Key Insights

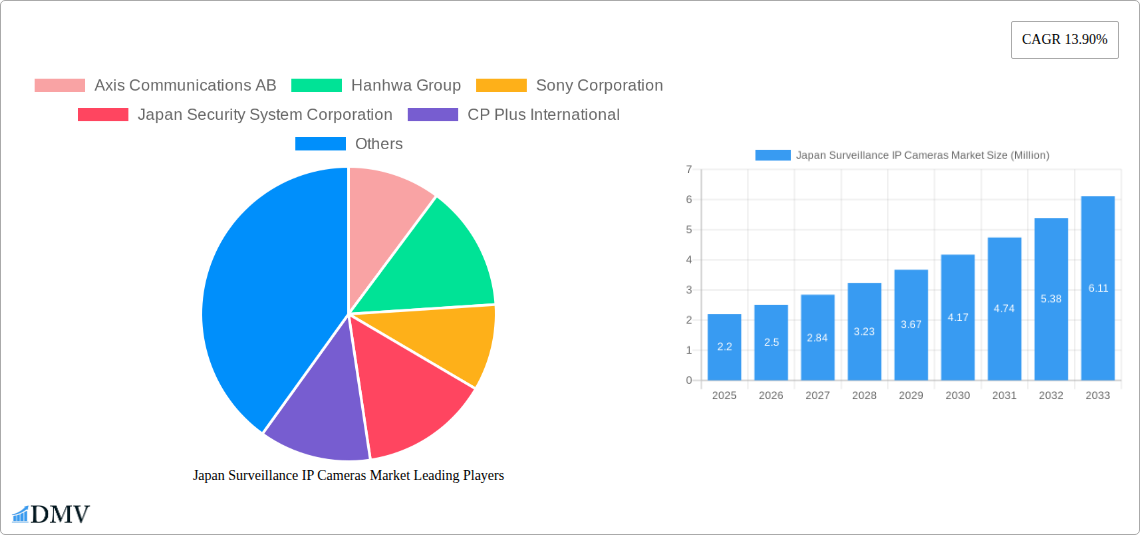

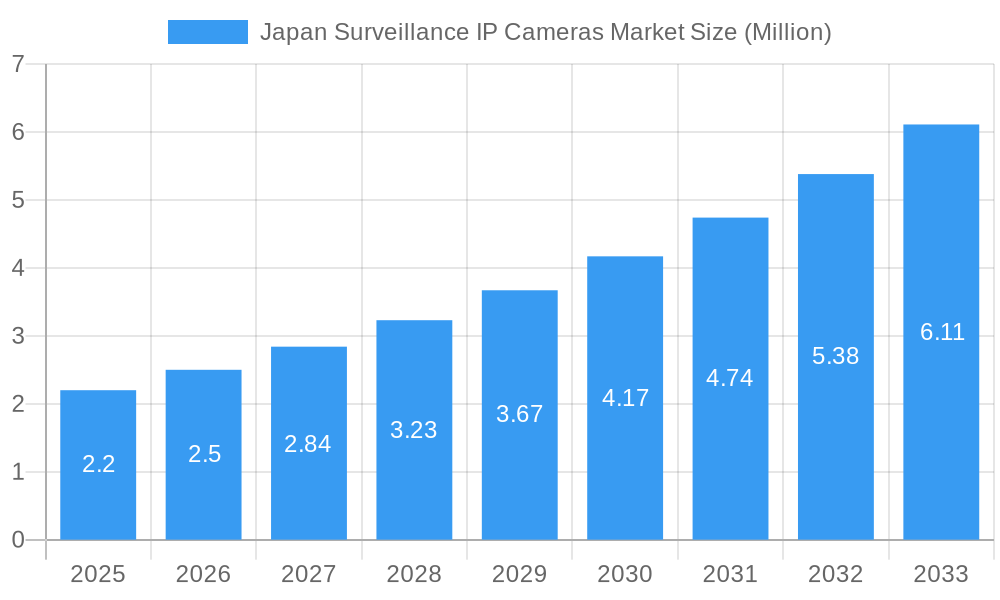

The Japan Surveillance IP Cameras Market is poised for significant expansion, driven by increasing demand for advanced security solutions across diverse end-user verticals. With a robust CAGR of 13.90%, the market is projected to reach a substantial market size of 2.20 Million by 2025. This growth is primarily fueled by escalating concerns regarding public safety, coupled with the burgeoning adoption of smart city initiatives and the continuous technological advancements in surveillance technology. Key drivers include the rising sophistication of cyber threats, necessitating enhanced network security for IP-based systems, and the growing integration of AI and machine learning for intelligent video analytics, such as facial recognition and anomaly detection. The government and defense sector, alongside banking and financial institutions, are leading the charge in adopting these sophisticated surveillance solutions to safeguard critical infrastructure and sensitive data. Furthermore, the expanding retail sector's focus on loss prevention and customer analytics, along with the healthcare industry's need for patient monitoring and facility security, are contributing significantly to market penetration.

Japan Surveillance IP Cameras Market Market Size (In Million)

The market is experiencing a dynamic shift towards higher resolution cameras, enhanced low-light performance, and miniaturized form factors, enabling more discreet and effective surveillance. Trends such as the increasing deployment of cloud-based surveillance systems are simplifying data management and accessibility, while the burgeoning IoT ecosystem is integrating IP cameras with other smart devices for comprehensive security networks. The residential sector is also witnessing a notable uptick in demand for smart home security cameras, reflecting a growing consumer awareness and desire for personal safety. Despite these positive growth trajectories, certain restraints, such as the high initial investment costs for advanced systems and concerns surrounding data privacy and cybersecurity, need to be strategically addressed by market players. However, the inherent benefits of IP cameras, including scalability, remote accessibility, and superior image quality, are expected to outweigh these challenges, propelling the Japan Surveillance IP Cameras Market to new heights throughout the forecast period of 2025-2033.

Japan Surveillance IP Cameras Market Company Market Share

Japan Surveillance IP Cameras Market: Comprehensive Analysis and Future Outlook (2019–2033)

Gain unparalleled insights into the dynamic Japan surveillance IP cameras market with this in-depth report. Spanning the historical period of 2019–2024 and projecting through the forecast period of 2025–2033, with a base year of 2025, this comprehensive analysis offers a strategic roadmap for stakeholders. Explore critical market segments including Banking and Financial Institutions, Transportation and Infrastructure, Government and Defense, Healthcare, Industrial, Retail, Enterprises, Residential, and Others (Hospitality and Educational Institutes). Uncover the latest industry developments and leverage high-ranking keywords such as "AI surveillance," "smart security," "network cameras," "video analytics," and "cybersecurity" to optimize your market strategy. This report provides a detailed breakdown of market composition, trends, industry evolution, leading regions, product innovations, growth drivers, obstacles, future opportunities, major players, key developments, and strategic forecasts, ensuring you are equipped with the knowledge to capitalize on the burgeoning IP camera market in Japan.

Japan Surveillance IP Cameras Market Market Composition & Trends

The Japan surveillance IP cameras market exhibits a moderate to high concentration, driven by a blend of established global players and robust domestic manufacturers. Innovation catalysts are primarily centered on advancements in Artificial Intelligence (AI) for video analytics, enhanced cybersecurity features to combat evolving threats, and the development of high-resolution imaging capabilities for improved situational awareness. Regulatory landscapes, while generally supportive of enhanced security measures, also emphasize data privacy and compliance, influencing product development and deployment strategies. The presence of effective substitute products, such as analog CCTV systems, is diminishing as IP technology offers superior functionality and scalability. End-user profiles are increasingly sophisticated, demanding integrated solutions that offer not only surveillance but also operational efficiency and predictive capabilities. Mergers and acquisitions (M&A) activities, though not as prevalent as in some other global markets, are strategic, focusing on consolidating market share, acquiring specialized technologies, or expanding geographical reach. Market share distribution indicates a steady growth in the adoption of advanced IP cameras across all verticals, with significant M&A deal values expected to emerge as larger players seek to integrate cutting-edge AI capabilities into their portfolios. The market is shaped by an ongoing demand for reliable, intelligent, and secure surveillance solutions that can adapt to Japan's unique urban and industrial environments.

Japan Surveillance IP Cameras Market Industry Evolution

The Japan surveillance IP cameras market has undergone a significant evolutionary transformation, shifting from traditional analog systems to sophisticated Internet Protocol (IP) based solutions. This transition, observed throughout the historical period of 2019–2024, has been fueled by a persistent drive for enhanced security, driven by both public and private sector imperatives, and the increasing adoption of smart city initiatives across the nation. The forecast period of 2025–2033 is poised to witness accelerated growth, with an estimated compound annual growth rate (CAGR) of XX%, propelled by the integration of AI and machine learning capabilities. Early adoption metrics show a clear upward trend in the penetration of high-definition (HD) and ultra-high-definition (UHD) cameras, with a significant increase in the deployment of cameras equipped with advanced video analytics functionalities. Consumer demand has evolved from basic video recording to a need for intelligent systems capable of real-time threat detection, behavioral analysis, and proactive security measures. Technological advancements have been pivotal, with improvements in sensor technology leading to better low-light performance, wider dynamic range, and enhanced image clarity. The miniaturization of components and the development of more robust and weather-resistant camera designs have also contributed to wider application possibilities. Furthermore, the growing emphasis on data security and privacy in Japan has spurred the development of encrypted transmission protocols and on-device processing capabilities, ensuring compliance with stringent data protection regulations. The estimated year of 2025 is expected to see a market value of approximately XX Million Yen, underscoring the robust growth trajectory. This evolution is not merely about hardware; it encompasses the entire ecosystem of network video recorders (NVRs), video management software (VMS), and cloud-based surveillance solutions, all contributing to a more integrated and intelligent security infrastructure. The market's growth trajectory is also influenced by Japan's demographic shifts, with an aging population necessitating advanced remote monitoring and automated security solutions, particularly in residential and healthcare sectors.

Leading Regions, Countries, or Segments in Japan Surveillance IP Cameras Market

The Japan surveillance IP cameras market is predominantly driven by demand within the Enterprises segment, closely followed by Government and Defense, and Retail. This dominance is attributable to a confluence of factors that underscore the critical need for advanced security and operational oversight within these sectors.

- Enterprises: This segment's leadership is fueled by a continuous drive for enhanced physical security, loss prevention, and operational efficiency. Major corporations in sectors like manufacturing, technology, and logistics are investing heavily in comprehensive IP surveillance systems to monitor production lines, secure intellectual property, and optimize supply chain visibility. The increasing sophistication of business operations demands intelligent video analytics for employee monitoring, access control, and workplace safety.

- Government and Defense: National security concerns, the need for border surveillance, critical infrastructure protection, and law enforcement applications are significant drivers for IP camera adoption. Government agencies are increasingly deploying advanced surveillance solutions in public spaces, transportation hubs, and sensitive installations. Investments in smart city projects further bolster this segment's growth, integrating surveillance into broader urban management systems.

- Retail: The retail sector prioritizes loss prevention, customer behavior analysis, and inventory management. IP cameras equipped with AI capabilities are instrumental in detecting shoplifting, analyzing customer traffic patterns, optimizing store layouts, and enhancing the overall shopping experience. The rise of e-commerce and the need to secure both physical and online operations also contribute to the segment's demand.

The Banking and Financial Institutions segment also represents a substantial market, driven by the stringent security requirements for protecting assets, preventing fraud, and ensuring regulatory compliance. The Transportation and Infrastructure sector is seeing increased investment in surveillance for public safety, traffic management, and the security of transportation networks like railways and airports. While Healthcare and Industrial sectors are growing, their adoption rates are influenced by specific regulatory needs and the pace of technological integration. Residential surveillance, though a growing area, still constitutes a smaller portion compared to commercial and public sectors, but is expected to see an upward trend with the increasing affordability and ease of use of smart home security systems.

Japan Surveillance IP Cameras Market Product Innovations

Product innovations in the Japan surveillance IP cameras market are focused on integrating cutting-edge technologies to enhance surveillance capabilities. Advancements include high-resolution sensors (4K and beyond) for crystal-clear imagery, advanced AI-powered video analytics for intelligent event detection, object recognition, and facial recognition. Innovations also encompass improved low-light performance through sophisticated IR illumination and WDR (Wide Dynamic Range) technologies, ensuring clear visuals in challenging lighting conditions. Cybersecurity features are paramount, with encryption and secure network protocols becoming standard. Furthermore, the integration of PTZ (Pan-Tilt-Zoom) functionality with AI precision, as seen in recent product launches, allows for dynamic monitoring and rapid response to detected events, significantly boosting situational awareness.

Propelling Factors for Japan Surveillance IP Cameras Market Growth

The Japan surveillance IP cameras market is experiencing robust growth driven by several key factors. The persistent and evolving security threats, both physical and cyber, necessitate advanced surveillance solutions for businesses, public institutions, and homes. The Japanese government's push for smart city initiatives and the modernization of critical infrastructure, including transportation networks and public spaces, is a significant catalyst. Furthermore, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in video analytics is transforming surveillance from passive monitoring to proactive threat detection and operational intelligence. The technological advancements leading to higher resolution cameras, better low-light performance, and enhanced cybersecurity features are making IP cameras more attractive and versatile. Economic growth and increased disposable income in the residential sector are also contributing to the adoption of smart home security solutions.

Obstacles in the Japan Surveillance IP Cameras Market Market

Despite its strong growth, the Japan surveillance IP cameras market faces certain obstacles. High initial investment costs associated with advanced IP systems and their integration can be a deterrent for small and medium-sized enterprises (SMEs). Concerns over data privacy and cybersecurity threats, while driving the need for secure solutions, also present a challenge, as the complexity of securing vast amounts of video data requires constant vigilance and investment in robust cybersecurity measures. Technical expertise and skilled labor shortages for installation, configuration, and maintenance of sophisticated IP surveillance systems can also hinder widespread adoption. Furthermore, the evolving regulatory landscape surrounding data handling and surveillance practices, while necessary, can create compliance burdens for manufacturers and end-users.

Future Opportunities in Japan Surveillance IP Cameras Market

The Japan surveillance IP cameras market is ripe with future opportunities. The escalating demand for AI-powered video analytics presents significant potential for growth, enabling predictive policing, intelligent traffic management, and advanced threat detection. The continued development and adoption of the Internet of Things (IoT) will foster the integration of IP cameras with other smart devices, creating comprehensive security and operational ecosystems. The expansion of smart city projects across Japan will drive demand for scalable and interconnected surveillance solutions. Furthermore, the growing awareness of home security among the aging population and the increasing demand for remote monitoring solutions offer substantial opportunities in the residential sector. The development of more affordable yet feature-rich IP cameras will further broaden market accessibility.

Major Players in the Japan Surveillance IP Cameras Market Ecosystem

- Axis Communications AB

- Hanhwa Group

- Sony Corporation

- Japan Security System Corporation

- CP Plus International

- Eagle Eye Networks

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology Co Ltd

- Cisco Systems

- VIVOTEK

- iPRO

- Kowa Company Limited

- Honeywell International Inc

Key Developments in Japan Surveillance IP Cameras Market Industry

- July 2024: Hanwha Vision introduced two cutting-edge AI PTZ Plus cameras, the XNP-C9310R and XNP-C7310R, featuring 4K resolution, 300-meter IR range, and advanced PTZ control for enhanced situational awareness and swift response.

- July 2024: Bosch's FLEXIDOME 3100i camera expanded its product line, emphasizing robust security, advanced video analytics, and data protection, ideal for discreet surveillance in sensitive locations with up to 30m IR illumination and integrated varifocal lenses.

- May 2024: VIVOTEK launched the 9383-Series network camera, bringing AI video analytics for people and vehicle attribute discernment, seamlessly integrating with VIVOTEK's Core+ AI NVR and VAST Security Station (VSS) system.

Strategic Japan Surveillance IP Cameras Market Market Forecast

The Japan surveillance IP cameras market is strategically positioned for sustained growth, projected to reach an estimated market value of XX Million Yen by 2033, growing at a CAGR of XX% from the base year of 2025. This expansion will be predominantly fueled by the relentless integration of Artificial Intelligence (AI) into video analytics, enabling predictive capabilities and enhanced threat detection. The ongoing government investment in smart city infrastructure and critical asset protection will continue to be a significant demand driver. Furthermore, the increasing adoption of IoT devices and the demand for comprehensive, interconnected security solutions will create new market avenues. The market's future trajectory is also shaped by the ongoing need for robust cybersecurity features, ensuring the integrity and privacy of surveillance data. Emerging trends in high-resolution imaging and advanced low-light performance will further enhance the value proposition of IP cameras, driving their adoption across diverse end-user verticals.

Japan Surveillance IP Cameras Market Segmentation

-

1. End User Vertical

- 1.1. Banking and Financial Institutions

- 1.2. Transporation and Infrastructure

- 1.3. Government and Defense

- 1.4. Healthcare

- 1.5. Industrial

- 1.6. Retail

- 1.7. Enterprises

- 1.8. Residential

- 1.9. Others (Hospitality and Educational Institutes)

Japan Surveillance IP Cameras Market Segmentation By Geography

- 1. Japan

Japan Surveillance IP Cameras Market Regional Market Share

Geographic Coverage of Japan Surveillance IP Cameras Market

Japan Surveillance IP Cameras Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Demand for High Resolution Cameras

- 3.3. Market Restrains

- 3.3.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Demand for High Resolution Cameras

- 3.4. Market Trends

- 3.4.1. Increasing Government Investment Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Surveillance IP Cameras Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Vertical

- 5.1.1. Banking and Financial Institutions

- 5.1.2. Transporation and Infrastructure

- 5.1.3. Government and Defense

- 5.1.4. Healthcare

- 5.1.5. Industrial

- 5.1.6. Retail

- 5.1.7. Enterprises

- 5.1.8. Residential

- 5.1.9. Others (Hospitality and Educational Institutes)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End User Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hanhwa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sony Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Japan Security System Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CP Plus International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eagle Eye Networks

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dahua Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cisco Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VIVOTEK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 iPRO

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kowa Company Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc *List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Japan Surveillance IP Cameras Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Surveillance IP Cameras Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Surveillance IP Cameras Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 2: Japan Surveillance IP Cameras Market Volume Billion Forecast, by End User Vertical 2020 & 2033

- Table 3: Japan Surveillance IP Cameras Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Surveillance IP Cameras Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Japan Surveillance IP Cameras Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 6: Japan Surveillance IP Cameras Market Volume Billion Forecast, by End User Vertical 2020 & 2033

- Table 7: Japan Surveillance IP Cameras Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Japan Surveillance IP Cameras Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Surveillance IP Cameras Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the Japan Surveillance IP Cameras Market?

Key companies in the market include Axis Communications AB, Hanhwa Group, Sony Corporation, Japan Security System Corporation, CP Plus International, Eagle Eye Networks, Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, Cisco Systems, VIVOTEK, iPRO, Kowa Company Limited, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Japan Surveillance IP Cameras Market?

The market segments include End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Demand for High Resolution Cameras.

6. What are the notable trends driving market growth?

Increasing Government Investment Driving the Demand.

7. Are there any restraints impacting market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Demand for High Resolution Cameras.

8. Can you provide examples of recent developments in the market?

July 2024: Hanwha Vision introduced two cutting-edge AI PTZ Plus cameras, the XNP-C9310R and XNP-C7310R. These cameras are designed to swiftly zoom and focus, enhancing situational awareness and response times. With resolutions reaching up to 4K, an adaptable IR range of 300 meters, and a sizable 4K 1/1.8” visual sensor, the cameras ensure clear images, even in low-light conditions. Additionally, their extended tilt range and precise PTZ control make it effortless for teams to monitor details and expansive scenes.July 2024: Bosch's FLEXIDOME 3100i camera expanded its product line, prioritizing robust security alongside advanced video analytics and data protection. Its unobtrusive design makes it a prime choice for discreet surveillance in schools, office buildings, and other sensitive locations. The indoor variant, available with or without IR illumination, enhances adaptability to diverse project needs—the IR feature guarantees clear visuals up to 30m (98ft) in low-light conditions. Additionally, the cameras boast integrated varifocal lenses, ensuring crisp, detailed images with a customizable field of view.May 2024: VIVOTEK broadened its portfolio with the launch of the 9383-Series network camera. This camera brings AI video analytics within reach, enabling users to discern people and vehicle attributes effortlessly. This not only bolsters operational efficiency but also streamlines management. Moreover, the 9383-Series seamlessly pairs with VIVOTEK's Core+ AI Network Video Recorder (NVR) and the VAST Security Station (VSS) system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Surveillance IP Cameras Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Surveillance IP Cameras Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Surveillance IP Cameras Market?

To stay informed about further developments, trends, and reports in the Japan Surveillance IP Cameras Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence