Key Insights

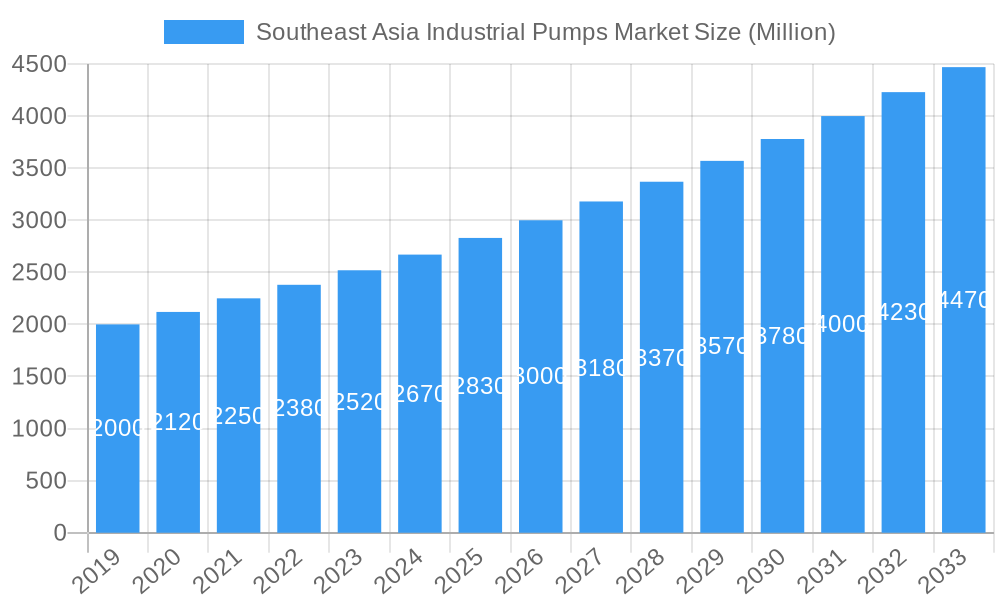

The Southeast Asia industrial pumps market is projected for significant expansion, fueled by robust industrialization, infrastructure development, and substantial investments in manufacturing, water and wastewater treatment, oil and gas, and food and beverage sectors. With an estimated market size of $5.1 billion in 2024 and a CAGR of 8.4%, the region demonstrates a strong growth trajectory. Key drivers include the escalating demand for energy-efficient and technologically advanced pumps, driven by stringent environmental regulations and the imperative for operational cost optimization. Emerging economies, particularly Vietnam, Indonesia, and the Philippines, are spearheading this growth through their expanding manufacturing bases and urbanization projects necessitating advanced water management solutions.

Southeast Asia Industrial Pumps Market Market Size (In Billion)

The historical performance from 2019 to 2024 has established a solid foundation for future expansion. This period likely saw increased adoption of innovative pumping technologies and a diversification of end-user industries. The forecast period of 2025-2033 anticipates continued momentum, with advancements in smart pump technology, IoT integration for predictive maintenance, and the development of specialized pumps for niche applications poised to further stimulate market growth. The increasing focus on sustainable practices and the necessity to upgrade aging industrial infrastructure will also significantly shape the market. Both regional and international manufacturers are actively expanding their presence and product portfolios to meet the evolving demands of this dynamic market. The projected market size of $5.1 billion in 2024 underscores the vital role industrial pumps play in Southeast Asia's economic development.

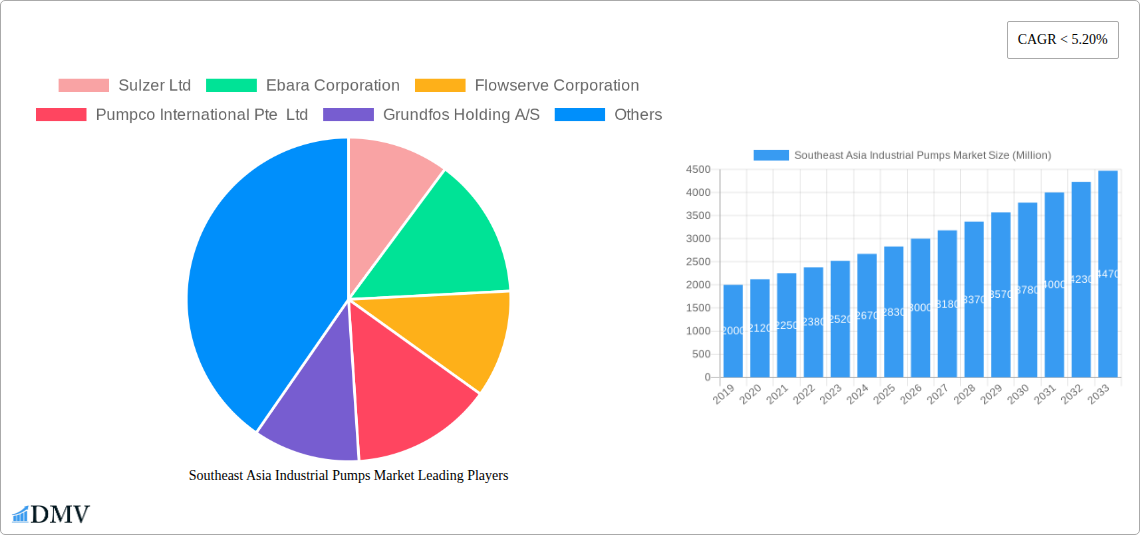

Southeast Asia Industrial Pumps Market Company Market Share

Southeast Asia Industrial Pumps Market: Comprehensive Analysis and Growth Forecast (2019–2033)

Gain critical insights into the expanding Southeast Asia industrial pumps market with this detailed report. Covering the period from 2019 to 2033, with a base year of 2024 and a forecast period of 2025–2033, this analysis meticulously examines market dynamics, key trends, and future projections. Explore the evolving landscape of industrial pumps, driven by robust industrialization, infrastructure development, and an increasing emphasis on water management and sustainability across key Southeast Asian economies.

Southeast Asia Industrial Pumps Market Market Composition & Trends

The Southeast Asia industrial pumps market is characterized by a dynamic interplay of established global players and emerging local manufacturers. Market concentration is moderately consolidated, with leading companies like Sulzer Ltd, Ebara Corporation, and Flowserve Corporation holding significant shares. However, the presence of specialized regional players such as Pumpco International Pte Ltd and Kirloskar Brothers Limited contributes to a competitive ecosystem. Innovation is a key catalyst, with a continuous push for energy-efficient, robust, and technologically advanced pumping solutions to meet stringent environmental regulations and operational demands. The regulatory landscape, particularly concerning water treatment and emissions, plays a crucial role in shaping product development and market adoption. Substitute products, while present in niche applications, are largely overshadowed by the superior performance and reliability of industrial pumps for core industrial processes. End-user profiles are diverse, spanning critical sectors like Oil and Gas, Water and Wastewater, Chemicals and Petrochemicals, Power Generation, Pharmaceutical/Life Sciences, and Food and Beverage. Mergers and acquisitions (M&A) activities, while not extensively documented with specific values for this region, are anticipated to play a role in market consolidation and expansion of technological capabilities. The market share distribution is influenced by factors such as application suitability, price points, and after-sales support.

Southeast Asia Industrial Pumps Market Industry Evolution

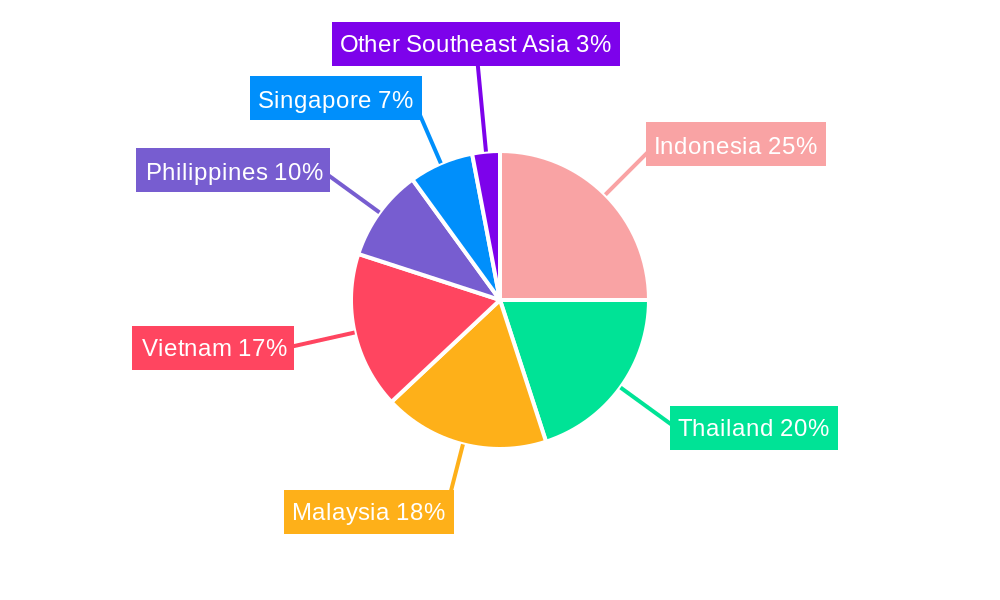

The Southeast Asia industrial pumps market has witnessed a significant evolution driven by rapid industrialization and infrastructure development across nations like Indonesia, Thailand, Vietnam, Malaysia, and the Philippines. This growth trajectory has been fueled by substantial investments in sectors such as manufacturing, petrochemicals, and utilities, all of which rely heavily on efficient pumping systems. Technological advancements have been at the forefront of this evolution, with a discernible shift towards smart pumps, variable speed drives, and IoT-enabled monitoring systems. These innovations not only enhance operational efficiency and reduce energy consumption but also provide valuable data for predictive maintenance, thereby minimizing downtime and operational costs. For instance, the adoption of energy-efficient pumps in the water and wastewater treatment sector is projected to grow at a CAGR of approximately 8.5% during the forecast period, driven by increasing environmental concerns and governmental initiatives to improve water infrastructure. The demand for specialized pumps, such as those used in the pharmaceutical and food and beverage industries, which require high hygiene standards and precise fluid handling, is also on an upward trend, reflecting the region's growing sophisticated manufacturing base. Shifting consumer demands, influenced by global trends towards sustainability and operational excellence, are pushing manufacturers to develop pumps with longer lifespans, lower maintenance requirements, and reduced environmental impact. The base year of 2025 sees a market value estimated at over $1,500 Million, poised for substantial expansion in the coming years. The historical period (2019-2024) has laid a strong foundation, with a consistent year-on-year growth of around 6-7%, demonstrating the inherent resilience and potential of this market. The estimated market value in 2025 is projected to be approximately $1,650 Million, with a projected CAGR of over 7.8% from 2025 to 2033, reaching an estimated value exceeding $3,000 Million by 2033. This robust growth underscores the critical role of industrial pumps in supporting the region's economic development and industrial advancement.

Leading Regions, Countries, or Segments in Southeast Asia Industrial Pumps Market

The Southeast Asia industrial pumps market is experiencing significant growth, with a dominant presence in several key segments and regions. The Water and Wastewater end-user industry stands out as a primary driver of this market's expansion. This dominance is propelled by several factors, including the increasing demand for clean water, the imperative to upgrade aging water infrastructure, and the growing focus on effective wastewater treatment to mitigate environmental pollution. Governments across Southeast Asia are heavily investing in water infrastructure projects, driven by population growth, urbanization, and the need to comply with international environmental standards. For example, countries like Singapore, Thailand, and Vietnam are actively implementing large-scale water management and sanitation projects, directly boosting the demand for a wide array of industrial pumps.

Within the Centrifugal pump type segment, Multi-stage and Submersible pumps are particularly prominent. Multi-stage centrifugal pumps are essential for applications requiring high head and flow rates, commonly found in water distribution networks and industrial process applications. Submersible pumps are crucial for dewatering, sewage management, and raw water intake in various infrastructure projects. The Oil and Gas sector, while mature in some areas, continues to be a significant consumer, particularly for exploration, extraction, and refining processes, driving demand for robust and high-performance pumps.

Key drivers contributing to the dominance of these segments include:

- Governmental Initiatives and Investments: Significant public funding allocated to water and wastewater treatment projects, coupled with stringent regulations on water quality and effluent discharge, are creating sustained demand.

- Urbanization and Population Growth: The rapid expansion of urban centers across Southeast Asia necessitates enhanced water supply and sanitation systems, directly impacting pump demand.

- Industrial Expansion: The continuous growth of manufacturing, petrochemical, and power generation industries fuels the need for reliable and efficient pumping solutions for various processes.

- Technological Advancements: The adoption of energy-efficient and smart pumping technologies is enhancing the appeal of centrifugal pumps, particularly multi-stage and submersible variants, due to their cost-effectiveness and performance.

- Focus on Sustainability: Increasing awareness and regulatory pressure to reduce water wastage and pollution are driving investments in advanced water and wastewater management systems, where industrial pumps play a pivotal role.

The Chemicals and Petrochemicals segment also represents a substantial market share, fueled by the region's growing chemical manufacturing capabilities and large-scale refining operations. This sector requires specialized pumps capable of handling corrosive, abrasive, and hazardous fluids, driving demand for high-alloy and engineered pump solutions. The Power Generation sector, with its continuous need for efficient water circulation and cooling systems, also contributes significantly to the market's overall growth.

Southeast Asia Industrial Pumps Market Product Innovations

The Southeast Asia industrial pumps market is witnessing a surge in product innovations focused on enhanced efficiency, reduced energy consumption, and intelligent operation. Manufacturers are increasingly incorporating variable speed drives (VSDs) and advanced motor technologies to optimize pump performance based on real-time demand, leading to significant energy savings of up to 50% in certain applications, as demonstrated by Grundfos's Distributed Pumping System. The development of robust, corrosion-resistant materials and modular designs is extending pump lifespan and simplifying maintenance. Furthermore, the integration of IoT capabilities enables remote monitoring, diagnostics, and predictive maintenance, offering unparalleled operational insights and minimizing downtime. Sulzer's introduction of the SES and SKS ranges, designed for municipal and commercial applications with robust construction and material options, exemplifies the trend towards reliable, high-performance solutions. These innovations are crucial for sectors like pharmaceuticals and food and beverage, where hygiene and precise fluid handling are paramount.

Propelling Factors for Southeast Asia Industrial Pumps Market Growth

Several key factors are propelling the growth of the Southeast Asia industrial pumps market. Firstly, robust industrialization and infrastructure development across the region, particularly in manufacturing, oil & gas, and petrochemicals, necessitate significant investment in pumping systems. Secondly, increasing government focus on water and wastewater management, driven by environmental concerns and population growth, is creating a sustained demand for efficient water treatment and distribution solutions. Thirdly, technological advancements, such as the adoption of energy-efficient pumps, smart technologies, and IoT integration, are driving market penetration by offering cost savings and improved operational performance. The commitment to sustainability and reducing operational expenditure further amplifies the demand for these advanced pumping solutions.

Obstacles in the Southeast Asia Industrial Pumps Market Market

Despite the strong growth trajectory, the Southeast Asia industrial pumps market faces certain obstacles. Intense price competition from both established global players and emerging local manufacturers can pressure profit margins. Stringent and evolving regulatory standards related to emissions and energy efficiency, while driving innovation, can also pose compliance challenges and increase R&D costs. Supply chain disruptions, exacerbated by geopolitical factors and logistics complexities, can lead to increased lead times and material costs. Furthermore, a shortage of skilled labor for installation, maintenance, and repair of advanced pumping systems can hinder market adoption in certain areas.

Future Opportunities in Southeast Asia Industrial Pumps Market

The Southeast Asia industrial pumps market is ripe with future opportunities. The growing demand for smart and connected pumps offers significant potential, driven by the need for data-driven operational insights and predictive maintenance. The expansion of renewable energy projects, such as solar and wind farms, will create new applications for specialized pumping systems. Furthermore, the increasing focus on circular economy principles and advanced waste management will drive demand for innovative pumps in waste-to-energy and resource recovery facilities. Emerging markets within Southeast Asia, with their nascent industrial bases, also present substantial untapped potential for market penetration.

Major Players in the Southeast Asia Industrial Pumps Market Ecosystem

- Sulzer Ltd

- Ebara Corporation

- Flowserve Corporation

- Pumpco International Pte Ltd

- Grundfos Holding A/S

- Kirloskar Brothers Limited

- Dancomech Holdings Berhad

Key Developments in Southeast Asia Industrial Pumps Market Industry

- October 2021: Grundfos launched its Distributed Pumping System in Thailand, offering up to 50% energy consumption reduction for cooling large commercial buildings, significantly cutting operational costs and aiding sustainability goals.

- January 2022: Sulzer expanded its clean water pump portfolio with the launch of the SES and SKS ranges, compliant with EN733 standards. These pumps are suitable for municipalities, water treatment facilities, and commercial/irrigation applications, featuring robust cast iron casings and various impeller material options, supplied as complete packages with motors.

Strategic Southeast Asia Industrial Pumps Market Market Forecast

The strategic forecast for the Southeast Asia industrial pumps market anticipates continued robust growth, fueled by ongoing industrial expansion, infrastructure development, and an increasing emphasis on sustainability and operational efficiency. The demand for smart and energy-efficient pumping solutions will be a key growth catalyst, driven by both regulatory pressures and the pursuit of reduced operational costs. Emerging opportunities in sectors like renewable energy and advanced waste management will further diversify and expand the market. Investments in upgrading existing infrastructure and the development of new industrial facilities across the region are expected to maintain a high demand for reliable and advanced pumping technologies, ensuring a positive outlook for the market.

Southeast Asia Industrial Pumps Market Segmentation

-

1. Type

-

1.1. Positive Displacement

- 1.1.1. Rotary Pump

- 1.1.2. Reciprocating

- 1.1.3. Peristaltic

-

1.2. Centrifugal

- 1.2.1. Single-stage

- 1.2.2. Multi-stage

- 1.2.3. Submersible

- 1.2.4. Others

-

1.1. Positive Displacement

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater

- 2.3. Chemicals and Petrochemicals

- 2.4. Power Generation

- 2.5. Pharmaceutical/Life Sciences

- 2.6. Food and Beverage

- 2.7. Other End-user Industries

Southeast Asia Industrial Pumps Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia Industrial Pumps Market Regional Market Share

Geographic Coverage of Southeast Asia Industrial Pumps Market

Southeast Asia Industrial Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in Building and Construction; Technological Advancements in Manufacturing

- 3.3. Market Restrains

- 3.3.1. ; Lack of Social Awareness About the Benefits of Adopting Assistive Robotic Systems

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Industry to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Displacement

- 5.1.1.1. Rotary Pump

- 5.1.1.2. Reciprocating

- 5.1.1.3. Peristaltic

- 5.1.2. Centrifugal

- 5.1.2.1. Single-stage

- 5.1.2.2. Multi-stage

- 5.1.2.3. Submersible

- 5.1.2.4. Others

- 5.1.1. Positive Displacement

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater

- 5.2.3. Chemicals and Petrochemicals

- 5.2.4. Power Generation

- 5.2.5. Pharmaceutical/Life Sciences

- 5.2.6. Food and Beverage

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Positive Displacement

- 6.1.1.1. Rotary Pump

- 6.1.1.2. Reciprocating

- 6.1.1.3. Peristaltic

- 6.1.2. Centrifugal

- 6.1.2.1. Single-stage

- 6.1.2.2. Multi-stage

- 6.1.2.3. Submersible

- 6.1.2.4. Others

- 6.1.1. Positive Displacement

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Oil and Gas

- 6.2.2. Water and Wastewater

- 6.2.3. Chemicals and Petrochemicals

- 6.2.4. Power Generation

- 6.2.5. Pharmaceutical/Life Sciences

- 6.2.6. Food and Beverage

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Positive Displacement

- 7.1.1.1. Rotary Pump

- 7.1.1.2. Reciprocating

- 7.1.1.3. Peristaltic

- 7.1.2. Centrifugal

- 7.1.2.1. Single-stage

- 7.1.2.2. Multi-stage

- 7.1.2.3. Submersible

- 7.1.2.4. Others

- 7.1.1. Positive Displacement

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Oil and Gas

- 7.2.2. Water and Wastewater

- 7.2.3. Chemicals and Petrochemicals

- 7.2.4. Power Generation

- 7.2.5. Pharmaceutical/Life Sciences

- 7.2.6. Food and Beverage

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Positive Displacement

- 8.1.1.1. Rotary Pump

- 8.1.1.2. Reciprocating

- 8.1.1.3. Peristaltic

- 8.1.2. Centrifugal

- 8.1.2.1. Single-stage

- 8.1.2.2. Multi-stage

- 8.1.2.3. Submersible

- 8.1.2.4. Others

- 8.1.1. Positive Displacement

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Oil and Gas

- 8.2.2. Water and Wastewater

- 8.2.3. Chemicals and Petrochemicals

- 8.2.4. Power Generation

- 8.2.5. Pharmaceutical/Life Sciences

- 8.2.6. Food and Beverage

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Positive Displacement

- 9.1.1.1. Rotary Pump

- 9.1.1.2. Reciprocating

- 9.1.1.3. Peristaltic

- 9.1.2. Centrifugal

- 9.1.2.1. Single-stage

- 9.1.2.2. Multi-stage

- 9.1.2.3. Submersible

- 9.1.2.4. Others

- 9.1.1. Positive Displacement

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Oil and Gas

- 9.2.2. Water and Wastewater

- 9.2.3. Chemicals and Petrochemicals

- 9.2.4. Power Generation

- 9.2.5. Pharmaceutical/Life Sciences

- 9.2.6. Food and Beverage

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Southeast Asia Industrial Pumps Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Positive Displacement

- 10.1.1.1. Rotary Pump

- 10.1.1.2. Reciprocating

- 10.1.1.3. Peristaltic

- 10.1.2. Centrifugal

- 10.1.2.1. Single-stage

- 10.1.2.2. Multi-stage

- 10.1.2.3. Submersible

- 10.1.2.4. Others

- 10.1.1. Positive Displacement

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Oil and Gas

- 10.2.2. Water and Wastewater

- 10.2.3. Chemicals and Petrochemicals

- 10.2.4. Power Generation

- 10.2.5. Pharmaceutical/Life Sciences

- 10.2.6. Food and Beverage

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sulzer Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ebara Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flowserve Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pumpco International Pte Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Grundfos Holding A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kirloskar Brothers Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dancomech Holdings Berhad*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Sulzer Ltd

List of Figures

- Figure 1: Global Southeast Asia Industrial Pumps Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Southeast Asia Industrial Pumps Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Southeast Asia Industrial Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Southeast Asia Industrial Pumps Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 5: North America Southeast Asia Industrial Pumps Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Southeast Asia Industrial Pumps Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Southeast Asia Industrial Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Southeast Asia Industrial Pumps Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Southeast Asia Industrial Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Southeast Asia Industrial Pumps Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 11: South America Southeast Asia Industrial Pumps Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: South America Southeast Asia Industrial Pumps Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Southeast Asia Industrial Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Southeast Asia Industrial Pumps Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Southeast Asia Industrial Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Southeast Asia Industrial Pumps Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 17: Europe Southeast Asia Industrial Pumps Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Europe Southeast Asia Industrial Pumps Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Southeast Asia Industrial Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 23: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Southeast Asia Industrial Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Southeast Asia Industrial Pumps Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Southeast Asia Industrial Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Southeast Asia Industrial Pumps Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 29: Asia Pacific Southeast Asia Industrial Pumps Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Asia Pacific Southeast Asia Industrial Pumps Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Southeast Asia Industrial Pumps Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 30: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 39: Global Southeast Asia Industrial Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Southeast Asia Industrial Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Industrial Pumps Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Southeast Asia Industrial Pumps Market?

Key companies in the market include Sulzer Ltd, Ebara Corporation, Flowserve Corporation, Pumpco International Pte Ltd, Grundfos Holding A/S, Kirloskar Brothers Limited, Dancomech Holdings Berhad*List Not Exhaustive.

3. What are the main segments of the Southeast Asia Industrial Pumps Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Building and Construction; Technological Advancements in Manufacturing.

6. What are the notable trends driving market growth?

Water and Wastewater Industry to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; Lack of Social Awareness About the Benefits of Adopting Assistive Robotic Systems.

8. Can you provide examples of recent developments in the market?

October 2021 - Grundfos launched its Distributed Pumping System in Thailand, which can reduce energy consumption for cooling large commercial buildings by up to 50%, substantially cutting operational costs and helping Thai companies achieve their sustainability goals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Industrial Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Industrial Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Industrial Pumps Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Industrial Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence