Key Insights

The European biodegradable plastic packaging market is experiencing significant expansion, propelled by growing environmental consciousness and stringent regulations designed to curb plastic waste. Projections indicate a sustained upward trend, with a projected market size of $112.49 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 8.4% from the base year of 2025. Key growth catalysts include heightened consumer demand for sustainable products, increased awareness of conventional plastic's environmental impact, and supportive government initiatives promoting eco-friendly packaging. The pharmaceutical, food, and beverage sectors are primary consumers, employing biodegradable plastics for packaging solutions such as bottles, syringes, vials, pouches, and cartons. Despite challenges like higher production costs and certain barrier property limitations, ongoing technological innovations are enhancing material performance and addressing these concerns. The market exhibits distinct regional strengths, with Germany, France, Italy, the United Kingdom, and the Netherlands being prominent European markets. Leading industry players are actively investing in R&D, expanding product offerings, and strategically positioning themselves for continued growth fueled by greater availability, affordability, consumer demand, and regulatory support for biodegradable plastic options.

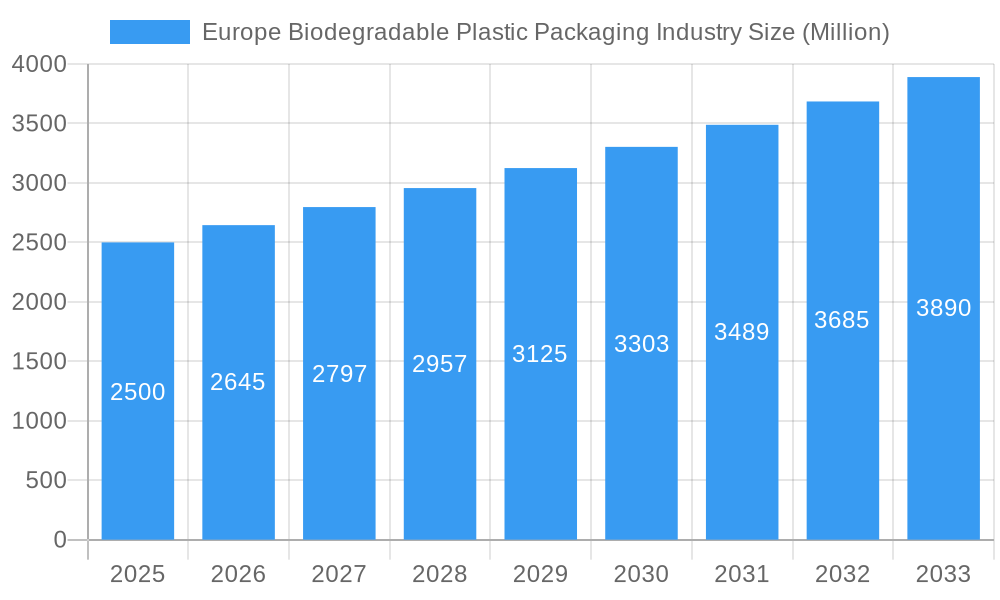

Europe Biodegradable Plastic Packaging Industry Market Size (In Billion)

The competitive arena is characterized by active participation from both established corporations and emerging enterprises. While Western Europe holds substantial market potential, growth is anticipated across the entire European region as eco-friendly packaging awareness expands. Diverse product applications cater to varied industry needs. Success in this sector hinges on balancing material science innovation, efficient production, and a commitment to sustainable supply chains. Long-term market expansion is further supported by evolving environmental legislation, increased consumer environmental awareness, and continuous advancements in bioplastic materials and manufacturing technologies.

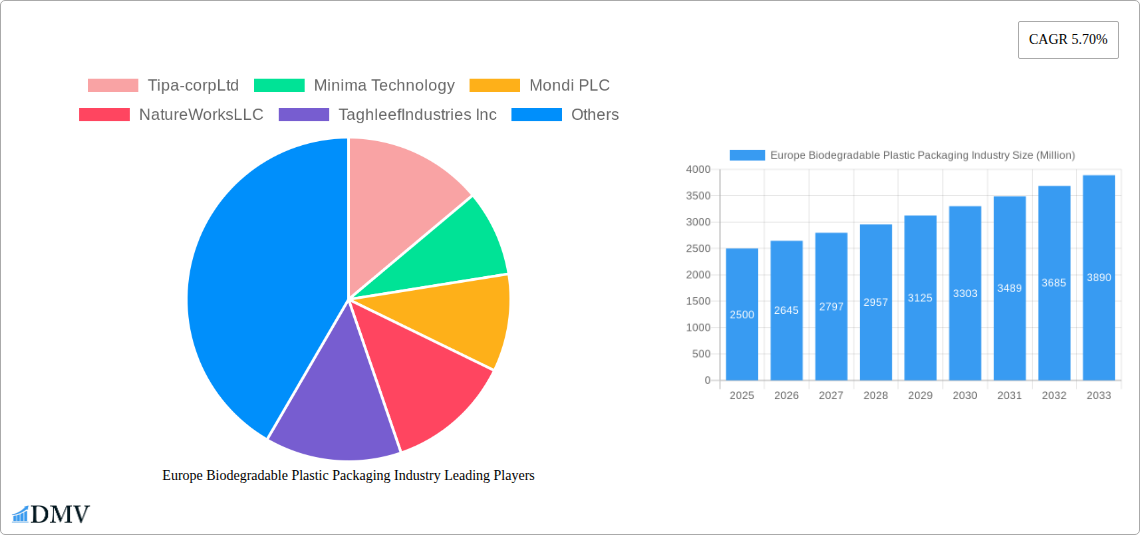

Europe Biodegradable Plastic Packaging Industry Company Market Share

Europe Biodegradable Plastic Packaging Industry: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Europe biodegradable plastic packaging industry, providing crucial data and trends for stakeholders seeking to navigate this rapidly evolving market. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report incorporates a detailed analysis of market size, segmentation, leading players, and future growth prospects, offering invaluable insights for strategic decision-making. The total market value is projected to reach xx Million by 2033.

Europe Biodegradable Plastic Packaging Industry Market Composition & Trends

This section delves into the competitive landscape of the European biodegradable plastic packaging market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution among key players such as Tipa-corpLtd, Minima Technology, Mondi PLC, NatureWorks LLC, Taghleef Industries Inc, Amcor Limited, Tetra Pak International SA, and Biogreen. The report quantifies market share for each major player and analyzes recent M&A activities, including deal values (xx Million) and their impact on market dynamics. The analysis also considers the influence of regulatory changes (e.g., the EU’s Single-Use Plastics Directive) and the emergence of substitute materials on market growth. Innovation catalysts, such as advancements in bio-based polymers and improved biodegradability, are also thoroughly assessed, offering a complete picture of the market's current state and future trajectory. Finally, an in-depth profile of end-users across various sectors (Pharmaceutical, Beverage, Food) is provided, highlighting their specific packaging needs and preferences.

Europe Biodegradable Plastic Packaging Industry Industry Evolution

This section provides a detailed analysis of the Europe biodegradable plastic packaging industry's evolution from 2019 to 2033. We examine the historical period (2019-2024) and the forecast period (2025-2033), focusing on growth trajectories, technological progress, and evolving consumer preferences. Specific data points, including compound annual growth rates (CAGRs) and adoption rates of biodegradable packaging across different sectors, are presented. The analysis incorporates the impact of technological advancements, such as improvements in biopolymer production and the development of innovative packaging designs, on market growth. Shifting consumer demands for sustainable and environmentally friendly packaging, coupled with increasing regulatory pressures, are also examined in detail. The report explores the transition from traditional plastic packaging to biodegradable alternatives and the factors driving this shift, providing a comprehensive overview of the industry's dynamic evolution.

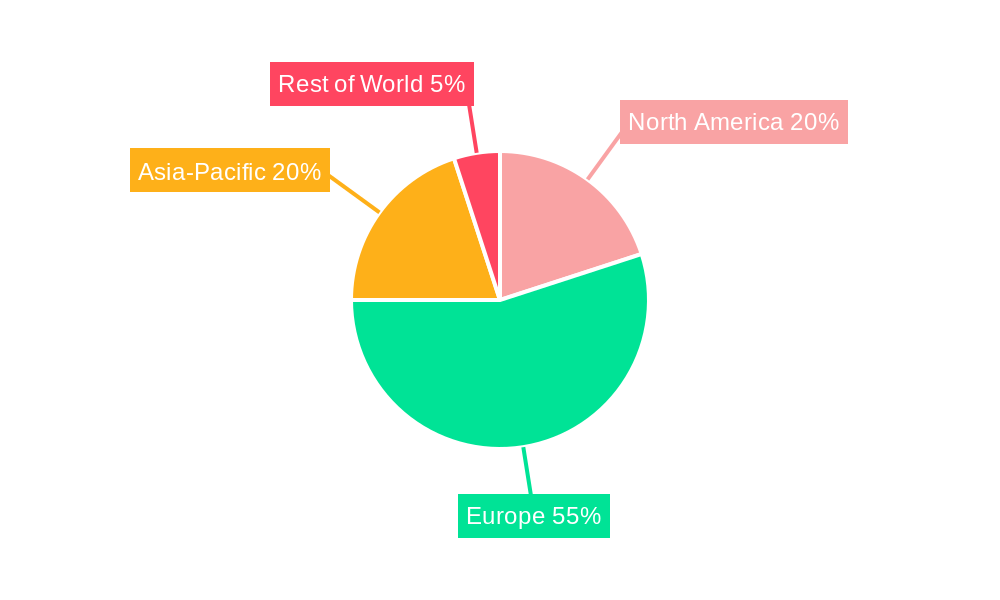

Leading Regions, Countries, or Segments in Europe Biodegradable Plastic Packaging Industry

This section identifies the leading regions, countries, and segments within the European biodegradable plastic packaging market. The analysis considers various segments, including end-user types (Pharmaceutical, Beverage, Food), product types (Plastic Bottles, Prefillable Syringes, Vials and Ampoules, Bags and Pouches, Cartons, Cups, Glass Bottles), and geographical regions (United States, Canada, and other European countries).

- Key Drivers:

- Strong regulatory support for sustainable packaging in specific regions (e.g., EU).

- High consumer demand for eco-friendly products in certain markets.

- Significant investments in R&D and infrastructure development for biodegradable packaging solutions.

- Favorable government policies and incentives for biodegradable plastic adoption.

The analysis explores the factors contributing to the dominance of specific regions or segments, providing a detailed understanding of the market's geographical and sectoral distribution. The report also highlights regional disparities in adoption rates and growth potential, offering a nuanced perspective on the market's landscape.

Europe Biodegradable Plastic Packaging Industry Product Innovations

This section showcases recent product innovations, applications, and performance metrics within the biodegradable plastic packaging industry. It highlights the unique selling propositions (USPs) of innovative products, emphasizing improvements in biodegradability, compostability, barrier properties, and overall performance compared to conventional plastics. Key technological advancements, such as the use of novel bio-based polymers and advanced manufacturing techniques, are discussed, along with their impact on product quality and market competitiveness.

Propelling Factors for Europe Biodegradable Plastic Packaging Industry Growth

The growth of the European biodegradable plastic packaging market is driven by a confluence of technological, economic, and regulatory influences. Stringent environmental regulations aimed at reducing plastic waste are a major catalyst. Furthermore, growing consumer awareness of environmental issues and the increasing demand for eco-friendly products fuel market expansion. The cost-competitiveness of biodegradable packaging compared to traditional options is also a contributing factor, along with continuous technological advancements that improve the performance and functionality of biodegradable materials.

Obstacles in the Europe Biodegradable Plastic Packaging Industry Market

Despite its growth potential, the biodegradable plastic packaging market faces several challenges. Regulatory complexities and inconsistencies across different European countries create barriers to entry and market expansion. Supply chain disruptions and limitations in the availability of raw materials can impact production capacity and pricing. Competitive pressures from established players in the traditional plastic packaging market also pose a significant hurdle. These factors can collectively hinder the market's overall growth trajectory.

Future Opportunities in Europe Biodegradable Plastic Packaging Industry

The European biodegradable plastic packaging market presents numerous future opportunities. The expansion into new market segments, such as cosmetics and personal care, offers significant growth potential. Advancements in biopolymer technology, resulting in improved performance and cost-effectiveness, open up new avenues for market penetration. Emerging consumer trends, such as the growing demand for compostable and home-compostable packaging, further enhance future prospects.

Major Players in the Europe Biodegradable Plastic Packaging Industry Ecosystem

Key Developments in Europe Biodegradable Plastic Packaging Industry Industry

- January 2023: Amcor Limited launches a new range of compostable packaging solutions for the food industry.

- March 2022: Mondi PLC partners with a biopolymer producer to develop innovative biodegradable films for flexible packaging.

- June 2021: Tipa-corpLtd secures significant funding to expand its production capacity for biodegradable pouches. (Further developments can be added here as they occur).

Strategic Europe Biodegradable Plastic Packaging Industry Market Forecast

The European biodegradable plastic packaging market is poised for significant growth in the coming years. Driven by stringent regulations, increasing consumer demand for sustainable packaging, and ongoing technological advancements, the market is projected to expand significantly by 2033. The forecast incorporates various factors, including market size projections, growth rates, and key trends shaping the future of the industry. The continuous innovation in bio-based materials and advancements in biodegradability technologies will further propel market growth. The market's future trajectory promises a significant shift towards more sustainable and environmentally friendly packaging solutions.

Europe Biodegradable Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Biodegradable Plastic Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Biodegradable Plastic Packaging Industry Regional Market Share

Geographic Coverage of Europe Biodegradable Plastic Packaging Industry

Europe Biodegradable Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing demand for Sustainable Products; Stringent government Regulations

- 3.3. Market Restrains

- 3.3.1. Manufacturing Complications & Lower ROI

- 3.4. Market Trends

- 3.4.1. Starch Blend Material to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biodegradable Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tipa-corpLtd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Minima Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NatureWorksLLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TaghleefIndustries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tetra Pak International SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biogreen

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Tipa-corpLtd

List of Figures

- Figure 1: Europe Biodegradable Plastic Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Biodegradable Plastic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biodegradable Plastic Packaging Industry?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Europe Biodegradable Plastic Packaging Industry?

Key companies in the market include Tipa-corpLtd, Minima Technology, Mondi PLC, NatureWorksLLC, TaghleefIndustries Inc, Amcor Limited, Tetra Pak International SA, Biogreen.

3. What are the main segments of the Europe Biodegradable Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.49 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing demand for Sustainable Products; Stringent government Regulations.

6. What are the notable trends driving market growth?

Starch Blend Material to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Manufacturing Complications & Lower ROI.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biodegradable Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biodegradable Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biodegradable Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Biodegradable Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence