Key Insights

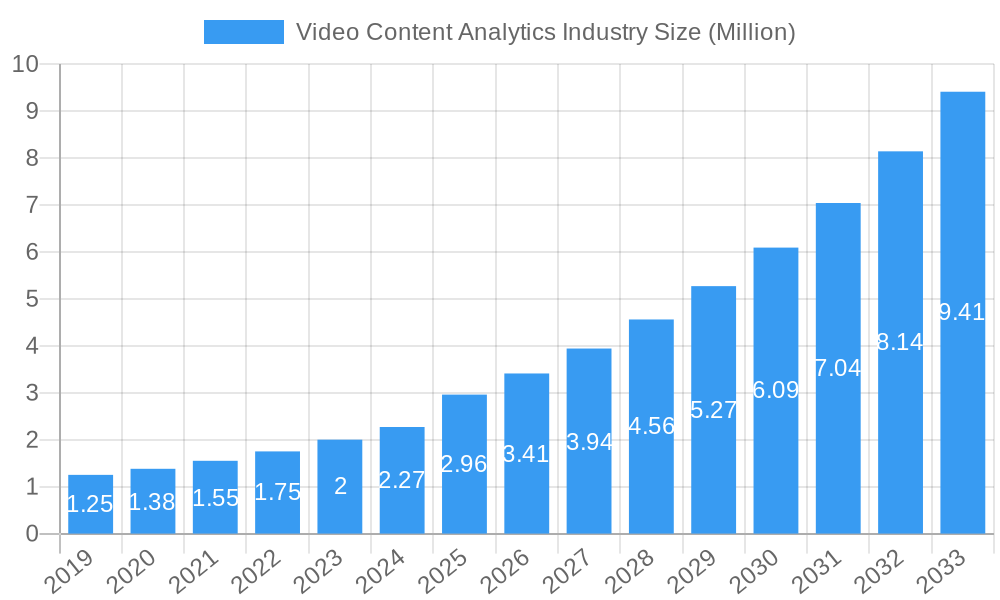

The global Video Content Analytics (VCA) market is experiencing robust expansion, projected to reach a significant $2.96 million by 2025 and continue its impressive trajectory with a Compound Annual Growth Rate (CAGR) of 15.20% through 2033. This surge is primarily fueled by an escalating demand for intelligent video surveillance solutions across a multitude of industries seeking enhanced security, operational efficiency, and data-driven decision-making. The increasing volume of video data generated by an ever-growing network of cameras, coupled with advancements in Artificial Intelligence (AI) and Machine Learning (ML) algorithms, are critical drivers empowering sophisticated VCA capabilities. These technologies enable the automated analysis of video streams for object detection, facial recognition, behavior analysis, and anomaly detection, far surpassing traditional manual monitoring. The market is seeing a pronounced shift towards cloud-based VCA solutions, driven by their scalability, cost-effectiveness, and ease of deployment, while on-premise solutions continue to cater to specific security and regulatory requirements.

Video Content Analytics Industry Market Size (In Million)

The VCA market is segmented by type into Software, encompassing both on-premise and cloud deployments, and Services, which include integration, support, and consulting. Key end-user verticals driving adoption are BFSI and Healthcare, prioritizing advanced security and compliance, followed closely by Retail & Logistics for inventory management and loss prevention, and Critical Infrastructure for public safety. The Defense and Security sector also represents a substantial market due to the inherent need for threat detection and situational awareness. The proliferation of smart cities initiatives and the growing adoption of IoT devices further bolster the demand for VCA to process real-time video feeds for various urban management functions. While the market is poised for substantial growth, potential restraints include data privacy concerns, the high initial investment for comprehensive VCA systems, and the need for skilled personnel to manage and interpret the analytical outputs. Despite these challenges, ongoing technological innovations and expanding application areas are expected to propel the VCA market to new heights.

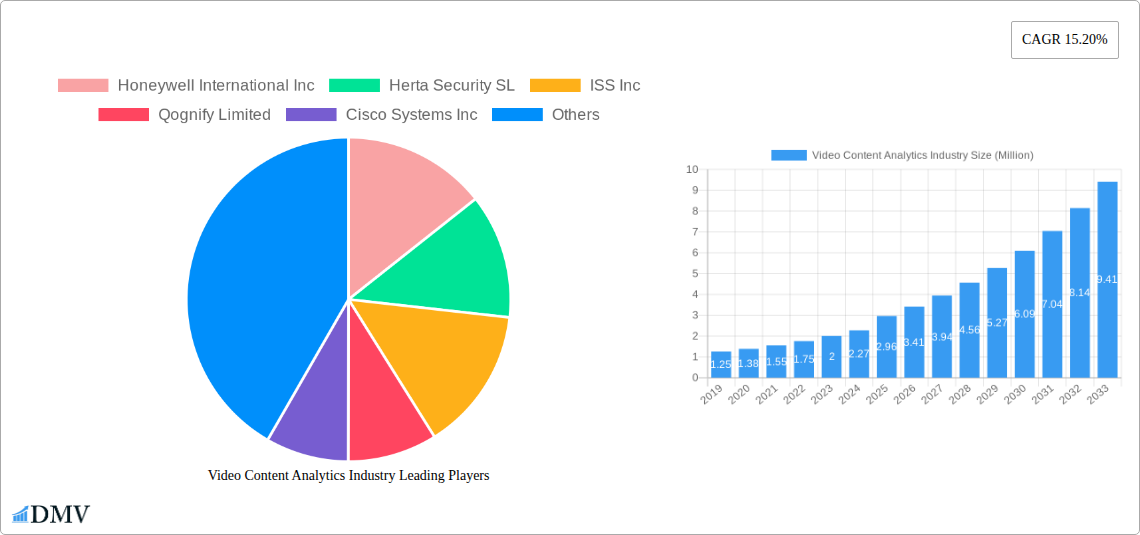

Video Content Analytics Industry Company Market Share

Gain unparalleled insights into the rapidly evolving Video Content Analytics Industry with this definitive report. Spanning the historical period of 2019-2024 and projecting future growth through 2033, this analysis is your essential guide to understanding market dynamics, technological advancements, and strategic opportunities. We delve deep into the core of video intelligence, exploring its transformative impact across diverse sectors.

This report is meticulously crafted for stakeholders seeking to navigate the complexities of the video analytics market, optimize their strategies, and capitalize on emerging trends in AI video surveillance, computer vision analytics, and video intelligence solutions. Prepare to unlock the full potential of visual data.

Video Content Analytics Industry Market Composition & Trends

The Video Content Analytics Industry exhibits a dynamic market composition characterized by a moderate concentration of leading players and a steady influx of innovative solutions. Key trends indicate a significant shift towards cloud-based deployments, driven by scalability and cost-effectiveness, alongside continued demand for robust on-premise systems for sectors with stringent data security requirements. Innovation catalysts are primarily fueled by advancements in Artificial Intelligence (AI) and Machine Learning (ML), enabling more sophisticated video recognition, object detection, and behavioral analysis. The regulatory landscape is evolving, with increasing focus on data privacy and ethical AI deployment, influencing the development and adoption of video analytics platforms. Substitute products, such as manual surveillance or basic CCTV systems, are rapidly being outpaced by the efficiency and actionable insights provided by advanced video content analytics. End-user profiles reveal a growing reliance on these solutions across multiple verticals, including BFSI for fraud detection and security, Healthcare for patient monitoring and safety, and Retail & Logistics for inventory management and loss prevention. Mergers and acquisitions (M&A) activity is a notable trend, with companies consolidating to enhance their technology portfolios and market reach. For instance, recent M&A deals have seen valuations in the hundreds of Million range, reflecting the strategic importance of this sector.

- Market Share Distribution: Leading vendors hold a combined XX% market share, with a fragmented landscape for niche solutions.

- M&A Deal Values: A significant increase in M&A valuations, averaging over $500 Million for strategic acquisitions in the past two years.

- Key Trends:

- Dominance of cloud-based video analytics solutions.

- Integration of AI and ML for advanced insights.

- Increasing regulatory scrutiny on data privacy.

- Growing adoption in retail, security, and infrastructure.

Video Content Analytics Industry Industry Evolution

The Video Content Analytics Industry has witnessed an extraordinary evolution, transforming from rudimentary motion detection to sophisticated AI-powered intelligence platforms. Historically, the market's growth trajectory was primarily shaped by the increasing deployment of surveillance cameras, initially for security and loss prevention purposes. However, the advent and rapid maturation of AI and computer vision technologies have fundamentally reshaped its landscape. Over the study period (2019-2033), we project a compound annual growth rate (CAGR) of approximately 18% from the base year of 2025. This exponential growth is underpinned by a confluence of factors, including the proliferation of high-resolution cameras, the availability of vast datasets for training AI models, and the escalating need for real-time, actionable insights from video feeds. Technological advancements have been relentless, with innovations in deep learning algorithms enabling more accurate facial recognition, license plate recognition, anomalous behavior detection, and crowd analysis. These advancements have significantly broadened the applicability of video analytics beyond traditional security applications into areas like customer behavior analysis, operational efficiency, and predictive maintenance. Consumer demand has also shifted dramatically; organizations are no longer satisfied with mere recording capabilities but actively seek solutions that can proactively identify threats, optimize processes, and provide data-driven decision-making support. The adoption metrics showcase a clear upward trend, with an estimated XX% of new surveillance camera deployments now incorporating advanced video analytics capabilities. The market is steadily moving towards intelligent video solutions that offer not just monitoring but also automated analysis and actionable alerts, driving significant value for businesses across all sectors. This continuous innovation cycle, coupled with increasing market awareness and demand, positions the video analytics market for sustained and robust growth.

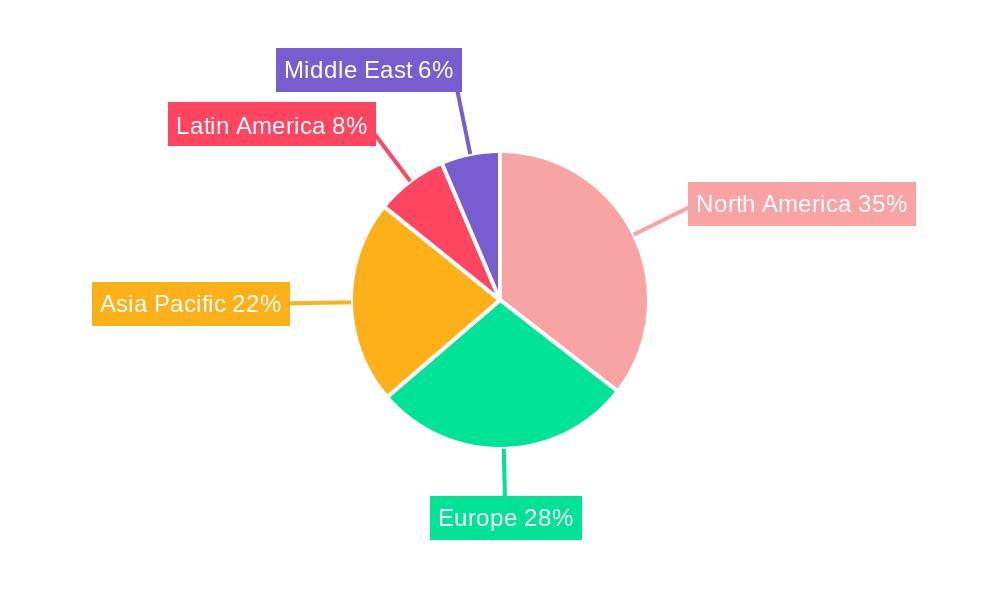

Leading Regions, Countries, or Segments in Video Content Analytics Industry

The Video Content Analytics Industry is experiencing significant dominance from specific regions and segments, driven by a combination of technological adoption, investment trends, and regulatory support. Among the segments, Software (On-premise and Cloud) commands a substantial market share, with cloud-based solutions witnessing accelerated growth due to their inherent scalability, flexibility, and cost-effectiveness for a wide array of applications. The Defense and Security end-user vertical is a perpetual leader, driven by the imperative for enhanced national security, border control, and threat detection. However, the Retail & Logistics and BFSI sectors are rapidly gaining ground, fueled by their critical need for operational efficiency, fraud prevention, and enhanced customer experience through video analytics solutions.

In terms of regional leadership, North America, particularly the United States, is a frontrunner, propelled by substantial investments in AI research and development, a mature technology infrastructure, and a high rate of adoption across various industries. Europe follows closely, with stringent data protection regulations like GDPR paradoxically driving the development of more privacy-compliant and sophisticated video analysis tools. Asia Pacific, led by countries like China and India, is emerging as a high-growth region, driven by rapid urbanization, smart city initiatives, and increasing security concerns, with significant investment in AI video surveillance and computer vision analytics.

Dominant Segment: Software (On-premise and Cloud)

- Key Drivers: Cloud's scalability and cost-efficiency; demand for advanced features like AI video analytics and real-time video analysis.

- On-premise Importance: Critical for sectors with high data security and privacy needs, such as BFSI and government.

Leading End-User Vertical: Defense and Security

- Key Drivers: National security mandates, counter-terrorism efforts, border surveillance, and public safety initiatives.

- Investment Trends: Significant government spending on advanced security infrastructure and video intelligence platforms.

High-Growth End-User Verticals: Retail & Logistics and BFSI

- Retail & Logistics: Focus on inventory management, supply chain optimization, loss prevention, and customer analytics.

- BFSI: Emphasis on fraud detection, transaction monitoring, customer authentication (e.g., facial recognition), and branch security.

Emerging Regional Powerhouse: Asia Pacific

- Key Drivers: Smart city projects, infrastructure development, increasing adoption of IoT and AI technologies, and growing security consciousness.

- Regulatory Support: Government initiatives promoting technological adoption and data-driven solutions.

Video Content Analytics Industry Product Innovations

Product innovations in the Video Content Analytics Industry are rapidly advancing, focusing on enhanced accuracy, real-time processing, and broader application capabilities. Key advancements include the development of more sophisticated AI video analytics algorithms capable of accurately identifying complex events, such as unusual crowd behavior or specific object types, even in challenging environmental conditions. The integration of edge computing allows for processing video data directly on the camera or at the network's edge, reducing latency and bandwidth requirements for real-time video analysis. Furthermore, the ability to fuse data from multiple cameras and sensor types is leading to more comprehensive situational awareness. Unique selling propositions often revolve around specialized analytics modules for facial recognition, license plate recognition, and people counting, catering to specific industry needs. Performance metrics are continually improving, with object detection accuracy rates exceeding 95% and real-time processing speeds achieving sub-second latency for critical alerts.

Propelling Factors for Video Content Analytics Industry Growth

The Video Content Analytics Industry is propelled by several key factors. The relentless advancement in AI and Machine Learning technologies, particularly in deep learning, is a primary driver, enabling more sophisticated and accurate video analysis. The increasing ubiquity of high-resolution surveillance cameras, coupled with the growing volume of video data generated daily, creates a fertile ground for analytics solutions. Economic benefits, such as improved operational efficiency, fraud reduction, and enhanced security, are compelling organizations to invest in video intelligence platforms. Furthermore, government initiatives promoting smart cities, public safety, and critical infrastructure protection are significant catalysts, fostering widespread adoption of AI video surveillance.

- Technological Advancements: AI, ML, deep learning for improved accuracy and insights.

- Data Proliferation: Increasing number of surveillance cameras and video data generation.

- Economic Benefits: Cost savings through automation, fraud prevention, and operational efficiency.

- Government Initiatives: Smart city projects, public safety mandates, and critical infrastructure security.

Obstacles in the Video Content Analytics Industry Market

Despite its strong growth, the Video Content Analytics Industry faces several obstacles. Regulatory challenges, particularly concerning data privacy and ethical use of AI, can lead to slow adoption or require significant compliance efforts. The high initial investment cost for advanced video analytics solutions and the need for specialized IT infrastructure can be a barrier for smaller businesses. Supply chain disruptions, impacting the availability of hardware components for surveillance systems, can also hinder deployment. Furthermore, the competitive landscape, with numerous vendors offering similar functionalities, creates pressure on pricing and necessitates continuous innovation to maintain market share. Integration complexities with existing IT systems can also pose a challenge for seamless implementation of video intelligence platforms.

- Regulatory Hurdles: Data privacy laws, ethical AI guidelines impacting deployment.

- High Initial Investment: Cost of sophisticated hardware and software for video analysis.

- Integration Complexity: Challenges in integrating with legacy systems.

- Talent Shortage: Lack of skilled professionals for AI and video analytics development and deployment.

Future Opportunities in Video Content Analytics Industry

Future opportunities in the Video Content Analytics Industry are abundant and diverse. The expansion into emerging markets with nascent surveillance infrastructure presents significant growth potential. Advancements in AI will continue to unlock new applications, such as predictive analytics for proactive threat identification and personalized customer experiences. The integration of video analytics with other IoT devices and data sources will create richer, more holistic insights for businesses. Opportunities also lie in developing specialized solutions for niche industries like agriculture, environmental monitoring, and smart manufacturing. The growing demand for privacy-preserving analytics, such as anonymization and synthetic data generation, will also open new avenues for innovation in computer vision analytics.

- Emerging Markets: Untapped potential in developing economies with growing surveillance needs.

- Advanced AI Applications: Predictive analytics, anomaly detection, and behavioral profiling.

- IoT Integration: Synergistic insights from combining video data with other sensor data.

- Privacy-Preserving Analytics: Development of solutions that respect user privacy.

Major Players in the Video Content Analytics Industry Ecosystem

- Honeywell International Inc

- Herta Security SL

- ISS Inc

- Qognify Limited

- Cisco Systems Inc

- Genetec Inc

- Verint Systems Inc

- NEC Corporation

- Agent Video Intelligence Ltd

- Identiv Inc

- Aventura Technologies Inc

- International Business Machines Corporation

- Objectvideo Labs LLC

Key Developments in Video Content Analytics Industry Industry

- November 2022: Servian, an Australian data consulting firm, and VisualCortex, a video intelligence platform provider, signed a referral and services agreement. This collaboration enables Servian to recommend VisualCortex's Video Intelligence Platform to its clients in Australia and New Zealand, while also offering implementation and integration services, demonstrating a growing trend of strategic partnerships in the video analytics market.

- October 2022: Awiros is set to deploy advanced video analytics for the Bengaluru Safe City project. Leveraging its AI-based Video Intelligence platform, the company will provide automatic number plate recognition, facial recognition systems, and other Video AI applications for over 7000 cameras. This initiative aims to empower real-time situational analysis for the Bengaluru City Police, enhancing public safety and rapid response capabilities, highlighting the impact of AI video surveillance on smart city development.

Strategic Video Content Analytics Industry Market Forecast

The Video Content Analytics Industry is poised for substantial and sustained growth, driven by an increasing demand for intelligent data processing and enhanced security measures. Future opportunities are deeply rooted in the continued evolution of AI and machine learning, enabling more sophisticated computer vision analytics and real-time video analysis. The market will witness a stronger push towards cloud-based solutions, offering scalability and accessibility, while also seeing the maturation of edge computing for immediate on-device processing. Strategic partnerships and mergers will continue to shape the competitive landscape, fostering innovation and market consolidation. The expanding adoption across diverse end-user verticals, including retail, healthcare, and critical infrastructure, will further fuel market expansion, making video intelligence solutions an indispensable component of modern business operations and public safety strategies. The projected market value is expected to reach XXX Million by 2033, with a robust CAGR of approximately 18% from 2025.

Video Content Analytics Industry Segmentation

-

1. Type

- 1.1. Software (On-premise and Cloud)

- 1.2. Services

-

2. End User

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Retail & Logistics

- 2.4. Critical Infrastructure

- 2.5. Hospitality and Transportation

- 2.6. Defense and Security

- 2.7. Other End-user verticals (Manufacturing, etc.)

Video Content Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Video Content Analytics Industry Regional Market Share

Geographic Coverage of Video Content Analytics Industry

Video Content Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis among Enterprises on Obtaining Actionable Insights; Technological Advancements coupled with High Investments in City Surveillance

- 3.3. Market Restrains

- 3.3.1. Steep Learning Curve Regarding Connected Agriculture

- 3.4. Market Trends

- 3.4.1. Retail Industry is expected to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software (On-premise and Cloud)

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Retail & Logistics

- 5.2.4. Critical Infrastructure

- 5.2.5. Hospitality and Transportation

- 5.2.6. Defense and Security

- 5.2.7. Other End-user verticals (Manufacturing, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software (On-premise and Cloud)

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Retail & Logistics

- 6.2.4. Critical Infrastructure

- 6.2.5. Hospitality and Transportation

- 6.2.6. Defense and Security

- 6.2.7. Other End-user verticals (Manufacturing, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software (On-premise and Cloud)

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Retail & Logistics

- 7.2.4. Critical Infrastructure

- 7.2.5. Hospitality and Transportation

- 7.2.6. Defense and Security

- 7.2.7. Other End-user verticals (Manufacturing, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software (On-premise and Cloud)

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Retail & Logistics

- 8.2.4. Critical Infrastructure

- 8.2.5. Hospitality and Transportation

- 8.2.6. Defense and Security

- 8.2.7. Other End-user verticals (Manufacturing, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software (On-premise and Cloud)

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Retail & Logistics

- 9.2.4. Critical Infrastructure

- 9.2.5. Hospitality and Transportation

- 9.2.6. Defense and Security

- 9.2.7. Other End-user verticals (Manufacturing, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Video Content Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Software (On-premise and Cloud)

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Retail & Logistics

- 10.2.4. Critical Infrastructure

- 10.2.5. Hospitality and Transportation

- 10.2.6. Defense and Security

- 10.2.7. Other End-user verticals (Manufacturing, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herta Security SL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ISS Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qognify Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Genetec Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Verint Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NEC Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agent Video Intelligence Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Identiv Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aventura Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 International Business Machines Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Objectvideo Labs LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Video Content Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Video Content Analytics Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Video Content Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Video Content Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East Video Content Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Video Content Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Video Content Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Video Content Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Video Content Analytics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Video Content Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Video Content Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Content Analytics Industry?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Video Content Analytics Industry?

Key companies in the market include Honeywell International Inc, Herta Security SL, ISS Inc, Qognify Limited, Cisco Systems Inc, Genetec Inc, Verint Systems Inc, NEC Corporation, Agent Video Intelligence Ltd, Identiv Inc, Aventura Technologies Inc, International Business Machines Corporation, Objectvideo Labs LLC.

3. What are the main segments of the Video Content Analytics Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis among Enterprises on Obtaining Actionable Insights; Technological Advancements coupled with High Investments in City Surveillance.

6. What are the notable trends driving market growth?

Retail Industry is expected to Hold a Major Share.

7. Are there any restraints impacting market growth?

Steep Learning Curve Regarding Connected Agriculture.

8. Can you provide examples of recent developments in the market?

November 2022: Servian, Australia's data consulting firm, and VisualCortex, the video intelligence Platform bridging computer vision's potential to practical business outcomes, have signed a referral and services agreement. According to the terms of the collaboration agreement, Servian would be able to recommend VisualCortex's Video Intelligence Platform to its current and potential clients in Australia and New Zealand, as well as provide implementation, integration, model creation, and related professional services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Video Content Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Video Content Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Video Content Analytics Industry?

To stay informed about further developments, trends, and reports in the Video Content Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence