Key Insights

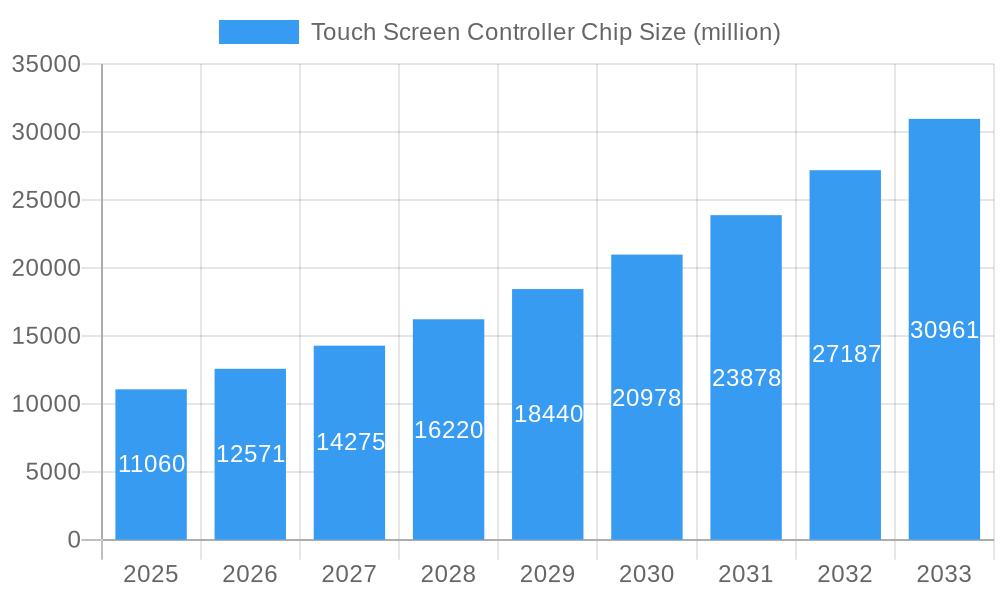

The global Touch Screen Controller Chip market is poised for robust expansion, with an estimated market size of USD 11.06 billion in 2025. This significant growth is fueled by a compelling compound annual growth rate (CAGR) of 13.8% projected over the forecast period from 2025 to 2033. The increasing proliferation of touch-enabled devices across consumer electronics, automotive, manufacturing, and the medical industry is the primary driver for this surge. As consumers and businesses alike demand more intuitive and responsive user interfaces, the demand for sophisticated touch screen controller chips that offer enhanced accuracy, multi-touch capabilities, and energy efficiency will continue to escalate. The ongoing advancements in sensor technology and integrated circuit design are enabling smaller, more powerful, and cost-effective controller chips, further accelerating market adoption.

Touch Screen Controller Chip Market Size (In Billion)

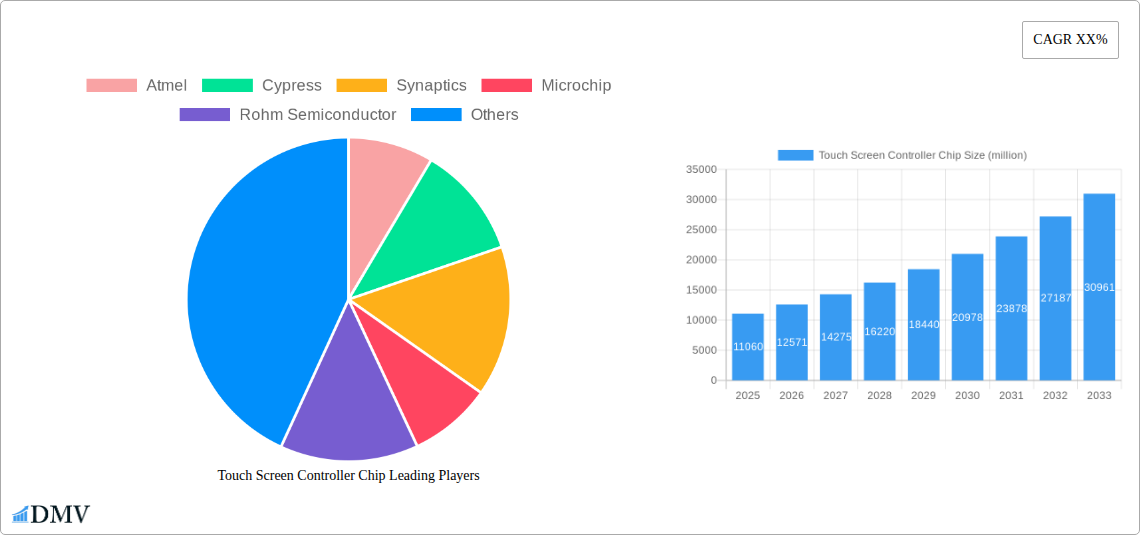

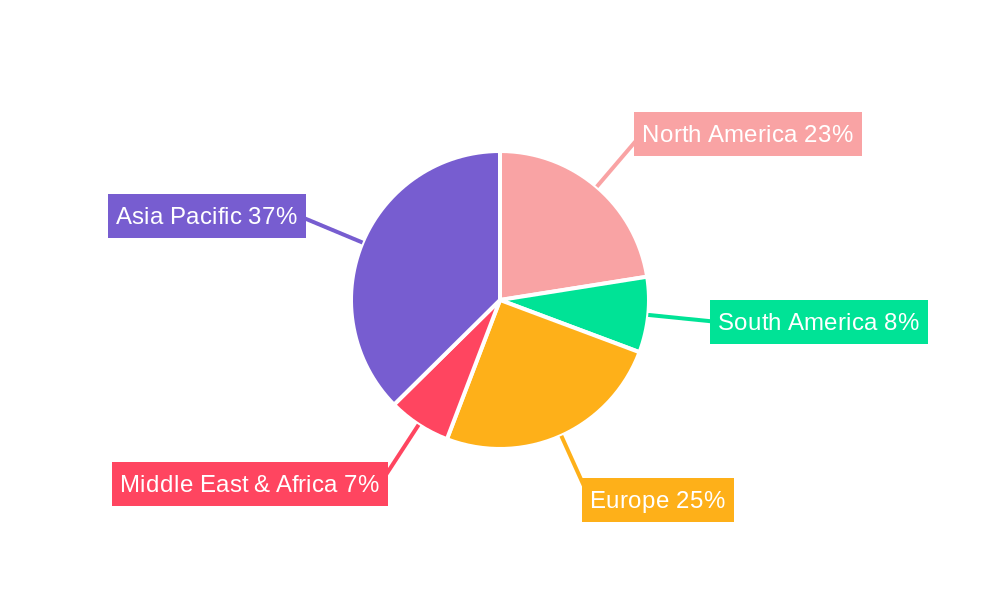

The market segmentation highlights a diverse landscape of applications and chip types. Traditional mutual capacitance and self-capacitance chips, along with their single-layer variants, continue to serve established markets, while the emergence of self-capacitance and mutual-capacitance integrated chips signifies a trend towards higher performance and integrated solutions. Key industry players like Atmel, Cypress, Synaptics, and Microchip are at the forefront of innovation, driving technological advancements and catering to the evolving needs of various sectors. Geographically, the Asia Pacific region, particularly China, is expected to dominate market share due to its extensive manufacturing capabilities and a rapidly growing consumer base for electronic devices. North America and Europe will remain significant markets, driven by technological adoption in automotive and medical applications. Restraints, such as the initial high development costs for cutting-edge technologies and potential supply chain disruptions, will need to be navigated by market participants.

Touch Screen Controller Chip Company Market Share

Touch Screen Controller Chip Market Composition & Trends

This comprehensive report delves into the intricate dynamics of the global Touch Screen Controller Chip Market, a critical component driving the proliferation of interactive displays across a multitude of applications. We meticulously analyze market concentration, identifying dominant players and emerging challengers such as Atmel, Cypress, Synaptics, Microchip, Rohm Semiconductor, Texas Instruments, Analog Devices, Focal Tech, Mstar, ELAN Microelectronics, Himax Technologies, Sitronix, ZINITIX, Goodix Technology, Blestech, Silead, Chiponeic, and Hynitron. Our study illuminates the innovation catalysts that are reshaping the industry, including advancements in sensing technologies and power efficiency, crucial for the Consumer Electronics, Automotive, Manufacturing, and Medical Industry segments. The report scrutinizes the regulatory landscapes, understanding their impact on product development and market access, particularly concerning Self-capacitance and Mutual-capacitance Integrated Chips. We explore the evolving end-user profiles, from the ubiquitous smartphone to sophisticated industrial control panels, and assess the strategic implications of M&A activities, including past deal values estimated to be in the billions, for market consolidation and technological advancement.

- Market Concentration: High, with significant market share held by a select group of established vendors.

- Innovation Catalysts: Miniaturization, power efficiency, enhanced touch accuracy, support for multi-touch gestures, and integration with advanced AI functionalities.

- Regulatory Landscapes: Focus on safety standards, power consumption regulations (e.g., Energy Star), and data privacy for touch-enabled devices.

- Substitute Products: While direct substitutes for the core controller chip functionality are limited, advancements in alternative input methods are indirectly influencing market demand.

- End-User Profiles: Increasingly sophisticated demands for seamless user experiences in smartphones, tablets, wearables, automotive infotainment systems, industrial HMIs, and medical devices.

- M&A Activities: Strategic acquisitions and partnerships aimed at expanding product portfolios, gaining access to new technologies, and consolidating market presence, with estimated deal values in the billions.

Touch Screen Controller Chip Industry Evolution

The Touch Screen Controller Chip Industry has witnessed a remarkable trajectory of growth and transformation, propelled by relentless technological innovation and the insatiable consumer demand for intuitive interfaces. Over the Study Period of 2019–2033, with a Base Year of 2025 and a Forecast Period extending to 2033, the market has consistently demonstrated robust expansion. In the Historical Period of 2019–2024, the industry saw a compound annual growth rate (CAGR) of approximately 15%, driven by the widespread adoption of smartphones and tablets. Technological advancements have been pivotal, with the transition from resistive to capacitive touchscreens ushering in an era of multi-touch capabilities and enhanced responsiveness. The report highlights the increasing sophistication of Traditional Mutual Capacitance Chips and the emergence of highly efficient Single-layer Mutual Capacitance Chips and Single-layer Self-capacitance Chips, catering to the diverse needs of various applications.

The Estimated Year of 2025 positions the market for continued, albeit potentially moderated, growth as saturation in certain consumer segments is addressed by expansion into new verticals like automotive and industrial automation. The evolution of Self-capacitance and Mutual-capacitance Integrated Chips signifies a push towards greater integration and cost-effectiveness, enabling smaller form factors and lower power consumption in devices. This evolution is not merely driven by incremental improvements but by fundamental shifts in how users interact with technology. The proliferation of the Internet of Things (IoT) has created a surge in demand for touch-enabled devices beyond traditional consumer electronics, including smart home appliances, industrial control systems, and wearable technology. The Automotive Industry, in particular, is a significant growth engine, with touchscreens becoming integral to infotainment systems, dashboard controls, and advanced driver-assistance systems (ADAS). Medical devices are also increasingly relying on touch interfaces for their ease of use and hygienic operation.

The market's growth is also influenced by economic factors, such as the increasing disposable income in developing regions, which fuels the demand for consumer electronics. Furthermore, governmental initiatives promoting digital transformation and the adoption of smart technologies in sectors like manufacturing and healthcare indirectly support the growth of the touch screen controller chip market. The ongoing research and development efforts by leading companies like Atmel, Cypress, Synaptics, Microchip, Rohm Semiconductor, Texas Instruments, Analog Devices, Focal Tech, Mstar, ELAN Microelectronics, Himax Technologies, Sitronix, ZINITIX, Goodix Technology, Blestech, Silead, Chiponeic, and Hynitron are continuously pushing the boundaries of performance, accuracy, and power efficiency. The market’s ability to adapt to these evolving demands, offering solutions for both high-volume consumer applications and specialized industrial and medical use cases, underscores its resilience and long-term potential. The projected CAGR for the Forecast Period (2025–2033) is estimated to be around 12%–14%, indicating sustained and significant market expansion.

Leading Regions, Countries, or Segments in Touch Screen Controller Chip

The global Touch Screen Controller Chip Market is characterized by regional dominance and segment-specific growth drivers, with Asia Pacific emerging as the leading region due to its robust manufacturing ecosystem and burgeoning consumer electronics market. This region, encompassing countries like China, South Korea, and Taiwan, is home to major manufacturing hubs for smartphones, tablets, and other touch-enabled devices, contributing to a substantial demand for Traditional Mutual Capacitance Chips and Single-layer Mutual Capacitance Chips. The significant presence of key players like Focal Tech, Mstar, and Chiponeic further solidifies Asia Pacific's leadership.

Within the Application segments, Consumer Electronics remains the largest contributor, driven by the continuous innovation and replacement cycles of smartphones, laptops, and wearable devices. However, the Automotive Industry is exhibiting the most rapid growth, with the increasing integration of advanced infotainment systems, digital cockpits, and autonomous driving technologies necessitating sophisticated touch screen controller solutions. The demand for robust and reliable Self-capacitance and Mutual-capacitance Integrated Chips is particularly high in this sector, alongside specialized chips that offer enhanced durability and operability in diverse environmental conditions.

In terms of Types, Single-layer Mutual Capacitance Chips are experiencing a surge in adoption due to their cost-effectiveness and suitability for a wide range of consumer devices. Concurrently, the advanced capabilities offered by Self-capacitance and Mutual-capacitance Integrated Chips are gaining traction in premium applications where precise multi-touch gestures and stylus support are paramount. The Medical Industry represents a growing, albeit niche, segment, with a demand for highly accurate, hygienic, and reliable touch solutions, often favoring specialized Traditional Mutual Capacitance Chips with enhanced certifications.

- Leading Region: Asia Pacific, driven by manufacturing prowess and high consumer demand.

- Dominant Application Segment: Consumer Electronics, with significant growth in Automotive.

- Key Type Trends: Rising adoption of Single-layer Mutual Capacitance Chips for cost-efficiency and Self-capacitance and Mutual-capacitance Integrated Chips for advanced functionality.

- Emerging Growth Areas: Automotive infotainment, industrial automation, and medical devices.

- Investment Trends: Strong R&D investment in Asia Pacific and North America, focusing on next-generation touch technologies.

- Regulatory Support: Government initiatives promoting digitalization and advanced manufacturing indirectly benefit the market.

Touch Screen Controller Chip Product Innovations

The Touch Screen Controller Chip landscape is constantly evolving with groundbreaking innovations aimed at enhancing user experience and device functionality. Companies are focusing on developing ultra-low power consumption chips, crucial for battery-powered devices, alongside highly responsive controllers that support advanced multi-touch gestures and stylus input with near-zero latency. Innovations in noise immunity are enabling reliable touch operation even in harsh environments, a critical factor for Automotive and Manufacturing applications. Furthermore, the integration of advanced algorithms for touch detection and object recognition is paving the way for intuitive and intelligent interfaces in Consumer Electronics and Medical Industry devices. The development of cost-effective Single-layer Mutual Capacitance Chips and highly integrated Self-capacitance and Mutual-capacitance Integrated Chips is democratizing advanced touch capabilities across a broader spectrum of devices, with performance metrics continuously improving in terms of touch accuracy, resolution, and signal-to-noise ratio.

Propelling Factors for Touch Screen Controller Chip Growth

The Touch Screen Controller Chip Market is being propelled by several key factors. The pervasive demand for interactive and intuitive user interfaces across virtually all electronic devices, from smartphones to industrial machinery, is a primary driver. Technological advancements, such as the development of higher resolution, lower power consumption, and more accurate touch controllers, are continuously expanding the potential applications. The rapid growth of the Automotive Industry, with its increasing adoption of sophisticated in-car entertainment and control systems, and the burgeoning Medical Industry, where touch interfaces enhance usability and hygiene, are significant growth catalysts. Furthermore, supportive government policies promoting digitalization and smart manufacturing across various economies are creating a fertile ground for the expansion of the touch screen controller chip market.

Obstacles in the Touch Screen Controller Chip Market

Despite the robust growth, the Touch Screen Controller Chip Market faces several obstacles. Intense competition among numerous players, including established giants and agile startups, can lead to price erosion and squeezed profit margins. Supply chain disruptions, exacerbated by global geopolitical events and raw material shortages, can impact production timelines and increase costs. Furthermore, the stringent regulatory requirements in certain sectors, particularly for Medical Industry applications, necessitate extensive testing and certification, which can be time-consuming and expensive. The increasing complexity of touch technologies also demands significant R&D investment, posing a challenge for smaller companies.

Future Opportunities in Touch Screen Controller Chip

The future holds significant opportunities for the Touch Screen Controller Chip Market. The expansion of the IoT ecosystem, with billions of connected devices requiring interactive interfaces, presents a vast untapped market. Advancements in flexible and transparent touch technologies are opening doors for innovative product designs in wearables, smart textiles, and advanced display applications. The growing demand for haptic feedback integration within touch screens presents another avenue for innovation and market differentiation. Furthermore, the increasing adoption of touch interfaces in emerging markets and in specialized industrial and defense applications will continue to fuel market growth.

Major Players in the Touch Screen Controller Chip Ecosystem

- Atmel

- Cypress

- Synaptics

- Microchip

- Rohm Semiconductor

- Texas Instruments

- Analog Devices

- Focal Tech

- Mstar

- ELAN Microelectronics

- Himax Technologies

- Sitronix

- ZINITIX

- Goodix Technology

- Blestech

- Silead

- Chiponeic

- Hynitron

Key Developments in Touch Screen Controller Chip Industry

- 2023: Synaptics launches new line of touch controller ICs with advanced AI capabilities for enhanced gesture recognition in consumer electronics.

- 2023: Goodix Technology announces mass production of ultra-thin under-display fingerprint sensors, integrating touch and biometric authentication.

- 2024: Cypress Semiconductor (now Infineon) introduces high-performance automotive touch controllers with advanced safety features and extended operating temperature ranges.

- 2024: Texas Instruments expands its portfolio with energy-efficient touch controller solutions for IoT devices.

- 2024: Focal Tech showcases advancements in single-layer touch solutions for cost-sensitive applications.

- 2025: Rohm Semiconductor unveils next-generation touch solutions optimized for automotive HUDs and infotainment systems.

- 2025: Microchip Technology enhances its microcontroller-based touch sensing solutions for industrial and medical applications.

Strategic Touch Screen Controller Chip Market Forecast

The strategic forecast for the Touch Screen Controller Chip Market indicates sustained growth, driven by ongoing innovation and the expansion of touch interfaces into new and existing applications. The increasing demand for highly integrated, power-efficient, and accurate touch solutions will continue to shape product development. The Automotive and Medical Industry segments are poised for significant expansion, creating lucrative opportunities for specialized chip designs. Mergers and acquisitions are expected to continue, consolidating the market and fostering further technological advancements. Emerging trends in flexible displays and advanced haptics will also play a crucial role in shaping the market's future landscape, promising a dynamic and evolving ecosystem for touch screen controller chips.

Touch Screen Controller Chip Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Manufacturing

- 1.4. Medical Industry

- 1.5. Other

-

2. Types

- 2.1. Traditional Mutual Capacitance Chip

- 2.2. Single-layer Mutual Capacitance Chip

- 2.3. Traditional Self-capacitance Chip

- 2.4. Single-layer Self-capacitance Chip

- 2.5. Self-capacitance and Mutual-capacitance Integrated Chip

Touch Screen Controller Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Touch Screen Controller Chip Regional Market Share

Geographic Coverage of Touch Screen Controller Chip

Touch Screen Controller Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Manufacturing

- 5.1.4. Medical Industry

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Traditional Mutual Capacitance Chip

- 5.2.2. Single-layer Mutual Capacitance Chip

- 5.2.3. Traditional Self-capacitance Chip

- 5.2.4. Single-layer Self-capacitance Chip

- 5.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Automotive

- 6.1.3. Manufacturing

- 6.1.4. Medical Industry

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Traditional Mutual Capacitance Chip

- 6.2.2. Single-layer Mutual Capacitance Chip

- 6.2.3. Traditional Self-capacitance Chip

- 6.2.4. Single-layer Self-capacitance Chip

- 6.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Automotive

- 7.1.3. Manufacturing

- 7.1.4. Medical Industry

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Traditional Mutual Capacitance Chip

- 7.2.2. Single-layer Mutual Capacitance Chip

- 7.2.3. Traditional Self-capacitance Chip

- 7.2.4. Single-layer Self-capacitance Chip

- 7.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Automotive

- 8.1.3. Manufacturing

- 8.1.4. Medical Industry

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Traditional Mutual Capacitance Chip

- 8.2.2. Single-layer Mutual Capacitance Chip

- 8.2.3. Traditional Self-capacitance Chip

- 8.2.4. Single-layer Self-capacitance Chip

- 8.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Automotive

- 9.1.3. Manufacturing

- 9.1.4. Medical Industry

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Traditional Mutual Capacitance Chip

- 9.2.2. Single-layer Mutual Capacitance Chip

- 9.2.3. Traditional Self-capacitance Chip

- 9.2.4. Single-layer Self-capacitance Chip

- 9.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Touch Screen Controller Chip Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronics

- 10.1.2. Automotive

- 10.1.3. Manufacturing

- 10.1.4. Medical Industry

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Traditional Mutual Capacitance Chip

- 10.2.2. Single-layer Mutual Capacitance Chip

- 10.2.3. Traditional Self-capacitance Chip

- 10.2.4. Single-layer Self-capacitance Chip

- 10.2.5. Self-capacitance and Mutual-capacitance Integrated Chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Atmel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cypress

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Synaptics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microchip

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rohm Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Texas Instruments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Analog Devices

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Focal Tech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mstar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ELAN Microelectronics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Himax Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sitronix

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ZINITIX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Goodix Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Blestech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Silead

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Chiponeic

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Hynitron

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Atmel

List of Figures

- Figure 1: Global Touch Screen Controller Chip Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Touch Screen Controller Chip Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Touch Screen Controller Chip Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Touch Screen Controller Chip Volume (K), by Application 2025 & 2033

- Figure 5: North America Touch Screen Controller Chip Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Touch Screen Controller Chip Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Touch Screen Controller Chip Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America Touch Screen Controller Chip Volume (K), by Types 2025 & 2033

- Figure 9: North America Touch Screen Controller Chip Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Touch Screen Controller Chip Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Touch Screen Controller Chip Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Touch Screen Controller Chip Volume (K), by Country 2025 & 2033

- Figure 13: North America Touch Screen Controller Chip Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Touch Screen Controller Chip Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Touch Screen Controller Chip Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Touch Screen Controller Chip Volume (K), by Application 2025 & 2033

- Figure 17: South America Touch Screen Controller Chip Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Touch Screen Controller Chip Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Touch Screen Controller Chip Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America Touch Screen Controller Chip Volume (K), by Types 2025 & 2033

- Figure 21: South America Touch Screen Controller Chip Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Touch Screen Controller Chip Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Touch Screen Controller Chip Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Touch Screen Controller Chip Volume (K), by Country 2025 & 2033

- Figure 25: South America Touch Screen Controller Chip Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Touch Screen Controller Chip Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Touch Screen Controller Chip Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Touch Screen Controller Chip Volume (K), by Application 2025 & 2033

- Figure 29: Europe Touch Screen Controller Chip Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Touch Screen Controller Chip Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Touch Screen Controller Chip Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe Touch Screen Controller Chip Volume (K), by Types 2025 & 2033

- Figure 33: Europe Touch Screen Controller Chip Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Touch Screen Controller Chip Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Touch Screen Controller Chip Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Touch Screen Controller Chip Volume (K), by Country 2025 & 2033

- Figure 37: Europe Touch Screen Controller Chip Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Touch Screen Controller Chip Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Touch Screen Controller Chip Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Touch Screen Controller Chip Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Touch Screen Controller Chip Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Touch Screen Controller Chip Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Touch Screen Controller Chip Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa Touch Screen Controller Chip Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Touch Screen Controller Chip Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Touch Screen Controller Chip Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Touch Screen Controller Chip Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Touch Screen Controller Chip Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Touch Screen Controller Chip Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Touch Screen Controller Chip Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Touch Screen Controller Chip Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Touch Screen Controller Chip Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Touch Screen Controller Chip Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Touch Screen Controller Chip Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Touch Screen Controller Chip Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific Touch Screen Controller Chip Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Touch Screen Controller Chip Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Touch Screen Controller Chip Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Touch Screen Controller Chip Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Touch Screen Controller Chip Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Touch Screen Controller Chip Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Touch Screen Controller Chip Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Touch Screen Controller Chip Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Touch Screen Controller Chip Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 10: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Touch Screen Controller Chip Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Touch Screen Controller Chip Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 22: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Touch Screen Controller Chip Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Touch Screen Controller Chip Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 34: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Touch Screen Controller Chip Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Touch Screen Controller Chip Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 58: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Touch Screen Controller Chip Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Touch Screen Controller Chip Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Touch Screen Controller Chip Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Touch Screen Controller Chip Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Touch Screen Controller Chip Revenue undefined Forecast, by Types 2020 & 2033

- Table 76: Global Touch Screen Controller Chip Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Touch Screen Controller Chip Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Touch Screen Controller Chip Volume K Forecast, by Country 2020 & 2033

- Table 79: China Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Touch Screen Controller Chip Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Touch Screen Controller Chip Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Touch Screen Controller Chip?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the Touch Screen Controller Chip?

Key companies in the market include Atmel, Cypress, Synaptics, Microchip, Rohm Semiconductor, Texas Instruments, Analog Devices, Focal Tech, Mstar, ELAN Microelectronics, Himax Technologies, Sitronix, ZINITIX, Goodix Technology, Blestech, Silead, Chiponeic, Hynitron.

3. What are the main segments of the Touch Screen Controller Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Touch Screen Controller Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Touch Screen Controller Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Touch Screen Controller Chip?

To stay informed about further developments, trends, and reports in the Touch Screen Controller Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence