Key Insights

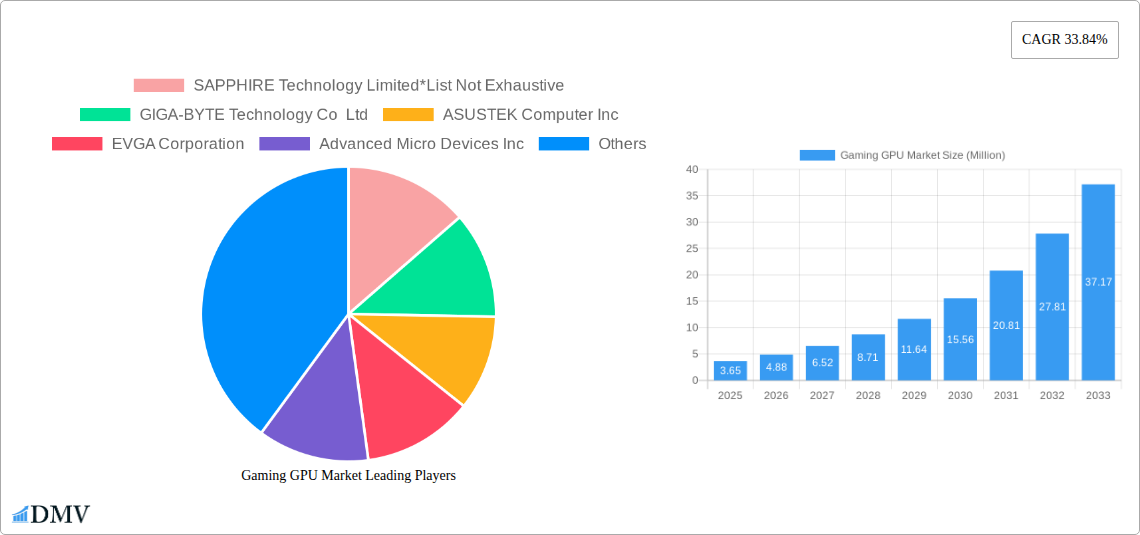

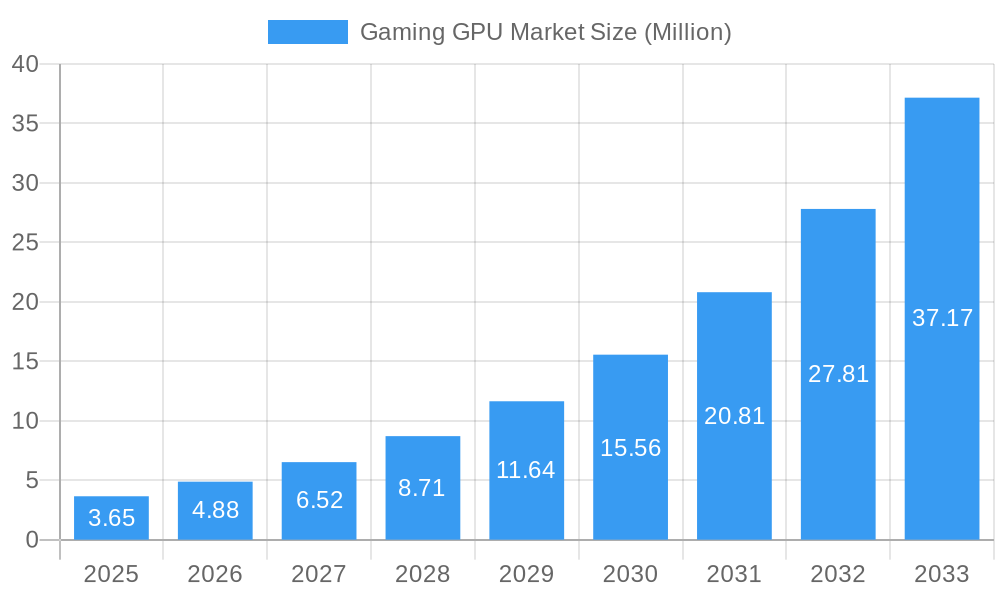

The global Gaming GPU market is poised for explosive growth, projected to reach a substantial $3.65 Million by 2025 and continue its upward trajectory at an impressive compound annual growth rate (CAGR) of 33.84%. This remarkable expansion is primarily driven by the insatiable demand for visually immersive gaming experiences, advancements in graphics technology enabling photorealistic rendering, and the ever-increasing popularity of esports and competitive gaming. The proliferation of powerful mobile devices and the continuous innovation in PC hardware, including dedicated graphic cards, are further fueling this surge. The market is witnessing a significant shift towards higher-performance GPUs capable of handling demanding game titles and virtual reality applications, making it a dynamic and rapidly evolving sector within the broader technology landscape.

Gaming GPU Market Market Size (In Million)

The forecast period, spanning from 2025 to 2033, anticipates sustained high growth due to several key trends. The integration of AI and machine learning in GPU architecture is enhancing gaming performance and enabling new visual effects. The burgeoning gaming console market and the increasing adoption of GPUs in automotive systems for advanced driver-assistance systems (ADAS) and infotainment are also contributing to market expansion. While the market enjoys robust growth, potential restraints include the high cost of cutting-edge GPU hardware, supply chain disruptions that can impact availability, and the increasing energy consumption associated with high-performance graphics cards. Nevertheless, the overwhelming demand for enhanced gaming experiences and the continuous technological advancements by key players like NVIDIA, AMD, and Intel are expected to propel the Gaming GPU market to new heights.

Gaming GPU Market Company Market Share

Gaming GPU Market: Unlocking Next-Gen Performance and Immersive Experiences (2019-2033)

This comprehensive Gaming GPU Market report delves deep into the dynamic landscape of graphics processing units, analyzing key trends, technological advancements, and future projections for dedicated and integrated graphics solutions across a multitude of devices. With an estimated market size of $XX Billion in 2025, the Gaming GPU industry is poised for significant expansion driven by the insatiable demand for higher fidelity gaming, professional visualization, and AI-powered applications. This report, covering the period from 2019 to 2033, with a base year of 2025, provides critical insights for stakeholders seeking to capitalize on the burgeoning graphics card market and understand the competitive ecosystem of Nvidia GPUs, AMD GPUs, and Intel GPUs.

Gaming GPU Market Market Composition & Trends

The Gaming GPU Market exhibits a moderately concentrated structure, with a few dominant players like Nvidia and AMD holding significant market share. Innovation remains a primary catalyst, with ongoing research and development in areas such as ray tracing, AI upscaling (DLSS, FSR), and improved power efficiency driving adoption. Regulatory landscapes, particularly concerning supply chain integrity and environmental standards, are increasingly influencing manufacturing processes. Substitute products, while limited in high-performance gaming, include integrated graphics solutions for entry-level and mobile applications. End-user profiles are diverse, ranging from casual mobile gamers and esports enthusiasts to professional content creators and AI developers. Mergers and acquisitions are sporadic but impactful, reshaping the competitive dynamics.

- Market Share Distribution: Dominated by Nvidia and AMD, with Intel and other niche players vying for smaller segments.

- M&A Deal Values: Historically ranging from tens to hundreds of millions of dollars, impacting technological integration and market access.

- Innovation Catalysts: Advances in silicon fabrication, architectural design, and software optimization are key drivers.

Gaming GPU Market Industry Evolution

The Gaming GPU Market has witnessed a remarkable evolution, transitioning from basic rendering capabilities to sophisticated parallel processing powerhouses essential for modern computing. The historical period (2019-2024) saw rapid advancements in discrete GPU technology, marked by increasing core counts, higher clock speeds, and the widespread adoption of technologies like real-time ray tracing, significantly enhancing visual fidelity in PC gaming. Dedicated graphic cards consistently led the market, offering unparalleled performance for enthusiast gamers. Integrated graphics solutions, primarily leveraged by Intel and AMD within their CPUs, have also seen substantial improvements, becoming increasingly capable for casual gaming and mainstream computing tasks, thereby expanding the accessibility of visually rich experiences.

The base year of 2025 is projected to be a pivotal point, with the market capitalizing on the momentum generated by cutting-edge architectures and an expanding ecosystem of graphically demanding applications. The forecast period (2025-2033) anticipates sustained growth, driven by several interconnected factors. The burgeoning esports scene and the increasing popularity of AAA titles demanding higher resolutions and frame rates are directly fueling the demand for more powerful gaming graphics cards. Furthermore, the integration of AI and machine learning across various software applications, from content creation to scientific simulations, is creating a significant parallel demand for GPU compute capabilities, extending the market beyond traditional gaming. Emerging trends such as cloud gaming, while potentially shifting the hardware paradigm, also necessitate robust GPU infrastructure at the server level. The continuous innovation cycle, with companies like Nvidia and AMD regularly releasing new generations of GPUs, ensures a constant upgrade cycle and sustained market activity. The graphics card price point, while fluctuating with supply and demand, remains a critical factor influencing adoption rates across different consumer segments. The overall industry trajectory points towards a future where GPUs are indispensable for an ever-widening array of computational tasks.

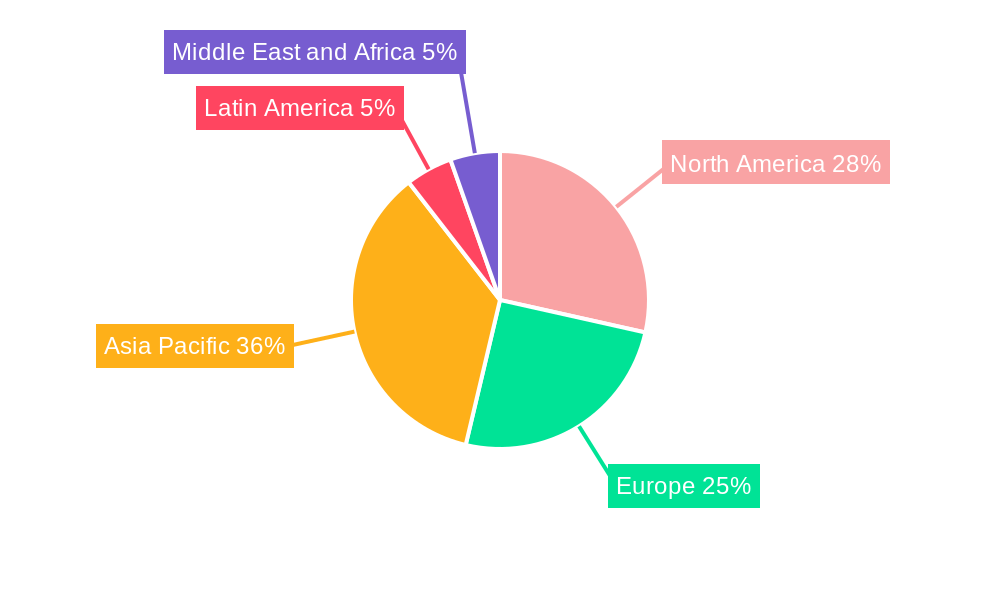

Leading Regions, Countries, or Segments in Gaming GPU Market

North America currently stands as a dominant region in the Gaming GPU Market, driven by a combination of high disposable income, a mature gaming culture, and significant investment in PC hardware. The United States, in particular, is a powerhouse, boasting a large population of avid gamers, professional content creators, and a robust technology sector that readily adopts advanced graphics solutions. This dominance is further bolstered by strong retail infrastructure and a competitive market for high-end components, making high-performance GPUs readily accessible to a significant consumer base.

- Dominant Segment: Dedicated Graphic Cards: These continue to reign supreme in the high-performance gaming segment due to their superior processing power and dedicated memory, crucial for demanding titles and resolutions. The sub-segment of gaming PCs is the primary driver for this category.

- Key Drivers:

- Evolving Gaming Technologies: Support for ray tracing, higher refresh rates (e.g., 4K 480Hz, 8K 165Hz), and advanced rendering techniques.

- Esports Growth: The professionalization of esports creates a continuous demand for top-tier gaming hardware to ensure competitive advantage.

- Content Creation Boom: The rise of streamers, YouTubers, and digital artists necessitates powerful GPUs for video editing, 3D rendering, and graphic design.

- Technological Innovation: Frequent product launches by Nvidia and AMD with incremental performance gains and new feature sets incentivize upgrades.

- Gaming Console Integration: While distinct, the success of console gaming indirectly influences the perception and demand for powerful graphics capabilities.

- Key Drivers:

Europe and Asia-Pacific are also significant markets, with rapid growth observed in countries like China, South Korea, and parts of Southeast Asia, fueled by a burgeoning middle class and a younger demographic that is increasingly engaged with gaming and digital entertainment. The graphics card market size is expected to see continued expansion across these regions, driven by localized content creation and the growing adoption of gaming PCs and mobile gaming devices.

Gaming GPU Market Product Innovations

Product innovations in the Gaming GPU Market are primarily centered on enhancing performance, power efficiency, and visual fidelity. NVIDIA's introduction of RTX 40 Mobile GPUs, offering desktop-class performance in laptops, is a prime example, enabling unprecedented gaming experiences on portable devices. AMD's RDNA 3 architecture, powering the RX 7900 XTX and RX 7900 XT, represents a leap in efficiency and performance, enabling support for ultra-high refresh rate displays like DisplayPort 2.1 for stunning 4K and 8K visuals. These advancements are critical for delivering immersive gaming experiences, faster content creation workflows, and improved AI inference capabilities across various applications.

Propelling Factors for Gaming GPU Market Growth

The Gaming GPU Market is experiencing robust growth driven by several interconnected factors. The relentless advancement of gaming technology, with titles demanding higher resolutions, frame rates, and complex visual effects like ray tracing, directly fuels the need for more powerful graphics processing units. The exponential growth of the esports industry and the increasing professionalization of content creation further amplify this demand. Furthermore, the expanding applications of GPUs beyond gaming, particularly in artificial intelligence, machine learning, and scientific computing, are creating new revenue streams and driving innovation in graphics card technology. Economic prosperity in emerging markets is also a significant contributor, as a growing middle class gains access to disposable income for premium gaming hardware.

Obstacles in the Gaming GPU Market Market

Despite its growth, the Gaming GPU Market faces several obstacles. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, have historically led to inflated prices and limited availability of graphics cards. The high cost of flagship GPUs can be a barrier for budget-conscious consumers, limiting market penetration in certain segments. Intense competition among major players like Nvidia and AMD, while driving innovation, also results in rapid product obsolescence and significant R&D investments, which can impact profit margins. Regulatory scrutiny regarding environmental impact and energy consumption of high-performance GPUs is also an emerging challenge that manufacturers must address.

Future Opportunities in Gaming GPU Market

The Gaming GPU Market is ripe with future opportunities. The continued miniaturization and performance enhancements of mobile GPUs will unlock new possibilities in mobile gaming and augmented reality (AR)/virtual reality (VR) experiences on handheld devices. The increasing adoption of AI across industries will drive demand for powerful, specialized GPUs for machine learning training and inference, creating a significant market beyond traditional gaming. The metaverse and the development of persistent, immersive virtual worlds will necessitate highly capable graphics hardware for both users and creators. Furthermore, the evolution of cloud gaming services, while changing the hardware consumption model, will still require massive GPU deployments in data centers, presenting a distinct opportunity for GPU manufacturers.

Major Players in the Gaming GPU Market Ecosystem

- SAPPHIRE Technology Limited

- GIGA-BYTE Technology Co Ltd

- ASUSTEK Computer Inc

- EVGA Corporation

- Advanced Micro Devices Inc

- Imagination Technologies Group

- Qualcomm Technologies Inc

- Arm Limited

- Nvidia Corporation

- Intel Corporation

Key Developments in Gaming GPU Market Industry

- January 2023: NVIDIA introduced RTX 40 Mobile GPUs, promising laptop gamers performance on par with that of desktop systems. The business unveiled the GeForce RTX 4090 and GeForce RTX 4080. These GPUs are nonetheless very powerful even though the mobile versions are much smaller than the desktop counterparts. They can drive "3x 4K" monitors in Surround Gaming at 60 frames per second. That translates to 11,520 by 2160 pixels or over 25 megapixels. Further highlighting the usefulness of its powerful Ada GPUs for productivity applications, NVIDIA has developed its flagship-class RTX 40 GPU to provide "2X quicker video export."

- November 2022: AMD unveiled new graphics cards for high-end gaming based on the fast and economical RDNA 3 architecture. The company's new RDNA 3 architectures have been used for the first time in its RX 7900 XTX and RX 7900 XT graphics cards. According to the manufacturer, the new graphics cards also enable DisplayPort 2.1 displays, giving outstanding images and ultra-high frame rates at up to 4K 480Hz and 8K 165Hz refresh rates.

Strategic Gaming GPU Market Market Forecast

The Gaming GPU Market is projected to experience robust and sustained growth through 2033, driven by an escalating demand for immersive gaming experiences and the burgeoning role of GPUs in AI and professional visualization. Key growth catalysts include the continuous innovation in dedicated graphic cards, the increasing capabilities of integrated graphics solutions, and the expanding market for mobile gaming and cloud gaming. Strategic investments in R&D by major players like Nvidia and AMD, focusing on performance per watt and novel architectural designs, will continue to propel the market forward. The rising adoption of AR/VR technologies and the potential of the metaverse present significant future growth opportunities, solidifying the indispensable nature of advanced GPUs in the digital landscape.

Gaming GPU Market Segmentation

-

1. Type

- 1.1. Dedicated Graphic Cards

- 1.2. Integrated Graphics Solutions

- 1.3. Other Market Types

-

2. Device

- 2.1. Mobile Devices

- 2.2. PCs and Workstations

- 2.3. Gaming Consoles

- 2.4. Automotive

- 2.5. Other Devices

Gaming GPU Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Gaming GPU Market Regional Market Share

Geographic Coverage of Gaming GPU Market

Gaming GPU Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 33.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand for Gaming Consoles

- 3.2.2 Augmented Reality (AR)

- 3.2.3 and Virtual Reality (VR) in the industry; Increasing Demand for Advanced Displays with Higher Refresh Rates

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1 Rising Demand for Gaming Consoles

- 3.4.2 Augmented Reality (AR)

- 3.4.3 and Virtual Reality (VR) in the industry are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dedicated Graphic Cards

- 5.1.2. Integrated Graphics Solutions

- 5.1.3. Other Market Types

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Mobile Devices

- 5.2.2. PCs and Workstations

- 5.2.3. Gaming Consoles

- 5.2.4. Automotive

- 5.2.5. Other Devices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dedicated Graphic Cards

- 6.1.2. Integrated Graphics Solutions

- 6.1.3. Other Market Types

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Mobile Devices

- 6.2.2. PCs and Workstations

- 6.2.3. Gaming Consoles

- 6.2.4. Automotive

- 6.2.5. Other Devices

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dedicated Graphic Cards

- 7.1.2. Integrated Graphics Solutions

- 7.1.3. Other Market Types

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Mobile Devices

- 7.2.2. PCs and Workstations

- 7.2.3. Gaming Consoles

- 7.2.4. Automotive

- 7.2.5. Other Devices

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dedicated Graphic Cards

- 8.1.2. Integrated Graphics Solutions

- 8.1.3. Other Market Types

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Mobile Devices

- 8.2.2. PCs and Workstations

- 8.2.3. Gaming Consoles

- 8.2.4. Automotive

- 8.2.5. Other Devices

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dedicated Graphic Cards

- 9.1.2. Integrated Graphics Solutions

- 9.1.3. Other Market Types

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Mobile Devices

- 9.2.2. PCs and Workstations

- 9.2.3. Gaming Consoles

- 9.2.4. Automotive

- 9.2.5. Other Devices

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Gaming GPU Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dedicated Graphic Cards

- 10.1.2. Integrated Graphics Solutions

- 10.1.3. Other Market Types

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Mobile Devices

- 10.2.2. PCs and Workstations

- 10.2.3. Gaming Consoles

- 10.2.4. Automotive

- 10.2.5. Other Devices

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAPPHIRE Technology Limited*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GIGA-BYTE Technology Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASUSTEK Computer Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EVGA Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Micro Devices Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Imagination Technologies Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qualcomm Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arm Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nvidia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Intel Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SAPPHIRE Technology Limited*List Not Exhaustive

List of Figures

- Figure 1: Global Gaming GPU Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gaming GPU Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Gaming GPU Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Gaming GPU Market Revenue (Million), by Device 2025 & 2033

- Figure 5: North America Gaming GPU Market Revenue Share (%), by Device 2025 & 2033

- Figure 6: North America Gaming GPU Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Gaming GPU Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gaming GPU Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Gaming GPU Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Gaming GPU Market Revenue (Million), by Device 2025 & 2033

- Figure 11: Europe Gaming GPU Market Revenue Share (%), by Device 2025 & 2033

- Figure 12: Europe Gaming GPU Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Gaming GPU Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gaming GPU Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Gaming GPU Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Gaming GPU Market Revenue (Million), by Device 2025 & 2033

- Figure 17: Asia Pacific Gaming GPU Market Revenue Share (%), by Device 2025 & 2033

- Figure 18: Asia Pacific Gaming GPU Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Gaming GPU Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Gaming GPU Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Gaming GPU Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Gaming GPU Market Revenue (Million), by Device 2025 & 2033

- Figure 23: Latin America Gaming GPU Market Revenue Share (%), by Device 2025 & 2033

- Figure 24: Latin America Gaming GPU Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Gaming GPU Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gaming GPU Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Gaming GPU Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Gaming GPU Market Revenue (Million), by Device 2025 & 2033

- Figure 29: Middle East and Africa Gaming GPU Market Revenue Share (%), by Device 2025 & 2033

- Figure 30: Middle East and Africa Gaming GPU Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Gaming GPU Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 3: Global Gaming GPU Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 6: Global Gaming GPU Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 9: Global Gaming GPU Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 12: Global Gaming GPU Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 15: Global Gaming GPU Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Gaming GPU Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Gaming GPU Market Revenue Million Forecast, by Device 2020 & 2033

- Table 18: Global Gaming GPU Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming GPU Market?

The projected CAGR is approximately 33.84%.

2. Which companies are prominent players in the Gaming GPU Market?

Key companies in the market include SAPPHIRE Technology Limited*List Not Exhaustive, GIGA-BYTE Technology Co Ltd, ASUSTEK Computer Inc, EVGA Corporation, Advanced Micro Devices Inc, Imagination Technologies Group, Qualcomm Technologies Inc, Arm Limited, Nvidia Corporation, Intel Corporation.

3. What are the main segments of the Gaming GPU Market?

The market segments include Type, Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Gaming Consoles. Augmented Reality (AR). and Virtual Reality (VR) in the industry; Increasing Demand for Advanced Displays with Higher Refresh Rates.

6. What are the notable trends driving market growth?

Rising Demand for Gaming Consoles. Augmented Reality (AR). and Virtual Reality (VR) in the industry are Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

January 2023: NVIDIA introduced RTX 40 Mobile GPUs, promising laptop gamers performance on par with that of desktop systems. The business unveiled the GeForce RTX 4090 and GeForce RTX 4080. These GPUs are nonetheless very powerful even though the mobile versions are much smaller than the desktop counterparts. They can drive "3x 4K" monitors in Surround Gaming at 60 frames per second. That translates to 11,520 by 2160 pixels or over 25 megapixels. Further highlighting the usefulness of its powerful Ada GPUs for productivity applications, NVIDIA has developed its flagship-class RTX 40 GPU to provide "2X quicker video export."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming GPU Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming GPU Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming GPU Market?

To stay informed about further developments, trends, and reports in the Gaming GPU Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence