Key Insights

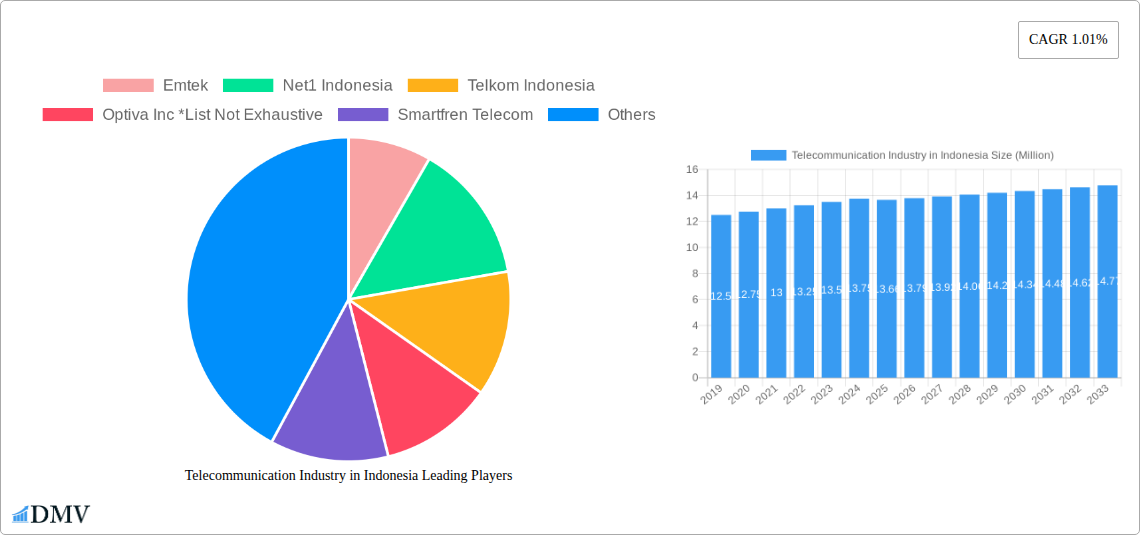

The Indonesian telecommunication industry is projected for steady growth, with an estimated market size of $13.66 million in 2025. This market is expected to expand at a Compound Annual Growth Rate (CAGR) of 1.01% during the forecast period of 2025-2033, indicating a mature yet stable market. The primary drivers for this growth are anticipated to be the increasing demand for robust data services, the pervasive adoption of Over-The-Top (OTT) content, and the continuous expansion of pay-TV services. These factors are fueled by Indonesia's large and young population, a growing digital economy, and ongoing government initiatives to enhance digital infrastructure. The market is segmented into Voice Services (both wired and wireless), Data services, and OTT and Pay TV Services. While voice services form a foundational segment, the most dynamic growth is expected in data and OTT/Pay TV, reflecting global consumer trends towards digital entertainment and connectivity.

Telecommunication Industry in Indonesia Market Size (In Million)

Key trends shaping the Indonesian telecommunication landscape include the ongoing migration from traditional voice to data-centric services, the increasing penetration of smartphones, and the growing reliance on mobile data for communication, entertainment, and commerce. Furthermore, investments in 5G technology, although still in its nascent stages in some areas, are poised to become a significant long-term driver, enabling higher speeds and new service possibilities. However, the industry faces certain restraints, such as intense price competition among major players, the high cost of infrastructure development, and the need to navigate regulatory complexities. Companies like Telkom Indonesia, Indosat Ooredoo, and XL Axiata are at the forefront of this evolving market, constantly innovating to meet consumer demands and capitalize on emerging opportunities within the diverse segments and regions across Indonesia.

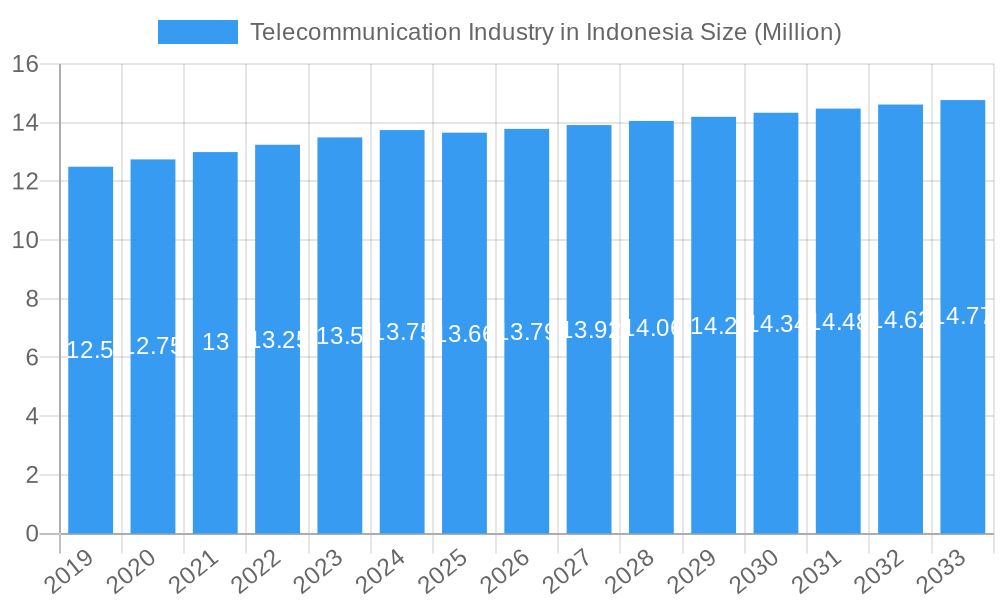

Telecommunication Industry in Indonesia Company Market Share

Telecommunication Industry in Indonesia Market Composition & Trends

The Indonesian telecommunication industry is a dynamic and rapidly evolving sector, characterized by significant market concentration and a constant drive for innovation. Driven by a vast and increasingly connected population, the market composition is shaped by intense competition among major players, influencing market share distribution. While specific market share percentages for individual companies are subject to ongoing shifts, the landscape is dominated by a few key operators. Innovation catalysts include the relentless pursuit of faster data speeds, broader network coverage, and the integration of new technologies like 5G. The regulatory landscape, overseen by bodies like the Ministry of Communication and Information Technology (Kominfo), plays a crucial role in shaping competition, spectrum allocation, and infrastructure development. Substitute products, such as over-the-top (OTT) communication apps, are increasingly impacting traditional voice and messaging services. End-user profiles range from individual consumers seeking affordable data plans and entertainment to enterprises requiring robust connectivity solutions and digital transformation services. Merger and acquisition (M&A) activities, though not always publicly disclosed with specific deal values, are strategically employed by larger entities to consolidate market position and expand service offerings. The overall market is characterized by a blend of aggressive expansion and strategic consolidation, aiming to capture the burgeoning digital economy. XXX

Telecommunication Industry in Indonesia Industry Evolution

The Indonesian telecommunication industry has undergone a remarkable transformation, marked by consistent and robust growth trajectories fueled by a confluence of technological advancements and evolving consumer demands. Historically, the sector's evolution was primarily driven by the expansion of basic voice and SMS services, forming the foundational pillar of connectivity. However, the advent of mobile broadband and the proliferation of smartphones have catalyzed a significant shift. The adoption of 3G and 4G networks has been instrumental, enabling a surge in data consumption. For instance, data traffic has witnessed a compound annual growth rate (CAGR) exceeding 30% over the past decade, underscoring the nation's insatiable appetite for digital content and services. This growth has been further propelled by increasing smartphone penetration rates, which now stand at over 70% of the adult population. The market has witnessed a dramatic increase in internet subscriptions, reaching hundreds of millions. Furthermore, the competitive pricing strategies implemented by operators have made mobile internet services more accessible to a broader segment of the population, including those in rural and remote areas. The industry's evolution is also characterized by a continuous investment in network infrastructure, with operators consistently upgrading to newer technologies to meet the escalating demand for higher speeds and lower latency. This includes the ongoing rollout of 5G in major urban centers, promising to unlock new possibilities for digital services and applications. Shifting consumer demands have moved beyond basic connectivity to encompass seamless streaming, online gaming, e-commerce, and digital payment solutions, forcing operators to diversify their service portfolios and invest in value-added services. The transition from traditional telecommunication services to a more comprehensive digital ecosystem is a defining characteristic of the industry's current evolution, with ongoing investments in fiber optics and cloud infrastructure further solidifying this trend. The market is projected to continue its upward trajectory, with an anticipated CAGR of approximately 8-10% over the next decade.

Leading Regions, Countries, or Segments in Telecommunication Industry in Indonesia

Within the diverse landscape of the Indonesian telecommunication industry, Data and OTT Services have emerged as the undisputed leading segment, driving significant market expansion and innovation. This dominance is not monolithic but rather a complex interplay of several factors that have propelled data consumption and Over-The-Top (OTT) services to the forefront.

- Investment Trends: Major telecommunication companies, including Telkom Indonesia, Indosat Ooredoo, and XL Axiata, have strategically prioritized and heavily invested in expanding their 4G and 5G network infrastructure. These investments are directly aimed at enhancing data transmission capabilities, ensuring wider coverage, and providing the high-speed connectivity essential for data-intensive applications and OTT platforms. Billions of US Dollars are channeled annually into network upgrades and expansion projects.

- Regulatory Support: While regulations govern spectrum allocation and network deployment, the government has largely fostered an environment conducive to digital growth. Policies aimed at promoting digital literacy and internet accessibility indirectly support the expansion of data and OTT services by creating a larger user base. The focus on digital transformation initiatives further bolsters this segment.

- Shifting Consumer Behavior: The Indonesian population, particularly the youth demographic, exhibits a strong preference for digital content consumption, social networking, and instant messaging services offered by OTT players. The ubiquitously of affordable smartphones and data plans has democratized access to these services, making them an integral part of daily life. This has led to a substantial increase in average data consumption per user, with figures often exceeding 10 Gigabytes per month per user in urban areas.

- Ecosystem Development: The growth of e-commerce, ride-hailing services, online education, and digital entertainment platforms directly fuels the demand for robust data connectivity. These interconnected digital ecosystems create a virtuous cycle, where the expansion of one necessitates the advancement of the other. The synergistic relationship between these services and the underlying telecommunication infrastructure solidifies the dominance of the data and OTT segment.

- Competitive Landscape: Intense competition among operators to capture market share in the data segment has led to aggressive pricing strategies and innovative data package offerings. This has further stimulated demand and made data services more affordable and appealing to a wider consumer base, reinforcing its leading position.

The dominance of the Data and OTT Services segment is a testament to Indonesia's rapid digital transformation, where connectivity is no longer just about voice but about enabling a vast array of digital interactions and experiences. This segment's continued growth is expected to outpace traditional voice services significantly in the coming years, with projections indicating it will account for over 70% of the telecommunication revenue by 2030.

Telecommunication Industry in Indonesia Product Innovations

Indonesian telecommunication operators are actively innovating to enhance user experience and service offerings. Recent product innovations focus on delivering faster and more reliable internet speeds through 5G network expansion, enabling seamless streaming, advanced mobile gaming, and immersive augmented reality (AR) and virtual reality (VR) applications. Companies are also introducing personalized data packages tailored to specific user needs, such as unlimited streaming or gaming bundles, often integrated with exclusive content partnerships. The development of integrated digital platforms that combine mobile services with entertainment, financial technology (fintech), and IoT solutions represents a significant leap, aiming to create a comprehensive digital ecosystem for consumers. Performance metrics for these innovations include reduced latency, increased download/upload speeds reaching several Gigabits per second in 5G zones, and improved network stability, all contributing to a superior user experience.

Propelling Factors for Telecommunication Industry in Indonesia Growth

Several key factors are propelling the growth of the Indonesian telecommunication industry. Technologically, the ongoing rollout of 5G networks and the expansion of 4G infrastructure into underserved areas are crucial. Economically, a growing middle class with increasing disposable income drives demand for data services and advanced mobile devices. Furthermore, the government's strong emphasis on digital transformation and the development of a digital economy provides a supportive regulatory environment. This includes initiatives like the "Palapa Ring" project, which aims to expand fiber optic networks across the archipelago, connecting remote areas. The sheer size of Indonesia's young, digitally native population also acts as a significant demographic driver, eager to adopt new technologies and digital services.

Obstacles in the Telecommunication Industry in Indonesia Market

Despite its robust growth, the Indonesian telecommunication industry faces several obstacles. Regulatory complexities and frequent policy shifts can create uncertainty for investors and hinder long-term planning. Geographical challenges, with its vast archipelago, make equitable network expansion and maintenance in remote or challenging terrains extremely costly and logistically difficult. Supply chain disruptions, particularly for essential network equipment, can impact deployment timelines and operational efficiency. Intense competitive pressures, especially in price-sensitive market segments, can squeeze profit margins for operators. Furthermore, the digital divide remains a significant concern, with disparities in internet access and affordability between urban and rural areas hindering inclusive growth.

Future Opportunities in Telecommunication Industry in Indonesia

Emerging opportunities in the Indonesian telecommunication industry are vast. The continued expansion of 5G technology beyond major cities presents a significant opportunity for enhanced mobile broadband and new enterprise solutions. The burgeoning Internet of Things (IoT) market, driven by smart cities, industrial automation, and connected homes, offers substantial growth potential. The increasing demand for digital services in sectors like education, healthcare, and fintech provides a fertile ground for telcos to expand their offerings. Furthermore, leveraging artificial intelligence (AI) and big data analytics can enable personalized services and more efficient network management, unlocking new revenue streams. The development of satellite broadband solutions could also bridge connectivity gaps in the most remote regions.

Major Players in the Telecommunication Industry in Indonesia Ecosystem

- Emtek

- Net1 Indonesia

- Telkom Indonesia

- Optiva Inc

- Smartfren Telecom

- Transvision

- Indosat Ooredoo

- XL Axiata

- Tri Indonesia

- Bakrie Telecom

- First Media

Key Developments in Telecommunication Industry in Indonesia Industry

- August 2022: PT XL Axiata Tbk (XL Axiata) announced its ongoing commitment to building 4G network infrastructure across 94 districts and 1,085 villages in Central Sulawesi. This significant network expansion represents a long-term financial and societal investment aimed at providing high-quality telecommunications and internet access to rural communities, including areas like Banggai.

- July 2022: PT Smartfren Telecom Tbk received a reported investment from Chinese technology giant Alibaba, potentially worth over USD 100 million. This strategic investment signals Alibaba's intent to deepen its market penetration in Indonesia by partnering with a major Indonesian conglomerate and gaining access to its extensive ecosystem, which spans communications, technology, and various other industries.

Strategic Telecommunication Industry in Indonesia Market Forecast

The strategic forecast for the Indonesian telecommunication market points towards continued robust growth, fueled by ongoing technological advancements and evolving digital consumerism. The aggressive deployment of 5G networks will be a primary growth catalyst, enabling a new wave of high-bandwidth applications and services. The expansion of fiber optic infrastructure will further solidify the foundation for faster and more reliable data transmission. The increasing adoption of IoT devices across various sectors, coupled with the government's push for digitalization, presents substantial opportunities for telcos to provide integrated connectivity and platform solutions. Market players are expected to focus on delivering personalized services and developing comprehensive digital ecosystems to cater to the diverse needs of Indonesia's vast and young population, ensuring sustained revenue growth and market expansion throughout the forecast period.

Telecommunication Industry in Indonesia Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay TV Services

-

1.1. Voice Services

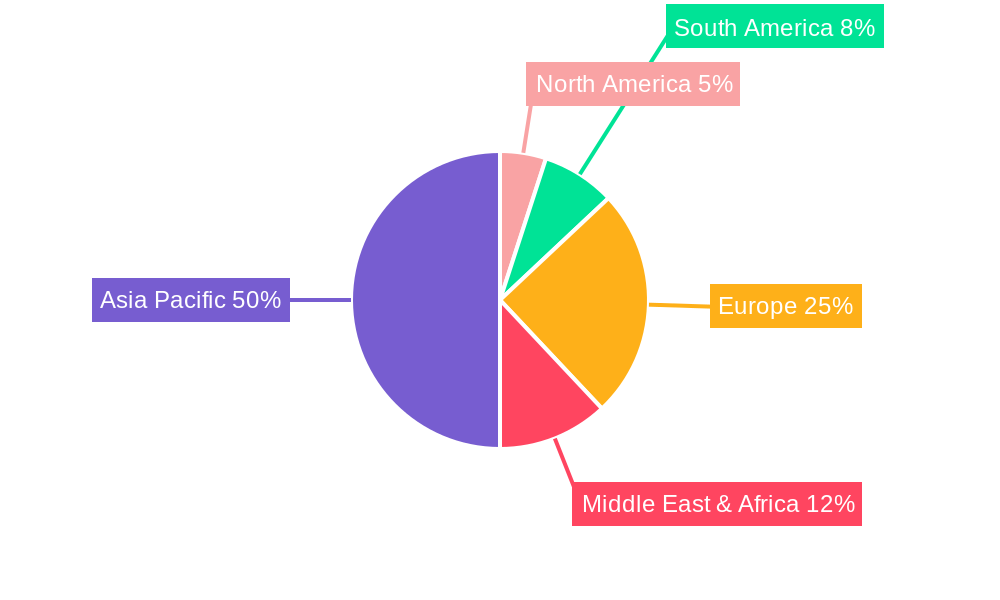

Telecommunication Industry in Indonesia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telecommunication Industry in Indonesia Regional Market Share

Geographic Coverage of Telecommunication Industry in Indonesia

Telecommunication Industry in Indonesia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pace of 5G Roll Out; Digital Transformation Boosting Telecom

- 3.3. Market Restrains

- 3.3.1. ; Lack of Infrastructure and Limited Awareness about E-learning

- 3.4. Market Trends

- 3.4.1. Increased Pace of 5G Roll Out

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. North America Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and

- 6.1.3. OTT and Pay TV Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 7. South America Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and

- 7.1.3. OTT and Pay TV Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 8. Europe Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and

- 8.1.3. OTT and Pay TV Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 9. Middle East & Africa Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and

- 9.1.3. OTT and Pay TV Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 10. Asia Pacific Telecommunication Industry in Indonesia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and

- 10.1.3. OTT and Pay TV Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Emtek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Net1 Indonesia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Telkom Indonesia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Optiva Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smartfren Telecom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Transvision

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Indosat Ooredoo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 XL Axiata

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tri Indonesia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bakrie Telecom

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 First Media

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Emtek

List of Figures

- Figure 1: Global Telecommunication Industry in Indonesia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Telecommunication Industry in Indonesia Revenue (Million), by Segmenta 2025 & 2033

- Figure 3: North America Telecommunication Industry in Indonesia Revenue Share (%), by Segmenta 2025 & 2033

- Figure 4: North America Telecommunication Industry in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Telecommunication Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Telecommunication Industry in Indonesia Revenue (Million), by Segmenta 2025 & 2033

- Figure 7: South America Telecommunication Industry in Indonesia Revenue Share (%), by Segmenta 2025 & 2033

- Figure 8: South America Telecommunication Industry in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Telecommunication Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Telecommunication Industry in Indonesia Revenue (Million), by Segmenta 2025 & 2033

- Figure 11: Europe Telecommunication Industry in Indonesia Revenue Share (%), by Segmenta 2025 & 2033

- Figure 12: Europe Telecommunication Industry in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Telecommunication Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Telecommunication Industry in Indonesia Revenue (Million), by Segmenta 2025 & 2033

- Figure 15: Middle East & Africa Telecommunication Industry in Indonesia Revenue Share (%), by Segmenta 2025 & 2033

- Figure 16: Middle East & Africa Telecommunication Industry in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Telecommunication Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Telecommunication Industry in Indonesia Revenue (Million), by Segmenta 2025 & 2033

- Figure 19: Asia Pacific Telecommunication Industry in Indonesia Revenue Share (%), by Segmenta 2025 & 2033

- Figure 20: Asia Pacific Telecommunication Industry in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Telecommunication Industry in Indonesia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 2: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 4: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 9: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 14: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 25: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 33: Global Telecommunication Industry in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Telecommunication Industry in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecommunication Industry in Indonesia?

The projected CAGR is approximately 1.01%.

2. Which companies are prominent players in the Telecommunication Industry in Indonesia?

Key companies in the market include Emtek, Net1 Indonesia, Telkom Indonesia, Optiva Inc *List Not Exhaustive, Smartfren Telecom, Transvision, Indosat Ooredoo, XL Axiata, Tri Indonesia, Bakrie Telecom, First Media.

3. What are the main segments of the Telecommunication Industry in Indonesia?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pace of 5G Roll Out; Digital Transformation Boosting Telecom.

6. What are the notable trends driving market growth?

Increased Pace of 5G Roll Out.

7. Are there any restraints impacting market growth?

; Lack of Infrastructure and Limited Awareness about E-learning.

8. Can you provide examples of recent developments in the market?

In August 2022, PT XL Axiata Tbk (XL Axiata) announced that it would keep building the network infrastructure for the 4G XL Axiata Network that covers 94 districts and 1,085 villages in Central Sulawesi. The costly network expansion by XL Axiata across Sulawesi is a long-term financial and societal investment. It would help the local community access high-quality XL Axiata telecommunications and internet networks in rural parts of Central Sulawesi, including Banggai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecommunication Industry in Indonesia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecommunication Industry in Indonesia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecommunication Industry in Indonesia?

To stay informed about further developments, trends, and reports in the Telecommunication Industry in Indonesia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence