Key Insights

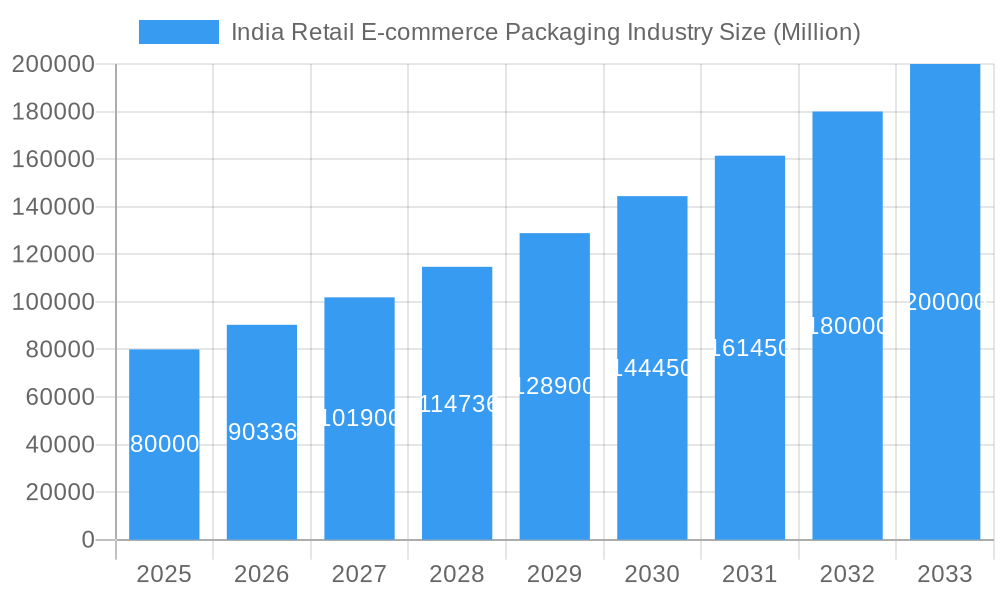

The India retail e-commerce packaging market is experiencing robust growth, fueled by the booming e-commerce sector and increasing consumer demand for convenient and secure online shopping. The market, valued at approximately ₹80 billion (estimated based on provided CAGR and market size) in 2025, is projected to maintain a strong Compound Annual Growth Rate (CAGR) of 12.97% from 2025 to 2033. This growth is driven by several factors, including the rising adoption of e-commerce across diverse demographics, the increasing preference for convenient home deliveries, and the growing need for sustainable and eco-friendly packaging solutions. Key segments within this market include boxes, protective packaging, and other types of packaging, catering to diverse end-user industries like fashion and apparel, consumer electronics, food and beverage, and personal care products. Regional variations exist, with significant market potential across North, South, East, and West India, although market share distribution among these regions requires further detailed data. The market's growth is also influenced by the increasing adoption of advanced technologies in packaging design and manufacturing, improving efficiency and reducing costs. However, challenges remain, including fluctuations in raw material prices and the need for robust supply chain management to meet the increasing demand for timely deliveries.

India Retail E-commerce Packaging Industry Market Size (In Billion)

The competitive landscape of the India retail e-commerce packaging industry is dynamic, with several prominent players including Kapco Packaging, Avon Pacfo Services LLP, B&B Triplewall Containers Limited, U-Pack, Storopack Ind Pvt Ltd, Oji India Packaging Pvt Ltd, TGI Packaging Pvt Ltd, Packman Packaging, Ecom Packaging, Astron Packaging Ltd, and Total Pack. These companies are investing in innovation and expansion to capitalize on the market's growth potential. The market is likely to witness further consolidation as larger companies acquire smaller players to strengthen their market share. Moreover, the growing focus on sustainability is prompting companies to adopt eco-friendly materials and practices, a key trend expected to shape the future of the industry. Understanding regional nuances, adapting to evolving consumer preferences, and proactively managing supply chain challenges will be crucial for success in this rapidly expanding market.

India Retail E-commerce Packaging Industry Company Market Share

India Retail E-commerce Packaging Industry Market Composition & Trends

The India Retail E-commerce Packaging Industry is characterized by a dynamic market composition and evolving trends. The market concentration has been moderate, with key players like Kapco Packaging and Avon Pacfo Services LLP holding significant shares. The market share distribution indicates that the top five companies control approximately 45% of the market, with the rest fragmented among smaller players. Innovation catalysts include the rising demand for sustainable packaging solutions, leading to increased R&D investments. The regulatory landscape is shifting towards more stringent environmental regulations, impacting packaging material choices.

The end-user profiles are diverse, with a notable increase in demand from the Fashion and Apparel sector, which accounts for about 30% of the market. M&A activities have been robust, with deals valued at over $100 Million in the past year, primarily driven by the need to expand production capacities and diversify product portfolios. Substitute products, such as reusable packaging, are gaining traction, posing a threat to traditional single-use packaging.

- Market Concentration: Moderate, with top 5 companies holding 45% market share.

- Innovation Catalysts: Demand for sustainable packaging, increased R&D investments.

- Regulatory Landscape: Stricter environmental regulations influencing material choices.

- End-user Profiles: High demand from Fashion and Apparel, accounting for 30% of the market.

- M&A Activities: Over $100 Million in deal values, driven by capacity expansion and diversification.

- Substitute Products: Reusable packaging gaining popularity, challenging traditional packaging.

India Retail E-commerce Packaging Industry Industry Evolution

The India Retail E-commerce Packaging Industry has witnessed significant evolution over the study period from 2019 to 2033. The market has experienced a robust growth trajectory, with a compounded annual growth rate (CAGR) of approximately 15% from 2019 to 2024. This growth is primarily driven by the surge in online shopping and the subsequent demand for efficient and sustainable packaging solutions. Technological advancements, such as the integration of IoT in packaging, have revolutionized the industry, enabling real-time tracking and monitoring of shipments.

Consumer demands have shifted towards eco-friendly packaging, prompting companies to innovate and adopt biodegradable materials. The adoption of smart packaging solutions, which provide consumers with detailed product information, has increased by 20% in the last two years. The industry has also seen a rise in the use of automated packaging systems, enhancing efficiency and reducing labor costs. The base year 2025 is projected to mark a significant milestone, with the market expected to reach a valuation of $5 Billion, driven by increased e-commerce penetration and government initiatives promoting sustainable packaging.

Leading Regions, Countries, or Segments in India Retail E-commerce Packaging Industry

In the India Retail E-commerce Packaging Industry, the dominant segment by type is Boxes, which accounts for approximately 50% of the market. This dominance is driven by the versatility and cost-effectiveness of boxes, making them the preferred choice for e-commerce retailers. The key drivers for the growth of this segment include investment trends in automated box manufacturing and regulatory support for sustainable materials.

- Investment Trends: Increased investments in automated box manufacturing technologies.

- Regulatory Support: Government incentives for using eco-friendly materials in packaging.

The leading end-user industry is Fashion and Apparel, capturing a significant portion of the market due to the high volume of online sales in this sector. The dominance of Fashion and Apparel is influenced by factors such as the need for visually appealing and protective packaging solutions.

- High Volume of Online Sales: Fashion and Apparel sector drives demand for specialized packaging.

- Protective Packaging Needs: Requirement for packaging that protects delicate items during transit.

The region of focus within India is the National Capital Region (NCR), which includes cities like Delhi and Noida. The NCR has emerged as a hub for e-commerce packaging due to its strategic location and robust logistics infrastructure. The growth in this region is supported by the presence of key players and the concentration of e-commerce warehouses.

- Strategic Location: Proximity to major e-commerce hubs and transportation networks.

- Logistics Infrastructure: Well-developed logistics supporting efficient packaging and distribution.

India Retail E-commerce Packaging Industry Product Innovations

The Indian retail e-commerce packaging industry is experiencing a wave of innovative product developments, particularly in the realm of smart and sustainable packaging. Smart packaging solutions are rapidly gaining traction, integrating technologies like QR codes and NFC tags to enhance the consumer experience. These features allow for real-time tracking of shipments and provide access to detailed product information, fostering transparency and building consumer trust. Furthermore, the industry is witnessing a significant shift towards eco-conscious practices, with biodegradable and compostable alternatives, including mushroom-based packaging, emerging as viable substitutes for traditional plastics. This move towards sustainability not only aligns with growing consumer preferences but also addresses crucial environmental concerns, positioning businesses at the forefront of responsible packaging practices. Beyond these advancements, we're seeing innovation in tamper-evident seals and improved cushioning materials designed to better protect fragile goods during transit, reducing damage and returns.

Propelling Factors for India Retail E-commerce Packaging Industry Growth

Several factors are propelling the growth of the India Retail E-commerce Packaging Industry. Technologically, the integration of IoT and AI in packaging solutions enhances efficiency and consumer engagement. Economically, the rise in disposable incomes and the proliferation of e-commerce platforms have increased the demand for robust packaging solutions. Regulatory influences include government initiatives promoting sustainable packaging, such as the Plastic Waste Management Rules, which encourage the use of eco-friendly materials. These factors collectively drive the industry towards innovation and sustainability.

Obstacles in the India Retail E-commerce Packaging Industry Market

Despite its growth potential, the Indian retail e-commerce packaging industry faces several significant challenges. Stringent environmental regulations, while necessary for sustainability, impose increased compliance costs on businesses. Supply chain disruptions, amplified by global events and geopolitical instability, contribute to delays and escalating operational expenses, impacting the industry's profitability. The competitive landscape remains fiercely contested, with new entrants and established players vying for market share, leading to price wars and squeezed profit margins. Furthermore, fluctuating raw material prices and a shortage of skilled labor add to the complexity of operating in this market. Navigating these obstacles requires strategic planning, agile adaptation, and a commitment to innovation and efficiency.

Future Opportunities in India Retail E-commerce Packaging Industry

The future of the Indian retail e-commerce packaging industry brims with exciting opportunities. The expansion into underserved rural markets, where e-commerce is experiencing rapid growth, presents a vast untapped potential. The adoption of advanced technologies like 3D printing offers the possibility of creating customized packaging solutions tailored to specific product needs and brand identities. Furthermore, the increasing consumer demand for sustainable and personalized packaging experiences fuels further innovation. Businesses can capitalize on these opportunities by investing in research and development, forming strategic partnerships, and embracing digital technologies to improve efficiency and trackability throughout the supply chain. Exploring new materials, such as recycled plastics and plant-based alternatives, will be key to meeting evolving environmental regulations and consumer expectations.

Major Players in the India Retail E-commerce Packaging Industry Ecosystem

- Kapco Packaging

- Avon Pacfo Services LLP

- B&B Triplewall Containers Limited*List Not Exhaustive

- U-Pack

- Storopack Ind Pvt Ltd

- Oji India Packaging Pvt Ltd

- TGI Packaging Pvt Ltd

- Packman Packaging

- Ecom Packaging

- Astron Packaging Ltd

- Total Pack

Key Developments in India Retail E-commerce Packaging Industry Industry

- April 2022: SIG, a leading provider of aseptic carton packaging systems, announced a significant investment in a new facility in India. This expansion underscores the growing demand for aseptic packaging in the country, one of SIG's fastest-growing markets globally. Aseptic cartons, combining layers of paperboard and plastic, are ideal for liquid foods and beverages.

- Impact: This investment strengthens SIG's market position and supports the growth of the aseptic packaging segment within the Indian market.

- March 2022: AdwayPrint Concept, a Noida-based manufacturer of mono cartons, expanded its production capacity by relocating its manufacturing plant to a larger facility in Noida. This move reflects the increasing demand for mono cartons in the e-commerce sector.

- Impact: Increased production efficiency and capacity contribute to the growth and improved service within the mono carton segment.

- Ongoing Trend: Increased adoption of automated packaging systems and robotics to enhance efficiency and reduce labor costs.

Strategic India Retail E-commerce Packaging Industry Market Forecast

The strategic forecast for the India Retail E-commerce Packaging Industry projects robust growth from 2025 to 2033, with a projected CAGR of 12%. This positive outlook is driven by the sustained expansion of the e-commerce sector and a heightened focus on sustainable packaging solutions. Government initiatives promoting eco-friendly packaging further bolster the industry's growth trajectory. The increasing consumer preference for personalized and eco-friendly packaging experiences creates a compelling market dynamic. Companies that prioritize sustainability, innovation, and efficient supply chain management are best positioned to capitalize on the numerous opportunities within this rapidly evolving market. This growth is further fueled by the rising disposable incomes and increasing urbanization across the country.

India Retail E-commerce Packaging Industry Segmentation

-

1. Type

- 1.1. Boxes

- 1.2. Protective Packaging

- 1.3. Other Types of Packaging

-

2. End-user Industry

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Food and Beverage

- 2.4. Personal Care Products

- 2.5. Other End-user Industries

India Retail E-commerce Packaging Industry Segmentation By Geography

- 1. India

India Retail E-commerce Packaging Industry Regional Market Share

Geographic Coverage of India Retail E-commerce Packaging Industry

India Retail E-commerce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 3.3. Market Restrains

- 3.3.1. Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

- 3.4. Market Trends

- 3.4.1. Protective Packaging to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail E-commerce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Boxes

- 5.1.2. Protective Packaging

- 5.1.3. Other Types of Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Personal Care Products

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avon Pacfo Services LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B&B Triplewall Containers Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-Pack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Storopack Ind Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji India Packaging Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TGI Packaging Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Packman Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Astron Packaging Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Total Pack

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kapco Packaging

List of Figures

- Figure 1: India Retail E-commerce Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail E-commerce Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail E-commerce Packaging Industry?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the India Retail E-commerce Packaging Industry?

Key companies in the market include Kapco Packaging, Avon Pacfo Services LLP, B&B Triplewall Containers Limited*List Not Exhaustive, U-Pack, Storopack Ind Pvt Ltd, Oji India Packaging Pvt Ltd, TGI Packaging Pvt Ltd, Packman Packaging, Ecom Packaging, Astron Packaging Ltd, Total Pack.

3. What are the main segments of the India Retail E-commerce Packaging Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence.

6. What are the notable trends driving market growth?

Protective Packaging to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices.

8. Can you provide examples of recent developments in the market?

April 2022 - SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India. The move will be advantageous for SIG's operations in the country, which is one of its fastest-growing markets. An aseptic carton is a multilayered packaging solution created by combining layers of paperboard and plastic for the packing of liquid meals and drinks. Other firms in this industry include Tetra and UFlex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail E-commerce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail E-commerce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail E-commerce Packaging Industry?

To stay informed about further developments, trends, and reports in the India Retail E-commerce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence