Key Insights

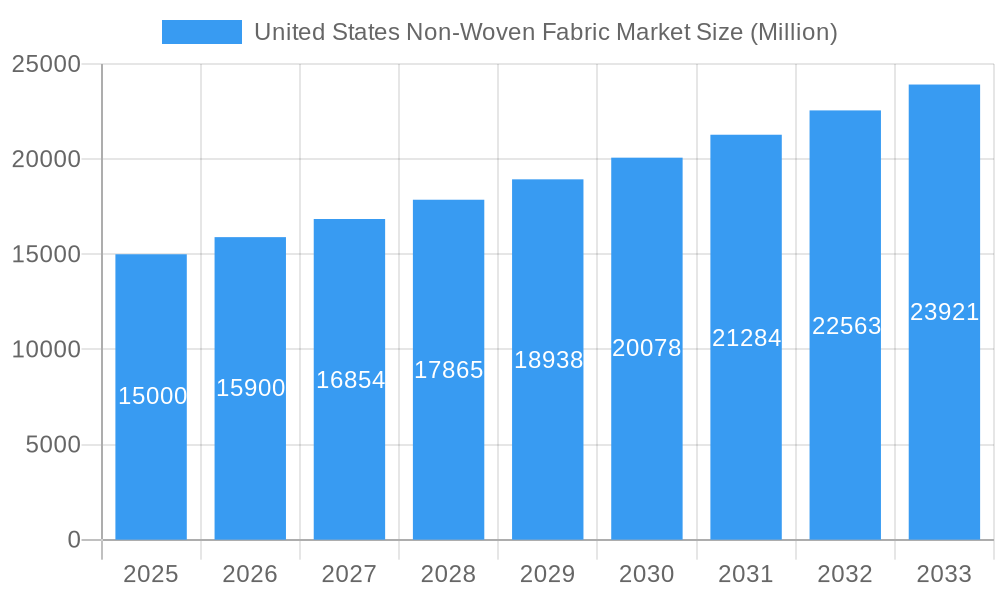

The United States non-woven fabric market is experiencing robust growth, driven by increasing demand across diverse sectors. With a current market size exceeding $XX million (estimated based on global market size and US market share), the market is projected to maintain a Compound Annual Growth Rate (CAGR) of over 6% from 2025 to 2033. This expansion is fueled by several key factors. The construction industry's reliance on non-wovens for insulation, roofing, and filtration applications is a major contributor. Similarly, the healthcare sector's demand for hygiene products like wipes, masks, and surgical gowns is significantly boosting market growth. The automotive industry also utilizes non-wovens extensively in interior components and filtration systems. Technological advancements in spunbond, wet-laid, and dry-laid technologies are leading to the development of more durable, versatile, and cost-effective non-woven fabrics, further stimulating market expansion. The increasing preference for sustainable and recyclable materials is also driving innovation within the industry, with manufacturers focusing on eco-friendly options like recycled polyester and polypropylene. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to market growth.

United States Non-Woven Fabric Market Market Size (In Billion)

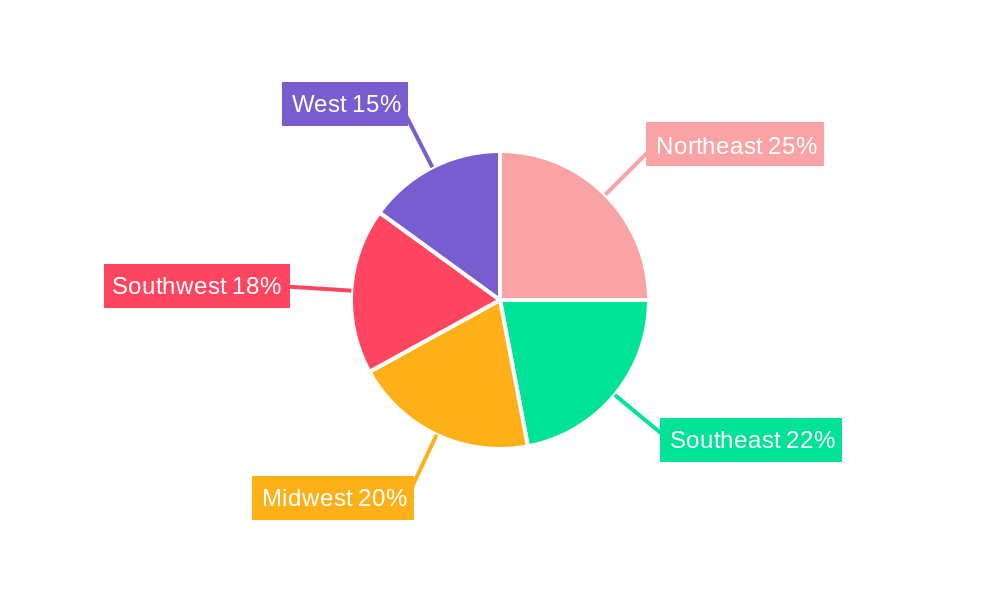

Market segmentation reveals significant opportunities. Polyester and polypropylene remain dominant materials, reflecting their cost-effectiveness and performance characteristics. However, increasing environmental concerns are pushing the adoption of sustainable alternatives, including rayon and fluff pulp. The regional breakdown suggests that the Northeast, Southeast, Midwest, Southwest, and West regions all contribute significantly to the US market, with regional differences likely influenced by industrial concentrations and consumer preferences. Major players like KCWW, Glatfelter Corporation, and Ahlstrom-Munksjö are actively shaping the market landscape through technological innovation and strategic partnerships. Future growth is expected to be driven by continued expansion in key end-user industries and the development of advanced non-woven materials with enhanced performance properties. The market's steady growth trajectory makes it an attractive investment opportunity for both established players and new entrants.

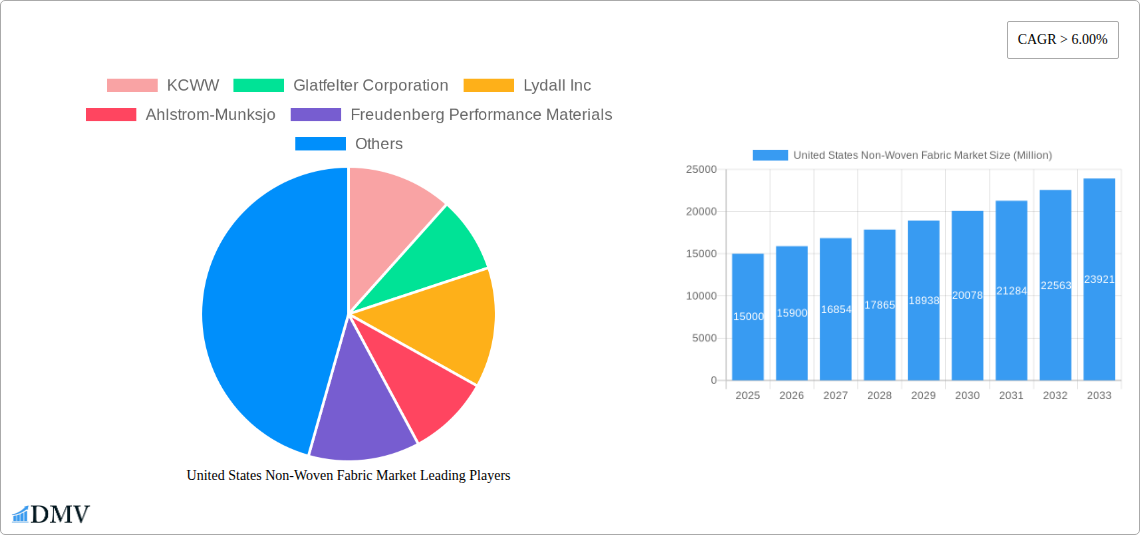

United States Non-Woven Fabric Market Company Market Share

United States Non-Woven Fabric Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the United States non-woven fabric market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic industry. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

United States Non-Woven Fabric Market Market Composition & Trends

This section delves into the competitive landscape of the US non-woven fabric market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user preferences, and merger & acquisition (M&A) activity. The market is characterized by a moderately concentrated structure, with key players holding significant market share. However, the presence of numerous smaller players ensures a competitive environment.

Market Share Distribution: While precise figures are proprietary to the full report, the market share is distributed among major players like 3M, DuPont, and Berry Global Inc., with smaller players contributing significantly to the overall market. KCWW, Glatfelter Corporation, and Lydall Inc. also hold notable shares. The remaining share is distributed among various other companies, making it a relatively fragmented but consolidated market.

Innovation Catalysts: Continuous advancements in materials science, particularly in sustainable and high-performance fibers like Polypropylene and Polyester, are driving innovation. Increased demand for eco-friendly products is pushing the industry towards biodegradable and recyclable non-wovens.

Regulatory Landscape: Environmental regulations regarding waste management and product sustainability are impacting material selection and manufacturing processes. Compliance with these regulations is a key factor for market participants.

Substitute Products: The market faces competition from alternative materials in specific applications. However, the unique properties of non-woven fabrics, such as breathability, flexibility, and cost-effectiveness, maintain their dominant position in many end-use industries.

End-User Profiles: The report profiles key end-user industries, including healthcare (medical gowns, masks), automotive (interior components), construction (insulation), and textiles (geotextiles), analyzing their specific needs and demands for non-woven fabrics.

M&A Activities: The past five years have witnessed xx Million in M&A deal value, indicating consolidation and strategic expansion within the market. Major players are acquiring smaller companies to enhance their product portfolios and expand their market reach.

United States Non-Woven Fabric Market Industry Evolution

This section provides a detailed analysis of the evolution of the US non-woven fabric market, tracing its growth trajectories, technological progress, and evolving consumer preferences. The market has experienced a steady growth rate of approximately xx% annually during the historical period (2019-2024). This is driven by the increasing demand across various end-use segments, particularly the healthcare and automotive industries.

Technological advancements, such as the development of advanced fiber structures and enhanced manufacturing processes (like spunbond, wet-laid, and dry-laid techniques), have resulted in improved product performance and broader applications. The adoption rate of innovative technologies like spunbond, a common technique for creating soft, hydrophilic nonwovens, is growing steadily, driven by the increasing demand for hygiene products. Consumer demand for sustainable and eco-friendly products is also a major influence. This is evident in the growing market share of polypropylene, a softer and more sustainable alternative to polyester in applications like disposable diapers and feminine hygiene products. The shift towards sustainable solutions is further reinforced by initiatives such as Berry Global’s ISCC PLUS certification. The market's growth trajectory shows no signs of slowing down and is expected to maintain a robust pace during the forecast period (2025-2033), exceeding xx Million in value by the end of this period.

Leading Regions, Countries, or Segments in United States Non-Woven Fabric Market

The US non-woven fabric market demonstrates diverse regional and segmental growth, but no single region or state dominates overwhelmingly. Growth is fairly spread across the country.

By Technology:

Spunbond: This technology segment currently holds the largest market share due to its versatility and cost-effectiveness in a wide range of applications. Key drivers include high demand for hygiene products and increasing automation in manufacturing.

Wet-laid & Dry-laid: These technologies cater to niche applications and represent smaller but growing segments.

Other Technologies: This segment includes innovative technologies still under development, offering future growth potential.

By Material:

Polypropylene: This material dominates due to its cost-effectiveness, softness, and suitability for various applications. Increased focus on sustainability also bolsters its market share.

Polyester: This material holds a significant share, particularly in industrial applications.

Other Materials: This segment includes materials like Rayon and Fluff Pulp, which cater to specific niche applications.

By End-User Industry:

Healthcare: This segment exhibits the highest growth rate due to the increasing demand for disposable medical products.

Automotive: This is a significant segment, driven by increasing vehicle production and interior applications.

Construction: This sector offers considerable growth potential, especially with developments in insulation materials.

United States Non-Woven Fabric Market Product Innovations

Recent innovations include persistently hydrophilic spunbond nonwovens (as exemplified by Toray Industries’ advancements), offering enhanced softness and absorbency for hygiene applications. The integration of nanotechnology and bio-based materials is creating high-performance, eco-friendly non-woven fabrics, enhancing the unique selling proposition of many products.

Propelling Factors for United States Non-Woven Fabric Market Growth

Several factors drive market growth, including:

Technological advancements: Innovations in fiber technology, manufacturing processes, and material science contribute to superior product performance and expand application areas.

Growing end-user industries: The expansion of the healthcare, automotive, and construction sectors fuels demand for non-woven fabrics.

Increased consumer awareness: Growing consumer preference for sustainable and eco-friendly products is pushing manufacturers to develop and adopt innovative manufacturing processes.

Obstacles in the United States Non-Woven Fabric Market Market

Challenges include:

Fluctuations in raw material prices: Price volatility affects production costs and profitability.

Stringent environmental regulations: Compliance requirements can increase production costs.

Intense competition: The market's fragmented nature necessitates continuous innovation and cost optimization to maintain competitiveness.

Future Opportunities in United States Non-Woven Fabric Market

Emerging opportunities lie in:

Bio-based and biodegradable materials: The increasing demand for sustainable solutions offers significant growth potential.

Advanced functionalities: The development of non-wovens with specialized properties (e.g., antimicrobial, self-healing) expands application areas.

New applications: Exploring emerging applications in areas like filtration, energy storage, and advanced packaging creates new market opportunities.

Major Players in the United States Non-Woven Fabric Market Ecosystem

- KCWW

- Glatfelter Corporation

- Lydall Inc

- Ahlstrom-Munksjo

- Freudenberg Performance Materials

- 3M

- Fybon Nonwovens Inc

- Jasztex Inc

- PFNonwovens Holding SRO

- Suominen Corporation

- DuPont

- Johns Manville

- Berry Global Inc

Key Developments in United States Non-Woven Fabric Market Industry

September 2022: Toray Industries, Inc. developed a persistently hydrophilic and soft spunbond nonwoven fabric for sanitary applications, signaling a significant advancement in material technology.

June 2022: Berry Global's US manufacturing locations received ISCC PLUS certification, reflecting the growing demand for sustainable non-woven materials and highlighting the industry's commitment to environmental responsibility.

Strategic United States Non-Woven Fabric Market Market Forecast

The US non-woven fabric market is poised for continued growth, driven by technological advancements, increasing demand from key end-user industries, and a strong focus on sustainability. The market is expected to experience significant expansion in the forecast period, driven by innovative product launches, strategic acquisitions, and the increasing adoption of sustainable materials. The market's future potential is substantial, making it an attractive investment destination.

United States Non-Woven Fabric Market Segmentation

-

1. Technology

- 1.1. Spunbond

- 1.2. Wet-laid

- 1.3. Dry-laid

- 1.4. Other Technologies

-

2. Material

-

2.1. Polyester

- 2.1.1. Polyester Staple Fiber

- 2.1.2. Polyester Resin (Bottle Grade)

-

2.2. Polypropylene

- 2.2.1. Polypropylene Resin

- 2.2.2. Polypropylene Staple Fiber

- 2.3. Polyethylene

- 2.4. Rayon

- 2.5. Fluff Pulp

- 2.6. Other Materials

-

2.1. Polyester

-

3. End-User Industry

- 3.1. Construction

- 3.2. Textiles

- 3.3. Healthcare

- 3.4. Automotive

- 3.5. Other End-User Industries

United States Non-Woven Fabric Market Segmentation By Geography

- 1. United States

United States Non-Woven Fabric Market Regional Market Share

Geographic Coverage of United States Non-Woven Fabric Market

United States Non-Woven Fabric Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond

- 3.3. Market Restrains

- 3.3.1. Low Durability and Strength of the Fabric; Other Restraints

- 3.4. Market Trends

- 3.4.1. The Healthcare Industry Promotes the Demand for Non-Woven Fabric

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Non-Woven Fabric Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Spunbond

- 5.1.2. Wet-laid

- 5.1.3. Dry-laid

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyester

- 5.2.1.1. Polyester Staple Fiber

- 5.2.1.2. Polyester Resin (Bottle Grade)

- 5.2.2. Polypropylene

- 5.2.2.1. Polypropylene Resin

- 5.2.2.2. Polypropylene Staple Fiber

- 5.2.3. Polyethylene

- 5.2.4. Rayon

- 5.2.5. Fluff Pulp

- 5.2.6. Other Materials

- 5.2.1. Polyester

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Construction

- 5.3.2. Textiles

- 5.3.3. Healthcare

- 5.3.4. Automotive

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KCWW

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glatfelter Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lydall Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ahlstrom-Munksjo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Freudenberg Performance Materials

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3M

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fybon Nonwovens Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jasztex Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PFNonwovens Holding SRO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suominen Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DuPont

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johns Manville

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Berry Global Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KCWW

List of Figures

- Figure 1: United States Non-Woven Fabric Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Non-Woven Fabric Market Share (%) by Company 2025

List of Tables

- Table 1: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: United States Non-Woven Fabric Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: United States Non-Woven Fabric Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Non-Woven Fabric Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Non-Woven Fabric Market?

Key companies in the market include KCWW, Glatfelter Corporation, Lydall Inc, Ahlstrom-Munksjo, Freudenberg Performance Materials, 3M, Fybon Nonwovens Inc, Jasztex Inc, PFNonwovens Holding SRO, Suominen Corporation*List Not Exhaustive, DuPont, Johns Manville, Berry Global Inc.

3. What are the main segments of the United States Non-Woven Fabric Market?

The market segments include Technology, Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond.

6. What are the notable trends driving market growth?

The Healthcare Industry Promotes the Demand for Non-Woven Fabric.

7. Are there any restraints impacting market growth?

Low Durability and Strength of the Fabric; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Toray Industries, Inc. developed a spunbond nonwoven fabric that is both persistently hydrophilic and soft on the skin. This fabric can be used to make disposable diapers, masks, feminine hygiene products, and other sanitary items. When the production technology is fully established, the company intends to begin full-scale production. Polypropylene, which is softer than polyester, is commonly used in spunbond nonwoven materials for sanitary applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Non-Woven Fabric Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Non-Woven Fabric Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Non-Woven Fabric Market?

To stay informed about further developments, trends, and reports in the United States Non-Woven Fabric Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence