Key Insights

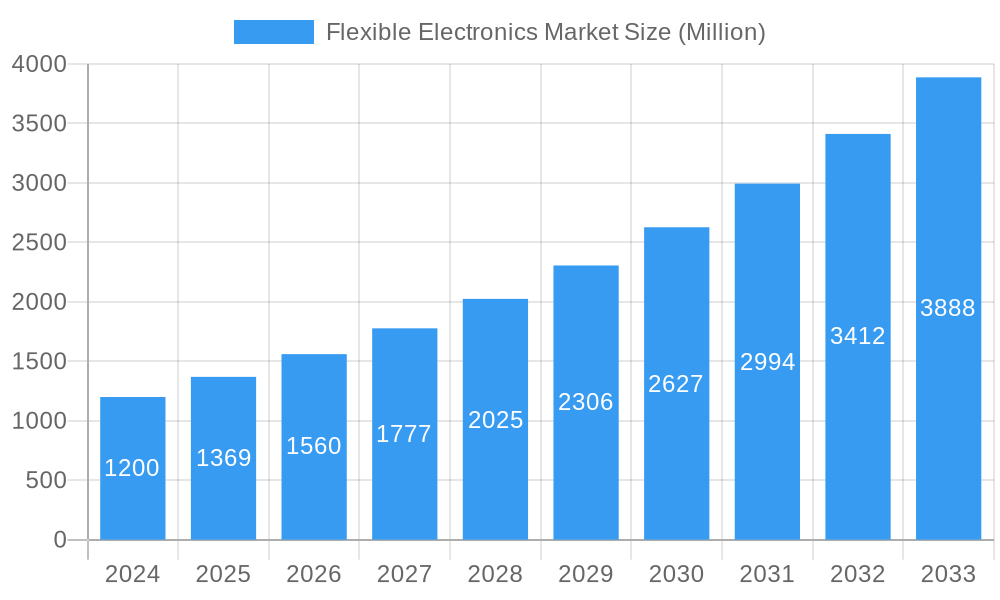

The Flexible Electronics Market is poised for remarkable expansion, with a current market size estimated at $1.2 billion in 2024. This dynamic sector is projected to experience a robust Compound Annual Growth Rate (CAGR) of 14.1% through 2033. This significant growth is primarily fueled by an increasing demand for lightweight, adaptable, and embedded electronic components across a multitude of industries. The proliferation of wearable devices, smart packaging, and next-generation displays are key drivers, pushing the boundaries of what electronic devices can achieve. Furthermore, advancements in materials science and manufacturing processes are continuously lowering costs and improving the performance of flexible electronic components, making them increasingly accessible and attractive for integration into everyday products. The ability of flexible electronics to conform to irregular surfaces and enable novel form factors is a critical advantage that continues to drive innovation and adoption.

Flexible Electronics Market Market Size (In Billion)

The market's trajectory is also influenced by key trends such as the integration of IoT capabilities into flexible devices, the development of bio-integrated flexible electronics for healthcare, and the miniaturization of components for even more discreet applications. While the market is characterized by strong growth, certain restraints may emerge, including the need for further standardization, potential challenges in large-scale manufacturing for highly complex circuits, and the ongoing competition from traditional rigid electronics in specific applications. Nevertheless, the pervasive adoption across Consumer Electronics, Automotive, Healthcare, and Military and Defense sectors, coupled with the innovative efforts of leading companies like Samsung Electronics, LG Electronics, and E Ink Holdings, strongly indicates a future dominated by flexible electronic solutions, reshaping product design and functionality across the global landscape.

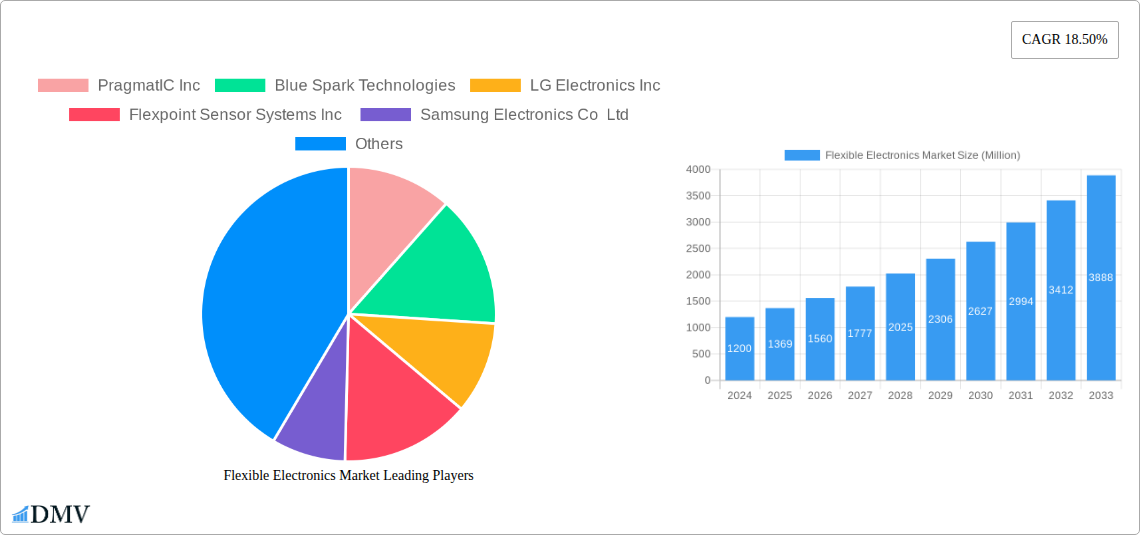

Flexible Electronics Market Company Market Share

This in-depth report delivers an exhaustive analysis of the flexible electronics market, a rapidly evolving sector poised for exponential growth. Covering the historical period of 2019–2024, base year 2025, and an extended forecast period from 2025–2033, this research provides critical insights for stakeholders seeking to capitalize on emerging trends and technological advancements. The global flexible electronics market size is projected to reach USD XXX billion by 2033, driven by innovation in sensing, lighting, display technologies, and applications across consumer electronics, automotive, healthcare, and military and defense sectors.

Flexible Electronics Market Market Composition & Trends

The flexible electronics market is characterized by a dynamic landscape with a moderate level of concentration, driven by continuous innovation and strategic alliances. Key players are investing heavily in research and development to introduce novel functionalities and improve device performance, leading to a competitive environment. The regulatory landscape is gradually evolving to support the adoption of advanced electronic components, particularly in sectors like healthcare and automotive. Substitute products, while present in some niche applications, are increasingly being outpaced by the superior versatility and miniaturization offered by flexible solutions. End-user profiles are expanding beyond traditional consumer electronics to encompass sophisticated applications in medical wearables, smart textiles, and advanced automotive systems. Mergers and acquisitions (M&A) activity remains robust, with significant deal values indicative of the strategic importance of acquiring flexible electronics capabilities. For instance, recent M&A activities within the wearable electronics market and the organic electronics market highlight the consolidation of expertise and market share.

- Market Concentration: Moderate, with key players establishing strong footholds.

- Innovation Catalysts: Advances in material science, miniaturization, and energy harvesting technologies.

- Regulatory Landscapes: Evolving to support new applications, especially in regulated industries like healthcare.

- Substitute Products: Facing increasing competition from the performance and form factor advantages of flexible electronics.

- End-User Profiles: Diversifying from consumer gadgets to critical industrial and medical applications.

- M&A Activities: High, indicating strategic consolidation and investment in the sector, with deal values in the range of USD XX to XXX billion in the historical period.

Flexible Electronics Market Industry Evolution

The flexible electronics industry has witnessed a remarkable evolution, transitioning from nascent experimental stages to a mature and rapidly expanding market. This transformation is largely attributed to groundbreaking technological advancements and a palpable shift in consumer and industry demands for more adaptable, integrated, and aesthetically pleasing electronic solutions. Over the study period of 2019–2033, the market has seen a consistent upward trajectory in growth rates, with the base year of 2025 serving as a pivotal point for accelerating adoption. The initial historical period of 2019–2024 laid the groundwork, characterized by significant R&D breakthroughs and early-stage commercialization.

Technological evolution has been a primary driver, with breakthroughs in materials like conductive inks, organic semiconductors, and advanced polymers enabling the creation of devices that are not only flexible but also lightweight, durable, and energy-efficient. The development of processes like roll-to-roll printing has significantly reduced manufacturing costs and increased production scalability, making flexible electronic components more accessible. This has directly fueled the expansion of applications in consumer electronics, including bendable smartphone displays, rollable TVs, and advanced wearables.

Consumer demand has played an equally crucial role, with a growing preference for devices that offer enhanced portability, user experience, and integration into everyday life. The rise of the Internet of Things (IoT) has created a fertile ground for flexible electronics, enabling the development of smart sensors and distributed electronic systems that can be seamlessly embedded into clothing, packaging, and diverse surfaces. The flexible display market, in particular, has seen substantial innovation, moving beyond simple flexibility to encompass stretchable and foldable form factors.

The automotive industry is increasingly adopting flexible electronics for integrated lighting solutions, smart surfaces, and advanced driver-assistance systems (ADAS). Similarly, the healthcare sector is leveraging flexible electronics for wearable diagnostic devices, intelligent bandages, and implantable sensors, revolutionizing patient monitoring and treatment. The military and defense sector is also a significant adopter, utilizing flexible electronics for lightweight, durable communication devices, advanced surveillance systems, and flexible displays for tactical equipment. The forecast period of 2025–2033 is expected to see sustained, high-double-digit compound annual growth rates (CAGR) as these applications mature and new markets emerge, pushing the global flexible electronics market to reach USD XXX billion.

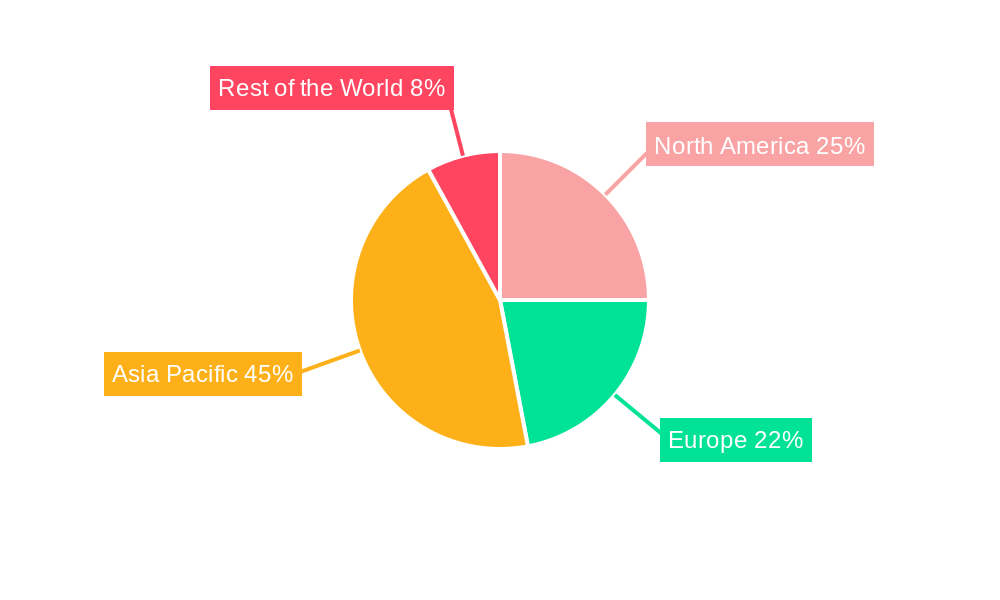

Leading Regions, Countries, or Segments in Flexible Electronics Market

The flexible electronics market exhibits distinct regional and segmental leadership, driven by a confluence of technological innovation, robust investment trends, supportive regulatory frameworks, and specific industry demands. Among the application segments, Display technologies are currently a dominant force, fueled by the insatiable demand for more immersive and versatile visual experiences in consumer electronics. The evolution from rigid to flexible and foldable displays for smartphones, tablets, and televisions has significantly boosted market penetration. The Sensing application is rapidly gaining traction, with the proliferation of wearable health trackers, environmental sensors, and advanced automotive safety systems demanding highly integrated and conformable sensing solutions.

In terms of end-user industries, Consumer Electronics currently leads the market, driven by major technology companies incorporating flexible display and sensor technologies into their product portfolios. The continuous pursuit of thinner, lighter, and more aesthetically pleasing devices makes flexible electronics an indispensable component. However, the Automotive sector is emerging as a critical growth engine, with an increasing number of flexible electronic solutions being integrated into vehicles for lighting, interior displays, and advanced driver-assistance systems (ADAS). The Healthcare sector is another significant area of growth, with flexible electronics enabling the development of novel wearable diagnostic devices, smart bandages, and implantable sensors that enhance patient care and remote monitoring. The Military and Defense sector also presents substantial opportunities, demanding rugged, lightweight, and adaptable electronic systems.

Geographically, Asia Pacific is a leading region in the flexible electronics market, primarily due to the presence of major manufacturing hubs, significant investments in R&D, and a large consumer base for electronic devices. Countries like South Korea, Japan, and China are at the forefront of innovation and production. North America and Europe are also key markets, characterized by strong demand for advanced flexible electronic solutions in the automotive, healthcare, and defense sectors, coupled with robust research institutions and government support for emerging technologies.

- Dominant Application Segment: Display technologies, driven by foldable and bendable screens in consumer electronics.

- Fastest Growing Application Segment: Sensing, propelled by advancements in wearables and IoT devices.

- Leading End-User Industry: Consumer Electronics, with consistent adoption across a wide range of devices.

- Emerging Growth End-User Industry: Automotive, due to increasing integration of smart features and lighting solutions.

- Key Regional Hubs: Asia Pacific (South Korea, Japan, China) for manufacturing and innovation; North America and Europe for advanced applications and R&D.

- Investment Trends: Significant capital infusion into flexible display manufacturing and R&D for medical and automotive applications.

- Regulatory Support: Government initiatives and funding for advanced materials and electronics research in key regions.

Flexible Electronics Market Product Innovations

Product innovation in the flexible electronics market is a relentless pursuit of enhanced functionality, miniaturization, and seamless integration. Companies are pushing the boundaries with breakthroughs in organic light-emitting diode (OLED) technology, creating skin-attachable displays like those announced by Samsung in June 2021, capable of stretching with bodily movement, paving the way for revolutionary wearable health devices. Beyond displays, innovation extends to flexible sensors that can detect a wide range of stimuli with unprecedented sensitivity and form factor, enabling their integration into clothing and textiles for biometric monitoring and smart apparel. The development of ultra-thin, flexible batteries by companies like Imprint Energy Inc. is also a critical advancement, providing a power source for these new generation devices. Furthermore, advancements in printable electronics are enabling cost-effective manufacturing of complex circuits on flexible substrates, opening doors for widespread adoption in diverse applications from smart packaging to flexible solar cells. The unique selling proposition lies in the ability to create electronic devices that conform to any surface, bend, fold, and even stretch, offering a level of design freedom and user experience previously unimaginable.

Propelling Factors for Flexible Electronics Market Growth

The flexible electronics market is propelled by a confluence of powerful technological, economic, and regulatory factors. Technologically, continuous advancements in material science, particularly in conductive inks, organic semiconductors, and novel polymers, enable the creation of more robust, efficient, and cost-effective flexible devices. The miniaturization of electronic components and the development of advanced manufacturing techniques like roll-to-roll processing are significantly reducing production costs and increasing scalability. Economically, the increasing disposable income in emerging markets and the growing demand for sophisticated consumer electronics, wearables, and smart home devices are creating a vast consumer base. The automotive industry's drive for enhanced safety, comfort, and connectivity is also a major economic catalyst, necessitating flexible and integrated electronic solutions. Regulatory initiatives promoting innovation, sustainability, and the adoption of advanced technologies, especially in healthcare and environmental monitoring, are further accelerating market growth. For instance, government funding for research into next-generation displays and sensors directly fuels innovation and adoption.

Obstacles in the Flexible Electronics Market Market

Despite its immense growth potential, the flexible electronics market faces several obstacles. Manufacturing challenges related to yield, scalability, and cost-effectiveness for certain complex flexible electronic components remain a significant barrier. The high cost of raw materials, especially for advanced organic compounds and specialized substrates, can also limit widespread adoption in price-sensitive markets. Durability and reliability concerns in harsh environments or under continuous stress still need to be fully addressed for certain applications, particularly in the automotive and industrial sectors. Furthermore, the evolving regulatory landscape, while generally supportive, can sometimes create complexities in terms of standardization and certification for new technologies, especially in sensitive areas like medical devices. Intense competition from established rigid electronics manufacturers and the rapid pace of technological obsolescence also present ongoing challenges.

Future Opportunities in Flexible Electronics Market

The flexible electronics market is brimming with exciting future opportunities driven by emerging technologies and evolving consumer trends. The continued advancement in stretchable electronics holds immense potential for highly conformal wearable devices, advanced prosthetics, and interactive fabrics that seamlessly integrate technology into our lives. The integration of flexible electronics with artificial intelligence (AI) and the Internet of Things (IoT) will unlock new possibilities for smart environments, predictive maintenance, and personalized healthcare solutions. Emerging markets in regions with a growing middle class and increasing digital penetration represent significant untapped potential. Furthermore, the development of flexible and transparent electronics could revolutionize augmented reality (AR) and virtual reality (VR) devices, offering more immersive and natural user experiences. The drive for sustainable and eco-friendly electronics also presents an opportunity for the development of biodegradable and recyclable flexible electronic components.

Major Players in the Flexible Electronics Market Ecosystem

- PragmatIC Inc

- Blue Spark Technologies

- LG Electronics Inc

- Flexpoint Sensor Systems Inc

- Samsung Electronics Co Ltd

- Imprint Energy Inc

- OLEDWorks LLC

- Royole Corporation

- FlexEnable Ltd

- E Ink Holdings Inc

- AU Optronics Corp

- BOE Technology Group Co Ltd

Key Developments in Flexible Electronics Market Industry

- June 2021: Samsung announced the development of an organic light-emitting diode (OLED) display that is skin-attachable and stretches in response to bodily movement. This elastic technology is expected to play a significant role in wearable health devices.

- Q3 2022: LG Electronics Inc. showcased advancements in its foldable and rollable display technologies, signaling a continued focus on premium flexible screen solutions for the consumer electronics market.

- Early 2023: FlexEnable Ltd. partnered with an undisclosed automotive giant to explore the integration of flexible displays for advanced in-car infotainment and control systems.

- Late 2023: E Ink Holdings Inc. reported significant growth in its e-paper display segment, with increasing adoption in smart signage, retail applications, and electronic shelf labels, all leveraging flexible display technology.

- First Half 2024: PragmatIC Inc. secured substantial Series B funding to scale up its advanced semiconductor printing capabilities for flexible electronics, aiming to lower the cost of advanced flexible devices.

Strategic Flexible Electronics Market Market Forecast

The flexible electronics market is poised for significant expansion, driven by relentless innovation and expanding applications across diverse industries. The forecast period of 2025–2033 will witness a substantial CAGR, fueled by the growing demand for advanced display technologies, highly integrated sensing capabilities, and innovative lighting solutions. The increasing adoption in the consumer electronics, automotive, and healthcare sectors, supported by government initiatives and substantial private investments, will continue to shape market dynamics. The continuous refinement of material science and manufacturing processes will further reduce costs and enhance the performance of flexible electronic components, opening up new avenues for growth and market penetration, ultimately contributing to the projected USD XXX billion market valuation.

Flexible Electronics Market Segmentation

-

1. Application

- 1.1. Sensing

- 1.2. Lighting

- 1.3. Display

- 1.4. Others Applications

-

2. End User Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Healthcare

- 2.4. Military and Defense

- 2.5. Other End User Industries

Flexible Electronics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Flexible Electronics Market Regional Market Share

Geographic Coverage of Flexible Electronics Market

Flexible Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Emerging Need For Lightweight

- 3.2.2 Mechanically Flexible

- 3.2.3 and Cost-effective Products; Growing R&D is Expanding the Application Scope

- 3.3. Market Restrains

- 3.3.1. Consumers Security Related Concerns

- 3.4. Market Trends

- 3.4.1. 3D Integration in Healthcare is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sensing

- 5.1.2. Lighting

- 5.1.3. Display

- 5.1.4. Others Applications

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Healthcare

- 5.2.4. Military and Defense

- 5.2.5. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flexible Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sensing

- 6.1.2. Lighting

- 6.1.3. Display

- 6.1.4. Others Applications

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Healthcare

- 6.2.4. Military and Defense

- 6.2.5. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Flexible Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sensing

- 7.1.2. Lighting

- 7.1.3. Display

- 7.1.4. Others Applications

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Healthcare

- 7.2.4. Military and Defense

- 7.2.5. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Flexible Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sensing

- 8.1.2. Lighting

- 8.1.3. Display

- 8.1.4. Others Applications

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Healthcare

- 8.2.4. Military and Defense

- 8.2.5. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Flexible Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sensing

- 9.1.2. Lighting

- 9.1.3. Display

- 9.1.4. Others Applications

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Healthcare

- 9.2.4. Military and Defense

- 9.2.5. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 PragmatIC Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Blue Spark Technologies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 LG Electronics Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flexpoint Sensor Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Imprint Energy Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OLEDWorks LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Royole Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 FlexEnable Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 E Ink Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 AU Optronics Corp

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BOE Technology Group Co Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 PragmatIC Inc

List of Figures

- Figure 1: Global Flexible Electronics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Flexible Electronics Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Flexible Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Flexible Electronics Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 5: North America Flexible Electronics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: North America Flexible Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Flexible Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Flexible Electronics Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Flexible Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Flexible Electronics Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 11: Europe Flexible Electronics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Flexible Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Flexible Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Flexible Electronics Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Flexible Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Flexible Electronics Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 17: Asia Pacific Flexible Electronics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: Asia Pacific Flexible Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Flexible Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Flexible Electronics Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Rest of the World Flexible Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Flexible Electronics Market Revenue (undefined), by End User Industry 2025 & 2033

- Figure 23: Rest of the World Flexible Electronics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: Rest of the World Flexible Electronics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Flexible Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flexible Electronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Flexible Electronics Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 3: Global Flexible Electronics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Flexible Electronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Flexible Electronics Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 6: Global Flexible Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Flexible Electronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Flexible Electronics Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 9: Global Flexible Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Flexible Electronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Flexible Electronics Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 12: Global Flexible Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Flexible Electronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Flexible Electronics Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 15: Global Flexible Electronics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Electronics Market?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Flexible Electronics Market?

Key companies in the market include PragmatIC Inc, Blue Spark Technologies, LG Electronics Inc, Flexpoint Sensor Systems Inc , Samsung Electronics Co Ltd, Imprint Energy Inc, OLEDWorks LLC, Royole Corporation, FlexEnable Ltd, E Ink Holdings Inc, AU Optronics Corp, BOE Technology Group Co Ltd.

3. What are the main segments of the Flexible Electronics Market?

The market segments include Application, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emerging Need For Lightweight. Mechanically Flexible. and Cost-effective Products; Growing R&D is Expanding the Application Scope.

6. What are the notable trends driving market growth?

3D Integration in Healthcare is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Consumers Security Related Concerns.

8. Can you provide examples of recent developments in the market?

June 2021 - Samsung has announced the development of an organic light-emitting diode (OLED) display that is skin-attachable and stretches in response to bodily movement. This elastic technology is expected to play a significant role in wearable health devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Electronics Market?

To stay informed about further developments, trends, and reports in the Flexible Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence