Key Insights

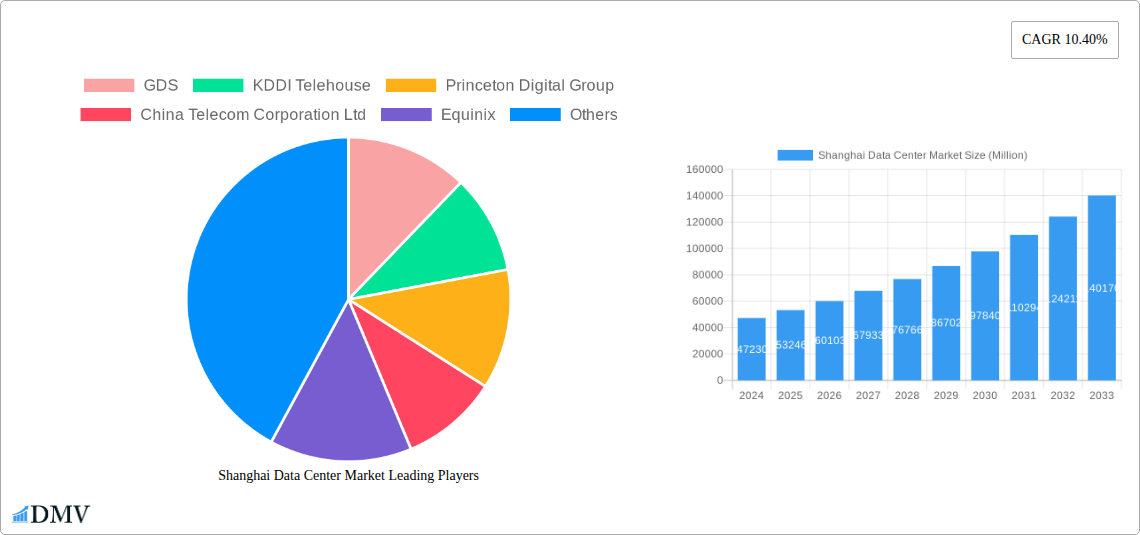

The Shanghai Data Center Market is experiencing robust growth, projected to reach an estimated USD 47.23 billion in 2024, driven by a CAGR of 12.8% through 2033. This expansion is primarily fueled by the escalating demand for digital infrastructure to support cloud computing, big data analytics, AI development, and the burgeoning digital economy within one of China's most dynamic economic hubs. Key drivers include substantial investments from hyperscale cloud providers and telecommunications companies seeking to capitalize on Shanghai's strategic location and its role as a pivotal center for commerce and innovation. The increasing adoption of advanced technologies by enterprises across various sectors, such as BFSI, manufacturing, and e-commerce, further necessitates the expansion and upgrading of data center capacities, including colocation services ranging from retail to wholesale and hyperscale deployments.

Shanghai Data Center Market Market Size (In Billion)

The market's growth trajectory is further bolstered by ongoing digital transformation initiatives and government support for the technology sector. Emerging trends such as the adoption of edge computing to reduce latency for real-time applications and the increasing focus on sustainable data center operations, incorporating green energy solutions and efficient cooling technologies, are shaping the market landscape. While the market benefits from strong demand, it also faces certain restraints, including high operational costs, the availability of skilled talent, and evolving regulatory frameworks. Nevertheless, the sheer volume of data generated and processed, coupled with the continuous influx of foreign and domestic investment, positions Shanghai as a preeminent market for data center development and operations in the Asia-Pacific region and globally. The market segmentation analysis highlights a significant demand across all data center sizes, from small to massive, and a growing preference for Tier 1 & 2 facilities offering high reliability and performance, indicating a maturing and sophisticated market.

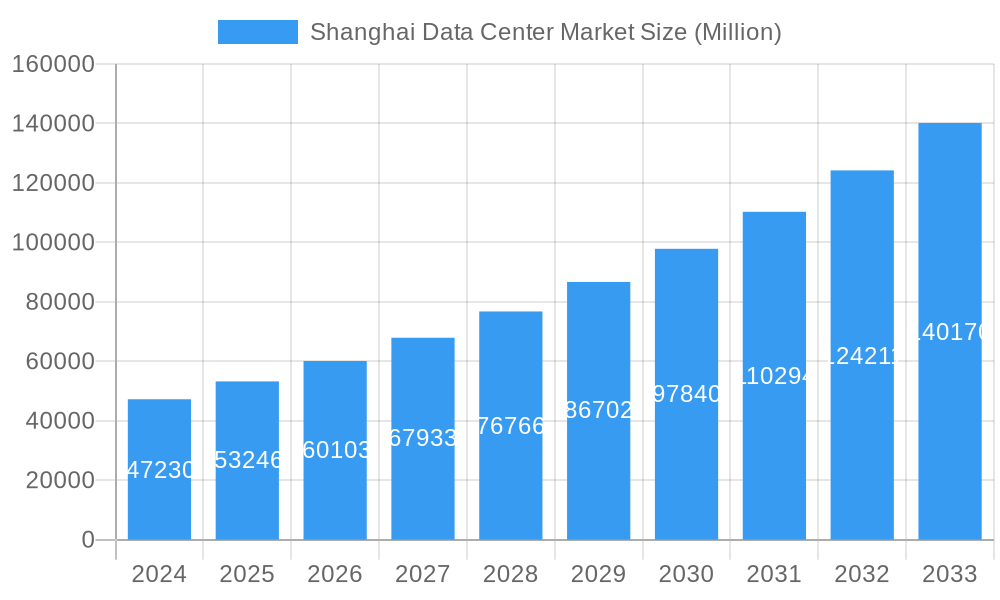

Shanghai Data Center Market Company Market Share

This in-depth report offers an unparalleled analysis of the Shanghai Data Center Market, providing critical insights for stakeholders navigating this dynamic landscape. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this research equips you with data-driven strategies to capitalize on the burgeoning opportunities within China's premier digital infrastructure hub. The report delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities, all underpinned by robust historical data from 2019–2024.

Shanghai Data Center Market Market Composition & Trends

The Shanghai Data Center Market is characterized by a high degree of competition and a rapid pace of innovation, driven by escalating demand for digital services and robust economic growth. Market concentration is influenced by a mix of established domestic players and expanding international operators, each vying for significant market share. Innovation catalysts are primarily found in the adoption of advanced cooling technologies, AI-driven management systems, and sustainable power solutions. The regulatory landscape, while evolving, provides a framework for growth, with ongoing governmental support for digital infrastructure development. Substitute products are limited, with colocation and cloud services being the primary models. End-user profiles are diverse, encompassing Cloud & IT providers, Telecom operators, Media & Entertainment companies, Government entities, BFSI institutions, Manufacturing firms, and a rapidly growing E-Commerce sector. Mergers and Acquisitions (M&A) activity is a significant trend, with deal values expected to reach several billion as companies consolidate to gain scale and market presence. The market's strategic importance ensures continuous investment and strategic realignments.

- Market Concentration: Dominated by a few key players with strategic expansion plans, alongside a growing number of niche providers.

- Innovation Catalysts: Focus on energy efficiency, AI-powered operations, and high-density computing solutions.

- Regulatory Landscape: Favorable government policies supporting digital transformation and data infrastructure.

- End-User Diversification: Broad adoption across industries, from traditional sectors to emerging digital-first businesses.

- M&A Activity: Increasing consolidation to enhance service offerings and expand geographical reach, with deal values in the billion range.

Shanghai Data Center Market Industry Evolution

The Shanghai Data Center Market has witnessed a remarkable transformation throughout the historical period (2019–2024) and is poised for exponential growth in the forecast period (2025–2033). The industry's evolution is intrinsically linked to China's rapid digital acceleration, driven by an insatiable demand for cloud computing, big data analytics, and artificial intelligence applications. In the historical period, we observed a substantial increase in data center capacity to accommodate the surge in online activities, e-commerce growth, and the expansion of 5G networks. The shift towards hyperscale data centers has been a defining characteristic, driven by major cloud providers and large enterprises seeking economies of scale and superior performance. Technological advancements have consistently pushed the boundaries of efficiency and performance, with advancements in cooling technologies, power management systems, and network connectivity becoming critical differentiators. For instance, the adoption rate of liquid cooling solutions, essential for high-density computing, has seen significant traction, projected to grow at a compound annual growth rate (CAGR) of over 15% from 2025 onwards. Consumer demand has also played a pivotal role, with an increasing reliance on mobile internet, streaming services, and IoT devices generating unprecedented data volumes. This has compelled data center operators to continuously upgrade their infrastructure to offer low latency and high availability services. The market has seen a clear trend towards increased Absorption, with utilized capacity growing substantially. In the 2025 base year, Utilized capacity is estimated to be around XX billion square feet. Wholesale and Hyperscale colocation types are the primary drivers of this absorption, accounting for an estimated XX% and XX% respectively of the utilized market. The Cloud & IT sector remains the largest end-user segment, consuming an estimated XX% of the total utilized capacity, followed by Telecom (XX%) and E-Commerce (XX%). The market's growth trajectory is further bolstered by significant investments from both domestic and international players, aiming to expand their footprint and service offerings to meet the evolving needs of businesses and consumers.

Leading Regions, Countries, or Segments in Shanghai Data Center Market

Within the dynamic Shanghai Data Center Market, specific segments are demonstrating exceptional dominance, driven by a confluence of strategic investment, technological advancement, and supportive regulatory frameworks. The Mega DC Size segment stands out, with large-scale facilities capable of housing massive compute power becoming increasingly prevalent. These facilities are crucial for supporting hyperscale cloud providers and large enterprises with extensive data processing needs. The Tier 4 classification is also a significant marker of quality and reliability, with an increasing number of operators investing in building and certifying their facilities to this highest standard, ensuring unparalleled uptime and resilience, a critical factor for BFSI and Government sectors.

The Utilized segment of Absorption is overwhelmingly driven by the Hyperscale colocation type. This is fueled by the immense demand from Cloud & IT end-users, who require vast and scalable infrastructure to support their global service offerings. The Cloud & IT sector is projected to account for over XX% of the utilized capacity by 2025, a figure expected to climb further through the forecast period. The Telecom sector also represents a substantial portion, estimated at XX%, driven by the rollout of 5G and increased data traffic.

- Dominant DC Size: Mega data centers, offering massive scale and capacity for hyperscale operations and enterprise cloud deployments.

- Leading Tier Type: Tier 4 facilities, emphasizing business continuity and zero downtime for mission-critical applications.

- Primary Absorption Segment: Utilized capacity, with a strong preference for Hyperscale colocation.

- Key End User: Cloud & IT providers leading the demand, followed by Telecom and E-Commerce, reflecting the digital economy's core.

- Investment Trends: Significant capital inflows into building out Mega and Tier 4 facilities to meet hyperscale and enterprise requirements.

- Regulatory Support: Government initiatives encouraging the development of advanced digital infrastructure, particularly in key economic zones.

Shanghai Data Center Market Product Innovations

Product innovations in the Shanghai Data Center Market are revolutionizing efficiency and performance. Advanced cooling solutions, such as direct liquid cooling and immersion cooling, are emerging to manage the heat generated by high-density compute racks, crucial for AI and HPC workloads. AI-powered infrastructure management platforms are optimizing energy consumption and predicting maintenance needs, enhancing operational efficiency. Furthermore, advancements in modular data center designs allow for rapid deployment and scalability, responding swiftly to market demands. These innovations are not just about hardware but also about intelligent software integration, creating a more resilient and cost-effective digital ecosystem, with a focus on reducing PUE (Power Usage Effectiveness) to below 1.2.

Propelling Factors for Shanghai Data Center Market Growth

Several potent factors are propelling the Shanghai Data Center Market towards unprecedented growth. The relentless surge in digital data generation, fueled by the proliferation of IoT devices, AI applications, and the expansion of cloud services, forms the bedrock of this expansion. The Chinese government's strategic focus on fostering a robust digital economy, coupled with initiatives like "New Infrastructure," directly incentivizes the development of advanced data center facilities. Economic growth and the increasing adoption of digital technologies across all industries, from BFSI to manufacturing and e-commerce, further amplify the demand for scalable and reliable data storage and processing capabilities. The ongoing rollout of 5G networks also necessitates more distributed and high-capacity data center infrastructure to support increased mobile data traffic and low-latency applications.

Obstacles in the Shanghai Data Center Market Market

Despite its robust growth, the Shanghai Data Center Market faces several significant obstacles. High operational costs, particularly concerning energy consumption and land acquisition in prime urban locations, present a substantial challenge. Stringent environmental regulations, while crucial for sustainability, require significant investment in energy-efficient technologies and renewable energy sources, which can increase upfront capital expenditure. The availability of skilled labor for the operation and maintenance of advanced data center facilities is also a concern, necessitating continuous training and development programs. Furthermore, geopolitical tensions and evolving trade policies can introduce supply chain disruptions for critical hardware components, potentially impacting expansion timelines and costs. Competition among a growing number of providers also puts pressure on pricing and service offerings.

Future Opportunities in Shanghai Data Center Market

The Shanghai Data Center Market presents a wealth of future opportunities. The burgeoning demand for edge computing solutions, driven by the need for low-latency processing for applications like autonomous driving and smart manufacturing, opens up new avenues for smaller, distributed data centers. The increasing adoption of AI and machine learning across industries will continue to fuel demand for high-density computing power, creating opportunities for specialized data center designs. Furthermore, the growing emphasis on sustainability offers a chance for providers to differentiate themselves through green data center designs, powered by renewable energy. The continuous expansion of cloud services and the digital transformation of traditional industries will ensure sustained demand for colocation and managed services, particularly for hyperscale and enterprise-grade solutions.

Major Players in the Shanghai Data Center Market Ecosystem

- GDS

- KDDI Telehouse

- Princeton Digital Group

- China Telecom Corporation Ltd

- Equinix

- Chayora Lt

- NTT Ltd

Key Developments in Shanghai Data Center Market Industry

- 2023/Q4: GDS announces significant expansion plans, investing billions to build new hyperscale facilities in strategic locations across China, including Shanghai.

- 2024/Q1: Equinix completes the acquisition of a major data center operator, strengthening its presence and service offerings in the Shanghai market.

- 2024/Q2: China Telecom Corporation Ltd unveils a new initiative to develop energy-efficient data centers, focusing on renewable energy integration and advanced cooling technologies.

- 2024/Q3: NTT Ltd announces a partnership to deploy cutting-edge AI infrastructure, driving demand for high-density computing capabilities within its Shanghai facilities.

- 2024/Q4: Princeton Digital Group secures substantial funding to accelerate its expansion and development of carrier-neutral data centers across key Chinese metropolitan areas.

Strategic Shanghai Data Center Market Market Forecast

The strategic forecast for the Shanghai Data Center Market is exceptionally promising, driven by an unyielding demand for digital infrastructure. Growth catalysts include the continued rapid expansion of cloud computing, the increasing integration of AI and IoT technologies, and the ongoing digital transformation across all business sectors. Opportunities in edge computing and the development of sustainable, green data centers will further shape the market. The robust investment from major players and supportive government policies underscore a future characterized by significant capacity expansion and technological advancement, solidifying Shanghai's position as a leading global data hub with a market valuation projected to reach hundreds of billions by 2033.

Shanghai Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

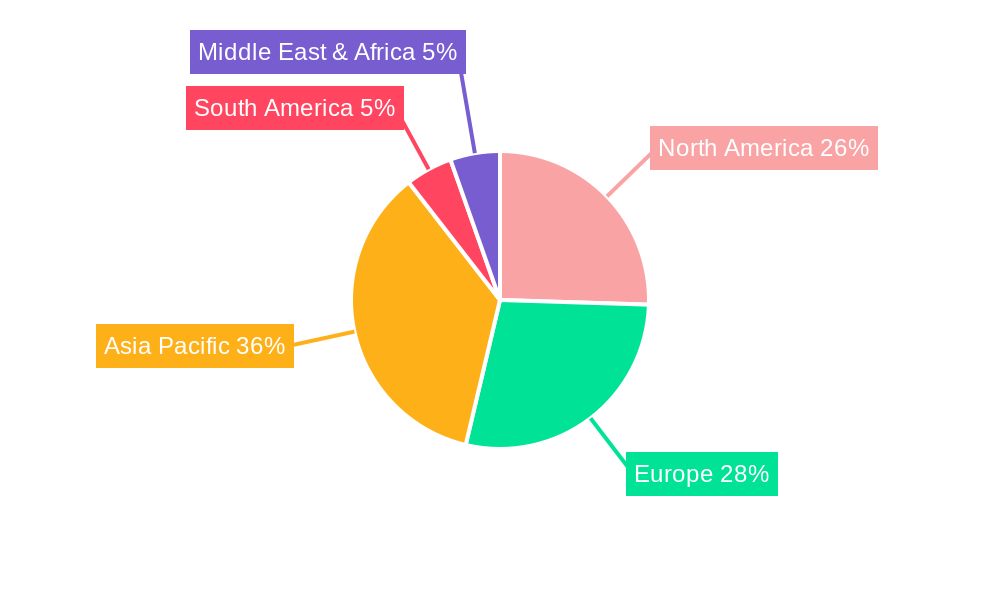

Shanghai Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Shanghai Data Center Market Regional Market Share

Geographic Coverage of Shanghai Data Center Market

Shanghai Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous roll out of 5G; Growth of high-quality defensive companies; Demand for new digital services

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Increasing cloud and colocation services are anticipated to drive the growth of data center market in the Shanghai.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Shanghai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GDS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KDDI Telehouse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Princeton Digital Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Telecom Corporation Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Equinix

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chayora Lt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NTT Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 GDS

List of Figures

- Figure 1: Global Shanghai Data Center Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Shanghai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 3: North America Shanghai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Shanghai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 5: North America Shanghai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Shanghai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 7: North America Shanghai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Shanghai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Shanghai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Shanghai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 11: South America Shanghai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Shanghai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 13: South America Shanghai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Shanghai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 15: South America Shanghai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Shanghai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Shanghai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Shanghai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 19: Europe Shanghai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Shanghai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 21: Europe Shanghai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Shanghai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 23: Europe Shanghai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Shanghai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Shanghai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Shanghai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Shanghai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Shanghai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Shanghai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Shanghai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Shanghai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Shanghai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Shanghai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Shanghai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Shanghai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Shanghai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Shanghai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Shanghai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Shanghai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Shanghai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Shanghai Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 2: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 3: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 4: Global Shanghai Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 6: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 7: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Global Shanghai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 13: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 14: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 15: Global Shanghai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 20: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 21: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Global Shanghai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 33: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 34: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 35: Global Shanghai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Shanghai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 43: Global Shanghai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 44: Global Shanghai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 45: Global Shanghai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Shanghai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shanghai Data Center Market?

The projected CAGR is approximately 12.8%.

2. Which companies are prominent players in the Shanghai Data Center Market?

Key companies in the market include GDS, KDDI Telehouse, Princeton Digital Group, China Telecom Corporation Ltd, Equinix, Chayora Lt, NTT Ltd.

3. What are the main segments of the Shanghai Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Continuous roll out of 5G; Growth of high-quality defensive companies; Demand for new digital services.

6. What are the notable trends driving market growth?

Increasing cloud and colocation services are anticipated to drive the growth of data center market in the Shanghai..

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shanghai Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shanghai Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shanghai Data Center Market?

To stay informed about further developments, trends, and reports in the Shanghai Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence