Key Insights

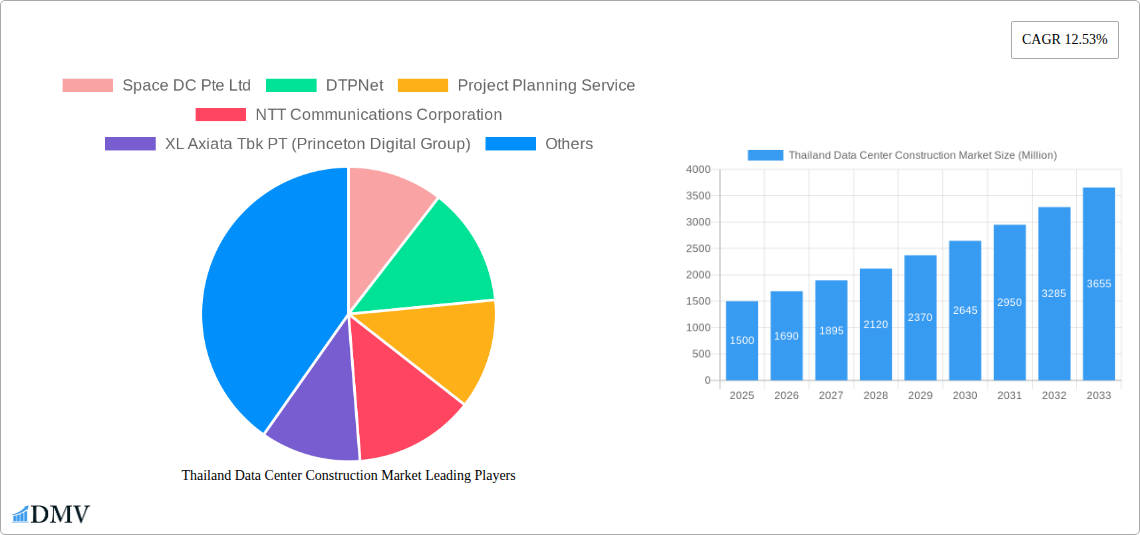

The Thailand Data Center Construction Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.53% anticipated through 2033. This dynamic growth is propelled by an escalating demand for digital infrastructure, driven by rapid digitalization across key sectors like IT and Telecommunications, Banking, Financial Services, and Insurance (BFSI), and Government. The increasing adoption of cloud computing, big data analytics, and the burgeoning Internet of Things (IoT) ecosystem are fundamentally reshaping data storage and processing needs, necessitating the construction of advanced and scalable data center facilities. Furthermore, the Thai government's focus on the Thailand 4.0 initiative, aimed at transforming the nation into an innovation-driven economy, is a significant catalyst, fostering investments in digital infrastructure and encouraging the development of hyperscale and colocation data centers.

Thailand Data Center Construction Market Market Size (In Billion)

The market’s segmentation reveals a pronounced emphasis on Electrical Infrastructure, particularly Power Distribution Solutions, which include sophisticated PDU systems, automatic transfer switches, and advanced switchgear. The growing need for reliable power and operational continuity also underscores the importance of Power Backup Solutions such as UPS and generators. On the mechanical front, Cooling Systems are evolving, with a notable trend towards more efficient solutions like immersion cooling and direct-to-chip cooling, reflecting the industry’s drive for energy efficiency and performance enhancement in densely packed server environments. Emerging trends also include a growing demand for Tier 3 and Tier 4 facilities, indicating a shift towards higher levels of redundancy and uptime crucial for critical business operations. Despite the promising outlook, the market faces restraints such as high initial capital investment, the availability of skilled labor for complex construction and maintenance, and navigating evolving regulatory landscapes and environmental considerations, which developers must strategically address to ensure sustained growth and profitability.

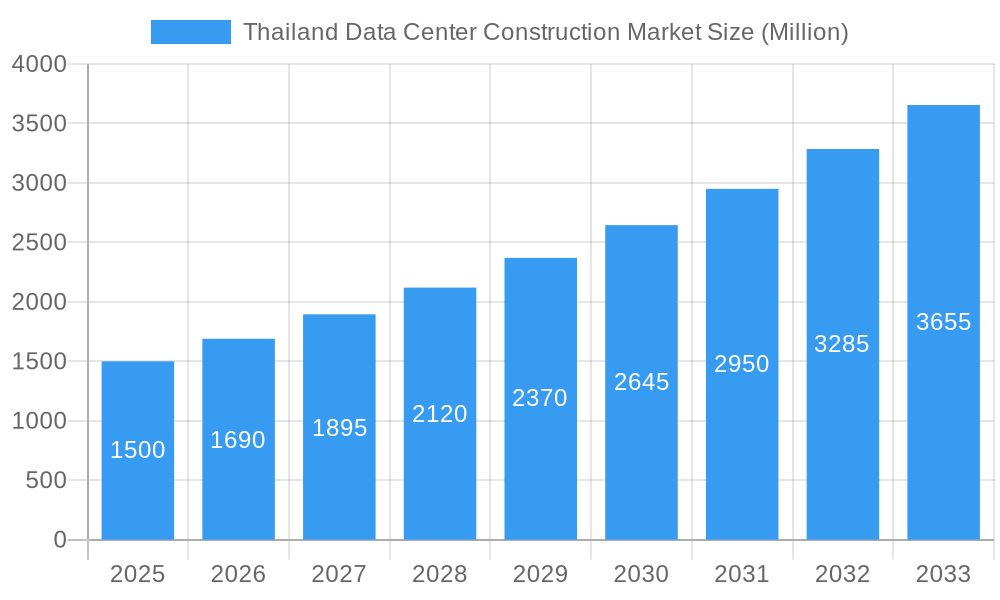

Thailand Data Center Construction Market Company Market Share

This comprehensive report provides an in-depth analysis of the Thailand Data Center Construction Market, offering critical insights for stakeholders seeking to capitalize on the nation's burgeoning digital economy. Covering the historical period of 2019–2024 and extending to a forecast period of 2025–2033, with a base year of 2025, this report meticulously examines market dynamics, growth drivers, and future potential. Dive into the intricate details of electrical infrastructure, including Power Distribution Solutions (PDU - Basic & Smart - Metered & Switched solutions, Transfer Switches - Static, Automatic (ATS), Switchgear - Low-Voltage, Medium-Voltage, Power Panels and Components, Other Power Distribution Solutions) and Power Backup Solutions (UPS, Generators), alongside mechanical infrastructure encompassing advanced Cooling Systems (Immersion Cooling, Direct-To-Chip Cooling, Rear Door Heat Exchanger, In-Row and In-Rack Cooling) and Racks. Explore the competitive landscape, segment-wise performance, and future trajectory of this rapidly evolving market.

Thailand Data Center Construction Market Market Composition & Trends

The Thailand data center construction market is characterized by a dynamic interplay of established players and emerging entrants, fostering an environment ripe for innovation and strategic expansion. Market concentration is influenced by significant investments from both domestic conglomerates and international hyperscalers, particularly in the IT and Telecommunications and Banking, Financial Services, and Insurance (BFSI) sectors. Key innovation catalysts include the increasing demand for high-density computing, edge computing solutions, and the adoption of advanced cooling technologies to enhance energy efficiency. The regulatory landscape, while evolving, is increasingly supportive of digital infrastructure development, attracting foreign direct investment. Substitute products are minimal in the context of dedicated data center construction, with the primary competitive pressure stemming from colocation services and on-premise solutions. End-user profiles are diverse, ranging from large enterprises to government entities, all requiring robust and scalable data storage and processing capabilities. Mergers and acquisitions (M&A) activity, while currently moderate, is anticipated to rise as market consolidation occurs, with deal values projected to reach XXX Million.

- Market Concentration: Moderate, with significant players dominating specific segments.

- Innovation Catalysts: Demand for hyperscale facilities, edge computing, sustainability initiatives, AI/ML integration.

- Regulatory Landscape: Increasingly favorable for digital infrastructure development, with government incentives and streamlined approval processes.

- Substitute Products: Limited for new builds, but competition exists from existing colocation providers.

- End-User Profiles: BFSI, IT & Telecom, Government & Defense, Healthcare, E-commerce, Manufacturing.

- M&A Activities: Expected to increase with market maturity and consolidation.

Thailand Data Center Construction Market Industry Evolution

The Thailand data center construction market has witnessed a remarkable evolution, driven by a confluence of technological advancements, shifting consumer demands, and strategic government initiatives aimed at positioning the nation as a regional digital hub. From 2019 to 2024, the market experienced steady growth, fueled by the rapid adoption of cloud computing, the proliferation of mobile devices, and the burgeoning e-commerce sector. This period saw initial investments in foundational infrastructure, primarily focusing on Tier 3 facilities to meet the needs of enterprise clients.

The base year of 2025 marks a significant inflection point, with accelerated investments anticipated in the forecast period of 2025–2033. This growth trajectory is propelled by the increasing demand for hyperscale data centers to support global cloud providers and the burgeoning artificial intelligence (AI) and machine learning (ML) workloads. Technological advancements are at the forefront of this evolution. We are seeing a significant push towards more energy-efficient mechanical infrastructure, with a growing interest in Immersion Cooling and Direct-To-Chip Cooling solutions to manage the heat generated by high-performance computing. Furthermore, the emphasis on electrical infrastructure is shifting towards robust Power Backup Solutions, including advanced UPS systems and high-capacity Generators, ensuring uninterrupted operations.

Consumer demands have also evolved, with a heightened focus on data sovereignty, security, and low latency. This necessitates the construction of more geographically distributed data centers, including edge facilities, to bring processing power closer to end-users. The Thai government's National Digital Economy and Society Policy aims to foster this growth, creating a conducive environment for both domestic and international investors. By 2025, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 12% to 15%, driven by these converging factors. The adoption of sustainable construction practices and the integration of renewable energy sources are also becoming critical considerations, reflecting a global trend towards environmentally responsible data center development. The market's evolution is a clear testament to Thailand's commitment to embracing the digital future.

Leading Regions, Countries, or Segments in Thailand Data Center Construction Market

The dominance within the Thailand Data Center Construction Market is strategically distributed across key segments, driven by varying levels of demand, investment, and infrastructure maturity. Within the Infrastructure: Market Segmentation - By Electrical Infrastructure, the Power Distribution Solution segment, encompassing PDU - Basic & Smart - Metered & Switched solutions, Transfer Switches (Static, Automatic (ATS)), Switchgear (Low-Voltage, Medium-Voltage), and Power Panels and Components, consistently commands a substantial share. This is a direct consequence of the foundational requirement for reliable and efficient power delivery in any data center. Similarly, Power Backup Solutions, including UPS and Generators, are critical components, ensuring business continuity and resilience, thus experiencing significant demand.

In the realm of Mechanical Infrastructure, Cooling Systems emerge as a pivotal segment, with a growing emphasis on advanced solutions like In-Row and In-Rack Cooling to manage increasing heat densities. While Immersion Cooling and Direct-To-Chip Cooling are still nascent, their adoption is expected to rise significantly in the coming years, driven by the need for enhanced energy efficiency and higher performance. General Construction forms the bedrock of all data center projects, with its market share directly correlating to the overall expansion of data center capacity.

The Tier Type segmentation reveals a strong preference for Tier 3 facilities, reflecting the balance between reliability and cost-effectiveness for a broad spectrum of enterprise clients. However, the demand for higher Tier 4 certifications is escalating, particularly from financial institutions and government entities requiring maximum uptime.

Geographically, the Bangkok Metropolitan Region remains the undisputed leader due to its concentration of businesses, skilled workforce, and established connectivity infrastructure. This region attracts the lion's share of investments in IT and Telecommunications and Banking, Financial Services, and Insurance end-users, which are the primary drivers of data center construction. The Government and Defense sector also contributes significantly to demand, particularly for secure and resilient facilities.

- Key Segment Dominance Drivers:

- Electrical Infrastructure (Power Distribution & Backup): Essential for operational continuity and efficiency, driving consistent demand.

- Mechanical Infrastructure (Cooling Systems): Increasing demand for advanced cooling solutions due to high-density computing.

- Tier 3 Data Centers: Offers a robust balance of reliability and cost for a wide range of enterprise needs.

- Bangkok Metropolitan Region: Concentrated demand from key end-users and robust connectivity.

- IT & Telecommunications and BFSI End Users: Primary drivers of hyperscale and enterprise-grade data center construction.

Thailand Data Center Construction Market Product Innovations

Innovations in the Thailand data center construction market are primarily centered on enhancing efficiency, sustainability, and performance. Advanced cooling systems, such as liquid cooling solutions including Immersion Cooling and Direct-To-Chip Cooling, are gaining traction, offering superior heat dissipation for high-density computing environments, thereby reducing energy consumption and operational costs. In electrical infrastructure, the integration of smart PDUs (Power Distribution Units) with real-time monitoring and remote management capabilities is becoming a standard feature, enabling better power utilization and proactive maintenance. The development of modular data center designs allows for faster deployment and scalability, catering to the dynamic needs of businesses. Performance metrics are being redefined by lower Power Usage Effectiveness (PUE) ratios, increased rack density support, and reduced latency achieved through localized edge data center construction.

Propelling Factors for Thailand Data Center Construction Market Growth

Several key factors are propelling the growth of the Thailand data center construction market. The rapid digital transformation across industries, fueled by the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT), is creating an insatiable demand for reliable data storage and processing. Government initiatives, such as the Thailand 4.0 digital economy plan, are actively promoting investment in digital infrastructure through supportive policies and incentives. Furthermore, the strategic geographical location of Thailand within Southeast Asia makes it an attractive hub for regional connectivity and data exchange, drawing international hyperscalers and cloud service providers. The growing e-commerce sector and the demand for robust IT infrastructure from the BFSI and telecommunications sectors are also significant growth catalysts.

Obstacles in the Thailand Data Center Construction Market Market

Despite robust growth, the Thailand data center construction market faces several obstacles. The availability of skilled labor for specialized construction and maintenance roles remains a challenge, potentially impacting project timelines and quality. Supply chain disruptions, particularly for specialized equipment and materials, can lead to delays and increased costs. Regulatory hurdles, including complex permitting processes and evolving environmental regulations, can also pose challenges for developers. Furthermore, the high upfront capital investment required for data center construction and the ongoing operational costs associated with power and cooling present financial barriers, especially for smaller players. Intense competition from established colocation providers and the potential for oversupply in certain sub-markets can also exert downward pressure on pricing.

Future Opportunities in Thailand Data Center Construction Market

The Thailand data center construction market presents numerous future opportunities. The burgeoning demand for AI and machine learning capabilities necessitates the construction of high-performance computing facilities, opening avenues for advanced hardware and cooling solutions. The growth of the edge computing market presents opportunities for smaller, distributed data centers closer to end-users, particularly in burgeoning industrial zones and smart city initiatives. Increased adoption of sustainable practices and renewable energy sources offers opportunities for green data center development and related technologies. Furthermore, the ongoing digital transformation of government services and the defense sector will continue to drive demand for secure and resilient data infrastructure. Emerging sectors like the metaverse and advanced gaming also signal future growth potential.

Major Players in the Thailand Data Center Construction Market Ecosystem

- Space DC Pte Ltd

- DTPNet

- Project Planning Service

- NTT Communications Corporation

- XL Axiata Tbk PT (Princeton Digital Group)

- Equinix Inc

- Telkomsigma

- GTN Data Center

- TAKNET Systems (Thailand ) Co Ltd

- Arup Group

- Lintasarta

- PT DCI Indonesia (DCI)

- Biznet Networks

- JupiterDC

- PT Faasri Utama Sakti

- Gulf Energy Development Public Company Limited

- Delta Electronics (Thailand)

- Indosat Tbk PT

Key Developments in Thailand Data Center Construction Market Industry

- February 2023: Singapore Telecom Limited (Singtel), Gulf Energy Development PLC (Gulf), and Advanced Info Services PLC (AIS) established a joint venture to build a 20 MW capacity data center in Thailand by 2025. This facility will be operated by GSA Data Center Company Limited (GSA). The company aims to match the large-scale data center requirements of cloud players in the country. This development signifies a major investment push towards hyperscale facilities and underscores Thailand's growing appeal as a regional data center hub.

Strategic Thailand Data Center Construction Market Market Forecast

The Thailand data center construction market is poised for significant growth, driven by strong demand from cloud service providers, enterprises, and the government's digital transformation agenda. The forecast period of 2025–2033 will witness accelerated investments in hyperscale and edge data centers, fueled by the proliferation of AI, IoT, and 5G technologies. Innovations in cooling systems and power efficiency will be critical differentiators. The market's strategic importance as a regional hub will continue to attract global players, fostering competition and driving technological advancements. Overall, the outlook for Thailand's data center construction sector remains exceptionally positive, presenting substantial opportunities for stakeholders involved in its development and operation.

Thailand Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 2 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 2 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Thailand Data Center Construction Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Construction Market Regional Market Share

Geographic Coverage of Thailand Data Center Construction Market

Thailand Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 Migration to Cloud by large businesses9.2 Established 'Mobile-First' Landscape Since the Recent Past

- 3.3. Market Restrains

- 3.3.1. 10.1 Shortage of Skilled Professionals Presenting a Challenge for Several Contractors

- 3.4. Market Trends

- 3.4.1. Tier 3 is the Largest Tier Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 2 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 2 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space DC Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DTPNet

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Project Planning Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NTT Communications Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XL Axiata Tbk PT (Princeton Digital Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Equinix Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telkomsigma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GTN Data Center

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TAKNET Systems (Thailand ) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arup Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lintasarta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT DCI Indonesia (DCI)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Biznet Networks

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JupiterDC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PT Faasri Utama Sakti

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Gulf Energy Development Public Company Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Delta Electronics (Thailand)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Indosat Tbk PT

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Space DC Pte Ltd

List of Figures

- Figure 1: Thailand Data Center Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 2: Thailand Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 3: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 4: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 5: Thailand Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Thailand Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 7: Thailand Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 8: Thailand Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 9: Thailand Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 10: Thailand Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 11: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 12: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 2 and 2 2020 & 2033

- Table 13: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 14: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 15: Thailand Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Thailand Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 17: Thailand Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 18: Thailand Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 19: Thailand Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 20: Thailand Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 21: Thailand Data Center Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 22: Thailand Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 23: Thailand Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 24: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 25: Thailand Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 26: Thailand Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 27: Thailand Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 28: Thailand Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 29: Thailand Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 30: Thailand Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 31: Thailand Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 32: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 33: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 2 and 2 2020 & 2033

- Table 34: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 35: Thailand Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 36: Thailand Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 37: Thailand Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 38: Thailand Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 39: Thailand Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 40: Thailand Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 41: Thailand Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 42: Thailand Data Center Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Construction Market?

The projected CAGR is approximately 27.78%.

2. Which companies are prominent players in the Thailand Data Center Construction Market?

Key companies in the market include Space DC Pte Ltd, DTPNet, Project Planning Service, NTT Communications Corporation, XL Axiata Tbk PT (Princeton Digital Group), Equinix Inc, Telkomsigma, GTN Data Center, TAKNET Systems (Thailand ) Co Ltd, Arup Group, Lintasarta, PT DCI Indonesia (DCI), Biznet Networks, JupiterDC, PT Faasri Utama Sakti, Gulf Energy Development Public Company Limited, Delta Electronics (Thailand), Indosat Tbk PT.

3. What are the main segments of the Thailand Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 2 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

9.1 Migration to Cloud by large businesses9.2 Established 'Mobile-First' Landscape Since the Recent Past.

6. What are the notable trends driving market growth?

Tier 3 is the Largest Tier Type.

7. Are there any restraints impacting market growth?

10.1 Shortage of Skilled Professionals Presenting a Challenge for Several Contractors.

8. Can you provide examples of recent developments in the market?

February 2023:Singapore Telecom Limited (Singtel), Gulf Energy Development PLC (Gulf), and Advanced Info Services PLC (AIS), established a joint venture to build a 20 MW capacity data center in Thailand by 2025. This facility will be operated by GSA Data Center Company Limited (GSA). The company aims to match the large-scale data center requirements of cloud players in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence