Key Insights

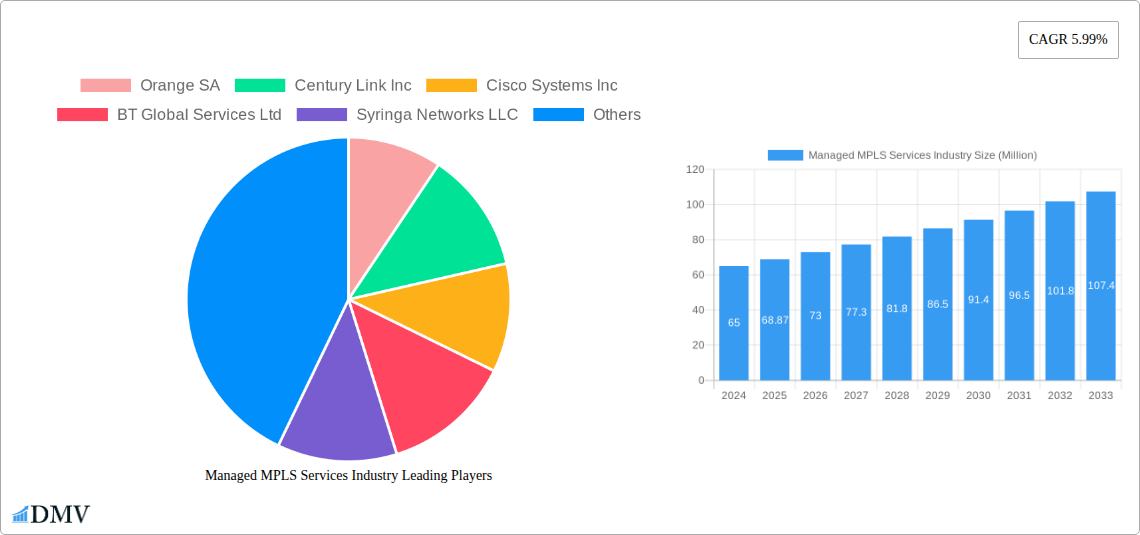

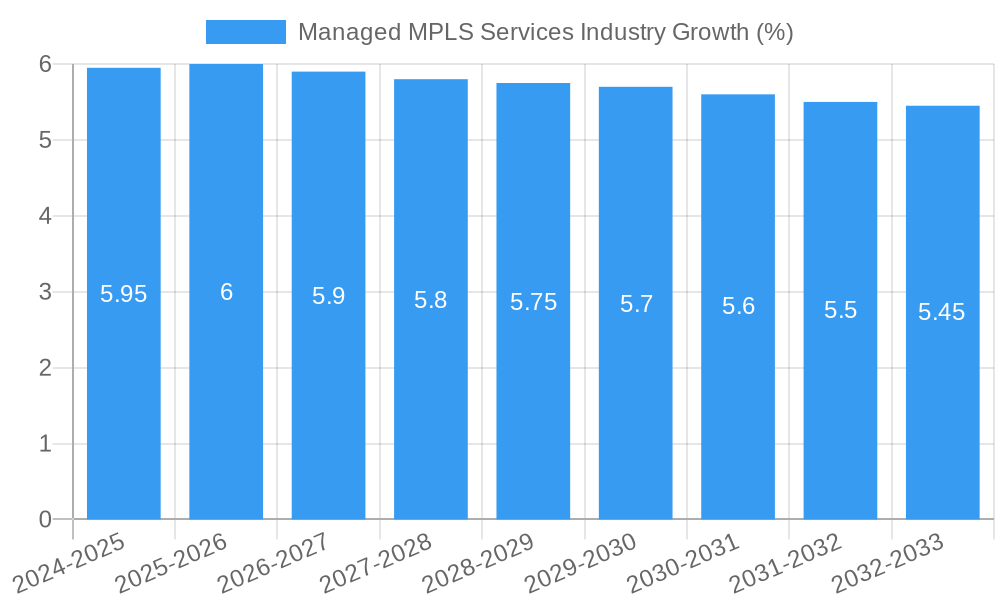

The Managed MPLS Services industry is experiencing robust growth, projected to reach an estimated market size of $68.87 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.99% through 2033. This upward trajectory is primarily driven by the escalating demand for reliable, secure, and high-performance network connectivity across various industries. Businesses are increasingly relying on these services to support their digital transformation initiatives, cloud adoption strategies, and the seamless integration of diverse applications. The inherent benefits of MPLS, such as Quality of Service (QoS) guarantees, traffic prioritization, and enhanced security features, make it an indispensable solution for organizations dealing with critical data and complex network architectures. The market is further propelled by the continuous evolution of technology, leading to the development of more sophisticated and feature-rich managed MPLS offerings that cater to the dynamic needs of enterprises.

The market's expansion is also influenced by significant trends in cloud connectivity and the growing adoption of hybrid and multi-cloud environments. Healthcare, BFSI, Retail, Manufacturing, and Government sectors are leading the charge in leveraging managed MPLS services to ensure uninterrupted operations, secure data transmission, and efficient communication. While the market demonstrates strong growth potential, it faces certain restraints. The increasing adoption of alternative networking technologies like SD-WAN presents a competitive challenge, offering greater flexibility and cost-effectiveness in certain scenarios. However, for mission-critical applications demanding guaranteed performance and security, MPLS continues to hold a strong position. The ongoing research and development efforts in optimizing MPLS infrastructure and integrating it with emerging technologies are expected to further solidify its market standing and address some of these competitive pressures, ensuring sustained relevance and continued market expansion.

Managed MPLS Services Industry Market Composition & Trends

The Managed MPLS Services Industry is characterized by a dynamic market concentration, driven by a few key players, with a significant portion of the market share held by Orange SA, CenturyLink Inc., Cisco Systems Inc., BT Global Services Ltd, Syringa Networks LLC, Sprint Nextel Corporation, AT&T Communications Inc, Netmagic Solutions Pvt Ltd (NTT Communications), Verizon Communications Inc, and Vodafone Group PLC. Innovation catalysts are primarily focused on enhancing network agility, security, and seamless cloud integration. Regulatory landscapes, while generally supportive of network infrastructure, can pose challenges in certain regions regarding data sovereignty. Substitute products, such as SD-WAN, are gaining traction but are often implemented alongside MPLS, creating hybrid solutions rather than direct replacements. End-user profiles span across critical sectors including Healthcare, BFSI, Retail, Manufacturing, Government, and IT and Telecommunication, all of which rely on secure and reliable connectivity. M&A activities, with estimated deal values in the multi-million dollar range, are shaping the competitive landscape as larger entities acquire specialized providers to expand their service portfolios and geographical reach. The market share distribution reflects ongoing consolidation and strategic partnerships aimed at capturing a larger segment of the global managed MPLS market.

Managed MPLS Services Industry Industry Evolution

The Managed MPLS Services Industry has undergone a significant evolution, transitioning from a niche enterprise solution to a foundational component of modern business operations. The historical period from 2019 to 2024 witnessed steady growth, driven by increasing enterprise reliance on private networks for secure and predictable data transmission. MPLS-based VPNs have remained a core offering, providing robust connectivity for branch offices and remote users. The base year of 2025 marks a pivotal point, with the market projected to accelerate significantly in the forecast period of 2025–2033. Technological advancements, such as the integration of Software-Defined Networking (SDN) principles within MPLS architectures, have enhanced network flexibility and management capabilities. The demand for higher bandwidth and lower latency for applications like real-time collaboration, video conferencing, and mission-critical data processing has fueled this expansion. Furthermore, the increasing adoption of cloud computing has necessitated robust and reliable cloud connectivity solutions, a segment where MPLS plays a crucial role in facilitating secure access to public, private, and hybrid cloud environments. The IP transit segment has also seen sustained demand as businesses expand their online presence and require stable internet backbone access. Shifting consumer demands, influenced by the rapid digital transformation across various sectors, have placed a premium on managed services that offer simplified network management, enhanced security, and guaranteed Quality of Service (QoS). The growth rate, projected to be in the xx% range annually during the forecast period, is indicative of the industry's resilience and adaptability. Adoption metrics for managed MPLS services continue to climb as businesses recognize the operational efficiencies and competitive advantages they provide. The industry is moving towards more intelligent, automated, and integrated network solutions, with a strong emphasis on security and performance, reflecting a continuous journey of innovation and market adaptation.

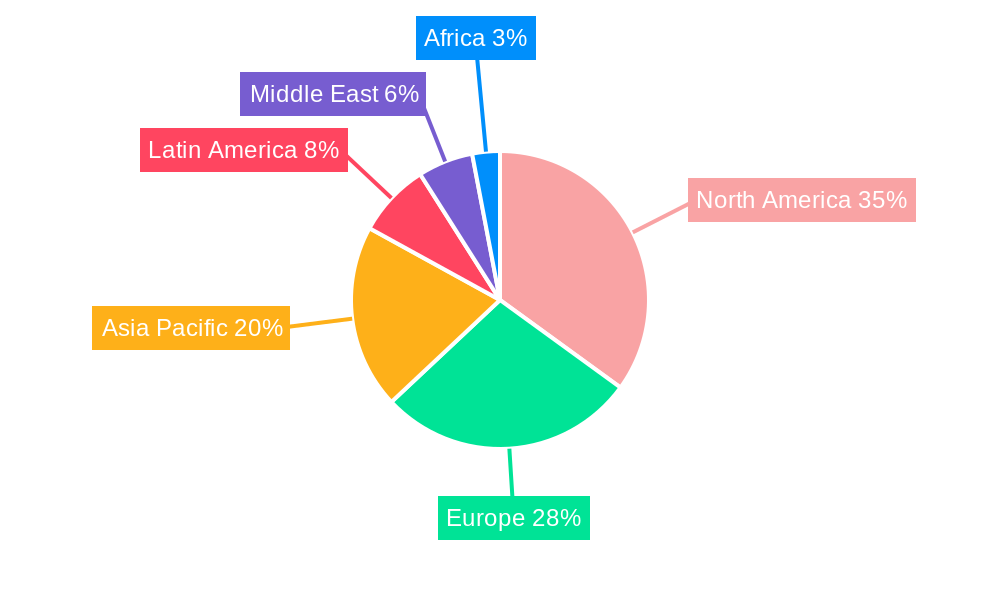

Leading Regions, Countries, or Segments in Managed MPLS Services Industry

The Managed MPLS Services Industry showcases a discernible dominance in key regions and among specific segments, driven by a confluence of factors including robust digital infrastructure, high enterprise adoption rates, and supportive economic conditions. North America, particularly the United States, stands out as a leading region due to its mature market, presence of major service providers like AT&T Communications Inc. and Verizon Communications Inc., and a high concentration of enterprises across critical verticals.

- Dominant Service Segment: MPLS-based VPNs continue to be the bedrock of managed MPLS offerings, forming the largest segment by revenue. This is primarily due to the persistent need for secure, private connectivity for multi-site organizations. The demand for secure and reliable connections for remote workforces and inter-branch communication remains exceptionally high.

- Emerging Service Segment: Cloud connectivity is experiencing rapid growth. As businesses increasingly leverage cloud services, the requirement for seamless and secure integration between on-premises infrastructure and cloud platforms becomes paramount. MPLS serves as a crucial enabler for hybrid cloud strategies, offering guaranteed performance and security for cloud-based applications and data.

- Key End-User Verticals:

- BFSI (Banking, Financial Services, and Insurance): This sector exhibits strong leadership due to its stringent security requirements, the need for high-speed transactions, and extensive branch networks. The inherent reliability and QoS offered by MPLS are critical for their operations.

- Healthcare: The increasing digitalization of patient records, telemedicine initiatives, and the need for secure access to sensitive health data make managed MPLS services indispensable for this vertical.

- IT and Telecommunication: As a foundational technology for many other services, this sector naturally represents a significant portion of MPLS adoption, both for their internal operations and as a service offered to clients.

- Key Drivers in North America:

- Technological Sophistication: A highly advanced technological landscape and a willingness to adopt cutting-edge solutions.

- Enterprise Demand: A large base of enterprises across all major verticals that require robust and secure network solutions.

- Investment Trends: Significant ongoing investments by major telecommunication companies in network infrastructure and managed services.

- Regulatory Support: Favorable regulatory environments that encourage investment in communication infrastructure.

- Dominance Factors: The concentration of Fortune 500 companies, a well-developed digital economy, and a proactive approach to adopting advanced networking solutions contribute to North America's leadership. The prevalence of stringent data privacy regulations in sectors like BFSI and Healthcare further solidifies the need for secure MPLS networks. The availability of a comprehensive ecosystem of service providers and managed solution vendors ensures that enterprises have access to a wide array of tailored MPLS services. The continuous evolution of network technologies, including the integration of SDN and NFV with MPLS, also plays a crucial role in maintaining its relevance and driving adoption across these leading segments and regions. The projected market size for these segments is in the multi-million dollar range, reflecting their substantial contribution to the overall industry.

Managed MPLS Services Industry Product Innovations

Recent product innovations in the Managed MPLS Services Industry focus on enhancing network intelligence, security, and integration capabilities. Service providers are increasingly embedding AI and machine learning for proactive network monitoring, anomaly detection, and automated fault resolution, ensuring higher uptime and performance. The integration of MPLS with SD-WAN technologies allows for more flexible traffic steering, application prioritization, and optimized cloud access. Advanced security features, including integrated firewalls, intrusion detection/prevention systems, and encrypted tunnels, are becoming standard offerings. Performance metrics are being redefined by guaranteed Service Level Agreements (SLAs) that encompass not just bandwidth and latency but also jitter and packet loss, crucial for real-time applications. These innovations are driven by the need to deliver a more agile, secure, and cost-effective networking solution that aligns with the evolving demands of cloud-native enterprises. The unique selling proposition lies in offering a unified, intelligent, and resilient network fabric that underpins digital transformation initiatives.

Propelling Factors for Managed MPLS Services Industry Growth

Several key growth drivers are propelling the Managed MPLS Services Industry. The escalating demand for secure and reliable connectivity for distributed workforces and multi-site enterprises remains a primary catalyst. The increasing adoption of cloud computing, necessitating seamless and high-performance cloud connectivity, further fuels market expansion. Technological advancements, such as the integration of SDN and AI, are enhancing network agility and management capabilities. Furthermore, stringent data security and compliance regulations across various industries like BFSI and Healthcare mandate the use of robust, private network solutions. The growing trend of outsourcing IT infrastructure management to specialized providers also contributes significantly to the growth of managed MPLS services, allowing businesses to focus on their core competencies.

Obstacles in the Managed MPLS Services Industry Market

Despite its robust growth, the Managed MPLS Services Industry faces certain obstacles. The emergence and increasing maturity of Software-Defined Wide Area Network (SD-WAN) solutions present a competitive challenge, offering more flexibility and potentially lower costs for certain use cases. Regulatory hurdles in specific regions, particularly concerning data localization and cross-border data flow, can complicate global deployments. Supply chain disruptions, though less pronounced now, can impact the timely deployment of new network infrastructure. Furthermore, the perceived complexity and higher cost compared to some public internet-based solutions can be a barrier for smaller enterprises or those with less critical connectivity needs. These factors, alongside ongoing price pressures from competitors, collectively moderate the pace of overall market expansion.

Future Opportunities in Managed MPLS Services Industry

The Managed MPLS Services Industry is poised for future opportunities driven by several emerging trends. The continued growth of hybrid and multi-cloud environments presents a significant opportunity for managed MPLS providers to offer integrated connectivity solutions. The expansion of 5G networks will also create opportunities for enhanced mobile backhaul and seamless integration with enterprise networks. The increasing focus on edge computing will necessitate robust and low-latency network solutions, where MPLS can play a vital role. Furthermore, the demand for specialized managed services, such as network analytics, security automation, and IoT connectivity, will open new avenues for revenue generation and market differentiation. The ongoing digital transformation across industries will continue to create a persistent need for secure, reliable, and high-performance network infrastructure.

Major Players in the Managed MPLS Services Industry Ecosystem

- Orange SA

- CenturyLink Inc.

- Cisco Systems Inc.

- BT Global Services Ltd

- Syringa Networks LLC

- Sprint Nextel Corporation

- AT&T Communications Inc

- Netmagic Solutions Pvt Ltd (NTT Communications)

- Verizon Communications Inc

- Vodafone Group PLC

Key Developments in Managed MPLS Services Industry Industry

- November 2022: Wipro and VMware announce a cloud services partnership to offer VMware's cloud computing and remote work platform, which will allow enterprises to provide multi-cloud enterprise tools and focus on sectors such as banking, financial services, and insurance (BFSI), healthcare, and consumer and retail services.

- April 2022: Government-owned RailTel Corporation of India (RailTel) announced the installation of Multi-Protocol Label Switching (MPLS)-Virtual Private Networks (VPNs) in 33 locations of RVNL across the country.

Strategic Managed MPLS Services Industry Market Forecast

The Managed MPLS Services Industry is set for robust growth, driven by the indispensable need for secure, reliable, and high-performance connectivity in the digital age. The strategic forecast points towards an accelerated trajectory, fueled by the increasing adoption of cloud services, the expansion of hybrid work models, and the persistent demand from critical sectors like BFSI, Healthcare, and Government. Innovations in network virtualization, AI-driven management, and seamless integration with emerging technologies like 5G and edge computing will further solidify MPLS's position. Market potential remains substantial as enterprises continue to prioritize robust network infrastructure for their digital transformation initiatives. The shift towards more sophisticated, integrated, and managed networking solutions will continue to propel this market forward, with growth catalysts rooted in enhanced security, predictable performance, and simplified network operations.

Managed MPLS Services Industry Segmentation

-

1. Service (Qualitative Trend Analysis)

- 1.1. MPLS-based VPNs

- 1.2. IP transit

- 1.3. Cloud connectivity

-

2. End-user Vertical

- 2.1. Healthcare

- 2.2. BFSI

- 2.3. Retail

- 2.4. Manufacturing

- 2.5. Government

- 2.6. IT and Telecommunication

- 2.7. Other End-user Verticals

Managed MPLS Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Managed MPLS Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Mobile Backhaul Networks; Increased Penetration of Cloud Services

- 3.3. Market Restrains

- 3.3.1. Higher Costs Associated With MPLS

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 5.1.1. MPLS-based VPNs

- 5.1.2. IP transit

- 5.1.3. Cloud connectivity

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Healthcare

- 5.2.2. BFSI

- 5.2.3. Retail

- 5.2.4. Manufacturing

- 5.2.5. Government

- 5.2.6. IT and Telecommunication

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 6. North America Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 6.1.1. MPLS-based VPNs

- 6.1.2. IP transit

- 6.1.3. Cloud connectivity

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Healthcare

- 6.2.2. BFSI

- 6.2.3. Retail

- 6.2.4. Manufacturing

- 6.2.5. Government

- 6.2.6. IT and Telecommunication

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 7. Europe Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 7.1.1. MPLS-based VPNs

- 7.1.2. IP transit

- 7.1.3. Cloud connectivity

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Healthcare

- 7.2.2. BFSI

- 7.2.3. Retail

- 7.2.4. Manufacturing

- 7.2.5. Government

- 7.2.6. IT and Telecommunication

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 8. Asia Pacific Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 8.1.1. MPLS-based VPNs

- 8.1.2. IP transit

- 8.1.3. Cloud connectivity

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Healthcare

- 8.2.2. BFSI

- 8.2.3. Retail

- 8.2.4. Manufacturing

- 8.2.5. Government

- 8.2.6. IT and Telecommunication

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 9. Latin America Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 9.1.1. MPLS-based VPNs

- 9.1.2. IP transit

- 9.1.3. Cloud connectivity

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Healthcare

- 9.2.2. BFSI

- 9.2.3. Retail

- 9.2.4. Manufacturing

- 9.2.5. Government

- 9.2.6. IT and Telecommunication

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 10. Middle East Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 10.1.1. MPLS-based VPNs

- 10.1.2. IP transit

- 10.1.3. Cloud connectivity

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Healthcare

- 10.2.2. BFSI

- 10.2.3. Retail

- 10.2.4. Manufacturing

- 10.2.5. Government

- 10.2.6. IT and Telecommunication

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Service (Qualitative Trend Analysis)

- 11. North America Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Managed MPLS Services Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Orange SA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Century Link Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Cisco Systems Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 BT Global Services Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Syringa Networks LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sprint Nextel Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 AT&T Communications Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Netmagic Solutions Pvt Ltd (NTT Communications)

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Verizon Communications Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Vodafone Group PLC

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Orange SA

List of Figures

- Figure 1: Global Managed MPLS Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Managed MPLS Services Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Managed MPLS Services Industry Revenue (Million), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 28: North America Managed MPLS Services Industry Volume (K Unit), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 29: North America Managed MPLS Services Industry Revenue Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 30: North America Managed MPLS Services Industry Volume Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 31: North America Managed MPLS Services Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 32: North America Managed MPLS Services Industry Volume (K Unit), by End-user Vertical 2024 & 2032

- Figure 33: North America Managed MPLS Services Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: North America Managed MPLS Services Industry Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 35: North America Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Managed MPLS Services Industry Revenue (Million), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 40: Europe Managed MPLS Services Industry Volume (K Unit), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 41: Europe Managed MPLS Services Industry Revenue Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 42: Europe Managed MPLS Services Industry Volume Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 43: Europe Managed MPLS Services Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 44: Europe Managed MPLS Services Industry Volume (K Unit), by End-user Vertical 2024 & 2032

- Figure 45: Europe Managed MPLS Services Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 46: Europe Managed MPLS Services Industry Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 47: Europe Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Europe Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Europe Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Europe Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Managed MPLS Services Industry Revenue (Million), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 52: Asia Pacific Managed MPLS Services Industry Volume (K Unit), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 53: Asia Pacific Managed MPLS Services Industry Revenue Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 54: Asia Pacific Managed MPLS Services Industry Volume Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 55: Asia Pacific Managed MPLS Services Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 56: Asia Pacific Managed MPLS Services Industry Volume (K Unit), by End-user Vertical 2024 & 2032

- Figure 57: Asia Pacific Managed MPLS Services Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 58: Asia Pacific Managed MPLS Services Industry Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 59: Asia Pacific Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 61: Asia Pacific Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 63: Latin America Managed MPLS Services Industry Revenue (Million), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 64: Latin America Managed MPLS Services Industry Volume (K Unit), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 65: Latin America Managed MPLS Services Industry Revenue Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 66: Latin America Managed MPLS Services Industry Volume Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 67: Latin America Managed MPLS Services Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 68: Latin America Managed MPLS Services Industry Volume (K Unit), by End-user Vertical 2024 & 2032

- Figure 69: Latin America Managed MPLS Services Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 70: Latin America Managed MPLS Services Industry Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 71: Latin America Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: Latin America Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 73: Latin America Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 75: Middle East Managed MPLS Services Industry Revenue (Million), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 76: Middle East Managed MPLS Services Industry Volume (K Unit), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 77: Middle East Managed MPLS Services Industry Revenue Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 78: Middle East Managed MPLS Services Industry Volume Share (%), by Service (Qualitative Trend Analysis) 2024 & 2032

- Figure 79: Middle East Managed MPLS Services Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 80: Middle East Managed MPLS Services Industry Volume (K Unit), by End-user Vertical 2024 & 2032

- Figure 81: Middle East Managed MPLS Services Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 82: Middle East Managed MPLS Services Industry Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 83: Middle East Managed MPLS Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East Managed MPLS Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East Managed MPLS Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East Managed MPLS Services Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Managed MPLS Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Managed MPLS Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 4: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 5: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Global Managed MPLS Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Managed MPLS Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Spain Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Italy Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Spain Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Belgium Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Belgium Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Netherland Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Netherland Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Nordics Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: China Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: China Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Japan Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: India Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: South Korea Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Southeast Asia Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Southeast Asia Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Australia Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Indonesia Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Indonesia Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Phillipes Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Phillipes Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Singapore Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Singapore Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Thailandc Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Thailandc Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Brazil Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Brazil Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Argentina Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Argentina Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Peru Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Peru Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Chile Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Chile Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Colombia Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Colombia Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Ecuador Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Ecuador Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Venezuela Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Venezuela Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Rest of South America Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of South America Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: United States Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: United States Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Canada Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Canada Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Mexico Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Mexico Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 91: United Arab Emirates Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: United Arab Emirates Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Saudi Arabia Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Saudi Arabia Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: South Africa Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: South Africa Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Rest of Middle East and Africa Managed MPLS Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Rest of Middle East and Africa Managed MPLS Services Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 100: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 101: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 102: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 103: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 105: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 106: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 107: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 108: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 109: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 110: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 111: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 112: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 113: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 114: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 115: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 116: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 117: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 118: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 119: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 120: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 121: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 122: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 123: Global Managed MPLS Services Industry Revenue Million Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 124: Global Managed MPLS Services Industry Volume K Unit Forecast, by Service (Qualitative Trend Analysis) 2019 & 2032

- Table 125: Global Managed MPLS Services Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 126: Global Managed MPLS Services Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 127: Global Managed MPLS Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 128: Global Managed MPLS Services Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed MPLS Services Industry?

The projected CAGR is approximately 5.99%.

2. Which companies are prominent players in the Managed MPLS Services Industry?

Key companies in the market include Orange SA, Century Link Inc, Cisco Systems Inc, BT Global Services Ltd, Syringa Networks LLC, Sprint Nextel Corporation, AT&T Communications Inc, Netmagic Solutions Pvt Ltd (NTT Communications), Verizon Communications Inc , Vodafone Group PLC.

3. What are the main segments of the Managed MPLS Services Industry?

The market segments include Service (Qualitative Trend Analysis), End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Mobile Backhaul Networks; Increased Penetration of Cloud Services.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Higher Costs Associated With MPLS.

8. Can you provide examples of recent developments in the market?

November 2022 - Wipro and VMware announce a cloud services partnership to offer VMware's cloud computing and remote work platform, which will allow enterprises to provide multi-cloud enterprise tools and focus on sectors such as banking, financial services, and insurance (BFSI), healthcare, and consumer and retail services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed MPLS Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed MPLS Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed MPLS Services Industry?

To stay informed about further developments, trends, and reports in the Managed MPLS Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence