Key Insights

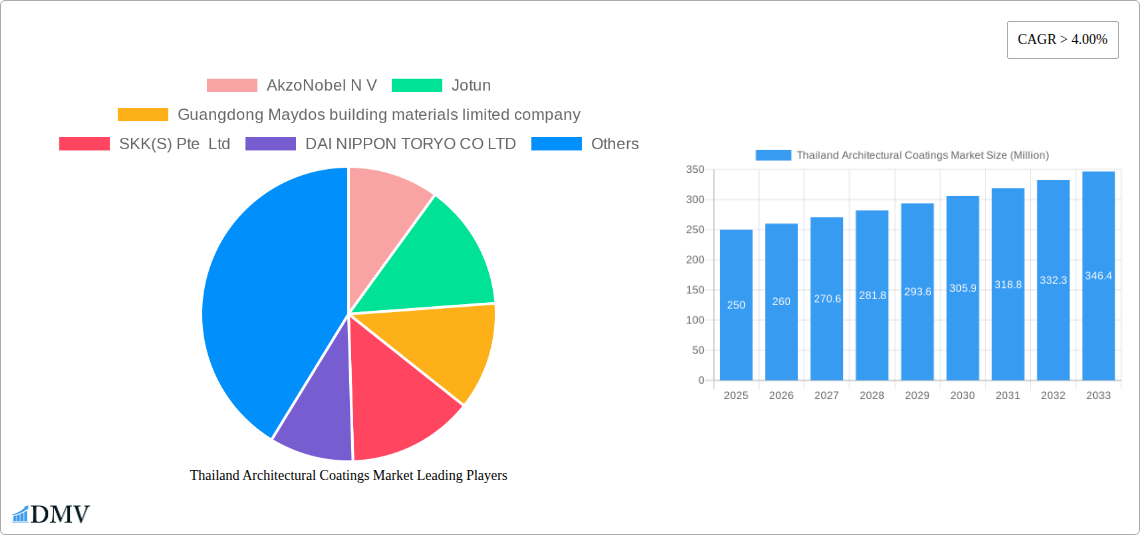

The Thailand architectural coatings market is projected to reach $1.1 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This growth is propelled by Thailand's expanding construction sector, driven by urbanization and infrastructure development, creating substantial demand for high-performance coatings. Growing consumer emphasis on aesthetics and protective coating benefits is also boosting the adoption of premium products. Advancements in eco-friendly waterborne coatings with reduced VOC emissions further stimulate market expansion. The market is segmented by resin type (acrylic, alkyd, epoxy, polyester, polyurethane), end-user (commercial, residential), and technology (solventborne, waterborne). The residential segment is anticipated to lead, supported by increasing disposable incomes and demand for visually appealing homes. Leading companies such as AkzoNobel, Jotun, and Nippon Paint are capitalizing on brand recognition and technological expertise to secure market share and foster innovation.

Thailand Architectural Coatings Market Market Size (In Billion)

Potential restraints include volatility in raw material costs, impacting profitability. Intense competition and new market entrants necessitate ongoing product innovation and efficient supply chain operations. Environmental regulations and VOC emission standards are compelling manufacturers to adopt sustainable formulations. Despite these hurdles, the Thailand architectural coatings market demonstrates a positive long-term outlook, supported by consistent economic expansion and national infrastructure initiatives. The market's diverse resin types and end-user segments present significant opportunities for both established and emerging businesses.

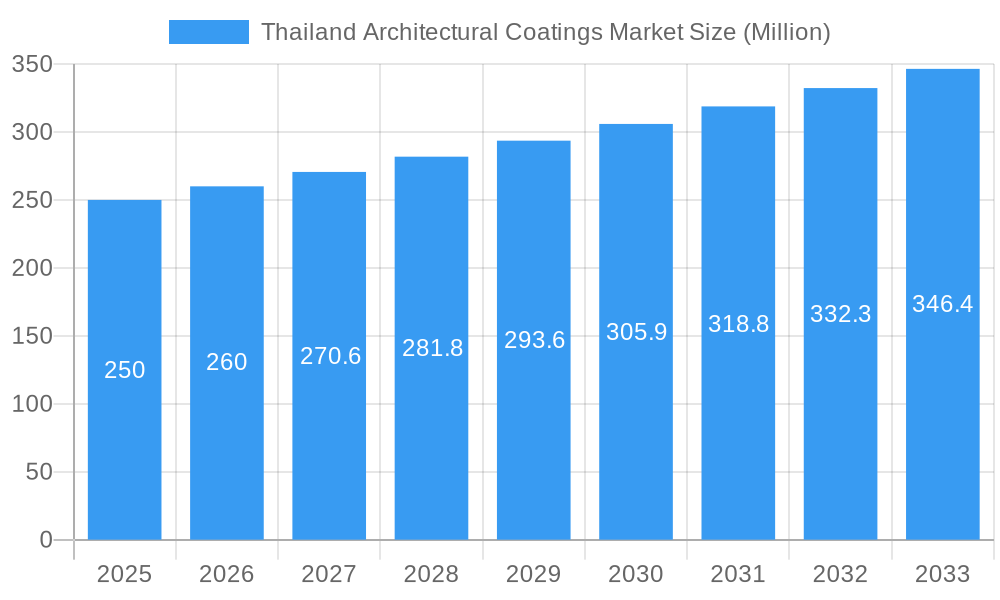

Thailand Architectural Coatings Market Company Market Share

Thailand Architectural Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Thailand architectural coatings market, offering a detailed overview of market dynamics, competitive landscape, and future growth prospects. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Valuable insights are provided for stakeholders including manufacturers, distributors, investors, and government agencies seeking to understand this dynamic market. The market size is projected to reach xx Million by 2033.

Thailand Architectural Coatings Market Composition & Trends

This section delves into the intricate composition of the Thailand architectural coatings market, analyzing key trends shaping its evolution. We examine market concentration, revealing the market share distribution among key players like AkzoNobel N V, Jotun, and Nippon Paint Holdings Co Ltd. The report explores the role of innovation, specifically advancements in resin types (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others) and technology (Solventborne and Waterborne), as catalysts for growth. Furthermore, we dissect the regulatory landscape, analyzing its impact on market participants. The influence of substitute products and evolving end-user profiles (Commercial and Residential) are also examined. Finally, the report analyzes M&A activities, including deal values and their implications for market consolidation. Specific metrics such as market share percentages and M&A deal values (in Millions) are provided for a data-driven understanding. The influence of factors like government regulations and economic growth in impacting the market will be analyzed.

- Market Concentration: Analysis of market share held by top players.

- Innovation Catalysts: Examination of new resin types and technological advancements.

- Regulatory Landscape: Assessment of existing and upcoming regulations.

- Substitute Products: Impact of alternative coating solutions.

- End-User Profiles: Analysis of residential vs. commercial demand.

- M&A Activities: Detailed overview of mergers and acquisitions, including deal values (in Millions).

Thailand Architectural Coatings Market Industry Evolution

This section provides a comprehensive analysis of the Thailand architectural coatings market's evolution from 2019 to 2033. We trace the market's growth trajectory, quantifying growth rates (CAGR) during the historical (2019-2024) and forecast (2025-2033) periods. Technological advancements, such as the increasing adoption of waterborne coatings over solventborne alternatives, and their impact on market share are discussed in detail. The report also examines shifting consumer demands, analyzing preferences for eco-friendly and high-performance coatings. Detailed data points on adoption rates for various technologies and specific consumer preferences are presented. The influence of changing lifestyles and architectural trends will be examined.

Leading Regions, Countries, or Segments in Thailand Architectural Coatings Market

This section identifies the dominant regions, countries, and segments within the Thailand architectural coatings market. We pinpoint the leading resin type (e.g., Acrylic, Alkyd, etc.), the most significant end-user sector (Commercial or Residential), and the prevailing coating technology (Solventborne or Waterborne). A detailed analysis of the factors contributing to this dominance is provided.

Key Drivers (Bullet Points):

- Investment trends in specific segments.

- Regulatory support for particular technologies.

- Consumer preferences and building construction trends.

- Economic factors influencing construction activities.

Dominance Factors (Paragraphs): In-depth analysis of the underlying reasons for the dominance of the leading segments, backed by quantitative data.

Thailand Architectural Coatings Market Product Innovations

This section showcases recent product innovations in the Thailand architectural coatings market. We highlight key product launches, such as Nippon Paint Holdings Co., Ltd.'s Weatherbond paint (April 2021) and Air Care Paint (August 2020), emphasizing their unique selling propositions (USPs) and the technological advancements incorporated in their development. Performance metrics, including durability, sustainability, and aesthetic appeal, are also evaluated.

Propelling Factors for Thailand Architectural Coatings Market Growth

This section identifies the key drivers fueling the growth of the Thailand architectural coatings market. We explore technological advancements, including the development of eco-friendly and high-performance coatings; economic factors such as construction activity and infrastructure development; and supportive government regulations promoting sustainable building practices. Specific examples of each factor are provided to illustrate their influence.

Obstacles in the Thailand Architectural Coatings Market

This section examines the challenges hindering growth in the Thailand architectural coatings market. These include regulatory hurdles, supply chain disruptions (quantified by impact on market growth), and intense competition among established and emerging players. The section analyzes the quantifiable impact of these obstacles.

Future Opportunities in Thailand Architectural Coatings Market

This section highlights promising future opportunities in the Thailand architectural coatings market. We focus on emerging markets (e.g., specific geographic regions or niche applications), technological innovations (e.g., smart coatings or advanced functionalities), and evolving consumer trends (e.g., demand for sustainable or customized solutions).

Major Players in the Thailand Architectural Coatings Market Ecosystem

- AkzoNobel N V

- Jotun

- Guangdong Maydos building materials limited company

- SKK(S) Pte Ltd

- DAI NIPPON TORYO CO LTD

- TAI-YO

- Hato Paint (J K R ) Co Ltd

- Nippon Paint Holdings Co Ltd

- Thai Toa Industries Co LTD

- Berger Paints India

- TOA Paint Public Company Limited

- Kansai Paint Co Ltd

Key Developments in Thailand Architectural Coatings Market Industry

- August 2020: Nippon Paint Holdings Co., Ltd. launched Air Care Paint, inhibiting viruses and bacteria. This launch significantly impacted the market by introducing a health-conscious product.

- April 2021: Nippon Paint Holdings Co., Ltd. released Weatherbond paint utilizing Cross-Link Technology. This innovation enhanced the durability and weather resistance of coatings, influencing product selection.

Strategic Thailand Architectural Coatings Market Forecast

This section summarizes the key growth catalysts for the Thailand architectural coatings market, projecting a positive outlook driven by sustained infrastructure development, increasing construction activities, and rising consumer preference for high-performance and sustainable coatings. The forecast anticipates robust growth, driven by government initiatives and technological advancements, positioning the market for significant expansion throughout the forecast period.

Thailand Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Thailand Architectural Coatings Market Segmentation By Geography

- 1. Thailand

Thailand Architectural Coatings Market Regional Market Share

Geographic Coverage of Thailand Architectural Coatings Market

Thailand Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jotun

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Guangdong Maydos building materials limited company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SKK(S) Pte Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAI NIPPON TORYO CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TAI-YO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hato Paint (J K R ) Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nippon Paint Holdings Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thai Toa Industries Co LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berger Paints India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TOA Paint Public Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Paint Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: Thailand Architectural Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 2: Thailand Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 3: Thailand Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Thailand Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: Thailand Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: Thailand Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 7: Thailand Architectural Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand Architectural Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: Thailand Architectural Coatings Market Revenue billion Forecast, by Sub End User 2020 & 2033

- Table 10: Thailand Architectural Coatings Market Volume liter Forecast, by Sub End User 2020 & 2033

- Table 11: Thailand Architectural Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Thailand Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: Thailand Architectural Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 14: Thailand Architectural Coatings Market Volume liter Forecast, by Resin 2020 & 2033

- Table 15: Thailand Architectural Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Thailand Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Architectural Coatings Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Thailand Architectural Coatings Market?

Key companies in the market include AkzoNobel N V, Jotun, Guangdong Maydos building materials limited company, SKK(S) Pte Ltd, DAI NIPPON TORYO CO LTD, TAI-YO, Hato Paint (J K R ) Co Ltd, Nippon Paint Holdings Co Ltd, Thai Toa Industries Co LTD, Berger Paints India, TOA Paint Public Company Limited, Kansai Paint Co Ltd.

3. What are the main segments of the Thailand Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

April 2021: The company released a new Weatherbond paint using Nippon Paint Holdings Co., Ltd. Cross-Link Technology.August 2020: The company released a new paint Nippon Paint Holdings Co., Ltd. Air Care Paint which inhibit viruses and bacteria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Thailand Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence