Key Insights

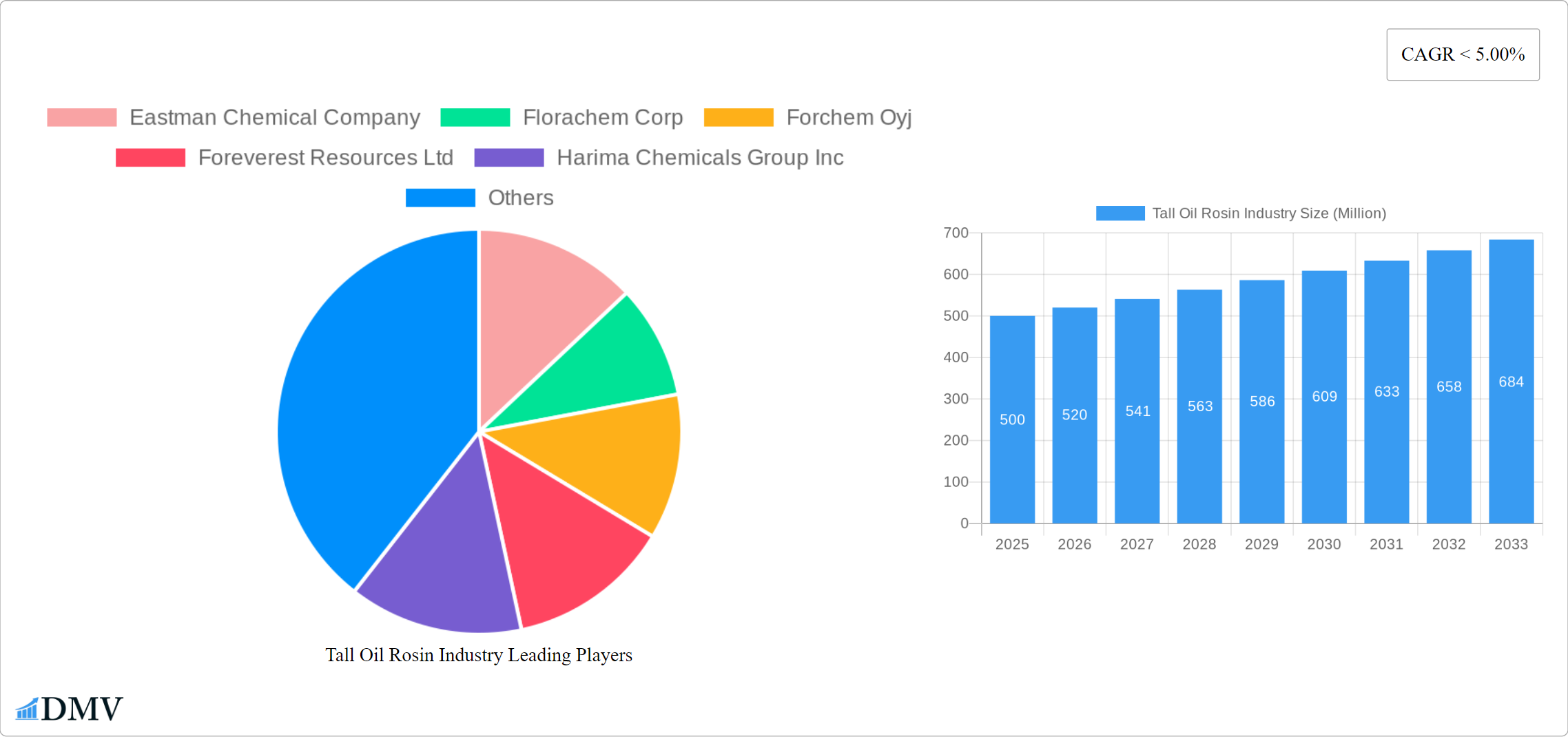

The Tall Oil Rosin (TOR) market is poised for significant expansion, driven by escalating demand across diverse end-use applications. Factors such as the thriving paper and packaging sector, increasing utilization in adhesives and coatings, and TOR's position as a sustainable resin alternative have propelled its growth. The market is projected to reach a size of $709.2 million by the base year 2025, demonstrating a compound annual growth rate (CAGR) of 4.1% throughout the forecast period ending 2033. This growth trajectory is further bolstered by the expanding construction industry and the heightened adoption of bio-based materials.

Tall Oil Rosin Industry Market Size (In Million)

Innovation in TOR-derived products and growing environmental consciousness favoring sustainable solutions are key growth drivers. The inherent versatility, cost-effectiveness, and favorable properties of TOR ensure sustained demand from critical industries. Emerging challenges, including raw material price volatility and competitive technologies, necessitate strategic market monitoring to ensure continued positive development.

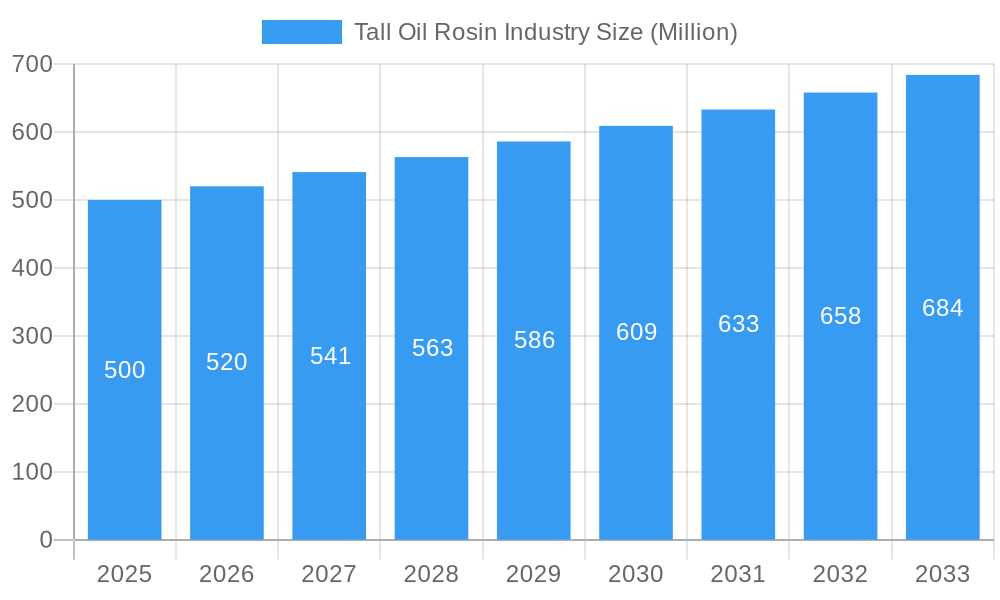

Tall Oil Rosin Industry Company Market Share

Tall Oil Rosin Industry Market Composition & Trends

The global Tall Oil Rosin Industry is a dynamic and evolving market, projected to reach a valuation of [Insert Latest Market Value Here, e.g., 1,500 Million USD] by [Insert Latest Year Here, e.g., 2028]. The market exhibits a concentrated structure, with a few dominant players shaping its landscape. Key industry leaders such as Eastman Chemical Company, Ingevity Corporation, and Kraton Corporation collectively hold a substantial market share, estimated at around 40%. The industry's trajectory is heavily influenced by the relentless pursuit of sustainable, high-performance materials. Continuous advancements in extraction and refining technologies are pivotal, enabling the development of novel rosin-based products with significantly enhanced properties and expanded application spectrums.

- Regulatory Landscape: The industry operates within a framework of rigorous environmental and product safety regulations. Adherence to international standards like REACH and national guidelines from agencies such as the EPA is crucial and significantly impacts market strategies and product development.

- Substitute Products: While alternatives such as gum rosin and various synthetic resins present competitive pressures, tall oil rosin continues to solidify its market position due to its inherent eco-friendly characteristics and competitive cost-effectiveness.

- End-User Profiles: The primary consumers of tall oil rosin are found in the adhesives, coatings, and rubber industries. The adhesives sector remains the largest segment, accounting for approximately 35% of the total market consumption, highlighting its critical role.

- M&A Activities: The past half-decade has witnessed substantial consolidation within the industry, with mergers and acquisitions exceeding [Insert Latest M&A Value Here, e.g., 600 Million USD]. These strategic moves have been instrumental in bolstering production capacities and expanding market penetration for the involved entities.

The intricate interplay of these elements fosters a robust yet challenging environment, demanding continuous adaptation and strategic foresight from all stakeholders within the Tall Oil Rosin Industry.

Tall Oil Rosin Industry Industry Evolution

The evolution of the Tall Oil Rosin Industry, spanning from 2019 to 2033, demonstrates a clear pattern of sustained growth, propelled by significant technological breakthroughs and evolving consumer preferences. In 2025, the market size was estimated at [Insert Latest Market Value Here, e.g., 1,500 Million USD], with a projected Compound Annual Growth Rate (CAGR) of approximately 4.5% anticipated throughout the forecast period of 2025–2033. A key driver has been the advancement in refining processes, yielding high-purity tall oil rosin that impeccably meets the exacting specifications of diverse end-user sectors.

There has been a marked surge in consumer demand for sustainable and bio-based materials, particularly within the adhesives and coatings segments. This trend has invigorated research and development efforts, with leading companies like Ingevity Corporation and Kraton Corporation actively investing in exploring novel applications for tall oil rosin. The integration of tall oil rosin into adhesive formulations has seen an impressive year-on-year increase of approximately 10% since 2019, underscoring its escalating importance in the market.

Furthermore, the industry is increasingly prioritizing sustainable operational practices, with a strong emphasis on minimizing carbon footprints and optimizing resource efficiency. The successful incorporation of tall oil rosin into eco-friendly product lines has unlocked new avenues for market expansion, with projections indicating the market could reach [Insert Latest Projected Market Value Here, e.g., 2,100 Million USD] by 2033. This transformative evolution is a testament to the industry's inherent adaptability and its considerable potential for future growth.

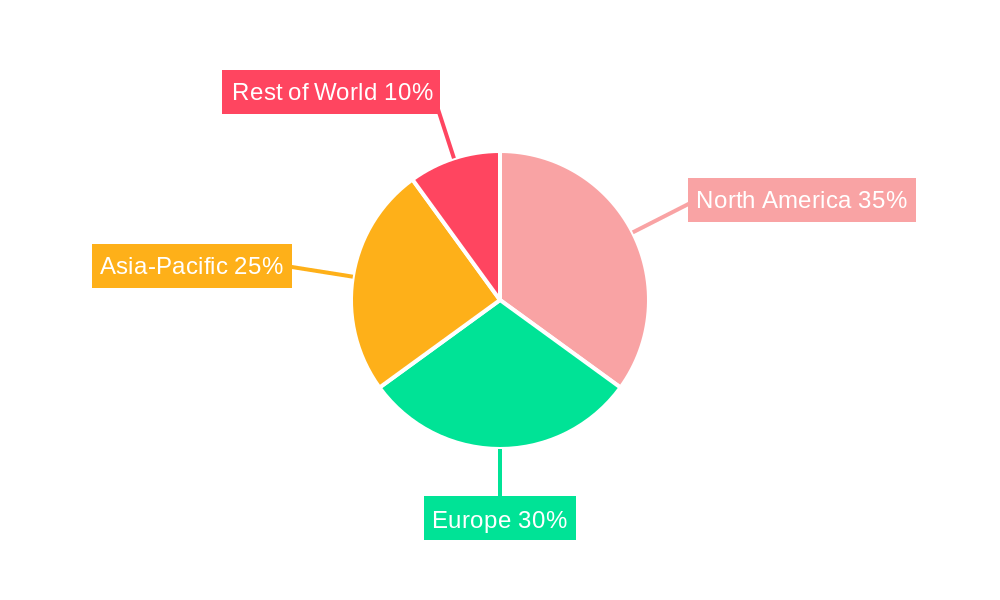

Leading Regions, Countries, or Segments in Tall Oil Rosin Industry

North America emerges as the dominant region in the Tall Oil Rosin Industry, with the United States leading the market due to its robust industrial base and high demand for adhesives and coatings. The region's market size is projected to reach xx Million by 2033, driven by several key factors:

- Investment Trends: Significant investments in R&D and production facilities have bolstered the region's position. In 2024, investments in the tall oil rosin sector exceeded 200 Million.

- Regulatory Support: Favorable regulations promoting the use of bio-based materials have encouraged market growth. The US government's initiatives to reduce reliance on petroleum-based products have been instrumental.

- Consumer Demand: The high demand for sustainable products in sectors like construction and automotive has propelled the adoption of tall oil rosin.

In-depth analysis reveals that North America's dominance is further reinforced by the presence of major players such as Ingevity Corporation and Kraton Corporation, which have established strong supply chains and distribution networks. Europe follows closely, with countries like Finland and Sweden playing significant roles due to their advanced forestry industries and focus on sustainability. The adhesives segment remains the largest, driven by its versatility and wide application across various industries. The region's market dynamics are also influenced by ongoing technological advancements and a strong emphasis on environmental stewardship.

Tall Oil Rosin Industry Product Innovations

Product innovation within the Tall Oil Rosin Industry is primarily focused on elevating performance characteristics and championing sustainability. Recent advancements include the introduction of ultra-high purity tall oil rosin variants, which deliver superior tackiness and enhanced adhesion capabilities. These innovations are a direct result of sophisticated refining techniques that ensure exceptional quality and consistency. The core competitive advantage of these new products lies in their sustainable, bio-derived nature, aligning perfectly with the escalating global demand for environmentally responsible materials. Alongside this, technological progress has paved the way for the development of rosin-based resins exhibiting enhanced thermal stability and superior resistance to oxidative degradation, thereby broadening their applicability in demanding high-performance adhesive and coating systems.

Propelling Factors for Tall Oil Rosin Industry Growth

The robust growth trajectory of the Tall Oil Rosin Industry is significantly influenced by a confluence of critical factors:

- Technological Advancements: Continuous innovation in refining and processing technologies is paramount, enabling the production of higher-grade tall oil rosin that precisely fulfills the stringent requirements of contemporary end-user industries.

- Economic Influences: The escalating demand for sustainable, cost-effective material solutions across the adhesives and coatings sectors serves as a major impetus for market expansion.

- Regulatory Support: Favorable government policies and initiatives that advocate for the increased utilization of bio-based products provide a supportive environment for the broader adoption of tall oil rosin. For instance, the European Union's Green Deal actively promotes the transition towards a more sustainable economic model, indirectly benefiting the tall oil rosin market.

Obstacles in the Tall Oil Rosin Industry Market

The Tall Oil Rosin Industry faces several obstacles that impact its growth:

- Regulatory Challenges: Compliance with stringent environmental regulations increases production costs and complicates market entry.

- Supply Chain Disruptions: Fluctuations in raw material availability, particularly pine-based feedstocks, can disrupt supply chains and affect market stability.

- Competitive Pressures: The presence of substitute products like gum rosin and synthetic resins intensifies competition, potentially eroding market share. The impact of these pressures is estimated to reduce market growth by 1-2% annually.

Future Opportunities in Tall Oil Rosin Industry

Emerging opportunities in the Tall Oil Rosin Industry include:

- New Markets: Expansion into emerging economies with growing industrial sectors presents significant growth potential.

- Technological Innovations: Advances in bio-based materials and circular economy practices offer new avenues for product development.

- Consumer Trends: Increasing consumer preference for sustainable products drives demand for tall oil rosin in various applications, particularly in adhesives and coatings.

Major Players in the Tall Oil Rosin Industry Ecosystem

- Eastman Chemical Company

- Florachem Corp

- Forchem Oyj

- Foreverest Resources Ltd

- Harima Chemicals Group Inc

- Ilim Group

- Ingevity Corporation

- Kraton Corporation

- OOO Torgoviy Dom Lesokhimik

- Pine Chemical Group

- Segezha-Group

- Songchuan Pine Chemicals Co Ltd

- Stora Enso

*List Not Exhaustive

Key Developments in Tall Oil Rosin Industry Industry

- September 2022: Ingevity Corporation implemented a general price adjustment for its tall oil fatty acid, distilled tall oil, and related derivative products, alongside its rosin-based resins within the industrial specialties portfolio. This strategic pricing decision reflects rising input costs and the sustained high demand for sustainable material solutions, influencing prevailing market dynamics and pricing strategies.

- September 2021: Kraton Corp. announced price increases ranging from 10% to 15% across its crude tall oil refinery products and its derivative company. This pricing adjustment serves as an indicator of the industry's response to inflationary pressures and the necessity of maintaining profitability amidst robust demand.

Strategic Tall Oil Rosin Industry Market Forecast

The strategic forecast for the Tall Oil Rosin Industry from 2025 to 2033 indicates robust growth, driven by increasing demand for sustainable materials and ongoing technological advancements. The market is expected to reach xx Million by 2033, with a CAGR of 4.5%. Key growth catalysts include the expansion into new markets, particularly in Asia-Pacific, and the development of innovative products that cater to the evolving needs of end-user industries. The industry's focus on sustainability and circular economy practices presents significant opportunities for future growth, positioning tall oil rosin as a vital component in the global shift towards eco-friendly solutions.

Tall Oil Rosin Industry Segmentation

-

1. Application

- 1.1. Pulp & Paper

- 1.2. Inks and Toners

- 1.3. Adhesives

- 1.4. Paints and Coatings

- 1.5. Electronics

- 1.6. Hygiene Products

- 1.7. Rubber

- 1.8. Other Applications

-

2. End-user Industry

- 2.1. Printing

- 2.2. Automotive

- 2.3. Building and Construction

- 2.4. Chemicals

- 2.5. Electronics and Electrical

- 2.6. Mining

- 2.7. Other End-user Industries

Tall Oil Rosin Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Tall Oil Rosin Industry Regional Market Share

Geographic Coverage of Tall Oil Rosin Industry

Tall Oil Rosin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Renewable Rosins; Increasing Demand for Cost-effective & Vegetarian-friendly Products

- 3.3. Market Restrains

- 3.3.1. Growing Need for Renewable Rosins; Increasing Demand for Cost-effective & Vegetarian-friendly Products

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Pulp and Paper Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pulp & Paper

- 5.1.2. Inks and Toners

- 5.1.3. Adhesives

- 5.1.4. Paints and Coatings

- 5.1.5. Electronics

- 5.1.6. Hygiene Products

- 5.1.7. Rubber

- 5.1.8. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Printing

- 5.2.2. Automotive

- 5.2.3. Building and Construction

- 5.2.4. Chemicals

- 5.2.5. Electronics and Electrical

- 5.2.6. Mining

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pulp & Paper

- 6.1.2. Inks and Toners

- 6.1.3. Adhesives

- 6.1.4. Paints and Coatings

- 6.1.5. Electronics

- 6.1.6. Hygiene Products

- 6.1.7. Rubber

- 6.1.8. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Printing

- 6.2.2. Automotive

- 6.2.3. Building and Construction

- 6.2.4. Chemicals

- 6.2.5. Electronics and Electrical

- 6.2.6. Mining

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pulp & Paper

- 7.1.2. Inks and Toners

- 7.1.3. Adhesives

- 7.1.4. Paints and Coatings

- 7.1.5. Electronics

- 7.1.6. Hygiene Products

- 7.1.7. Rubber

- 7.1.8. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Printing

- 7.2.2. Automotive

- 7.2.3. Building and Construction

- 7.2.4. Chemicals

- 7.2.5. Electronics and Electrical

- 7.2.6. Mining

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pulp & Paper

- 8.1.2. Inks and Toners

- 8.1.3. Adhesives

- 8.1.4. Paints and Coatings

- 8.1.5. Electronics

- 8.1.6. Hygiene Products

- 8.1.7. Rubber

- 8.1.8. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Printing

- 8.2.2. Automotive

- 8.2.3. Building and Construction

- 8.2.4. Chemicals

- 8.2.5. Electronics and Electrical

- 8.2.6. Mining

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pulp & Paper

- 9.1.2. Inks and Toners

- 9.1.3. Adhesives

- 9.1.4. Paints and Coatings

- 9.1.5. Electronics

- 9.1.6. Hygiene Products

- 9.1.7. Rubber

- 9.1.8. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Printing

- 9.2.2. Automotive

- 9.2.3. Building and Construction

- 9.2.4. Chemicals

- 9.2.5. Electronics and Electrical

- 9.2.6. Mining

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Tall Oil Rosin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pulp & Paper

- 10.1.2. Inks and Toners

- 10.1.3. Adhesives

- 10.1.4. Paints and Coatings

- 10.1.5. Electronics

- 10.1.6. Hygiene Products

- 10.1.7. Rubber

- 10.1.8. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Printing

- 10.2.2. Automotive

- 10.2.3. Building and Construction

- 10.2.4. Chemicals

- 10.2.5. Electronics and Electrical

- 10.2.6. Mining

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eastman Chemical Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Florachem Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forchem Oyj

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Foreverest Resources Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Harima Chemicals Group Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ilim Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ingevity Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kraton Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OOO Torgoviy Dom Lesokhimik

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pine Chemical Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Segezha-Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Songchuan Pine Chemicals Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stora Enso*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Eastman Chemical Company

List of Figures

- Figure 1: Global Tall Oil Rosin Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Tall Oil Rosin Industry Revenue (million), by Application 2025 & 2033

- Figure 3: Asia Pacific Tall Oil Rosin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Tall Oil Rosin Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Tall Oil Rosin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Tall Oil Rosin Industry Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Tall Oil Rosin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Tall Oil Rosin Industry Revenue (million), by Application 2025 & 2033

- Figure 9: North America Tall Oil Rosin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Tall Oil Rosin Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: North America Tall Oil Rosin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Tall Oil Rosin Industry Revenue (million), by Country 2025 & 2033

- Figure 13: North America Tall Oil Rosin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Tall Oil Rosin Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Tall Oil Rosin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Tall Oil Rosin Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 17: Europe Tall Oil Rosin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Tall Oil Rosin Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Tall Oil Rosin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Tall Oil Rosin Industry Revenue (million), by Application 2025 & 2033

- Figure 21: South America Tall Oil Rosin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Tall Oil Rosin Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: South America Tall Oil Rosin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Tall Oil Rosin Industry Revenue (million), by Country 2025 & 2033

- Figure 25: South America Tall Oil Rosin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tall Oil Rosin Industry Revenue (million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Tall Oil Rosin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Tall Oil Rosin Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Tall Oil Rosin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Tall Oil Rosin Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Tall Oil Rosin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Tall Oil Rosin Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Tall Oil Rosin Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 13: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Tall Oil Rosin Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 19: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Tall Oil Rosin Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: France Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 27: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Tall Oil Rosin Industry Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Tall Oil Rosin Industry Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Tall Oil Rosin Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Tall Oil Rosin Industry Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Tall Oil Rosin Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tall Oil Rosin Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Tall Oil Rosin Industry?

Key companies in the market include Eastman Chemical Company, Florachem Corp, Forchem Oyj, Foreverest Resources Ltd, Harima Chemicals Group Inc, Ilim Group, Ingevity Corporation, Kraton Corporation, OOO Torgoviy Dom Lesokhimik, Pine Chemical Group, Segezha-Group, Songchuan Pine Chemicals Co Ltd, Stora Enso*List Not Exhaustive.

3. What are the main segments of the Tall Oil Rosin Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 709.2 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Renewable Rosins; Increasing Demand for Cost-effective & Vegetarian-friendly Products.

6. What are the notable trends driving market growth?

Increasing Usage in the Pulp and Paper Industry.

7. Are there any restraints impacting market growth?

Growing Need for Renewable Rosins; Increasing Demand for Cost-effective & Vegetarian-friendly Products.

8. Can you provide examples of recent developments in the market?

In September 2022, Ingevity Corporation announced a general price increase for tall oil fatty acid and distilled tall oil products and derivatives, also for rosin-based resins associated with its industrial specialties portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tall Oil Rosin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tall Oil Rosin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tall Oil Rosin Industry?

To stay informed about further developments, trends, and reports in the Tall Oil Rosin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence