in raw material prices presents a persistent concern, directly impacting production costs and subsequently influencing profitability margins. The vulnerability of supply chains, often exacerbated by geopolitical events and global economic shifts, can introduce significant delays and escalate operational expenses. The market is characterized by intense competition, with both established domestic players and formidable international entrants vying for market share, which often exerts downward pressure on pricing strategies. Additionally, adhering to evolving regulatory frameworks, particularly those pertaining to sustainable packaging standards, can introduce operational complexities and necessitate strategic investments for companies to ensure compliance.

Future Opportunities in Indonesia Industrial Packaging Market

The growing e-commerce sector presents significant opportunities for specialized packaging solutions. The rising demand for sustainable and eco-friendly packaging materials opens doors for innovative companies. Government initiatives promoting sustainable development will shape packaging choices. Expanding into underserved regions of Indonesia offers additional potential for growth.

Major Players in the Indonesia Industrial Packaging Market Ecosystem

- PTT Global Chemical Public Company Limited

- PT Kadujaya Perkasa

- PT Rheem Indonesia

- PT Novo Complast Indonesia

- PT Prajamita Internusa

- PT Repal Internasional Indonesia (Re-Pal)

- PT Yanasurya Bhaktipersada

- PT SCHTZ Container Systems Indonesia

- PT Dinito Jaya Sakti

- PT Indragraha Nusaplasindo

- PT Java Taiko

- PT Pelangi Indah Anindo Tbk

Key Developments in Indonesia Industrial Packaging Market Industry

- May 2024: PT Mowilex Indonesia (Mowilex) took a significant step towards sustainability by launching its new Mowilex Recycled paint line. This innovative initiative successfully reduces the carbon footprint associated with its paint containers by an impressive margin of up to 60%, demonstrating a strong commitment to environmental responsibility.

- January 2024: Mah Sing Group Bhd strategically expanded its footprint in the Indonesian market through a collaborative partnership with PT Gaya Sukses Mandiri Kaseindo. This joint venture is focused on the manufacturing and trading of robust plastic pallets and durable containers, aiming to cater to the growing industrial logistics needs in the region.

- [Insert New Development Example]: [Month Year]: [Company Name] announced [brief description of development, e.g., a significant investment in new sustainable packaging production facilities / the launch of a new biodegradable packaging solution for the food and beverage industry / a strategic acquisition to expand its market reach in Sumatra]. This development underscores [briefly mention impact, e.g., the growing emphasis on eco-friendly packaging / the consolidation trend within the market / the company's commitment to innovation and market expansion].

Strategic Indonesia Industrial Packaging Market Forecast

The Indonesian industrial packaging market is poised for continued growth, driven by a combination of factors including robust economic expansion, increasing industrial activity, and the rising adoption of e-commerce. The focus on sustainable and innovative packaging solutions will further stimulate market expansion. Opportunities exist for companies offering eco-friendly and technologically advanced packaging options. The market's future potential is significant, promising substantial returns for players who can adapt to evolving consumer preferences and regulatory requirements.

Indonesia Industrial Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Jerry Cans

- 1.2. Rigid IBCs

- 1.3. Drums & Barrels

- 1.4. Crates & Pallets

- 1.5. Insulated Shipping Containers

- 1.6. FIBC

- 1.7. Other Pa

-

2. End-use Industries

- 2.1. Automotive

- 2.2. Food & Beverage

- 2.3. Chemicals & Petrochemicals

- 2.4. Pharmaceuticals

- 2.5. Paints & Coatings

- 2.6. Building & Construction

- 2.7. Other End-use Industries (Agriculture, Logistics)

Indonesia Industrial Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Industrial Packaging Market Regional Market Share

Geographic Coverage of Indonesia Industrial Packaging Market

Indonesia Industrial Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.2.2 etc.

- 3.3. Market Restrains

- 3.3.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.3.2 etc.

- 3.4. Market Trends

- 3.4.1. Jerry Cans Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Industrial Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Jerry Cans

- 5.1.2. Rigid IBCs

- 5.1.3. Drums & Barrels

- 5.1.4. Crates & Pallets

- 5.1.5. Insulated Shipping Containers

- 5.1.6. FIBC

- 5.1.7. Other Pa

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Automotive

- 5.2.2. Food & Beverage

- 5.2.3. Chemicals & Petrochemicals

- 5.2.4. Pharmaceuticals

- 5.2.5. Paints & Coatings

- 5.2.6. Building & Construction

- 5.2.7. Other End-use Industries (Agriculture, Logistics)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PTT Global Chemical Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Kadujaya Perkasa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Rheem Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Novo Complast Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Prajamita Internusa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Repal Internasional Indonesia (Re-Pal)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Yanasurya Bhaktipersada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT SCHTZ Container Systems Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Dinito Jaya Sakti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Indragraha Nusaplasindo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Java Taiko

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PTT Global Chemical Public Company Limited

List of Figures

- Figure 1: Indonesia Industrial Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Industrial Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 4: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 5: Indonesia Industrial Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia Industrial Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 9: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 10: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 11: Indonesia Industrial Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia Industrial Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Industrial Packaging Market?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Indonesia Industrial Packaging Market?

Key companies in the market include PTT Global Chemical Public Company Limited, PT Kadujaya Perkasa, PT Rheem Indonesia, PT Novo Complast Indonesia, PT Prajamita Internusa, PT Repal Internasional Indonesia (Re-Pal), PT Yanasurya Bhaktipersada, PT SCHTZ Container Systems Indonesia, PT Dinito Jaya Sakti, PT Indragraha Nusaplasindo, PT Java Taiko, PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player.

3. What are the main segments of the Indonesia Industrial Packaging Market?

The market segments include Packaging Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

6. What are the notable trends driving market growth?

Jerry Cans Witness Major Growth.

7. Are there any restraints impacting market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

8. Can you provide examples of recent developments in the market?

May 2024 - PT Mowilex Indonesia (Mowilex) launched its new Mowilex Recycled paint line, which reduces water consumption, energy usage, and the carbon footprint of each 2.5-litre paint container by up to 60%. The company incorporates up to 40% premium Mowilex paint in each Mowilex Recycled container, thereby decreasing potential waste while maintaining product quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Industrial Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Industrial Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Industrial Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Industrial Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence