Key Insights

The South American water treatment chemicals market is poised for significant expansion, propelled by escalating urbanization, industrial growth, and a heightened emphasis on water quality and sustainability. With a projected compound annual growth rate (CAGR) of 7.4%, the market is estimated to reach $2.9 billion by 2024. This trajectory is underpinned by increasingly stringent wastewater discharge regulations, the widespread adoption of advanced water treatment technologies, and substantial investments in regional water infrastructure. Key market segments encompass potable water treatment, industrial wastewater treatment, and municipal wastewater treatment, each contributing to the overall market valuation.

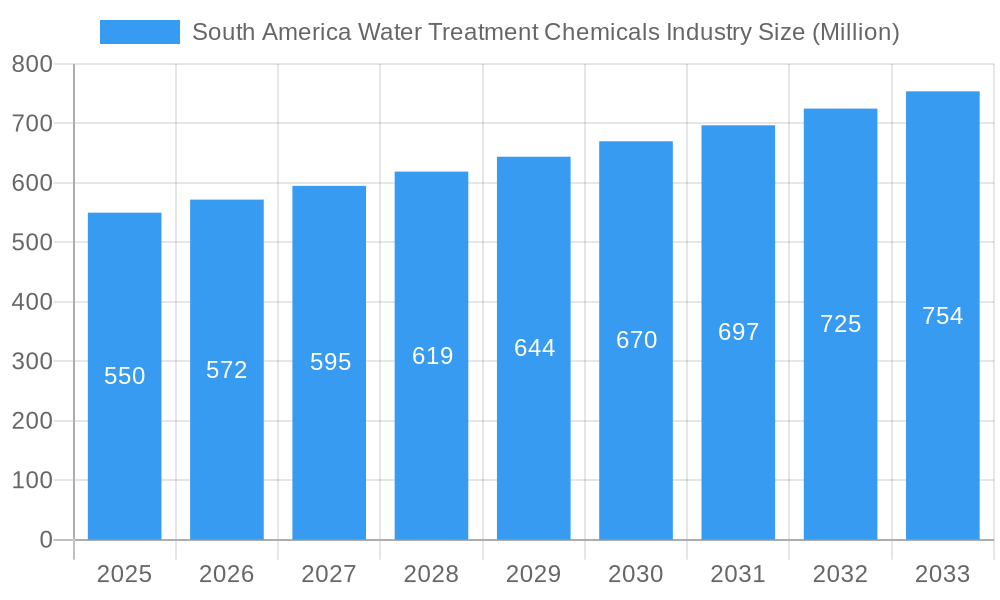

South America Water Treatment Chemicals Industry Market Size (In Billion)

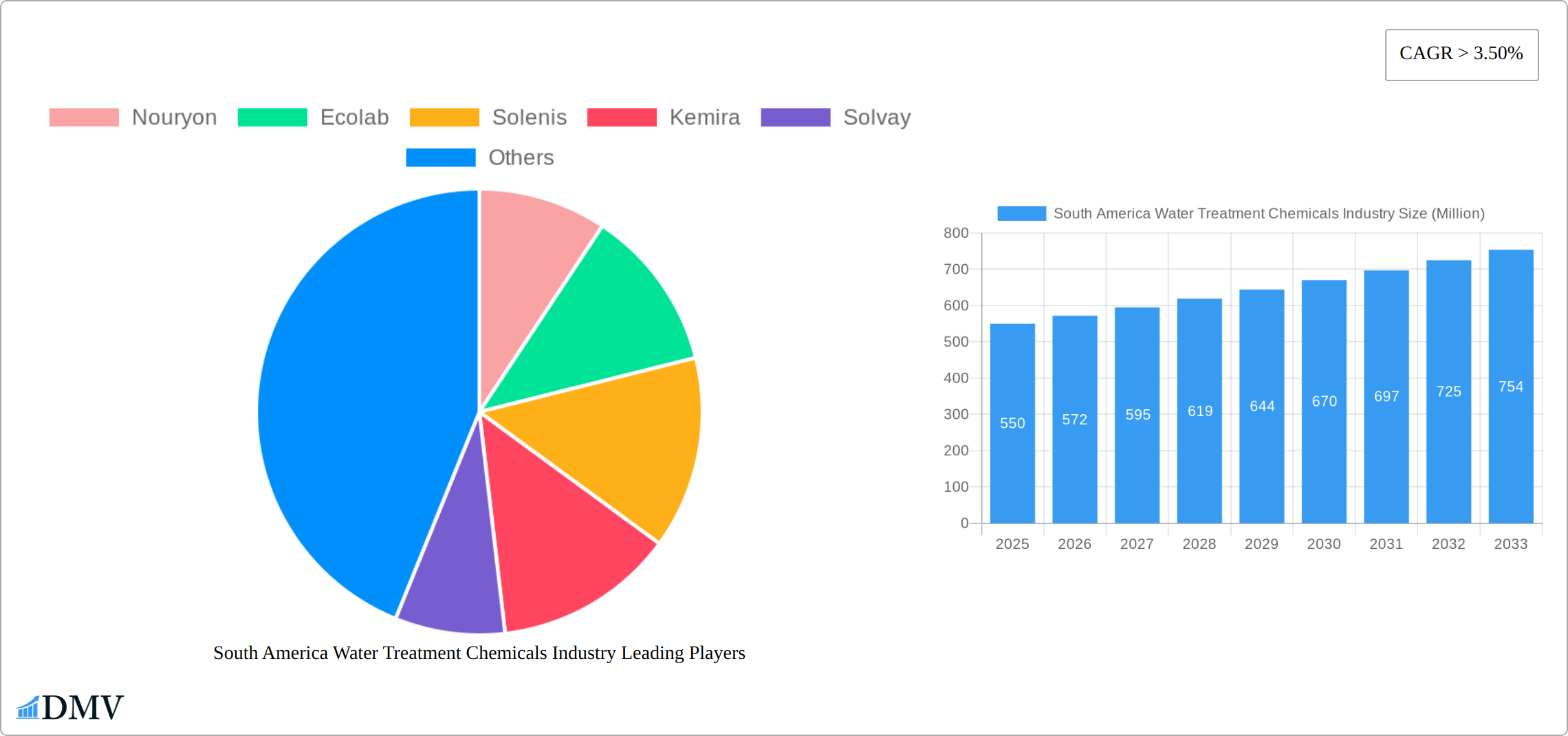

Leading industry players, including Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries, SNF, and Suez, are actively vying for market dominance through technological innovation and established distribution channels. The market's future growth will be shaped by supportive government policies for sustainable water management, expansion in core industrial sectors such as mining, agriculture, and manufacturing, and increasing public awareness regarding water quality. Potential challenges include economic volatility in specific South American nations and infrastructure limitations.

South America Water Treatment Chemicals Industry Company Market Share

Geographically, market dynamics vary across countries, influenced by economic development, regulatory environments, and infrastructure investment. Companies are prioritizing the development of sustainable and innovative water treatment solutions to meet burgeoning demand while proactively addressing regulatory complexities and supply chain vulnerabilities. The South American water treatment chemicals market exhibits a strong positive outlook, driven by sustained regional growth trends.

South America Water Treatment Chemicals Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the South America water treatment chemicals market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key trends, growth drivers, and challenges shaping the industry's future. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

South America Water Treatment Chemicals Industry Market Composition & Trends

This section dissects the competitive landscape, regulatory environment, and evolving dynamics of the South American water treatment chemicals market. We analyze market concentration, revealing the market share distribution among key players such as Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries Ltd, SNF, and Suez. The report further explores the impact of mergers and acquisitions (M&A), quantifying deal values and their influence on market consolidation. Innovation catalysts, such as advancements in water treatment technologies and the increasing demand for sustainable solutions, are also examined. The regulatory landscape, including environmental regulations and water quality standards, is analyzed, along with the impact of substitute products and evolving end-user profiles (municipal, industrial, etc.). We estimate the total M&A deal value in the historical period (2019-2024) at approximately xx Million, with xx% of deals involving companies with a market share above 5%.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Stringent environmental regulations and growing demand for efficient water treatment solutions.

- M&A Activity: Significant consolidation observed during 2019-2024, driven by economies of scale and technological advancements.

- Substitute Products: Limited viable substitutes, with the market primarily dominated by chemical-based solutions.

South America Water Treatment Chemicals Industry Evolution

This section traces the evolution of the South America water treatment chemicals market, detailing market growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2025. We analyze the historical growth rate (2019-2024) at xx% and project the future growth rate (2025-2033) at xx%. Technological advancements, such as the adoption of advanced oxidation processes (AOPs) and membrane filtration techniques, are discussed, along with their impact on market dynamics. The shift towards sustainable and environmentally friendly water treatment solutions is also examined, including the growing adoption of bio-based chemicals and the increasing focus on water reuse and recycling. This analysis incorporates data on adoption rates for new technologies and consumer preferences for different types of water treatment chemicals.

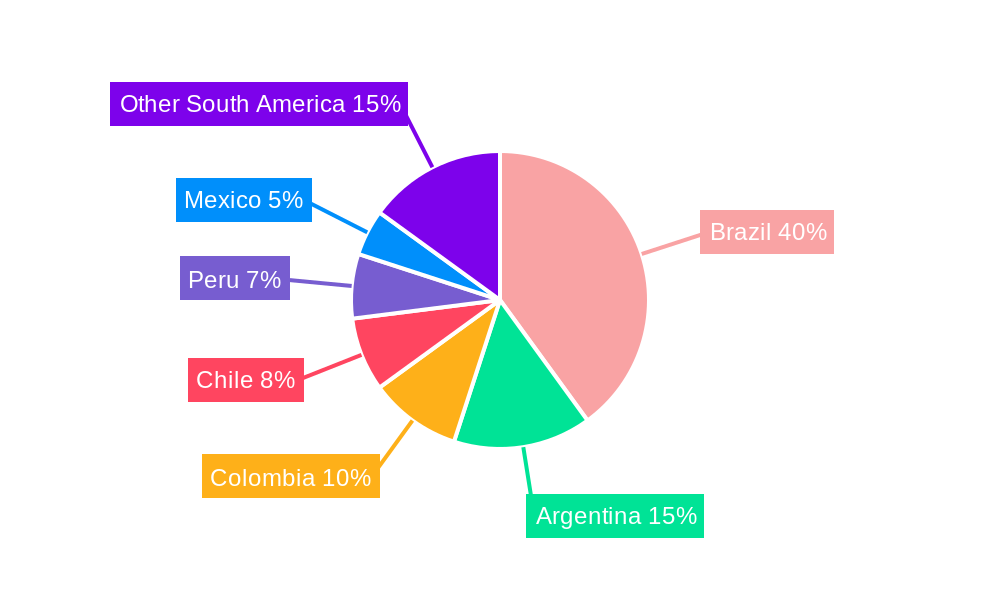

Leading Regions, Countries, or Segments in South America Water Treatment Chemicals Industry

The South American water treatment chemicals market is characterized by distinct regional leadership and segment dominance. Brazil currently stands as the leading market, propelled by its significant industrial base, rapid urbanization, and ongoing investments in water infrastructure. The country's proactive stance on environmental regulations further incentivizes the adoption of advanced water treatment solutions, contributing to its market leadership.

-

Key Drivers for Brazil's Dominance:

- Substantial and continuous investments in upgrading and expanding water and wastewater treatment infrastructure.

- Enforcement of increasingly stringent environmental protection laws and water quality standards, mandating the use of sophisticated treatment chemicals.

- High demand for treated water across a wide spectrum of industries, including mining, agriculture, food and beverage, and manufacturing.

- A growing focus on water reuse and recycling initiatives, driving demand for specialized treatment chemicals.

-

Other Promising Markets: Beyond Brazil, countries such as Argentina, Chile, and Colombia are demonstrating robust growth potential. This expansion is largely attributable to their expanding industrial sectors, rising populations, and a growing awareness and concern regarding water scarcity and quality. These nations are increasingly investing in their water management systems, creating significant opportunities for water treatment chemical suppliers.

In terms of market segmentation, the municipal water treatment segment is projected to command the largest share of the market by 2025, estimated at approximately 55%. This is followed by the industrial water treatment segment, expected to hold around 35%. The remaining percentage will be accounted for by other applications such as commercial and utility water treatment.

Brazil's preeminence in this sector is a direct result of a powerful combination of factors: substantial capital allocated to water infrastructure development, a robust and progressively enforced regulatory landscape that champions the adoption of cutting-edge treatment technologies, and the sheer volume of industrial water consumption across its diverse economic sectors.

South America Water Treatment Chemicals Industry Product Innovations

The landscape of water treatment chemicals in South America is being continuously reshaped by a wave of innovative solutions. The primary focus of these advancements is on developing high-performance, environmentally responsible chemicals that address complex water quality challenges while minimizing ecological impact. Prominent examples include:

- Advanced Oxidation Processes (AOPs): These technologies are gaining traction for their exceptional ability to degrade persistent organic pollutants and recalcitrant contaminants, offering a more thorough and effective treatment compared to conventional methods.

- Bio-based Coagulants and Flocculants: A significant shift towards sustainability is evident with the development and adoption of coagulants and flocculants derived from renewable biological sources. These offer environmentally friendly alternatives to traditional chemical-based products, contributing to greener water treatment practices.

- Smart and Digital Water Treatment Solutions: Innovations are also emerging in the integration of digital technologies, enabling real-time monitoring, predictive analysis, and automated chemical dosing for optimized treatment processes.

These innovations are not only about enhanced efficacy but also about delivering tangible benefits such as improved operational efficiency, a significantly reduced environmental footprint, and substantial cost savings for end-users. The unique selling propositions of these advanced products often revolve around their superior performance metrics, the potential for reduced chemical dosages, and ultimately, lower overall operational expenditures.

Propelling Factors for South America Water Treatment Chemicals Industry Growth

The expansion of the South American water treatment chemicals market is being driven by a dynamic interplay of several critical factors:

- Industrial and Urban Expansion: Continued industrial growth and increasing urbanization across the region are directly translating into a higher demand for efficient and reliable water treatment solutions for both industrial processes and municipal supply.

- Stringent Environmental Regulations: Governments in South America are progressively implementing and enforcing stricter environmental regulations and water quality standards. This regulatory pressure is a key catalyst, compelling industries and municipalities to adopt more advanced, effective, and sustainable water treatment technologies and chemicals.

- Government Investments in Infrastructure: Significant government initiatives and investments focused on developing and upgrading water and wastewater infrastructure are a cornerstone of market growth. These projects create a sustained demand for a wide array of water treatment chemicals.

- Technological Advancements: Ongoing research and development are leading to breakthroughs in treatment technologies such as Advanced Oxidation Processes (AOPs) and enhanced membrane filtration techniques. These advancements not only improve treatment efficiency and effectiveness but also drive the demand for specialized chemicals that complement these technologies.

- Growing Water Scarcity Concerns: Increasing awareness and the tangible impacts of water scarcity in certain regions are pushing for more sophisticated water management strategies, including water reuse and desalination, which in turn boost the demand for specific water treatment chemicals.

Obstacles in the South America Water Treatment Chemicals Industry Market

Challenges include volatile raw material prices, potential supply chain disruptions, and intense competition among established and emerging players. Regulatory hurdles and the need for investments in infrastructure can also hinder growth. These factors can impact market profitability and expansion plans.

Future Opportunities in South America Water Treatment Chemicals Industry

Future opportunities lie in the adoption of advanced water treatment technologies, expanding into underserved markets, and developing sustainable and environmentally friendly solutions. Growing awareness of water scarcity and the increasing need for water reuse and recycling present significant growth prospects. The development of innovative chemicals addressing emerging contaminants also offers exciting potential.

Major Players in the South America Water Treatment Chemicals Industry Ecosystem

- Nouryon

- Ecolab

- Solenis

- Kemira

- Solvay

- Lonza

- Kurita Water Industries Ltd

- SNF

- Suez

Key Developments in South America Water Treatment Chemicals Industry Industry

- 2024 Q4: Ecolab launched a new range of sustainable water treatment chemicals for industrial applications in Brazil.

- 2023 Q3: Solenis and Kemira announced a joint venture to expand their presence in the Chilean water treatment market.

- 2022 Q2: Nouryon invested in a new production facility for water treatment chemicals in Argentina. (Further developments to be added)

Strategic South America Water Treatment Chemicals Industry Market Forecast

The outlook for the South America water treatment chemicals market is exceptionally promising, with projections indicating substantial and sustained growth over the forecast period. This optimistic trajectory is underpinned by a confluence of powerful market forces:

- Continued Industrial Expansion: The ongoing industrialization across various sectors in South America will continue to drive the demand for effective water treatment solutions to manage process water and wastewater.

- Elevated Environmental Stewardship: A growing commitment to environmental protection and sustainability is leading to increasingly stringent regulations regarding water quality and discharge standards. This will necessitate the adoption of more advanced and eco-friendly water treatment chemicals.

- Embracing Innovative Technologies: The market is actively embracing technological advancements in water treatment, including AOPs, membrane technologies, and digital monitoring solutions. This trend fuels the demand for specialized chemicals that optimize the performance of these advanced systems.

- Sustained Infrastructure Investment: Governments and private entities are expected to continue their significant investments in building, upgrading, and maintaining water and wastewater treatment infrastructure, creating a stable and growing market for treatment chemicals.

- Rising Urbanization and Population Growth: The increasing concentration of populations in urban centers amplifies the demand for safe and reliable municipal water supplies and effective wastewater management, further boosting the market.

- Focus on Sustainable Water Management: A broader shift towards sustainable water resource management, including water reuse and conservation efforts, will drive the need for specialized treatment chemicals that enable these practices.

These converging factors collectively position the South America water treatment chemicals market for significant expansion, offering considerable opportunities for innovation, investment, and profitability in the coming years.

South America Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Flocculant & Coagulants

- 1.2. Biocides & Disinfectants

- 1.3. Defoamers & Defoaming Agents

- 1.4. pH & Adjusters & Softeners

- 1.5. Scale & Corrosion Inhibitors

- 1.6. Others

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil & Gas

- 2.3. Chemical Manufcaturing

- 2.4. Mining & Mineral Processing

- 2.5. Mining and Mineral Processing

- 2.6. Food & Beverage

- 2.7. Pulp & Ppaer

- 2.8. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Water Treatment Chemicals Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of South America Water Treatment Chemicals Industry

South America Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Conformance to Stringent Environmental Regulations; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Conformance to Stringent Environmental Regulations; Other Drivers

- 3.4. Market Trends

- 3.4.1. Oil & Gas Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global South America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flocculant & Coagulants

- 5.1.2. Biocides & Disinfectants

- 5.1.3. Defoamers & Defoaming Agents

- 5.1.4. pH & Adjusters & Softeners

- 5.1.5. Scale & Corrosion Inhibitors

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil & Gas

- 5.2.3. Chemical Manufcaturing

- 5.2.4. Mining & Mineral Processing

- 5.2.5. Mining and Mineral Processing

- 5.2.6. Food & Beverage

- 5.2.7. Pulp & Ppaer

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Flocculant & Coagulants

- 6.1.2. Biocides & Disinfectants

- 6.1.3. Defoamers & Defoaming Agents

- 6.1.4. pH & Adjusters & Softeners

- 6.1.5. Scale & Corrosion Inhibitors

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil & Gas

- 6.2.3. Chemical Manufcaturing

- 6.2.4. Mining & Mineral Processing

- 6.2.5. Mining and Mineral Processing

- 6.2.6. Food & Beverage

- 6.2.7. Pulp & Ppaer

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Flocculant & Coagulants

- 7.1.2. Biocides & Disinfectants

- 7.1.3. Defoamers & Defoaming Agents

- 7.1.4. pH & Adjusters & Softeners

- 7.1.5. Scale & Corrosion Inhibitors

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil & Gas

- 7.2.3. Chemical Manufcaturing

- 7.2.4. Mining & Mineral Processing

- 7.2.5. Mining and Mineral Processing

- 7.2.6. Food & Beverage

- 7.2.7. Pulp & Ppaer

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Flocculant & Coagulants

- 8.1.2. Biocides & Disinfectants

- 8.1.3. Defoamers & Defoaming Agents

- 8.1.4. pH & Adjusters & Softeners

- 8.1.5. Scale & Corrosion Inhibitors

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil & Gas

- 8.2.3. Chemical Manufcaturing

- 8.2.4. Mining & Mineral Processing

- 8.2.5. Mining and Mineral Processing

- 8.2.6. Food & Beverage

- 8.2.7. Pulp & Ppaer

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nouryon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ecolab

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Solenis

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Kemira

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Solvay

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Lonza

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kurita Water industries Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 SNF

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Suez*List Not Exhaustive

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Nouryon

List of Figures

- Figure 1: Global South America Water Treatment Chemicals Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Brazil South America Water Treatment Chemicals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Brazil South America Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Brazil South America Water Treatment Chemicals Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Brazil South America Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Brazil South America Water Treatment Chemicals Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Brazil South America Water Treatment Chemicals Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil South America Water Treatment Chemicals Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Brazil South America Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina South America Water Treatment Chemicals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Argentina South America Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Argentina South America Water Treatment Chemicals Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 13: Argentina South America Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Argentina South America Water Treatment Chemicals Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Argentina South America Water Treatment Chemicals Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina South America Water Treatment Chemicals Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Argentina South America Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Rest of South America South America Water Treatment Chemicals Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Rest of South America South America Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Rest of South America South America Water Treatment Chemicals Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Rest of South America South America Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Rest of South America South America Water Treatment Chemicals Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Rest of South America South America Water Treatment Chemicals Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of South America South America Water Treatment Chemicals Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of South America South America Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global South America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Water Treatment Chemicals Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the South America Water Treatment Chemicals Industry?

Key companies in the market include Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water industries Ltd, SNF, Suez*List Not Exhaustive.

3. What are the main segments of the South America Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

; Conformance to Stringent Environmental Regulations; Other Drivers.

6. What are the notable trends driving market growth?

Oil & Gas Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

; Conformance to Stringent Environmental Regulations; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the South America Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence