Key Insights

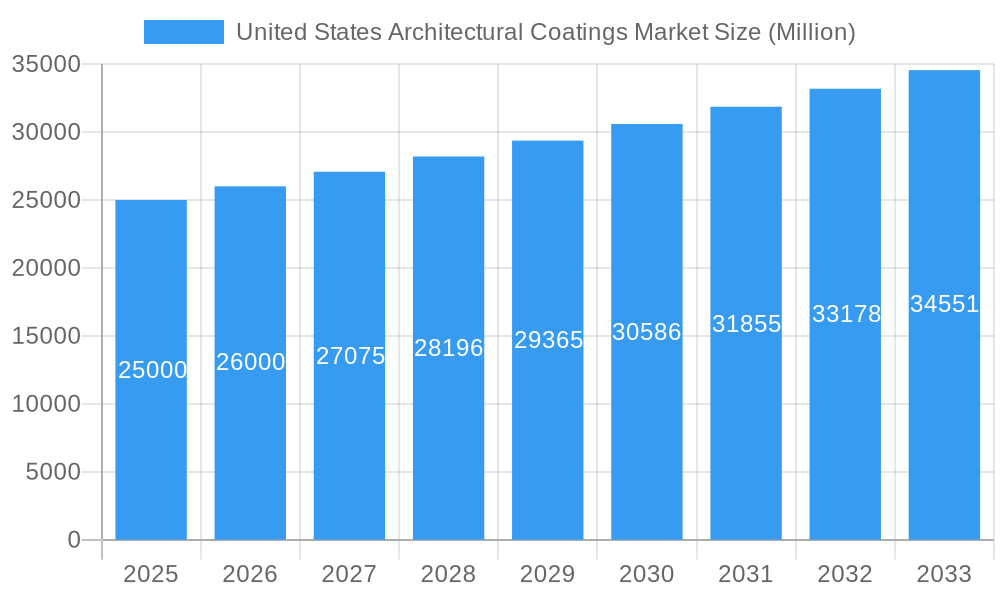

The United States architectural coatings market, encompassing paints and coatings for residential and commercial structures, represents a significant industry with robust expansion prospects. The market is projected to reach a value of 83.68 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 5.9%. Key growth drivers include escalating construction activity, a heightened demand for aesthetically appealing and durable finishes, and supportive government initiatives promoting energy-efficient buildings. The increasing adoption of eco-friendly and sustainable coatings, characterized by low VOC emissions and recycled content, further stimulates market growth. However, the market is subject to constraints such as volatile raw material costs, stringent environmental regulations, and potential economic downturns impacting construction investments. Leading companies like Sherwin-Williams, PPG Industries, and Benjamin Moore are driving competition through product innovation, strategic mergers, and diversification into specialized coating segments.

United States Architectural Coatings Market Market Size (In Billion)

Geographically, the United States architectural coatings market exhibits diversity across product categories, including interior and exterior paints, primers, and specialty coatings. Applications span residential, commercial, and industrial sectors, with distribution channels encompassing retail, wholesale, and direct-to-contractor sales. The forecast period from 2025 to 2033 anticipates sustained market expansion. This dynamic landscape offers substantial investment opportunities for both established enterprises and emerging companies within this evolving sector. Detailed regional analysis will further illuminate specific market trends and opportunities.

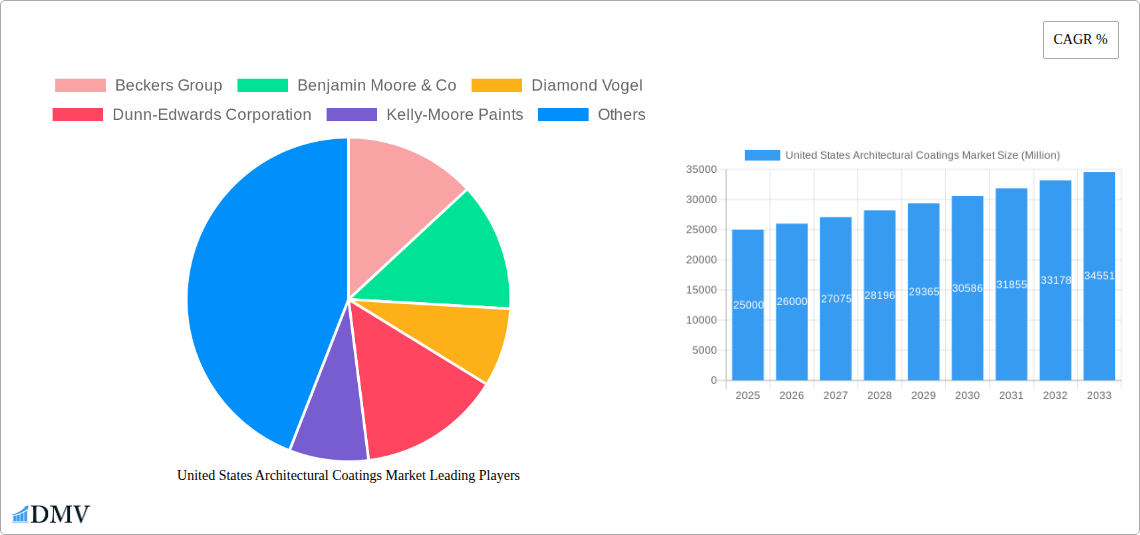

United States Architectural Coatings Market Company Market Share

United States Architectural Coatings Market: A Comprehensive Report (2019-2033)

This insightful report delivers a meticulous analysis of the United States Architectural Coatings Market, providing a detailed overview of its current state, future trajectory, and key players. With a comprehensive study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report is an indispensable resource for stakeholders seeking to navigate this dynamic market. The market is estimated to be worth xx Million in 2025 and projected to reach xx Million by 2033, exhibiting a significant Compound Annual Growth Rate (CAGR) of xx%.

United States Architectural Coatings Market Composition & Trends

This section delves into the intricate dynamics of the US Architectural Coatings Market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with the top five players commanding a combined market share of approximately xx%. Innovation is fueled by increasing demand for sustainable and high-performance coatings, prompting significant R&D investments by major players. Stringent environmental regulations are shaping product development, pushing the industry towards low-VOC and eco-friendly options. Competition from substitute materials like vinyl siding and fiber cement is notable, but the architectural coatings market retains its strong position due to aesthetic appeal and design flexibility. Key end-users include residential construction, commercial building projects, and the industrial sector. Significant M&A activities have reshaped the market landscape, with notable transactions resulting in xx Million in deal value during the period 2019-2024.

- Market Concentration: Top 5 players hold xx% market share.

- Innovation Catalysts: Demand for sustainable, high-performance coatings.

- Regulatory Landscape: Stringent environmental regulations driving low-VOC formulations.

- Substitute Products: Competition from vinyl siding and fiber cement.

- End-User Profiles: Residential, commercial, and industrial sectors.

- M&A Activity: xx Million in deal value (2019-2024).

United States Architectural Coatings Market Industry Evolution

The US Architectural Coatings Market has experienced significant evolution over the past five years, characterized by robust growth, technological advancements, and shifting consumer preferences. The market's growth trajectory has been influenced by factors such as the construction boom, rising disposable incomes, and growing emphasis on home improvement. Technological innovation has focused on the development of advanced coatings with improved durability, weather resistance, and aesthetic properties. The adoption of water-based coatings has significantly increased, driven by environmental concerns and regulatory pressures. Consumer demand for specialized coatings, such as antimicrobial and self-cleaning coatings, is also witnessing steady growth. The market has shown a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption rate of water-based coatings is currently at xx%, expected to reach xx% by 2033.

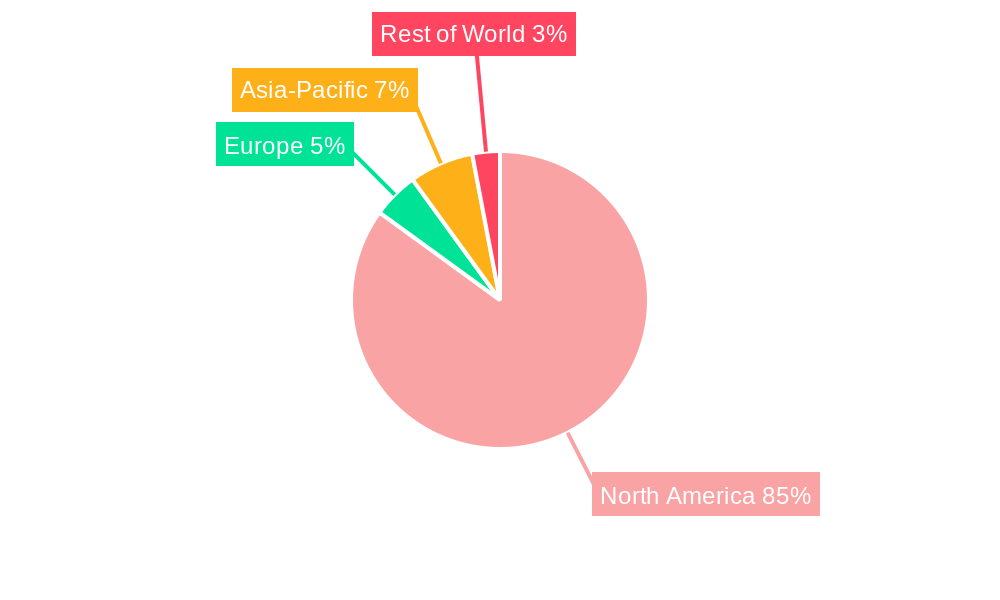

Leading Regions, Countries, or Segments in United States Architectural Coatings Market

The Northeast region currently dominates the US Architectural Coatings Market due to factors like high population density, robust construction activities, and a strong preference for high-quality architectural finishes. This dominance is further supported by favorable government policies and significant investments in infrastructure projects. Other regions are experiencing substantial growth, but the Northeast maintains its leading position.

- Key Drivers (Northeast Region):

- High population density and construction activity.

- Strong demand for high-quality architectural finishes.

- Favorable government policies and infrastructure investments.

- Dominance Factors: The Northeast's established construction industry, coupled with consumer preference for premium coatings, contributes to its market leadership.

United States Architectural Coatings Market Product Innovations

Recent innovations focus on enhancing the durability, aesthetics, and sustainability of architectural coatings. Formulations now incorporate advanced polymers and additives, leading to improved resistance to weathering, UV degradation, and microbial growth. The development of self-cleaning and anti-graffiti coatings demonstrates a strong focus on performance enhancements. Furthermore, the increasing use of water-based and low-VOC options showcases a growing emphasis on environmental responsibility. These innovations are attracting substantial market interest and are key drivers of market expansion.

Propelling Factors for United States Architectural Coatings Market Growth

Several factors are driving the growth of the US Architectural Coatings Market. The ongoing expansion of the construction industry, both residential and commercial, is a primary growth driver. Increased disposable incomes are allowing homeowners and businesses to invest more in aesthetic improvements and property maintenance. Moreover, supportive government policies aimed at promoting sustainable building practices are indirectly supporting the demand for eco-friendly coatings. Finally, technological advancements and the introduction of innovative products contribute significantly to market expansion.

Obstacles in the United States Architectural Coatings Market

Despite significant growth potential, the market faces certain challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and market stability. Stringent environmental regulations can add to manufacturing costs and complexity. Intense competition among established players and the emergence of new entrants create pricing pressure. These factors can collectively influence overall market growth trajectories.

Future Opportunities in United States Architectural Coatings Market

Future opportunities lie in the growing demand for specialized coatings, such as those with antimicrobial and self-cleaning properties. The increasing focus on sustainable building practices will further fuel demand for eco-friendly coatings. Exploring new market segments, such as the industrial and infrastructure sectors, holds significant potential for growth. Furthermore, investing in R&D to develop cutting-edge formulations will provide a competitive edge.

Major Players in the United States Architectural Coatings Market Ecosystem

- Beckers Group

- Benjamin Moore & Co

- Diamond Vogel

- Dunn-Edwards Corporation

- Kelly-Moore Paints

- Masco Corporation

- PPG Industries Inc

- RPM International Inc

- The Sherwin-Williams Company

Key Developments in United States Architectural Coatings Market Industry

- June 2021: PPG acquired all shares of Tikkurila, expanding its product portfolio and market reach. Tikkurila's brands include Tikkurila, ALCRO, Teks, Vivacolor, and Beckers.

- August 2021: PPG introduced new PPG ENVIROCRON™ PCS P4 powder coatings, catering to architectural, home decor, and furniture applications.

- January 2022: PPG expanded its relationship with The Home Depot and HD Supply, strengthening its distribution network and professional market reach.

Strategic United States Architectural Coatings Market Forecast

The US Architectural Coatings Market is poised for continued growth, driven by several key catalysts. The ongoing expansion of the construction sector, coupled with rising consumer demand for high-performance and sustainable coatings, will be major contributors. Technological advancements, such as the development of innovative formulations and application methods, will further propel market expansion. The market's inherent resilience and sustained demand for aesthetic and protective coatings ensures its positive outlook for the foreseeable future.

United States Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

United States Architectural Coatings Market Segmentation By Geography

- 1. United States

United States Architectural Coatings Market Regional Market Share

Geographic Coverage of United States Architectural Coatings Market

United States Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beckers Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Benjamin Moore & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Diamond Vogel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dunn-Edwards Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kelly-Moore Paints

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Masco Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PPG Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RPM International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Sherwin-Williams Compan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Beckers Group

List of Figures

- Figure 1: United States Architectural Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: United States Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 2: United States Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: United States Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 4: United States Architectural Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 6: United States Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: United States Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 8: United States Architectural Coatings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Architectural Coatings Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the United States Architectural Coatings Market?

Key companies in the market include Beckers Group, Benjamin Moore & Co, Diamond Vogel, Dunn-Edwards Corporation, Kelly-Moore Paints, Masco Corporation, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Compan.

3. What are the main segments of the United States Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.68 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: PPG announced an expanded relationship with The Home Depot and HD Supply to provide a comprehensive range of professional PPG paint products and services specific to the needs of professional customers.August 2021: PPG introduced new PPG ENVIROCRONTM PCS P4 powder coatings for Architectural, home decor, and furniture applications.June 2021: PPG acquired all the shares of Tikkurila. Tikkurila's brands include Tikkurila, ALCRO, Teks, Vivacolor, and Beckers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the United States Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence