Key Insights

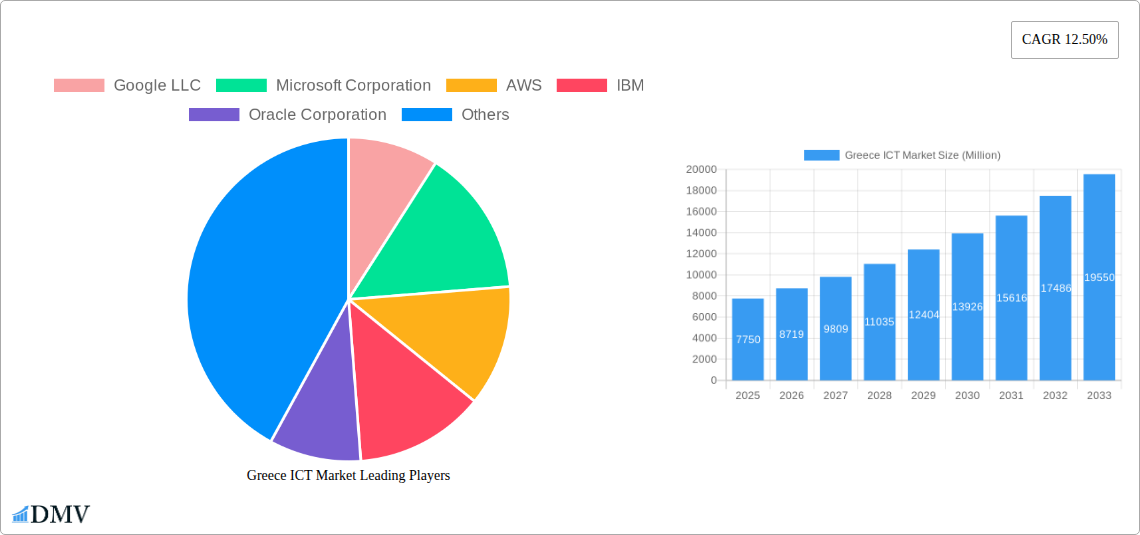

The Greek Information and Communications Technology (ICT) market is poised for significant expansion, projected to reach approximately USD 7750 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.50%. This dynamic growth is underpinned by several key drivers, most notably the increasing adoption of cloud computing solutions, the continuous digital transformation initiatives across various industries, and the government's strategic focus on developing a robust digital infrastructure. The expansion of 5G networks, coupled with the escalating demand for cybersecurity solutions, further fuels this upward trajectory. Moreover, the Greek government's commitment to leveraging technology for economic growth and improved public services is a critical factor, encouraging investment and innovation within the ICT sector.

Greece ICT Market Market Size (In Billion)

The market's evolution will be shaped by prevailing trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into business processes, the growing popularity of the Internet of Things (IoT) for enhanced operational efficiency, and the burgeoning demand for data analytics services. While these drivers and trends paint a promising picture, potential restraints include the ongoing need for upskilling the workforce to meet evolving technological demands and the initial investment costs associated with adopting advanced ICT solutions. However, the resilient nature of the Greek economy and its increasing integration into the European digital landscape suggest that these challenges are manageable, paving the way for sustained and impressive growth in the ICT sector. The market segmentation reveals a strong presence of both hardware and software solutions, with IT Services and Telecommunication Services playing crucial roles. Small and Medium Enterprises (SMEs) are increasingly investing in ICT to enhance their competitiveness, while Large Enterprises are focusing on sophisticated solutions for operational optimization and data-driven decision-making. Key industry verticals like BFSI, IT and Telecom, and Government are leading the adoption, with Manufacturing and Retail & E-commerce also showing significant momentum.

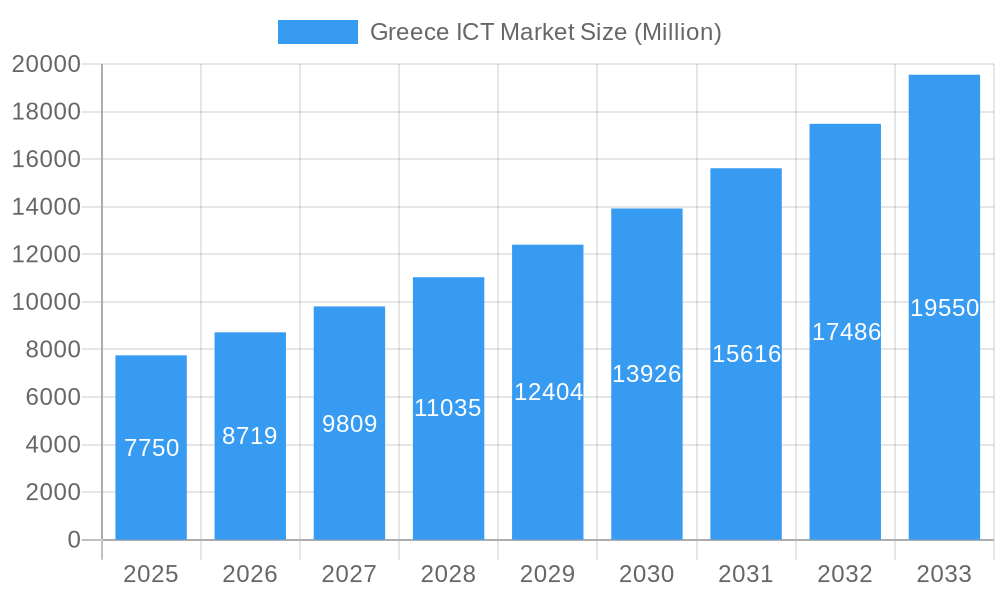

Greece ICT Market Company Market Share

Unlock the future of Greece's dynamic Information and Communications Technology (ICT) landscape with this in-depth market report. Covering the study period of 2019–2033, with a base and estimated year of 2025, this report provides strategic insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Expertly crafted to rank high in search results for terms like "Greece ICT market analysis," "Greek technology trends," "digital transformation Greece," and "ICT investment Greece," this report is essential for stakeholders, investors, and industry leaders seeking to capitalize on the burgeoning Greek digital economy. Dive deep into the impact of major players like Google LLC, Microsoft Corporation, AWS, IBM, Oracle Corporation, Cisco Systems Inc, SAP SE, HP Inc, Dell Technologies Inc, and Intel Corporation across hardware, software, IT services, and telecommunication services segments, catering to both small and medium enterprises (SMEs) and large enterprises. Explore its influence on key verticals including BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, and Energy and Utilities.

Greece ICT Market Market Composition & Trends

The Greece ICT market exhibits a dynamic composition shaped by both established global technology giants and emerging local players. Market concentration is evident, with a significant share held by companies providing core IT services and telecommunication services, reflecting the nation's push towards digitalization. Innovation is largely catalyzed by the increasing adoption of cloud computing, artificial intelligence, and cybersecurity solutions across various industry verticals. The regulatory landscape is evolving, with government initiatives aimed at fostering digital infrastructure development and promoting e-government services. While substitute products exist, particularly in the commoditized hardware space, the increasing complexity of IT needs drives demand for integrated solutions and specialized software. End-user profiles are diverse, with large enterprises leading in adoption of sophisticated solutions, while small and medium enterprises (SMEs) are increasingly recognizing the benefits of digital transformation for competitiveness and efficiency. Mergers and acquisitions (M&A) activities are anticipated to rise, driven by the strategic importance of the Greek market in the Eastern Mediterranean and the ongoing consolidation within the global tech industry. Anticipated M&A deal values will likely reflect the strategic acquisition of specialized technology providers and infrastructure assets, projecting a growth in market consolidation, with an estimated market share distribution seeing IT Services holding a substantial portion, followed by Telecommunication Services, Software, and Hardware.

Greece ICT Market Industry Evolution

The Greece ICT market has undergone a significant transformation over the historical period of 2019–2024, transitioning from a nascent digital economy to a rapidly expanding hub for technological innovation and adoption. This evolution has been propelled by a concerted effort from both the public and private sectors to modernize infrastructure and embrace digital solutions. Market growth trajectories have been consistently upward, with an estimated annual growth rate of XX% observed during the historical period, largely driven by government investments in digital infrastructure and the increasing demand for advanced IT services from businesses across various sectors. Technological advancements have been rapid, with widespread adoption of cloud computing services, accelerating digital transformation initiatives within the BFSI, Government, and Retail and E-commerce sectors. The penetration of high-speed broadband internet and the rollout of 5G networks by leading telecommunication services providers have laid a robust foundation for further digital advancements. Shifting consumer demands have also played a pivotal role; consumers are increasingly expecting seamless digital experiences, driving e-commerce growth and the demand for personalized digital services. This has spurred innovation in areas such as mobile applications, online platforms, and data analytics. The forecast period of 2025–2033 is poised to witness even more accelerated growth, with projected annual growth rates of XX%, fueled by emerging technologies like AI, IoT, and blockchain, alongside continued investment in digital infrastructure and cybersecurity. The increasing digitalization of critical sectors such as Manufacturing and Energy and Utilities will further solidify Greece's position as a significant player in the European ICT landscape. The adoption of sophisticated enterprise resource planning (ERP) systems and customer relationship management (CRM) software by both large enterprises and increasingly by SMEs underscores the maturation of the Greek business environment.

Leading Regions, Countries, or Segments in Greece ICT Market

Within the multifaceted Greece ICT market, several segments and sectors stand out for their dominance and growth potential during the forecast period of 2025–2033. IT Services emerges as a leading segment, driven by the escalating demand for digital transformation solutions, cloud integration, cybersecurity services, and managed IT support across all enterprise sizes. The increasing reliance of large enterprises and the growing digital adoption by small and medium enterprises (SMEs) on sophisticated IT infrastructure and applications fuel this segment's dominance. The BFSI sector is a prime driver of this growth, with financial institutions heavily investing in digital banking platforms, fintech solutions, and robust cybersecurity measures to enhance customer experience and operational efficiency. Similarly, the Government sector is a significant contributor, propelled by national strategies focused on e-governance, digital public services, and the modernization of state infrastructure, requiring extensive IT services and telecommunication services.

Key Drivers for Dominance:

- Digital Transformation Initiatives: Government and industry-led programs encouraging digital adoption across all sectors.

- Investment Trends: Significant private and public investments in cloud infrastructure, data analytics, and cybersecurity.

- Regulatory Support: Favorable policies promoting digital innovation and foreign investment in the ICT sector.

- Technological Advancements: Widespread adoption of cloud computing, AI, and IoT solutions, increasing the need for expert IT service providers.

- Growing E-commerce Penetration: The robust growth of the Retail and E-commerce sector necessitates advanced digital infrastructure and IT support.

The dominance of IT Services is further bolstered by the strategic imperative for businesses to leverage specialized expertise for managing complex IT environments, ensuring data security, and optimizing their digital operations. This is closely followed by Telecommunication Services, which form the backbone of the digital economy, with ongoing investments in 5G and fiber optic networks enabling faster data transmission and supporting the growth of data-intensive applications. The IT and Telecom industry vertical itself is a major consumer of ICT solutions, further amplifying the demand for these services. The increasing adoption of advanced software solutions, from enterprise resource planning (ERP) to customer relationship management (CRM) and specialized industry-specific applications, also contributes significantly to the market's dynamism. While Hardware remains essential, its growth is increasingly tied to the broader ecosystem of digital services and solutions. The sustained investment in digital infrastructure, coupled with a strategic focus on enhancing digital capabilities across all industries, solidifies IT Services as the most prominent and fastest-growing segment in the Greece ICT market for the foreseeable future.

Greece ICT Market Product Innovations

Greece's ICT market is witnessing a surge in product innovations driven by the demand for advanced digital solutions. Companies are focusing on developing AI-powered analytics platforms for personalized customer experiences in the Retail and E-commerce sector, and intelligent automation tools to optimize operations in Manufacturing and Energy and Utilities. The cybersecurity landscape is evolving with sophisticated threat detection and response systems, crucial for protecting sensitive data in the BFSI and Government sectors. Furthermore, advancements in cloud-native software and hybrid cloud solutions are offering greater flexibility and scalability for businesses of all sizes. The development of specialized telecommunication services infrastructure, including the expansion of 5G networks and the establishment of new data center facilities, is enabling the deployment of real-time, data-intensive applications. These innovations are enhancing performance metrics such as processing speed, data security, and user engagement, positioning Greece as a growing hub for technological advancement.

Propelling Factors for Greece ICT Market Growth

The Greece ICT market is experiencing robust growth driven by a confluence of strategic factors. Government initiatives promoting digital transformation, such as the "Digital Greece" program, are a significant catalyst, fostering innovation and investment. The increasing adoption of cloud computing and artificial intelligence (AI) by businesses of all sizes, from SMEs to large enterprises, is expanding the market for IT services and software. Furthermore, significant investments in telecommunication services infrastructure, including the expansion of broadband and 5G networks, are enhancing connectivity and enabling the widespread use of digital technologies. The growing demand for enhanced cybersecurity solutions to protect sensitive data in sectors like BFSI and Government is also a key growth driver. Economic recovery and a positive investment climate are further encouraging businesses to embrace digital solutions for improved efficiency and competitiveness.

Obstacles in the Greece ICT Market Market

Despite its strong growth trajectory, the Greece ICT market faces several obstacles that could impede its progress. Regulatory complexities and bureaucratic hurdles can sometimes slow down the implementation of new technologies and investment projects. A shortage of skilled ICT professionals, particularly in specialized areas like cybersecurity and AI, presents a significant challenge in meeting the growing demand for talent. Cybersecurity threats and data privacy concerns remain a persistent barrier, necessitating continuous investment in robust security measures and compliance frameworks. Supply chain disruptions, while improving, can still impact the availability and cost of critical hardware components. Additionally, digital divide issues in certain regions and among specific demographics require targeted interventions to ensure inclusive digital participation and prevent widening inequalities. The cost of advanced technology adoption can also be a restraint for some SMEs.

Future Opportunities in Greece ICT Market

The Greece ICT market is ripe with future opportunities, driven by emerging technologies and evolving market demands. The continued expansion of cloud computing services presents significant opportunities for cloud providers and managed service providers. The growing adoption of Internet of Things (IoT) solutions across industries like Manufacturing and Energy and Utilities will create demand for connected devices, data analytics, and integrated platforms. The increasing focus on sustainability and green technology will also drive demand for ICT solutions that support energy efficiency and environmental monitoring. Furthermore, the strategic location of Greece as a gateway to Europe, Asia, and Africa, coupled with investments in new data center facilities and subsea cable landing stations, positions the country as a key hub for digital infrastructure and data services. The ongoing digital transformation of the public sector and the growing e-commerce market offer continuous avenues for growth in IT services and software.

Major Players in the Greece ICT Market Ecosystem

- Google LLC

- Microsoft Corporation

- AWS

- IBM

- Oracle Corporation

- Cisco Systems Inc

- SAP SE

- HP Inc

- Dell Technologies Inc

- Intel Corporation

Key Developments in Greece ICT Market Industry

- May 2024: Deutsche Telekom's Greek subsidiary, OTE Group, has inked a preliminary agreement to divest its Romanian mobile operations to an investment firm primarily owned by Digi Communications. This development follows OTE's disclosure six months earlier of talks with Quantum Projects Group about a similar transaction. However, the current deal sees OTE partnering with West Network Invest, a venture jointly owned by Digi Communications and Clever Media Group.

- May 2024: Grid Telecom, a wholly owned subsidiary of Greece's Independent Power Transmission Operator (IPTO), in collaboration with Quadrivium Digital, is set to construct a cable landing station (CLS) on Crete, a Greek island. This new CLS, situated within Quadrivium's upcoming 20MW data center campus, will serve as a pivotal node, anchoring international subsea cable systems from Asia and Africa as they traverse the Eastern Mediterranean.

Strategic Greece ICT Market Market Forecast

The strategic Greece ICT market forecast indicates sustained and robust growth throughout the forecast period of 2025–2033. Key growth catalysts include the ongoing digital transformation across all industry verticals, fueled by substantial investments in IT services, software, and advanced telecommunication services infrastructure. The increasing adoption of cloud computing, AI, and IoT technologies by both large enterprises and SMEs will drive innovation and demand for cutting-edge solutions. Favorable government policies and a strengthening investment climate are expected to attract further foreign direct investment, solidifying Greece's position as a regional digital hub. The development of new data centers and subsea cable landing stations will enhance connectivity and data management capabilities, creating significant opportunities in the digital infrastructure space. The market potential remains high, driven by the continuous evolution of the digital landscape and the increasing integration of technology into everyday business operations and consumer lives.

Greece ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Greece ICT Market Segmentation By Geography

- 1. Greece

Greece ICT Market Regional Market Share

Geographic Coverage of Greece ICT Market

Greece ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation

- 3.3. Market Restrains

- 3.3.1. Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation

- 3.4. Market Trends

- 3.4.1. Rapid Deployment of 5G Network across the Nation will drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Google LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AWS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oracle Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAP SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HP Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Google LLC

List of Figures

- Figure 1: Greece ICT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Greece ICT Market Share (%) by Company 2025

List of Tables

- Table 1: Greece ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Greece ICT Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Greece ICT Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 4: Greece ICT Market Volume Billion Forecast, by Size of Enterprise 2020 & 2033

- Table 5: Greece ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: Greece ICT Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: Greece ICT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Greece ICT Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Greece ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Greece ICT Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Greece ICT Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 12: Greece ICT Market Volume Billion Forecast, by Size of Enterprise 2020 & 2033

- Table 13: Greece ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: Greece ICT Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Greece ICT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Greece ICT Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece ICT Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the Greece ICT Market?

Key companies in the market include Google LLC, Microsoft Corporation, AWS, IBM, Oracle Corporation, Cisco Systems Inc, SAP SE, HP Inc, Dell Technologies Inc, Intel Corporatio.

3. What are the main segments of the Greece ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation.

6. What are the notable trends driving market growth?

Rapid Deployment of 5G Network across the Nation will drive the Market.

7. Are there any restraints impacting market growth?

Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation.

8. Can you provide examples of recent developments in the market?

May 2024 - Deutsche Telekom's Greek subsidiary, OTE Group, has inked a preliminary agreement to divest its Romanian mobile operations to an investment firm primarily owned by Digi Communications. This development follows OTE's disclosure six months earlier of talks with Quantum Projects Group about a similar transaction. However, the current deal sees OTE partnering with West Network Invest, a venture jointly owned by Digi Communications and Clever Media Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece ICT Market?

To stay informed about further developments, trends, and reports in the Greece ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence