Key Insights

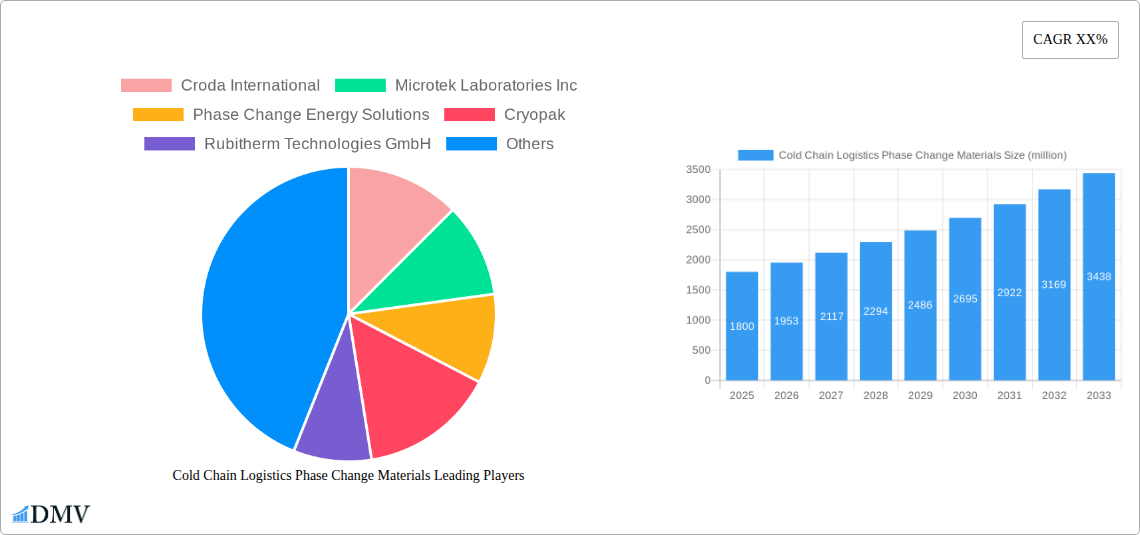

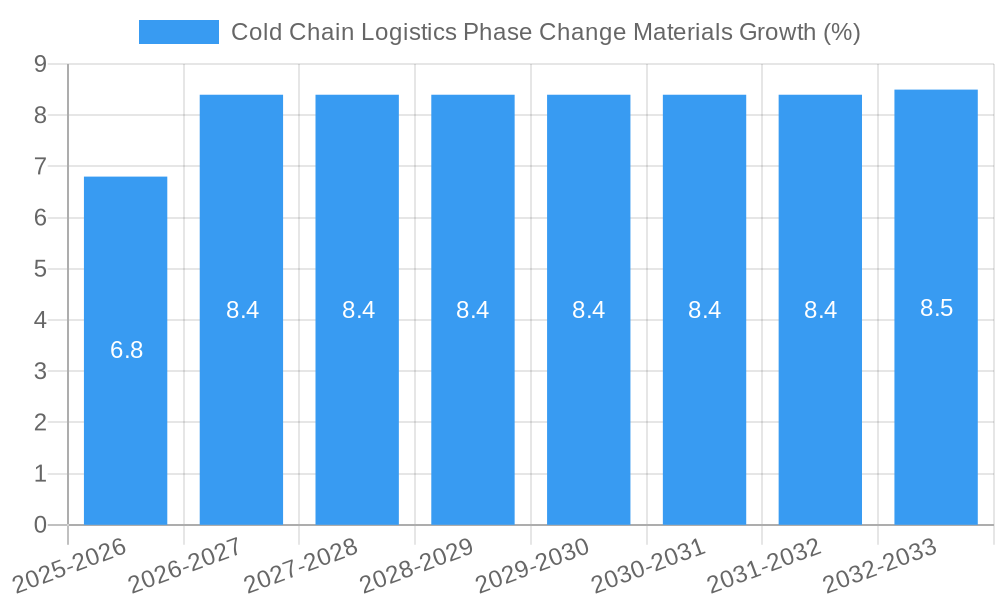

The global Cold Chain Logistics Phase Change Materials market is poised for significant expansion, projected to reach a substantial market size of approximately $1,800 million by 2025. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of roughly 8.5% anticipated over the forecast period of 2025-2033. The primary impetus for this upward trajectory stems from the escalating demand for reliable temperature-controlled logistics solutions across critical sectors. The pharmaceutical and vaccine transportation segment, in particular, is a dominant force, propelled by an increasing global need for safe and effective drug and vaccine distribution, especially in the wake of recent health crises. Furthermore, the expanding global food and beverage industry, with its increasing emphasis on maintaining product integrity and extending shelf life through chilled and frozen supply chains, also significantly contributes to market growth. The inherent ability of phase change materials (PCMs) to absorb and release latent heat at specific temperatures makes them indispensable for maintaining precise temperature ranges, thereby minimizing product spoilage and ensuring quality.

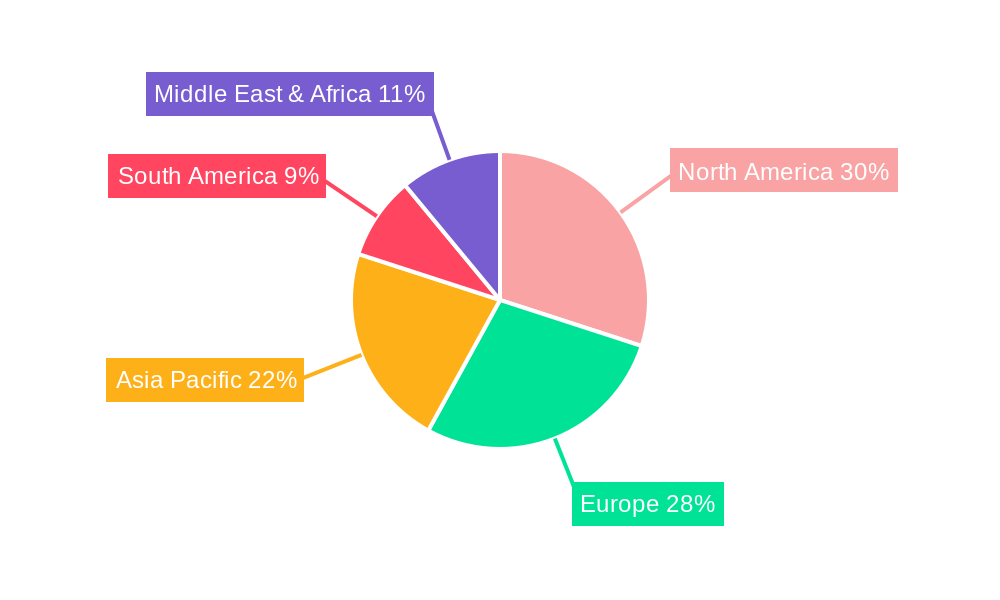

The market's expansion is further bolstered by ongoing technological advancements in PCM formulations, leading to improved thermal performance, longer duration of temperature control, and enhanced sustainability. Innovations in both inorganic and organic PCMs are catering to a wider spectrum of application needs and environmental considerations. However, certain restraints exist, including the initial cost of advanced PCM solutions and the need for greater consumer and industry education regarding their benefits and optimal utilization. The competitive landscape features a mix of established players and emerging innovators, all vying to capture market share through product development, strategic partnerships, and geographic expansion. Companies are focusing on developing customized PCM solutions for specific temperature requirements and developing more eco-friendly and cost-effective options. Key regions like North America and Europe currently lead in market adoption due to well-established cold chain infrastructure and stringent regulatory requirements, while the Asia Pacific region is anticipated to exhibit the fastest growth due to rapid industrialization and increasing investments in cold chain logistics.

Cold Chain Logistics Phase Change Materials Market Composition & Trends

The global Cold Chain Logistics Phase Change Materials market is characterized by a dynamic interplay of innovation, regulatory frameworks, and evolving end-user needs. With a market share distribution that sees specialized players catering to niche applications, the concentration is moderate, fostering healthy competition. Key innovation catalysts include advancements in material science for enhanced thermal stability and eco-friendliness, alongside increasing demand for reliable temperature-controlled solutions. Regulatory landscapes, particularly concerning pharmaceutical and food safety, are becoming more stringent, driving the adoption of advanced PCM solutions. Substitute products, such as traditional insulation and active cooling systems, pose a competitive threat, but the superior energy efficiency and passive nature of PCMs are increasingly recognized. End-user profiles range from pharmaceutical giants requiring precise temperature excursions for high-value drugs and vaccines to food and beverage companies ensuring product integrity from farm to fork. Mergers and acquisitions (M&A) activity is anticipated to see a significant CAGR of XX% in deal values, driven by strategic consolidations to expand product portfolios and market reach. For instance, a recent acquisition in the medical cold chain segment involved a deal valued at over XXX million. The market’s growth is also propelled by investments in R&D by leading entities like Croda International and Phase Change Energy Solutions, aimed at developing next-generation PCMs with tailored melting points.

Cold Chain Logistics Phase Change Materials Industry Evolution

The evolution of the Cold Chain Logistics Phase Change Materials industry has been a testament to relentless innovation and an unwavering response to escalating global demands for robust temperature-controlled supply chains. Over the study period of 2019–2033, the market has witnessed a transformative journey, moving from niche applications to becoming an indispensable component across critical sectors. This evolution is deeply rooted in increasing awareness and stringent regulations surrounding the integrity of temperature-sensitive goods, particularly pharmaceuticals and vaccines, which have seen a compound annual growth rate (CAGR) of XX% in their reliance on advanced cold chain solutions. The base year of 2025 marks a significant inflection point, with an estimated market size of XXX million, projected to grow substantially throughout the forecast period. Technological advancements have been the bedrock of this growth. Early adopters focused on basic eutectic salt-based PCMs, but the industry has rapidly progressed towards organic PCMs and advanced composite materials offering superior performance, extended phase change durations, and improved recyclability. This advancement has directly addressed the limitations of traditional cooling methods, offering a more sustainable and cost-effective alternative, with adoption metrics for advanced PCM solutions showing a XX% increase year-on-year in the food and beverage segment alone. Shifting consumer demands for fresher, safer food products and the unprecedented global rollout of temperature-sensitive pharmaceuticals have amplified the need for reliable cold chain logistics. This has spurred significant investment in R&D, with companies like Cryopak and Rubitherm Technologies GmbH consistently pushing the boundaries of PCM technology, developing solutions that can maintain precise temperature ranges for extended durations, even in challenging environmental conditions. The industry's trajectory is further shaped by a growing emphasis on sustainability and reducing carbon footprints, making PCMs an attractive option due to their passive temperature regulation capabilities, thereby reducing reliance on energy-intensive active cooling systems. The market growth trajectory, estimated at a CAGR of XX% from 2025 to 2033, underscores the indispensable role PCMs are poised to play in future global supply chains.

Leading Regions, Countries, or Segments in Cold Chain Logistics Phase Change Materials

The dominance within the Cold Chain Logistics Phase Change Materials market is predominantly observed in the Drug and Vaccine Transportation application segment. This segment's leadership is fueled by a confluence of critical factors, including the extremely stringent regulatory requirements for maintaining precise temperature ranges during the transit of life-saving medications and vaccines. Governments worldwide are investing heavily in robust pharmaceutical supply chains, driven by public health initiatives and the increasing prevalence of biologics and temperature-sensitive therapeutics. Key drivers for this dominance include:

- Regulatory Support: Mandates from health authorities like the FDA and EMA for validated temperature control during transport have made advanced PCM solutions a necessity, not a luxury. The market for pharmaceutical cold chain packaging solutions alone is projected to reach XXX million by 2033.

- Investment Trends: Significant R&D investments by pharmaceutical giants and logistics providers in developing and adopting sophisticated cold chain solutions, often exceeding XXX million annually, are directly benefiting PCM suppliers.

- Growth in Biologics: The burgeoning market for biologics, which are inherently more temperature-sensitive than traditional drugs, necessitates highly reliable and precise temperature management, a forte of advanced PCMs.

- Global Health Initiatives: Global vaccination programs and the need to distribute vaccines to remote and challenging terrains further amplify the demand for dependable, passive cooling technologies offered by PCMs.

In terms of geographical dominance, North America and Europe currently lead the market, largely due to their well-established pharmaceutical industries, advanced healthcare infrastructure, and stringent regulatory bodies that enforce high standards for cold chain integrity. The presence of key players like Cold Chain Technologies, Inc. and PLUSS Advanced Technologies in these regions further solidifies their leadership. The Type segment sees Organic Phase Change Materials gaining significant traction due to their better performance, non-corrosive nature, and wider range of tunable melting points compared to their inorganic counterparts. While inorganic PCMs remain prevalent in certain cost-sensitive applications, the demand for higher performance and enhanced safety profiles is steering the market towards organic alternatives, with an estimated market share of XX% by 2033. The combined market value for Drug and Vaccine Transportation using Organic PCMs is projected to exceed XXX million by the end of the forecast period.

Cold Chain Logistics Phase Change Materials Product Innovations

Product innovation in Cold Chain Logistics Phase Change Materials is rapidly advancing, focusing on enhanced thermal performance and expanded application versatility. Companies are developing PCMs with tighter melting point ranges, improved latent heat capacity, and prolonged thermal stability, crucial for maintaining exact temperatures for extended durations. Unique selling propositions include the development of bio-based and biodegradable PCMs, addressing sustainability concerns, alongside solutions integrated into smart packaging for real-time temperature monitoring. These advancements, such as advanced encapsulated PCMs offering superior containment and reusability, are critical for sectors like Drug and Vaccine Transportation, where temperature excursions can be catastrophic.

Propelling Factors for Cold Chain Logistics Phase Change Materials Growth

The growth of the Cold Chain Logistics Phase Change Materials market is propelled by a potent combination of factors. Technologically, advancements in PCM formulation, including microencapsulation and composite materials, offer superior thermal performance and extended temperature control, crucial for high-value shipments. Economically, the increasing cost of product spoilage and the rising value of temperature-sensitive goods, particularly pharmaceuticals, make robust cold chain solutions an essential investment. Regulatory landscapes globally are tightening requirements for temperature-controlled logistics, further driving adoption. For instance, stringent guidelines for vaccine distribution have created a surge in demand for reliable passive cooling technologies.

Obstacles in the Cold Chain Logistics Phase Change Materials Market

Despite its robust growth, the Cold Chain Logistics Phase Change Materials market faces several obstacles. Regulatory challenges, while driving adoption, can also create hurdles due to the complex validation processes required for pharmaceutical and food applications. Supply chain disruptions, exacerbated by geopolitical events or raw material shortages, can impact the availability and cost of PCM components, leading to price volatility estimated at XX% fluctuations. Competitive pressures from established traditional insulation methods and evolving active cooling technologies require continuous innovation and cost optimization from PCM manufacturers. Furthermore, the initial investment cost for advanced PCM solutions can be a barrier for some smaller enterprises.

Future Opportunities in Cold Chain Logistics Phase Change Materials

Emerging opportunities in the Cold Chain Logistics Phase Change Materials market are abundant, driven by expanding applications and technological breakthroughs. The growth of e-commerce for perishable goods and pharmaceuticals presents a significant avenue for PCM-based shipping solutions. The development of novel PCM formulations tailored for specific temperature profiles in emerging markets and the increasing demand for sustainable cold chain solutions offer substantial growth potential. Furthermore, the integration of PCMs with IoT sensors for intelligent cold chain management is a burgeoning area, promising enhanced visibility and control over shipments, potentially creating a market segment valued at over XXX million within the next decade.

Major Players in the Cold Chain Logistics Phase Change Materials Ecosystem

The Cold Chain Logistics Phase Change Materials ecosystem is populated by innovative and globally recognized companies dedicated to advancing temperature-controlled supply chains. Key players include:

- Croda International

- Microtek Laboratories Inc

- Phase Change Energy Solutions

- Cryopak

- Rubitherm Technologies GmbH

- Cold Chain Technologies, Inc.

- PLUSS Advanced Technologies

- Insolcorp, Inc.

- PCM Products

- Climator Sweden AB

- Phase Change Products Pty Ltd (PCP)

- Guangzhou Zhongjia

- BOCA International Limited

- AXIOTHERM

Key Developments in Cold Chain Logistics Phase Change Materials Industry

- 2023 Nov: Launch of advanced encapsulated organic PCMs by Rubitherm Technologies GmbH, offering enhanced thermal stability for ultra-cold chain applications.

- 2023 Oct: Cold Chain Technologies, Inc. acquired a leading competitor, expanding its product portfolio and market reach in North America, with a deal value estimated at XXX million.

- 2023 Sep: Phase Change Energy Solutions announced a strategic partnership with a major pharmaceutical logistics provider to develop bespoke PCM solutions for vaccine distribution, impacting an estimated XXX million shipments annually.

- 2023 Aug: Introduction of bio-based PCMs by PLUSS Advanced Technologies, addressing growing sustainability concerns within the cold chain industry.

- 2023 Jul: Cryopak unveiled a new range of recyclable PCM packs, contributing to a greener cold chain, with an expected market penetration of XX% within two years.

- 2022 Dec: Croda International invested heavily in R&D for next-generation PCMs with improved energy storage capacity, projecting a XX% increase in product efficiency.

Strategic Cold Chain Logistics Phase Change Materials Market Forecast

The strategic forecast for the Cold Chain Logistics Phase Change Materials market is exceptionally robust, driven by an increasing emphasis on product integrity and safety across global supply chains. The market is poised for significant growth, fueled by the expanding pharmaceutical and biopharmaceutical sectors, where precise temperature control is non-negotiable. Emerging economies present vast untapped potential as their cold chain infrastructure develops. Continued innovation in PCM technology, including smart and sustainable solutions, will further solidify their position as indispensable components in efficient and reliable temperature-controlled logistics, with a projected market value to reach XXX million by 2033.

Cold Chain Logistics Phase Change Materials Segmentation

-

1. Application

- 1.1. Drug and Vaccine Transportation

- 1.2. Food and Beverage Transportation

- 1.3. Others

-

2. Types

- 2.1. Inorganic Phase Change Materials

- 2.2. Organic Phase Change Materials

Cold Chain Logistics Phase Change Materials Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold Chain Logistics Phase Change Materials REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug and Vaccine Transportation

- 5.1.2. Food and Beverage Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Inorganic Phase Change Materials

- 5.2.2. Organic Phase Change Materials

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug and Vaccine Transportation

- 6.1.2. Food and Beverage Transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Inorganic Phase Change Materials

- 6.2.2. Organic Phase Change Materials

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug and Vaccine Transportation

- 7.1.2. Food and Beverage Transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Inorganic Phase Change Materials

- 7.2.2. Organic Phase Change Materials

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug and Vaccine Transportation

- 8.1.2. Food and Beverage Transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Inorganic Phase Change Materials

- 8.2.2. Organic Phase Change Materials

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug and Vaccine Transportation

- 9.1.2. Food and Beverage Transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Inorganic Phase Change Materials

- 9.2.2. Organic Phase Change Materials

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cold Chain Logistics Phase Change Materials Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug and Vaccine Transportation

- 10.1.2. Food and Beverage Transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Inorganic Phase Change Materials

- 10.2.2. Organic Phase Change Materials

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Croda International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microtek Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Phase Change Energy Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cryopak

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rubitherm Technologies GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cold Chain Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PLUSS Advanced Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insolcorp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PCM Products

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Climator Sweden AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Phase Change Products Pty Ltd (PCP)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Guangzhou Zhongjia

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 BOCA International Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AXIOTHERM

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Croda International

List of Figures

- Figure 1: Global Cold Chain Logistics Phase Change Materials Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cold Chain Logistics Phase Change Materials Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cold Chain Logistics Phase Change Materials Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cold Chain Logistics Phase Change Materials Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cold Chain Logistics Phase Change Materials Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cold Chain Logistics Phase Change Materials Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cold Chain Logistics Phase Change Materials Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cold Chain Logistics Phase Change Materials Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cold Chain Logistics Phase Change Materials Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cold Chain Logistics Phase Change Materials Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cold Chain Logistics Phase Change Materials Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cold Chain Logistics Phase Change Materials Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cold Chain Logistics Phase Change Materials Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cold Chain Logistics Phase Change Materials Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cold Chain Logistics Phase Change Materials Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cold Chain Logistics Phase Change Materials Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cold Chain Logistics Phase Change Materials Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Chain Logistics Phase Change Materials?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cold Chain Logistics Phase Change Materials?

Key companies in the market include Croda International, Microtek Laboratories Inc, Phase Change Energy Solutions, Cryopak, Rubitherm Technologies GmbH, Cold Chain Technologies, Inc, PLUSS Advanced Technologies, Insolcorp, Inc, PCM Products, Climator Sweden AB, Phase Change Products Pty Ltd (PCP), Guangzhou Zhongjia, BOCA International Limited, AXIOTHERM.

3. What are the main segments of the Cold Chain Logistics Phase Change Materials?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Chain Logistics Phase Change Materials," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Chain Logistics Phase Change Materials report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Chain Logistics Phase Change Materials?

To stay informed about further developments, trends, and reports in the Cold Chain Logistics Phase Change Materials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence