Key Insights

The Canadian foodservice packaging market is projected for significant expansion, driven by the robust growth of the foodservice industry, a heightened demand for convenient and sustainable packaging, and a clear consumer shift towards takeout and delivery services. The market, estimated at $110.29 billion in 2025, is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. Key growth drivers include the increasing popularity of quick-service restaurants (QSRs) and fast-casual dining, which require substantial packaging volumes for both dine-in and off-premises consumption. Additionally, a growing emphasis on eco-friendly and recyclable packaging, influenced by rising environmental awareness and regulatory pressures, is fundamentally reshaping market trends. The market encompasses both rigid and flexible packaging materials, serving a wide array of food applications from produce to meat and poultry. Major end-user sectors include institutional and hospitality, alongside restaurants.

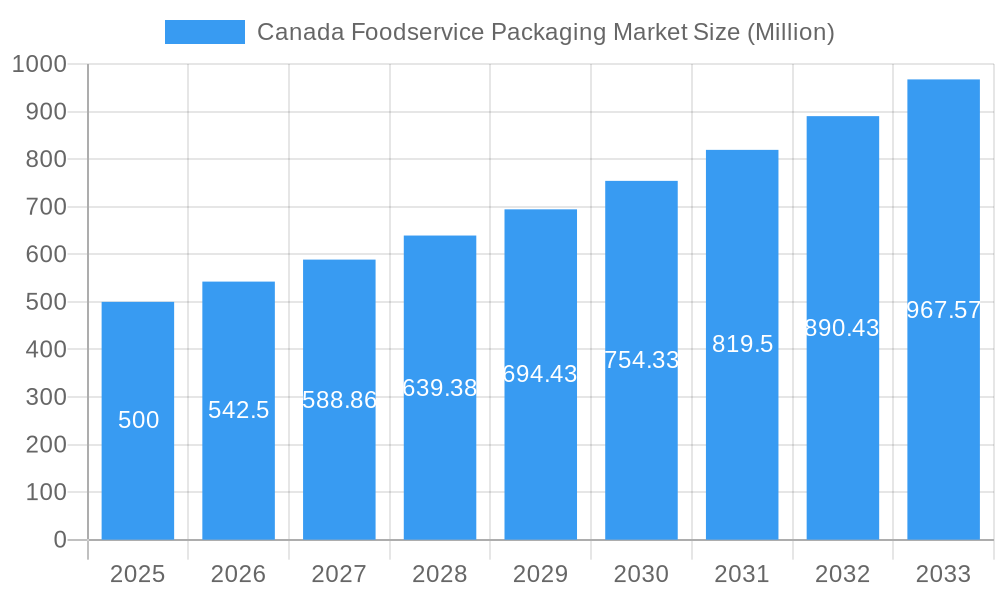

Canada Foodservice Packaging Market Market Size (In Billion)

While significant opportunities exist, the market faces challenges such as fluctuating raw material prices, particularly for plastics, which can affect manufacturer profitability. Intense competition from established and emerging players necessitates continuous innovation and strategic market positioning. The competitive landscape features a blend of multinational corporations and regional suppliers, fostering a dynamic environment. Companies achieving success are prioritizing differentiation through sustainable product lines, tailored solutions, and optimized supply chain management. The adoption of innovative packaging technologies, including compostable and biodegradable alternatives, will further shape market dynamics and accelerate the transition to environmentally responsible practices within the foodservice sector. The Canadian foodservice packaging market is well-positioned for sustained growth, offering compelling opportunities for stakeholders.

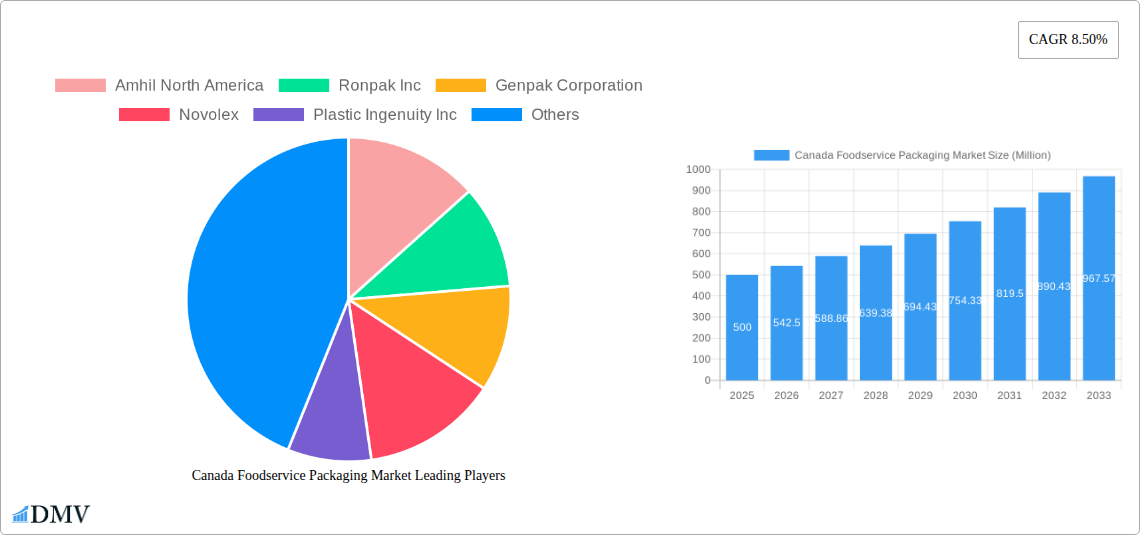

Canada Foodservice Packaging Market Company Market Share

Canada Foodservice Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada Foodservice Packaging Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

Canada Foodservice Packaging Market Composition & Trends

This section delves into the intricate composition of the Canadian foodservice packaging market, examining its structure, driving forces, and regulatory landscape. We analyze market concentration, revealing the share held by key players like Amhil North America, Ronpak Inc, Genpak Corporation, Novolex, Plastic Ingenuity Inc, Pactiv Evergreen Inc, Berry Global Inc, Tellus Product, Huhtamaki Americas Inc, and Dart Container Corporation. The report further explores innovation catalysts, including advancements in sustainable packaging materials and technologies. The influence of regulatory landscapes, particularly concerning sustainability initiatives and waste reduction, is meticulously examined. A detailed analysis of substitute products and their impact on market dynamics is also included. Finally, we delve into end-user profiles, providing insights into the consumption patterns of various segments, and assess M&A activities, including deal values and their impact on market consolidation.

- Market Share Distribution: The report details the market share of each major player, providing a clear picture of the competitive landscape. For example, Pactiv Evergreen Inc. is estimated to hold xx% market share in 2025.

- M&A Activity: An in-depth look at merger and acquisition activity within the market, including deal values and their impact on market consolidation. For example, the xx Million acquisition of Company X by Company Y in 2024 is analyzed.

- Innovation Catalysts: Exploration of factors driving innovation, including government incentives for sustainable packaging.

- Regulatory Landscape: Analysis of current and impending regulations impacting the market.

- Substitute Products: An evaluation of the impact of alternative packaging solutions.

Canada Foodservice Packaging Market Industry Evolution

This section provides a comprehensive analysis of the Canada Foodservice Packaging Market's evolutionary path. We analyze historical data from 2019 to 2024, revealing market growth trajectories and identifying key inflection points. The report examines technological advancements that have reshaped the industry, including the increasing adoption of sustainable materials like biodegradable plastics and compostable containers. We also explore how evolving consumer demands, particularly the growing preference for eco-friendly packaging, are influencing market trends. Specific data points, such as compound annual growth rates (CAGR) for different segments and adoption rates for new technologies, are provided to offer a robust quantitative perspective. The growing preference for single-use packaging made from recyclable materials is discussed at length, alongside the impact of consumer preference for food transparency and food safety.

Leading Regions, Countries, or Segments in Canada Foodservice Packaging Market

This section pinpoints the dominant regions, countries, and segments within the Canadian foodservice packaging market. A detailed examination of market performance across various segments (By Material Type: Rigid, Other Rigid Material Types (Stirrer/Straws, Cutlery, etc.), Flexible; By Application: Fruits and Vegetables, Baked Goods, Dairy Products, Meat and Poultry, Specialty Processed Foods, Other Applications; By End-user Industry: Restaurants, Other Restaurants: Institutional and Hospitality) is conducted. We use both detailed paragraphs and bullet points to present our key findings. The rigid segment dominates due to its strength and stability characteristics.

- Key Drivers:

- Investment Trends: Significant investments in sustainable packaging solutions are driving growth in specific segments.

- Regulatory Support: Government initiatives promoting sustainable packaging are boosting market expansion in certain sectors.

- Dominance Factors: Detailed analysis of the factors contributing to the dominance of specific regions, countries, or segments, considering factors like population density, consumer preferences, and regulatory environments. The restaurant sector, for example, significantly fuels demand due to its high volume needs.

Canada Foodservice Packaging Market Product Innovations

This section highlights recent product innovations, focusing on their applications and performance metrics. We discuss unique selling propositions and technological advancements, such as the introduction of plant-based materials and the development of packaging with improved barrier properties. The market is seeing a rising demand for innovative packaging designed to improve product shelf life, enhance consumer convenience, and align with environmentally friendly practices. The introduction of antimicrobial coatings and recyclable flexible films are key innovation examples.

Propelling Factors for Canada Foodservice Packaging Market Growth

Several key factors are driving the growth of the Canada Foodservice Packaging Market. Technological advancements in sustainable packaging materials, coupled with supportive government regulations promoting eco-friendly options, are significant contributors. The increasing demand for convenient, safe, and environmentally responsible food packaging within the foodservice industry fuels continued market expansion.

Obstacles in the Canada Foodservice Packaging Market

The Canada Foodservice Packaging Market faces challenges including fluctuating raw material prices, supply chain disruptions caused by geopolitical events, and intense competition among established players and new entrants. These factors can lead to price volatility and affect the availability of materials, potentially hindering market growth. Stringent environmental regulations, while beneficial long-term, can also represent short-term challenges for companies adapting to new standards.

Future Opportunities in Canada Foodservice Packaging Market

The Canada Foodservice Packaging Market presents significant future opportunities. The rising consumer preference for sustainable packaging creates strong demand for eco-friendly alternatives. Emerging technologies like active and intelligent packaging offer potential for growth. Expansion into new market segments, such as ready-to-eat meals and meal kit delivery services, presents additional prospects.

Major Players in the Canada Foodservice Packaging Market Ecosystem

- Amhil North America

- Ronpak Inc

- Genpak Corporation

- Novolex

- Plastic Ingenuity Inc

- Pactiv Evergreen Inc

- Berry Global Inc

- Tellus Product

- Huhtamaki Americas Inc

- Dart Container Corporation

Key Developments in Canada Foodservice Packaging Market Industry

- April 2022: The Canadian government invested up to CAD 376,200 (USD 299,869) in the Canadian Produce Marketing Association (CPMA) to support the transition to sustainable food and produce packaging, focusing on reducing waste and enhancing sustainability.

- April 2022: Swiss Chalet launched sustainable packaging across Canada, aiming for 100% recyclable, renewable, and recycled resources in its packaging line.

Strategic Canada Foodservice Packaging Market Forecast

The Canada Foodservice Packaging Market is poised for substantial growth driven by increasing demand for sustainable and innovative packaging solutions. Continued investment in research and development, coupled with evolving consumer preferences and supportive government policies, will further propel market expansion. The focus on eco-friendly materials and circular economy initiatives presents lucrative opportunities for market players.

Canada Foodservice Packaging Market Segmentation

-

1. Material Type

-

1.1. Rigid

- 1.1.1. Corrugated Boxes

- 1.1.2. Paperbaord Boxes

- 1.1.3. Plastic Containers

- 1.1.4. Metal Cans

- 1.1.5. Other Ri

-

1.2. Flexible

- 1.2.1. Pouches

- 1.2.2. Paper, Film, and Foil

- 1.2.3. Bags and Sacks

- 1.2.4. Trays, Plates, and Food Bowls

- 1.2.5. Other Flexible Material Types

-

1.1. Rigid

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Baked Goods

- 2.3. Dairy Products

- 2.4. Meat and Poultry

- 2.5. Specialty Processed Foods

- 2.6. Other Applications

-

3. End-user Industry

-

3.1. Restaurants

- 3.1.1. Quick-service

- 3.1.2. Full-service

- 3.1.3. Other Restaurants

- 3.2. Institutional and Hospitality

-

3.1. Restaurants

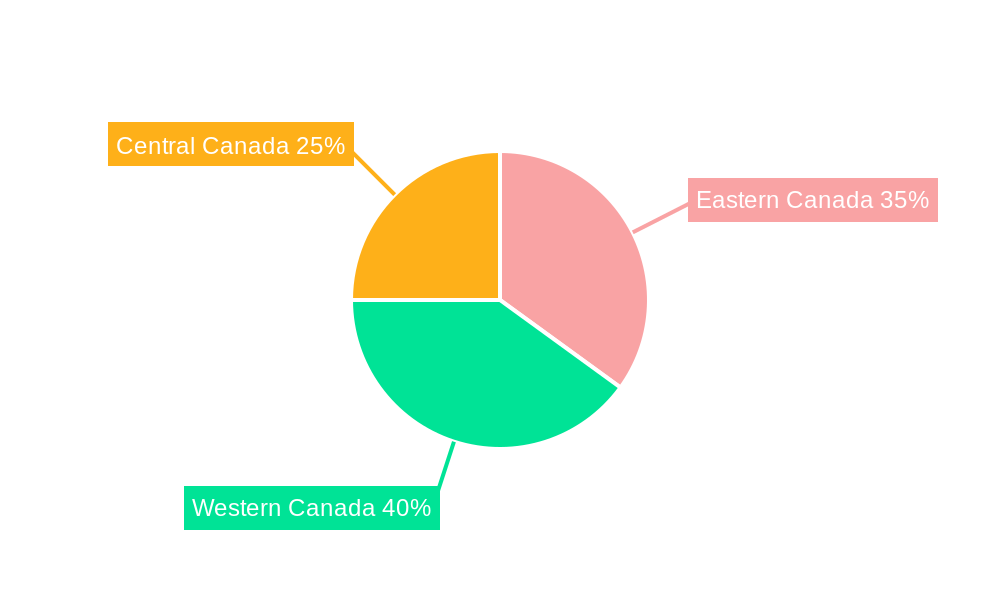

Canada Foodservice Packaging Market Segmentation By Geography

- 1. Canada

Canada Foodservice Packaging Market Regional Market Share

Geographic Coverage of Canada Foodservice Packaging Market

Canada Foodservice Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenience Food Remains High in Canada; Growing Demand for Sustainable Packaging Solution

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Demand for Convenience Food Remains High in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Foodservice Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Rigid

- 5.1.1.1. Corrugated Boxes

- 5.1.1.2. Paperbaord Boxes

- 5.1.1.3. Plastic Containers

- 5.1.1.4. Metal Cans

- 5.1.1.5. Other Ri

- 5.1.2. Flexible

- 5.1.2.1. Pouches

- 5.1.2.2. Paper, Film, and Foil

- 5.1.2.3. Bags and Sacks

- 5.1.2.4. Trays, Plates, and Food Bowls

- 5.1.2.5. Other Flexible Material Types

- 5.1.1. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Baked Goods

- 5.2.3. Dairy Products

- 5.2.4. Meat and Poultry

- 5.2.5. Specialty Processed Foods

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Restaurants

- 5.3.1.1. Quick-service

- 5.3.1.2. Full-service

- 5.3.1.3. Other Restaurants

- 5.3.2. Institutional and Hospitality

- 5.3.1. Restaurants

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amhil North America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ronpak Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genpak Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novolex

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plastic Ingenuity Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pactiv Evergreen Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tellus Product

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huhtamaki Americas Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dart Container Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amhil North America

List of Figures

- Figure 1: Canada Foodservice Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Foodservice Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Foodservice Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Canada Foodservice Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Canada Foodservice Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Canada Foodservice Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Foodservice Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Canada Foodservice Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Canada Foodservice Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Canada Foodservice Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Foodservice Packaging Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Canada Foodservice Packaging Market?

Key companies in the market include Amhil North America, Ronpak Inc, Genpak Corporation, Novolex, Plastic Ingenuity Inc, Pactiv Evergreen Inc, Berry Global Inc, Tellus Product, Huhtamaki Americas Inc, Dart Container Corporation.

3. What are the main segments of the Canada Foodservice Packaging Market?

The market segments include Material Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenience Food Remains High in Canada; Growing Demand for Sustainable Packaging Solution.

6. What are the notable trends driving market growth?

Demand for Convenience Food Remains High in Canada.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

April 2022: The Canadian government announced an investment to help Canada's fresh produce industry transition to sustainable food and produce packaging. The government aimed to reduce packaging waste and increase food and produce packaging sustainability. Agriculture and Agri-Food Minister Marie-Claude Bibeau said the government would invest up to CAD 376,200 (USD 299,869) in the Canadian Produce Marketing Association (CPMA). They were developing a new packaging circular economy, leveraging composting systems across Canada, and enhancing industry alignment with leading sustainable packaging in food and produce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Foodservice Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Foodservice Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Foodservice Packaging Market?

To stay informed about further developments, trends, and reports in the Canada Foodservice Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence